Renewable Energy Asset Management Market By Component(Hardware, Sensors, Cameras, Others, Software), Deployment Model(On-premise, Cloud), By Service(Professional Services, Managed Services), By Energy Type(Solar Energy, Wind Energy, Hydro Energy, Tidal Energy, Geothermal Energy, , Others) , By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

42535

-

Jan 2022

-

162

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Driving Factors

- Restraining Factors

- Renewable Energy Asset Management Market Segmentation Analysis

- Renewable Energy Asset Management Industry Segments

- Renewable Energy Asset Management Market Regional Analysis

- Renewable Energy Asset Management Industry By Region

- Renewable Energy Asset Management Market Key Player Analysis

- Renewable Energy Asset Management Industry Key Players

- Renewable Energy Asset Management Market Recent Development

- Report Scope

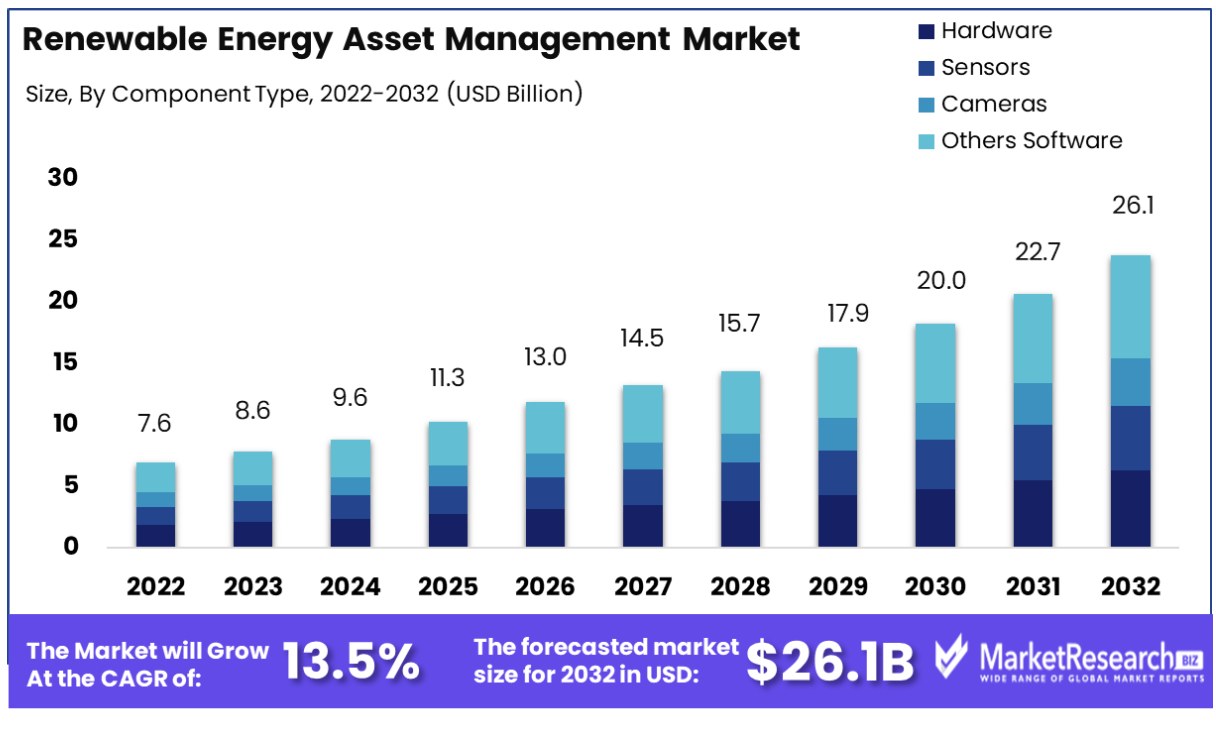

Renewable Energy Asset Management Market size is estimated to reach USD 26.1 Bn by 2032, an increase from its USD 7.6 Bn estimate by 2022. Growth projections estimate an annual compound compound annual growth rate of (CAGR) 13.5% during 2023-2032

Renewable Energy Asset Management involves overseeing and optimizing the performance, financial returns, and lifespan of renewable energy assets like wind turbines, solar panels, and hydroelectric facilities. This includes maintenance, performance monitoring, compliance management, and financial tracking. Effective asset management maximizes energy output, ensures regulatory compliance, and enhances investment returns. It's crucial for sustainable energy projects, to balance the intricate relationship between technological efficiency, environmental impact, and economic viability.

The expected growth in renewable deployment, with a 17% increase to 42 GW by 2024 and nearly a quarter of electricity generation, underscores a burgeoning demand for renewable energy asset management. Investments reaching 495 billion U.S. dollars worldwide in 2022 indicate a robust market trajectory. This surge necessitates efficient management solutions to optimize asset performance and returns, signaling substantial growth potential for companies offering specialized asset management services in the renewable sector.

Moreover, asset optimization services are crucial for renewable energy asset companies to maximize performance and minimize downtime. These services, including monitoring, analytics, and maintenance planning, cater to the increasing need for operational efficiency in renewable energy assets.

The early-stage nature of the energy storage market, characterized by anticipated innovation and financing activities, also presents expansive opportunities. The partnership between Macquarie Asset Management and Hydro, involving a significant investment in Hydro Rein, exemplifies the market's potential for growth and M&A activity. This trend indicates a growing interest in developing and investing in renewable energy assets, including storage solutions, signaling a dynamic and evolving market landscape.

The integration of energy storage with renewable assets is increasingly critical for enhancing dispatchability and grid services. Expertise in integrating these technologies offers a key growth avenue in renewable energy asset management. As the demand for more reliable and efficient renewable energy systems rises, companies providing solutions for effective storage integration can capitalize on this growing market need, positioning themselves as essential facilitators in the renewable energy value chain.

Further, the Inflation Reduction Act's (IRA) provisions, especially the investment tax credit for standalone storage systems, are set to dramatically boost the market. The potential for up to $1 trillion in storage investments by the early 2030s, backed by these incentives, creates a fertile environment for renewable energy asset management growth. This legislative support provides a stable investment landscape, encouraging the development and integration of storage solutions with renewable assets.

Driving Factors

Operational Cost Reduction Catalyzes Asset Management in Renewables

Solar represented 15.9% of electricity generated from renewable sources in 2022, up from 13.5% the previous year, and is predicted to account for 67% of renewable energy capacity growth between now and 2023. As solar farms and wind turbines become increasingly commonplace, effectively managing these assets becomes essential in maintaining profitability and remaining profitable. Energy optimization experts assist in improving the performance of renewable energy systems, limiting downtime, and cutting maintenance costs. The drive to cut operational expenses in the renewable sector not only boosts the market for asset management solutions but also aligns with the broader trend of maximizing efficiency in sustainable energy sources.

Transformative Energy Shifts Necessitate Resilient Management

As the energy industry undergoes transformative shifts, the growing need for asset management solutions to enhance the resiliency of energy networks is evident. The transition to renewable energy sources introduces complexities in energy production, distribution, and storage.

Asset management solutions play a critical role in helping networks adapt to changes, manage intermittent renewable sources, and ensure consistent energy supplies. The U.S. Department of Energy is actively devising strategies to bolster the resilience of energy systems across all three distribution channels - electricity, refined oil, and natural gas distribution networks.

Digital and Energy Transformations Drive Demand

The proliferation of digital and energy transformations has created a demand for asset management solutions to support and optimize the technical infrastructure in the renewable energy sector. The integration of digital technologies, such as IoT and AI, with renewable energy systems, has led to more complex operations requiring sophisticated management tools.

Energy Information Administration anticipates renewable deployment will expand by 17% to reach 42 GW by 2024 and account for nearly one-quarter of electricity production. Furthermore, the International Energy Agency projects that the residential sector with one billion households and 11 billion smart appliances could take an active role in interconnected energy systems by altering when they take electricity from the grid.

Long-term Investment Focus Enhances Asset Management Market

Owners increasingly focusing on investing in the long-term health of their renewable assets are driving the demand for asset management solutions. As renewable energy assets represent significant long-term investments, ensuring their optimal performance and longevity is crucial. Asset management solutions provide the necessary tools to monitor, maintain, and manage these assets over their lifespan.

This focus on long-term asset health and sustainability is a key factor driving the market, highlighting the shift in the renewable energy industry towards sustainable practices and long-term operational efficiency.

Restraining Factors

High Initial Investment Deters Investors in Renewable Energy Asset Management Market

Renewable energy asset management market growth has been restrained by the substantial initial investments required for projects. Building infrastructure for renewable energy like wind farms or solar panels typically involves substantial upfront costs such as land acquisition, equipment procurement, and installation. Initial expenses associated with renewable energy investments can be an overwhelming deterrent to potential investors, particularly those wary of long payback periods and fluctuating returns associated with these projects. Furthermore, their capital-intensive nature limits how many investors commit funds thus restricting market expansion within the renewable energy asset management sector.

Remote Locations of Renewable Projects Challenge Asset Management Market

The fact that many renewable energy projects are located in remote areas poses a challenge to the renewable energy asset management market. These remote locations can make it difficult to access and maintain assets, increasing operational complexities and maintenance costs.

Wind farms often are situated in off-shore or isolated regions to optimize wind exposure; however, their remote location makes daily monitoring, repairs, and maintenance challenging. Remote asset management has become an increasingly essential service, especially for renewable energy equipment like solar panels and wind turbines which often operate in isolated environments. The global remote asset management market is expected to experience exponential growth from USD 8.2 billion in 2022 up to USD 311 billion by 2032 at an anticipated compound annual growth rate of 43.87% between now and 2032.

Renewable Energy Asset Management Market Segmentation Analysis

By Component Type Analysis

In the renewable energy asset management market, hardware components, including sensors, cameras, and other monitoring devices, constitute the dominant segment, with a 57.3% share.

Sensors and cameras are integral for tracking performance, detecting faults, and conducting regular maintenance of solar panels, wind turbines, and other renewable energy equipment. sensors and cameras play a crucial role. These devices help in the early detection of operational issues or faults, enabling timely maintenance and repairs. This ensures that the equipment operates at optimal efficiency, reducing downtime and maximizing energy output.

Software solutions, although holding a smaller market share compared to hardware, are vital for data analysis, performance monitoring, and predictive maintenance. They provide critical insights for decision-making and optimizing asset performance.

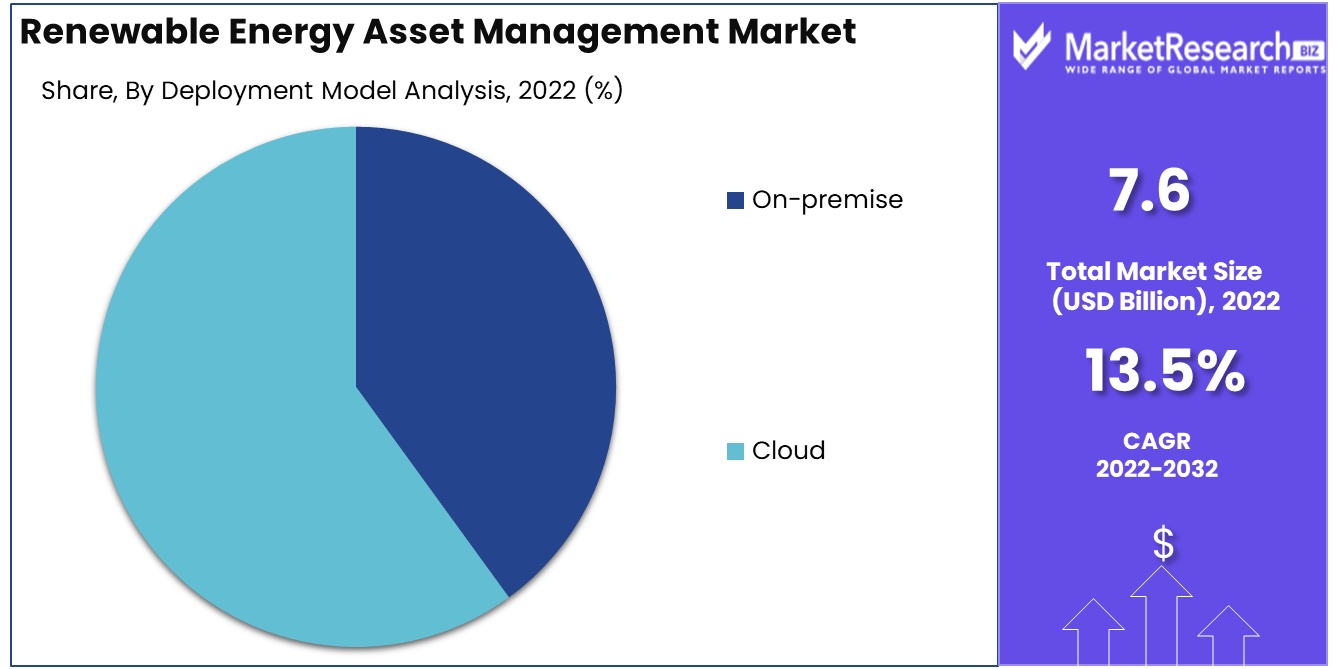

By Deployment Model Type Analysis

On-premise deployment in renewable energy asset management offers robust control and heightened security of sensitive data, appealing to organizations prioritizing data sovereignty. However, the industry is witnessing a progressive shift towards cloud-based solutions, propelled by the benefits of scalability, flexibility, and cost reductions.

Cloud platforms enable seamless integration of geographically dispersed renewable energy assets, fostering improved data aggregation and enhanced analytical capabilities. This transition to cloud-based solutions also opens doors for innovation in asset management, with advanced tools and algorithms that can leverage big data to optimize asset performance and predict maintenance needs.

By Service Type Analysis

Professional services in renewable energy asset management, encompassing consulting, implementation, and ongoing support, are crucial for ensuring the successful deployment and optimization of assets. These services provide expert guidance and tailored solutions to meet specific project needs.

On the other hand, the rising popularity of managed services reflects a market trend towards comprehensive, outsourced management solutions. These services relieve energy companies from the intricacies of daily asset management, allowing them to concentrate on their primary business functions while managed services providers ensure the efficient and effective operation of their renewable assets. This shift towards managed services represents a growing recognition of the value of outsourcing complex operational tasks to specialized providers.

By Energy Type Analysis

The renewable energy asset management market is predominantly led by solar energy, holding a 44.2% share, attributed to its global uptake influenced by the falling prices of solar panels and encouraging government policies. Managing solar assets effectively is vital for optimizing energy output and securing their sustainability over time.

Wind energy also holds a substantial portion of this market, emphasizing the need for efficient operation of wind farms, while hydro, tidal, and geothermal energies contribute to their unique management needs. Additionally, biomass energy and various other renewable sources add to the market's overall diversity, each necessitating distinct management approaches.

Renewable Energy Asset Management Industry Segments

By Component

- Hardware

- Sensors

- Cameras

- Others Software

Deployment Model

- On-premise

- Cloud

By Service

- Professional Services

- Managed Services

By Energy Type

- Solar Energy

- Wind Energy

- Hydro Energy

- Tidal Energy

- Geothermal Energy

- Biomass Energy

- Others

Renewable Energy Asset Management Market Regional Analysis

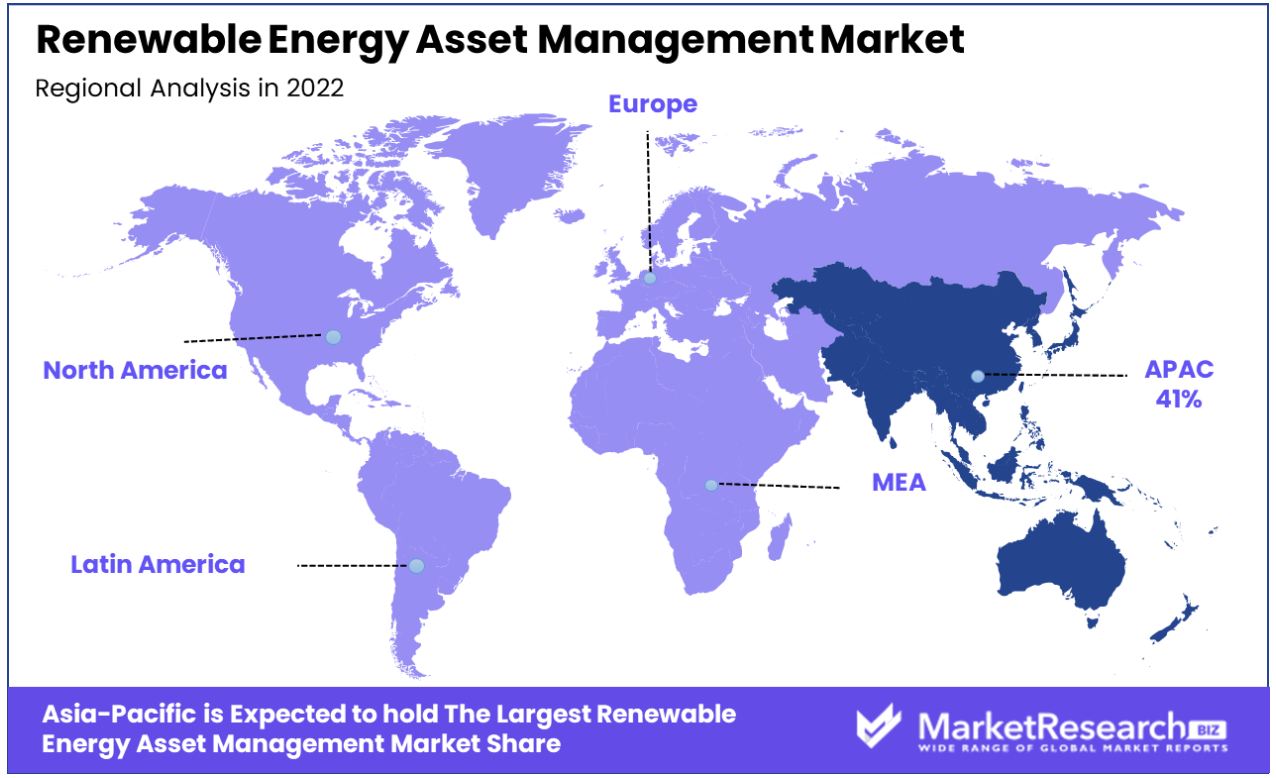

Asia Pacific Dominates with 41% Market Share in Renewable Energy Asset Management

Asia Pacific’s leading 41% share in the renewable energy asset management market, valued at USD 3.5 billion, is primarily driven by the region’s aggressive pursuit of renewable energy sources. Countries like China, India, and Japan are at the forefront, significantly investing in solar, wind, and hydroelectric power projects. The region's commitment to reducing carbon emissions and increasing energy independence catalyzes this investment. Additionally, Asia Pacific's growing economic development and increasing energy demand necessitate efficient renewable energy asset management to ensure sustainability and profitability.

The market dynamics in Asia Pacific are influenced by the region’s vast natural resources for renewable energy and supportive government policies. Incentives and subsidies for renewable energy projects, along with favorable regulatory frameworks, encourage the development and management of renewable assets. The increasing awareness of environmental sustainability among businesses and consumers in the region further boosts the market.

Europe's Strong Commitment to Renewable Energy Transition

Europe's renewable energy capacity has seen significant expansion, with the European Environment Agency (EEA) projecting that by 2030 its binding target for renewables will rise from 42.5% to 45.1% - this goal being driven mainly by solar power growth. European nations have set ambitious renewable energy goals and actively invested in their renewable infrastructure, according to early estimates by EEA early estimates for 2022 generating 22.5% of EU energy consumption from renewable sources - representing an increase from 2021 and driven largely by strong expansion in sola12

North America Has a Growing Focus on Sustainability and Technological Innovation

North America, particularly the United States and Canada, is seeing their renewable energy asset management market expand due to a greater focus on sustainability and technological innovation. More than $1.7 trillion U.S. dollars are anticipated to be invested in clean energy throughout 2023, including renewable power, storage, grids, efficiency improvement, slow-emission fuels, end-use renewables, and electrification projects. Additionally, 29 jurisdictions (representing around half of U.S. electricity retail sales) with mandatory renewable portfolio standards represent around half of retail electricity sales in North America; 24 jurisdictions including two new states added in 2023 have zero greenhouse gas (GHG) emissions goals from 2030-2050 that represent growing investments in renewable energy sources across North America. This evidences a trend toward investing more heavily in sustainable sources.

Renewable Energy Asset Management Industry By Region

North America

- The US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of the Middle East & Africa

Renewable Energy Asset Management Market Key Player Analysis

Greensolver and Trivone, with their expertise in technical and operational management, play pivotal roles in maintaining and improving the performance of wind and solar assets, reflecting the industry's shift towards comprehensive and proactive asset management strategies. Peacock Engineering Ltd and DNV GL, known for their consulting and engineering services, contribute significantly to the market by offering solutions that ensure regulatory compliance and technical excellence.

AccountsIQ and ABB Ltd., focusing on software solutions and automation technologies, underscore the importance of digitalization in managing renewable energy assets efficiently. Siemens AG and General Electric Company, global technology leaders, are key players in providing integrated solutions that encompass monitoring, maintenance, and optimization of renewable energy systems.

Overall, the Renewable Energy Asset Management Market is marked by a blend of specialized service offerings, technological innovation, and strategic expansion, with each company playing a distinct role in ensuring the efficient and sustainable operation of renewable energy assets.

Renewable Energy Asset Management Industry Key Players

- Incommodities

- Vector Renewables

- Greensolver

- Peacock Engineering Ltd

- Trivone

- DNV GL

- AccountsIQ

- ABB Ltd.

- Siemens AG

- General Electric Company

- S&C Electric Company

- Sentient Energy Inc.

- Aclara Technologies LLC

- Enetics Inc.

- Lindsey Manufacturing Co.

- Netcontrol Oy

Renewable Energy Asset Management Market Recent Development

Report Scope

Report Features Description Market Value (2022) USD 7.6 Billion Forecast Revenue (2032) USD 26.1 Billion CAGR (2023-2032) 13.5% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered (Hardware, Sensors, Cameras, Others, Software), Deployment Model(On-premise, Cloud), By Service(Professional Services, Managed Services), By Energy Type(Solar Energy, Wind Energy, Hydro Energy, Tidal Energy, Geothermal Energy, , Others) Regional Analysis North America - The US, Canada, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Incommodities, Vector Renewables, Greensolver, Peacock Engineering Ltd, Trivone, DNV GL, AccountsIQ, ABB Ltd., Siemens AG, General Electric Company, S&C Electric Company, Sentient Energy Inc., Aclara Technologies LLC, Enetics Inc., Lindsey Manufacturing Co., Netcontrol Oy Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Incommodities

- Vector Renewables

- Greensolver

- Peacock Engineering Ltd

- Trivone

- DNV GL

- AccountsIQ

- ABB Ltd.

- Siemens AG

- General Electric Company

- S&C Electric Company

- Sentient Energy Inc.

- Aclara Technologies LLC

- Enetics Inc.

- Lindsey Manufacturing Co.

- Netcontrol Oy