Sweet And Savoury Spread Market By Type(Chocolate spread, Honey, Jam and preserves, Nut and seed-based spreads, Yeast-based spreads), By Distribution Channel(Store-based, Non-store based), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

13609

-

April 2024

-

189

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

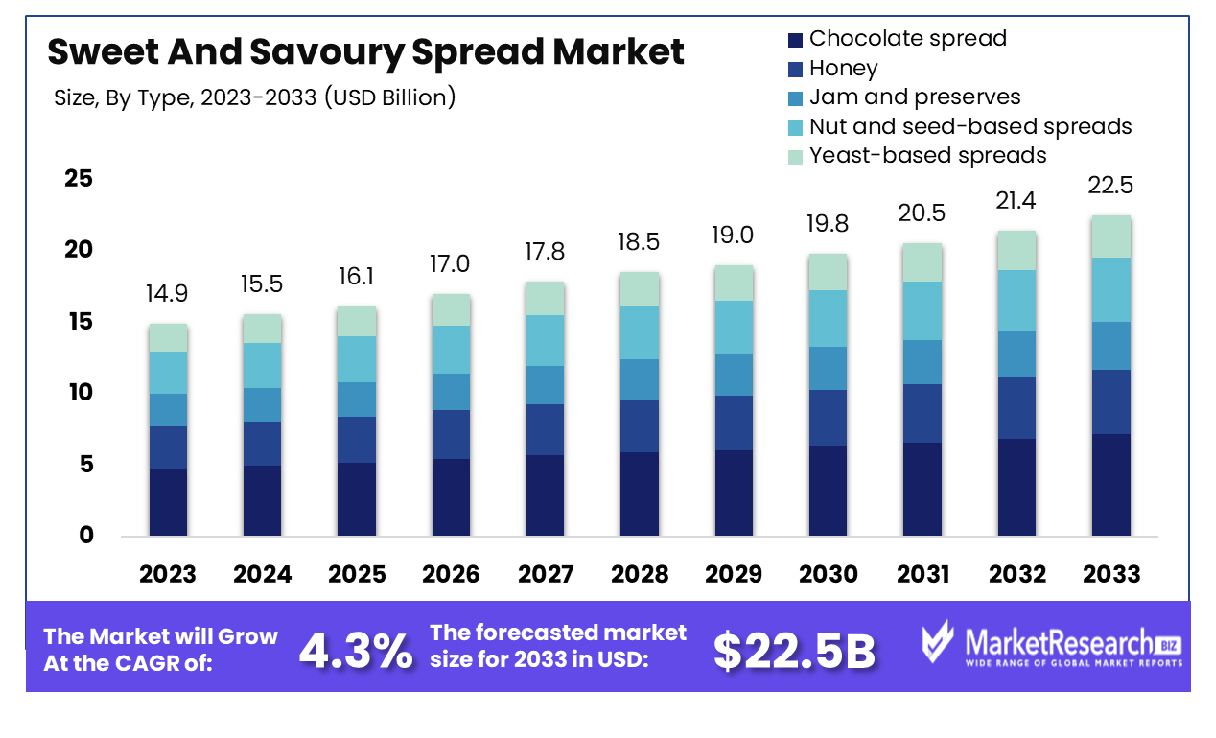

The Global Sweet And Savoury Spread Market was valued at USD 14.9 billion in 2023. It is expected to reach USD 22.5 billion by 2033, with a CAGR of 4.3% during the forecast period from 2024 to 2033.

A sweet and savory spread is defined as a versatile condiment and toppings that integrate both sweet and savory flavors that create a distinct and balanced taste experience. These spreads often incorporate ingredients like fruits, cheese, spices, herbs, nuts, and sometimes meats or vegetables. They can change broadly in texture ranging from smooth and creamy to chunky and textured. The general examples consist of fruit conserves with added herbs and cheeses, nut butter mixed with savory seasonings, and chutneys that include a mixture of fruits, species, and savory ingredients.

Sweet and savory spreads are used in different cooking applications that comprise toppings for bread, toast, and crackers, as endeavors to cheese boards or charcuterie platters, or as an ingredient in sandwiches, salads, and wraps. Such versatility permits creative flavor integration that attracts a broad range of palates by making them a well-preferred choice for both casual dining and gourmet cuisines.

A Challenge Dairy in May 2022, highlights that Challenge Butter, which is a leading US farmer-owned butter brand has declared the launch of challenge butter snack spreads. These new spreads make several of my favorite sweet and savory flavor profiles that range from chocolate and salted caramel to everything and buffalo which is available in a challenge butter-based spread.

Challenge Butter Snack Spreads are packaged in 6.5 oz tubs with an SRP of $3.99 and just smash shelves at Albertsons and its other businesses comprising Safeway, Jewel-Osco Vons, Meijer, Spartan Nash, Harris Teeter, SaveMart, Lucky’s, Lowe’s Foods and Woodman’s Markets, with additional retail availability to follow this summer.

Sweet and savory spreads provide versatility in different flavor profiles that cater to multiple tastes, choices, and cooking applications. They can raise simple dishes into gourmet creations by adding intricacy and depth to both sweet and savory dishes.

Moreover, these spreads offer ease and personalization options for improving the taste of snacks, main courses, and appetizers by making them a versatile pantry staple. The demand for sweet and savory spreads will increase due to its demand in the food industry which will help in market expansion in the coming years.

Key Takeaways

- Market Growth: The Global Sweet And Savoury Spread Market was valued at USD 14.9 billion in 2023. It is expected to reach USD 22.5 billion by 2033, with a CAGR of 4.3% during the forecast period from 2024 to 2033.

- By Type: Chocolate spread dominates the market by type, captivating consumers with its rich flavor and versatility.

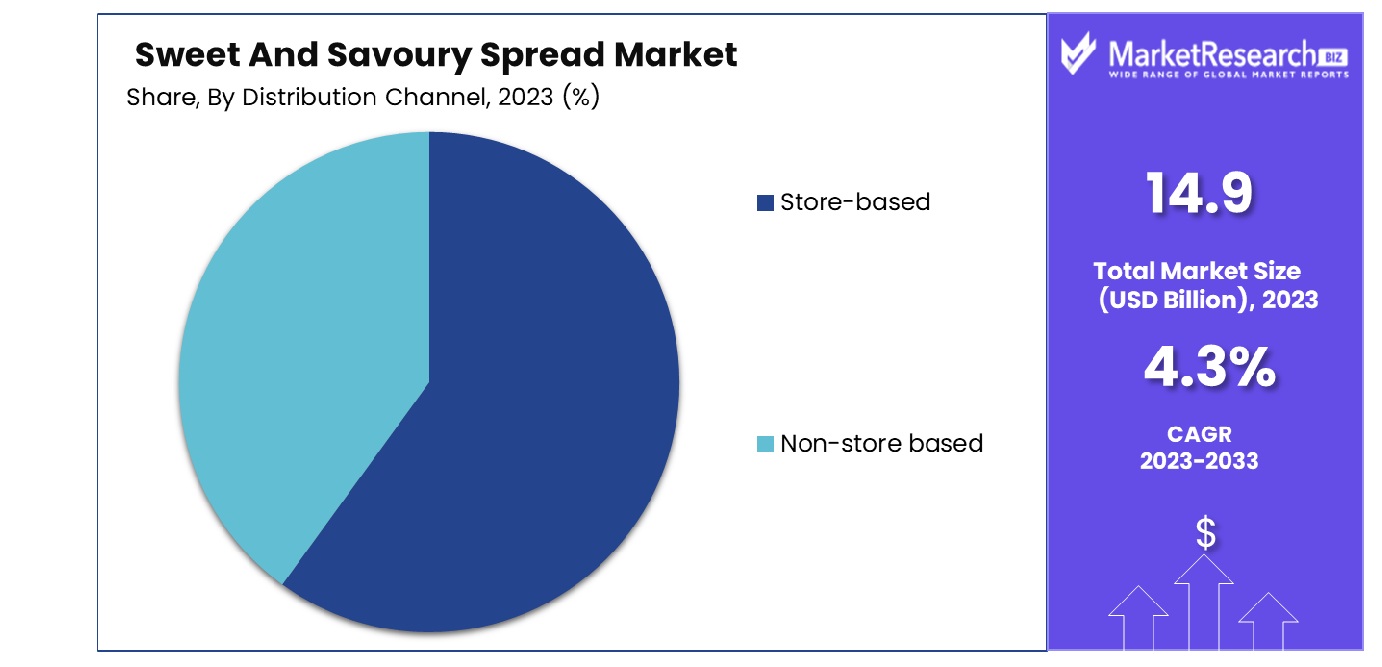

- By Distribution Channel: Store-based distribution channels ensure widespread availability, facilitating easy access for chocolate spread enthusiasts.

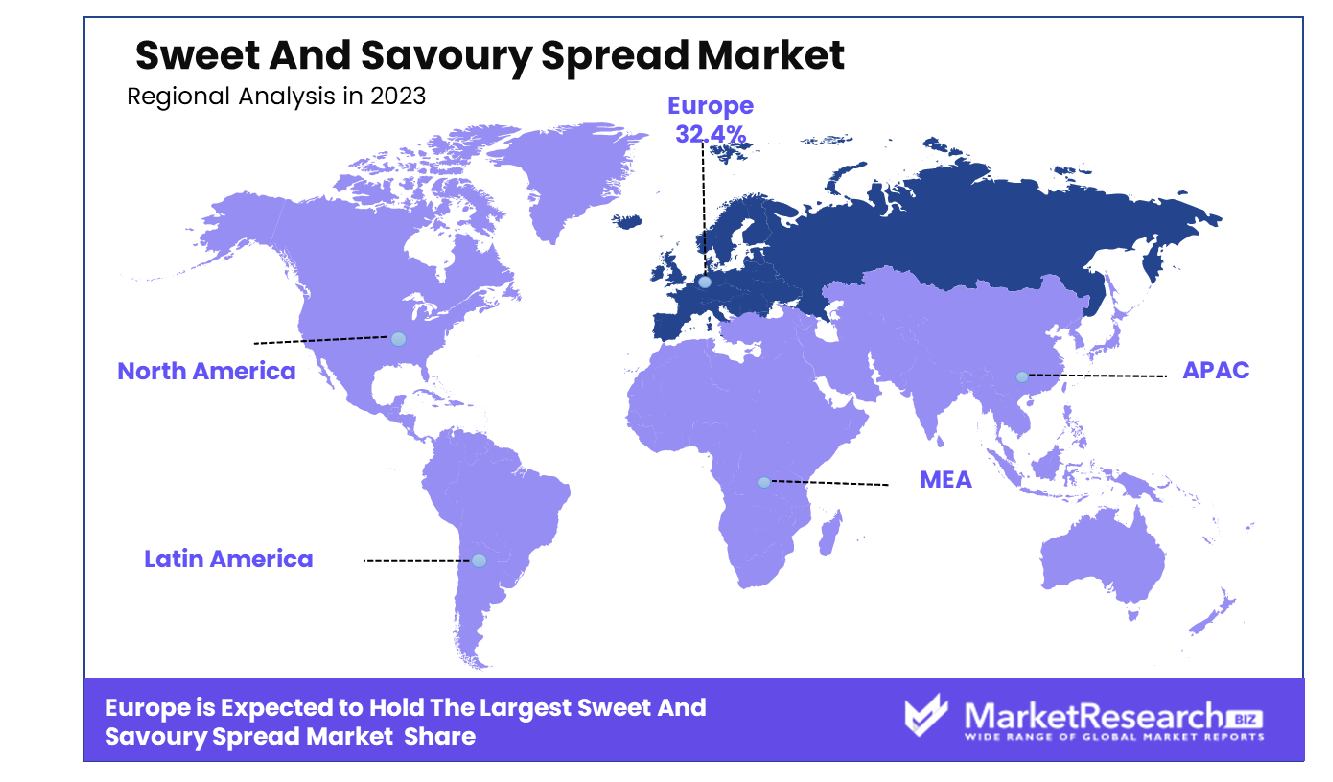

- Regional Dominance: Europe dominates the Sweet and Savoury Spread market with a 32.4% share.

- Growth Opportunity: The global Sweet and Savoury Spread Market in 2023 is characterized by innovation in flavors and healthier ingredients, expansion into online retail, and targeted marketing campaigns for diverse consumer preferences.

Driving factors

Shift in Consumer Lifestyle Drives On-the-Go Consumption and Sweet & Savory Spread Market Growth

The sweet and savory spread market is experiencing a significant surge, primarily attributed to the profound shift in consumer lifestyles favoring on-the-go consumption. Modern consumers, driven by busy schedules and convenience, are increasingly turning to easily accessible food options, propelling the demand for spreads. With spreads offering a convenient and versatile option for quick meals and snacks, their popularity has soared. Statistics reveal a notable uptick in sales, with a significant portion attributed to the convenience factor, aligning with the evolving consumer lifestyle.

Increased Bakery Product Consumption Fuels Sweet & Savory Spread Market Expansion

The rising demand for bakery products and their complementary items, including spreads, emerges as a pivotal driver propelling the growth of the sweet and savory spread market. As consumers indulge in baked goods like bread, pastries, and crackers, the demand for spreads as accompaniments naturally follows suit. This symbiotic relationship between bakery products and spreads results in a mutually beneficial cycle, fostering market growth. Notably, the bakery industry's expansion, coupled with innovative product offerings, further amplifies the consumption of spreads, reflecting positively on market dynamics.

Growing Nutritional Awareness Catalyzes Sweet & Savory Spread Market Growth

Increasing awareness among consumers regarding the nutritive value of spreads acts as a significant catalyst driving market expansion. With heightened consciousness surrounding health and wellness, consumers are actively seeking nutritious food options. Spreads, enriched with essential nutrients and wholesome ingredients, align with this growing trend, positioning themselves as healthier alternatives to conventional condiments. The proliferation of health-conscious consumers translates into a surge in demand for spreads, bolstering market growth. This trend underscores the pivotal role of nutritional awareness in shaping consumer preferences and influencing market dynamics.

Restraining Factors

Health Concerns Drive Demand for Low-Sugar Alternatives in the Sweet & Savory Spread Market

Health concerns surrounding the sugar content in sweet spreads emerge as a significant restraining factor impacting market growth. With increasing awareness of the adverse effects of excessive sugar consumption on health, consumers are becoming more discerning about their food choices. Statistics indicate a growing preference for low-sugar or sugar-free alternatives among health-conscious individuals.

This shifting consumer behavior poses a challenge for traditional sweet spreads laden with high sugar content, prompting manufacturers to innovate and introduce healthier options. Consequently, the demand for low-sugar spreads, enriched with natural sweeteners or sugar substitutes, experiences a notable upsurge, albeit at the expense of conventional offerings.

Volatility in Ingredient Prices Creates Uncertainty in the Sweet & Savory Spread Market

The fluctuating prices of key ingredients present a persistent challenge for players in the sweet and savory spread market, exerting pressure on profit margins and hindering market growth. Ingredients such as nuts, fruits, and oils are subject to price volatility due to various factors, including weather conditions, supply chain disruptions, and geopolitical tensions. Such fluctuations in ingredient costs necessitate frequent adjustments in product pricing, potentially deterring price-sensitive consumers and impacting overall market demand.

Moreover, unpredictable ingredient prices can disrupt production schedules and procurement strategies, leading to operational inefficiencies and logistical challenges for manufacturers. To mitigate the impact of volatile ingredient prices, industry players resort to strategic sourcing, inventory management, and product diversification strategies, albeit with varying degrees of success. Nonetheless, the persistent uncertainty surrounding ingredient costs remains a notable restraining factor shaping market dynamics in the sweet and savory spread segment.

By Type Analysis

Chocolate spread is favored for its indulgent taste and versatility in culinary applications.

In 2023, Chocolate Spread held a dominant market position in the By Type segment of the Sweet and Savoury Spread Market. The widespread popularity of chocolate spread can be attributed to its indulgent flavor profile and versatile usage across various culinary applications. Consumers gravitate towards chocolate spread for its rich taste, making it a favored choice for breakfast, snacks, and dessert accompaniments.

Following closely behind chocolate spread in market share is Honey spread. Honey's natural sweetness, coupled with its perceived health benefits, continues to resonate with health-conscious consumers seeking alternatives to refined sugars. Its versatility as a sweetener and its inclusion in various recipes contribute to its steady growth within the Sweet and Savoury Spread Market.

Jam and preserves also maintain a significant presence within the segment. With their wide range of fruit flavors and textures, jams, and preserves appeal to consumers looking for traditional and nostalgic tastes. Moreover, the perception of jams and preserves as wholesome and comforting aligns with consumer preferences for natural and minimally processed foods.

Nut and seed-based spreads have witnessed notable growth due to the rising demand for plant-based alternatives and protein-rich products. Consumers increasingly opt for nut and seed spreads such as almond butter, peanut butter, and sunflower seed spread for their nutritional value and satiating properties.

Lastly, yeast-based spreads represent a niche yet emerging segment within the market. These spreads, including Marmite and Vegemite, appeal to consumers seeking savory flavor profiles and umami-rich additions to their meals.

By Distribution Channel Analysis

Store-based distribution channels offer convenient accessibility for consumers seeking these products.

In 2023, Store-based distribution channels held a dominant market position in the By Distribution Channel segment of the Sweet and Savoury Spread Market. This dominance is attributed to the widespread availability and accessibility of sweet and savory spreads in traditional brick-and-mortar retail outlets. Store-based distribution channels encompass supermarkets, hypermarkets, convenience stores, and specialty food stores, offering consumers a wide array of options and brands to choose from conveniently.

Supermarkets and hypermarkets, in particular, play a pivotal role in driving sales within this segment. Their extensive product assortments, promotional activities, and strategic placement of sweet and savory spreads within store layouts contribute to heightened consumer visibility and impulse purchases. Additionally, the ability to physically inspect products and compare options fosters consumer trust and confidence in their purchase decisions.

Convenience stores also significantly contribute to the market share of store-based distribution channels. Their strategic locations, extended operating hours, and emphasis on convenience appeal to consumers seeking quick and hassle-free shopping experiences. The availability of single-serve packets and grab-and-go options further enhances their appeal, catering to on-the-go consumers.

Specialty food stores cater to niche markets and enthusiasts seeking premium and artisanal sweet and savory spreads. These stores often offer curated selections, personalized service, and unique product offerings, attracting discerning consumers willing to pay a premium for quality and exclusivity.

In contrast, Non-store-based distribution channels, such as online retail platforms and direct-to-consumer sales, represent a smaller but growing segment within the market. While these channels offer convenience and accessibility, they face challenges related to shipping costs, perishability concerns, and the inability of consumers to physically sample products before purchase.

Key Market Segments

By Type

- Chocolate spread

- Honey

- Jam and preserves

- Nut and seed-based spreads

- Yeast-based spreads

By Distribution Channel

- Store-based

- Non-store based

Growth Opportunity

Innovation in Flavor Combinations and Healthier Ingredient Options

The 2023 outlook for the global Sweet and Savoury Spread Market presents promising opportunities, primarily fueled by a wave of innovation in flavor combinations and the introduction of healthier ingredient options. As consumers increasingly prioritize health-conscious choices, manufacturers are responding with products that offer a balance between indulgence and nutrition. By incorporating natural and organic ingredients, as well as reducing sugar and sodium content, companies are poised to capture a larger share of the market.

Expansion into New Distribution Channels such as Online Retail

The rapid growth of e-commerce has opened up new avenues for the Sweet and Savoury Spread Market, providing an opportunity for companies to reach a broader consumer base. In 2023, we anticipate a significant expansion into online retail channels, leveraging the convenience and accessibility they offer. By partnering with e-commerce platforms and optimizing their online presence, manufacturers can tap into the burgeoning digital market and drive sales growth.

Marketing Campaigns Targeting Diverse Consumer Preferences and Usage Occasions

To capitalize on evolving consumer preferences, companies are ramping up their marketing efforts with campaigns tailored to diverse demographics and usage occasions. In 2023, we expect to see targeted strategies that resonate with health-conscious consumers, as well as those seeking indulgent treats for special occasions. By understanding the nuances of consumer behavior and preferences, brands can effectively position their products and drive demand in the Sweet and Savoury Spread Market.

Latest Trends

Rising Demand for Convenient and Healthy Breakfast Options

The latest trends in the global Sweet and Savoury Spread Market for 2023 are underscored by surging demand for convenient and healthy breakfast options. As hectic lifestyles become the norm, consumers seek quick and nutritious meal solutions, propelling the consumption of sweet and savory spreads. Manufacturers are responding by offering products that cater to this need, emphasizing convenience without compromising on taste or nutritional value. This trend is expected to drive significant growth in the market as consumers prioritize health and convenience in their dietary choices.

Growing Popularity of Ethnic Cuisines and Fusion Food Trends

Another prominent trend shaping the Sweet and Savoury Spread Market in 2023 is the growing popularity of ethnic cuisines and fusion food trends. As global culinary influences continue to merge, consumers are increasingly embracing innovative flavors and varieties in their spreads. Manufacturers are capitalizing on this trend by introducing a diverse range of products inspired by international cuisines, catering to adventurous palates seeking new taste experiences. From spicy Indian chutneys to tangy Korean kimchi spreads, the market is witnessing a proliferation of unique offerings that appeal to the evolving preferences of consumers worldwide.

Regional Analysis

Europe dominates the Sweet and Savoury Spread market, accounting for 32.4% of the global share.

North America, as a mature market, exhibits steady growth attributed to the increasing consumer preference for convenience foods. According to recent data, the region accounted for 27% of the global sweet and savory spread market share, driven primarily by the rising demand for healthier and organic spread options. Additionally, the prevalence of busy lifestyles and the growing trend of on-the-go consumption further bolster market growth.

In Europe, the market boasts a dominant position, capturing approximately 32.4% of the global market share. This stronghold is reinforced by factors such as the rich culinary heritage, coupled with the rising demand for premium and artisanal spread varieties. Moreover, heightened awareness regarding health and wellness drives the adoption of natural and organic spread options, thereby augmenting market expansion. The region's emphasis on sustainability and ethical sourcing further contributes to its market dominance.

Asia Pacific emerges as a lucrative market, characterized by rapid urbanization, changing dietary habits, and increasing disposable incomes. With a substantial population base and growing awareness regarding Western food trends, the region presents significant growth prospects. Market analysis indicates a notable increase in consumption rates, particularly in emerging economies like China and India, propelled by the expanding middle-class population and urbanization.

The Middle East & Africa and Latin America regions, although showing potential, exhibit comparatively slower growth rates. Factors such as economic volatility and cultural preferences influence market dynamics in these regions. However, initiatives aimed at product innovation and strategic marketing efforts are anticipated to stimulate market growth in the coming years.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In 2023, the global sweet and savory spread market witnessed significant competitive dynamics, with several key players vying for market share and consumer attention. Among these, Unilever emerged as a prominent force, leveraging its extensive distribution network, brand recognition, and diversified product portfolio to maintain a strong foothold in the market. Unilever's commitment to innovation and sustainability further solidified its position, resonating with increasingly conscientious consumers.

Similarly, The Kraft Heinz Company demonstrated resilience and adaptability, capitalizing on its heritage brands and strategic acquisitions to address evolving consumer preferences. By embracing digital marketing initiatives and product diversification, Kraft Heinz sustained its relevance in an ever-changing market landscape.

The J.M. Smucker Company showcased its ability to navigate market challenges, emphasizing product quality and consumer trust. With a focus on natural ingredients and flavor innovation, Smucker's appealed to health-conscious consumers while staying true to its heritage and tradition.

Conagra Brands, Inc. distinguished itself through strategic partnerships and portfolio optimization, aligning with consumer demand for convenience and indulgence. By leveraging data analytics and consumer insights, Conagra effectively tailored its offerings to meet diverse preferences and lifestyles.

Ferrero Group stood out for its premium positioning and commitment to craftsmanship, captivating consumers with indulgent experiences and aspirational branding. Premier Foods Plc, Wellness Foods Ltd., Nature Food Chocolatier, Nestle, ConAgra Foods Inc., and National Grape Co-operative Inc. also contributed to the market's vibrancy through product innovation, market expansion, and consumer engagement strategies. As competition intensifies, these key players are expected to continue driving growth and innovation, shaping the sweet and savory spread market in the years ahead.

Market Key Players

- Unilever

- The Kraft Heinz Company

- The J.M. Smucker Company

- Conagra Brands, Inc.

- Ferrero Group

- Premier Foods Plc,

- Wellness Foods Ltd.

- Nature food Chocolatier

- Nestle

- ConAgra Foods Inc.

- National Grape Co-operative Inc.

Recent Development

- In February 2024, Good Food conducted taste tests on novelty hot cross buns, revealing Cadbury Caramilk as the favored flavor, delighting consumers with its fluffy texture and rich caramel taste.

- In November 2023, Baskin-Robbins unveils November's Flavor of the Month, "Turkey Day Fixin's," blending sweet potato, cranberry sauce, autumn spice, and honey cornbread for a Thanksgiving-inspired ice cream delight.

- In August 2023, Chick-fil-A introduced the Honey Pepper Pimento Chicken Sandwich, blending Southern flavors of pimento cheese and pickled jalapenos for a unique twist on its classic chicken sandwich.

Report Scope

Report Features Description Market Value (2023) USD 14.9 Billion Forecast Revenue (2033) USD 22.5 Billion CAGR (2024-2032) 4.3% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Chocolate spread, Honey, Jam and preserves, Nut and seed-based spreads, Yeast-based spreads), By Distribution Channel(Store-based, Non-store based) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Unilever, The Kraft Heinz Company, The J.M. Smucker Company, Conagra Brands, Inc., Ferrero Group, Premier Foods Plc,, Wellness Foods Ltd., Nature Food Chocolatier, Nestle, ConAgra Foods Inc., National Grape Co-operative Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Unilever

- The Kraft Heinz Company

- The J.M. Smucker Company

- Conagra Brands, Inc.

- Ferrero Group

- Premier Foods Plc,

- Wellness Foods Ltd.

- Nature food Chocolatier

- Nestle

- ConAgra Foods Inc.

- National Grape Co-operative Inc.