Cinnamon Market By Product(Ceylon, Cassia, Saigon, Korintje), By Form(Quills, Chips, Powder, Oil, Others), By End-Use Application(Food & Beverage, Pharmaceuticals, Cosmetics), By Distribution Channel(Direct Sales, Distributors/Wholesalers, Online Retail), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

42971

-

Jan 2024

-

188

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Cinnamon Market Size, Share, Trends Analysis

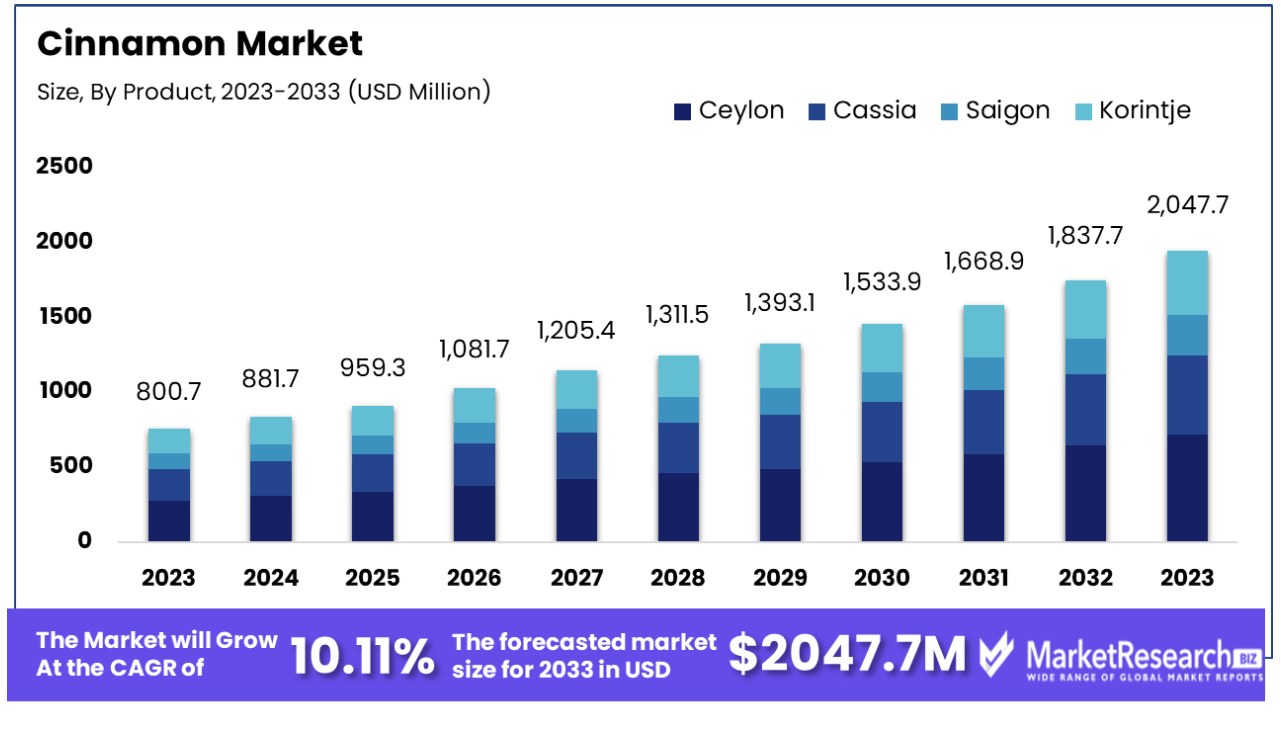

The Cinnamon Market was valued at USD 800.74 million in 2023. It is expected to reach USD 2047. 8 million by 2033, with a CAGR of 10.11% during the forecast period from 2024 to 2033.

The surge in demand for nutritious and delicious food as well as its use as treating for medical conditions are some of the main key driving factors for the cinnamon market. According to an article published by the World’s Top Exports in 2024, the worldwide sales for cinnamon exports from all the countries were valued at around USD 1 billion in 2022. There was an average of 38.6% of the overall value of the cinnamon exports for the exporting countries since 2018 when globally cinnamon shipments were valued at USD 728.4 million. Moreover, Mainland China is the leading exporter of cinnamon (USD 274.4 million, 27.2% of the total cinnamon exports) followed by Vietnam (USD 255.5 million, 25.3%), Srilanka (USD 217.3 million, 21.5%), Indonesia ($131.4 million,13%) and the Netherland (USD 22.7 million, 2.2%) are the top exporters of cinnamon. All the key suppliers produced over 89.3% of the globe’s spending on cinnamon exported at the time of 2022. Likewise, 89.2% of the global spending on cinnamon exports was transported from suppliers in ASIA and another 7.4% came from Europe.

Cinnamon is used for several purposes, particularly in medicinal and treatments. It comprises an element named cinnamaldehyde which is present in the oil. It helps to provide scent and is also responsible for the many health advantages and anti-inflammatory properties associated with cinnamon. It also includes other bioactive elements that can have antioxidants and anti-inflammatory effects.

These substances also help in controlling blood sugar, according to a study with any pre-diabetes take three daily 500 milligrams of 1/3 teaspoon of cinnamon daily for over 12 weeks, and the person can witness an improvement in plasma glucose and glucose tolerance in pre-diabetics. It also helps in protecting any cardio-related diseases. Many medical experts mentioned that cinnamon has anti-bacterial features that can help in controlling some types of bacteria that can cause disease and decay in food as well as cosmetics. It also plays a vital role in enhancing inflammation in women with rheumatoid arthritis. The demand for cinnamon will rapidly increase due to its medicinal features which will help in market expansion during the forecasted period.

Driving Factors

Natural Ingredient Demand Fuels Cinnamon Market

The burgeoning demand for natural and organic ingredients significantly propels the cinnamon market. The global sales of organic foods, surpassing $100 billion, with North America as a leading contributor, reflect a consumer shift towards natural products. Cinnamon, with its perception as a healthy, natural flavor, has become increasingly popular in various food and beverage products. For instance, its integration into oatmeal, protein powders, and coffee drinks exemplifies the spice's growing appeal. This trend towards natural ingredients positions cinnamon as an essential flavoring agent, influencing its market growth.

Spice Consumption Surge Elevates Cinnamon Popularity

As a key component in popular spice blends, including pumpkin spice and chai, cinnamon's foundational role underlines its market significance. For example, its use in Starbucks' Cinnamon Dolce Latte and other flavored beverages illustrates its widespread appeal. This growing consumer inclination towards flavorful spice combinations, with cinnamon at their core, is a crucial factor in the market's expansion.

Cinnamon's Health Halo Amplifies Market Growth

The perceived health benefits of cinnamon contribute significantly to its market growth. Recognized for its antioxidant properties and potential health benefits like blood sugar and cholesterol management, cinnamon has garnered attention in the "better-for-you" product category. Its inclusion in health-oriented products like protein bars and oatmeal resonates with health-conscious consumers. This perception of cinnamon as a beneficial spice not only increases its demand but also influences product development and innovation, furthering its market presence.

Restraining Factors

Volatility in Production and Prices Challenges the Cinnamon Market

The cinnamon market faces significant growth limitations due to the volatility in production and prices. Major exporting countries like Indonesia and Vietnam often experience fluctuations in cinnamon production, impacted by factors such as weather conditions, pests, and political instability. This volatility leads to inconsistencies in supply and cost, making it challenging for buyers and manufacturers to predict and plan for pricing. Such unpredictability can deter businesses from relying on cinnamon as a stable ingredient, especially in large-scale production, thereby restraining the market's growth and stability.

Competition from Synthetic Cinnamon Flavors Limits Market Expansion

Competition from cinnamon-flavored synthetics presents a notable challenge to the growth of the real cinnamon market. These synthetic flavors offer a more cost-effective alternative for food manufacturers, appealing particularly in contexts where cost reduction is a priority. While not identical to natural cinnamon, synthetic cinnamon flavors are often used in products where the subtlety of real cinnamon is not essential. For instance, many commercial cinnamon candies utilize synthetic cinnamon oil. This competition affects the demand for real cinnamon, especially in the mass market, thereby limiting the growth potential of the natural cinnamon industry.

Cinnamon Market Segmentation Analysis

By Product

Ceylon Cinnamon (34.5% market share) is the dominant segment in the cinnamon market. Known as "true" cinnamon, it is a prized agricultural product from Sri Lanka, holding 80% of the true cinnamon market. Ceylon cinnamon is favored for its ultra-low coumarin levels, which are safer for consumption compared to other varieties. Its delicate and sweet flavor, coupled with high-quality quills, makes it a premium choice in the culinary world. This variety is particularly popular among health-conscious consumers and in markets where quality and authenticity are highly valued.

Cassia Cinnamon, known for its stronger flavor, is seeing the highest growth rate in the market. Accounting for a significant portion of the world's cinnamon production, with China contributing 34%, Cassia is the most common type in the market. Its higher coumarin content, up to 1%, differentiates it from Ceylon cinnamon. Cassia's robust flavor and lower cost make it a popular choice in many commercial food applications. Saigon and Korintje cinnamon varieties also contribute to the market, each with unique flavor profiles and regional preferences.

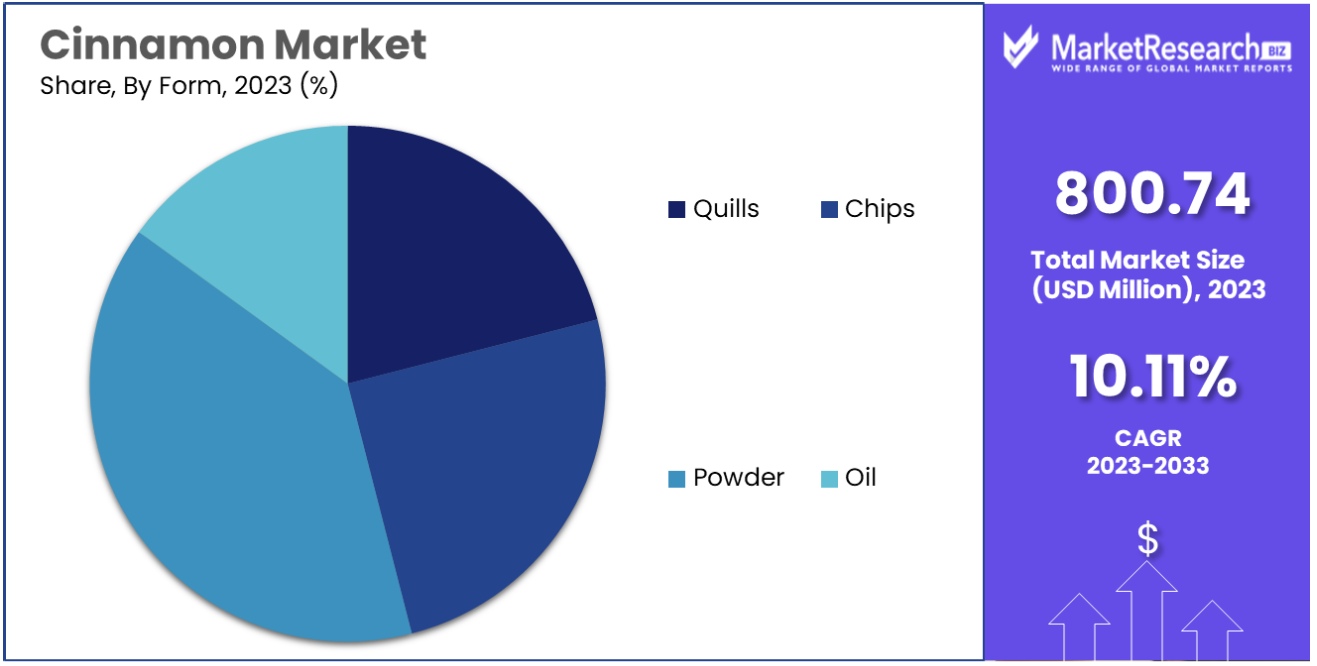

By Form

The powder form is the dominant segment in the cinnamon market. The convenience and ease of use of cinnamon powder make it a popular choice for both culinary and non-culinary applications. It is widely used in baking, cooking, flavoring beverages, and in spice blends. The powdered form allows for easy incorporation into recipes and products, making it a versatile and user-friendly option.

Other forms like Quills, Chips, Oil, and Others also hold significant market shares. Quills are preferred for their aesthetic appeal and flavor in gourmet cooking, while Chips are used in infusions and decoctions. Cinnamon oil, extracted from bark or leaves, is used in aromatherapy and flavoring.

By End-Use Application

Food & Beverage is the predominant end-user segment of the market for cinnamon. Cinnamon is widely used in many beverages and food products due to its distinctive flavor and aroma. It is a major ingredient in a wide range of confectioneries, baked goods, food items, and spice blends. Its use in drinks, ranging from coffee and tea as well as seasonal beverages, further increases its popularity. Pharmaceuticals and cosmetics segments are also important, taking advantage of the medicinal properties of cinnamon and its use in products for personal care.

By Distribution Channel

Distributors/Wholesalers form the dominant distribution channel in the cinnamon market. This segment plays a crucial role in bridging the gap between cinnamon producers and various market segments, including food and beverage manufacturers, retailers, and other end users. They offer a wide range of cinnamon products from different regions, catering to the diverse needs of the market.

Direct Sales and Online Retail channels are also important. Direct Sales allow producers to sell directly to consumers or businesses, often at a lower cost. Online Retail is growing rapidly, offering consumers the convenience of purchasing a wide range of cinnamon products from anywhere in the world. Despite this, the extensive network and market reach of Distributors/Wholesalers keeps them at the forefront of cinnamon distribution.

Cinnamon Industry Segments

By Product

- Ceylon

- Cassia

- Saigon

- Korintje

By Form

- Quills

- Chips

- Powder

- Oil

- Others

By End-Use Application:

- Food & Beverage

- Pharmaceuticals

- Cosmetics

By Distribution Channel:

- Direct Sales

- Distributors/Wholesalers

- Online Retail

Growth Opportunities

Sustainable and High-Quality Sourcing Elevates the Cinnamon Market

In the cinnamon market, there is a growing demand for sustainably sourced and high-quality products, which presents a significant opportunity for expansion. Buyers are increasingly concerned about environmental issues such as deforestation and ethical concerns like exploitative labor practices. Cinnamon sourced sustainably, and certified by credible third parties, can command premium pricing in the market. Additionally, implementing traceability systems could assure buyers of the quality and origin of cinnamon, addressing the demand for transparency. By prioritizing sustainable and ethical sourcing practices, cinnamon suppliers can tap into a more conscientious consumer base and potentially achieve higher market value.

Development of Cinnamon-Based Preservatives Offers New Market Opportunities

The potential to develop natural cinnamon-derived compounds as antimicrobial preservatives opens a new avenue in the cinnamon market, particularly for consumers who prefer to avoid conventional preservatives. There is a significant opportunity to harness cinnamon's natural properties to create preservatives that can be used in food products. This innovation aligns with the growing trend towards clean labels and natural ingredients in the food industry. By offering a natural alternative to traditional preservatives, cinnamon-based compounds can help food brands meet consumer demands for natural and clean-label products, thus driving growth in this segment of the cinnamon market.

Cinnamon Market Regional Analysis

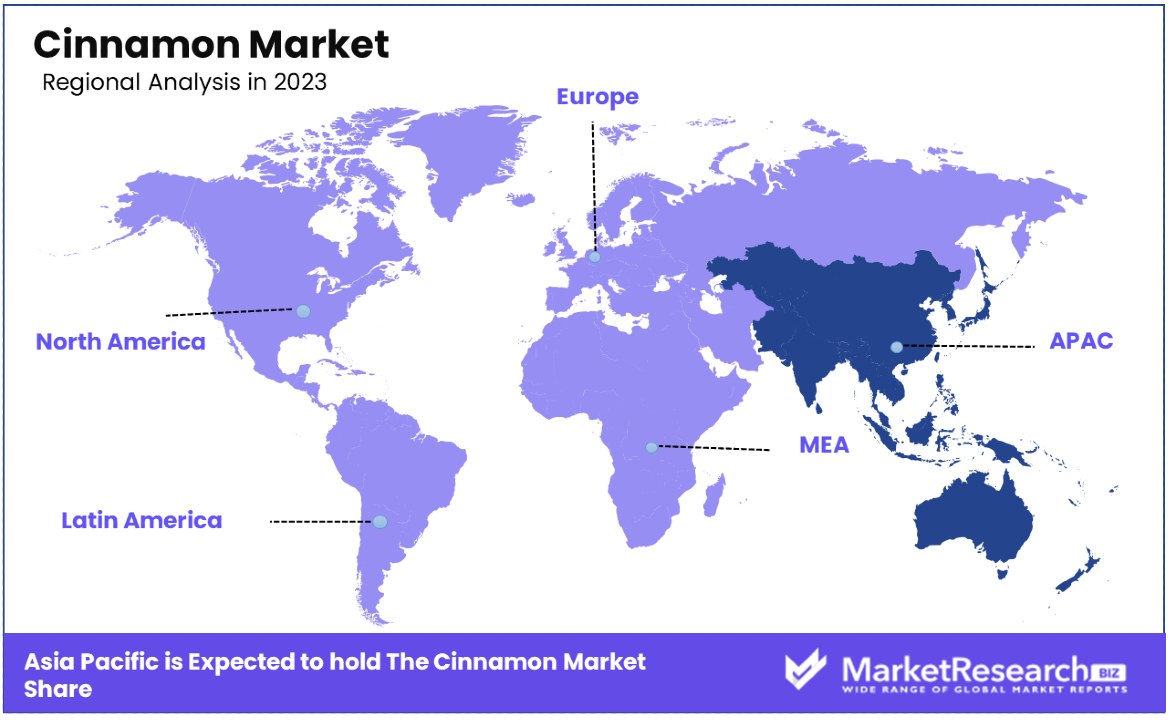

Asia Pacific Asserts Command with 43% Share in Global Cinnamon Market

Asia Pacific's significant hold on the global cinnamon market, capturing 43% of the market share, can be primarily attributed to its geographical and climatic advantages, which are conducive to cinnamon cultivation. This region, particularly countries like Indonesia, China, and Vietnam, has traditionally been the epicenter of cinnamon production, benefitting from rich, fertile soils and favorable weather conditions. Moreover, the age-old expertise in cinnamon farming and processing in these countries has honed their efficiency and quality, further cementing their dominance in the global market.

The cinnamon market in Asia Pacific is energized by its deep-rooted position in local cultures and cuisines. The spice's integral role in Asian culinary traditions propels constant demand, supplemented by emerging trends in health and wellness where cinnamon is recognized for its potential health benefits. Additionally, the expansion of international trade and globalization has enabled these countries to establish strong export markets, further bolstering the region's market position. The growing demand for natural and organic products in Western countries also augments export opportunities for Asian cinnamon producers.

Europe: A Growing Market with an Emphasis on Quality

In Europe, the cinnamon market is characterized by a growing consumer preference for high-quality, organic cinnamon, used both in culinary and wellness products. The region's stringent quality control standards and increasing consumer awareness about the health benefits of cinnamon are driving market growth.

North America: Diverse Applications and Health Trends

The North American market for cinnamon is driven by its diverse applications in the food and beverage industry, and a growing trend of health-conscious consumers incorporating cinnamon into their diets. The United States represents a significant portion of this demand, where cinnamon is popularly used in various culinary preparations and as a dietary supplement.

Cinnamon Industry By Region

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

Cinnamon Market Key Player Analysis

In the Cinnamon Market, a sector characterized by its diverse applications in culinary and medicinal contexts, the companies listed are key in shaping global supply and consumer preferences. McCormick & Co. Inc. and B.G. Foods, Inc. are industry leaders, known for their extensive distribution networks and broad range of spice products. Their strategic positioning emphasizes quality, flavor, and accessibility, significantly influencing global cinnamon consumption.

Ceylon Spice Company and Pure Ceylon Cinnamon, originating from Sri Lanka, a major cinnamon-producing region, are notable for their focus on authentic Ceylon cinnamon. Their commitment to traditional cultivation and processing methods underlines the market's value for heritage and quality.

Elite Spice and First Spice Mixing Company offer a range of cinnamon products catering to both retail and industrial needs. Their flexibility in product offerings reflects the market's adaptability to diverse consumer demands. HDDES Group and EOAS International are key players in the export market, contributing significantly to the global availability of cinnamon.

Cinnamon Industry Key Players

- Ceylon Spice Company

- Elite Spice

- First Spice Mixing Company

- B.G. Foods, Inc.

- HDDES Group

- Rongxian Ruifeng

- MDH Spices

- C.F Saucer Company

- Organic Spices Inc.

- Penzeys Spices

- The Spice Merchants

- C.F. Sauer Company

- PT Mitra Ayu Adi Pratama

- Dong Duong

- McCormick & Co. Inc.

- EOAS International

- Watkins

- Nature's Way

- Fuchs Gewürze

- Taj Agro Products Ltd.

- Guangxi Jinggui

- Pure Ceylon Cinnamon

- Everest Spices

- Goya Foods Inc.

- Bio Foods Pvt. Ltd.

- Rathna Ceylon Cinnamon

- Frontier Co-op

- Bart Ingredients

- Guangxi Pengbo

- Biofoods

Cinnamon Market Recent Development

- In January 2024, BJ’s Restaurant expanded its dessert menu with the limited-time Cinnamon Roll Pizookie, featuring four freshly baked cinnamon rolls piled high with vanilla bean ice cream, cream cheese icing, and caramel sauce.

- In January 2024, Egglife Foods introduces an exclusive variety pack at Sam's Club featuring two packs of original and one pack of sweet cinnamon egg white wraps. The expansion aligns with the company's growth strategy to cater to health-conscious consumers and broaden its product range.

- In December 2023, Taylor Swift prepared homemade cinnamon rolls for Travis Kelce before a Kansas City Chiefs game, according to former NFL player Bernie Kosar. The two were having a pregame meal at Kelce's house, and Swift's gesture was praised by Kosar, who called her a great role model.

Report Scope

Report Features Description Market Value (2023) USD 800.74 Million Forecast Revenue (2033) USD 2047. 8 Million CAGR (2024-2032) 10.11% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Ceylon, Cassia, Saigon, Korintje), By Form(Quills, Chips, Powder, Oil, Others), By End-Use Application:(Food & Beverage, Pharmaceuticals, Cosmetics), By Distribution Channel:(Direct Sales, Distributors/Wholesalers, Online Retail) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Ceylon Spice Company, Elite Spice, First Spice Mixing Company, B.G. Foods, Inc., HDDES Group, Rongxian Ruifeng, MDH Spices, C.F Saucer Company, Organic Spices Inc., Penzeys Spices, The Spice Merchants, C.F. Sauer Company, PT Mitra Ayu Adi Pratama, Dong Duong, McCormick & Co. Inc., EOAS International, Watkins, Nature's Way, Fuchs Gewürze, Taj Agro Products Ltd., Guangxi Jinggui, Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) - Ceylon

-

-

- Ceylon Spice Company

- Elite Spice

- First Spice Mixing Company

- B.G. Foods, Inc.

- HDDES Group

- Rongxian Ruifeng

- MDH Spices

- C.F Saucer Company

- Organic Spices Inc.

- Penzeys Spices

- The Spice Merchants

- C.F. Sauer Company

- PT Mitra Ayu Adi Pratama

- Dong Duong

- McCormick & Co. Inc.

- EOAS International

- Watkins

- Nature's Way

- Fuchs Gewürze

- Taj Agro Products Ltd.

- Guangxi Jinggui

- Pure Ceylon Cinnamon

- Everest Spices

- Goya Foods Inc.

- Bio Foods Pvt. Ltd.

- Rathna Ceylon Cinnamon

- Frontier Co-op

- Bart Ingredients

- Guangxi Pengbo

- Biofoods