Global Spices and Seasonings Market By Product Type (Spices (Pepper, Ginger, Cinnamon, Others), Herbs (Garlic, Oregano, Others), Salt & Salt Substitutes), By Application (Meat and Poultry Products, Snacks and Convenience Food, Bakery and Confectionery, Soups, Sauces and Dressings, Frozen Products, Beverages, Others), By Distribution Channel (Foodservice, Retail), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2025-2034

-

51482

-

February 2025

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

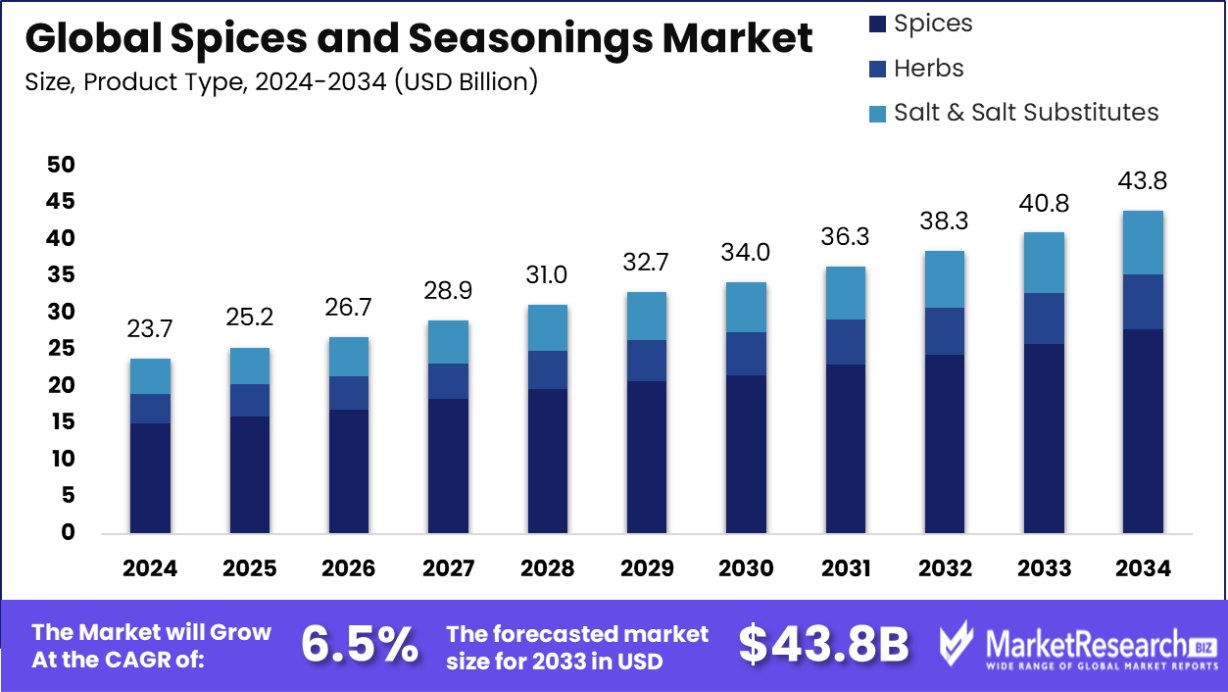

Global Spices and Seasonings Market was valued at USD 23.7 billion in 2024. It is expected to reach USD 43.8 billion by 2034, with a CAGR of 6.5% during the forecast period from 2025 to 2034.

Spices and Seasonings are plant-derived substances used to add flavor, color, and aroma to food. Spices generally come from roots, seeds, bark, or fruits of plants, while seasonings can include both herbs (leaves and stems of plants) and other flavor-enhancing ingredients like salt, pepper, and vinegar.

Popular spices include turmeric, cinnamon, black pepper, and cloves, while seasonings can involve ingredients like garlic powder, chili flakes, and mixed herb blends. These products are integral in cuisines around the world, offering diverse flavors and potential health benefits.

The spices and Seasonings Market refers to the global industry dealing with the production, distribution, and sale of spices, herbs, and related flavoring products. This market encompasses various forms, including whole spices, ground spices, and seasoning blends.

It spans food service, retail, and online distribution channels, catering to both individual consumers and businesses like restaurants and food processors. Growing global demand for culinary diversity and an increasing interest in cooking at home drive the market's growth, alongside innovations in packaging and product offerings.

The growing global interest in diverse cuisines, driven by increased cross-cultural exchanges and culinary experimentation, is a significant growth factor for the spices and seasonings market. Consumers are seeking authentic, exotic flavors and natural, clean-label products, leading to a rise in demand for premium and organic offerings. Additionally, health-conscious trends favoring spices with anti-inflammatory, antioxidant, and other wellness properties further boost market growth.

Consumer demand for spices and seasonings is increasingly influenced by the growing popularity of home cooking, particularly post-pandemic. The convenience and affordability of ready-to-use spice mixes and blends, along with a rise in health-conscious eating habits, have heightened demand. Additionally, there is an increasing focus on ethnic and international cuisines, further driving demand for a wide variety of spices and seasonings.

There is a significant opportunity in the development of organic, sustainable, and health-focused spices and seasoning products. With consumers shifting towards clean-label and preservative-free options, brands that offer ethically sourced, natural, and functional products can capitalize on emerging trends.

Key Takeaways

- Global Spices and Seasonings Market was valued at USD 23.7 billion in 2024. It is expected to reach USD 43.8 billion by 2034, with a CAGR of 6.5% during the forecast period from 2025 to 2034.

- Spices account for 63.5% of the Spices and Seasonings Market, driving global demand.

- Meat and poultry products account for 31.4% of the Spices and Seasonings Market's application share.

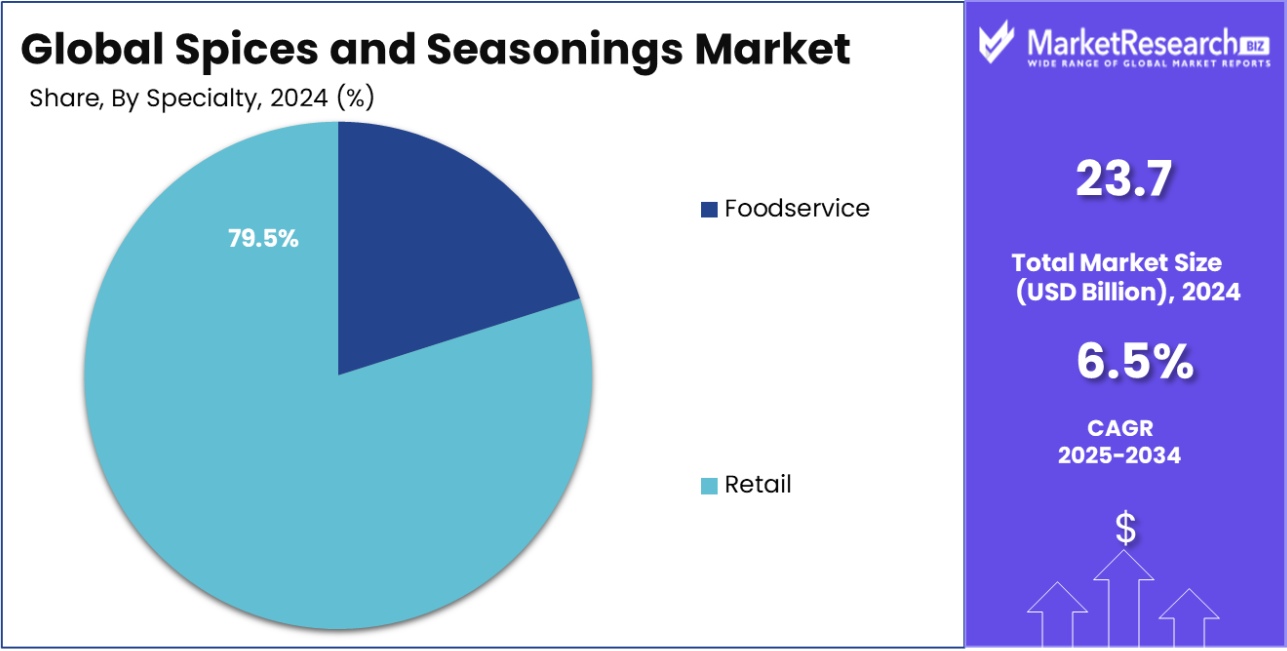

- Retail channels dominate the Spices and Seasonings Market, contributing to 79.5% of overall distribution.

By Product Type Analysis

Spices dominate the market, accounting for 63.5% of sales.

In 2024, Spices held a dominant market position in the By Product Type segment of the Spices and Seasonings Market, with a 63.5% share. This segment includes key spices such as pepper, ginger, cinnamon, and others. Among these, pepper emerged as the largest contributor, owing to its wide application across various culinary and industrial uses.

Ginger, with its diverse health benefits and culinary uses, also witnessed a significant share, further driving the growth of the spices segment. Cinnamon, primarily used in both sweet and savory dishes, contributed to the overall demand, supported by rising consumer preference for organic and natural ingredients.

In addition to spices, the herbs category also played a crucial role in market expansion. Garlic and oregano led the herb segment, driven by their increasing incorporation in both fresh and dried forms across food preparations globally. Other herbs contributed to the segment's diversity, with rosemary, thyme, and basil becoming increasingly popular in culinary practices.

The Salt & Salt Substitutes segment, while smaller in comparison, maintained steady growth. Consumers are gradually shifting toward healthier salt alternatives, contributing to the growth of salt substitutes in the market. Overall, the spices and seasonings market remains robust, with spices dominating the product type segment.

By Application Analysis

Meat and poultry products drive 31.4% of spice consumption globally.

In 2024, Meat and Poultry Products held a dominant market position in the By Application segment of the Spices and Seasonings Market, with a 31.4% share. This category was the leading driver in the demand for spices and seasonings, as spices play a vital role in enhancing the flavor, texture, and overall appeal of meat and poultry dishes.

The growing consumer preference for seasoned and ready-to-cook meat products contributed significantly to the market's expansion. Additionally, the rising popularity of grilled and marinated meats further boosted the demand for spices in this segment.

The Snacks and Convenience Food segment also saw considerable growth, fueled by the increasing demand for flavored and ready-to-eat snack options. Spices and seasonings are essential in enhancing the taste profiles of various snack products, such as chips, nuts, and processed foods.

The Bakery and Confectionery segment followed closely behind, with spices like cinnamon, nutmeg, and ginger playing an integral role in flavoring baked goods and sweets. Meanwhile, Soups, Sauces, and Dressings, alongside Frozen Products, also contributed to market growth, driven by consumers' increasing demand for quick, convenient, and flavorful food options.

The Beverages segment, while smaller in comparison, continues to show potential, particularly with the rising trend of spiced teas and flavored drinks.

By Distribution Channel Analysis

Retail channels represent 79.5% of the spices and seasonings market.

In 2024, Retail held a dominant market position in the By Distribution Channel segment of the Spices and Seasonings Market, with a 79.5% share. This segment's growth was primarily driven by the increasing consumer demand for spices and seasonings in household cooking.

Retail channels, including supermarkets, hypermarkets, and online grocery stores, provide convenient access to a wide range of spices and seasonings, catering to a diverse consumer base. The growing trend of home cooking, especially during the pandemic, has further fueled the popularity of retail purchases, with consumers seeking high-quality and authentic flavoring options for their meals.

The Foodservice segment, although smaller in comparison, held a significant share of the market. As the global foodservice industry, including restaurants, hotels, and catering services, continues to recover post-pandemic, the demand for spices and seasonings in bulk has risen. Chefs and food manufacturers are increasingly seeking innovative and premium spice blends to cater to evolving consumer tastes and dietary preferences.

While Retail continues to dominate the market, the Foodservice segment is expected to grow steadily in the coming years, driven by the expansion of quick-service restaurants (QSRs) and the increasing use of spices in commercial kitchens for both traditional and experimental culinary creations.

Key Market Segments

By Product Type

- Spices

— Pepper

— Ginger

— Cinnamon

— Others - Herbs

— Garlic

— Oregano

— Others - Salt & Salt Substitutes

By Application

- Meat and Poultry Products

- Snacks and Convenience Food

- Bakery and Confectionery

- Soups, Sauces and Dressings

- Frozen Products

- Beverages

- Others

By Distribution Channel

- Foodservice

- Retail

Driving Factors

Rising Demand for Home Cooking and Meal Prep

The increasing trend of home cooking, especially post-pandemic, has driven the demand for spices and seasonings. Consumers are increasingly looking for ways to elevate their meals, with spices playing a key role in enhancing flavor and diversity in everyday cooking.

As more people experiment with different cuisines, the market for spices in retail channels has seen robust growth, further fueled by meal prep and cooking at home.

Growing Popularity of Health-Conscious and Natural Products

As consumers become more health-conscious, there is a rising preference for natural, organic, and health-benefiting spices. Spices such as turmeric, ginger, and cinnamon are increasingly valued for their medicinal properties, including anti-inflammatory and antioxidant benefits.

This shift toward clean, natural ingredients is driving the demand for healthier seasoning alternatives, propelling the growth of organic spice products in both retail and foodservice sectors.

Innovation in Spice Blends and New Flavors

The evolving consumer desire for unique and bold flavors has led to the development of innovative spice blends. Manufacturers are experimenting with new combinations, catering to diverse tastes and cultural preferences.

Spices and seasonings that offer a fusion of global flavors or cater to specific dietary needs, such as low-sodium or gluten-free options, are gaining popularity. This innovation is attracting consumers who want to try new and exciting tastes in their cooking.

Restraining Factors

Volatility in Spice Prices Due to Supply Chain Issues

Fluctuations in the prices of spices have been a major concern for the market. Global supply chain disruptions, climatic conditions, and geopolitical factors can cause unpredictable price increases, impacting both manufacturers and consumers.

The rising costs of raw spices, such as pepper and cumin, can create financial strain for producers and may discourage consumers from purchasing high-quality or premium products.

Stringent Regulations and Quality Control Challenges

The spices and seasonings market is heavily regulated, especially in terms of food safety and quality control standards. These regulations can create barriers for manufacturers, as they must meet stringent compliance requirements to ensure product quality and safety.

Moreover, contamination risks and concerns about adulteration of spices may lead to consumer distrust, negatively affecting market growth and the ability of smaller producers to compete.

Intense Competition from Substitutes and Alternatives

The growing availability of spice substitutes and flavor enhancers, such as artificial flavorings and MSG, poses a challenge to the market. These alternatives are often cheaper, have longer shelf lives, and can be used in bulk, making them attractive options for manufacturers.

The shift toward these substitutes, particularly in processed foods and fast food chains, can limit the growth of traditional spices and seasonings in the market.

Growth Opportunity

Expansion of Organic and Clean Label Products

As consumers continue to prioritize health and wellness, there is a growing demand for organic, clean-label spices and seasonings. Manufacturers can capitalize on this trend by offering products free from artificial additives and preservatives.

This shift toward natural and organic ingredients presents an opportunity for brands to differentiate themselves in the market, attract health-conscious consumers, and build long-term brand loyalty in the growing organic food sector.

Growing Demand for Ethnic and Global Flavors

With increasing globalization and a more diverse consumer base, there is an opportunity to expand the availability of ethnic and regional spice blends. Consumers are becoming more adventurous with their taste preferences, seeking out global flavors such as Indian, Mexican, and Mediterranean.

Spices and seasonings manufacturers can cater to this growing demand by offering a wider range of ethnic seasonings, tapping into emerging trends in fusion cuisine.

Growth in E-commerce and Online Retail Channels

The rapid expansion of e-commerce platforms presents a significant opportunity for the spices and seasonings market. With more consumers turning to online shopping for convenience and variety, spice brands can reach a broader audience by establishing a strong online presence.

By offering subscription services, curated spice kits, and convenient home delivery options, companies can capitalize on the growing trend of online food shopping and personalized culinary experiences.

Latest Trends

Rise in Popularity of Plant-Based and Vegan Spices

With the growing shift toward plant-based and vegan diets, spices and seasonings are being increasingly used to enhance the flavors of plant-based foods. This trend is reflected in the demand for vegan spice blends that cater to the unique flavors and textures of plant-based meats, dairy alternatives, and vegan-friendly dishes.

Brands are responding by developing new seasonings that complement plant-based culinary creations, helping to boost market growth.

Convenience-driven Spice Solutions for Busy Consumers

As lifestyles become busier, there is a rising trend for convenient, ready-to-use spice solutions. Pre-mixed spice blends, seasonings for meal kits, and single-use spice packets are gaining popularity among consumers seeking quick and easy ways to add flavor to their meals.

This trend is particularly evident in the growing demand for meal prep products and on-the-go snacks, driving innovation in convenient spice packaging and offerings tailored for busy lifestyles.

Growing Popularity of Functional and Medicinal Spices

Consumers are becoming more aware of spices' health benefits, leading to an increasing demand for functional seasonings. Spices known for their medicinal properties, such as turmeric, ginger, and cinnamon, are incorporated into everyday meals for their potential health benefits, including anti-inflammatory and digestive properties.

This trend is paving the way for brands to introduce functional spice blends that target specific wellness needs, fueling growth in the market.

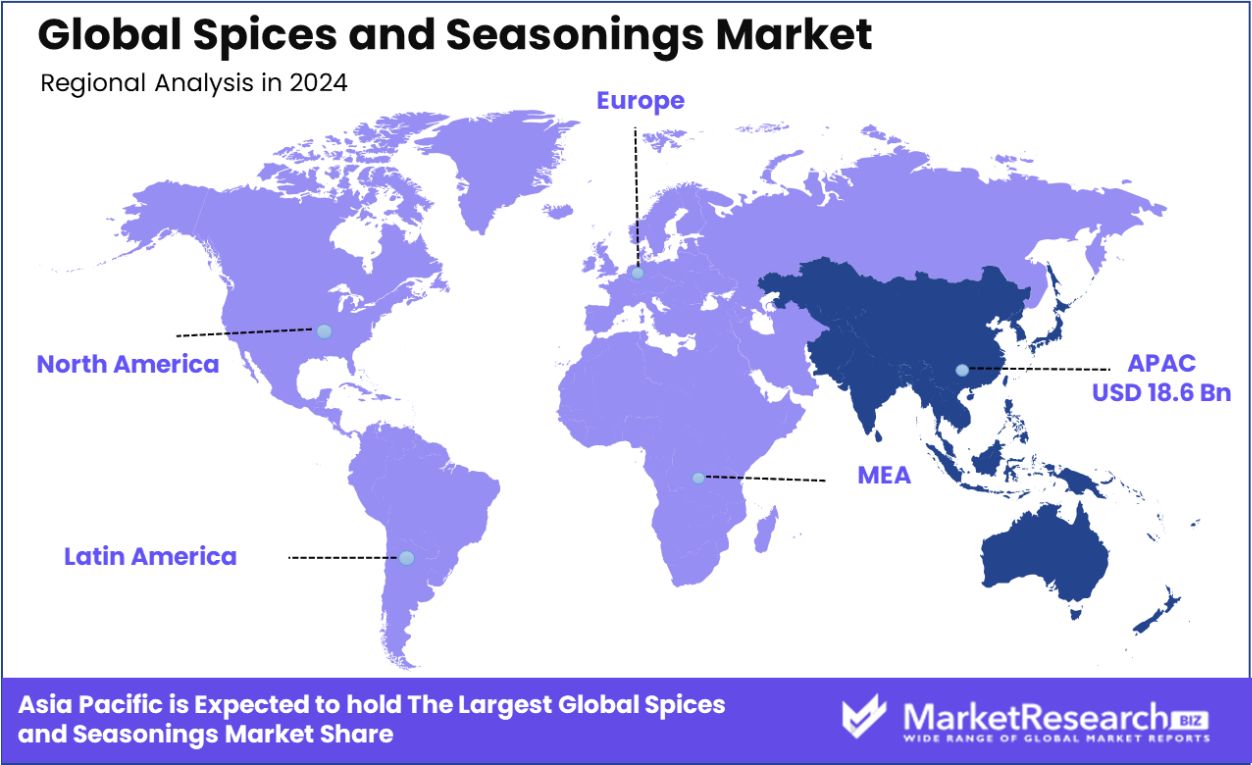

Regional Analysis

The Asia Pacific region dominates the global spices and seasonings market, accounting for 78.5% of the total market share, valued at USD 18.6 billion. The strong presence of spice-producing countries like India, China, and Indonesia drives the market's growth, as these regions are key producers and exporters of various spices such as black pepper, cardamom, and chili. Increased consumption of ethnic cuisines and a growing demand for processed and packaged spices fuel the region's dominance.

North America represents a significant share of the global spices and seasonings market, driven by rising consumer demand for ethnic foods, health-conscious products, and natural seasonings. The market in this region benefits from a strong retail and food service industry, with the U.S. leading in consumption.

Europe holds a substantial share in the spices and seasonings market, with increasing preferences for diverse culinary flavors. A growing trend of healthy eating, along with an expanding demand for organic and premium products, drives the market growth, particularly in countries like Germany, France, and the UK.

The Middle East & Africa market for spices and seasonings is experiencing steady growth, supported by a rich culinary tradition reliant on spices. The increasing popularity of ready-to-eat meals, coupled with a demand for authentic regional flavors, is spurring market expansion.

Latin America exhibits a moderate growth rate in the spices and seasonings market, with consumer demand driven by the adoption of traditional and international cuisines. Countries such as Brazil and Mexico are key contributors to the regional market, driven by growing food processing and retail sectors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, the global spices and seasonings market remains highly competitive, with several key players leading innovation and shaping market dynamics. Companies such as McCormick & Company, Unilever plc, and Kerry Group plc dominate the market through their strong brand recognition, diverse product offerings, and expansive distribution networks.

McCormick’s robust product portfolio, including its acquisition of brands like Schwartz and Simply Organic, positions it as a market leader, particularly in North America and Europe. Unilever, with its iconic Knorr and Hellmann's brands, taps into consumer demand for convenient, flavorful, and health-conscious products.

Ajinomoto Co., Inc. and ARIAKE JAPAN CO., LTD., with their deep roots in Asia, continue to lead the market in functional seasonings and umami-based products. Their strength lies in their ability to offer authentic and premium spice blends catering to both traditional and modern consumer tastes, particularly in Asian cuisines.

Olam International and Döhler GmbH are major players in the agricultural and spice processing sectors, supplying raw materials and customized seasoning solutions. Their global supply chains ensure consistent quality, while innovation in spice blending enhances their competitive edge. Similarly, Associated British Foods plc, with its diversified presence in both food manufacturing and retail, holds a solid market position.

Everest Food Products Pvt. Ltd., DS Group, and Spice Hunter bring regional dominance, with Everest catering to Indian and Southeast Asian markets through affordable yet flavorful spice blends. Meanwhile, Sensient Technologies Corporation and Worlée-Chemie GmbH specialize in the development of innovative seasoning solutions for food processors, with a focus on natural ingredients.

Top Key Players in the Market

- Ajinomoto Co, Inc.

- ARIAKE JAPAN CO, LTD.

- Associated British Foods plc

- Baria Pepper Co. Ltd.

- Döhler GmbH

- DS Group

- EVEREST Food Products Pvt. Ltd.

- The Kraft Heinz Company

- Kerry Group plc

- McCormick & Company

- Olam International

- Sensient Technologies Corporation

- SHS Group

- Spice Hunter (Sauer Brands Inc.)

- Unilever plc

- Worlée-Chemie GmbH

Recent Developments

- In April 2023, The Kraft Heinz Company unveiled Just Spices in the U.S. market, following its acquisition of a majority stake in the business just one year prior. This site uses cookies to enhance user experience.

- In April 2023, The McCormick brand revealed an extension of its collaboration with Tabitha Brown, launching five new salt-free, vegan seasoning products in U.S. grocery stores. These products, co-developed with Tabitha Brown, include McCormick Like Sweet Like Smoky All Purpose Seasoning, McCormick Burger Bliss Seasoning Mix, McCormick Very Good Garlic All Purpose Seasoning, McCormick Sauté Sensation Seasoning Mix, and McCormick Taco Tantalizer Seasoning Mix.

Report Scope

Report Features Description Market Value (2024) USD 23.7 Billion Forecast Revenue (2034) USD 43.8 Billion CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Spices (Pepper, Ginger, Cinnamon, Others), Herbs (Garlic, Oregano, Others), Salt & Salt Substitutes), By Application (Meat and Poultry Products, Snacks and Convenience Food, Bakery and Confectionery, Soups, Sauces and Dressings, Frozen Products, Beverages, Others), By Distribution Channel (Foodservice, Retail) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Ajinomoto Co, Inc., ARIAKE JAPAN CO, LTD., Associated British Foods plc, Baria Pepper Co. Ltd., Döhler Gmb, DS Group, EVEREST Food Products Pvt. Ltd., The Kraft Heinz Company, Kerry Group plc, McCormick & Company, Olam International, Sensient Technologies Corporation, SHS Group, Spice Hunter (Sauer Brands Inc.), Unilever plc, Worlée-Chemie GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Ajinomoto Co, Inc.

- ARIAKE JAPAN CO, LTD.

- Associated British Foods plc

- Baria Pepper Co. Ltd.

- Döhler GmbH

- DS Group

- EVEREST Food Products Pvt. Ltd.

- The Kraft Heinz Company

- Kerry Group plc

- McCormick & Company

- Olam International

- Sensient Technologies Corporation

- SHS Group

- Spice Hunter (Sauer Brands Inc.)

- Unilever plc

- Worlée-Chemie GmbH