Truck Disc Brake Market Report By Product Type (Disc Brake Pads, Disc Brake Rotors, Brake Calipers, Other Components), By Material (Cast Iron, Aluminum, Composite Materials), By Sales Channel (OEM [Original Equipment Manufacturer], Aftermarket), By Vehicle Type (Light Duty Trucks, Medium Duty Trucks, Heavy Duty Trucks), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

1897

-

July 2024

-

175

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

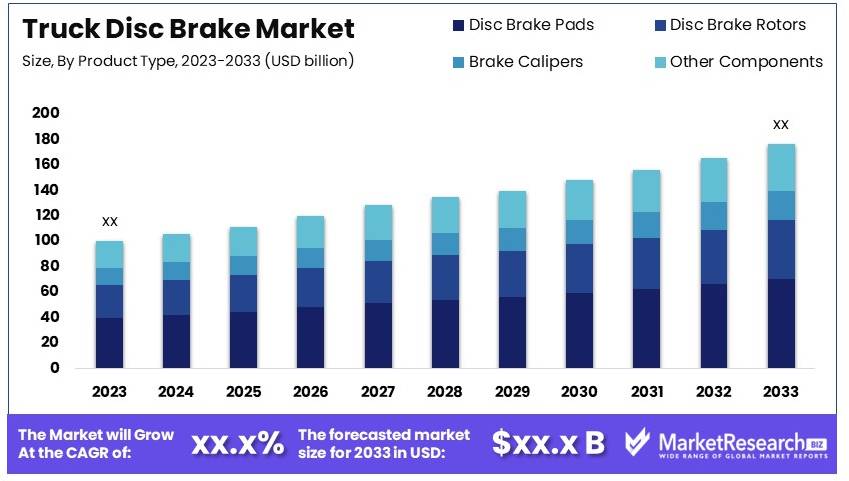

The Global Truck Disc Brake Market size is expected to be worth around USD xx.x Billion by 2033, from USD xx Billion in 2023, growing at a CAGR of xx.x% during the forecast period from 2024 to 2033.

The Truck Disc Brake Market refers to the segment of the automotive industry focused on the design, manufacture, and distribution of disc brake systems specifically for trucks. Disc brakes, which utilize calipers to squeeze pairs of pads against a disc or rotor to create friction, are essential for the safe operation of trucks, offering superior stopping power and reliability compared to drum brakes.

This market is driven by stringent safety regulations, the growing commercial trucking sector, and advancements in braking technology that increase efficiency and durability. As trucks are critical to freight and logistics operations globally, the demand for high-performance, durable disc brake systems is continually rising. This market's expansion is also supported by innovations in materials and design that improve the lifespan and performance of brake systems.

The truck disc brake market is poised for significant growth, driven by stringent government regulations and the critical role of trucks in international trade. The Commercial Vehicle Safety Alliance (CVSA) plays a pivotal role in enforcing safety standards. Their annual Brake Safety Week inspections highlight the necessity for high-quality brake systems. In 2021, CVSA inspected 35,764 commercial motor vehicles, and 12% were placed out of service due to brake-related issues. This data underscores the urgent need for compliance with safety regulations to mitigate accidents and enhance road safety.

Furthermore, the trucking industry is a cornerstone of international trade, with trucks facilitating a substantial portion of surface trade. In 2022, trucks transported 61.9% of the value of surface trade between the U.S. and Canada and accounted for 83.5% of cross-border trade with Mexico. These figures illustrate the crucial role of reliable braking systems in ensuring the safe and efficient transport of goods across borders.

Market dynamics indicate that the demand for advanced truck disc brakes will continue to rise. Manufacturers are investing in research and development to produce more durable and efficient braking systems. These advancements are necessary to meet the increasing regulatory requirements and the operational demands of international freight transportation.

The truck disc brake market is expected to expand, supported by regulatory pressures and the vital importance of trucks in global trade. Companies that innovate and comply with stringent safety standards will be well-positioned to capitalize on this growth. The industry's focus on enhancing brake performance and reliability is essential for sustaining the momentum of international trade and ensuring road safety.

Key Takeaways

- Market Value: The Truck Disc Brake Market is anticipated to experience significant growth, though specific figures were not provided.

- By Product Type Analysis: Disc Brake Pads dominate with 40%; they are essential for safety and performance in heavy-duty vehicles.

- By Material Analysis: Cast Iron leads with 50%; it is favored for its durability and cost-effectiveness in manufacturing brake components.

- By Sales Channel Analysis: OEM dominates with 60%; original equipment manufacturers ensure high-quality and tailored solutions for vehicles.

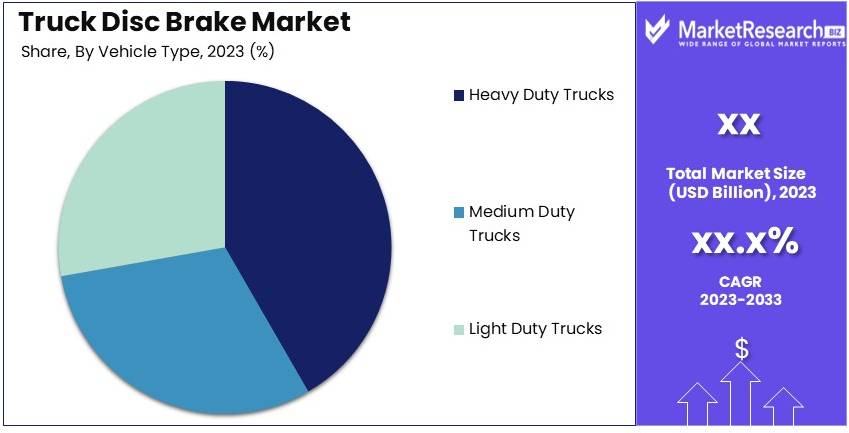

- By Vehicle Type Analysis: Heavy Duty Trucks lead with 45%; they require robust braking systems due to their size and load capacity.

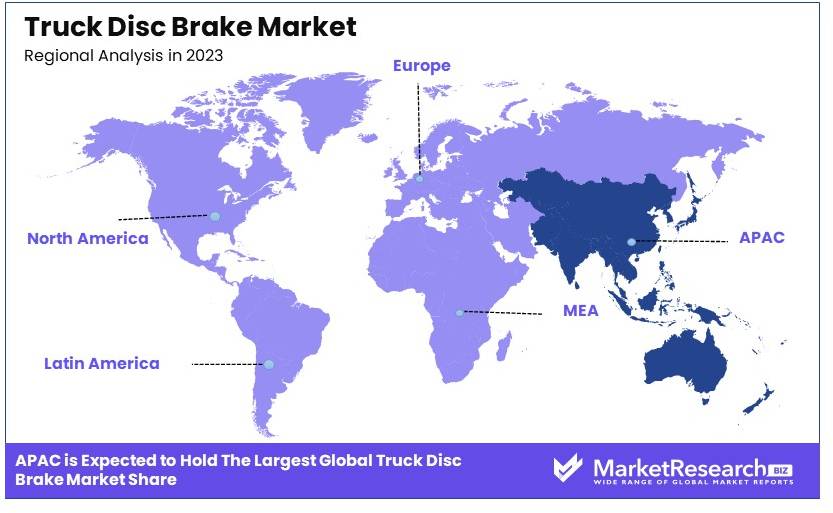

- Dominant Region: Asia Pacific leads with approximately 37%; this is due to the region's large automotive manufacturing base.

- High Growth Region: North America is expected to show significant growth, driven by the increasing demand for commercial vehicles and stringent safety regulations.

- Analyst Viewpoint: The truck disc brake market is steadily growing with moderate competition. Future growth will be driven by advancements in brake technology and regulatory standards.

- Growth Opportunities: Key players can leverage advancements in materials technology and focus on developing eco-friendly brake solutions to meet regulatory demands.

Driving Factors

Increasing Demand for Enhanced Braking Performance and Safety Drives Market Growth

The trucking industry's emphasis on safety has notably increased the demand for advanced braking systems. Disc brakes, known for their superior performance in harsh conditions, are becoming essential for trucks, especially in heavy-duty applications. They offer more reliable stopping power, which is crucial for preventing accidents.

Major truck manufacturers like Daimler, Volvo, and PACCAR are now installing disc brakes as standard features on new models to comply with stringent safety standards and to meet customer expectations for safer vehicles. This shift is driving the growth of the truck disc brake market as safety becomes a paramount concern for the industry.

Emphasis on Reducing Maintenance Costs and Downtime Drives Market Growth

Truck disc brakes are gaining popularity due to their longer lifespan and lower maintenance requirements compared to drum brakes. This translates into significant cost savings for truck operators, as less frequent brake maintenance reduces downtime and improves vehicle availability.

Companies like Knorr-Bremse and Wabco are leading the way with disc brake systems designed for extended service intervals and easier maintenance. The economic advantages of these innovations are compelling for fleet owners and operators, enhancing the overall operational efficiency and profitability of their businesses, which in turn boosts the market for disc brakes.

Technological Advancements in Brake Systems Drives Market Growth

Continuous innovation in truck brake technology is a key factor in the growth of the disc brake market. Developments such as electronic braking systems (EBS), anti-lock braking systems (ABS), and automatic brake adjusters have significantly improved the functionality and safety of disc brakes.

These features help enhance vehicle stability and reduce the risk of accidents, making disc brakes an even more attractive option for truck manufacturers and fleet operators. Companies like Meritor and Bendix are at the forefront of these technological advancements, driving the industry toward more efficient and safer braking solutions. This ongoing technological evolution not only supports current market growth but also sets the stage for future developments in truck safety technology.

Restraining Factors

Higher Initial Costs Compared to Drum Brakes Restrain Market Growth

Disc brake systems generally have a higher upfront cost than traditional drum brakes. This higher initial investment can be a barrier for truck operators, especially smaller fleets or owner-operators with tight budgets.

The immediate financial strain can discourage these buyers from opting for disc brakes despite their long-term benefits. Although disc brakes offer reduced maintenance costs and improved fuel efficiency, the initial expense remains a significant hurdle. This financial challenge limits the adoption of disc brakes in the truck market, particularly among budget-conscious operators.

Availability of Aftermarket Parts and Trained Technicians Restrains Market Growth

The adoption of disc brakes may be limited in regions where aftermarket parts and trained technicians are scarce. Proper installation and maintenance of disc brake systems require specialized knowledge and tools.

Areas lacking adequate infrastructure and training resources face significant challenges in supporting disc brake systems. This lack of support deters truck operators from switching to disc brakes, preferring the more familiar drum brakes with readily available parts and expertise. This infrastructural limitation hampers the widespread adoption of disc brakes in the truck market.

Product Type Analysis

Disc Brake Pads dominate with 40% due to their essential role in braking efficiency and frequent replacement needs.

The Truck Disc Brake Market is segmented by product type into Disc Brake Pads, Disc Brake Rotors, Brake Calipers, and Other Components. Disc Brake Pads are crucial for the braking system's effectiveness. They convert kinetic energy into thermal energy, enabling trucks to stop safely. The high demand for disc brake pads is driven by their frequent wear and tear, necessitating regular replacements. This consistent demand makes disc brake pads a dominant segment in the market. Technological advancements in pad materials have improved their performance, contributing to market growth. Additionally, the increasing focus on road safety regulations globally is driving the adoption of high-quality brake pads, further boosting this segment.

Disc Brake Rotors and Brake Calipers also play significant roles. Rotors work with pads to stop the vehicle, making them essential for braking systems. Innovations in rotor design, such as vented rotors, enhance heat dissipation and improve performance. Brake Calipers are vital for applying pressure to the brake pads against the rotors. Advanced caliper designs, like floating and fixed calipers, offer better braking performance and durability. Other components, such as sensors and actuators, enhance the overall efficiency and safety of the braking system, contributing to the market's growth.

Material Analysis

Cast Iron dominates with 50% due to its durability and cost-effectiveness.

The market by material is divided into Cast Iron, Aluminum, and Composite Materials. Cast Iron is widely used in truck disc brakes due to its high strength and ability to withstand extreme temperatures. It offers excellent durability, making it a preferred choice for heavy-duty applications. The cost-effectiveness of cast iron also contributes to its dominance in the market. Despite its weight, which can impact fuel efficiency, its advantages in performance and longevity outweigh the drawbacks for many applications. The widespread availability of cast iron and its established manufacturing processes further support its leading position.

Aluminum and Composite Materials are also important. Aluminum billets offers significant weight savings, which can improve fuel efficiency and reduce emissions. This material is particularly attractive for light and medium-duty trucks. However, its higher cost compared to cast iron limits its widespread adoption. Composite Materials, such as carbon-ceramic composites, provide exceptional performance with reduced weight and improved heat resistance. These materials are increasingly used in high-performance and specialized applications, although their high cost remains a barrier to broader adoption. As advancements in material technology continue, the market for aluminum and composites is expected to grow, enhancing the overall development of the truck disc brake market.

Sales Channel Analysis

OEM dominates with 60% due to direct supply relationships and stringent quality requirements.

The market is segmented by sales channel into OEM (Original Equipment Manufacturer) and Aftermarket. OEMs are the primary source of disc brake systems for new trucks. They ensure that brakes meet the stringent quality and safety standards required for new vehicles. The close relationships between OEMs and truck manufacturers ensure a steady demand for high-quality disc brake systems. OEMs benefit from economies of scale, which can reduce costs and improve margins. Additionally, technological innovations and advancements in brake systems are often first introduced through OEM channels, making them a key driver of market growth.

The Aftermarket segment also plays a crucial role. It provides replacement parts and upgrades for existing vehicles, catering to the needs of truck owners and operators. The aftermarket is essential for maintaining and enhancing the performance of trucks throughout their lifecycle. It offers a wide range of products, from standard replacements to high-performance upgrades. The increasing age of truck fleets in many regions drives the demand for aftermarket parts. Additionally, the growing trend of vehicle customization and performance enhancement supports the aftermarket segment's growth. Both OEM and Aftermarket channels are vital for the overall development and expansion of the truck disc brake market.

Vehicle Type Analysis

Heavy Duty Trucks dominate with 45% due to their extensive usage in freight and logistics.

The market by vehicle type includes Light Duty Trucks, Medium Duty Trucks, and Heavy Duty Trucks. Heavy Duty Trucks require robust and reliable braking systems due to their size, weight, and the demanding conditions they operate in. These trucks are essential for transporting goods over long distances, often carrying heavy loads. The high performance and durability requirements for braking systems in heavy duty trucks drive the demand for advanced disc brake components. The growth of the logistics and freight industries, especially with the rise of e-commerce, has further increased the need for efficient and reliable heavy-duty trucks, bolstering this segment's dominance.

Light Duty and Medium Duty Trucks are also significant. Light Duty Trucks, often used for urban delivery and personal use, benefit from disc brakes that offer improved performance and safety. The increasing focus on reducing emissions and enhancing fuel efficiency in light duty trucks drives the adoption of advanced braking systems. Medium Duty Trucks serve a variety of commercial purposes, from construction to distribution. Their versatile use cases require reliable braking systems that can perform under diverse conditions. The growth in infrastructure development and urbanization boosts the demand for medium duty trucks, contributing to the overall market growth. Together, these segments ensure a comprehensive development of the truck disc brake market, catering to a wide range of applications and needs.

Key Market Segments

By Product Type

- Disc Brake Pads

- Disc Brake Rotors

- Brake Calipers

- Other Components

By Material

- Cast Iron

- Aluminum

- Composite Materials

By Sales Channel

- OEM (Original Equipment Manufacturer)

- Aftermarket

By Vehicle Type

- Light Duty Trucks

- Medium Duty Trucks

- Heavy Duty Trucks

Growth Opportunities

Advancements in Material Science and Brake Pad Technology Offer Growth Opportunity

Innovations in material science and brake pad technology are paving the way for the development of more robust and efficient disc brakes for trucks. The introduction of advanced materials and improved coatings significantly extends the lifespan of brake components, reduces maintenance frequency, and enhances overall braking performance.

These improvements not only meet the increasing demands of the transportation industry for durability and reliability but also offer manufacturers a competitive edge in the market. Companies investing in these technological advancements are positioned to lead the market by providing solutions that address the critical needs of improved safety and operational efficiency in trucking. The ongoing research in this field is expected to continue driving growth and innovation in the truck disc brake market.

Development of Autonomous and Electric Truck Technologies Offers Growth Opportunity

The evolution of autonomous and electric truck technologies presents substantial opportunities for the disc brake industry. Disc brakes, known for their superior performance and lower maintenance compared to drum brakes, are ideally suited for the next generation of trucks. These vehicles often require more precise and reliable braking systems, especially those capable of integrating with regenerative braking systems, which are prevalent in electric vehicles.

As the industry moves towards more sustainable and transportation management systems, disc brake manufacturers that can adapt and innovate to meet these new technological standards are well-placed to capture significant market share. This alignment with emerging truck technologies signifies a promising growth trajectory in the disc brake sector.

Trending Factors

Increasing Safety Regulations Are Trending Factors

Stricter safety regulations are significantly influencing the truck disc brake market. Governments worldwide are enforcing rigorous safety standards for commercial vehicles, necessitating the use of high-performance braking systems. For instance, the European Union's ECE R90 regulation mandates stringent testing and performance criteria for replacement brake parts. This has led to increased demand for reliable and efficient disc brakes.

Compliance with these regulations has become a critical factor for market players, pushing for innovations and quality enhancements. The focus on reducing road accidents and enhancing vehicle safety is thus driving the market forward, with manufacturers investing in advanced brake technologies to meet these regulatory requirements.

Rising Demand for Commercial Vehicles Are Trending Factors

The growing demand for commercial vehicles is a key driver for the truck disc brake market. With the expansion of the logistics and transportation sectors, the need for reliable and efficient braking systems is rising. The increase in vehicle production directly impacts the demand for advanced braking solutions.

Fleet operators prioritize disc brakes for their superior performance and durability, essential for heavy-duty operations. This trend is amplified by the rise in e-commerce and the consequent need for efficient freight movement, further boosting the market. The continued growth in commercial vehicle sales underlines the importance of robust and reliable braking systems.

Regional Analysis

Asia Pacific Dominates with 37% Market Share in the Truck Disc Brake Market

Asia Pacific's leadership with a 37% share of the truck disc brake market is driven by its expansive automotive manufacturing base and increasing vehicle production rates. The region benefits from cost-effective manufacturing processes and high local demand for commercial vehicles due to growing logistics and transportation needs. Additionally, stringent vehicle safety regulations across several Asian countries push for higher adoption of advanced braking systems, including disc brakes.

The rapid urbanization and industrial growth in Asia Pacific necessitate robust transportation infrastructures, thereby boosting the truck market and subsequently the demand for reliable disc brakes. The presence of major automotive players in countries like China, India, and Japan further fuels technological innovations in disc brake systems, enhancing overall market growth. Additionally, increased focus on vehicle safety and emission standards supports the shift from traditional drum brakes to more efficient disc brake systems.

Regional Market Share Analysis:

- North America: Holds about 25% of the market. The region's focus on safety features and the adoption of newer, safer truck models drive demand for advanced disc brake systems.

- Europe: Captures approximately 24% of the market. High standards for vehicle safety and performance, along with stringent regulations on vehicle emissions, bolster the adoption of high-quality disc brakes.

- Middle East & Africa: With a 5% market share, growth is limited but gradually increasing due to infrastructure developments and an expanding commercial vehicle base.

- Latin America: Represents 9% of the market. Economic recovery and modernization of transport fleets are slowly driving the adoption of better braking systems in commercial vehicles.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Truck Disc Brake Market features leading companies that impact the industry through technological advancements and strategic initiatives. The key players include ZF Friedrichshafen AG, Wabco Holdings Inc., Meritor, Inc., Knorr-Bremse AG, Haldex AB, Brembo S.p.A., Aisin Seiki Co., Ltd., Mando Corporation, Akebono Brake Industry Co., Ltd., TMD Friction Holdings GmbH, Federal-Mogul Corporation, Nissin Kogyo Co., Ltd., and Robert Bosch GmbH.

ZF Friedrichshafen AG and Knorr-Bremse AG are industry leaders known for their cutting-edge brake systems. Their strong R&D capabilities and extensive product portfolios make them dominant forces in the market. Meritor, Inc. and Wabco Holdings Inc. are recognized for their innovative solutions and strong OEM relationships, which enhance their market influence.

Brembo S.p.A. and Akebono Brake Industry Co., Ltd. are celebrated for their high-performance brake systems, catering to both aftermarket and OEM segments. Aisin Seiki Co., Ltd. and Mando Corporation have a significant presence in the Asian market, leveraging their local expertise and cost-effective solutions.

Federal-Mogul Corporation and TMD Friction Holdings GmbH are key players in the friction materials segment, providing essential components for disc brakes. Nissin Kogyo Co., Ltd. and Robert Bosch GmbH, with their diversified automotive portfolios, strengthen their positions through continuous innovation and quality products.

Haldex AB's focus on air disc brakes and trailer applications positions it well in niche markets. These companies drive market growth through strategic partnerships, technological advancements, and a focus on safety and performance.

Market Key Players

- ZF Friedrichshafen AG

- Wabco Holdings Inc.

- Meritor, Inc.

- Knorr-Bremse AG

- Haldex AB

- Brembo S.p.A.

- Aisin Seiki Co., Ltd.

- Mando Corporation

- Akebono Brake Industry Co., Ltd.

- TMD Friction Holdings GmbH

- Federal-Mogul Corporation

- Nissin Kogyo Co., Ltd.

- Robert Bosch GmbH

Recent Developments

- 2023: Akebono Brake Corporation expanded its ProACT and Severe Duty Ultra-Premium Disc Brake Pad line with 11 new part numbers.

- July 2024: Bosch Engineering announced that it is enhancing public transportation safety by equipping trams in Iasi with advanced braking systems.

Report Scope

Report Features Description Market Value (2023) USD xx Billion Forecast Revenue (2033) USD xx.x Billion CAGR (2024-2033) xx.x% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Disc Brake Pads, Disc Brake Rotors, Brake Calipers, Other Components), By Material (Cast Iron, Aluminum, Composite Materials), By Sales Channel (OEM [Original Equipment Manufacturer], Aftermarket), By Vehicle Type (Light Duty Trucks, Medium Duty Trucks, Heavy Duty Trucks) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape ZF Friedrichshafen AG, Wabco Holdings Inc., Meritor, Inc., Knorr-Bremse AG, Haldex AB, Brembo S.p.A., Aisin Seiki Co., Ltd., Mando Corporation, Akebono Brake Industry Co., Ltd., TMD Friction Holdings GmbH, Federal-Mogul Corporation, Nissin Kogyo Co., Ltd., Robert Bosch GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- ZF Friedrichshafen AG

- Wabco Holdings Inc.

- Meritor, Inc.

- Knorr-Bremse AG

- Haldex AB

- Brembo S.p.A.

- Aisin Seiki Co., Ltd.

- Mando Corporation

- Akebono Brake Industry Co., Ltd.

- TMD Friction Holdings GmbH

- Federal-Mogul Corporation

- Nissin Kogyo Co., Ltd.

- Robert Bosch GmbH