Oilseeds Market By Oilseed Type(Sunflower, Soybean, Other), By Product(Animal Feed, Edible Oil), By Breeding(Genetically Modified, Conventional), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

6963

-

Jul 2023

-

180

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

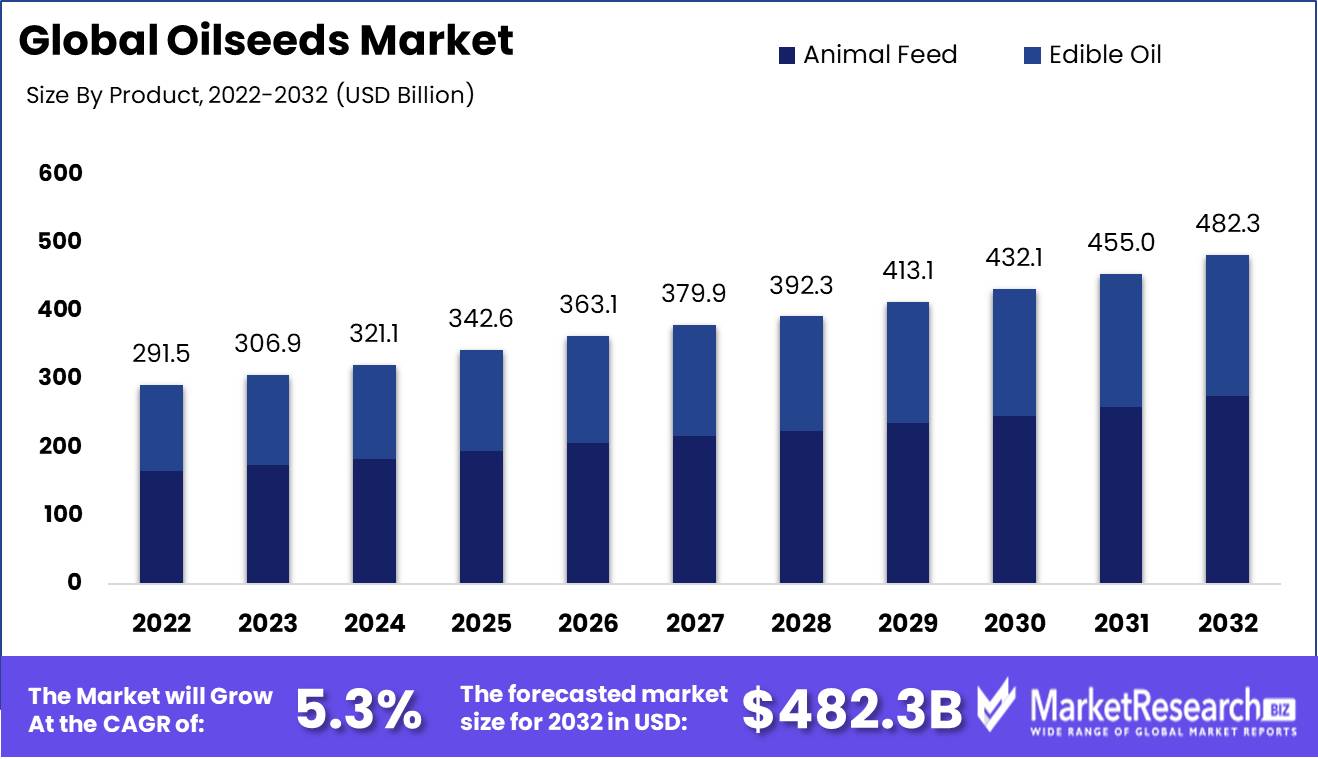

Oilseeds Market size is expected to be worth around USD 482.3 Bn by 2032 from USD 291.5 Bn in 2022, growing at a CAGR of 5.3% during the forecast period from 2023 to 2032.

The objective of the oilseeds market is to meet the rising global demand for oils and their byproducts. This market focuses on the cultivation of specific seed varieties optimized for oil extraction, ensuring high-quality oil and satisfying the diverse needs of industries and consumers around the globe.

Due to its adaptability and breadth of applications, the oilseeds market is of utmost importance. Primarily, it is a significant source of consumable oils, which serve as dietary staples for millions of people around the world. In addition, oilseeds play a significant role in the production of biofuels, which contributes to the pursuit of greener and more sustainable energy sources.

Due to technological advancements, the oilseeds market has witnessed remarkable innovations. The genetic modification of seeds to increase oil content and improve crop yield is a significant development. This innovation has enabled farmers to produce more oilseeds with fewer resources, thereby minimizing environmental impact and boosting productivity.

The oilseeds market has attracted substantial public and private sector investments. Numerous businesses have recognized the growth and profit potential of this market, which has led to the establishment of large-scale oilseed processing facilities and research and development centers. These investments have paved the way for oilseeds and their byproducts to be incorporated into a variety of products and services.

Numerous industries have made substantial investments in the development of the oilseeds market because they recognize its potential. Manufacturers of food and beverages rely on a steady supply of high-quality oils to produce their products. Additionally, oilseeds are utilized by the cosmetics industry for the production of skin care and beautification products. In addition, the pharmaceutical industry uses oilseeds in the production of numerous medications.

Driving factors

Growing Demand for Vegetable Oils and Foods Rich in Protein

The global oilseeds market is experiencing a substantial increase in demand due to the rising demand for vegetable oils and protein-rich food products. As the global population continues to rise, the demand for nutritious and sustainable food sources increases. Oils derived from oilseeds have become an integral element of the human diet. Not only are they used for cooking, but they are also essential ingredients in numerous food products.

Industry Expansion in the Food and Beverage Sector

The rapid expansion of the food and beverage industry has also contributed to the oilseeds market's propelling forces. With changing consumer preferences and dietary patterns, there has been a significant increase in the demand for high-quality food products. Oilseeds provide essential culinary oils and contribute to the formulation of flavorings, dressings, and other food additives, thereby playing a crucial role in this industry. Increased demand from the food and beverage industry has contributed to the growth of the oilseeds market.

Technological Advances in Oilseed Cultivation and Processing

Oilseed cultivation and processing techniques have been revolutionized by technological advances, resulting in increased yields and enhanced quality of oilseeds. Precision farming, irrigation systems, and bioengineering, among other innovations in agricultural practices, have enabled farmers to increase crop yield, minimize harvest losses, and ensure increased production. Utilizing modern processing technologies enhances the extraction of oils from oilseeds, thereby ensuring the production of high-quality, value-added products.

Restraining Factors

Possible Changes in Commodity Prices

Due to factors such as supply and demand dynamics, global economic conditions, geopolitical events, and weather-related disruptions, commodity prices, including the price of oilseeds, are subject to significant volatility. For producers, processors, and traders functioning in the oilseeds market, fluctuations in commodity prices can pose significant difficulties. The uncertainty caused by such price fluctuations can have an effect on investment decisions, production planning, profit margins, and market competitiveness as a whole.

The effects of adversity on a company's bottom line can be mitigated by implementing a solid risk management strategy. This includes closely monitoring market trends, mitigating against price volatility with futures contracts or other financial instruments, diversifying sources of raw materials and markets, and embracing technology and innovation to boost operational efficiency and productivity.

Problems in Pest and Disease Control

Pests and diseases are perennial obstacles for the agriculture industry, and the market for oilseeds is no exception. Insect pests, fungi infections, bacteria, and viruses can cause significant damage to oilseed crops, resulting in substantial yield losses and quality degradation. Effective pest and disease management practices are necessary to minimize these risks and ensure sustainable production.

Integrated pest management (IPM) strategies that incorporate preventive measures, biological control methods, cultural practices, and the prudent use of pesticides can help mitigate potential pest and disease management difficulties. Moreover, investing in R&D to create disease-resistant varieties and early detection systems can contribute to enhancing crop health and minimizing production losses.

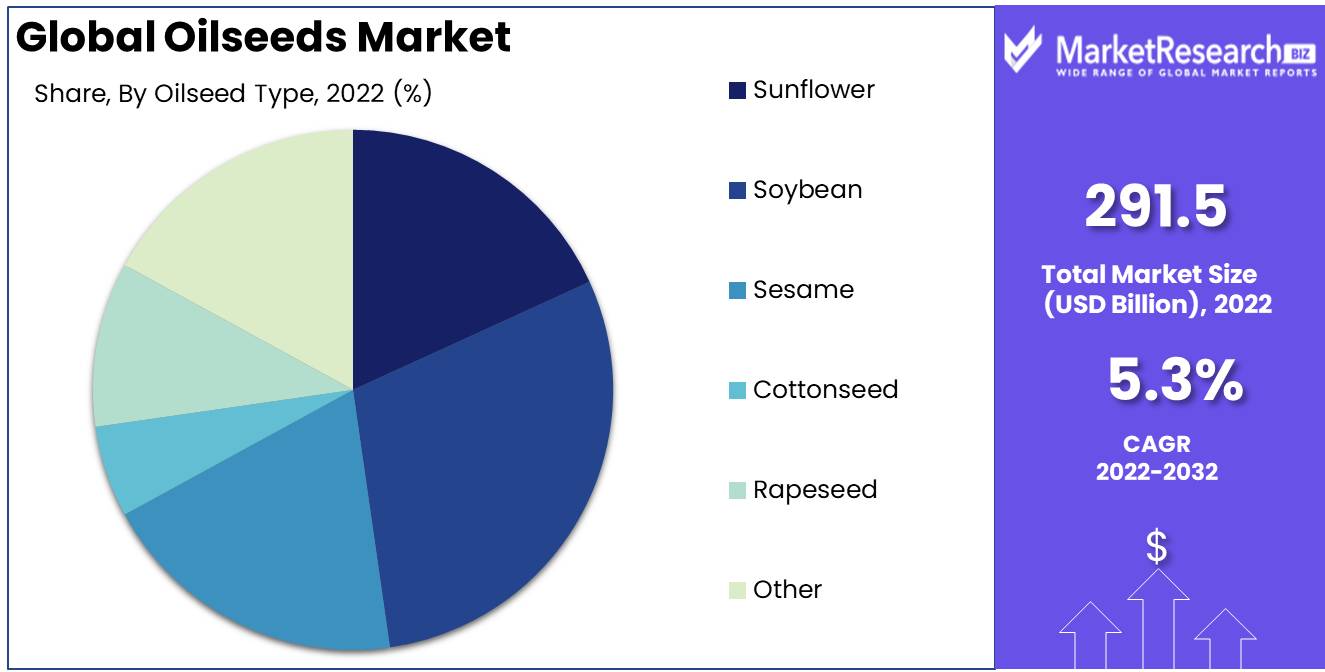

Type Analysis

Diverse segments compete for dominance in the lucrative and rapidly expanding oilseeds market. The Soybean segment presently holds the largest market share, making it one of the most significant players in this industry. This section will explore the reasons behind the dominance of the Soybean segment, its relationship to economic development in emerging economies, consumer trends and behaviors toward this segment, and its expected growth rate over the next few years.

The Soybean segment has become the dominant force in the oilseeds market, commanding the largest market share. The success of this segment can be attributed to a number of factors. To begin with, soybeans are extremely versatile and are utilized in a variety of industries, including food refining, animal feed production, and biodiesel production. This versatility has contributed to its widespread adoption and popularity.

Moreover, due to their high yield potential and relatively low production costs, soybeans have proven to be a profitable crop for producers. This has prompted many farmers to transition from other oilseed crops to soybeans, contributing to the market expansion of the Soybean segment.

Product Analysis

As a crucial by-product segment, Animal Feed dominates the oilseeds market. The use of oilseeds in the production of food and drink is a common practice in the United States. The demand for animal feed has increased consistently as a result of a growing global population, rising income levels, and shifting dietary preferences, especially in emerging economies.

Oilseeds, such as soybeans, rapeseed, sunflower seeds, and others, are protein- and nutrient-dense, making them valuable additions to the diets of livestock and poultry. The processing of oilseeds results in the extraction of oil, which is commonly consumed for a variety of purposes. However, the remaining meal after oil extraction is an exceptional source of protein and other nutrients for livestock and poultry animals.

The global development of the livestock and poultry industries has been primarily driven by the rising demand for meat, milk, and eggs. As a result, the demand for animal feed derived from oilseeds to support the livestock and poultry industries has increased substantially.

Key Market Segments

By Oilseed Type

- Sunflower

- Soybean

- Sesame

- Cottonseed

- Rapeseed

- Other

By Product

- Animal Feed

- Edible Oil

By Breeding

- Genetically Modified

- Conventional

Growth Opportunity

Utilizing Advances in Genetic Engineering and Biotechnology

Genetic engineering and biotechnology advancements present an intriguing opportunity for the oilseeds market. Utilizing cutting-edge technologies such as gene editing and genetic modification, scientists can create oilseed varieties with improved characteristics. These advancements permit the creation of oilseed crops that are not only disease-resistant and high-yielding but also have enhanced nutritional profiles, extended shelf lives, and desirable sensory properties. This innovation creates opportunities to satisfy evolving consumer demands and preferences, thereby fostering market growth.

In order to capitalize on these advancements, collaboration with agricultural and biotechnology research institutions becomes essential. Companies can accelerate the development and commercialization of genetically enhanced oilseed varieties by collaborating with subject-matter experts to access shared knowledge, resources, and expertise. This partnership strengthens the industry's research and innovation capabilities, thereby enhancing its global market position.

Market Diversification and Niche Market Opportunities

Emerging markets with increasing edible oil consumption offer substantial growth potential, but oilseed producers must also investigate market diversification and identify niche opportunities. The oilseeds market is not restricted to only conventional edible oils. Added-value and specialty oilseed products offer latent growth and profit potential.

By investing in research and development, companies are able to capitalize on the unique characteristics of various oilseeds to serve niche market segments. Among health-conscious consumers, high-quality cold-pressed oils, organic oilseeds, and specialty oils such as avocado oil and walnut oil have gained popularity. By focusing on these niche products, companies can differentiate themselves and capture a larger market share, thereby nurturing continued growth.

Adopting Sustainable Methodologies and Certifications

As consumers place a greater emphasis on sustainability and environmental awareness, the adoption of sustainable agricultural practices becomes essential for the growth of the oilseeds industry. By instituting practices such as precision farming, crop rotation, and integrated pest management, companies can reduce their ecological footprint while maximizing crop yields and quality.

Obtaining internationally recognized certifications, such as organic, fair trade, or sustainable agriculture certifications, not only increases the marketability and premium positioning of oilseed products, but it also opens the door to new markets. Numerous consumers actively seek out products with these certifications, giving companies a competitive advantage and facilitating market expansion.

Latest Trends

Oilseed Crops: Soybean, Rapeseed, and Sunflower

Over the years, the soybean, rapeseed, and sunflower oilseeds have experienced significant growth. Not only are these oilseeds abundant in essential nutrients, but they are also extremely versatile. Soybean is extensively used in the production of cooking oil, animal feed, and biofuels due to its high protein content. Rapeseed oilseeds, on the other hand, are one of the healthiest options due to their low levels of saturated fat. Due to their high vitamin E content, sunflower oilseeds are esteemed in the cosmetics and personal care industries.

Increased demand for non-GMO and organic oil seeds

In recent years, consumer demand for non-GMO and organic oilseed products has increased. As consumers become more aware of health and environmental concerns, they seek out products that are free of genetically modified organisms (GMOs) and produced using sustainable farming methods. This trend has increased the production and availability of non-GMO and organic oilseed products, tailored to health-conscious consumers.

Oilseeds in Food Processing and Functional Ingredients

In the culinary processing and functional ingredient industries, oilseeds have found widespread application. They are utilized not only as cooking oils but also as ingredients in a variety of dietary products. Oilseeds are a valuable addition to processed foods, snacks, and baked products due to their high content of essential fatty acids, vitamins, and minerals. Due to their potential health advantages, oilseeds are also used as functional ingredients in the production of dietary supplements, functional foods, and nutraceuticals.

Production of Biofuel Feedstocks on the Rise

The transition toward renewable energy sources has increased the demand for biofuels, paving the way for a rise in biofuel feedstock production. Oilseeds, specifically soybeans, are a significant feedstock for biodiesel production. The use of oilseeds as biofuel feedstock not only decreases reliance on fossil fuels but also contributes to the reduction of greenhouse gas emissions. This growing trend is anticipated to have a substantial impact on the oilseeds market, propelling its growth and providing sustainable energy solutions.

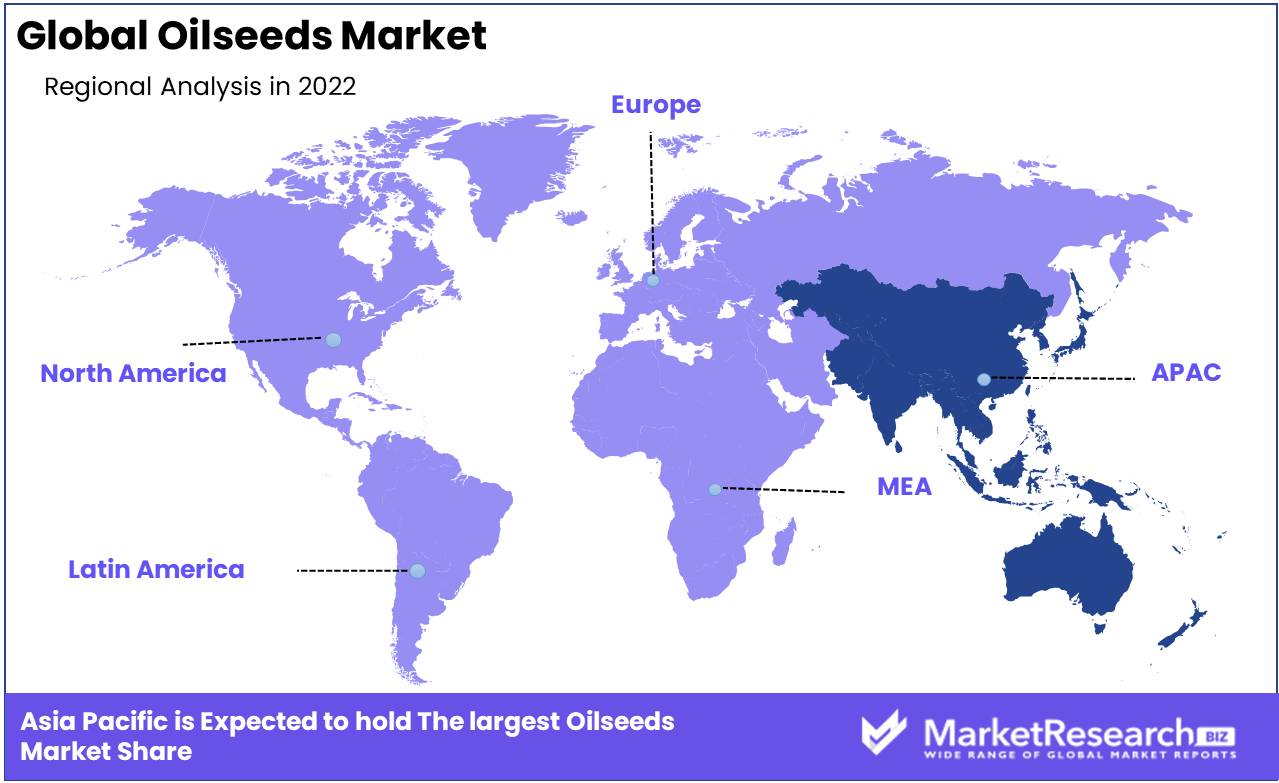

Regional Analysis

The Asia-Pacific area dominates the oilseeds market.

The Asia-Pacific region has a substantial advantage in terms of available territory. The ability to cultivate oilseeds on a large scale is a hallmark of the United States. These countries have extensive farmland and favorable climatic conditions, allowing for increased crop production. The region's copious land availability enables the production of substantial quantities of oilseeds, satisfying both local and global demand.

In addition, the Asia-Pacific region has made significant investments in research and development, paving the way for innovative farming techniques and advanced agricultural practices. Governments and private entities in countries such as Japan, South Korea, and Singapore are actively involved in financing research initiatives to improve seed quality, boost crop yield, and optimize crop management. This commitment to continuous development has resulted in increased yields and enhanced quality of oilseeds, giving the region a competitive advantage in the global market.

Its robust infrastructure also contributes significantly to the Asia-Pacific region's market dominance in oilseeds. The region has a well-established transportation network, which ensures effective logistics and the seamless transport of oilseeds from the farm to the market. This infrastructure facilitates on-time delivery and reduces the possibility of deterioration or damage during transport. Furthermore, the presence of cutting-edge processing facilities enables the efficient extraction of oil from oilseeds, thereby enhancing the region's market competitiveness.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Cargill Incorporated, a prominent player in the oilseed industry, has provided innovative and sustainable solutions for decades. The company's website states that it has a strong reputation for producing high-quality products. The dedication of Cargill to quality, accuracy, and customer satisfaction has propelled them to the vanguard of the market.

Dow, an additional prominent player, has significantly shaped the oilseed industry. Dow's extensive research and development efforts and cutting-edge technological innovations have consistently resulted in innovative solutions in the field. Strategic partnerships and collaborations enable the company to create consumer value while maintaining a high level of sustainability.

Chr. Hansen Holding A/S, a Danish corporation, specializes in the development of natural agricultural solutions. With a primary concentration on delivering sustainable and eco-friendly products, they've attained widespread recognition in the oilseeds market. Chr. Hansen Holding A/S's commitment to quality, coupled with their emphasis on research and development, positions them as a vital player in their industry.

Top Key Players in Oilseeds Market

- Cargill Incorporated (U.S.)

- Dow (U.S.)

- BASF SE (Germany)

- Chr. Hansen Holding A/S (Denmark)

- DSM (Netherlands)

- DuPont (U.S.)

- Evonik Industries AG (Germany)

- NOVUS INTERNATIONAL (U.S.)

- Alltech (Nicholasville)

- Associated British Foods plc (U.K.)

- Charoen Pokphand Foods PCL (Thailand)

- Nutreco (Netherlands)

- ForFarmers. (Netherlands)

- De Heus Animal Nutrition (Netherlands)

- Land O'Lakes (U.S.)

- Kent Nutrition Group (U.S.)

- J. D. HEISKELL & CO. (U.S.)

- Perdue Farms (U.S.)

- SunOpta (Canada)

- Scratch Peck Feeds (U.S.)

- De Heus Animal Nutrition (Netherlands)

- MEGAMIX (Russia)

- Agrofeed (Hungary)

Recent Development

- In 2023, China, the greatest oilseed consumer in the world, made a historic announcement to increase its oilseed production. Motivated by the rising demand for oilseeds, the country aims to satisfy the needs of both its domestic market and global customers.

- In 2022, India, a significant oilseed exporter, revealed intentions to expand its oilseed export market, following China's announcement. Recognizing the untapped potential of its oilseed industry, India aims to utilize its production capacity to meet the rising global demand.

- In 2021, Brazil a prominent force in agricultural commodities, disclosed its investment in new techniques for oilseed cultivation. By exploring innovations and enhancing cultivation techniques, Brazil aims to increase its oilseed output while maintaining sustainability.

Report Scope

Report Features Description Market Value (2022) USD 291.5 Bn Forecast Revenue (2032) USD 482.3 Bn CAGR (2023-2032) 5.3% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Oilseed Type(Sunflower, Soybean, Other), By Product(Animal Feed, Edible Oil), By Breeding(Genetically Modified, Conventional) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Cargill Incorporated (U.S.), Dow (U.S.), BASF SE (Germany), Chr. Hansen Holding A/S (Denmark), DSM (Netherlands), DuPont (U.S.), Evonik Industries AG (Germany), NOVUS INTERNATIONAL (U.S.), Alltech (Nicholasville), Associated British Foods plc (U.K.), Charoen Pokphand Foods PCL (Thailand), Nutreco (Netherlands), ForFarmers. (Netherlands), De Heus Animal Nutrition (Netherlands), Land O'Lakes (U.S.), Kent Nutrition Group (U.S.), J. D. HEISKELL & CO. (U.S.), Perdue Farms (U.S.), SunOpta (Canada), Scratch Peck Feeds (U.S.), De Heus Animal Nutrition (Netherlands), MEGAMIX (Russia), Agrofeed (Hungary) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Cargill Incorporated (U.S.)

- Dow (U.S.)

- BASF SE (Germany)

- Chr. Hansen Holding A/S (Denmark)

- DSM (Netherlands)

- DuPont (U.S.)

- Evonik Industries AG (Germany)

- NOVUS INTERNATIONAL (U.S.)

- Alltech (Nicholasville)

- Associated British Foods plc (U.K.)

- Charoen Pokphand Foods PCL (Thailand)

- Nutreco (Netherlands)

- ForFarmers. (Netherlands)

- De Heus Animal Nutrition (Netherlands)

- Land O'Lakes (U.S.)

- Kent Nutrition Group (U.S.)

- J. D. HEISKELL & CO. (U.S.)

- Perdue Farms (U.S.)

- SunOpta (Canada)

- Scratch Peck Feeds (U.S.)

- De Heus Animal Nutrition (Netherlands)

- MEGAMIX (Russia)

- Agrofeed (Hungary)