Solar Cable Market By Material(Copper, Aluminium Alloy), By Cable Type(Stranded, Solid), By Application(Residential, Commercial, Industrial), By End User(Solar Panels Wiring, Underground ssrvice Entrances, Service Terminal Connections), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

23542

-

Feb 2024

-

177

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Report Overview

- Key Takeaways

- Driving factors

- Restraining Factors

- By Material Analysis

- By Cable Type Analysis

- By Application Analysis

- By End User Analysis

- Key Market Segments

- Growth Opportunity

- Latest Trends

- Shift Towards Halogen-Free Solar Cables

- Integration of Smart Technology in Solar Cabling

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

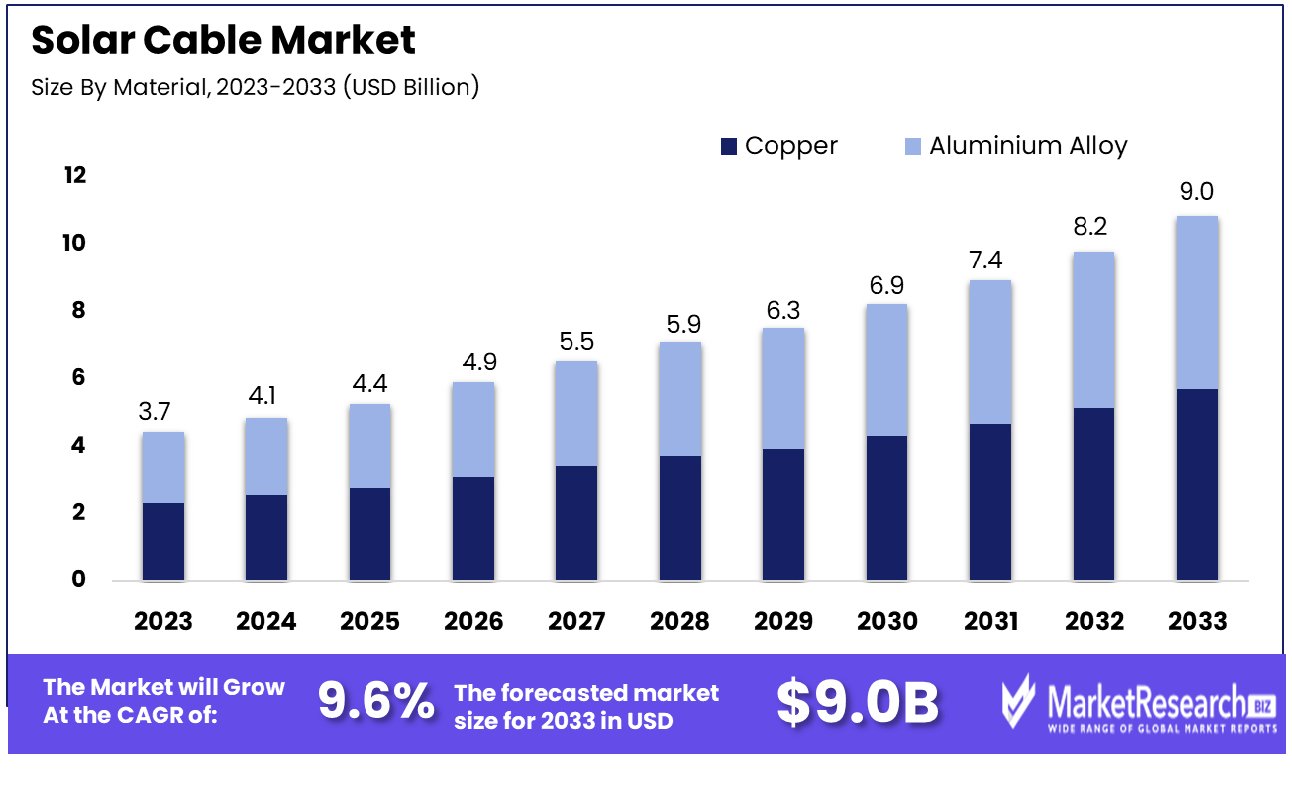

The global Solar Cable Market was valued at USD 3.7 billion in 2023, It is expected to reach USD 9.0 billion by 2033, with a CAGR of 9.6% during the forecast period from 2024 to 2033.

The Solar Cable Market encompasses a specialized segment of the electrical cable industry, dedicated to producing and distributing cables designed for the optimal operation of solar photovoltaic (PV) systems. These cables are engineered to withstand environmental stressors, including UV radiation, extreme temperatures, and moisture, ensuring reliable electrical connectivity in solar installations.

The market's significance is amplified by the global shift towards renewable energy sources, making it pivotal for stakeholders and Product Managers—in the renewable energy sector to comprehend its dynamics. The market's growth rate is attributed to increasing solar power installations worldwide, driven by the demand for sustainable and clean energy solutions.

The Solar Cable Market is currently experiencing a significant trajectory of growth, underpinned by the escalating global emphasis on renewable energy sources and the imperative to diminish carbon footprints. This upsurge is further bolstered by substantial investments and technological advancements within the sector.

For instance, Greenalia's recent endeavor to expand its solar projects in Texas, facilitated by a $200 million credit deal, exemplifies the robust confidence in solar energy's potential. This venture, alongside Toyota Boshoku America's investment in the Texas Solar Nova 1 project, underscores a persistent investor interest in solar energy, notwithstanding the prevailing political headwinds.

Moreover, the European market is witnessing a renaissance in solar innovation, spearheaded by entities such as NexWafe. The continent's solar installations approached a remarkable milestone of nearly 60GW in 2023, indicating a vibrant and expanding market ecosystem. The focus on cutting-edge Heterojunction Technology (HJT) and Tunnel Oxide Passivated Contacts (TOPcon) cell technologies, promising efficiencies of up to 26%, delineates a significant leap forward in enhancing solar energy's viability and cost-effectiveness.

These developments are indicative of a broader, global shift towards more sustainable energy solutions, positioning the solar cable market for unprecedented growth and innovation. As such, the solar cable market is poised for a sustained period of expansion, driven by technological advancements, strategic investments, and a collective shift towards greener, more sustainable energy alternatives.

Key Takeaways

- Market Growth: The Solar Cable Market was valued at USD 3.7 billion in 2023, It is expected to reach USD 9.0 billion by 2033, with a CAGR of 9.6% during the forecast period from 2024 to 2033.

- By Material: In the Solar Cable Market, Copper emerged as the leading material, showcasing widespread adoption.

- By Cable Type: Stranded cables were predominantly favored by the industry, indicating a preference for flexibility and durability.

- By Application: The Residential sector surfaced as the primary application area, driving demand for solar cables.

- By End User: Solar panel wiring stood out as the dominant end-user segment, reflecting its critical importance.

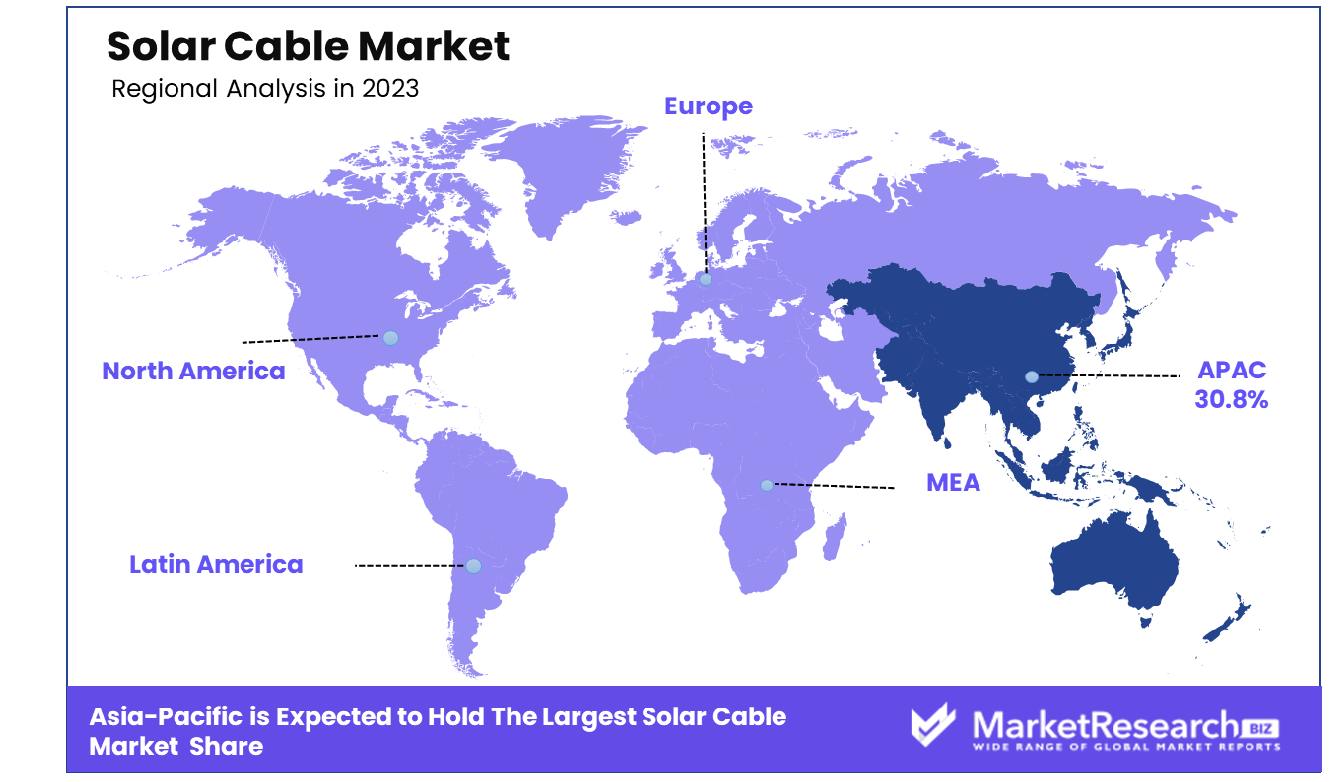

- Regional Dominance: Asia-Pacific dominates the solar cable industry with a market share of 30.8%.

- Growth Opportunity: Emerging markets offer growth opportunities for the solar cable industry, driven by renewable energy adoption and innovations enhancing cable efficiency and durability for expanded global presence and technological leadership.

Driving factors

Rising Global Demand for Renewable Energy

The global emphasis on transitioning to renewable energy sources has significantly fueled the growth of the solar cable market. This shift is propelled by heightened awareness of environmental issues and a concerted effort to reduce carbon footprints worldwide. Governments across various nations are implementing policies and providing incentives to support solar energy projects, thereby driving demand for solar cables, which are essential for the efficient transmission of electricity generated from solar panels.

Technological Advancements in Solar Cable Manufacturing

Technology advancement in solar cable manufacturing has played an essential role in expanding its market. Innovations in materials and manufacturing processes have resulted in solar cables that are more efficient, durable, and resistant to environmental factors. These improvements enhance the performance and reliability of solar power systems, making solar energy a more attractive option for both residential and commercial applications. Consequently, the demand for high-quality solar cables is expected to continue rising as solar energy projects proliferate globally.

Expansion of Solar Energy Infrastructure

Solar energy infrastructure's expansion around the globe has fueled rapid expansion in solar cable market growth. As countries invest in solar power plants and the deployment of solar panels in urban and remote locations increases, the need for solar cables, which are integral to connecting solar panels to the power grid, escalates. This expansion is not only limited to new installations but also encompasses the upgrading of existing solar power systems to accommodate higher capacities, further stimulating the demand for solar cables.

Restraining Factors

High Initial Installation Costs

The significant initial costs associated with the installation of solar energy systems, including the procurement of high-quality solar cables, can act as a major deterrent for potential adopters. The expenditure encompasses not only the cables themselves but also the cost of compatible components and professional installation services. This financial barrier can be particularly prohibitive for residential users and small-scale enterprises, thereby limiting the expansion of the solar cable market. The need for specialized, durable cables that can withstand environmental factors and ensure efficient energy transmission further escalates the initial outlay, impacting the market's accessibility and growth.

Regulatory and Standardization Challenges

Navigating the complex landscape of regulations and standards can pose significant challenges for manufacturers and installers of solar cables. The solar industry is subject to stringent quality and safety standards that vary widely across different regions and jurisdictions. Compliance with these evolving standards requires continuous research and development efforts, as well as regular updates to product designs and manufacturing processes. This not only increases the cost of production but also slows down the time to market for new and innovative solar cable solutions. Moreover, inconsistency in regulatory frameworks can create uncertainties, hindering the global trade of solar cables and affecting market growth negatively.

By Material Analysis

Copper emerged as the dominant material in the solar cable market, leading in usage and preference.

In 2023, Copper held a dominant market position in the By Material segment of the Solar Cable Market, underpinning its pivotal role in the industry's supply chain. This prominence is largely attributed to copper's superior electrical conductivity, durability, and flexibility, which are critical attributes for efficient solar energy transmission. The intrinsic properties of copper, such as its excellent thermal conductivity and resistance to corrosion, further consolidate its suitability for solar installations, ensuring long-term reliability and performance under varying environmental conditions.

Meanwhile, alternatives such as Aluminium Alloy also found application within the market, primarily due to their cost-effectiveness and lighter weight, which can be advantageous in specific contexts or installations. However, despite these benefits, the preference for copper in critical infrastructure and its enduring reliability often outweigh the lower upfront costs associated with aluminum alloys. The choice between copper and aluminum alloy materials ultimately hinges on a complex interplay of factors including cost, installation specifications, environmental conditions, and long-term performance expectations.

Copper's continued dominance in the Solar Cable Market speaks volumes of its efficiency and dependability. As the market continues to evolve, the demand for high-performance, durable materials is expected to further entrench copper's leading position, while also opening avenues for innovations in material science that could challenge or complement the existing dynamics.

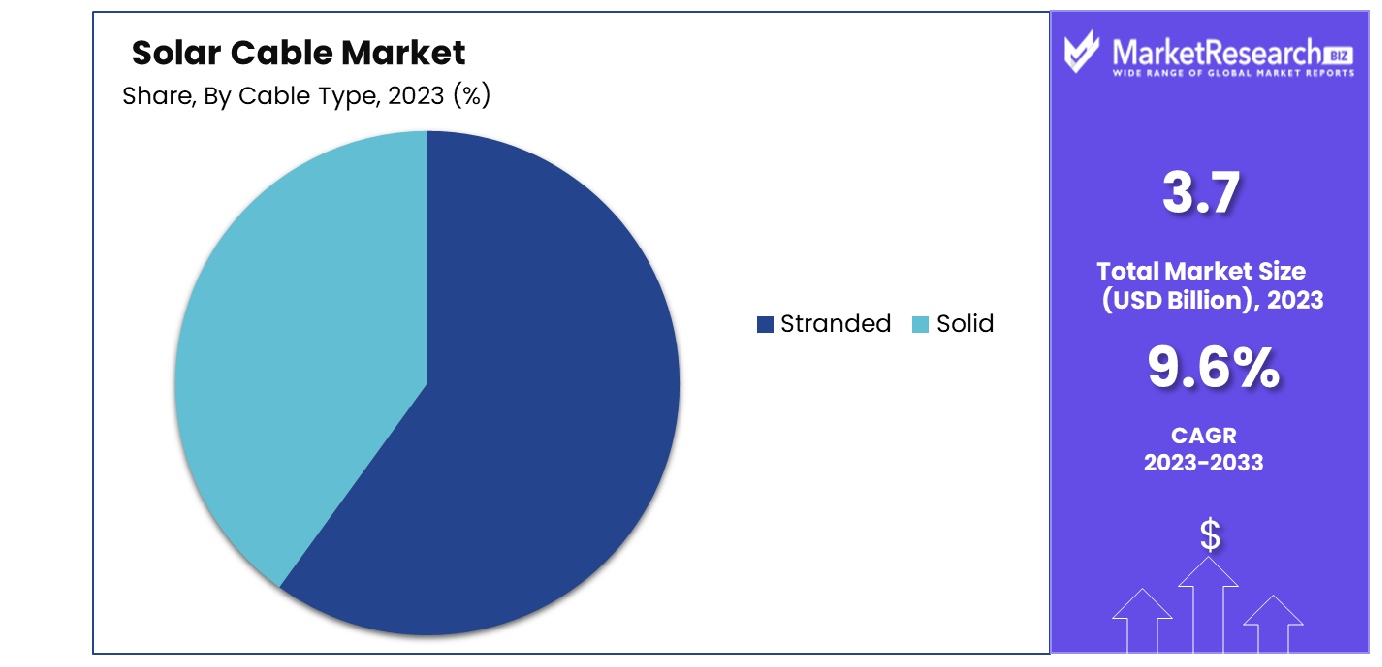

By Cable Type Analysis

Stranded cables were the most preferred type, offering flexibility and durability in various installations.

Stranded cables dominated the By Cable Type segment of the Solar Cable Market in 2023, standing out as market leaders through superior flexibility and durability. Their prominence can be attributed to rising renewable energy demand - solar power being one such form. Stranded cables' flexibility compared to Solid versions is enhanced, making installation in difficult and varied terrain easier while simultaneously decreasing cable breakage risks significantly and thus prolonging installation lifespans.

The market's inclination towards Stranded cables over Solid cables is further reinforced by their superior performance in dynamic environments subjected to frequent movements or temperature fluctuations. As solar energy projects have become more complex and ambitious, so has their demand for reliable cabling solutions, propelling the Stranded cable segment into prominence within the industry.

Moreover, advancements in cable technology and material science have augmented the efficiency and environmental resistance of Stranded cables, bolstering their adoption rate across both residential and commercial solar projects. As renewable energy expansion worldwide remains a top priority, Stranded cables play an integral part in achieving operational excellence and sustainability within the Solar Cable Market.

By Application Analysis

In terms of application, the residential sector saw the highest adoption of solar cables, reflecting growing homeowner interest.

In 2023, the Residential sector held a dominant market position within the "By Application" segment of the Solar Cable Market, underscoring a pivotal shift towards renewable energy solutions within domestic settings. This ascendancy can be attributed to several key factors, including heightened awareness around sustainable living practices, governmental incentives aimed at fostering green energy adoption, and the decreasing cost of solar installations for homeowners. Furthermore, advancements in solar technology have rendered residential solar systems more efficient and cost-effective, catalyzing their widespread implementation.

The Commercial and Industrial sectors, while also exhibiting significant growth, have followed with varied degrees of market penetration. Commercial solar cable adoption is driven by corporate sustainability goals and reduced operational costs, as well as the potential economic benefits of doing business using these cables. Meanwhile, the Industrial sector's growth is bolstered by large-scale solar projects and the need for robust, high-performance cabling solutions to ensure operational reliability and efficiency in harsh industrial environments.

Collectively, these key trends indicate a broader market evolution, with the Residential segment leading the charge toward a more sustainable and renewable energy future. The interplay between governmental policies, technological advancements, and consumer behavior patterns will continue to shape the trajectory of the Solar Cable Market across these segments.

By End User Analysis

Solar Panels Wiring led the end-user segments, highlighting its critical role in solar energy systems' efficiency and safety.

In 2023, Solar panel wiring held a dominant market position in the By End User segment of the Solar Cable Market, illustrating a pivotal shift towards renewable energy solutions and a growing emphasis on sustainable infrastructure development. This segment's prominence can be attributed to the escalating demand for efficient and reliable energy sources, coupled with significant advancements in solar technology. The integration of solar panels into residential, commercial, and industrial settings necessitates robust and durable wiring systems, thereby propelling the demand for high-quality solar cables.

Moreover, the Underground Service Entrances and Service Terminal Connections segments have also witnessed substantial growth, underpinned by the expansion of solar energy projects and the need for secure, long-lasting electrical connections. The surge in solar installations across various sectors necessitates enhanced connectivity solutions, driving the demand for specialized solar cables capable of withstanding environmental stresses and ensuring optimal energy transmission.

The market's evolution is further influenced by stringent regulatory standards and a collective move towards reducing carbon footprints, which have underscored the importance of adopting efficient wiring solutions in solar energy systems. Consequently, manufacturers and service providers are increasingly focusing on innovation, durability, and compliance in product offerings, aiming to cater to the sophisticated requirements of the solar cable market. This trend underscores a pivotal moment in the transition towards renewable energy sources, with Solar Panels Wiring emerging as a critical component in the development and implementation of solar energy projects.

Key Market Segments

By Material

- Copper

- Aluminium Alloy

By Cable Type

- Stranded

- Solid

By Application

- Residential

- Commercial

- Industrial

By End User

- Solar Panels Wiring

- Underground service Entrances

- Service Terminal Connections

Growth Opportunity

Expansion into Emerging Markets

The solar cable market is poised for significant expansion in emerging economies, driven by the increasing adoption of renewable energy sources and supportive government policies aimed at reducing carbon emissions. Countries in Asia, Africa, and Latin America are witnessing a surge in solar energy projects, catalyzed by their abundant solar resources and growing energy needs. This trend offers a lucrative growth opportunity for solar cable manufacturers to establish a presence or expand their operations in these regions.

Demand for durable, high-efficiency solar cables is expected to increase due to both new solar power plant construction projects and upgrades to existing infrastructure for supporting renewable energy generation. Manufacturers who can navigate the regulatory landscapes and form strategic partnerships with local entities will be well-positioned to capture market share.

Technological Advancements in Cable Efficiency and Durability

Innovation in solar cable technology presents another growth avenue within the solar cable market. The development of cables that combine higher efficiency, enhanced durability, and resistance to environmental factors is vital to the progress of solar energy systems. Advancements in materials science and engineering can lead to the production of solar cables that offer lower electrical losses, extended lifespans, and reduced maintenance costs.

These innovations not only meet the increasing demands for system efficiency and reliability but also provide a competitive edge in a market that values sustainability and performance. Companies investing in research and development to push the boundaries of solar cable technology can tap into new customer segments and strengthen their market position. This focus on technological advancement aligns with the broader industry trend toward increasing the efficiency and sustainability of renewable energy systems.

Latest Trends

Shift Towards Halogen-Free Solar Cables

A notable trend in the solar cable market is the increasing demand for halogen-free cables. This shift is driven by a growing emphasis on environmental sustainability and safety standards in the solar industry. Halogen-free cables, made from materials that do not emit toxic gases when exposed to fire, are becoming the preferred choice for installations in residential, commercial, and industrial sectors.

These cables not only contribute to safer solar energy systems but also align with global efforts to reduce hazardous substances in the environment. As regulations become stricter and awareness about environmental health rises, the demand for halogen-free solar cables is expected to surge, encouraging manufacturers to prioritize eco-friendly materials in their production processes.

Integration of Smart Technology in Solar Cabling

The integration of smart technology into solar cabling is transforming the way solar energy systems are monitored, maintained, and optimized. Smart solar cables equipped with sensors and IoT (Internet of Things) capabilities allow for real-time monitoring of system performance and early detection of faults.

This trend towards digitalization enables more efficient operation and maintenance of solar installations, leading to higher energy yields and reduced downtime. As the solar industry continues to evolve towards smarter and more connected systems, the demand for advanced solar cables with integrated technology is poised to grow, offering significant opportunities for innovation and market expansion. The U.S. added 32 gigawatts (GW) of new electricity-generating capacity in 2023, a growth of 52% from 2022.

Regional Analysis

Asia-Pacific leads with a 30.8% market share in the solar cable industry.

North America is witnessing steady growth, underpinned by supportive government policies and a growing inclination towards renewable energy sources. The United States, in particular, is a significant contributor to the region's market expansion, with initiatives aimed at doubling renewable energy production by 2030 fostering demand for solar cables.

Europe stands out for its stringent environmental regulations and ambitious goals for carbon neutrality. Countries like Germany and Spain are leading in solar installations, necessitating high-quality solar cables for efficient energy transmission.

Asia Pacific is the dominating region, accounting for approximately 30.8% of the global market share, driven by rapid industrialization and expanding solar energy projects in China, India, and Southeast Asia. The region benefits from favorable government policies, abundant solar resources, and escalating energy requirements, making it a hotspot for solar cable manufacturers.

Middle East & Africa are emerging markets with significant potential, thanks to abundant solar resources and increasing investments in renewable energy. Initiatives to diversify energy sources beyond oil are gradually taking root, with countries like Saudi Arabia and South Africa investing in solar energy infrastructure.

Latin America is experiencing growth in solar energy adoption, with countries like Brazil and Chile leading the way. The region's market is buoyed by increasing awareness of renewable energy benefits and government incentives to adopt solar power.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In the global solar cable market, key players such as General Cable Corporation, Atkore International Group Inc., Huber Suhner AG, Prysmian Group, and Allied Wire & Cable, among others, have significantly shaped the industry landscape in 2023. These companies are playing an essential role in driving innovation, providing high-quality, long-lasting solar cables necessary for efficient operation of solar power systems.

General Cable Corporation and Prysmian Group are noteworthy for their comprehensive range of solar cables that cater to various applications, underscoring their commitment to sustainability and renewable energy. Their products are known for reliability and performance, which is critical in reducing maintenance costs and maximizing the operational efficiency of solar installations.

Atkore International Group Inc. and Huber Suhner AG have distinguished themselves through their focus on technological advancements and product development. Their solar cables are designed to withstand harsh environmental conditions, ensuring long-term durability and safety, which is paramount for the success of solar energy projects.

Emerging players like Ningbo Pntech New Energy Co., Ltd, and Taiyo Cable Tech Co. Ltd. have also made significant inroads into the market, offering competitive solutions that emphasize cost-effectiveness without compromising quality. Their presence has introduced a dynamic competitive landscape, encouraging innovation and making solar energy more accessible.

Companies such as Lapp Group, Eldra B.V., and KBE Elektrotechnik GmbH have focused on the development of eco-friendly and sustainable solar cable solutions, aligning with the global shift towards environmental sustainability. Their efforts in producing cables that minimize environmental impact while maximizing performance are commendable.

Furthermore, specialized players like Phoenix Contact GmbH Co. KG and Havells have leveraged their expertise in electrical and connection technology to enhance the solar cable offerings, ensuring that the solar energy sector benefits from high-quality connectivity solutions.

Market Key Players

- General Cable Corporation

- Atkore International Group Inc.

- Huber Suhner AG

- Prysmian Group

- Allied Wire & Cable

- Lumberg Connect GmbH

- ReneSola Ltd

- Ram Ratna Wires Ltd.

- Ningbo Pntech New Energy Co., Ltd

- Taiyo Cable Tech Co. Ltd.

- Lapp Group, Eldra B.V

- KBE Elektrotechnik GmbH

- Phoenix Contact GmbH Co. KG

- Havells

Recent Development

- In February 2024, Vattenfall progresses the UK offshore hydrogen project with £9.3m funding. An 8MW electrolyzer at Aberdeen Bay's wind farm aims for early 2025 production, advancing clean energy transition.

- In February 2024, Spanish engineers unveil a groundbreaking airborne solar system, transcending terrestrial constraints. José Luis Peón González and José Raúl González Ruiánchez pioneer innovative PV technology, redefining energy generation possibilities.

- In February 2024, The U.S. PV industry experiences rapid growth, with NextEra's Desert Peak Energy Storage (325MW/1300MWh) and Intersect Power's Oberon solar (250MW) projects leading advancements in storage and solar integration.

- In February 2024, SECI commissioned India's largest Battery Energy Storage System (BESS) with 40MW/120MWh capacity in Chhattisgarh, utilizing solar energy, enhancing renewable energy infrastructure and sustainable land use.

- In February 2024, Polycab emphasizes solar cable importance for India's renewable energy goals. Efforts focus on efficiency, reliability, and environmental impact, aligning with the nation's ambitious targets for a sustainable future.

Report Scope

Report Features Description Market Value (2023) USD 3.7 Billion Forecast Revenue (2033) USD 9.0 Billion CAGR (2024-2032) 9.6% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Material(Copper, Aluminium Alloy), By Cable Type(Stranded, Solid), By Application(Residential, Commercial, Industrial), By End User(Solar Panels Wiring, Underground ssrvice Entrances, Service Terminal Connections) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape General Cable Corporation, Atkore International Group Inc., Huber Suhner AG, Prysmian Group, Allied Wire & Cable, Lumberg Connect GmbH, ReneSola Ltd, Ram Ratna Wires Ltd., Ningbo Pntech New Energy Co., Ltd, Taiyo Cable Tech Co. Ltd., Lapp Group, Eldra B.V, KBE Elektrotechnik GmbH, Phoenix Contact GmbH Co. KG, Havells Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- General Cable Corporation

- Atkore International Group Inc.

- Huber Suhner AG

- Prysmian Group

- Allied Wire & Cable

- Lumberg Connect GmbH

- ReneSola Ltd

- Ram Ratna Wires Ltd.

- Ningbo Pntech New Energy Co., Ltd

- Taiyo Cable Tech Co. Ltd.

- Lapp Group, Eldra B.V

- KBE Elektrotechnik GmbH

- Phoenix Contact GmbH Co. KG

- Havells