Transportation Management System Market Based on the Deployment Mode(On-Premise, Cloud-Based), Based on the Mode Of Transportation(Roadways, Railways, Waterways, Airways), Based on End-User Vertical(Manufacturing, Retail & E-commerce, Logistics, Government Organizations, Other End-Use Verticals), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

22709

-

Feb 2024

-

174

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

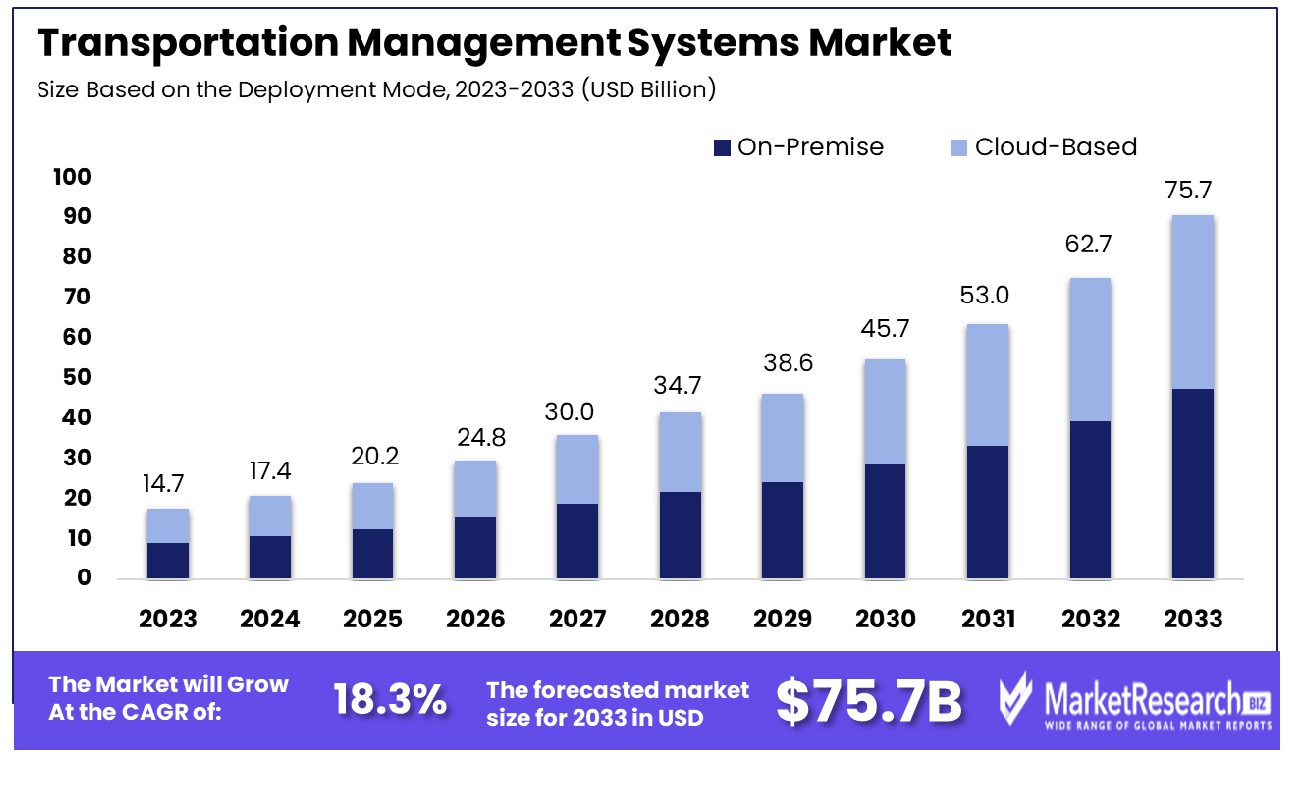

The transportation management system was valued at USD 14.7 billion in 2023, It is expected to reach USD 75.7 billion by 2033, with a CAGR of 18.3% during the forecast period from 2024 to 2033. The surge in demand for new advanced technologies, the rise of retail and e-commerce industries, and the sudden growth in requirement for real-time tracking are some of the main key driving factors for the transportation management systems market.

Transportation management systems are defined as software solutions that rationalize and augment the planning, and supervising of the transportation processes and execution within a supply chain. It also enables the efficacy movement of the goods from the starting of the origin to the end of the destination by offering tools for route planning, shipment tracking, carrier selection, and performance analysis.

Transportation management systems facilitate firms to improve the visibility into their supply chain by decreasing transportation expenses and enhancing whole operational efficiency. It automates work like order consolidation, real-time monitoring, and freight rate negotiation which can lead to a better decision-making process and resource utilization. By making centralized transportation-based information and techniques, the transportation sector encourages many businesses and firms to make informed decisions, by improving customer satisfaction and answering promptly to dynamic market demands that can ultimately contribute to a more agile and cost-effective supply chain management.

Supply Chain 24/7 in January 2023, highlights that as per a survey conducted by Peerless Research Group’s Warehouse software and Automation 2022, there are 26% of firms are currently using TMS and 72% of those companies that have had those TMS in place for anywhere from 1 year to 10 years. There are about ½ of these TMS users who say that they have got an ROI on the software within 12 months or less.

Moreover, in February 2023, emphasizes the US transportation industry which had a 1.26 trillion market size in December 2022. Each day, the US transportation system has moved an average of over 50 million tons of freight that was valued at more than USD 50 billion. Meanwhile, the North American logistic market size reached USD 1,413.4 billion in 2022.

Transportation management systems play a vital role in augmenting the supply chain logistics industries. By automating and rationalizing transportation methods, TMS improves visibility, decreases expenses, and enhances operation efficacy. It makes sure to have good decision-making, effective resource utilization, and real-time tracking. TMS also contributes to having a responsive and active supply chain management, by making timely delivery of items, reducing the delays, and helping with customer satisfaction. The demand for the TMS will increase due to its requirement in logistics and supply chain that will help in market expansion during the forecast period.

Key Takeaways

- Market Growth: Transportation Management System Market was valued at USD 14.7 billion in 2023, It is expected to reach USD 75.7 billion by 2033, with a CAGR of 18.3% during the forecast period from 2024 to 2033.

- Based on the Deployment Mode: On-premise deployment mode leads with a commanding 58.6%, indicating a preference for localized infrastructure solutions.

- Based on the Mode Of Transportation: Roadways emerge as the dominant mode of transportation at 40.5%, reflecting a significant reliance on land-based logistics.

- Based on End-User Vertical: Manufacturing stands out as the top end-user vertical, holding a substantial share of 37.2%.

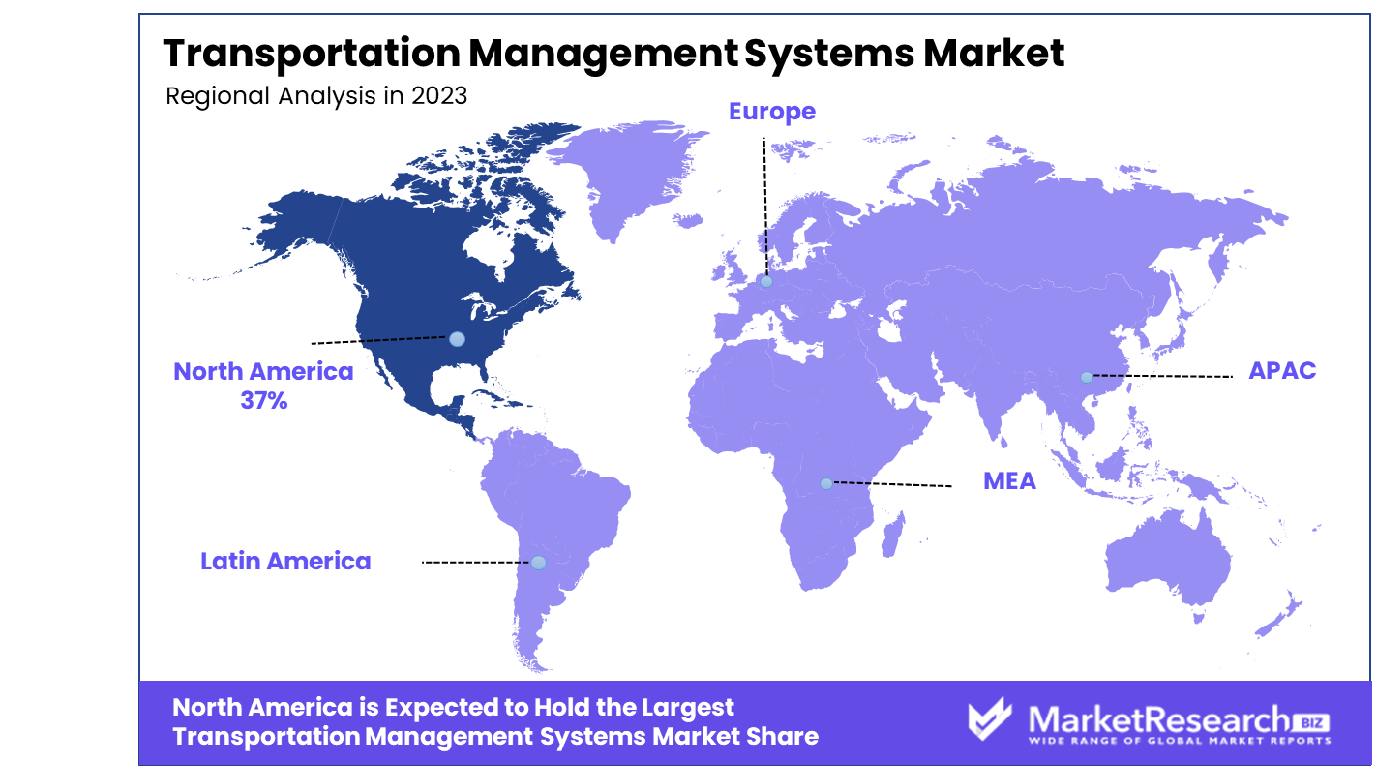

- Regional Dominance: North America Dominates with a 37% Market Share in the Transportation Management Systems Industry.

- Growth Opportunity: The TMS market is expanding with increased adoption by SMBs, as vendors offer scaled-down solutions, stimulating growth. Integration with warehouse automation enhances operational efficiency, driving demand for advanced TMS solutions.

Driving factors

Increased Efficiency and Cost Reduction in Logistics Operations Drives Market Growth

The imperative for enhanced efficiency and cost reduction in logistics operations serves as a critical catalyst for the transportation management systems (TMS) market's expansion. The anticipation of logistics costs escalating from 12%-20% to 15%-25% of e-commerce sales by 2023 underscores the urgent need for companies to mitigate warehousing, fulfillment, and shipping expenses.

TMS emerges as a pivotal solution, enabling firms to streamline route optimization, automate planning processes, and minimize unnecessary mileage. This optimization leads to substantial cost savings and directly contributes to the market's growth by addressing the core operational pain points of companies across the logistics spectrum.

Globalized Supply Chains Complexity Drives Market Growth

The intricacy of managing logistics across international borders, accentuated by diverse regulations, languages, and customs procedures, propels the demand for transportation management systems. TMS delivers unparalleled visibility and control over global transportation networks, simplifying the complex logistics landscape.

This capability is essential for companies navigating the multifaceted challenges of global supply chains, ensuring efficient and compliant operations. The role of TMS in mitigating these complexities not only drives market growth but also enhances the resilience and agility of supply chains worldwide.

Sustainability and Emission Reductions Drive Market Growth

Sustainability concerns, particularly around emission reductions, significantly influence the transportation management systems market. The CDP 2020 Global Supply Chain Report reveals that supply chain emissions are on average 11.4 times higher than operational emissions, accounting for approximately 92% of an organization's total greenhouse gas (GHG) emissions.

TMS plays a vital role in addressing this issue by offering advanced data analytics for strategic emission planning, load optimization, modal shifts, and network design. This focus on sustainability not only aligns with corporate social responsibility goals but also drives TMS market growth by providing a tangible solution to a pressing global challenge.

Rise of Omni-channel Retail and E-commerce Drives Market Growth

The exponential growth of omni-channel retail and e-commerce has precipitated a surge in small, frequent freight shipments, necessitating robust transportation management systems. TMS becomes indispensable for shippers, enabling efficient management of parcel deliveries, returns, and tracking.

This surge in e-commerce activities amplifies the demand for TMS, as companies strive to meet consumer expectations for fast, transparent, and reliable delivery services. The critical role of TMS in supporting the dynamic requirements of omnichannel retail and e-commerce significantly contributes to the sector's growth, underscoring its importance in the modern digital economy.

Restraining Factors

Integration Challenges Stifle TMS Adoption

The integration of Transportation Management Systems (TMS) with pre-existing legacy systems, such as Warehouse Management Systems (WMS), Enterprise Resource Planning (ERP), or accounting software, represents a significant barrier to market growth. These technical and financial challenges can significantly delay implementation processes, deterring companies from adopting advanced TMS solutions.

The complexity of ensuring seamless communication between the new TMS and various legacy systems adds to the operational overhead, making the transition cumbersome and resource-intensive for organizations.

Data Security Concerns Slow Cloud-Based TMS Expansion

In the realm of Transportation Management Systems, data security emerges as a critical concern, particularly for cloud-based solutions that manage sensitive shipment information. Companies express apprehension regarding the vulnerability of their data to cyber-attacks, which can have severe repercussions, including financial loss and damage to reputation.

This heightened scrutiny of the security capabilities of cloud-based TMS solutions decelerates their adoption rate, as businesses demand robust security measures to protect their critical data from potential breaches and ensure compliance with increasingly stringent data protection regulations.

Based on Deployment Mode Analysis

On-Premise deployment mode prevails with a dominance of 58.6% in market adoption.

On-premise segment is currently the dominant deployment mode within the TMS market, accounting for 58.6% of the market share. This preference is rooted in the enhanced security, control, and customization offered by on-premise systems, which are particularly valued by large enterprises with complex logistics operations. These solutions allow companies to maintain direct oversight of their TMS infrastructure, ensuring that their specific operational requirements are met.

However, the Cloud-Based segment growth is rapidly growing, driven by its scalability, cost-effectiveness, and ease of integration with existing supply chain industry management systems. Cloud segment TMS solutions offer the flexibility to adapt to changing business needs, making them increasingly popular among small to medium-sized enterprises seeking to optimize their transportation operations without significant upfront investments.

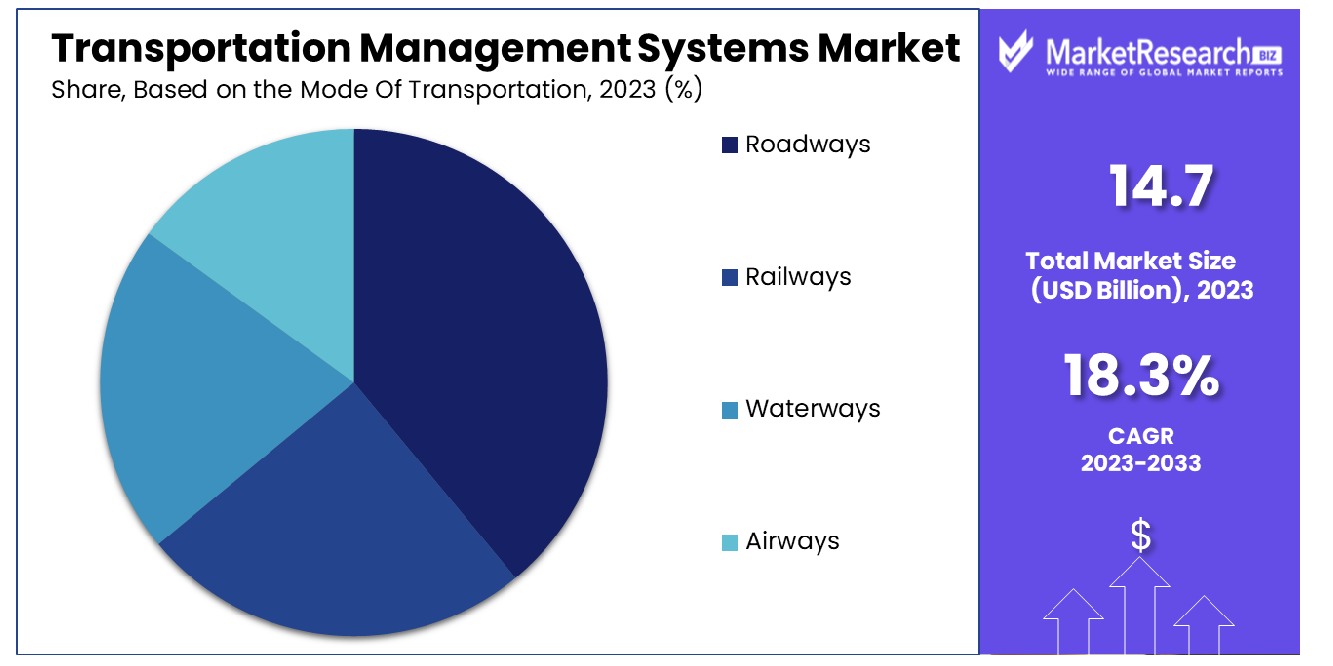

Based on Mode of Transportation Analysis

Roadways emerge as the dominant mode of transportation, commanding a 40.5% share.

The Roadways segment leads the market with a 40.5% share, attributed to the extensive road network and the flexibility it offers for door-to-door delivery. Road transportation is a crucial element of the supply chain, providing vital connectivity between other modes of transportation and the final delivery points.

While roadways dominate, the Railways, Waterways, and Airways segments play significant roles in the transportation matrix. Railways offer cost-effective, long-distance transportation for bulk goods, while waterways are critical for international trade. Airways provide the fastest transportation option for time-sensitive goods, albeit at a higher cost. Each of these modes complements road transport by offering additional options for freight movement, catering to diverse logistical requirements.

Based on End-User Vertical Analysis

Manufacturing stands out as the dominant end-user vertical, capturing 37.2% market share.

The manufacturing segment emerges as the leading end-user vertical of TMS, holding a 37.2% market share. This dominance is due to the complex supply chains of the manufacturing sector, which require efficient coordination of raw materials and finished goods across multiple locations. TMS solutions enable manufacturers to streamline their transportation operations, reduce costs, and improve delivery times, which is essential for maintaining competitiveness in the global market.

Other key end-user segments include Retail & E-commerce, Logistics, Government Organizations, and Other End-Use Verticals. Retail & E-commerce benefits from TMS in managing the rapid movement of goods in response to consumer demands, while logistics companies utilize TMS to offer enhanced services to their clients. Government organizations apply TMS for public transportation and infrastructure management, demonstrating the versatility of TMS applications across different sectors.

Key Market Segments

Based on the Deployment Mode

- On-Premise

- Cloud-Based

Based on the Mode Of Transportation

- Roadways

- Railways

- Waterways

- Airways

Based on End-User Vertical

- Manufacturing

- Retail & E-commerce

- Logistics

- Government Organizations

- Other End-Use Verticals

Growth Opportunity

Increased Adoption in Small and Mid-Sized Businesses: A New Frontier for TMS Growth

The transportation management systems (TMS) market is witnessing a significant shift as vendors tailor solutions to meet the needs of small and mid-sized businesses (SMBs). This strategic pivot opens up a vast new segment, significantly expanding the market's addressable size.

By offering scaled-down, cost-effective versions of their platforms, TMS providers are tapping into the vast potential of SMBs seeking to optimize their logistics and supply chain operations. This democratization of technology not only fosters inclusivity but also stimulates market growth by catering to a previously underserved segment. The move towards accommodating SMBs is reflective of a broader industry trend towards flexibility and scalability, promising to broaden the TMS market's horizon.

Integration with Warehouse Automation: Synergizing for Efficiency

The convergence of transportation management systems (TMS) with warehouse automation represents a transformative growth opportunity within the logistics sector. By integrating TMS with cutting-edge automated warehouse solutions, companies can achieve unprecedented levels of operational efficiency, from streamlined picking and sorting processes to optimized inventory management.

This synergy enhances the value proposition of TMS, making it an indispensable tool for businesses looking to capitalize on the full potential of digital transformation in logistics. The integration facilitates seamless end-to-end supply chain visibility and control, thereby driving demand for advanced TMS solutions that can seamlessly interface with warehouse automation technologies.

Latest Trends

Integration of Artificial Intelligence (AI) and Machine Learning (ML)

Transportation Management Systems (TMS) are increasingly incorporating AI and ML capabilities to optimize route planning, enhance real-time tracking, and predict supply chain disruptions. AI-driven algorithms analyze vast amounts of data to identify patterns and trends, enabling TMS to make data-driven decisions, improve efficiency, and reduce costs.

ML algorithms continuously learn from data, allowing TMS to adapt and evolve in response to changing market dynamics and customer demands. This trend is revolutionizing the transportation industry, driving greater automation, agility, and responsiveness in logistics operations.

Focus on Sustainability and Environmental Responsibility

With growing environmental concerns and stricter regulations, there's a notable trend toward integrating sustainability initiatives into Transportation Management Systems. Companies are prioritizing eco-friendly practices by optimizing routes to minimize fuel consumption, reducing carbon emissions, and incorporating alternative modes of transportation such as electric vehicles and rail transport.

TMS is also leveraging data analytics to measure carbon footprint, track greenhouse gas emissions, and identify opportunities for improvement. By aligning with sustainable practices, organizations not only reduce their environmental impact but also enhance brand reputation and appeal to environmentally conscious consumers. This trend reflects a broader industry shift towards greener and more socially responsible supply chain practices, driving innovation and differentiation in the transportation management market.

Regional Analysis

North America Dominates with 37% Market Share in the Transportation Management Systems Market

North America's dominant 37% market share in the Transportation Management Systems (TMS) sector is driven by the region's advanced logistics and transportation infrastructure, coupled with a strong focus on technological innovation and digital transformation within supply chain management. The presence of a large number of logistics companies, including some of the world's leading firms, fuels the adoption of TMS solutions. Additionally, the region's stringent regulatory environment regarding transport and environmental standards necessitates efficient, technology-driven solutions, further propelling the market's growth.

The North American TMS market benefits from robust investments in cloud-based solutions, offering scalability, flexibility, and cost-efficiency, which appeal to both large enterprises and small to medium-sized businesses. The increasing e-commerce boom, particularly in the United States and Canada, has escalated the demand for sophisticated TMS solutions to manage complex logistics operations. Moreover, the region's openness to adopting Artificial Intelligence (AI) and Machine Learning (ML) within TMS solutions enhances operational efficiencies, predictive analytics, and real-time decision-making capabilities.

Europe: A Strong Contender with Emphasis on Sustainability

Europe holds a significant position in the global TMS market, with its market share characterized by a high adoption rate of TMS solutions among logistics and retail businesses. The region's focus on sustainability and green logistics drives the demand for TMS solutions that can offer route optimization, reduce carbon footprints, and improve overall efficiency. European companies are also leading in terms of integrating TMS with other supply chain management solutions, providing a holistic approach to logistics management.

Asia Pacific: Rapid Growth Driven by Emerging Economies

The Asia Pacific region is experiencing rapid growth in the TMS market, fueled by the expansion of manufacturing sectors and e-commerce in emerging economies such as China and India. The increasing complexity of supply chains in the region, along with a growing emphasis on cost reduction and service improvement, compels businesses to adopt advanced TMS solutions. The market's growth is further supported by government initiatives aimed at digitalizing the logistics sector, making the Asia Pacific a vibrant market with immense growth potential.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In the dynamic domain of transportation management systems (TMS), the convergence of technology and logistics has led to the emergence of major players that significantly influence market dynamics and strategic positioning. BluJay Solutions Ltd., with its comprehensive suite of logistics and transportation management software, stands out for its global reach and cloud-based platform, facilitating efficient supply chain operations. Cargobase and GoComet, as innovative platforms, bring agility and transparency to freight management, catering to the niche requirements of modern enterprises.

Cerasis, Inc., by offering a robust TMS solution, underscores the importance of freight optimization and cost reduction, while 3GTMS is renowned for its scalability and flexibility, supporting complex transportation logistics. Infor Inc. and SAP SE, with their extensive experience in enterprise resource planning, integrate transportation management into broader business systems, offering end-to-end visibility and control.

IBM Corporation and JDA Software Group (now part of Blue Yonder) leverage advanced analytics and artificial intelligence to enhance decision-making and operational efficiency. These technological advancements provide predictive insights, enabling proactive management of logistics challenges.

Market Key Players

- BluJay Solutions Ltd.

- Cargobase

- Cerasis, Inc.

- GoComet

- 3GTMS

- Infor Inc.

- IBM Corporation

- JDA Software Group

- McKesson Corporation

- Exxon Mobil Corporation

- CIGNA Corporation

- Valero

- Alpega

- Shipsy

- SAP SE

Recent Development

- In November 2023, Today, Aptean, a leading global provider of software solutions for mission-critical enterprises announced the acquisition of 3T Logistics & Technology Group (3T) which is a supplier of cloud-based, transportation management software (TMS) to shippers as well as transporters in Europe, the United Kingdom, and broader Europe.

- In May 2023, Manhattan Associates announced its Manhattan Active Yard Management solution. The yard management solution was redesigned to seamlessly integrate with its transportation and warehouse management solutions, all on one cloud-based platform.

- In April 2023, Trimble announced that they had completed the earlier announcement acquisition of Transporeon. Transposons platform software provides modular applications that run the global network of 145,000 shippers and 1,400 carriers and load recipients, with integrated management, sourcing monitoring, and payment tools.

- In April 2023, Descartes bought Localz, an established start-up with ten years of experience that helps retailers communicate with their customers throughout the day they deliver products or services. Localz technology platform integrates real-time tracking of vehicle locations and communications to enhance the customer experience of delivery.

Report Scope

Report Features Description Market Value (2023) USD 14.7 Billion Forecast Revenue (2033) USD 75.7 Billion CAGR (2024-2032) 18.3% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Based on the Deployment Mode(On-Premise, Cloud-Based), Based on the Mode Of Transportation(Roadways, Railways, Waterways, Airways), Based on End-User Vertical(Manufacturing, Retail & E-commerce, Logistics, Government Organizations, Other End-Use Verticals) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape BluJay Solutions Ltd., Cargobase, Cerasis, Inc., GoComet, 3GTMS, Infor Inc., IBM Corporation, JDA Software Group, McKesson Corporation, Exxon Mobil Corporation, CIGNA Corporation, Valero, Alpega, Shipsy, SAP SE Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- BluJay Solutions Ltd.

- Cargobase

- Cerasis, Inc.

- GoComet

- 3GTMS

- Infor Inc.

- IBM Corporation

- JDA Software Group

- McKesson Corporation

- Exxon Mobil Corporation

- CIGNA Corporation

- Valero

- Alpega

- Shipsy

- SAP SE