Turmeric Market by Product Type (Processed, Raw, Dried), by End User (Food and Beverages, Industrial, Health, Cosmetics Industry, Commercial, Household), by Distribution Channel (Direct, Indirect, Supermarkets/Hypermarkets, Convenience Stores, Retail stores, E-commerce, Others),by Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

5090

-

Aug 2023

-

156

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

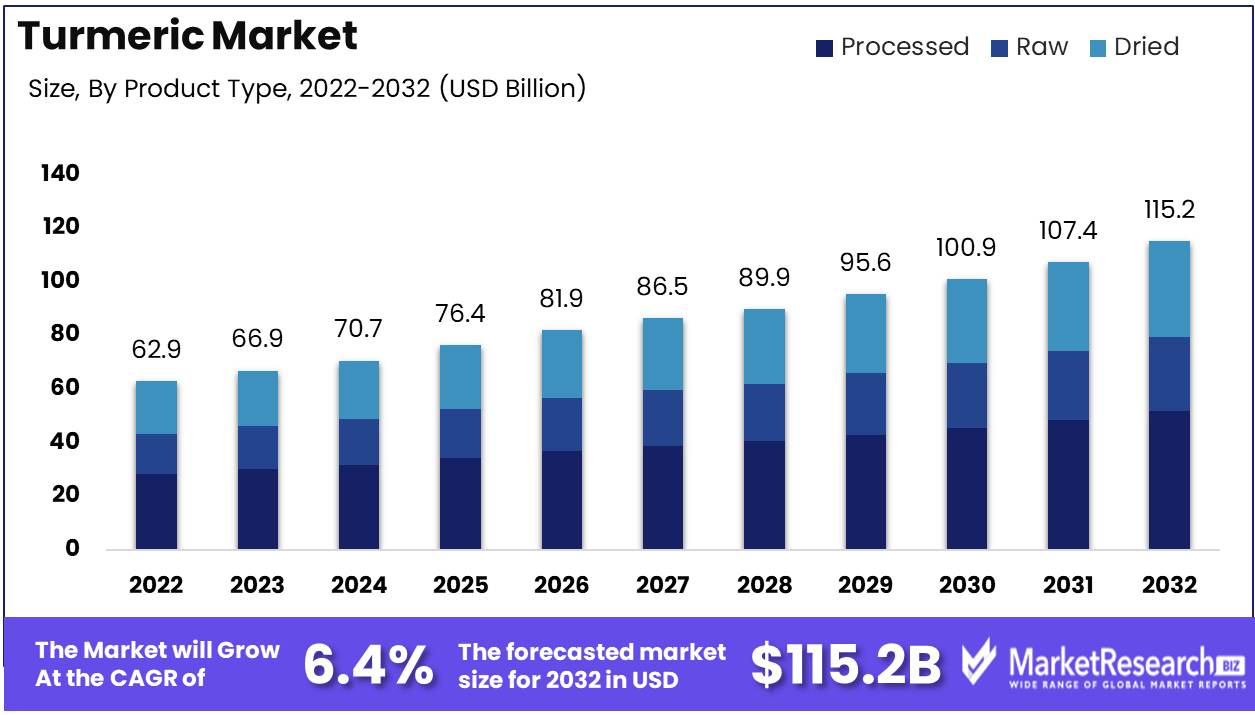

Turmeric Market size is expected to be worth around USD 115.2 Bn by 2032 from USD 62.9 Bn in 2022, growing at a CAGR of 6.4% during the forecast period from 2023 to 2032.

Turmeric Market With the potential for growth, is expected to grow significantly in the coming years. This report aims to provide a comprehensive analysis of the various factors driving this growth, including the market's opportunities and challenges, from a variety of perspectives. In addition, numerous significant industry players and their growth strategies are highlighted.The spice turmeric, known scientifically as Curcuma longa, is derived from the turmeric plant. Despite being an essential ingredient in Indian cuisine, its health benefits have been recognised for centuries. The primary objective of the turmeric market is to introduce innovative products and services that capitalise on turmeric's vast array of health benefits. With growing awareness of turmeric's potential benefits, this market is poised for rapid expansion.

In traditional medicine, turmeric has been utilized for centuries due to its anti-inflammatory and antioxidant properties. In addition, it has demonstrated enormous potential in the treatment of a variety of diseases, including arthritis, melancholy, and even cancer. As it is believed to help brighten the complexion, turmeric has also been used in cosmetics.

Several companies have incorporated turmeric into their products and services in recent years, resulting in a significant influx of investment in the turmeric market. Some food manufacturers have begun using turmeric as a natural food coloring, while others have introduced beverages infused with turmeric.

Driving factors

A rising demand for natural health remedies and dietary supplements among consumers.

The turmeric market is consistently expanding due to a number of motivating factors. Increasing demand for natural health supplements and treatments is one of the primary drivers of this expansion. Increasing numbers of individuals are placing a greater emphasis on their health and wellbeing, and as a result, they are turning to natural remedies and age-old medications. In addition, there has been a rise in interest in complementary and alternative medicine as well as holistic health, which has led to a rise in the market for turmeric-containing products.

Studies indicate that consuming turmeric is beneficial to one's health.

In addition to the spice's meteoric rise in popularity, the increasing body of evidence demonstrating turmeric's health benefits has played a significant role in its meteoric rise in popularity. As a consequence of recent research showing that turmeric can reduce inflammation and improve brain function, the demand for turmeric pills and meals with functional benefits has increased.

A market that is developing for nutritionally enhanced goods and beverages

The growth of the turmeric market is also affected by the expansion of the functional foods and beverages market. As people become more health conscious, they seek out products that provide additional health benefits beyond those associated with basic nutrition. As a direct result of this trend, the demand for functional foods and beverages, of which a significant number contain turmeric, has increased.

Restraining Factors

Competition within the Turmeric Market

The turmeric market has grown increasingly competitive over time. The global market for turmeric is anticipated to expand at a CAGR of 6.5% over the forecast period. India, Bangladesh, Sri Lanka, Pakistan, and Indonesia are the primary players on the turmeric market. India is the world's leading producer, supplier, and exporter of turmeric. The greatest obstacle for small-scale producers and local merchants is competing with large-scale enterprises that have superior access to technology, logistics, and distribution channels. This causes price fluctuations and makes it impossible for small-scale producers to meet demand.

Turmeric Costs

Turmeric prices have also been volatile over time. Prices are influenced by a number of variables, including supply and demand, climatic conditions, production costs, and government regulations. Increasing health awareness and demand from industries such as cosmetics, pharmaceuticals, and food processing have contributed to the steady increase in turmeric's demand. However, turmeric production has been unable to keep up with demand, resulting in a shortage and inflated prices. The fluctuating prices have made it challenging for sellers and purchasers to enter into long-term contracts and make investments.

Product Analysis

Currently, the processed turmeric segment dominates the turmeric market. The term "processed turmeric" refers to pulverized and packaged turmeric. This segment consists of both conventional and organic options.

Additionally, the economic growth of emerging economies drives the adoption of processed turmeric. As the middle class expands, the demand for convenience items such as processed turmeric rises. Additionally, online retailers are expanding their availability of processed turmeric, making it simpler for consumers to purchase from anywhere.

In addition to consumer preferences and behavior, the processed turmeric segment's market dominance is also supported by consumer trends and attitudes. The convenience of processed turmeric makes it an appealing option for consumers who want to incorporate turmeric into their diet but do not have time to manually pulverize the spice.

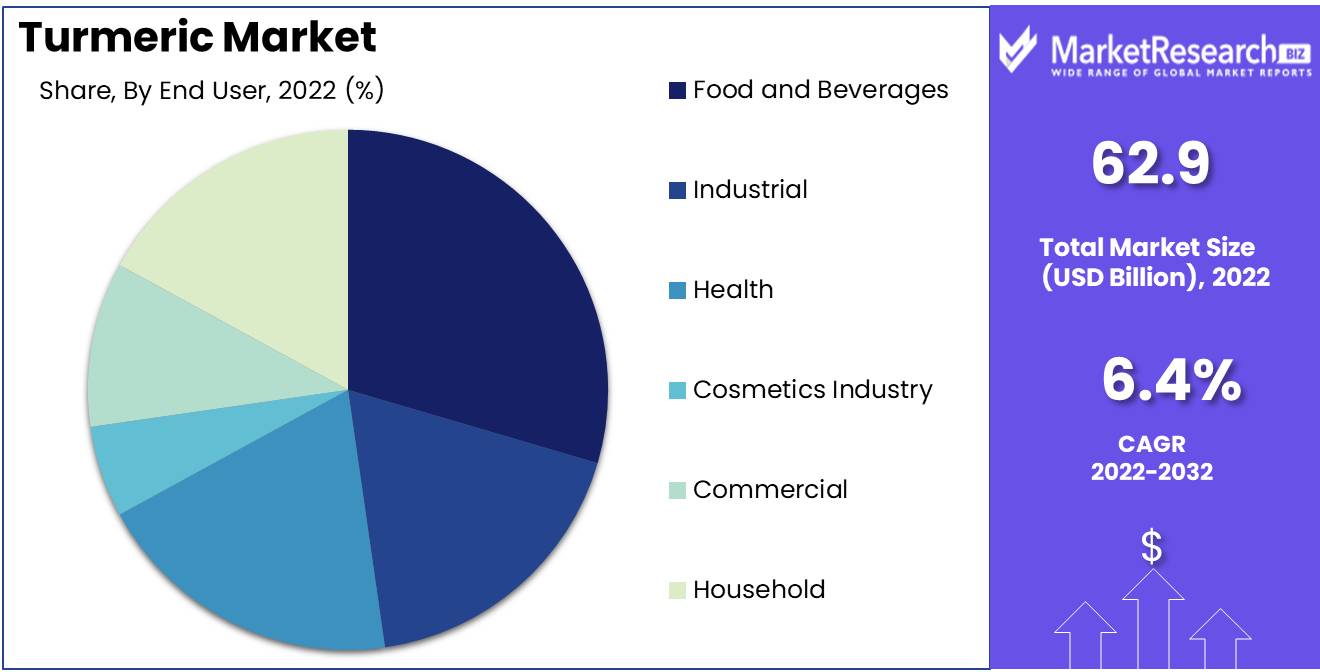

By End User Analysis

Turmeric is most commonly used in the food and beverage processing segment. In foods such as curries, pickles, and condiments, turmeric is commonly used as a flavoring and colouring agent. In addition to a lengthy history of use in traditional medicine, turmeric is increasingly being incorporated into functional food and beverage products.

The demand for turmeric in the food and beverage industry is fueled by the economic growth of emerging economies. As more individuals in these nations enter the middle class, their dietary preferences shift and they become more interested in packaged and processed foods. In addition, the expansion of e-commerce platforms facilitates consumer access to food and beverage products from around the globe, including those containing turmeric.

Consumer trends and behavior towards the food and beverage processing segment also contribute to the expansion of this segment's turmeric market. Consumers are becoming increasingly interested in functional foods that provide health benefits in addition to fundamental nutrition. The antioxidant and anti-inflammatory properties of turmeric make it a desirable ingredient in functional foods and beverages.

Key Market Segments

By Product Type Analysis

- Processed

- Raw

- Dried

By End User Analysis

- Food and Beverages

- Industrial

- Health

- Cosmetics Industry

- Commercial

- Household

By Distribution Channel

- Direct

- Indirect

- Supermarkets/Hypermarkets

- Convenience Stores

- Retail stores

- E-commerce

- Others

Growth Opportunity

Increasing demand for organic and natural food products

The development of the turmeric market has been fueled by the rising demand for natural and organic food products. Indian and Middle Eastern cuisines use turmeric powder extensively, and the demand for authentic natural condiments and organic food products has increased significantly in western nations. The use of turmeric in organic food products such as condiments, smoothies, and dressings is widespread.

Raising Recognition of Health Benefits

In recent years, awareness of turmeric's health benefits has increased significantly. Curcumin, the primary active component of turmeric, has been shown to have numerous health benefits. Curcumin's antioxidant and anti-inflammatory properties enable it to reduce the risk of chronic diseases like cancer, Alzheimer's disease, and heart disease. In recent years, there has been a significant increase in the demand for turmeric supplements, as people seek natural, plant-based remedies to enhance their health.

Expanding Utilisation in Diverse Industries

Numerous industries, such as cosmetics, pharmaceuticals, and food processing, make extensive use of turmeric. Extracts of turmeric are used to treat a variety of skin conditions, and it is a common ingredient in anti-aging lotions and cosmetics. Additionally, turmeric is utilised in pharmaceutical products like capsules and tablets. Turmeric is used in sauces, stews, and other food products by the food processing industry as a natural food colouring agent.

Latest Trends

Expansion of discretionary income and consumer health consciousness

There has been a significant increase in the global consumption of turmeric products as individuals become more health-conscious. Curcumin, a potent antioxidant and anti-inflammatory compound found in turmeric, has numerous health benefits, including reducing inflammation, enhancing the immune system, and promoting cardiac health. With an increase in disposable income, consumers are now willing to spend more on nutritious foods such as turmeric. This trend is anticipated to persist in the coming years, driving demand for turmeric products.

Increasing acceptance of ethnic flavours and cuisines

The increasing diversity of the world's population has resulted in a substantial increase in the prevalence of ethnic cuisines and flavours. The flavour profile of turmeric makes it an ideal seasoning for ethnic dishes. Historically, turmeric has been an essential ingredient in Asian cuisine. As more individuals experiment with new flavours and cuisines, there has been a global increase in demand for turmeric-based products. Leading food manufacturers and retailers are integrating turmeric into their products to meet consumer demand.

Advancements in agriculture and cultivation techniques

Increased global turmeric production has resulted from advancements in agricultural technology and cultivation techniques. With enhanced farming techniques, farmers are able to cultivate turmeric year-round, resulting in a constant supply of turmeric products. These developments have also resulted in an improvement in the quality of turmeric products, resulting in an increase in demand for high-quality turmeric products.

Favourable administrative rules and policies

Multiple governments have implemented policies to encourage the cultivation of turmeric, which has contributed to the expansion of the global turmeric market. In India, for instance, the government has launched a number of programmes to encourage the cultivation and export of turmeric in order to satisfy the rising global demand. These policies have resulted in increased investments in the turmeric industry, which has propelled the expansion of the turmeric market.

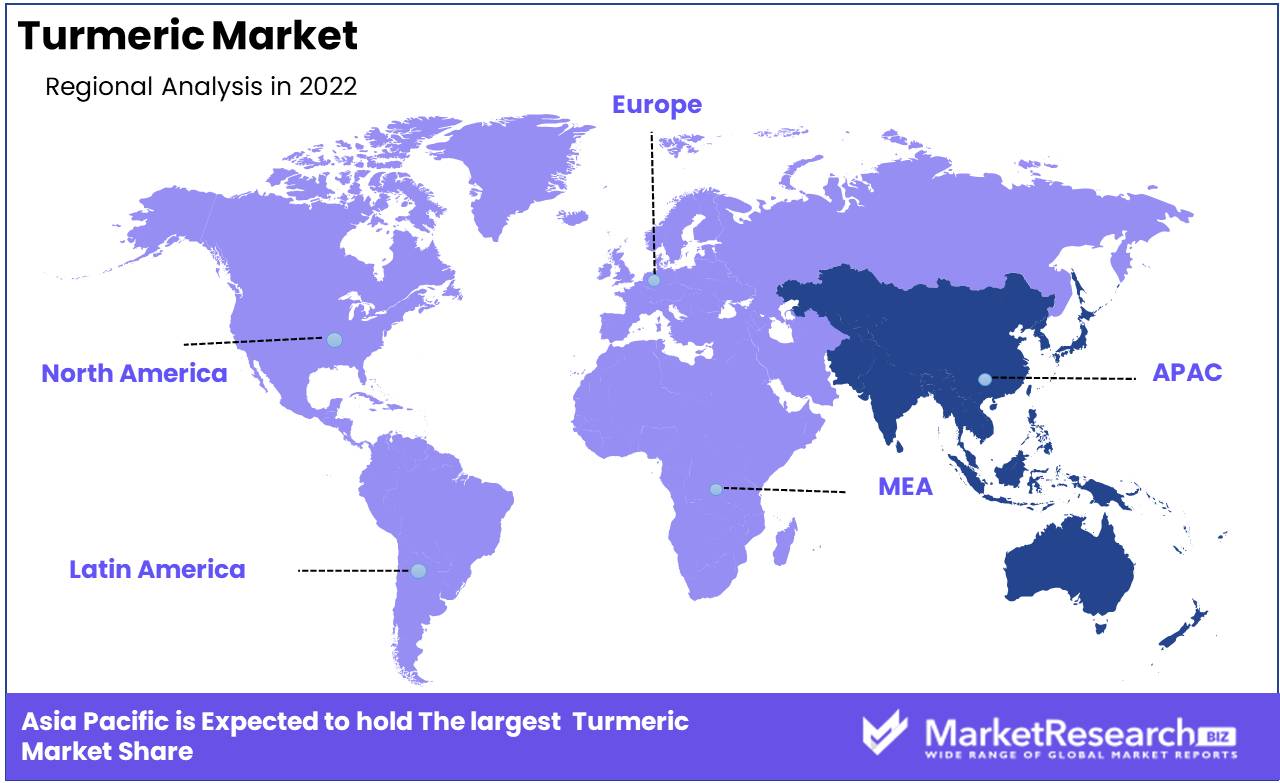

Regional Analysis

Asia Pacific - The Driving force of the Global Turmeric Market

Asia Pacific is the largest region in the global Turmeric Market, accounting for approximately 60% of the world's population. In recent years, the region has experienced substantial economic development, resulting in an expansion of its middle class and making it a highly dynamic and lucrative market for businesses worldwide.The growth of the Asia Pacific region is fueled by unprecedented levels of industrialization, infrastructure growth, and technological innovation. The region's economies, such as China, India, and Japan, are global leaders in manufacturing, technology, healthcare, and finance, creating new opportunities for businesses to expand while offering consumers a vast array of goods and services.

China, for example, dominates the global manufacturing sector, accounting for nearly 28 percent of global output. Its burgeoning middle class has created a massive demand for high-quality products such as smartphones and luxury automobiles, opening up new business opportunities for companies that can satisfy this demand.India, on the other hand, has emerged as a high-tech hub, with its strong and highly educated workforce fulfilling the demands of global companies, resulting in an increase in foreign investment in the nation. The nation has also established itself as a leader in the pharmaceutical industry, producing a sizeable portion of the world's generic medications.

japan's highly developed and refined economy has led the world in the production of high-tech items such as robots, cameras, and automobiles. Additionally, the country's geriatric population has created new opportunities in healthcare, and it remains a desirable location for foreign investment.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Turmeric is a multipurpose spice. Its unique flavor and health benefits make it a popular food and beverage ingredient. Consumers seeking economical, natural solutions for numerous ailments are driving turmeric's market growth. This article discusses turmeric market leaders and their impact.

Arjuna Natural, Synthite Industries Ltd., and Indian Foods control the turmeric market. These companies are leaders in turmeric production, distribution, and sales, and they innovate to meet consumer expectations. Besides these main firms, several small and medium-sized companies produce and distribute turmeric. These enterprises serve local turmeric demand and focus on local markets.

Arjuna Natural makes high-quality turmeric extracts. The worldwide corporation invests heavily in R&D to create new and creative goods. Another turmeric market leader is Synthite Industries Ltd. This Indian company sells turmeric extracts, oleoresins, and oils. It exports to 80 countries with a strong distribution network.

Indian Foods is a significant spice and herb supplier and an expanding turmeric market participant. The company sells raw turmeric, powder, and extracts. It dominates domestic markets and is expanding internationally.

Top Key Players in Turmeric Market

- Hansen A/S

- Sabinsa Corporation

- Synthite Industries Ltd.

- Everest Spices

- ITC Limited

- Kancor Ingredients Limited.

- Roha Dyechem Pvt. Ltd

- Kalsec Inc

- Arjuna Natural

- Frutarom Industries Ltd.

- Vigon International Inc.

Recent Development

- In 2021, Sunpure, South India's largest edible oil brand, entered the spice industry by launching turmeric and other powders, as part of its efforts to diversify its product portfolio and cater to the growing demand for spices in the Indian market. Sunpure's turmeric powder, made from high-quality turmeric sourced from select farms in South India, is expected to stir up market competition, with the company aiming to capture a significant share of the lucrative spice industry.

- In 2022, Cellavent Healthcare introduced a postbiotic-infused fermented turmeric ingredient, which aims to address the growing demand for functional foods and ingredients that offer multiple health benefits. Postbiotics are defined as the metabolic by-products of probiotics and have been found to have several health benefits, including improved gut health and immune function.

Report Scope

Report Features Description Market Value (2022) USD 115.2 Bn Forecast Revenue (2032) USD 62.9 Bn CAGR (2023-2032) 6.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type Analysis: Processed, Raw, Dried, By End User Analysis: Food and Beverages, Industrial, Health, Cosmetics Industry, Commercial, Household, By Distribution Channel: Direct, Indirect, Supermarkets/Hypermarkets, Convenience Stores, Retail stores, E-commerce, Others Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Hansen A/S, Sabinsa Corporation, Synthite Industries Ltd., Everest Spices, ITC Limited, Kancor Ingredients Limited., Roha Dyechem Pvt. Ltd, Kalsec Inc, Arjuna Natural, Frutarom Industries Ltd., Vigon International Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Hansen A/S

- Sabinsa Corporation

- Synthite Industries Ltd.

- Everest Spices

- ITC Limited

- Kancor Ingredients Limited.

- Roha Dyechem Pvt. Ltd

- Kalsec Inc

- Arjuna Natural

- Frutarom Industries Ltd.

- Vigon International Inc.