Logistics Market By Transportation type(Airways, Waterways, Railways, Roadways), By logistic type(First Party, Second Party, Third-Party), By End-user(Industrial and Manufacturing, Retail, Healthcare, Oil & Gas, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

7639

-

May 2024

-

300

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

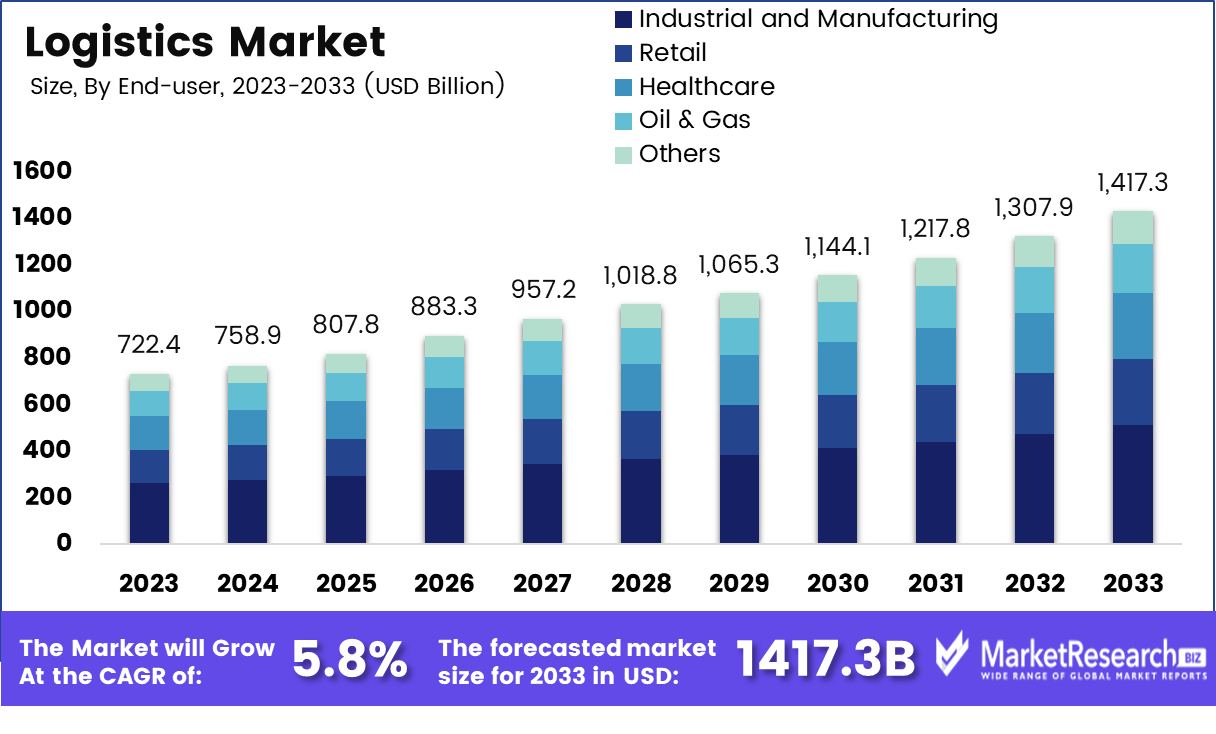

The Logistics Market size is expected to be worth around USD 1417.3 Bn by 2033 from USD 722.4 Bn in 2023, growing at a CAGR of 5.8% during the forecast period from 2024 to 2033.

The logistics market encompasses the comprehensive processes and services involved in the transportation, warehousing, and distribution of goods from origin to destination. It is a critical component of the global supply chain, ensuring the efficient and timely movement of products across various sectors. This market integrates advanced technologies, such as artificial intelligence, robotics, and big data analytics, to optimize operations and enhance supply chain visibility. As economies expand and e-commerce thrives, the logistics market is increasingly pivotal in supporting international trade, managing inventory, reducing operational costs, and improving customer satisfaction through faster delivery times.

The logistics market is currently witnessing a significant transformation, driven by multiple factors that are reshaping the industry's landscape. At the forefront, digital transformation within the sector is enhancing efficiency and scalability. Technologies such as the Internet of Things (IoT) and advanced robotics are being increasingly deployed to streamline operations and improve accuracy in inventory and delivery systems. These technological integrations are crucial as they not only optimize logistics operations but also play a pivotal role in ensuring workforce safety—a growing priority within the industry.

The logistics market is currently witnessing a significant transformation, driven by multiple factors that are reshaping the industry's landscape. At the forefront, digital transformation within the sector is enhancing efficiency and scalability. Technologies such as the Internet of Things (IoT) and advanced robotics are being increasingly deployed to streamline operations and improve accuracy in inventory and delivery systems. These technological integrations are crucial as they not only optimize logistics operations but also play a pivotal role in ensuring workforce safety—a growing priority within the industry.Amidst these advancements, the e-commerce boom continues to exert a profound influence on the market dynamics. The surge in online shopping has necessitated robust logistics solutions that can handle increased volumes of deliveries, often requiring sophisticated and agile response capabilities from logistics providers. This requirement is further compounded by consumer expectations for faster deliveries, adding pressure on logistics firms to innovate continually.

In this evolving market, companies like Patel Integrated Logistics Ltd. exemplify the sector's potential for growth and resilience. The company's recent financial performance, with a notable 5.47% increase in stock price to Rs 22.75, underscores the robust health of the logistics sector. Patel Integrated's impressive results for Q4FY24 and the full fiscal year reflect not only its operational success but also its strategic positioning to capitalize on sectoral expansion plans, despite global economic uncertainties. This performance is indicative of the broader trends in the logistics market, where adaptability and forward-thinking are key to leveraging opportunities and overcoming challenges. Such data points are essential for stakeholders to understand the current market trajectory and anticipate future developments in this vital industry.

Key Takeaways

- Market Value: The Logistics Market size is expected to be worth around USD 1417.3 Bn by 2033 from USD 722.4 Bn in 2023, growing at a CAGR of 5.8% during the forecast period from 2024 to 2033.

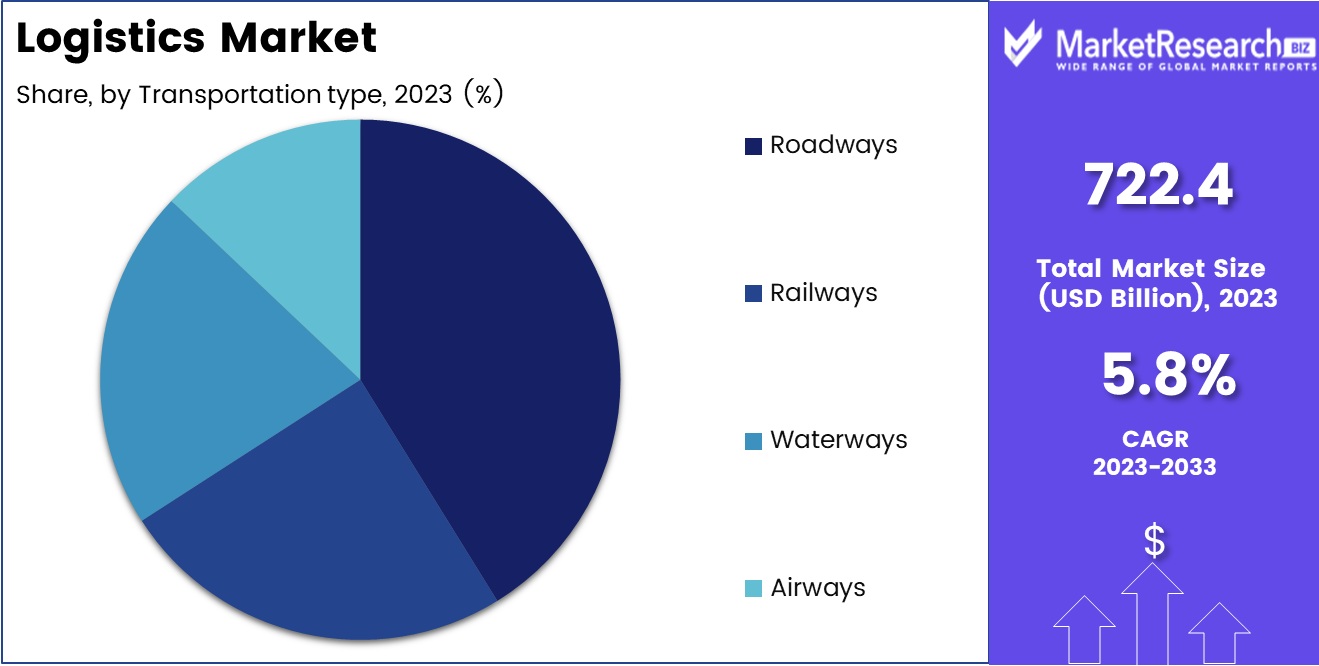

- Based on Transportation type: Roadways dominate the transportation segment in the logistics market.

- Based on Logistic type: Efficient third-party logistics services optimizing supply chain operations seamlessly worldwide.

- Based on End-user: Industrial and manufacturing logistics focus on streamlining operations and distribution.

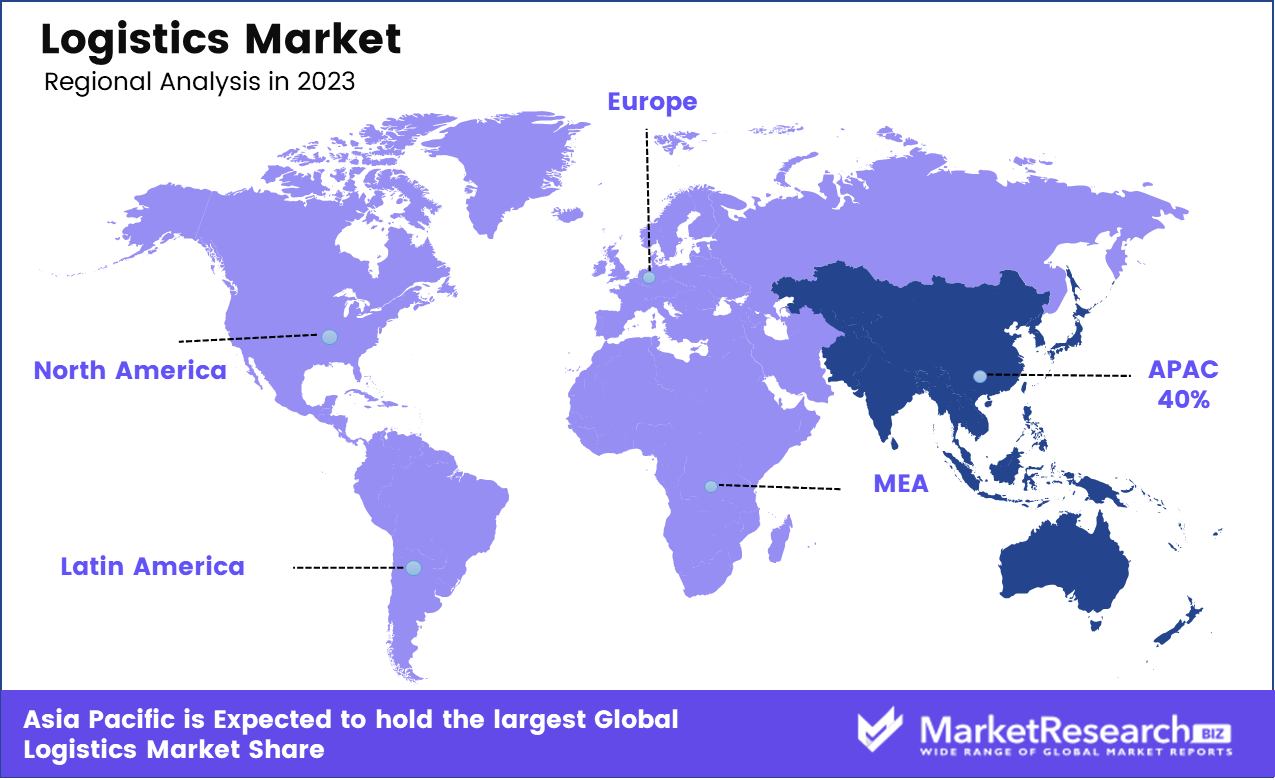

- Regional Analysis: Asia-Pacific holds a 40% share of the global logistics market.

- Growth opportunity: In 2023, the global logistics market is poised for substantial growth by capitalizing on increasing global trade, through enhanced shipping services and efficiency improvements, as well as seizing opportunities in rapidly growing markets like India by investing in express logistics capabilities and advanced technological solutions.

Driving factors

Rising Transportation Expenses: Driving Cost Efficiencies in Logistics

Rising transportation expenses are a pivotal factor propelling the logistics market's growth. The escalation in costs can be attributed to a complex blend of changing regulations, fluctuating fuel prices, and capacity limitations. These factors compel logistics companies to optimize routes and enhance operational efficiencies to maintain profitability. Regulations, often varying by region, dictate operational standards and environmental compliance, requiring companies to invest in newer, greener technologies and processes.

Fluctuating fuel prices add a layer of unpredictability, pushing companies to adopt fuel-efficient modes of transport and technologies. Capacity limitations, especially in freight and shipping, force a reevaluation of supply chain management strategies, potentially leading to increased investments in logistics infrastructure to accommodate growing demand.

Transparency and Supply Chain Visibility: Ensuring Reliability and Trust

The demand for transparency and supply chain visibility is another significant driver of growth in the logistics sector. In today's complex supply chains, end-to-end visibility is not merely a convenience but a necessity for managing operations efficiently and ensuring reliability in delivery systems. Enhanced visibility helps companies predict disruptions, manage inventories more effectively, and optimize delivery times, thereby improving service levels. The ability to track products from origin to destination fosters trust and satisfaction among clients, enhancing customer relationships and supporting business expansion.

Integration of Technology: Revolutionizing Logistics Through Innovation

The integration of advanced technologies such as blockchain, artificial intelligence (AI), and the Internet of Things (IoT) is revolutionizing the logistics industry. These technologies facilitate significant improvements in efficiency and accuracy. Blockchain offers immutable record-keeping and enhanced security features, ideal for transparent documentation and verification processes across global supply chains.

AI optimizes routing and predictive maintenance, reducing downtime and costs. IoT devices provide real-time data on vehicle locations and cargo conditions, enabling proactive management of assets. Together, these technologies not only streamline operations but also open new avenues for service offerings and business models in logistics.

Restraining Factors

Meeting Customer Expectations: Navigating the E-commerce Evolution

The rise of e-commerce and on-demand services has significantly reshaped customer expectations, placing immense pressure on the logistics sector. Customers now demand faster deliveries, real-time tracking, more flexible delivery options, and exceptional service. Fulfilling these expectations requires logistics companies to enhance their operational agility and invest in advanced technologies.

This surge in demand drives the logistics market to innovate continually and adapt its strategies to maintain customer satisfaction and competitive edge. For instance, implementing sophisticated IT systems for better inventory management and customer interface can help meet these evolving demands. However, the challenge lies in scaling these solutions cost-effectively without compromising service quality, pushing companies to refine their logistical frameworks continually.

Delivery Efficiency: Overcoming Urban Logistics Barriers

Delivery efficiency is a critical challenge that directly impacts the growth of the logistics market, particularly in urban areas. Congested city environments, coupled with the expectation for time-sensitive deliveries, present logistical hurdles that can impede operational efficiency. Urban logistics require innovative approaches to navigate traffic congestion and limited access areas effectively.

Strategies such as deploying micro-fulfillment centers, utilizing eco-friendly vehicles, and optimizing last-mile delivery operations are crucial. These measures not only aim to boost delivery efficiency but also seek to reduce environmental impact and enhance customer satisfaction by ensuring timely deliveries. The integration of technology such as real-time route optimization software and predictive analytics also plays a vital role in addressing these challenges, thereby supporting sustained growth in the logistics market amidst increasing urbanization pressures.

Transportation Type Analysis

Roadways dominate the logistics market, offering flexible, cost-effective transport solutions globally.

In 2023, Roadways held a dominant market position in the "By Transportation Type" segment of the Logistics Market. This prominence is attributed to several key factors that include extensive road infrastructure, flexibility in route management, and cost-effectiveness compared to other modes of transportation like airways and waterways.

The road transportation sector benefits significantly from its capability to provide door-to-door service, facilitating higher efficiency and convenience for last-mile deliveries—critical in the era of e-commerce and just-in-time delivery models. Furthermore, advancements in vehicle technology, such as increased fuel efficiency and the integration of GPS and IoT technologies, have enhanced the operational efficiencies of road logistics, reducing costs and improving service reliability.

Moreover, the growth of roadways in the logistics market is supported by substantial investments in road infrastructure by governments worldwide, aiming to boost economic growth through improved regional connectivity. These investments are often part of broader economic stimulus plans, which also include enhancements to safety and emission standards, pushing the sector toward more sustainable practices.

However, the road logistics sector faces challenges such as traffic congestion, regulatory changes, and the urgent need for supply chain decarbonization. The future growth of this segment will likely depend on how quickly it can integrate electric vehicles and autonomous driving technologies to mitigate environmental impacts and address the growing demands for quicker, more cost-effective delivery solutions.

Logistic Type Analysis

Third-Party Logistics (3PL) leads the market, enhancing supply chain efficiency and flexibility.

In 2023, Third-Party Logistics (3PL) held a dominant market position in the "By Logistic Type" segment of the Logistics Market. This dominance stems from the increasingly complex supply chain requirements of modern businesses and the growing need for specialized and scalable logistics solutions.

Third-party logistics providers offer significant advantages by managing inventory, warehousing, fulfillment, and shipping operations, allowing companies to focus on their core competencies rather than logistics management. The 3PL model supports businesses in achieving greater operational flexibility and efficiency, factors that are critical in a globalized market with fluctuating demand and supply dynamics.

The expansion of e-commerce has particularly propelled the growth of the 3PL segment. Online retailers, facing the need to ensure fast delivery times to maintain customer satisfaction, often rely on 3PL providers to manage their logistics efficiently. Furthermore, the integration of advanced technologies such as artificial intelligence, machine learning, and data analytics into the services provided by 3PL companies enhances visibility and control over the supply chain, making these services even more attractive to potential clients.

Moreover, the scalability offered by 3PL providers enables businesses to adjust their logistics operations based on current market conditions, a valuable feature especially in industries experiencing seasonal demand. This flexibility, combined with the cost savings associated with outsourcing logistics services, underscores the strong market position of third-party logistics providers.

End-user Analysis

Industrial and manufacturing sectors boost the logistics market with demand for robust, streamlined supply chains.

In 2023, the Industrial and Manufacturing sector held a dominant market position in the "By End-User" segment of the Logistics Market. This sector's leadership is primarily driven by its extensive reliance on the efficient and timely transportation of raw materials, components, and finished products, which are integral to maintaining production schedules and meeting market demands.

The robustness of Industrial and Manufacturing logistics is facilitated by highly integrated supply chain networks that optimize inventory management, reduce operational costs, and enhance product throughput via streamlined logistics operations. The adoption of Just-In-Time (JIT) manufacturing strategies, which require precise timing of material deliveries to minimize inventory costs, further underscores the critical role of sophisticated logistics solutions in this sector.

Technological advancements such as automation, robotics, and the Internet of Things (IoT) have significantly transformed logistics practices within the industry. These innovations enable real-time tracking and forecasting, which improves decision-making and reduces downtime by anticipating and mitigating potential disruptions in the supply chain.

Furthermore, as globalization increases, manufacturers are expanding their reach to new markets, necessitating a more complex logistics framework that can handle international regulations, longer transport routes, and varied logistical challenges across borders. This global expansion supports the growing demand for logistics services that are not only efficient but also compliant with international trade laws and environmental standards.

Global Logistics Market Segmentation:

By Transportation type

- Airways

- Waterways

- Railways

- Roadways

By Logistic type

- First Party

- Second Party

- Third-Party

By End-user

- Industrial and Manufacturing

- Retail

- Healthcare

- Oil & Gas

- Others (Media and entertainment)

Growth Opportunity

Leveraging Growth in Shipping Services

The global logistics market in 2023 stands to benefit significantly from the expanding shipping industry, driven by an increase in global trade activities. As import and export procedures grow more streamlined and volumes increase, there is a substantial opportunity for logistics companies to capitalize on the burgeoning demand.

Shipping services, crucial for moving goods across borders, are positioned to yield high profits as they adapt to the shifting dynamics of international trade. This includes investing in more efficient fleet management, enhancing digital tracking technologies, and improving intermodal connections to speed up shipping times and reduce costs, thereby maximizing profitability in a competitive environment.

Capitalizing on the Surge in Express Logistics

Another significant opportunity in 2023 is within the express logistics sector, particularly in burgeoning markets like India. With an anticipated annual growth rate of 21%, the express logistics industry in India is poised to play a pivotal role in enhancing the country’s trade framework and boosting its supply chain competitiveness. This rapid growth signals a crucial investment opportunity for global logistics firms to establish or expand their presence in the region.

By leveraging advanced logistics solutions such as automation, real-time data analytics, and enhanced last-mile delivery services, companies can effectively meet the increasing demand for quicker, more reliable delivery services, thus securing a substantial market share in one of the world's fastest-growing economies.

Latest Trends

Embracing Artificial Intelligence in Operations

A significant trend shaping the logistics industry in 2023 is the integration of Artificial Intelligence (AI). This technology is increasingly pivotal in transforming logistics operations, offering substantial improvements in efficiency and cost-effectiveness. AI’s role extends to predictive analytics, enabling companies to anticipate demand fluctuations and optimize inventory management.

Furthermore, AI-driven route planning helps in navigating the complexities of delivery networks, ensuring faster and more efficient transportation. In warehouse management, AI technologies automate labor-intensive tasks and streamline operations, reducing human error and enhancing throughput. As AI continues to evolve, its adoption can provide logistics companies with a competitive edge by significantly lowering operational delays and costs while improving service delivery.

Innovating Last-Mile Delivery

Another trend gaining momentum in 2023 is the optimization of last-mile delivery, recognized as one of the most critical and challenging aspects of the supply chain. Innovations such as autonomous delivery vehicles and drones are being increasingly deployed to address these challenges. These technologies offer potential solutions to reduce delivery times and costs, especially in urban environments where congestion and accessibility can hinder efficiency.

Autonomous vehicles and drones also minimize the need for human intervention, thus reducing operational costs and improving delivery predictability. This trend not only enhances customer satisfaction through timely deliveries but also positions logistics companies at the forefront of technological adoption, ready to meet evolving consumer expectations in a digitally-driven marketplace.

Regional Analysis

Asia-Pacific dominates the logistics market, holding a substantial 40% share of the global sector.

The global logistics market, a critical enabler of international trade and economic growth, displays distinct characteristics across various regions. In North America, the logistics sector is highly integrated with advanced technologies such as real-time tracking and autonomous delivery systems. This region benefits from a robust infrastructure and a strong e-commerce presence, driving demand for sophisticated logistic solutions. Europe, with its strategic geographic positioning and stringent regulatory frameworks, emphasizes sustainable and efficient logistics operations. The region's focus on reducing carbon emissions is accelerating the adoption of green logistics solutions.

Asia-Pacific, the most dominant region in the global logistics market, accounts for approximately 40% of the market share. This region's growth is propelled by rapid industrialization, expanding manufacturing base, and increasing intra-regional trade, particularly in China and India. The logistical frameworks in Asia-Pacific are being continuously upgraded to support the burgeoning e-commerce sector and vast cross-border trade flows.

The Middle East & Africa (MEA) region is witnessing a transformative phase in logistics, driven by infrastructure investments and strategic reforms to diversify economies away from oil dependence. The development of mega logistics hubs in the UAE and Saudi Arabia is particularly noteworthy, aimed at establishing the region as a critical link between Asia, Europe, and Africa.

Latin America, though smaller in comparison, is experiencing growth in its logistics market due to increased agricultural exports and e-commerce penetration. Challenges such as political instability and underdeveloped infrastructure are being actively addressed to improve logistical efficiency and connectivity.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2023, the global logistics market is defined by the strategic movements of several key players, each adapting to and driving the rapid transformations within the industry.

AmeriCold Logistics, LLC continues to lead in temperature-controlled warehousing and transportation services, capitalizing on the growing demand for perishable goods. C.H. Robinson Worldwide, Inc. leverages its robust freight and transportation management services to enhance supply chain efficiency across diverse industries. CEVA Holdings LLC distinguishes itself with its integrated logistics solutions, focusing on both freight management and contract logistics, which positions it well in emerging markets.

DHL International GmbH remains a powerhouse in global logistics, with significant investments in digital transformations and sustainability initiatives, aiming to strengthen its market position by enhancing operational efficiencies and customer service quality. Expeditors International of Washington Inc. continues to excel in freight forwarding, with a strong emphasis on customized logistics solutions.

FedEx Corporation is expanding its capabilities beyond traditional delivery services, incorporating robotics and AI to handle increasing e-commerce demands efficiently. J.B. Hunt Transport Services, Inc. is enhancing its intermodal transport services, focusing on technology-driven solutions to streamline operations. Kuehne + Nagel Ltd. focuses on digital innovation, particularly in the area of environmentally sustainable logistics solutions.

Penske Logistics, Inc. and Ryder System, Inc. both emphasize the importance of fleet management and supply chain solutions tailored to specific industry needs, deploying advanced technology to improve visibility and control across their networks.

Market Key Players

- AmeriCold Logistics, LLC

- H. Robinson Worldwide, Inc.

- CEVA Holdings LLC

- DHL International GmbH

- Expeditors International of Washington Inc.

- FedEx Corporation

- B. Hunt Transport Services, Inc.

- Kuehne + Nagel Ltd.

- Penske Logistics, Inc

- Ryder System, Inc

Recent Development

- In March 2024, Shein, a global fast fashion leader, is expanding its business model by offering its "supply chain as a service" to third-party brands and suppliers, leveraging its small-batch manufacturing and advanced technology to enhance fashion innovation and efficiency, according to The Wall Street Journal.

- In May 2024, Patel Integrated Logistics Ltd. experienced a significant surge of 5.47% in its stock price to Rs 22.75 following the announcement of impressive quarterly and annual financial results for FY24, highlighting robust growth in both revenue and profit amid a positive outlook for the logistics sector, as reported by the BSE Sensex Index and NSE Nifty-50 Index.

- In March 2024, MSC Mediterranean Shipping Company finalized terms to acquire French freight forwarder Clasquin through its subsidiary SAS Shipping Agencies Services Sàrl, aiming to strengthen its global logistics network, especially synergizing with its African operations, amidst ongoing sector consolidation.

- In March 2024, Accenture acquired Flo Group, a leading European consultancy, and Oracle business partner, to enhance its Oracle supply chain capabilities and support clients in building more resilient and agile supply chains in Europe.

Report Scope

Report Features Description Market Value (2023) USD 722.4 Bn Forecast Revenue (2033) USD 1417.3 Bn CAGR (2024-2033) 5.8% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Transportation type(Airways, Waterways, Railways, Roadways), By logistic type(First Party, Second Party, Third-Party), By End-user(Industrial and Manufacturing, Retail, Healthcare, Oil & Gas, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape AmeriCold Logistics, LLC, H. Robinson Worldwide, Inc., CEVA Holdings LLC, DHL International GmbH, Expeditors International of Washington Inc., FedEx Corporation, B. Hunt Transport Services, Inc., Kuehne + Nagel Ltd., Penske Logistics, Inc, Ryder System, Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- AmeriCold Logistics, LLC

- H. Robinson Worldwide, Inc.

- CEVA Holdings LLC

- DHL International GmbH

- Expeditors International of Washington Inc.

- FedEx Corporation

- B. Hunt Transport Services, Inc.

- Kuehne + Nagel Ltd.

- Penske Logistics, Inc

- Ryder System, Inc