Feminine Hygiene Products Market Report By Product Type (Sanitary Pads, Panty Liners, Tampons, Spray and Internal Cleaners, and Others), By Distribution Channel (Supermarkets and Hypermarkets, Pharmacy, Online Stores, and Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

10431

-

May 2023

-

167

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

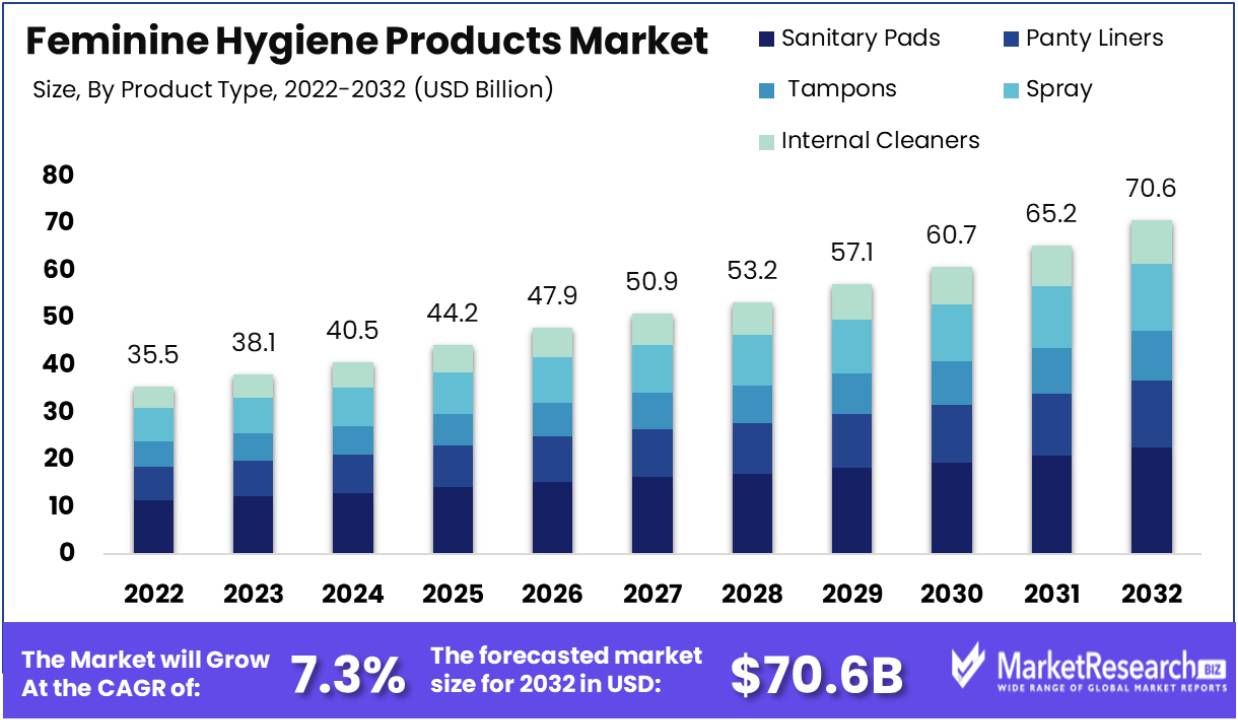

The feminine hygiene products market is expected to undergo a tremendous upswing, with CAGR of 7.3% throughout the forecast period. The market size is expected to expand from an estimated US$ 35.5 billion in 2022 to an astonishing US$ 70.6 billion by 2032 because of the industry's growth trajectory.

The growth of the feminine hygiene products market is linked to several compelling factors, including the middle class's increasing disposable income in developing nations like Brazil and China and the advent of more economical feminine hygiene alternatives. In the near future, market expansion is also projected to be significantly influenced by increased awareness of female health and hygiene.

A noteworthy example of this awareness initiative is Procter & Gamble's (P&G) 'Parivartan' program, actively conducted in schools across India. This program is designed to impart crucial knowledge about the menstrual cycle to young girls, emphasizing the significance of maintaining proper hygiene practices. This educational outreach reflects a significant step toward promoting female health and well-being.

In addition, the rising demand for specialist goods like tampons and panty liners in developing countries is anticipated to significantly drive market expansion and open up intriguing opportunities in this changing environment.

The market is gaining speed thanks to technological development and product developments, which also improve comfort and convenience. Menstrual cups and reusable pads are eco-friendly choices that are becoming more popular, which reflects a trend toward sustainability. The explosion of e-commerce and online retailing is expanding accessibility and represents a critical turning point in the development of the market.

Key Takeaways

- Sustainable movement: The market is seeing an increase in demand for environmentally friendly products like reusable pads and menstrual cups, which reflects a substantial movement towards sustainability.

- Educational Initiatives: Menstrual hygiene education for young girls is essential, with a focus on the long-term health advantages, thanks to initiatives like Procter & Gamble's "Parivartan" program in India.

- Global Expansion: Due to expanding middle-class populations and a greater emphasis on women's health, developing areas, in particular Brazil and China, are experiencing a rise in demand for feminine hygiene products.

- Tech-Driven Innovation: To keep up with changing consumer tastes, manufacturers are investing in new technologies to develop goods that are more comfortable, absorbent, and convenient.

- Consistent Growth Path: The market is anticipated to grow at a strong CAGR of 7.1%, propelled by variables including raised awareness and the appearance of less expensive alternatives.

Driving Factors

Campaigns for Education and Sensitization

An important effect of increased knowledge and instruction on menstrual health and hygiene has been on the market for sanitary goods. Governments, non-governmental organizations, and educational institutions are now aware of this important component of women's health, which has resulted in targeted efforts.

These campaigns and workshops, as well as other initiatives, seek to inform the public and de-stigmatize menstruation. Women are now placing more importance on their menstrual health and looking for sanitary goods as a result of this change in attitudes and practices. An enormous increase in demand for these products has been caused by the remarkable improvement in menstrual hygiene practices across the globe.

Increased Attention to Women's Empowerment and Gender Equality

Focusing on gender equality and women's empowerment has a huge impact on the market's growth. This recognition results from the realization that having access to high-quality menstrual hygiene products is a basic human right as well as an issue of basic cleanliness.

Women can regulate their menstrual cycles with dignity and assurance if they have access to goods that meet their specific needs. With this access, women can pursue their goals of education, employment, and socializing without having to be concerned about or uncomfortable due to poor menstrual hygiene.

Innovative Approaches and Technological Advancement

Technology development and innovative product creation are essential for the industry's global expansion. Investments made by manufacturers in R&D result in the development of improved goods that provide higher comfort, absorption, and convenience. Menstrual cups are regarded as a significant advancement because of their comfort, extended use, and environmental friendliness. Major corporations are also using organic and biodegradable products in response to the rise in eco-awareness. These improvements in features and designs are important propellants for the market's growth.

Restraining Factors

Cultural taboos and stigma

Menstruation continues to be shrouded in cultural taboos and stigma in many civilizations. These established notions might obstruct candid conversations about menstruation hygiene and health. Menstruation may be viewed as unclean or shameful in some cultures, which prevents people from learning about or using the necessary menstrual hygiene techniques. Women may be deterred from seeking out or using feminine hygiene products as a result of this stigma, which may have an impact on their general well-being.

Limited Access in Low-Income Areas

It might be difficult to find affordable, high-quality feminine hygiene products in economically underdeveloped areas. Women may be forced by financial constraints to use improvised or unclean remedies, which can harm their health.

By Product Type

The sanitary napkins/pads sector, which is anticipated to dominate with an amazing 4.7% CAGR, is set to experience significant expansion in the market. Women from varied socioeconomic backgrounds are becoming interested in sanitary. This is as a result of the increased awareness surrounding menstruation hygiene and the availability of sanitary napkins in different sizes, absorption technologies, and price points.

The sale of sanitary products worldwide is being boosted by this trend. Customers can choose goods that match their budget and usage preferences thanks to options like antimicrobial, different levels of absorption, fragrance-free, and a variety of sizes and forms.

Tampons, on the other hand, are predicted to take the second-largest market share. Tampons provide more comfort because of their discretion, practicality, and adaptability for sports like swimming. Customers like them more and more because they offer a stain-free experience, something sanitary napkins do not guarantee.

Tampon uptake, however, is slower in developing countries because of its perceived complexity and higher price. For the tampon market to expand, it is critical to address this understanding and need gap regarding feminine hygiene.

By Distribution Channel

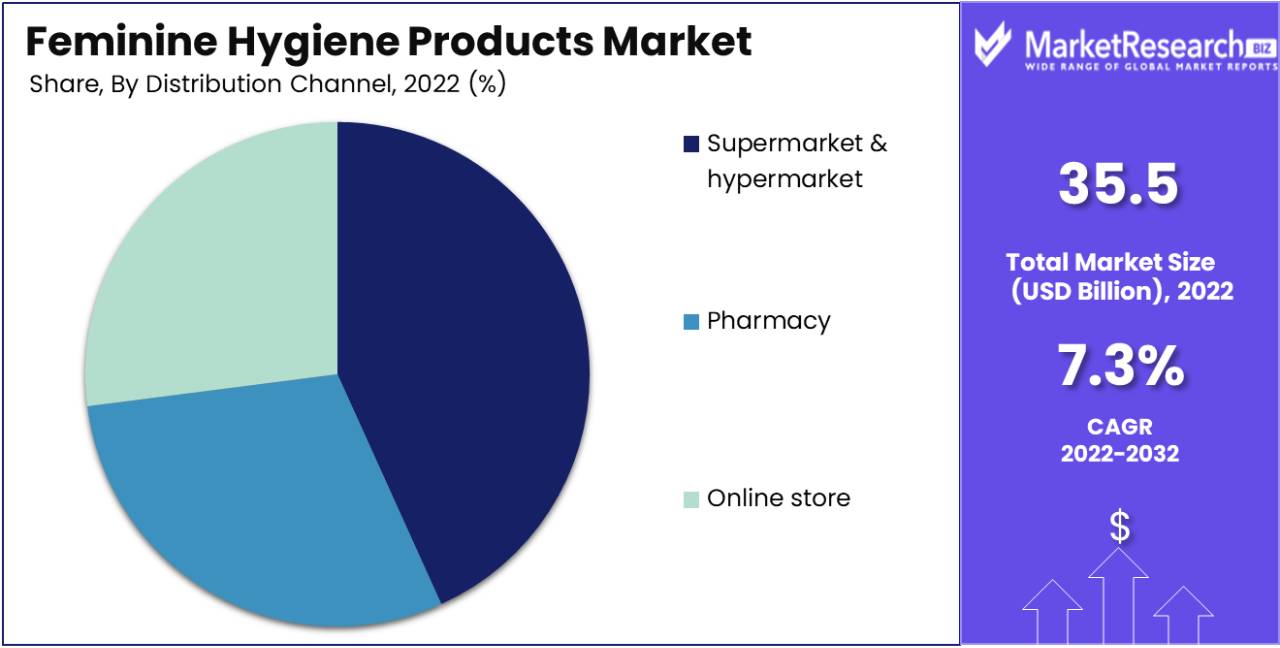

The market for feminine hygiene products is divided into segments based on the distribution channels used to sell them, with supermarkets, drugstores, specialty shops, online retailers.

Due to the widespread practice of women buying sanitary products alongside household essentials, supermarkets generate the most money out of all of these. The convenience that supermarkets provide is a major component in this market segment's expansion.

Since pharmacies carry both medicines and necessary sanitation goods, they are also preferred locations to purchase feminine hygiene products. To draw in female customers, several pharmacies collaborate with their parent firms.

On the other hand, internet retail stores are becoming more popular, especially among working women who like the convenience of online purchasing. Online retail outlets are anticipated to hold a sizable market share during the projection period due to the explosion in e-commerce.

Key Market Segments

By Product Type

- Sanitary Pads

- Panty Liners

- Tampons

- Spray

- Internal Cleaners

By Distribution Channel

- Supermarket and hypermarket

- Pharmacy

- Online store

- Others

Growth Opportunities

Market Expansion in Emerging Economies

The market for feminine hygiene is expected to experience significant growth in emerging economies, particularly those in Asia, Africa, and Latin America. A growing number of women are looking for high-quality hygiene products as disposable incomes rise and menstrual health awareness rises. Manufacturers have a big market to tap into thanks to this growing consumer base.

Sustainable Product Innovation

The market for sustainable and eco-friendly feminine hygiene products is expanding. Menstrual cups, reusable alternatives, and biodegradable materials are just a few examples of the opportunities manufacturers have to innovate. A niche market for sustainable feminine hygiene products has been developed as a result of these eco-friendly goods matching the needs of an expanding eco-conscious consumer base.

Latest Trends

Rising Demand for Sustainable Alternatives

Consumers are increasingly leaning towards eco-friendly options like biodegradable pads and menstrual cups. This shift is a reflection of a broader environmental consciousness among consumers who are looking for products that not only provide effective hygiene but also minimize their ecological footprint. As a result, manufacturers are exploring innovative materials and production methods to cater to this growing segment of environmentally-conscious consumers.

Technological Advancements for Increased Comfort

In response to evolving consumer preferences, manufacturers are integrating advanced technology into feminine hygiene products. These technological innovations aim to enhance comfort and performance. Women today are looking for products with improved absorption, superior leak protection, and overall comfort during their menstrual cycles. Manufacturers are investing in research and development to create products that not only meet these demands but also exceed them, thus redefining the standards of comfort and convenience in the industry.

Personalized and Subscription Model

Women have diverse needs during their menstrual cycles, and the industry is adapting to cater to these varied requirements. Products are now available in different absorbency levels and sizes, allowing women to choose what best suits their individual needs. Furthermore, subscription-based services have gained popularity, offering the convenience of regular deliveries, ensuring that women never run out of essential products. This model not only simplifies the purchasing process but also enhances customer loyalty.

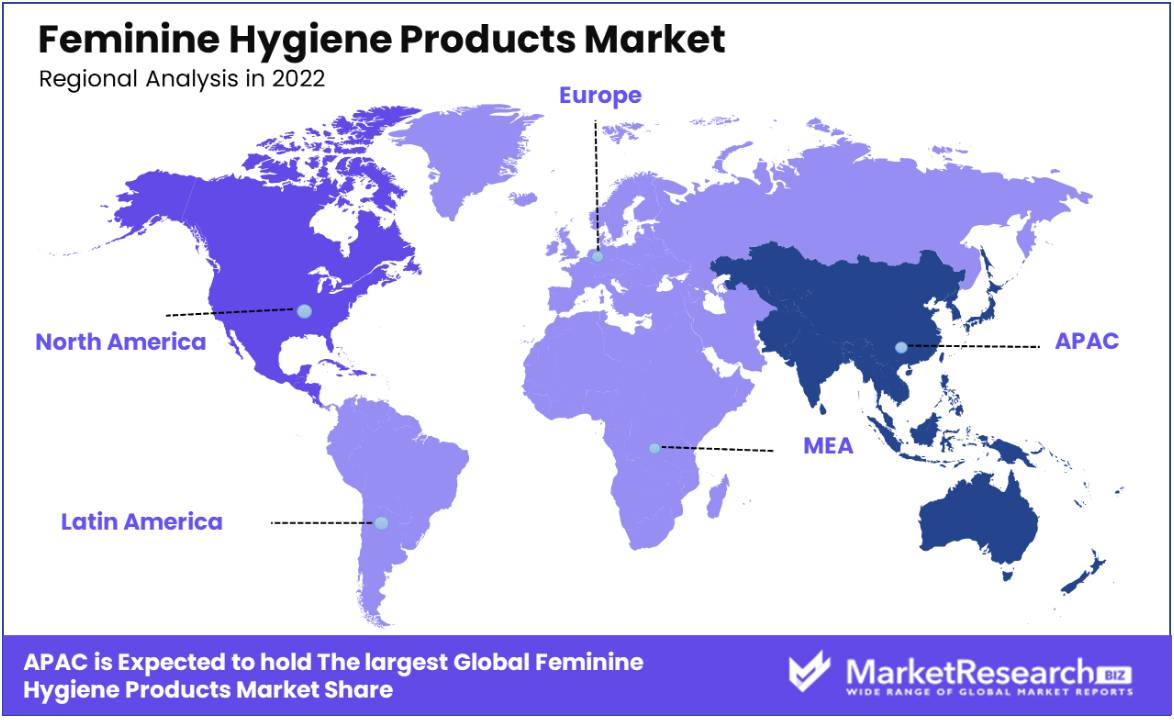

Regional Analysis

Asia Pacific emerged as the largest market, owing to factors such as increased awareness, cost-effectiveness, and availability of feminine hygiene products. The region's large population, particularly in large nations like China and India, has a sizable consumer base, which is being bolstered by sustained population increase. Urbanization contributes to growing disposable income, allowing for more prioritization of personal care items.

Furthermore, increased acknowledgment of the importance of menstrual health and decreased stigma associated with menstruation have increased acceptability and demand. Government programs targeted at raising awareness among women about menstrual health have also boosted market growth in the Asia Pacific area.

Furthermore, increased acknowledgment of the importance of menstrual health and decreased stigma associated with menstruation have increased acceptability and demand. Government programs targeted at raising awareness among women about menstrual health have also boosted market growth in the Asia Pacific area.Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key industry players include Procter & Gamble, Unilever, and Kimberley Clark, alongside local and startup firms. Manufacturers prioritize safer, user-friendly products, utilizing softer materials to minimize allergic reactions and rashes. Sustainable product development is also a focal point.

Companies aim for geographic expansion and product optimization based on consumer feedback, adapting to evolving preferences. For example, Care Form Labs launched user-friendly menstrual cups in March 2021, while OrganiCup introduced a mini-sized version for teenagers in 2020.

Key Players of the Feminine Hygiene Products Market

- Procter & Gamble Company

- Kimberly-Clark Corporation

- Unicharm Corporation

- Johnson & Johnson

- Essity AB

- Ontex Group

- Edgewell Personal Care

- Unilever PLC

Recent Developments

- Kimberly-Clark Corporation announced its newest product, Poise Ultra-Thin Pads with Wings, in April 2022. In guarding against bladder leaks, these extraordinarily thin pads provide a dependable 100% assurance of cleanliness, dryness, and freshness.

- Kimberly-Clark's American Huggies Brand collaborated with designers and beauty businesswoman Kristen Noel Crawley, who is also a mother, in 2022. They collaborated to design a special line of impacting t-shirts to address the need for diapers and promote awareness about poverty-stricken homes in the United States.

Report Scope

Report Features Description Market Value (2022) US$ 35.5 Bn Forecast Revenue (2032) US$ 70.6 Bn CAGR (2023-2032) 7.3% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Sanitary Pads, Panty Liners, Tampons, Spray and Internal Cleaners, and Others), By Distribution Channel (Supermarkets and Hypermarkets, Pharmacy, Online Stores, and Others) Regional Analysis North America – The US, Canada, Mexico, Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America, Eastern Europe – Russia, Poland, The Czech Republic, Greece, Rest of Eastern Europe, Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, Rest of Western Europe, APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC, Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, Rest of MEA Competitive Landscape Procter & Gamble Company, Kimberly-Clark Corporation, Unicharm Corporation, Johnson & Johnson, Essity AB, Ontex Group, Edgewell Personal Care, Unilever PLC. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Procter & Gamble Company

- Kimberly-Clark Corporation

- Unicharm Corporation

- Johnson & Johnson

- Essity AB

- Ontex Group

- Edgewell Personal Care

- Unilever PLC