Sanitary Napkin Market Report By Product Type (Menstrual Pads [Disposable Menstrual Pads, Cloth Menstrual Pads], Panty Liners), By Distribution Channel (Online Stores, Supermarkets/Hypermarkets, Pharmacy Stores, Convenience Stores, Others), By Absorption Level (Light Absorption, Medium Absorption, High Absorption), By Age Group (Below 18 Years, 18-30 Years, 31-40 Years, Above 40 Years), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

11545

-

August 2024

-

322

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

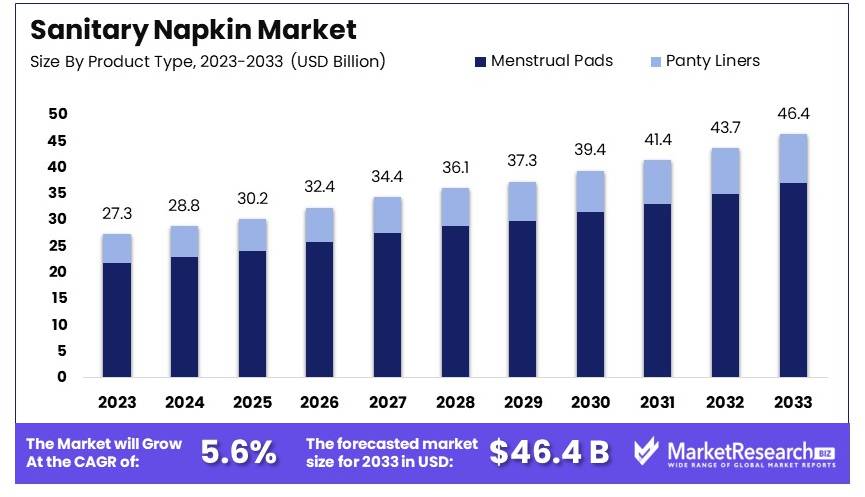

The Global Sanitary Napkin Market size is expected to be worth around USD 46.4 Billion by 2033, from USD 27.3 Billion in 2023, growing at a CAGR of 5.6% during the forecast period from 2024 to 2033.

The sanitary napkin market involves the production, distribution, and sale of menstrual hygiene products. These products are essential for women's health and well-being. The market is driven by increasing awareness of menstrual hygiene and the growing female population. Key players include manufacturers, retailers, and suppliers.

The market has seen significant growth due to rising disposable incomes and changing lifestyles. Innovations in product design, such as ultra-thin and biodegradable options, have further boosted demand. Major trends include the shift towards organic and eco-friendly products. The market is highly competitive, with numerous brands offering a wide range of products.

The sanitary napkin market is experiencing significant growth, driven by increasing awareness of menstrual hygiene management, especially in developing countries. By 2025, global consumption of sanitary napkins is projected to reach approximately 300 billion units. This surge is largely attributed to educational campaigns and initiatives promoting menstrual health, leading to greater product adoption among women.

However, the environmental impact of sanitary napkins is a growing concern. In India alone, over 113,000 tons of sanitary napkin waste are generated annually. This has prompted innovations in waste management technologies. Methods such as pyrolysis and CO2-assisted gasification are being explored to convert absorbent polymer wastes into syngas, a valuable byproduct. Additionally, there is a push towards developing biodegradable alternatives to traditional plastic-based products, addressing the environmental footprint of sanitary napkins.

The market is also seeing a shift towards sustainable and eco-friendly products. Consumers are becoming more conscious of the environmental impact of their choices, driving demand for biodegradable and compostable sanitary napkins. Manufacturers are responding by investing in research and development to create products that are both effective and environmentally friendly.

In conclusion, the sanitary napkin market is poised for robust growth, fueled by increased awareness and adoption in developing regions. The simultaneous push for environmental sustainability is fostering innovation in waste management and product development. As a result, the market is evolving to meet the dual demands of effective menstrual hygiene management and reduced environmental impact. This trend indicates a promising future for both consumers and manufacturers in the sanitary napkin industry.

Key Takeaways

- Market Value: The Sanitary Napkin Market was valued at USD 27.3 billion in 2023 and is expected to reach USD 46.4 billion by 2033, with a CAGR of 5.6%.

- Product Type Analysis: Disposable Menstrual Pads hold an 80% share; their convenience and hygienic properties drive demand.

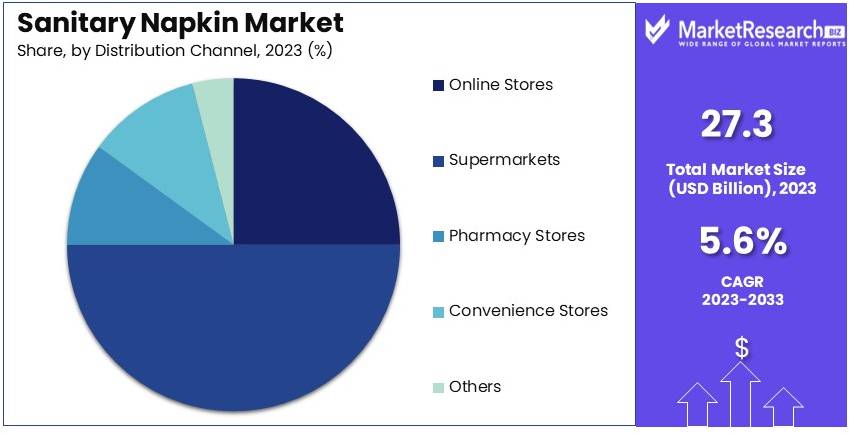

- Distribution Channel Analysis: Supermarkets/Hypermarkets account for 50%; accessibility and consumer preference fuel their prominence.

- Absorption Level Analysis: High Absorption dominates at 60%; it is preferred for its effectiveness and comfort.

- Age Group Analysis: The 18-30 years segment leads with 45%; a high consumer base in this range influences market trends.

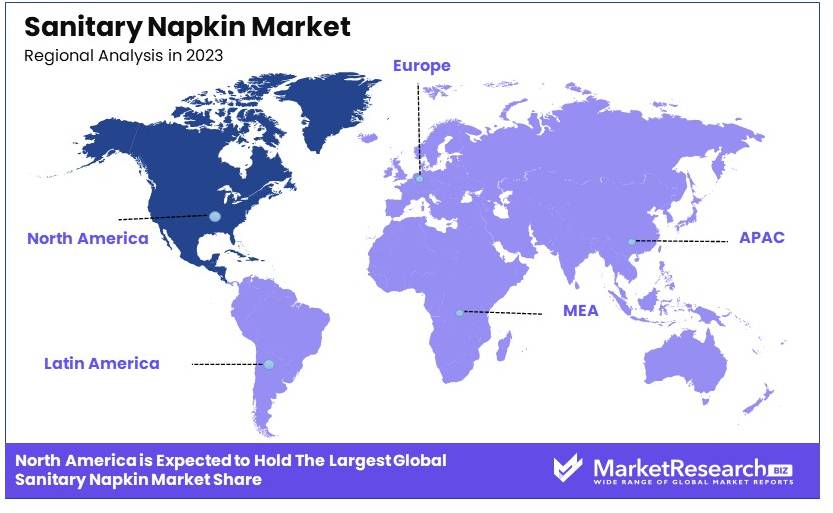

- Dominant Region: Asia-Pacific at 40% due to high population density and growing awareness of hygiene.

Driving Factors

Rising Disposable Income and Urbanization Drive Market Growth

As more women enter the workforce and urbanization increases, disposable incomes are growing, particularly in emerging economies. This allows women to afford better quality feminine hygiene products, including sanitary napkins.

In China, for instance, the urban population has grown from 49.9% in 2010 to 63.9% in 2020, according to the World Bank. This urbanization trend has correlated with increased sanitary napkin usage, as urban women typically have higher incomes and better access to these products. The interaction between rising income levels and urban living conditions has significantly driven the demand for sanitary napkins, leading to market growth.

Innovations in Product Design and Materials Drive Market Growth

Manufacturers are constantly innovating to improve the comfort, absorbency, and eco-friendliness of sanitary napkins. These advancements are attracting more consumers and expanding market share.

For example, companies like Procter & Gamble have introduced products like Always Infinity, which uses a foam material called FlexFoam for better absorption and comfort. Such innovations are driving growth by offering improved user experiences and addressing specific consumer needs. The ongoing research and development in product design are crucial in meeting consumer expectations and sustaining market expansion.

Expanding Distribution Channels and E-commerce Growth Drive Market Growth

The proliferation of modern retail formats and the rise of e-commerce have made sanitary napkins more accessible to a wider population. Online platforms provide discreet purchasing options and the convenience of home delivery, which is particularly appealing in cultures where menstruation is still taboo.

Amazon, for instance, reported a 64% increase in sanitary napkin sales in India in 2020, highlighting the growing importance of e-commerce in this market segment. The combination of traditional retail and online sales channels ensures broader reach and convenience for consumers, thereby boosting market growth.

Restraining Factors

Environmental Concerns and Waste Management Issues Restrain Market Growth

Traditional disposable sanitary napkins significantly contribute to non-biodegradable waste, raising serious environmental concerns. The growing awareness of these issues is driving some consumers to seek more eco-friendly alternatives.

A study by the Menstrual Health Alliance India estimated that 12.3 billion disposable sanitary napkins are discarded annually in India alone. This creates a substantial environmental challenge and prompts consumers to consider reusable or biodegradable options like menstrual cups, potentially limiting the market growth for conventional sanitary napkins.

Price Sensitivity in Developing Markets Restrains Market Growth

In many developing countries, the high cost of sanitary napkins remains a significant barrier to adoption, especially for low-income populations. Despite efforts to reduce prices, many women still use less hygienic alternatives due to financial constraints.

For instance, a 2016 study in Ethiopia found that 24.5% of adolescent girls missed school during their periods because they couldn't afford sanitary products. This highlights how price sensitivity affects product adoption and limits market growth in these regions.

Product Type Analysis

Disposable Menstrual Pads dominate the sanitary napkin market with an 80% share due to their convenience and widespread availability.

The sanitary napkin market is categorized mainly into menstrual pads, which include disposable menstrual pads and cloth menstrual pads, and panty liners. Disposable menstrual pads are the leading sub-segment, favored by consumers for their convenience, hygiene, and accessibility. These pads are designed for single use, which helps in maintaining personal hygiene and is especially appreciated in fast-paced urban lifestyles.

Cloth menstrual pads, while less common, are gaining traction among environmentally conscious consumers who prefer reusable products. Although they require more maintenance, their environmental and cost benefits over the long term attract a niche market segment.

Panty liners represent a significant portion of the market, used for non-menstrual daily protection or very light flow days. They are thinner and often used for maintaining daily freshness and slight urinary leaks, complementing the broader use of menstrual pads.

The dominance of disposable menstrual pads is sustained by ongoing product innovations aimed at improving comfort and absorbency, making them suitable for a wide range of menstrual flow types. This sub-segment’s growth is essential for driving overall market expansion, influenced by health and hygiene awareness and availability through widespread distribution channels.

Distribution Channel Analysis

Supermarkets/Hypermarkets lead the distribution channels with a 50% market share, driven by consumer preference for one-stop shopping experiences.

Sanitary napkins are distributed through various channels including online stores, supermarkets/hypermarkets, pharmacy stores, convenience stores, and others. Supermarkets and hypermarkets dominate this segment, as they provide consumers the convenience of purchasing sanitary napkins along with other personal care and household items under one roof. This channel benefits from high consumer traffic and the availability of a wide range of brands and products.

Online stores are quickly catching up, offering the advantages of privacy, convenience, and often broader selections of products, including international and niche brands not available in traditional stores. Pharmacy stores play a critical role in providing consumers with not only sanitary napkins but also professional health-related advice, catering to a segment that prefers purchasing such products from specialized outlets.

Convenience stores and other outlets provide accessibility and emergency purchase options, supporting the overall distribution network and ensuring sanitary napkins are widely available to meet immediate consumer needs.

Absorption Level Analysis

High Absorption sanitary napkins hold a leading position with 60% of the market segment, catering to the need for maximum protection and comfort.

The absorption level of sanitary napkins is a critical factor in product choice, categorized into light, medium, and high absorption. High absorption sanitary napkins are preferred by consumers, particularly for use during heavy flow days, overnight use, or for longer duration needs, ensuring safety and comfort without frequent changes.

Medium absorption pads are suitable for regular days and are preferred by those with a moderate flow, offering a balance between comfort and protection. Light absorption products are ideal for very light days or for women who prefer a minimal feel, often used towards the end of the menstrual cycle or combined with other menstrual hygiene products.

The market demand for high absorption sanitary napkins drives significant research and development efforts to enhance product effectiveness and comfort, employing new materials and technologies that can provide superior absorbency without increased bulk.

Age Group Analysis

The 18-30 years age group dominates the sanitary napkin market with 45% due to their high demographic prevalence and active lifestyle needs.

Sanitary napkins are used by different age groups, with distinct preferences and needs that vary with lifestyle, health, and physiological changes. The 18-30 years age group is the largest consumer base, driven by a combination of factors including a high number of menstruating individuals in this age bracket, active lifestyles, and higher engagement with menstrual hygiene education.

The below 18 years group is also significant, as this is typically when menstruation begins, and educational initiatives can influence brand loyalty and product choice. Women aged 31-40 years and above 40 years use sanitary napkins that may be specifically designed for different life stages, including post-maternity and pre-menopause phases, which may require different absorbency levels or additional features like odor control.

Each age group contributes to the market dynamics by influencing product formulations, marketing strategies, and distribution practices, ensuring that the needs of all consumers are met comprehensively.

Key Market Segments

By Product Type

- Menstrual Pads

- Disposable Menstrual Pads

- Cloth Menstrual Pads

- Panty Liners

By Distribution Channel

- Online Stores

- Supermarkets/Hypermarkets

- Pharmacy Stores

- Convenience Stores

- Others

By Absorption Level

- Light Absorption

- Medium Absorption

- High Absorption

By Age Group

- Below 18 Years

- 18-30 Years

- 31-40 Years

- Above 40 Years

Growth Opportunities

Eco-Friendly and Biodegradable Products Offer Growth Opportunity

There is a growing trend towards environmentally sustainable menstrual products. Companies developing biodegradable or reusable sanitary napkins have a significant opportunity to capture environmentally conscious consumers.

For example, Saathi Pads in India produces 100% biodegradable sanitary napkins made from banana fiber, addressing both environmental concerns and creating a unique market position. This move towards eco-friendly products appeals to a broad consumer base concerned with sustainability, providing a significant growth opportunity within the sanitary napkin market.

Customization and Personalization Offer Growth Opportunity

As consumer preferences become more diverse, there's an opportunity for brands to offer personalized sanitary napkin options. This could include products tailored for different flow levels, body types, or specific activities.

Thinx, a period underwear company, has successfully capitalized on this trend by offering a range of products designed for various activities and flow levels, demonstrating the potential for customized menstrual products. This trend towards personalization in sanitary products can attract a wider audience, meeting specific needs and preferences, and driving market growth.

Trending Factors

Focus on Menstrual Equity Are Trending Factors

There is a growing movement to address "period poverty" and ensure access to menstrual hygiene products for all women. This trend presents opportunities for companies to partner with governments and NGOs to provide affordable or subsidized products.

Scotland's initiative to make period products free for all, implemented in 2022, exemplifies this trend and could inspire similar programs globally. By participating in such initiatives, sanitary napkin manufacturers can expand their market presence and improve brand loyalty. These efforts not only address a significant social issue but also open new market opportunities by reaching underserved populations.

Subscription-Based Models Are Trending Factors

The trend of subscription-based services has reached the sanitary napkin market, offering convenience and personalized product selection. This model provides steady revenue streams for companies and builds customer loyalty.

Brands like LOLA and Cora have successfully implemented subscription services for menstrual products, indicating a growing consumer preference for such convenient options. Subscription services cater to the modern consumer's demand for convenience and regular delivery, ensuring they never run out of essential products. This trend enhances customer retention and creates a predictable income for businesses.

Regional Analysis

Asia-Pacific Dominates with 40% Market Share in the Sanitary Napkin Market

Asia-Pacific holds a dominant 40% market share in the sanitary napkin industry, driven by increasing awareness of women's health and hygiene. The region's large and growing female population, particularly in populous countries like China and India, supports sustained demand. Government initiatives promoting menstrual health awareness and affordability of sanitary products also play a significant role in this dominance.

The market dynamics in Asia-Pacific are influenced by cultural shifts towards more open discussions about women's health and the increasing purchasing power of women. The proliferation of local and international brands has created a competitive market that drives innovation and keeps prices accessible. Additionally, the expansion of distribution channels in rural and urban areas alike ensures wide product availability.

The future influence of Asia-Pacific on the global sanitary napkin market is expected to remain strong. Ongoing urbanization, coupled with educational campaigns about menstrual health, is likely to propel further growth. Technological advancements in product comfort and protection will continue to attract a broader consumer base, ensuring Asia-Pacific's leading position in the market.

Regional Market Shares:

- North America: Holds about 20% of the market share. The region's development is characterized by a focus on organic and eco-friendly products, aligning with the growing environmental concerns among consumers.

- Europe: Controls approximately 18% of the global market. Europe's market is buoyed by stringent product safety regulations and high consumer awareness about health and hygiene products.

- Middle East & Africa: This region accounts for around 10% of the market. Improvements in women's education and governmental health initiatives are gradually driving market growth.

- Latin America: With about 12% of the market share, growth in this region is stimulated by increasing social programs aimed at improving women's health and accessibility to hygiene products.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The sanitary napkin market features prominent players with substantial market influence and strategic positioning. Procter & Gamble Co. and Kimberly-Clark Corporation lead the market with their extensive product lines and strong global presence. They leverage innovative technologies and extensive marketing campaigns to maintain consumer loyalty.

Unicharm Corporation and Edgewell Personal Care Company focus on high-quality and diverse product offerings, catering to various consumer needs across different regions. Kao Corporation and Hengan International Group Company Limited capitalize on their strong foothold in the Asian markets, offering products tailored to local preferences.

Ontex Group NV and Svenska Cellulosa Aktiebolaget (SCA) emphasize sustainable and eco-friendly products, appealing to environmentally conscious consumers. Johnson & Johnson and Essity Aktiebolag utilize their healthcare expertise to provide reliable and comfortable hygiene solutions.

First Quality Enterprises, Inc., Daio Paper Corporation, and Drylock Technologies focus on affordability and accessibility, targeting the mass market. TZMO SA and Quanzhou Hengxue Women’s Hygienic Products Co., Ltd. strengthen their market position through regional dominance and innovative product developments.

These companies collectively drive market trends through product innovation, sustainability, and strategic expansions, ensuring a competitive and dynamic market environment.

Market Key Players

- Procter & Gamble Co.

- Kimberly-Clark Corporation

- Unicharm Corporation

- Edgewell Personal Care Company

- Kao Corporation

- Hengan International Group Company Limited

- Ontex Group NV

- Svenska Cellulosa Aktiebolaget (SCA)

- Johnson & Johnson

- Essity Aktiebolag

- First Quality Enterprises, Inc.

- Daio Paper Corporation

- Drylock Technologies

- TZMO SA

- Quanzhou Hengxue Women’s Hygienic Products Co., Ltd.

Recent Developments

- 2024: Soothe Healthcare, the maker of the Paree sanitary napkin brand, has secured an additional ₹100 crore in an extended Series C funding round. The round was led by Gulf Islamic Investments, Northern Arc, and KKR-backed Incred, bringing the total to ₹230 crore. The funds will be used to enhance manufacturing capabilities, boost marketing and distribution, and expand the product line, including their recently launched Super Cute's baby diapers.

- 2022: Johnson & Johnson launched the Stayfree Secure One sanitary napkins, which are designed to provide up to 12 hours of protection. This product incorporates a leak-proof design to prevent leaks during movement, addressing the needs of active women.

Report Scope

Report Features Description Market Value (2023) USD 27.3 Billion Forecast Revenue (2033) USD 46.4 Billion CAGR (2024-2033) 5.6% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Menstrual Pads [Disposable Menstrual Pads, Cloth Menstrual Pads], Panty Liners), By Distribution Channel (Online Stores, Supermarkets/Hypermarkets, Pharmacy Stores, Convenience Stores, Others), By Absorption Level (Light Absorption, Medium Absorption, High Absorption), By Age Group (Below 18 Years, 18-30 Years, 31-40 Years, Above 40 Years) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Procter & Gamble Co., Kimberly-Clark Corporation, Unicharm Corporation, Edgewell Personal Care Company, Kao Corporation, Hengan International Group Company Limited, Ontex Group NV, Svenska Cellulosa Aktiebolaget (SCA), Johnson & Johnson, Essity Aktiebolag, First Quality Enterprises, Inc., Daio Paper Corporation, Drylock Technologies, TZMO SA, Quanzhou Hengxue Women’s Hygienic Products Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Procter & Gamble Co.

- Kimberly-Clark Corporation

- Unicharm Corporation

- Edgewell Personal Care Company

- Kao Corporation

- Hengan International Group Company Limited

- Ontex Group NV

- Svenska Cellulosa Aktiebolaget (SCA)

- Johnson & Johnson

- Essity Aktiebolag

- First Quality Enterprises, Inc.

- Daio Paper Corporation

- Drylock Technologies

- TZMO SA

- Quanzhou Hengxue Women’s Hygienic Products Co., Ltd.