Global Organic Farming Market By Source(Plant-Based, Animal-based), By Farming Type(Pure Organic Farming, Integrated Organic Farming), By Technique(Weed Management, Crop Diversity, Soil Management, Chemical Management, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

12984

-

April 2024

-

154

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

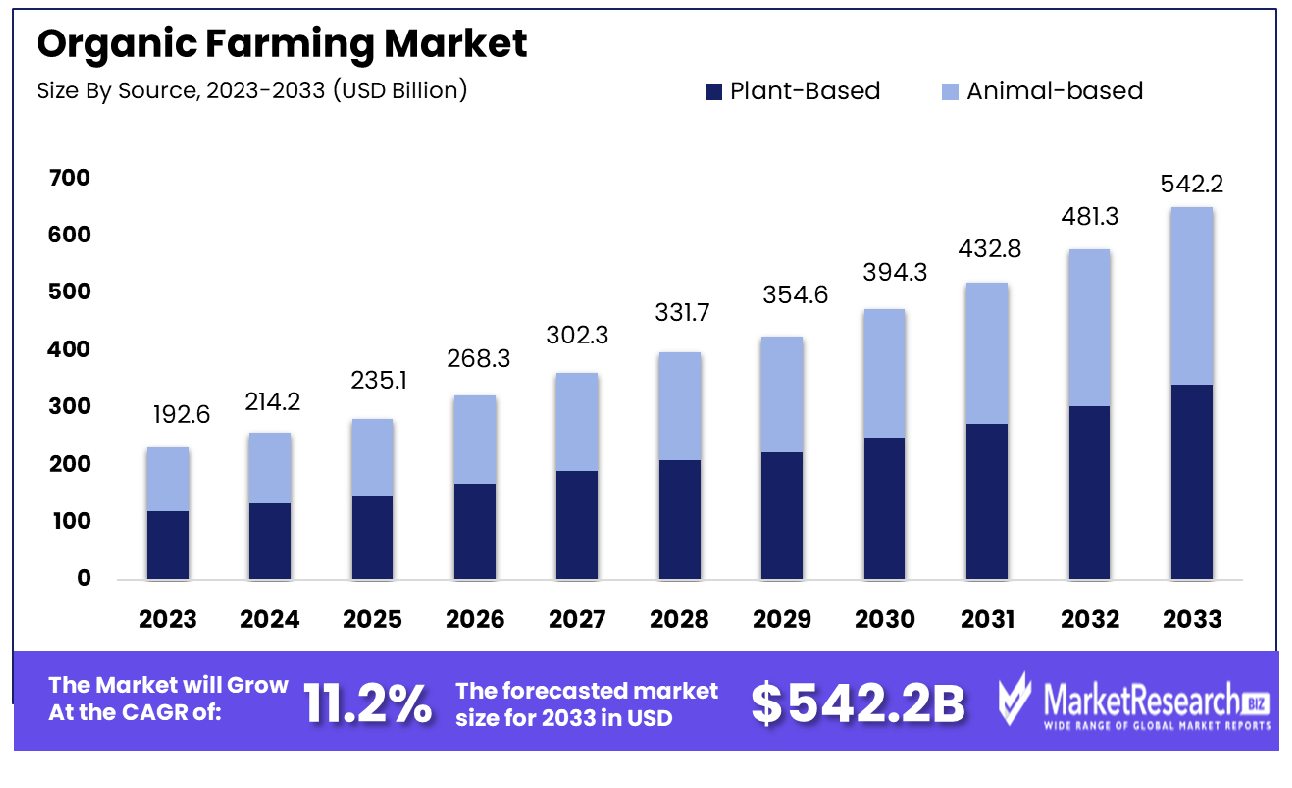

The Global Organic Farming Market was valued at USD 192.6 billion in 2023. It is expected to reach USD 542.2 billion by 2033, with a CAGR of 11.2% during the forecast period from 2024 to 2033. The surge in consumer awareness for organic products and the rise in investments by global corporate companies in agritech and agribusiness are some of the main key driving factors for the organic farming market.

Organic farming is defined as the wholesome approach to agriculture that prioritizes sustainability, biodiversity, and maintaining ecological balance. It comprises crop farming and raising livestock without using synthetic pesticides, fertilizers, herbicides, and other genetically modified organisms. Organic farmers use natural techniques like crop rotation, biological pest control, and composting to improve soil fertility and manage pests and diseases. Organic farming practices endeavor to lessen the environmental effects, preserve the water, and promote animal welfare. By eluding chemical inputs, organic agriculture shields the ecosystems, minimizes soil erosion, and alleviates water pollution.

According to a report published in February 2024, highlights that agriculture supports nearly 47% of the Indian population and pays 18% to the Indian GDP which changes the sector in many ways in terms of sustainability and security. After the launch of Paramparagat. Krishi Vikas Yojana (PKVY) in 2015- 2016, it has brought an area of 11.85 lakh hectares under organic farming. The Modi government also focuses on adding an extra 6 lakh hectares between 2022- 2023 and 2025-2026. Furthermore, the Government has also introduced the National Mission on Natural Farming in 2023-24 to augment chemical-free agriculture and widen the reach of natural farming. It has been backed by an investment of Rs. 459 crores.

According to a report published in February 2024, highlights that agriculture supports nearly 47% of the Indian population and pays 18% to the Indian GDP which changes the sector in many ways in terms of sustainability and security. After the launch of Paramparagat. Krishi Vikas Yojana (PKVY) in 2015- 2016, it has brought an area of 11.85 lakh hectares under organic farming. The Modi government also focuses on adding an extra 6 lakh hectares between 2022- 2023 and 2025-2026. Furthermore, the Government has also introduced the National Mission on Natural Farming in 2023-24 to augment chemical-free agriculture and widen the reach of natural farming. It has been backed by an investment of Rs. 459 crores.The Jaivik Kheti Portal, which fosters the marketing of organic products also brags of over 6.15 lakh farmers’ registrations. The Mission Organic Value Chain Development for North Eastern Region (MOVCDNER) of the Modi government has prolonged organic farming all across 1.73 lakh hectares, helping 1.89 lakh farmers. The scheme is accredited with the creation of 379 Farmer Producer Organisations (FPOs), the establishment of 205 collections, accumulation and grading units, 190 custom hiring centers, 123 processing units, and pack houses, and the development of 7 brands.

Organic farming promotes biodiversity by conserving native species and nurturing habitat diversity. Such techniques of farming promote good quality of soils, generate nutritional crops, and support local economies through sustainable farming methods. This is not just a set of methods but embodies a philosophy that acknowledges the interconnectedness of all life forms and focus on a pleasant balance between agriculture and nature. The demand for organic farming will increase due to its requirement in the agriculture sector which will help in market expansion in the coming years.

Key Takeaways

- Market Growth: Global Organic Farming Market was valued at USD 192.6 billion in 2023. It is expected to reach USD 542.2 billion by 2033, with a CAGR of 11.2% during the forecast period from 2024 to 2033.

- By Source: Source-based plant-based products are gaining popularity due to health consciousness.

By Farming Type: Pure organic farming ensures minimal chemical use, promoting sustainability and environmental health.

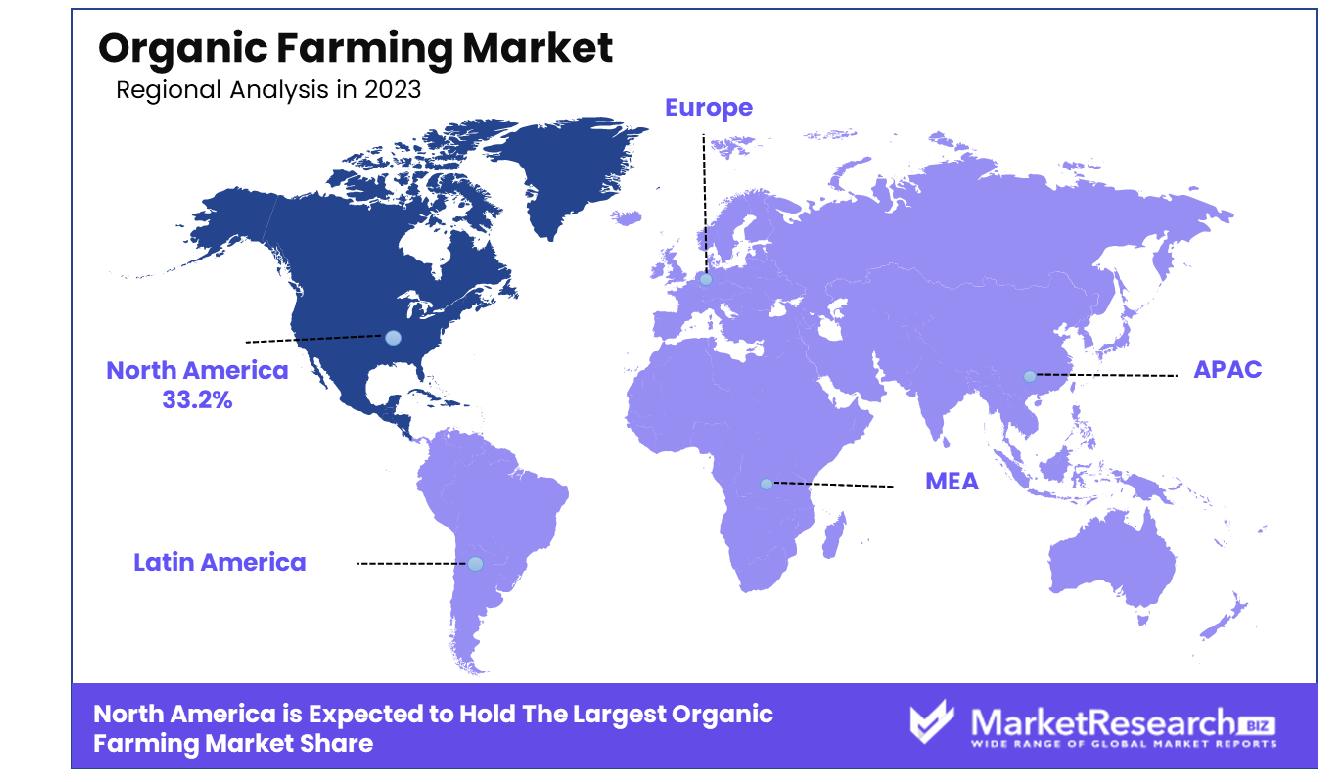

By Technique: Weed management techniques vary, including manual, mechanical, and organic herbicides. - Regional Dominance: In North America, the organic farming market grew by 33.2% in 2023.

- Growth Opportunity: In 2023, the global organic farming market thrived due to rising consumer demand for healthier options, government support through incentives, and the expansion of distribution channels for wider market reach.

Driving factors

Expansion of Cultivable Land Reflecting Organic Farming's Necessity

The need for more land due to lower crop yields in organic farming is a significant factor propelling the expansion of the Organic Farming Market. Organic farming practices, while sustainable and environmentally friendly, typically produce yields that are lower than those from conventional farming methods. This discrepancy arises from organic farming's reliance on natural processes and non-chemical means for pest and disease control, as well as its adherence to crop rotation and other soil-enrichment strategies that require more land to produce equivalent quantities of crops.

The demand for organic produce, however, continues to grow, necessitating the expansion of organic farms across more extensive areas to meet consumer needs. This dynamic underscores the market's growth potential, highlighting the critical balance between sustainability and productivity in agriculture.

Environmental Concerns Catalyzing the Shift Towards Organic Practices

The adverse effects of conventional agriculture on the environment catalyze the growing adoption of organic farming practices. Conventional farming's reliance on synthetic chemical fertilizers, pesticides, and herbicides has been linked to soil degradation, water contamination, and a decrease in biodiversity. In contrast, organic farming emphasizes soil health, ecological balance, and biodiversity, presenting a viable solution to these environmental challenges.

The recognition of conventional agriculture's unsustainability has spurred a shift towards organic farming, not only among consumers but also among policymakers and agricultural businesses. This shift can be seen through increased investments in organic farming practices and research, spurring market expansion as more farms transition towards certification of organic certification practices and certification practices.

Societal Shifts Fuelling Demand for Organic Products

The increasing demand for organic food products, driven by societal concerns about health, the environment, and animal welfare, significantly contributes to the growth of the Organic Farming Market. Consumers are becoming more conscious of the impact of their food choices on their health and the planet, leading to a preference for products that are perceived as safer, healthier, and more ethically produced. This major trend is supported by a growing body of research indicating the potential health benefits of organic foods, including lower pesticide residue levels and, in some cases, higher nutritional value.

Additionally, the transparency and traceability offered by organic certification appeal to consumers' desire for authenticity and accountability in food production. Organic farming's affinity with these values and concerns has caused an explosion of demand for its products, driving market expansion.

Restraining Factors

Economic Constraints and Consumer Pricing Pressures

Reduced incomes and increasing prices for consumer goods present a significant restraint on the growth of the Organic Farming Market. Organic products, known for their environmentally friendly and sustainable production methods, often come with higher price tags compared to conventionally produced items. This price premium can be attributed to organic farming's more labor-intensive practices, the costs of certification, and its typically reduced yields.

As consumers face economic constraints, including reduced incomes and the rising cost of living, their ability to purchase premium-priced organic products diminishes. This economic pressure can lead to a preference for more affordable, non-organic alternatives, thereby restraining the expansion of the organic market. The challenge for the organic sector lies in finding ways to reduce production and distribution costs to make organic products more accessible to a broader demographic, without compromising the principles and quality that define organic farming.

Challenges in the Organic Milk Segment

The decline in organic milk market share exemplifies specific challenges within sub-segments of the organic market. This decline can be attributed to a combination of factors, including the high price sensitivity among consumers in this category and the availability of alternative dairy and non-dairy organic beverages. Organic milk, like other organic products, typically commands a higher price due to the costs associated with organic livestock management, feed, and adherence to stringent animal welfare standards.

However, as consumers explore alternatives that offer similar perceived health and environmental benefits, such as plant-based milk alternatives, the demand for traditional organic milk has faced challenges. This key trend illustrates the necessity for innovation and diversification within the organic sector to maintain consumer interest and market share. The organic milk market's decrease serves as a reminder that consumer preferences can shift quickly; the organic industry must adapt quickly to changing market demands to remain profitable.

By Source Analysis

Plant-based organic products are sourced solely from plants, excluding animal-derived ingredients. This includes organic fruits, organic vegetables, grains, and legumes.

Plant-Based was the dominant market segment for organic Farming Market by Source in 2023. This can be attributed to consumer preferences shifting towards healthier and more eco-friendly foods; along with an increase in awareness regarding the environmental impact of animal products agriculture as well as concerns over animal welfare issues - leading many consumers to prefer plant-based alternatives over animal-derived ones.

Plant-based products offer numerous health benefits, including being lower in cholesterol and saturated fats while being rich in essential nutrients and antioxidants. Furthermore, the growing market trend of veganism and vegetarianism has propelled the demand for plant-based foods across various demographics, including millennials and Gen Z consumers who are particularly conscious of the ethical and environmental implications of their food choices.

In contrast, animal-based products face scrutiny due to issues such as antibiotic overuse, environmental degradation, and animal product cruelty concerns associated with intensive farming practices. It has led to a gradual yet consistent decrease in the consumption of animal-based products, encouraging the growth of the plant-based segment in the organic farming market.

Moving forward, market players in the organic farming industry are expected to capitalize on the momentum of the plant-based major trends by innovating and diversifying their product offerings. Additionally, strategic partnerships with retailers and food service providers, as well as investments in research and development, will be crucial for meeting the evolving demands of health-conscious consumers and maintaining a competitive edge in the market.

By Farming Type Analysis

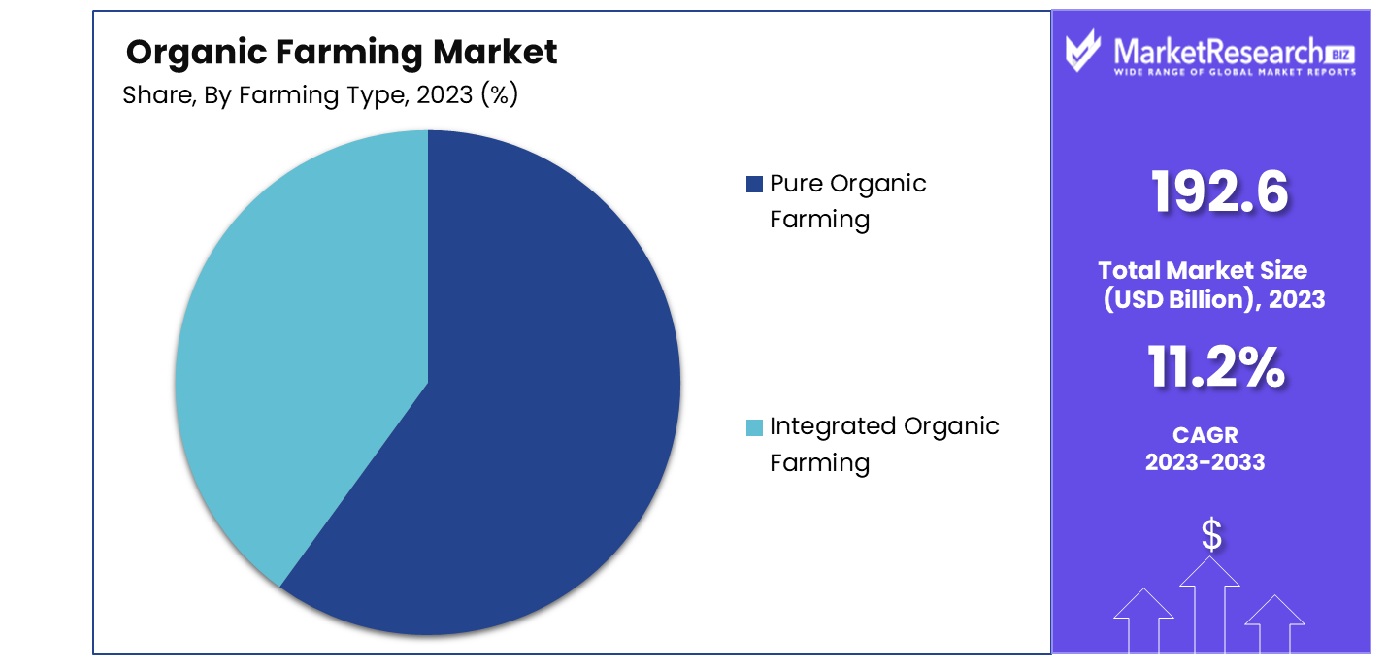

Pure organic farming involves cultivation methods that strictly adhere to organic principles, excluding synthetic inputs.

In 2023, Pure Organic Farming held a dominant market position in the By Farming Type segment of the Organic Farming Market. This segmental dominance was primarily attributed to the increasing consumer preference for pesticide-free and environmentally sustainable agricultural practices. Pure Organic Farming, characterized by its exclusive use of organic inputs and natural fertilizers, resonated strongly with consumers seeking healthier food options and environmentally friendly farming methods.

Integrated Organic Farming, though present in the market, faced stiff competition from Pure Organic Farming due to its reliance on a combination of organic and conventional farming practices. While Integrated Organic Farming offered certain advantages such as enhanced productivity and pest management, it struggled to match the growing consumer demand for purely organic products. Additionally, concerns regarding pesticide residues and environmental impact associated with integrated approaches further bolstered the appeal of Pure Organic Farming.

The growth of the Pure Organic Farming segment can be attributed to several factors, including increasing awareness about the harmful effects of chemical pesticides and fertilizers on human health and the environment. Government initiatives promoting organic farming, coupled with rising disposable incomes and changing consumer preferences, also contributed to the segment's expansion. Moreover, the proliferation of organic food stores and online platforms dedicated to organic products facilitated easier access for consumers, further fueling the demand for Pure Organic Farming products.

Looking ahead, the Pure Organic Farming segment is poised for continued growth, driven by ongoing consumer market trends favoring natural and sustainable agricultural practices. However, market players need to maintain product quality, ensure supply chain transparency, and address challenges related to scalability and production costs to capitalize fully on the burgeoning opportunities in the Organic Farming Market.

By Technique Analysis

Organic weed management techniques utilize natural methods such as mulching, hand weeding, and crop rotation.

2023 saw Weed Management become the dominant market player in the By Technique segment of the Organic Farming Market. This performance underlines its crucial role as an effective weed control strategy in organic agriculture, where synthetic herbicides are banned from use. Weed Management techniques such as mechanical cultivation, mulching, hand weeding, and cover cropping became widely adopted methods among organic farmers seeking sustainable and eco-friendly alternatives to chemical-based weed control solutions.

Crop Diversity, another significant technique within the segment, emphasizes the cultivation of a wide variety of crops within a single field or farming system. By promoting biodiversity and reducing the risk of pest and disease outbreaks, Crop Diversity techniques contribute to improved soil health, enhanced ecosystem resilience, and sustainable agricultural products productivity. However, despite its recognized benefits, Crop Diversity faced challenges related to crop rotation planning, market demand variability, and the need for specialized knowledge and skills among farmers.

Soil Management techniques, such as composting, crop residue management, and conservation tillage, also played a vital role in the By Technique segment. These practices aimed to enhance soil fertility, structure, and moisture retention while minimizing erosion and nutrient loss. Although Soil Management techniques offered numerous environmental and agronomic benefits, adoption barriers, including initial investment costs, technical complexity, and limited access to organic inputs, hindered their widespread implementation.

Chemical Management techniques, encompassing the use of natural substances and bio-based products for pest and disease control, emerged as a promising alternative to synthetic pesticides in organic farming. However, regulatory restrictions, efficacy concerns, and market availability limitations posed significant challenges to the widespread adoption of Chemical Management methods.

Key Market Segments

By Source

- Plant-Based

- Animal-based

By Farming Type

- Pure Organic Farming

- Integrated Organic Farming

By Technique

- Weed Management

- Crop Diversity

- Soil Management

- Chemical Management

- Others

Growth Opportunity

Growing Consumer Demand for Organic Food Products

The organic farming market witnessed a significant surge in 2023, primarily fueled by the escalating consumer demand for organic food products. This major trend reflects a paradigm shift in consumer preferences towards healthier and more sustainable food choices. Key factors such as increasing health awareness, concerns about harmful chemical residues in conventional farming, and a growing emphasis on environmental conservation have propelled the demand for organic produce.

As consumers become more discerning about the origin and quality of their food, the organic farming sector stands poised to capitalize on this burgeoning market opportunity. Market players can leverage this market trend by enhancing production capacities, investing in organic certification, and implementing robust marketing strategies to effectively communicate the benefits of organic products to consumers.

Government Incentives and Subsidies for Organic Farming Practices

In 2023, governments worldwide continued to incentivize and support organic farming practices through a variety of policies, subsidies, and regulatory frameworks. These initiatives aim to promote sustainable agricultural practices, reduce reliance on synthetic inputs, and mitigate environmental degradation. By providing financial support, technical assistance, and infrastructure development, governments are fostering a conducive environment for the rapid growth of the organic farming market.

Market participants can capitalize on these opportunities by availing themselves of government subsidies, adopting organic farming methods, and aligning their operations with regulatory standards. Collaborating with government agencies and industry stakeholders can further enhance market penetration and ensure sustainable strong growth in the organic farming sector.

Expansion of Distribution Channels to Reach a Wider Consumer Base

One of the key drivers of growth in the global organic farming market in 2023 was the expansion of distribution channels to reach a wider consumer base. Market players are increasingly diversifying their distribution networks through partnerships with retailers, e-commerce platforms, and direct-to-consumer models. This multi-channel approach allows organic producers to tap into new market segments, enhance product accessibility, and meet the evolving needs of consumers.

By leveraging digital platforms, implementing efficient logistics solutions, and establishing strategic alliances, organic farming businesses can optimize their distribution efforts and gain a competitive edge in the market. As consumer demand continues to grow, a robust and agile distribution strategy will be crucial for unlocking the full potential of the organic farming market in the coming years.

Latest Trends

Shift towards Healthier Lifestyles and Environmental Sustainability Driving Demand for Organic Produce

In 2023, a pronounced shift towards healthier lifestyles and environmental sustainability emerged as a primary driver of demand for organic produce. Consumers increasingly prioritize health-conscious choices, seeking food products free from synthetic chemicals and pesticides. This growing awareness of the potential health risks associated with conventional farming methods has propelled the demand for organic alternatives.

Moreover, heightened concerns about environmental sustainability have prompted consumers to support farming practices that minimize ecological impact. As a result, the organic farming market has experienced robust strong growth, with consumers willing to pay premiums for products aligned with their values of health and sustainability.

Government Initiatives Promoting Organic Farming Methods and Offering Subsidies, Fostering Market Growth

Government initiatives were instrumental in driving organic farming methods and market expansion during 2023. Recognizing its environmental and health advantages, governments across the world implemented policies designed to incentivize organic farming practices and support them financially. These initiatives included subsidies for organic certification, financial assistance for farmers transitioning to organic methods, and investments in research and development. Additionally, regulatory measures were enacted to ensure compliance with organic standards and to enhance consumer trust in organic products.

Such government support has not only facilitated the expansion of organic farming operations but has also contributed to the mainstreaming of organic produce in retail markets. Going forward, government intervention should continue to drive organic farming's rapid growth globally, driving further adoption of sustainable agricultural practices while meeting consumers' evolving preferences.

Regional Analysis

In North America, the organic farming market grew by 33.2% in the latest reporting period.

North America emerged as a dominant force in the global organic farming market, experiencing a remarkable growth rate of 33.2% in 2023. The region's robust performance can be attributed to several factors, including a strong consumer preference for organic products, supportive government policies promoting sustainable agriculture, and a well-established organic farming infrastructure.

According to data, North America accounted for a substantial share of the global organic farming market, reflecting the increasing demand for organic produce among health-conscious consumers. With a focus on environmental sustainability and health benefits, consumers in North America have been driving the expansion of organic farming practices, leading to significant market growth.

Europe maintained its position as a key player in the global organic farming market, supported by a mature organic food industry and stringent regulations governing organic production. The region exhibited steady growth, with consumer demand for organic products continuing to rise. Government initiatives promoting organic agriculture and increasing awareness about the benefits of organic farming contributed to Europe's sustained market growth. While facing challenges such as limited arable land and high production costs, Europe remained a dominant force in the global organic farming landscape.

Asia Pacific, with its vast agricultural landscape and growing consumer awareness, emerged as a promising market for organic farming. The region witnessed notable growth in organic farming practices, driven by rising disposable incomes, changing dietary preferences, and increasing concerns about food safety. Despite facing challenges related to infrastructure and certification, Asia Pacific showed immense potential for expansion in the organic farming sector.

Middle East & Africa and Latin America also showed signs of growth in the organic farming market, albeit at a slower pace compared to other regions. Factors such as water scarcity, climate variability, and limited awareness hindered the growth of organic farming in these regions. However, increasing consumer awareness about health and sustainability, coupled with government initiatives promoting organic agriculture, is expected to drive future growth in these markets.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global organic farming market witnessed significant contributions from key players, each shaping the landscape with their unique approaches and offerings. Among these, Pick's Organic Farm emerged as a prominent player, demonstrating a commendable commitment to sustainable agricultural practices and organic cultivation methods. Their emphasis on quality, coupled with efficient distribution networks, positioned them as a frontrunner in the market.

Indian Organic Farmers Producer Company Ltd. also played a pivotal role, leveraging India's vast agricultural resources to promote organic farming practices. Their collaborative model with local farmers fostered community engagement while ensuring high-quality organic produce for consumers worldwide.

Organic Farmers Co. stood out for its dedication to ethical sourcing and transparent supply chains, appealing to environmentally conscious consumers seeking trustworthy organic products. Their emphasis on fair trade practices and support for small-scale farmers contributed to the market's growth and sustainability.

Bayer AG and BASF SE, renowned multinational corporations, made notable strides in integrating organic solutions into their product portfolios. Their investments in research and key development signaled a broader industry shift towards sustainable agricultural products, driving innovation and pushing boundaries in organic farming technology.

Furthermore, Camson Bio Technologies Limited, ZUWA Organic Farms Pvt. Ltd., Gujarat State Fertilizers & Chemicals Ltd., Koppert Biological Systems, Inc., and Marrone Bio Innovations Inc. each brought valuable expertise and products to the market, collectively enriching the global organic farming sector with diverse offerings and solutions.

Market Key Players

- Pick's Organic Farm

- Indian Organic Farmers Producer Company Ltd.

- Organic Farmers Co.

- Bayer AG

- Camson Bio Technologies Limited

- ZUWA Organic Farms Pvt. Ltd.

- BASF SE

- Gujarat State Fertilizers & Chemicals Ltd.

- Koppert Biological Systems, Inc.

- Marrone Bio Innovations Inc.

Recent Development

- In March 2024, Bionema Group launches a tender for marketing its eco-friendly plant health management products, aiming to address concerns about synthetic fertilizers and promote sustainable agriculture.

- In March 2024, UConn's College of Engineering and College of Agriculture, Health and Natural Resources launched the Small Farm Innovations Project to assist Connecticut farmers with innovative tools, supported by a USDA grant.

- In February 2024, Take Root Organics expanded its range of organic tomato products, emphasizing sustainable farming practices and transparency in farming. The brand continues its commitment to organic and non-GMO offerings.

Report Scope

Report Features Description Market Value (2023) USD 192.6 Billion Forecast Revenue (2033) USD 542.2 Billion CAGR (2024-2032) 11.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Source(Plant-Based, Animal-based), By Farming Type(Pure Organic Farming, Integrated Organic Farming), By Technique(Weed Management, Crop Diversity, Soil Management, Chemical Management, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Pick's Organic Farm, Indian Organic Farmers Producer Company Ltd., Organic Farmers Co., Bayer AG, Camson Bio Technologies Limited, ZUWA Organic Farms Pvt. Ltd., BASF SE, Gujarat State Fertilizers & Chemicals Ltd., Koppert Biological Systems, Inc., Marrone Bio Innovations Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Pick's Organic Farm

- Indian Organic Farmers Producer Company Ltd.

- Organic Farmers Co.

- Bayer AG

- Camson Bio Technologies Limited

- ZUWA Organic Farms Pvt. Ltd.

- BASF SE

- Gujarat State Fertilizers & Chemicals Ltd.

- Koppert Biological Systems, Inc.

- Marrone Bio Innovations Inc.