Seed Market By Seeds Type(G. M. Seeds, Non-G.M. Seeds), By Seeds Category(Organic, Conventional), By Seeds Crop Type(Cereals & Grain, Fruits & Vegetables, Oilseeds & Pulses, Others), By Seeds Treatment(Treated, Non-Treated), By Seeds Trait(Herbicide Tolerant, Insecticide Resistant, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

13727

-

March 2024

-

139

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

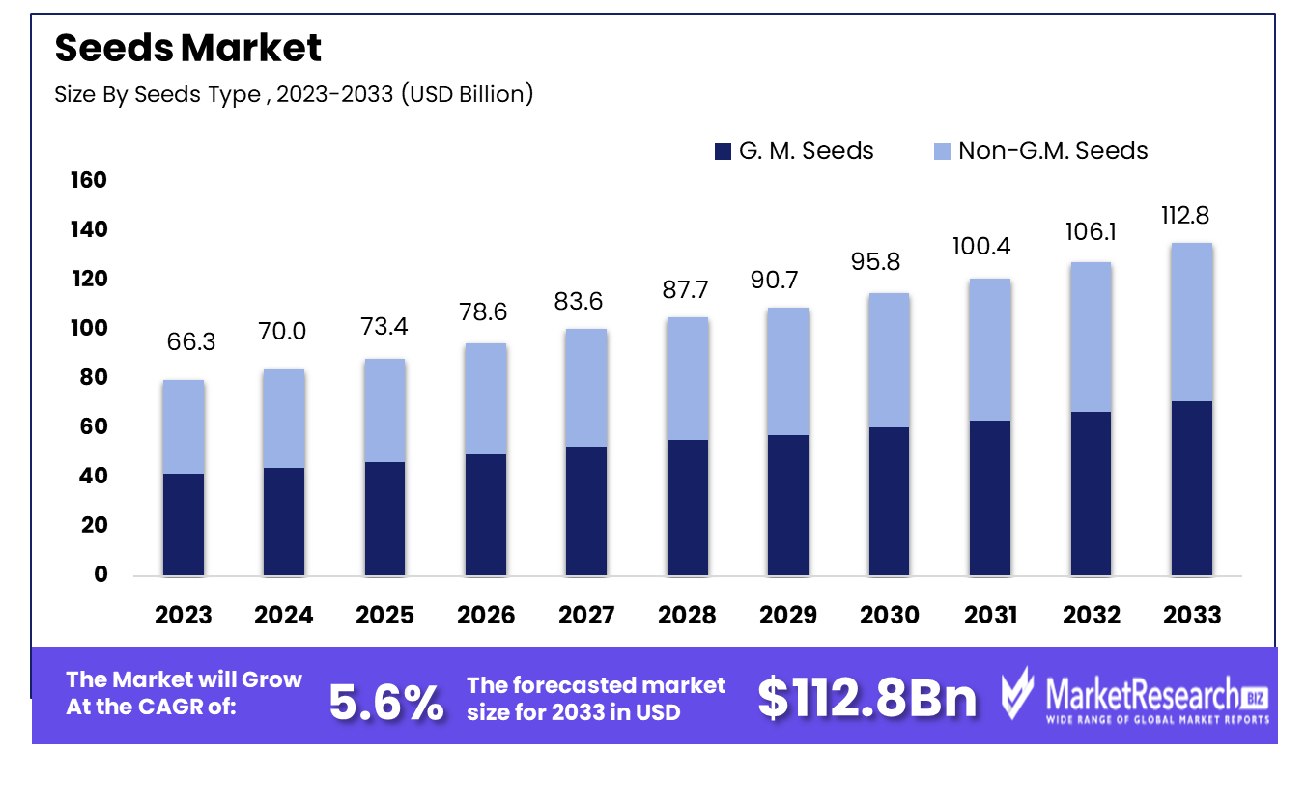

The seed market was valued at USD 66.3 billion in 2023. It is expected to reach USD 112.8 billion by 2033, with a CAGR of 5.6% during the forecast period from 2024 to 2033. The surge in demand for commercialization in agriculture, the rise in availability of rich arable lands, and advanced technologies are some of the main key driving factors for the seeds market.

The seeds are defined as the embryonic plants that are surrounded by a protective outer layering, typically found in the ovary of a flowering plant. These structures act as the means of reproduction for plants by carrying genetic data for the development of a new organism. Seeds can be broadly used in shape, size, and dispersal mechanism that adapts to the multiple surroundings in which plants flourish. The general anatomy of a seed comprises an embryo, a strong tissue, and a seed coat.

When situations are favorable, seed germination and the beginning of the new plant growth. This method consists of the absorption of water, activation of the enzymes, and the rise of the embryonic roots and shoots. Further than their biological importance, seeds hold great importance in human agriculture and nutrition. They are the basic source of food, oilseeds, and fibers by contributing to world agriculture and the farming of several crop essentials for human sustenance. Moreover, these seeds play a significant role in the preservation of plant biodiversity and the continuance of plant species across generations.

Times of India in December 2022, highlights that Dharti Agro launches hybrid seed which is one of the world’s first GMS based in Cowpea hybrids. Hybrids of Cowpea are highly suitable for off-season farming and are not photoperiod sensitive. Dharti Agro Chemicals Pvt ltd has released three hybrids in Cowpea such as Bubbly, Sherly, and Poorvaja. These have provided good performance in farmer’s cultivation by giving up to 100% heterosis in the daily season of Kharif and up to 200 to 250% heterosis in the off-season providing almost 2 times the profit as compared to the old varieties.

Seeds have gained much importance in modern contexts as a main component of sustainable agriculture and nutrition. With a surging significance on biodiversity, organic cultivation, climate climate-resilient crops, seeds are vital for making sure of food security and adapting to changing environmental conditions. Moreover, the increasing recognition of their capabilities in developing new varieties with rich nutritional profiles. Harnessing the genetic assortment in seeds becomes important for identifying world challenges by promoting resilient crops and developing a more sustainable and flourishing future. The demand for the seeds will increase due to its requirement in the agricultural sector which will help in market expansion in the coming years.

Key Takeaways

- Market Growth: Seed Market was valued at USD 66.3 billion in 2023. It is expected to reach USD 112.8 billion by 2033, with a CAGR of 5.6% during the forecast period from 2024 to 2033.

- By Seeds Type: In the Seeds Type segment, G. M. Seeds emerge as the dominant choice for consumers.

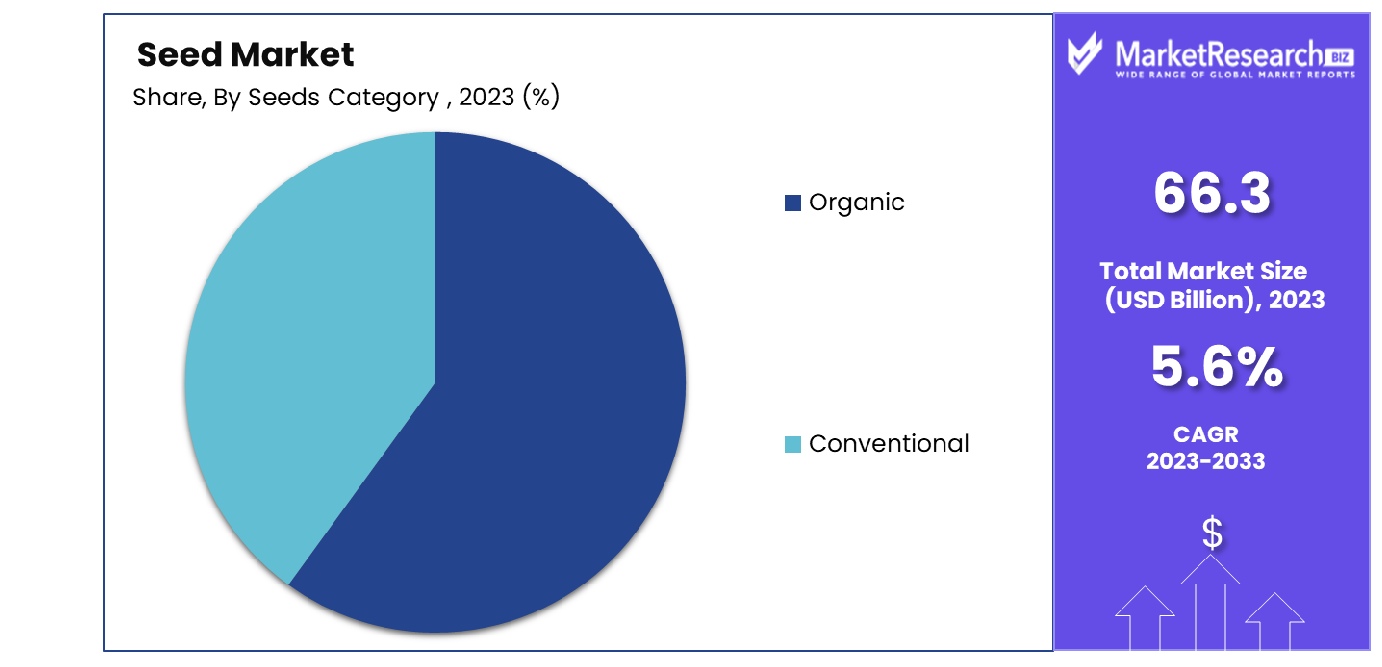

- By Seeds Category: The Organic category maintains its dominance within the Seeds Category segment.

- By Seeds Crop Type: Cereals & Grain seeds hold sway as the dominant choice in the Seeds Crop Type segment.

- By Seeds Treatment: Treated seeds maintain their dominance within the Seeds Treatment category.

- By Seeds Trait: Herbicide Tolerant seeds continue to dominate the Seeds Trait segment, showcasing their popularity.

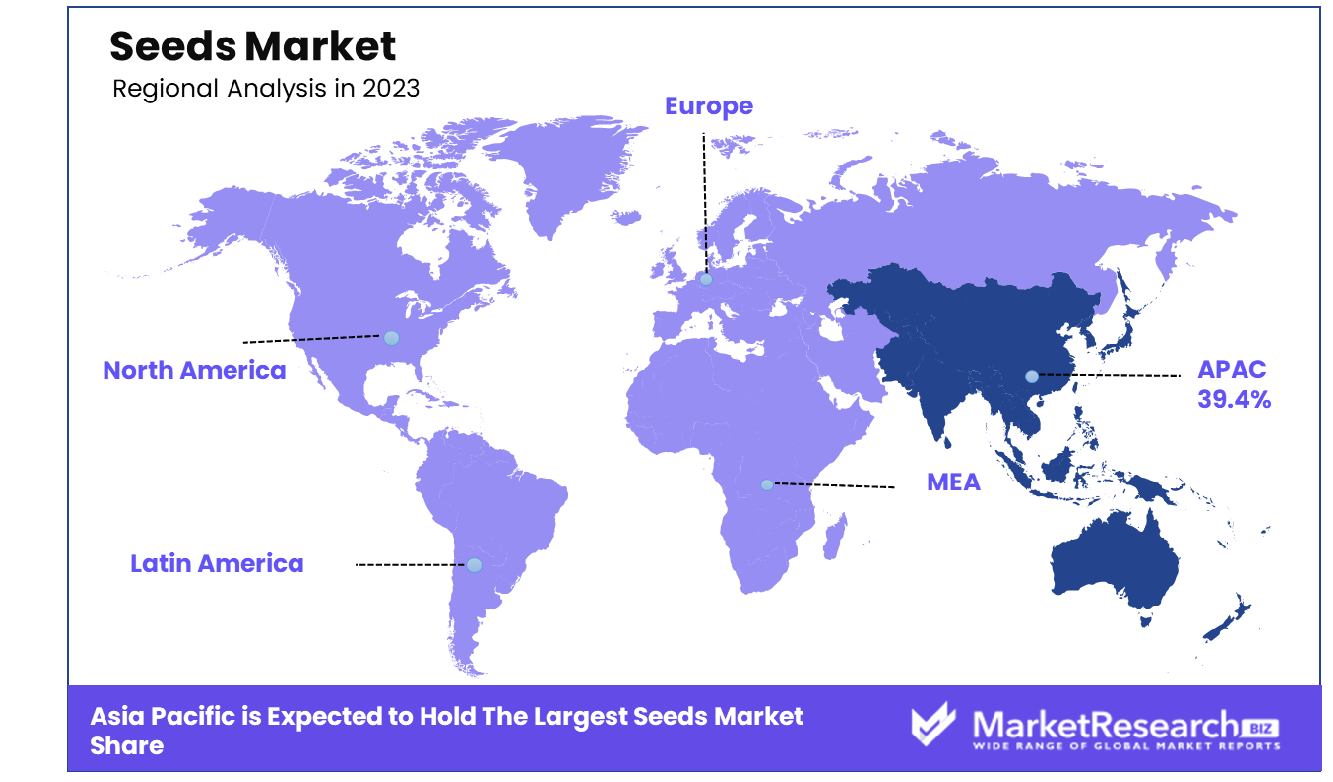

- Regional Dominance: Asia-Pacific dominates the seed market with an impressive 39.4% market share.

- Growth Opportunity: Expanding consumer awareness towards health and sustainability, coupled with technological advancements in seed genetics, drives growth. Emerging markets offer untapped potential for global expansion in the seed industry.

Driving factors

Technological Advancements and Innovation

The Seed Market is experiencing a significant surge driven by ongoing technological advancements and innovation. These innovations encompass various aspects, including genetic engineering, precision breeding techniques, and advanced biotechnological applications. Genetic modification techniques such as CRISPR-Cas9 have revolutionized seed development, enabling scientists to precisely edit plant technology genomes for desired traits such as drought resistance, pest tolerance, and improved nutritional content.

Furthermore, advancements in seed coating technologies have enhanced seed protection, germination rates, and overall crop performance. The integration of data analytics and machine learning in seed breeding programs has also expedited the development of high-yielding and climate-resilient seed varieties. Such technological progress not only enhances agricultural productivity but also addresses global challenges like food security and sustainability.

Increasing Demand for Organic and Non-GMO Seeds

The rising consumer preference for organic and non-genetically modified organism (GMO) products has become a significant driving force behind the growth of the Seed Market. Health-conscious consumers are increasingly seeking organic produce, driving demand for seeds that yield crops free from synthetic pesticides, herbicides, and GMOs. As consumers become more aware of the environmental and health impacts associated with conventional farming practices, they are willing to pay premiums for organic and non-GMO seeds.

This trend is further bolstered by regulatory initiatives promoting sustainable agriculture and stricter labeling requirements for GMO products. Consequently, seed companies are investing in research and development to expand their portfolio of organic and non-GMO seed varieties, catering to the evolving preferences of consumers and farmers alike.

Expansion of Precision Agriculture Practices

The adoption of precision agriculture practices is another key driver propelling the growth of the Seed Market. Precision agriculture leverages technologies such as global positioning systems (GPS), remote sensing, drones, and data analytics to optimize farm management practices. By precisely monitoring and managing variables such as soil moisture, nutrient levels, and crop health, farmers can enhance resource efficiency, minimize input costs, and maximize yields.

Seeds tailored for specific environmental conditions and agronomic practices play a crucial role in enabling precision agriculture. As farmers seek to maximize productivity while minimizing environmental impact, the demand for precision-engineered seeds suited to diverse agro-climatic regions and farming systems continues to escalate. This trend underscores the growing importance of seed companies in facilitating sustainable agricultural practices and fostering innovation in the agricultural sector.

Restraining Factors

Stringent Approval Processes

The growth of the seed market is hampered by the rigorous approval processes mandated by regulatory bodies. Obtaining approval for new seed varieties involves extensive testing, evaluation, and compliance with stringent regulations. These processes often entail substantial time and financial investments, delaying the commercialization of innovative seed products.

Moreover, the complexity of regulatory frameworks across different regions adds another layer of challenge, requiring companies to navigate diverse regulatory landscapes to gain market access. Consequently, the prolonged approval timelines impede market growth and innovation, limiting the introduction of novel seed varieties into the market.

Intellectual Property Rights (IPR) Issues

Intellectual property rights (IPR) play a pivotal role in shaping the competitive landscape of the seed market. However, disputes and legal challenges surrounding IPR create significant restraining factors for market major players. Patent infringements, licensing disputes, and conflicts over genetic resources often lead to protracted legal battles, draining resources and stifling innovation.

Moreover, the ambiguity surrounding gene editing technologies and their patentability further complicates the IPR landscape, fostering uncertainty among market participants. As a result, companies face obstacles in leveraging their proprietary technologies and accessing key genetic resources, hindering the development and commercialization of new seed varieties.

By Seeds Type Analysis

In the Seeds Type segment, G. M. Seeds reign supreme.

In 2023, G. M. Seeds held a dominant market position in the By Seeds Type segment of the Seed Market, encompassing both G. M. Seeds and Non-G.M. Seeds. G. M. Seeds, also known as genetically modified seeds, have garnered significant attention and adoption within the agricultural sector due to their enhanced traits such as resistance to pests, diseases, and herbicides, as well as improved yields.

The dominance of G. M. Seeds in this segment growth can be attributed to several factors. Firstly, advancements in biotechnology have facilitated the development of genetically modified crops with desirable traits, appealing to farmers seeking to optimize productivity and mitigate risks associated with crop losses. Additionally, the robust marketing and distribution networks of major seed companies have propelled the widespread availability and accessibility of G. M. Seeds across diverse agricultural regions.

However, the market for Non-G.M. Seeds remains substantial, particularly driven by the demand for organic and sustainable farming practices. Non-G.M. Seeds cater to a niche segment of consumers who prioritize natural and traditional cultivation methods, thereby contributing to the diversity within the Seed Market.

The competitive landscape within the By Seeds Type segment is characterized by the presence of prominent major players specializing in biotechnology and seed genetics. These companies invest heavily in research and development to innovate and introduce novel seed varieties that cater to evolving market demands and regulatory requirements.

Looking ahead, the By Seeds Type segment growth is poised for continued growth, fueled by ongoing technological advancements, shifting consumer preferences towards sustainable agriculture, and the need to address global food security challenges. Strategic collaborations, investments in research, and regulatory compliance will be pivotal for companies aiming to sustain their market leadership and capitalize on emerging opportunities within this dynamic segment of the Seed Market.

By Seeds Category Analysis

Organic seeds lead the way in the Seeds Category segment.

In 2023, Organic held a dominant market position in the By Seeds Category segment growth of the Seed Market. Organic seeds, distinguished by their adherence to stringent organic seed farming standards, accounted for a substantial share of the market, outpacing their conventional counterparts. The surge in consumer demand for organic produce, driven by heightened health consciousness and environmental sustainability concerns, propelled the growth of the organic seeds segment. Consumers increasingly prioritize products free from synthetic pesticides, genetically modified organisms (GMOs), and other artificial additives, aligning with the ethos of organic agriculture.

The growth of the market can be attributed to various factors, including increasing awareness regarding the adverse effects of chemical pesticides on human health and the environment. Additionally, government initiatives promoting organic farming practices and certifications further bolstered consumer confidence in organic seeds. Moreover, the burgeoning popularity of organic food products among health-conscious individuals and environmentally-conscious consumers contributed significantly to the expansion of the organic seeds market segment.

Conversely, while conventional seeds retained a portion of the market, their growth trajectory was tempered by the shifting consumer preferences towards organic alternatives. Despite being widely utilized in traditional farming practices, conventional seeds faced scrutiny due to concerns over pesticide residues and environmental sustainability issues associated with intensive agricultural practices.

Looking ahead, the By Seeds Category segment of the Seed Market is poised for continued growth, with organic seeds expected to maintain their dominant position. As consumer awareness regarding the benefits of organic agriculture continues to evolve and regulatory support for organic farming expands, the organic seeds market is anticipated to witness sustained demand, offering lucrative opportunities for stakeholders across the agricultural value chain.

By Seeds Crop Type Analysis

Cereals & Grain dominate the Seeds Crop Type segment.

In 2023, Cereals & Grain held a dominant market position in the By Seeds Crop Type segment of the Seed Market. The seeds market, categorized by crop type, witnessed robust growth driven by various factors including technological advancements in agriculture, increasing demand for food security, and the adoption of genetically modified (GM) seeds. Among these segments, Cereals & Grain emerged as the frontrunner, commanding a significant share of the market.

Cereals & Grain seeds encompass a wide array of crops such as wheat, rice, maize, barley, and oats, among others. These seeds are integral to global food production, serving as staple foods for a substantial portion of the world's population. The dominance of Cereals & Grain in the By Seeds Crop Type segment is attributed to several factors. Firstly, the sheer volume of consumption of cereals and grains globally underscores their importance in the agricultural sector. Additionally, advancements in seed technology, including the development of high-yielding varieties and hybrids, have enhanced the productivity and resilience of cereal crops, further consolidating their market position.

Moreover, the increasing awareness among farmers regarding the benefits of modern agricultural practices and the adoption of improved seed varieties has fueled the demand for Cereals & Grain seeds. Furthermore, the growing emphasis on sustainable agriculture and the need to address environmental concerns have led to the promotion of crops like wheat and barley, which are known for their efficient use of resources.

Looking ahead, the Cereals & Grain segment is poised for continued growth, driven by factors such as the expanding global population, rising disposable incomes, and changing dietary preferences. However, challenges such as climate change, water scarcity, and regulatory constraints necessitate ongoing innovation and adaptation within the seed industry to sustainably meet the growing demand for Cereals & Grain seeds.

By Seeds Treatment Analysis

Treated seeds hold sway in the seed treatment segment.

In 2023, Treated held a dominant market position in the By Seeds Treatment segment of the Seed Market. The market for treated seeds experienced significant growth, attributed to heightened demand for enhanced crop yields and disease resistance. Treated seeds, comprising genetically modified organisms (GMOs) and seeds treated with pesticides or fungicides, accounted for a substantial share of the market due to their proven efficacy in maximizing agricultural productivity.

Nonetheless, Non-Treated seeds also maintained a notable presence in the market, particularly among organic and environmentally conscious farmers. This segment catered to consumers seeking natural and sustainable farming practices, driving demand for untreated seeds free from synthetic chemicals. While Non-Treated seeds faced challenges related to pest and disease management, advancements in organic farming techniques and biocontrol agents bolstered their adoption.

The competition between Treated and Non-Treated seeds remained intense, with each segment catering to distinct consumer preferences and agricultural practices. Treated seeds continued to dominate large-scale commercial farming operations, where yield optimization and crop protection were paramount. Meanwhile, Non-Treated seeds found favor among niche markets focused on organic produce and eco-friendly farming methods.

Looking ahead, the By Seeds Treatment segment is poised for continued growth, fueled by technological advancements in seed treatment formulations and increasing awareness of sustainable agriculture practices. Market players are expected to invest in research and development to offer innovative seed treatments that strike a balance between productivity and environmental stewardship, thereby catering to diverse needs within the agricultural landscape.

By Seeds Trait Analysis

Herbicide Tolerant traits dominate the Seeds Trait segment's landscape.

In 2023, Herbicide Tolerant held a dominant market position in the By Seeds Trait segment of the Seed Market, showcasing robust growth and widespread adoption. This trajectory was fueled by escalating demand for crop protection solutions amidst the agricultural landscape's evolving challenges. Herbicide Tolerant seeds, engineered to withstand herbicide applications, emerged as a pivotal choice for farmers seeking efficient weed management strategies while optimizing crop yields.

The ascendancy of Herbicide Tolerant seeds can be attributed to their inherent benefits, including enhanced weed control, minimized labor costs, and streamlined agricultural operations. Farmers, recognizing the imperative need for sustainable practices and increased productivity, gravitated towards these seeds, leveraging their compatibility with herbicides to effectively combat weed infestations.

Moreover, the efficacy and reliability of Herbicide Tolerant seeds resonated strongly with agricultural stakeholders, instilling confidence in their ability to mitigate crop losses and bolster profitability. The seamless integration of biotechnological advancements into agricultural practices further bolstered the market position of herbicide-tolerant seeds, positioning them as indispensable assets in modern farming endeavors.

Looking ahead, the trajectory of the By Seeds Trait segment is poised for continued growth, with Herbicide Tolerant seeds anticipated to maintain their dominance. However, the landscape remains dynamic, with emerging innovations and regulatory dynamics shaping the competitive landscape. As such, stakeholders must remain vigilant, and attuned to evolving market industry trends and regulatory frameworks to capitalize on emerging opportunities and navigate potential challenges effectively.

Key Market Segments

By Seeds Type

- M. Seeds

- Non-G.M. Seeds

By Seeds Category

- Organic

- Conventional

By Seeds Crop Type

- Cereals & Grain

- Fruits & Vegetables

- Oilseeds & Pulses

- Others

By Seeds Treatment

- Treated

- Non-Treated

By Seeds Trait

- Herbicide Tolerant

- Insecticide Resistant

- Others

Growth Opportunity

Expanding Consumer Awareness Driving Growth in the Seed Market

The burgeoning awareness among consumers regarding health and environmental sustainability presents a significant growth opportunity for the seed market. With a heightened focus on the provenance of food and its impact on personal well-being and the environment, there's an increasing demand for natural, non-GMO, and organic products. This shift in consumer preferences towards healthier and eco-friendly alternatives has propelled the demand for seeds used in organic farming practices.

Additionally, the growing popularity of home gardening and urban farming further augments this trend. As consumers seek greater control over the quality and safety of their food, they are increasingly turning to seeds to cultivate their produce, fostering a promising market landscape.

Technological Advancements Revolutionizing Seed Genetics and Innovation

The convergence of biotechnology and agriculture has paved the way for groundbreaking advancements in seed genetics and innovation, presenting a transformative growth opportunity for the seed market. With rapid developments in genetic engineering techniques, such as CRISPR-Cas9 technology, researchers can precisely manipulate the genetic makeup of seeds to enhance traits like yield, disease resistance, and nutritional content.

These technological breakthroughs not only accelerate the breeding process but also enable the development of tailored seeds optimized for specific climatic conditions and agricultural practices. Moreover, advancements in seed coating technologies offer improved protection against pests, diseases, and environmental stressors, thereby enhancing crop productivity and sustainability. Embracing these technological innovations can propel the seed market toward unprecedented growth and resilience.

Emerging Markets and Untapped Potential Driving Global Expansion in the Seed Industry

The untapped potential of emerging markets presents a lucrative growth opportunity for the seed industry to expand its global footprint. Rapid urbanization, population growth, and changing dietary patterns in emerging economies fuel the demand for high-quality seeds capable of delivering increased yields and nutritional value. Moreover, government initiatives aimed at promoting sustainable agriculture and food security further catalyze market growth in these regions.

By strategically leveraging partnerships, distribution networks, and market insights, seed companies can capitalize on the untapped potential of emerging markets to gain a competitive edge and establish a strong presence. Additionally, investments in research and development tailored to the specific needs and challenges of these regions can unlock new avenues for growth and innovation, positioning the seed industry for long-term success on a global scale.

Latest Trends

Emergence of Sustainable Seed Practices in Agricultural Systems

In recent years, the seed market has witnessed a notable shift towards sustainability and environmental consciousness. This trend is primarily driven by increased consumer awareness regarding the importance of sustainable agriculture and the impact of conventional farming practices on the environment. Stakeholders across the agricultural sector are now prioritizing the adoption of sustainable seed practices, including organic farming methods, conservation agriculture, and the use of non-GMO seeds.

Technological Advancements Reshaping the Future of Seed Industry

The seed market is undergoing a rapid transformation fueled by technological advancements aimed at enhancing seed quality, resilience, and yield. Innovations such as precision breeding, genome editing, and advanced seed coating technologies are revolutionizing the way seeds are developed, tested, and distributed. These technologies not only enable the production of high-quality seeds tailored to specific environmental conditions but also facilitate the development of novel crop varieties with enhanced traits such as disease resistance, drought tolerance, and nutritional value.

Regional Analysis

Asia-Pacific dominates the seed market with a commanding 39.4% share, reflecting its pivotal agricultural influence.

North America, being a prominent agricultural hub, commands a significant share of the seed market. The region benefits from advanced agricultural practices, robust R&D investments, and favorable regulatory frameworks. According to a recent market analysis, North America held a substantial market share of approximately 31.2% in 2023, with a steady growth projection of 3.8% annually.

Europe, characterized by its stringent regulatory environment and increasing adoption of genetically modified organisms (GMOs), maintains a notable presence in the seed market. With a market share of around 25.6% in 2023, Europe remains a key player in driving innovation and sustainability in agriculture.

The Asia Pacific region emerges as the dominant force in the global seed market, capturing a substantial share of 39.4% in 2023. This growth rate can be attributed to the region's expanding population, rising demand for food security, and escalating investments in agricultural infrastructure. Furthermore, initiatives promoting sustainable farming practices and technological advancements contribute to the region's robust market position.

Middle East & Africa, while accounting for a smaller market share compared to other regions, exhibits untapped potential fueled by increasing agricultural modernization efforts and government initiatives. Latin America, renowned for its vast arable land and agroecological diversity, continues to attract investments, contributing to its significant market share.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In 2023, the global seed market witnessed the continued dominance of key players, each contributing to the industry's evolution and responding to dynamic market demands. Among these, Bayer AG, a stalwart in agricultural innovation from Germany, maintained its position as a frontrunner. Leveraging its expertise in crop science, Bayer AG navigated market challenges with strategic investments in research and development, enhancing seed traits for improved yield and resilience against environmental stressors.

DowDuPont Inc., headquartered in France, emerged as another significant player, capitalizing on its diverse portfolio and global reach. Through collaborative efforts and synergies across its business units, DowDuPont Inc. showcased resilience amidst market uncertainties, fostering innovation and sustainability in seed technologies.

Switzerland-based Syngenta AG solidified its presence as a leading force in the biggest seed companies, emphasizing sustainable agricultural practices and genetic advancements. With a robust commitment to addressing food security challenges, Syngenta AG continued to drive agricultural productivity while minimizing environmental impact.

The US-based Monsanto Company maintained its influence, leveraging its extensive seed portfolio and biotechnology expertise to address evolving market needs. With a focus on precision agriculture and digital solutions, Monsanto Company demonstrated resilience in a rapidly evolving market landscape.

Groupe Limagrain, based in France, showcased its dedication to seed quality and genetic diversity, contributing to global agricultural sustainability efforts. Similarly, KWS SAAT SE from Germany, Land O'Lakes Inc. from the US, Maharashtra Hybrid Seeds Co. from India, Gansu Dunhuang Seeds Co. Ltd from China, and Sakata Seeds Corporation from the US each played pivotal roles in shaping the global seed market through innovation, collaboration, and a commitment to advancing agricultural productivity while ensuring environmental stewardship.

Market Key Players

- Bayer AG (Germany)

- DowDuPont Inc. (France)

- Syngenta AG (Switzerland)

- Monsanto Company (US)

- Groupe Limagrain (France)

- KWS SAAT SE (Germany)

- Land O'Lakes Inc. (US)

- Maharashtra Hybrid Seeds Co. (India)

- Gansu Dunhuang Seeds Co. Ltd (China)

- Sakata Seeds Corporation (US)

Recent Development

- In March 2024, Protein Industries Canada announces a $13.2 million investment in fava bean innovation. Prairie Fava, DL Seeds, and Three Farmers collaborate to enhance fava bean varieties and develop sustainable protein snack options.

- In March 2024, Pop Vriend Seeds introduces new spinach varieties, including Azurite baby leaf resistant to mildew, on open days in Murcia. Launches Spinach 365 program for year-round supply consistency and Spot Disease Kit Foliar for disease management.

- In February 2024, AutoVRse secures $2M seed funding from Lumikai to advance VR/AR solutions and gaming projects. Plans expansion in the US, emphasizing enterprise product VRseBuilder and multiplayer rhythm VR game "District M."

Report Scope

Report Features Description Market Value (2023) USD 66.3 Billion Forecast Revenue (2033) USD 112.8 Billion CAGR (2024-2032) 5.6% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Seeds Type(G. M. Seeds, Non-G.M. Seeds), By Seeds Category(Organic, Conventional), By Seeds Crop Type(Cereals & Grain, Fruits & Vegetables, Oilseeds & Pulses, Others), By Seeds Treatment(Treated, Non-Treated), By Seeds Trait(Herbicide Tolerant, Insecticide Resistant, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Bayer AG (Germany), DowDuPont Inc. (France), Syngenta AG (Switzerland), Monsanto Company (US), Groupe Limagrain (France), KWS SAAT SE (Germany), Land O'Lakes Inc. (US), Maharashtra Hybrid Seeds Co. (India), Gansu Dunhuang Seeds Co. Ltd (China), Sakata Seeds Corporation (US) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Seeds Market Overview

- 2.1. Seeds Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Seeds Market Dynamics

- 3. Global Seeds Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Seeds Market Analysis, 2016-2021

- 3.2. Global Seeds Market Opportunity and Forecast, 2023-2032

- 3.3. Global Seeds Market Analysis, Opportunity and Forecast, By By Seeds Type , 2016-2032

- 3.3.1. Global Seeds Market Analysis by By Seeds Type : Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seeds Type , 2016-2032

- 3.3.3. G. M. Seeds

- 3.3.4. Non-G.M. Seeds

- 3.4. Global Seeds Market Analysis, Opportunity and Forecast, By By Seeds Category, 2016-2032

- 3.4.1. Global Seeds Market Analysis by By Seeds Category: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seeds Category, 2016-2032

- 3.4.3. Organic

- 3.4.4. Conventional

- 3.5. Global Seeds Market Analysis, Opportunity and Forecast, By By Seeds Crop Type , 2016-2032

- 3.5.1. Global Seeds Market Analysis by By Seeds Crop Type : Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seeds Crop Type , 2016-2032

- 3.5.3. Cereals & Grain

- 3.5.4. Fruits & Vegetables

- 3.5.5. Oilseeds & Pulses

- 3.5.6. Others

- 3.6. Global Seeds Market Analysis, Opportunity and Forecast, By By Seeds Treatment , 2016-2032

- 3.6.1. Global Seeds Market Analysis by By Seeds Treatment : Introduction

- 3.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seeds Treatment , 2016-2032

- 3.6.3. Treated

- 3.6.4. Non-Treated

- 3.7. Global Seeds Market Analysis, Opportunity and Forecast, By By Seeds Trait, 2016-2032

- 3.7.1. Global Seeds Market Analysis by By Seeds Trait: Introduction

- 3.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seeds Trait, 2016-2032

- 3.7.3. Herbicide Tolerant

- 3.7.4. Insecticide Resistant

- 3.7.5. Others

- 4. North America Seeds Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Seeds Market Analysis, 2016-2021

- 4.2. North America Seeds Market Opportunity and Forecast, 2023-2032

- 4.3. North America Seeds Market Analysis, Opportunity and Forecast, By By Seeds Type , 2016-2032

- 4.3.1. North America Seeds Market Analysis by By Seeds Type : Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seeds Type , 2016-2032

- 4.3.3. G. M. Seeds

- 4.3.4. Non-G.M. Seeds

- 4.4. North America Seeds Market Analysis, Opportunity and Forecast, By By Seeds Category, 2016-2032

- 4.4.1. North America Seeds Market Analysis by By Seeds Category: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seeds Category, 2016-2032

- 4.4.3. Organic

- 4.4.4. Conventional

- 4.5. North America Seeds Market Analysis, Opportunity and Forecast, By By Seeds Crop Type , 2016-2032

- 4.5.1. North America Seeds Market Analysis by By Seeds Crop Type : Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seeds Crop Type , 2016-2032

- 4.5.3. Cereals & Grain

- 4.5.4. Fruits & Vegetables

- 4.5.5. Oilseeds & Pulses

- 4.5.6. Others

- 4.6. North America Seeds Market Analysis, Opportunity and Forecast, By By Seeds Treatment , 2016-2032

- 4.6.1. North America Seeds Market Analysis by By Seeds Treatment : Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seeds Treatment , 2016-2032

- 4.6.3. Treated

- 4.6.4. Non-Treated

- 4.7. North America Seeds Market Analysis, Opportunity and Forecast, By By Seeds Trait, 2016-2032

- 4.7.1. North America Seeds Market Analysis by By Seeds Trait: Introduction

- 4.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seeds Trait, 2016-2032

- 4.7.3. Herbicide Tolerant

- 4.7.4. Insecticide Resistant

- 4.7.5. Others

- 4.8. North America Seeds Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.8.1. North America Seeds Market Analysis by Country : Introduction

- 4.8.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.8.2.1. The US

- 4.8.2.2. Canada

- 4.8.2.3. Mexico

- 5. Western Europe Seeds Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Seeds Market Analysis, 2016-2021

- 5.2. Western Europe Seeds Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Seeds Market Analysis, Opportunity and Forecast, By By Seeds Type , 2016-2032

- 5.3.1. Western Europe Seeds Market Analysis by By Seeds Type : Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seeds Type , 2016-2032

- 5.3.3. G. M. Seeds

- 5.3.4. Non-G.M. Seeds

- 5.4. Western Europe Seeds Market Analysis, Opportunity and Forecast, By By Seeds Category, 2016-2032

- 5.4.1. Western Europe Seeds Market Analysis by By Seeds Category: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seeds Category, 2016-2032

- 5.4.3. Organic

- 5.4.4. Conventional

- 5.5. Western Europe Seeds Market Analysis, Opportunity and Forecast, By By Seeds Crop Type , 2016-2032

- 5.5.1. Western Europe Seeds Market Analysis by By Seeds Crop Type : Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seeds Crop Type , 2016-2032

- 5.5.3. Cereals & Grain

- 5.5.4. Fruits & Vegetables

- 5.5.5. Oilseeds & Pulses

- 5.5.6. Others

- 5.6. Western Europe Seeds Market Analysis, Opportunity and Forecast, By By Seeds Treatment , 2016-2032

- 5.6.1. Western Europe Seeds Market Analysis by By Seeds Treatment : Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seeds Treatment , 2016-2032

- 5.6.3. Treated

- 5.6.4. Non-Treated

- 5.7. Western Europe Seeds Market Analysis, Opportunity and Forecast, By By Seeds Trait, 2016-2032

- 5.7.1. Western Europe Seeds Market Analysis by By Seeds Trait: Introduction

- 5.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seeds Trait, 2016-2032

- 5.7.3. Herbicide Tolerant

- 5.7.4. Insecticide Resistant

- 5.7.5. Others

- 5.8. Western Europe Seeds Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.8.1. Western Europe Seeds Market Analysis by Country : Introduction

- 5.8.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.8.2.1. Germany

- 5.8.2.2. France

- 5.8.2.3. The UK

- 5.8.2.4. Spain

- 5.8.2.5. Italy

- 5.8.2.6. Portugal

- 5.8.2.7. Ireland

- 5.8.2.8. Austria

- 5.8.2.9. Switzerland

- 5.8.2.10. Benelux

- 5.8.2.11. Nordic

- 5.8.2.12. Rest of Western Europe

- 6. Eastern Europe Seeds Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Seeds Market Analysis, 2016-2021

- 6.2. Eastern Europe Seeds Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Seeds Market Analysis, Opportunity and Forecast, By By Seeds Type , 2016-2032

- 6.3.1. Eastern Europe Seeds Market Analysis by By Seeds Type : Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seeds Type , 2016-2032

- 6.3.3. G. M. Seeds

- 6.3.4. Non-G.M. Seeds

- 6.4. Eastern Europe Seeds Market Analysis, Opportunity and Forecast, By By Seeds Category, 2016-2032

- 6.4.1. Eastern Europe Seeds Market Analysis by By Seeds Category: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seeds Category, 2016-2032

- 6.4.3. Organic

- 6.4.4. Conventional

- 6.5. Eastern Europe Seeds Market Analysis, Opportunity and Forecast, By By Seeds Crop Type , 2016-2032

- 6.5.1. Eastern Europe Seeds Market Analysis by By Seeds Crop Type : Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seeds Crop Type , 2016-2032

- 6.5.3. Cereals & Grain

- 6.5.4. Fruits & Vegetables

- 6.5.5. Oilseeds & Pulses

- 6.5.6. Others

- 6.6. Eastern Europe Seeds Market Analysis, Opportunity and Forecast, By By Seeds Treatment , 2016-2032

- 6.6.1. Eastern Europe Seeds Market Analysis by By Seeds Treatment : Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seeds Treatment , 2016-2032

- 6.6.3. Treated

- 6.6.4. Non-Treated

- 6.7. Eastern Europe Seeds Market Analysis, Opportunity and Forecast, By By Seeds Trait, 2016-2032

- 6.7.1. Eastern Europe Seeds Market Analysis by By Seeds Trait: Introduction

- 6.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seeds Trait, 2016-2032

- 6.7.3. Herbicide Tolerant

- 6.7.4. Insecticide Resistant

- 6.7.5. Others

- 6.8. Eastern Europe Seeds Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.8.1. Eastern Europe Seeds Market Analysis by Country : Introduction

- 6.8.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.8.2.1. Russia

- 6.8.2.2. Poland

- 6.8.2.3. The Czech Republic

- 6.8.2.4. Greece

- 6.8.2.5. Rest of Eastern Europe

- 7. APAC Seeds Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Seeds Market Analysis, 2016-2021

- 7.2. APAC Seeds Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Seeds Market Analysis, Opportunity and Forecast, By By Seeds Type , 2016-2032

- 7.3.1. APAC Seeds Market Analysis by By Seeds Type : Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seeds Type , 2016-2032

- 7.3.3. G. M. Seeds

- 7.3.4. Non-G.M. Seeds

- 7.4. APAC Seeds Market Analysis, Opportunity and Forecast, By By Seeds Category, 2016-2032

- 7.4.1. APAC Seeds Market Analysis by By Seeds Category: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seeds Category, 2016-2032

- 7.4.3. Organic

- 7.4.4. Conventional

- 7.5. APAC Seeds Market Analysis, Opportunity and Forecast, By By Seeds Crop Type , 2016-2032

- 7.5.1. APAC Seeds Market Analysis by By Seeds Crop Type : Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seeds Crop Type , 2016-2032

- 7.5.3. Cereals & Grain

- 7.5.4. Fruits & Vegetables

- 7.5.5. Oilseeds & Pulses

- 7.5.6. Others

- 7.6. APAC Seeds Market Analysis, Opportunity and Forecast, By By Seeds Treatment , 2016-2032

- 7.6.1. APAC Seeds Market Analysis by By Seeds Treatment : Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seeds Treatment , 2016-2032

- 7.6.3. Treated

- 7.6.4. Non-Treated

- 7.7. APAC Seeds Market Analysis, Opportunity and Forecast, By By Seeds Trait, 2016-2032

- 7.7.1. APAC Seeds Market Analysis by By Seeds Trait: Introduction

- 7.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seeds Trait, 2016-2032

- 7.7.3. Herbicide Tolerant

- 7.7.4. Insecticide Resistant

- 7.7.5. Others

- 7.8. APAC Seeds Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.8.1. APAC Seeds Market Analysis by Country : Introduction

- 7.8.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.8.2.1. China

- 7.8.2.2. Japan

- 7.8.2.3. South Korea

- 7.8.2.4. India

- 7.8.2.5. Australia & New Zeland

- 7.8.2.6. Indonesia

- 7.8.2.7. Malaysia

- 7.8.2.8. Philippines

- 7.8.2.9. Singapore

- 7.8.2.10. Thailand

- 7.8.2.11. Vietnam

- 7.8.2.12. Rest of APAC

- 8. Latin America Seeds Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Seeds Market Analysis, 2016-2021

- 8.2. Latin America Seeds Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Seeds Market Analysis, Opportunity and Forecast, By By Seeds Type , 2016-2032

- 8.3.1. Latin America Seeds Market Analysis by By Seeds Type : Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seeds Type , 2016-2032

- 8.3.3. G. M. Seeds

- 8.3.4. Non-G.M. Seeds

- 8.4. Latin America Seeds Market Analysis, Opportunity and Forecast, By By Seeds Category, 2016-2032

- 8.4.1. Latin America Seeds Market Analysis by By Seeds Category: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seeds Category, 2016-2032

- 8.4.3. Organic

- 8.4.4. Conventional

- 8.5. Latin America Seeds Market Analysis, Opportunity and Forecast, By By Seeds Crop Type , 2016-2032

- 8.5.1. Latin America Seeds Market Analysis by By Seeds Crop Type : Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seeds Crop Type , 2016-2032

- 8.5.3. Cereals & Grain

- 8.5.4. Fruits & Vegetables

- 8.5.5. Oilseeds & Pulses

- 8.5.6. Others

- 8.6. Latin America Seeds Market Analysis, Opportunity and Forecast, By By Seeds Treatment , 2016-2032

- 8.6.1. Latin America Seeds Market Analysis by By Seeds Treatment : Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seeds Treatment , 2016-2032

- 8.6.3. Treated

- 8.6.4. Non-Treated

- 8.7. Latin America Seeds Market Analysis, Opportunity and Forecast, By By Seeds Trait, 2016-2032

- 8.7.1. Latin America Seeds Market Analysis by By Seeds Trait: Introduction

- 8.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seeds Trait, 2016-2032

- 8.7.3. Herbicide Tolerant

- 8.7.4. Insecticide Resistant

- 8.7.5. Others

- 8.8. Latin America Seeds Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.8.1. Latin America Seeds Market Analysis by Country : Introduction

- 8.8.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.8.2.1. Brazil

- 8.8.2.2. Colombia

- 8.8.2.3. Chile

- 8.8.2.4. Argentina

- 8.8.2.5. Costa Rica

- 8.8.2.6. Rest of Latin America

- 9. Middle East & Africa Seeds Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Seeds Market Analysis, 2016-2021

- 9.2. Middle East & Africa Seeds Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Seeds Market Analysis, Opportunity and Forecast, By By Seeds Type , 2016-2032

- 9.3.1. Middle East & Africa Seeds Market Analysis by By Seeds Type : Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seeds Type , 2016-2032

- 9.3.3. G. M. Seeds

- 9.3.4. Non-G.M. Seeds

- 9.4. Middle East & Africa Seeds Market Analysis, Opportunity and Forecast, By By Seeds Category, 2016-2032

- 9.4.1. Middle East & Africa Seeds Market Analysis by By Seeds Category: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seeds Category, 2016-2032

- 9.4.3. Organic

- 9.4.4. Conventional

- 9.5. Middle East & Africa Seeds Market Analysis, Opportunity and Forecast, By By Seeds Crop Type , 2016-2032

- 9.5.1. Middle East & Africa Seeds Market Analysis by By Seeds Crop Type : Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seeds Crop Type , 2016-2032

- 9.5.3. Cereals & Grain

- 9.5.4. Fruits & Vegetables

- 9.5.5. Oilseeds & Pulses

- 9.5.6. Others

- 9.6. Middle East & Africa Seeds Market Analysis, Opportunity and Forecast, By By Seeds Treatment , 2016-2032

- 9.6.1. Middle East & Africa Seeds Market Analysis by By Seeds Treatment : Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seeds Treatment , 2016-2032

- 9.6.3. Treated

- 9.6.4. Non-Treated

- 9.7. Middle East & Africa Seeds Market Analysis, Opportunity and Forecast, By By Seeds Trait, 2016-2032

- 9.7.1. Middle East & Africa Seeds Market Analysis by By Seeds Trait: Introduction

- 9.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seeds Trait, 2016-2032

- 9.7.3. Herbicide Tolerant

- 9.7.4. Insecticide Resistant

- 9.7.5. Others

- 9.8. Middle East & Africa Seeds Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.8.1. Middle East & Africa Seeds Market Analysis by Country : Introduction

- 9.8.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.8.2.1. Algeria

- 9.8.2.2. Egypt

- 9.8.2.3. Israel

- 9.8.2.4. Kuwait

- 9.8.2.5. Nigeria

- 9.8.2.6. Saudi Arabia

- 9.8.2.7. South Africa

- 9.8.2.8. Turkey

- 9.8.2.9. The UAE

- 9.8.2.10. Rest of MEA

- 10. Global Seeds Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Seeds Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Seeds Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Bayer AG (Germany)

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. DowDuPont Inc. (France)

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Syngenta AG (Switzerland)

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Monsanto Company (US)

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Groupe Limagrain (France)

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. KWS SAAT SE (Germany)

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Land O'Lakes Inc. (US)

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Maharashtra Hybrid Seeds Co. (India)

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Gansu Dunhuang Seeds Co. Ltd (China)

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Sakata Seeds Corporation (US)

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

"

- List of Figures

- "

- Figure 1: Global Seeds Market Revenue (US$ Mn) Market Share by By Seeds Type in 2022

- Figure 2: Global Seeds Market Market Attractiveness Analysis by By Seeds Type , 2016-2032

- Figure 3: Global Seeds Market Revenue (US$ Mn) Market Share by By Seeds Categoryin 2022

- Figure 4: Global Seeds Market Market Attractiveness Analysis by By Seeds Category, 2016-2032

- Figure 5: Global Seeds Market Revenue (US$ Mn) Market Share by By Seeds Crop Type in 2022

- Figure 6: Global Seeds Market Market Attractiveness Analysis by By Seeds Crop Type , 2016-2032

- Figure 7: Global Seeds Market Revenue (US$ Mn) Market Share by By Seeds Treatment in 2022

- Figure 8: Global Seeds Market Market Attractiveness Analysis by By Seeds Treatment , 2016-2032

- Figure 9: Global Seeds Market Revenue (US$ Mn) Market Share by By Seeds Traitin 2022

- Figure 10: Global Seeds Market Market Attractiveness Analysis by By Seeds Trait, 2016-2032

- Figure 11: Global Seeds Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 12: Global Seeds Market Market Attractiveness Analysis by Region, 2016-2032

- Figure 13: Global Seeds Market Market Revenue (US$ Mn) (2016-2032)

- Figure 14: Global Seeds Market Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 15: Global Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Type (2016-2032)

- Figure 16: Global Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Category (2016-2032)

- Figure 17: Global Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Crop Type (2016-2032)

- Figure 18: Global Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Treatment (2016-2032)

- Figure 19: Global Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Trait (2016-2032)

- Figure 20: Global Seeds Market Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 21: Global Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Type (2016-2032)

- Figure 22: Global Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Category (2016-2032)

- Figure 23: Global Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Crop Type (2016-2032)

- Figure 24: Global Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Treatment (2016-2032)

- Figure 25: Global Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Trait (2016-2032)

- Figure 26: Global Seeds Market Market Share Comparison by Region (2016-2032)

- Figure 27: Global Seeds Market Market Share Comparison by By Seeds Type (2016-2032)

- Figure 28: Global Seeds Market Market Share Comparison by By Seeds Category (2016-2032)

- Figure 29: Global Seeds Market Market Share Comparison by By Seeds Crop Type (2016-2032)

- Figure 30: Global Seeds Market Market Share Comparison by By Seeds Treatment (2016-2032)

- Figure 31: Global Seeds Market Market Share Comparison by By Seeds Trait (2016-2032)

- Figure 32: North America Seeds Market Revenue (US$ Mn) Market Share by By Seeds Type in 2022

- Figure 33: North America Seeds Market Market Attractiveness Analysis by By Seeds Type , 2016-2032

- Figure 34: North America Seeds Market Revenue (US$ Mn) Market Share by By Seeds Categoryin 2022

- Figure 35: North America Seeds Market Market Attractiveness Analysis by By Seeds Category, 2016-2032

- Figure 36: North America Seeds Market Revenue (US$ Mn) Market Share by By Seeds Crop Type in 2022

- Figure 37: North America Seeds Market Market Attractiveness Analysis by By Seeds Crop Type , 2016-2032

- Figure 38: North America Seeds Market Revenue (US$ Mn) Market Share by By Seeds Treatment in 2022

- Figure 39: North America Seeds Market Market Attractiveness Analysis by By Seeds Treatment , 2016-2032

- Figure 40: North America Seeds Market Revenue (US$ Mn) Market Share by By Seeds Traitin 2022

- Figure 41: North America Seeds Market Market Attractiveness Analysis by By Seeds Trait, 2016-2032

- Figure 42: North America Seeds Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 43: North America Seeds Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 44: North America Seeds Market Market Revenue (US$ Mn) (2016-2032)

- Figure 45: North America Seeds Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 46: North America Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Type (2016-2032)

- Figure 47: North America Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Category (2016-2032)

- Figure 48: North America Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Crop Type (2016-2032)

- Figure 49: North America Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Treatment (2016-2032)

- Figure 50: North America Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Trait (2016-2032)

- Figure 51: North America Seeds Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 52: North America Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Type (2016-2032)

- Figure 53: North America Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Category (2016-2032)

- Figure 54: North America Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Crop Type (2016-2032)

- Figure 55: North America Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Treatment (2016-2032)

- Figure 56: North America Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Trait (2016-2032)

- Figure 57: North America Seeds Market Market Share Comparison by Country (2016-2032)

- Figure 58: North America Seeds Market Market Share Comparison by By Seeds Type (2016-2032)

- Figure 59: North America Seeds Market Market Share Comparison by By Seeds Category (2016-2032)

- Figure 60: North America Seeds Market Market Share Comparison by By Seeds Crop Type (2016-2032)

- Figure 61: North America Seeds Market Market Share Comparison by By Seeds Treatment (2016-2032)

- Figure 62: North America Seeds Market Market Share Comparison by By Seeds Trait (2016-2032)

- Figure 63: Western Europe Seeds Market Revenue (US$ Mn) Market Share by By Seeds Type in 2022

- Figure 64: Western Europe Seeds Market Market Attractiveness Analysis by By Seeds Type , 2016-2032

- Figure 65: Western Europe Seeds Market Revenue (US$ Mn) Market Share by By Seeds Categoryin 2022

- Figure 66: Western Europe Seeds Market Market Attractiveness Analysis by By Seeds Category, 2016-2032

- Figure 67: Western Europe Seeds Market Revenue (US$ Mn) Market Share by By Seeds Crop Type in 2022

- Figure 68: Western Europe Seeds Market Market Attractiveness Analysis by By Seeds Crop Type , 2016-2032

- Figure 69: Western Europe Seeds Market Revenue (US$ Mn) Market Share by By Seeds Treatment in 2022

- Figure 70: Western Europe Seeds Market Market Attractiveness Analysis by By Seeds Treatment , 2016-2032

- Figure 71: Western Europe Seeds Market Revenue (US$ Mn) Market Share by By Seeds Traitin 2022

- Figure 72: Western Europe Seeds Market Market Attractiveness Analysis by By Seeds Trait, 2016-2032

- Figure 73: Western Europe Seeds Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 74: Western Europe Seeds Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 75: Western Europe Seeds Market Market Revenue (US$ Mn) (2016-2032)

- Figure 76: Western Europe Seeds Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 77: Western Europe Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Type (2016-2032)

- Figure 78: Western Europe Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Category (2016-2032)

- Figure 79: Western Europe Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Crop Type (2016-2032)

- Figure 80: Western Europe Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Treatment (2016-2032)

- Figure 81: Western Europe Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Trait (2016-2032)

- Figure 82: Western Europe Seeds Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 83: Western Europe Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Type (2016-2032)

- Figure 84: Western Europe Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Category (2016-2032)

- Figure 85: Western Europe Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Crop Type (2016-2032)

- Figure 86: Western Europe Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Treatment (2016-2032)

- Figure 87: Western Europe Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Trait (2016-2032)

- Figure 88: Western Europe Seeds Market Market Share Comparison by Country (2016-2032)

- Figure 89: Western Europe Seeds Market Market Share Comparison by By Seeds Type (2016-2032)

- Figure 90: Western Europe Seeds Market Market Share Comparison by By Seeds Category (2016-2032)

- Figure 91: Western Europe Seeds Market Market Share Comparison by By Seeds Crop Type (2016-2032)

- Figure 92: Western Europe Seeds Market Market Share Comparison by By Seeds Treatment (2016-2032)

- Figure 93: Western Europe Seeds Market Market Share Comparison by By Seeds Trait (2016-2032)

- Figure 94: Eastern Europe Seeds Market Revenue (US$ Mn) Market Share by By Seeds Type in 2022

- Figure 95: Eastern Europe Seeds Market Market Attractiveness Analysis by By Seeds Type , 2016-2032

- Figure 96: Eastern Europe Seeds Market Revenue (US$ Mn) Market Share by By Seeds Categoryin 2022

- Figure 97: Eastern Europe Seeds Market Market Attractiveness Analysis by By Seeds Category, 2016-2032

- Figure 98: Eastern Europe Seeds Market Revenue (US$ Mn) Market Share by By Seeds Crop Type in 2022

- Figure 99: Eastern Europe Seeds Market Market Attractiveness Analysis by By Seeds Crop Type , 2016-2032

- Figure 100: Eastern Europe Seeds Market Revenue (US$ Mn) Market Share by By Seeds Treatment in 2022

- Figure 101: Eastern Europe Seeds Market Market Attractiveness Analysis by By Seeds Treatment , 2016-2032

- Figure 102: Eastern Europe Seeds Market Revenue (US$ Mn) Market Share by By Seeds Traitin 2022

- Figure 103: Eastern Europe Seeds Market Market Attractiveness Analysis by By Seeds Trait, 2016-2032

- Figure 104: Eastern Europe Seeds Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 105: Eastern Europe Seeds Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 106: Eastern Europe Seeds Market Market Revenue (US$ Mn) (2016-2032)

- Figure 107: Eastern Europe Seeds Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 108: Eastern Europe Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Type (2016-2032)

- Figure 109: Eastern Europe Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Category (2016-2032)

- Figure 110: Eastern Europe Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Crop Type (2016-2032)

- Figure 111: Eastern Europe Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Treatment (2016-2032)

- Figure 112: Eastern Europe Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Trait (2016-2032)

- Figure 113: Eastern Europe Seeds Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 114: Eastern Europe Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Type (2016-2032)

- Figure 115: Eastern Europe Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Category (2016-2032)

- Figure 116: Eastern Europe Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Crop Type (2016-2032)

- Figure 117: Eastern Europe Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Treatment (2016-2032)

- Figure 118: Eastern Europe Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Trait (2016-2032)

- Figure 119: Eastern Europe Seeds Market Market Share Comparison by Country (2016-2032)

- Figure 120: Eastern Europe Seeds Market Market Share Comparison by By Seeds Type (2016-2032)

- Figure 121: Eastern Europe Seeds Market Market Share Comparison by By Seeds Category (2016-2032)

- Figure 122: Eastern Europe Seeds Market Market Share Comparison by By Seeds Crop Type (2016-2032)

- Figure 123: Eastern Europe Seeds Market Market Share Comparison by By Seeds Treatment (2016-2032)

- Figure 124: Eastern Europe Seeds Market Market Share Comparison by By Seeds Trait (2016-2032)

- Figure 125: APAC Seeds Market Revenue (US$ Mn) Market Share by By Seeds Type in 2022

- Figure 126: APAC Seeds Market Market Attractiveness Analysis by By Seeds Type , 2016-2032

- Figure 127: APAC Seeds Market Revenue (US$ Mn) Market Share by By Seeds Categoryin 2022

- Figure 128: APAC Seeds Market Market Attractiveness Analysis by By Seeds Category, 2016-2032

- Figure 129: APAC Seeds Market Revenue (US$ Mn) Market Share by By Seeds Crop Type in 2022

- Figure 130: APAC Seeds Market Market Attractiveness Analysis by By Seeds Crop Type , 2016-2032

- Figure 131: APAC Seeds Market Revenue (US$ Mn) Market Share by By Seeds Treatment in 2022

- Figure 132: APAC Seeds Market Market Attractiveness Analysis by By Seeds Treatment , 2016-2032

- Figure 133: APAC Seeds Market Revenue (US$ Mn) Market Share by By Seeds Traitin 2022

- Figure 134: APAC Seeds Market Market Attractiveness Analysis by By Seeds Trait, 2016-2032

- Figure 135: APAC Seeds Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 136: APAC Seeds Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 137: APAC Seeds Market Market Revenue (US$ Mn) (2016-2032)

- Figure 138: APAC Seeds Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 139: APAC Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Type (2016-2032)

- Figure 140: APAC Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Category (2016-2032)

- Figure 141: APAC Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Crop Type (2016-2032)

- Figure 142: APAC Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Treatment (2016-2032)

- Figure 143: APAC Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Trait (2016-2032)

- Figure 144: APAC Seeds Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 145: APAC Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Type (2016-2032)

- Figure 146: APAC Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Category (2016-2032)

- Figure 147: APAC Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Crop Type (2016-2032)

- Figure 148: APAC Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Treatment (2016-2032)

- Figure 149: APAC Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Trait (2016-2032)

- Figure 150: APAC Seeds Market Market Share Comparison by Country (2016-2032)

- Figure 151: APAC Seeds Market Market Share Comparison by By Seeds Type (2016-2032)

- Figure 152: APAC Seeds Market Market Share Comparison by By Seeds Category (2016-2032)

- Figure 153: APAC Seeds Market Market Share Comparison by By Seeds Crop Type (2016-2032)

- Figure 154: APAC Seeds Market Market Share Comparison by By Seeds Treatment (2016-2032)

- Figure 155: APAC Seeds Market Market Share Comparison by By Seeds Trait (2016-2032)

- Figure 156: Latin America Seeds Market Revenue (US$ Mn) Market Share by By Seeds Type in 2022

- Figure 157: Latin America Seeds Market Market Attractiveness Analysis by By Seeds Type , 2016-2032

- Figure 158: Latin America Seeds Market Revenue (US$ Mn) Market Share by By Seeds Categoryin 2022

- Figure 159: Latin America Seeds Market Market Attractiveness Analysis by By Seeds Category, 2016-2032

- Figure 160: Latin America Seeds Market Revenue (US$ Mn) Market Share by By Seeds Crop Type in 2022

- Figure 161: Latin America Seeds Market Market Attractiveness Analysis by By Seeds Crop Type , 2016-2032

- Figure 162: Latin America Seeds Market Revenue (US$ Mn) Market Share by By Seeds Treatment in 2022

- Figure 163: Latin America Seeds Market Market Attractiveness Analysis by By Seeds Treatment , 2016-2032

- Figure 164: Latin America Seeds Market Revenue (US$ Mn) Market Share by By Seeds Traitin 2022

- Figure 165: Latin America Seeds Market Market Attractiveness Analysis by By Seeds Trait, 2016-2032

- Figure 166: Latin America Seeds Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 167: Latin America Seeds Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 168: Latin America Seeds Market Market Revenue (US$ Mn) (2016-2032)

- Figure 169: Latin America Seeds Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 170: Latin America Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Type (2016-2032)

- Figure 171: Latin America Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Category (2016-2032)

- Figure 172: Latin America Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Crop Type (2016-2032)

- Figure 173: Latin America Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Treatment (2016-2032)

- Figure 174: Latin America Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Trait (2016-2032)

- Figure 175: Latin America Seeds Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 176: Latin America Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Type (2016-2032)

- Figure 177: Latin America Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Category (2016-2032)

- Figure 178: Latin America Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Crop Type (2016-2032)

- Figure 179: Latin America Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Treatment (2016-2032)

- Figure 180: Latin America Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Trait (2016-2032)

- Figure 181: Latin America Seeds Market Market Share Comparison by Country (2016-2032)

- Figure 182: Latin America Seeds Market Market Share Comparison by By Seeds Type (2016-2032)

- Figure 183: Latin America Seeds Market Market Share Comparison by By Seeds Category (2016-2032)

- Figure 184: Latin America Seeds Market Market Share Comparison by By Seeds Crop Type (2016-2032)

- Figure 185: Latin America Seeds Market Market Share Comparison by By Seeds Treatment (2016-2032)

- Figure 186: Latin America Seeds Market Market Share Comparison by By Seeds Trait (2016-2032)

- Figure 187: Middle East & Africa Seeds Market Revenue (US$ Mn) Market Share by By Seeds Type in 2022

- Figure 188: Middle East & Africa Seeds Market Market Attractiveness Analysis by By Seeds Type , 2016-2032

- Figure 189: Middle East & Africa Seeds Market Revenue (US$ Mn) Market Share by By Seeds Categoryin 2022

- Figure 190: Middle East & Africa Seeds Market Market Attractiveness Analysis by By Seeds Category, 2016-2032

- Figure 191: Middle East & Africa Seeds Market Revenue (US$ Mn) Market Share by By Seeds Crop Type in 2022

- Figure 192: Middle East & Africa Seeds Market Market Attractiveness Analysis by By Seeds Crop Type , 2016-2032

- Figure 193: Middle East & Africa Seeds Market Revenue (US$ Mn) Market Share by By Seeds Treatment in 2022

- Figure 194: Middle East & Africa Seeds Market Market Attractiveness Analysis by By Seeds Treatment , 2016-2032

- Figure 195: Middle East & Africa Seeds Market Revenue (US$ Mn) Market Share by By Seeds Traitin 2022

- Figure 196: Middle East & Africa Seeds Market Market Attractiveness Analysis by By Seeds Trait, 2016-2032

- Figure 197: Middle East & Africa Seeds Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 198: Middle East & Africa Seeds Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 199: Middle East & Africa Seeds Market Market Revenue (US$ Mn) (2016-2032)

- Figure 200: Middle East & Africa Seeds Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 201: Middle East & Africa Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Type (2016-2032)

- Figure 202: Middle East & Africa Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Category (2016-2032)

- Figure 203: Middle East & Africa Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Crop Type (2016-2032)

- Figure 204: Middle East & Africa Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Treatment (2016-2032)

- Figure 205: Middle East & Africa Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Trait (2016-2032)

- Figure 206: Middle East & Africa Seeds Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 207: Middle East & Africa Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Type (2016-2032)

- Figure 208: Middle East & Africa Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Category (2016-2032)

- Figure 209: Middle East & Africa Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Crop Type (2016-2032)

- Figure 210: Middle East & Africa Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Treatment (2016-2032)

- Figure 211: Middle East & Africa Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Trait (2016-2032)

- Figure 212: Middle East & Africa Seeds Market Market Share Comparison by Country (2016-2032)

- Figure 213: Middle East & Africa Seeds Market Market Share Comparison by By Seeds Type (2016-2032)

- Figure 214: Middle East & Africa Seeds Market Market Share Comparison by By Seeds Category (2016-2032)

- Figure 215: Middle East & Africa Seeds Market Market Share Comparison by By Seeds Crop Type (2016-2032)

- Figure 216: Middle East & Africa Seeds Market Market Share Comparison by By Seeds Treatment (2016-2032)

- Figure 217: Middle East & Africa Seeds Market Market Share Comparison by By Seeds Trait (2016-2032)

"

- List of Tables

- "

- Table 1: Global Seeds Market Market Comparison by By Seeds Type (2016-2032)

- Table 2: Global Seeds Market Market Comparison by By Seeds Category (2016-2032)

- Table 3: Global Seeds Market Market Comparison by By Seeds Crop Type (2016-2032)

- Table 4: Global Seeds Market Market Comparison by By Seeds Treatment (2016-2032)

- Table 5: Global Seeds Market Market Comparison by By Seeds Trait (2016-2032)

- Table 6: Global Seeds Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 7: Global Seeds Market Market Revenue (US$ Mn) (2016-2032)

- Table 8: Global Seeds Market Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 9: Global Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Type (2016-2032)

- Table 10: Global Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Category (2016-2032)

- Table 11: Global Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Crop Type (2016-2032)

- Table 12: Global Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Treatment (2016-2032)

- Table 13: Global Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Trait (2016-2032)

- Table 14: Global Seeds Market Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 15: Global Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Type (2016-2032)

- Table 16: Global Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Category (2016-2032)

- Table 17: Global Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Crop Type (2016-2032)

- Table 18: Global Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Treatment (2016-2032)

- Table 19: Global Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Trait (2016-2032)

- Table 20: Global Seeds Market Market Share Comparison by Region (2016-2032)

- Table 21: Global Seeds Market Market Share Comparison by By Seeds Type (2016-2032)

- Table 22: Global Seeds Market Market Share Comparison by By Seeds Category (2016-2032)

- Table 23: Global Seeds Market Market Share Comparison by By Seeds Crop Type (2016-2032)

- Table 24: Global Seeds Market Market Share Comparison by By Seeds Treatment (2016-2032)

- Table 25: Global Seeds Market Market Share Comparison by By Seeds Trait (2016-2032)

- Table 26: North America Seeds Market Market Comparison by By Seeds Category (2016-2032)

- Table 27: North America Seeds Market Market Comparison by By Seeds Crop Type (2016-2032)

- Table 28: North America Seeds Market Market Comparison by By Seeds Treatment (2016-2032)

- Table 29: North America Seeds Market Market Comparison by By Seeds Trait (2016-2032)

- Table 30: North America Seeds Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 31: North America Seeds Market Market Revenue (US$ Mn) (2016-2032)

- Table 32: North America Seeds Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 33: North America Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Type (2016-2032)

- Table 34: North America Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Category (2016-2032)

- Table 35: North America Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Crop Type (2016-2032)

- Table 36: North America Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Treatment (2016-2032)

- Table 37: North America Seeds Market Market Revenue (US$ Mn) Comparison by By Seeds Trait (2016-2032)

- Table 38: North America Seeds Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 39: North America Seeds Market Market Y-o-Y Growth Rate Comparison by By Seeds Type (2016-2032)