Menstrual Cups Market By Product Type (Disposable Menstrual Cups and Reusable Menstrual Cups), By Material (Medical Grade Silicone, Thermoplastic Isomer, Rubber and Latex), By Shape (Cylindrical, V-Shaped, Disc-Shaped, Bell-Shaped, Collapsible), By Distribution Channel (Supermarkets and Hypermarkets, Pharmacy Stores and E-commerce), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

13094

-

Feb 2025

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

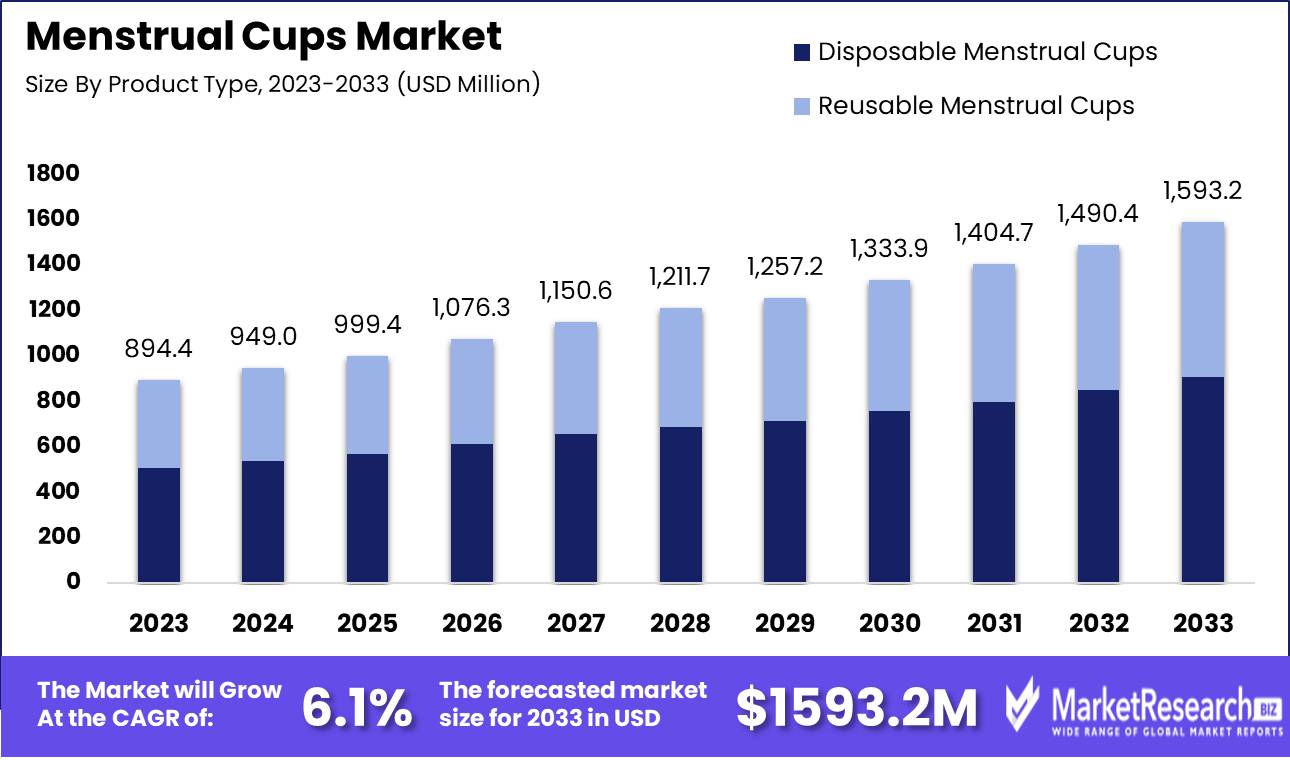

The Menstrual Cups Market size was valued at USD 894.4 Mn in 2023. It is expected to reach USD 1,593.2 Mn by 2033, with a CAGR of 6.1% during the forecast period from 2024 to 2033.

The surge in female hygiene awareness and the adoption of menstrual cups are some of the main driving factors for the menstrual cup market expansion. According to UNICEF and United Nations Funds, each year more than healthy males between the ages of 49 years menstruate every month. Women, girls, transgender men, and non-binary individuals can track their menstrual cycle healthily. Menstrual cups are more hygienic as compared to the out, and sanitary pads and tampons during the menstruation period. These cups come in different types of sizes and are reusable.

Menstrual cups are made up of medical silicone, rubber cost-effective which is safe, and can be used again. These are small, bell-shaped cups that females can use at the time of menstruation. These menstrual cups are eco-friendly and cost-effective. Traditional tampons require to be changed every 3 to 8 courante blood flow. Menstrual cups can hold the blood flow for much longer periods as well and they are a good choice for overnight protection. A menstrual cup can hold the blood flow up to 1 ounce, which is roughly twice the amount of any absorbent tampons and pad. It provides a greagivefort at the timtofpoor-incomed flow.

The increase in public awareness and acceptance of the menstrual cup cannot only ease the waste but also provide more encourage-denied accessibility for poor-income communities. Though disposable products are more convenient as they do need cleaning the females who are menstruating are encouraged to use the cups to decrease the environmental waste and lessen the purchase of hygiene distribution.

As menstrual health is an important aspect of vehicle hygiene, more individuals along these cups to feel comfortable and avoid uneasiness. Manufacturers are more concerned about feminine health which leads them to manufacture healthy cups to avoid any kinoki monetary tract infections. Online distributions and retail stores play a major role in expanding the market of menstrual cups. Consumers can get consumers sizes of cups on online platforms. There is a variety style of menstrucups that are available in the market. As the demand for menstrual cups will increase due to consumers’ awareness and their requirements, it will help the menstrual cup market gradually expand its market reach and grow the market during this forecasted period.Key Takeaways

- Market Growth: The Menstrual Cups Market size was valued at USD 894.4 Mn in 2023. It is expected to reach USD 1,593.2 Mn by 2033, with a CAGR of 6.1% during the forecast period from 2024 to 2033.

- By Product Type: In 2023, disposable menstrual cups led, with reusable cups gaining momentum.

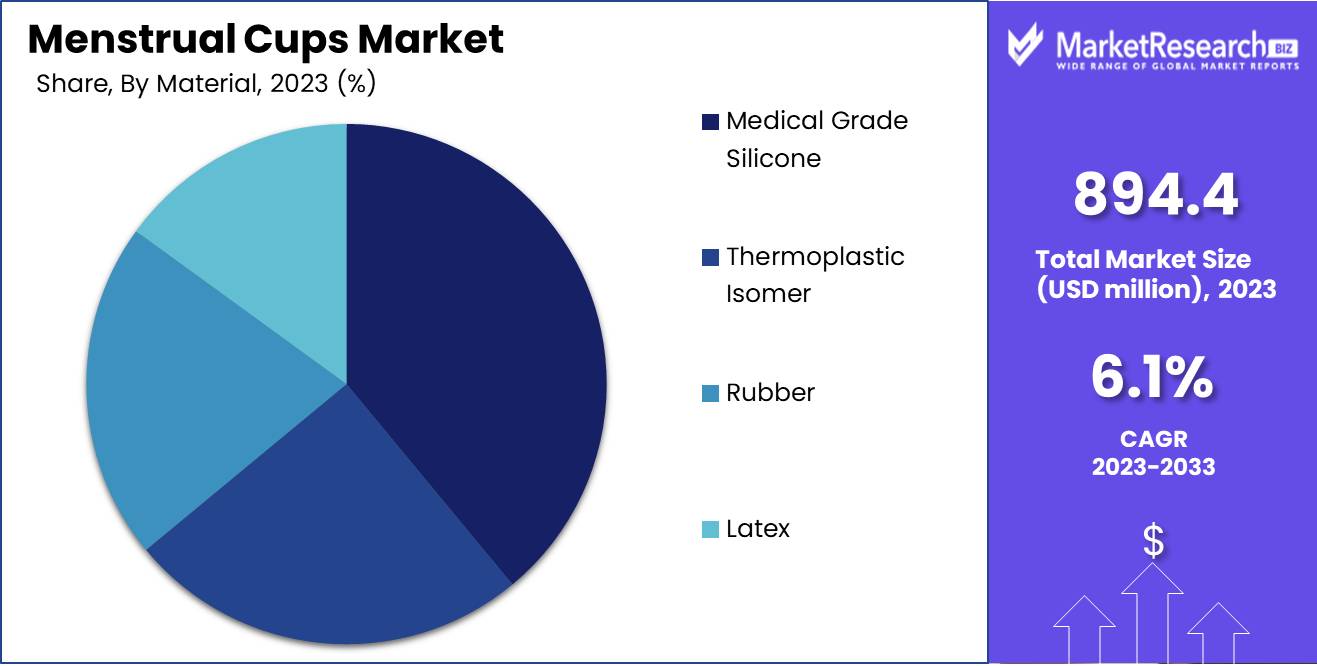

- By Material: In 2023, Medical Grade Silicone dominated the menstrual cup market by material.

- By Shape: In 2023, Bell-shaped menstrual cups led the market due to superior comfort.

- By Distribution Channel: In 2023, E-commerce dominated menstrual cup sales due to convenience.

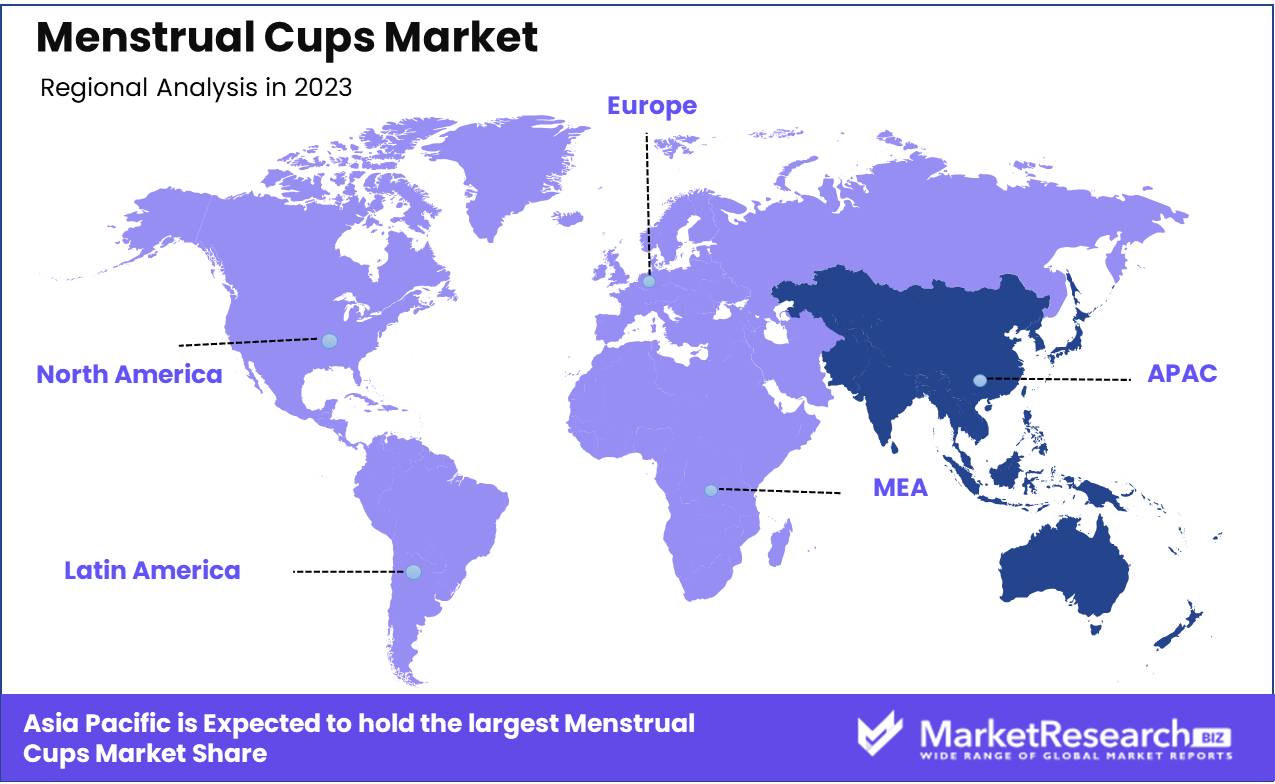

- Regional Dominance: Asia Pacific leads the global menstrual cups market with a 35% share.

- Growth Opportunity: Emerging markets are embracing menstrual cups due to increased awareness, affordability, and innovative product options.

Driving factors

Rising Awareness about Sustainability: Catalyzing Consumer Shift Towards Menstrual Cups

The growing global emphasis on sustainability is significantly driving the adoption of menstrual cups. As awareness about sustainable living increases, consumers are seeking products that align with eco-friendly practices. Menstrual cups, which are reusable and generate less waste compared to traditional sanitary products like tampons and pads, are being recognized for their sustainability benefits.

This shift is supported by statistics indicating a substantial rise in consumer preference for eco-friendly products. For instance, a survey reports that 73% of global consumers would change their consumption habits to reduce their environmental impact. This growing consciousness is fostering a robust demand for menstrual cups as part of broader sustainable living choices.

Reusability and Long Lifespan: Enhancing Cost-Effectiveness and Consumer Appeal

The reusability and long lifespan of menstrual cups are pivotal factors contributing to their market growth. Unlike single-use sanitary products, menstrual cups can be used for several years, providing a cost-effective solution for menstruators. This economic advantage is becoming increasingly attractive, especially in regions with higher awareness and education about menstrual health. Studies show that the average menstruator spends significantly less over a decade on menstrual cups compared to disposable products, making them a financially appealing option. The ability to reduce monthly expenditure on menstrual hygiene products is a compelling incentive, further driving market expansion.

Environmental Concerns: Driving Demand for Eco-Friendly Menstrual Solutions

Environmental concerns are increasingly influencing consumer behavior, leading to a rise in the adoption of menstrual cups. Traditional menstrual products contribute to substantial landfill waste and environmental pollution, with millions of tons of non-biodegradable waste generated annually. Menstrual cups, being reusable, offer a significant waste reduction. This environmental benefit is resonating with eco-conscious consumers and advocacy groups promoting sustainable menstruation solutions.

Restraining Factors

Initial Hesitation: A Barrier to Adoption and Market Expansion

Initial hesitation among potential users significantly restrains the growth of the menstrual cup market. This reluctance stems from a lack of familiarity and comfort with the product, as menstrual cups require a different insertion technique compared to traditional menstrual products like tampons and pads. This unfamiliarity can lead to concerns about usability, hygiene, and potential discomfort, deterring new users. According to market studies, a notable percentage of women express apprehension about trying menstrual cups, which can be attributed to a general resistance to change from established routines.

Moreover, misinformation and myths about the safety and efficacy of menstrual cups further exacerbate this hesitation. This initial resistance slows the adoption rate, thus impeding the market's potential growth trajectory. To counteract this, comprehensive educational campaigns and user-friendly product designs are essential to enhance user confidence and increase market penetration.

Conservative Societies: Cultural Constraints Limiting Market Reach

Conservative societal norms significantly impede the proliferation of menstrual cups, particularly in regions with traditional views on menstruation. In many conservative societies, discussions about menstrual health are often stigmatized, leading to a lack of awareness and open dialogue about innovative menstrual products like menstrual cups. Cultural taboos and restrictive gender norms discourage the exploration of menstrual health options, thus limiting market growth. For instance, in various parts of Asia and the Middle East, cultural restrictions significantly reduce the acceptance of menstrual cups, as the concept of reusable internal menstrual products may conflict with traditional beliefs about purity and modesty.

This cultural resistance not only limits consumer awareness and acceptance but also poses challenges to market entry and expansion for companies looking to introduce menstrual cups in these regions. Addressing these barriers requires culturally sensitive marketing strategies and community engagement initiatives to educate and shift perceptions, thereby facilitating broader acceptance and market growth.

By Product Type Analysis

In 2023, disposable menstrual cups led, with reusable cups gaining momentum.

In 2023, Disposable Menstrual Cups held a dominant market position in the By Product Type segment of the Menstrual Cups Market. The market segmentation includes Disposable Menstrual Cups and Reusable Menstrual Cups.

Disposable Menstrual Cups have gained significant traction due to their convenience and single-use nature, appealing to consumers seeking hygienic and hassle-free options. The growth in this segment is propelled by increasing consumer preference for products that offer ease of use and require minimal maintenance. Furthermore, the rising awareness of menstrual hygiene and the convenience of disposal contribute to the robust demand for disposable options.

In contrast, Reusable Menstrual Cups cater to environmentally conscious consumers and those seeking cost-effective long-term solutions. Although this Menstrual Cups segment is growing, it faces challenges such as higher upfront costs and the need for regular cleaning, which can deter some potential users. Despite these challenges, the reusable segment benefits from the increasing trend towards sustainable products and the long-term savings they offer, which resonate with a growing segment of the market prioritizing eco-friendly choices.

By Material Analysis

In 2023, Medical Grade Silicone dominated the menstrual cups market by material.

In 2023, medical-grade silicone held a dominant market position in the by-material segment of the Menstrual Cups Market. This material's superior biocompatibility, flexibility, and durability make it the preferred choice among consumers, driving its substantial market share. Medical-grade silicone menstrual cups are hypoallergenic, non-toxic, and free from hazardous chemicals, enhancing their appeal for health-conscious users and supporting their dominance in the market.

Thermoplastic Elastomer (TPE) emerged as a significant segment, offering a versatile alternative to silicone. TPE menstrual cups are appreciated for their softness and ease of molding, which allows for a range of design innovations. Their recyclability and lower production costs also make them attractive to both manufacturers and environmentally conscious consumers.

Rubber menstrual cups, although less prevalent, cater to a niche market. Known for their elasticity and resilience, rubber cups offer a cost-effective option, but concerns about latex allergies limit their broader adoption. Their market presence remains steady due to their long-standing use and affordability.

Latex menstrual cups represent a small segment due to rising allergy concerns and the availability of more advanced materials. While latex cups were among the earliest types introduced, their usage has declined in favor of silicone and TPE options, which offer better safety profiles and user comfort.

By Shape Analysis

In 2023, Bell-shaped menstrual cups led the market due to superior comfort.

In 2023, Bell-shaped menstrual cups held a dominant market position in the "By Shape" segment of the Menstrual Cups Market. This segment's popularity is primarily attributed to its ergonomic design, which offers enhanced comfort and a reliable fit, making it the preferred choice for many users. Bell-shaped cups typically feature a wider rim and a tapered body, facilitating easier insertion and removal, and providing a secure fit that minimizes leakage, thus driving user preference and market dominance.

Cylindrical menstrual cups, known for their uniform width from rim to base, cater to users who prioritize ease of cleaning and higher fluid capacity. This shape is particularly favored by individuals seeking longer wear times without compromising on comfort. V-shaped cups, with their narrower design and pointed base, appeal to users who prefer a more streamlined fit, often perceived as easier to insert and remove, especially for those with higher cervixes, contributing to their growing market share.

Disc-Shaped menstrual cups, designed to sit differently in the vaginal canal, are gaining traction for their unique positioning and comfort, especially during sexual intercourse, attracting a niche but expanding user base. Collapsible menstrual cups, characterized by their foldable design, offer superior portability and convenience, making them highly appealing to frequent travelers and those seeking discreet storage options, thereby carving out a significant niche within the market.

By Distribution Channel Analysis

In 2023, E-commerce dominated menstrual cup sales due to convenience.

In 2023, E-commerce held a dominant market position in the By Distribution Channel segment of the Menstrual Cups Market. This ascendancy can be attributed to several factors. Firstly, e-commerce platforms provide unparalleled convenience, allowing consumers to browse a wide variety of menstrual cup options, read user reviews, and make purchases from the comfort of their homes. This is particularly appealing for menstrual products, which some consumers prefer to buy discreetly. Additionally, the rise of digital literacy and increased internet penetration, especially in emerging markets, has expanded the consumer base for online menstrual cup purchases. Competitive pricing and frequent promotional offers on e-commerce platforms further attract cost-sensitive customers.

Supermarkets and Hypermarkets, while still significant, are more traditional channels that benefit from the high foot traffic and impulse buying opportunities. However, their share is increasingly challenged by the convenience and variety offered online. Pharmacy Stores continue to play a crucial role, particularly for first-time buyers seeking professional advice and those preferring immediate purchase without waiting for delivery. Nonetheless, the overall trend leans towards digital sales channels, driven by evolving consumer preferences and technological advancements.

Key Market Segments

By Product Type

- Disposable Menstrual Cups

- Reusable Menstrual Cups

By Material

- Medical Grade Silicone

- Thermoplastic Isomer

- Rubber

- Latex

By Shape

- Bell-Shaped

- Cylindrical

- V-Shaped

- Disc-Shaped

- Collapsible

By Distribution Channel

- Supermarkets and Hypermarkets

- Pharmacy Stores

- E-commerce

Growth Opportunity

Increased Adoption in Emerging Markets

Emerging markets are experiencing a notable surge in the adoption of menstrual cups, attributed to growing awareness and the push for sustainable menstrual hygiene solutions. Countries in Asia-Pacific, Latin America, and Africa are witnessing a shift from traditional sanitary products to more eco-friendly options. This transition is largely driven by the rising educational campaigns and the efforts of NGOs focusing on menstrual health awareness.

For instance, government-led initiatives in countries like India and Kenya are facilitating better access to menstrual hygiene products, including menstrual cups, thus broadening the market base. The affordability and long-term cost-effectiveness of menstrual cups also make them a viable option for consumers in these regions, enhancing their market penetration.

Product Innovation and Customization

The menstrual cups market is benefiting significantly from continuous product innovation and customization, catering to diverse consumer needs. Manufacturers are increasingly focusing on developing products that offer enhanced comfort, ease of use, and varied sizes to cater to different anatomical needs. Innovations such as collapsible cups, cups with removal stems, and those made from medical-grade silicone are gaining traction.

Additionally, customization options, including varied colors and packaging designs, are appealing to a broader demographic, enhancing consumer acceptance. Companies investing in research and development to introduce hypoallergenic and antibacterial materials are further boosting product appeal, positioning menstrual cups as a superior alternative to traditional menstrual products.

Latest Trends

Increasing Demand for Sustainable Menstrual Products: Driving Market Growth

In 2024, the global menstrual cups market is experiencing a significant surge in demand driven by a heightened consumer preference for sustainable menstrual products. As awareness about environmental issues grows, consumers are increasingly seeking alternatives to traditional single-use menstrual products such as pads and tampons.

Menstrual cups, being reusable and eco-friendly, are gaining traction as a sustainable option that aligns with the rising trend of environmental consciousness. This shift is not only reflected in consumer behavior but is also being actively promoted by manufacturers who are emphasizing the eco-friendly attributes of menstrual cups in their marketing strategies. Additionally, the cost-effectiveness of menstrual cups, which can be used for several years, is appealing to cost-conscious consumers, further propelling market growth.

Government Initiatives: Encouraging Adoption and Accessibility of Menstrual Cups

Governments around the world are playing a pivotal role in the growth of the menstrual cup market through various initiatives aimed at enhancing menstrual health and hygiene. Policies promoting menstrual equity and accessibility are being implemented, with a focus on providing free or subsidized menstrual products, including menstrual cups, to underserved populations. For instance, several countries have initiated programs to distribute menstrual cups in schools and community centers, aiming to reduce menstrual stigma and improve access to sustainable menstrual products. These initiatives are not only helping to raise awareness about menstrual cups but are also making them more accessible to a broader demographic, thereby accelerating market adoption.

Moreover, government-supported educational campaigns are instrumental in addressing misconceptions about menstrual cups, thereby fostering a more informed and open dialogue about menstrual health. These efforts collectively contribute to the expanding adoption of menstrual cups, positioning them as a mainstream menstrual hygiene product.

Regional Analysis

Asia Pacific leads the global menstrual cups market with a 35% share.

The global menstrual cups market exhibits significant regional diversity, driven by varying levels of awareness, accessibility, and socio-economic factors. In North America, the market is buoyed by high awareness and adoption rates, with the U.S. leading due to robust marketing efforts and a growing emphasis on sustainable menstrual products. The region's market share is notable, accounting for approximately 30% of global sales. Europe also demonstrates a strong market presence, with countries like the UK, Germany, and France spearheading adoption through supportive government policies and widespread environmental consciousness, contributing to a 25% market share.

Asia Pacific emerges as the dominating region, commanding the largest market share at approximately 35%. This growth is fueled by increasing urbanization, rising disposable incomes, and heightened awareness through educational campaigns, particularly in India and China. The Middle East & Africa, while currently representing a smaller market segment, shows promising growth potential due to increasing female workforce participation and improving healthcare infrastructure. Latin America, led by Brazil and Mexico, is gradually expanding its market footprint, driven by rising environmental concerns and the growing middle-class population, capturing around 10% of the global market. The regional dynamics reflect a diverse and evolving landscape, with Asia Pacific leading the charge in market expansion.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global menstrual cups market in 2024 is poised for substantial growth, driven by increasing awareness and demand for sustainable feminine hygiene products. The landscape is dominated by a mix of established players and emerging innovators, each contributing uniquely to market dynamics.

Mooncup Ltd continues to leverage its pioneering status, focusing on eco-friendly initiatives and community engagement. Their strong brand loyalty and robust distribution network position them well in mature markets. The Keeper, Inc. maintains its niche appeal with a focus on natural rubber materials, appealing to consumers with specific sustainability preferences. Their strategy emphasizes educational outreach and user-friendly product design.

Irisana Group stands out with its innovation in product features, including enhanced comfort and ease of use, catering to a broad demographic. Their strategic partnerships are expanding their market reach in Europe and Latin America. Diva International Inc., a market leader, capitalizes on its extensive marketing campaigns and strong retail presence. Their product diversification and emphasis on brand visibility continue to drive market penetration and customer retention.LadyCup and SckoonCup are gaining traction with their emphasis on aesthetic appeal and customization options, targeting younger demographics and first-time users with vibrant designs and color variations.

Anigan and YUUKI Company s.r.o. are focusing on affordability and accessibility, positioning themselves competitively in price-sensitive regions while maintaining quality standards. Lunette Menstrual Cups is enhancing its market share through strategic global expansions and strong digital marketing initiatives, appealing to tech-savvy consumers. Femmycycle distinguishes itself with patented designs emphasizing leak prevention and comfort, attracting a loyal customer base seeking innovative solutions.

Market Key Players

- Mooncup Ltd

- The Keeper, Inc.

- Irisana Group

- Diva International Inc.

- LadyCup

- SckoonCup

- Anigan

- YUUKI Company s.r.o.

- Lunette Menstrual Cups

- Femmycycle

Recent Development

- In May 2024, Report Ocean's "North America and Europe Menstrual Cup Market" report for 2024 highlights the market's growth driven by eco-consciousness and cost-effectiveness, projected to reach $811 million by 2026. Despite challenges like limited awareness and cultural taboos, increasing adoption reflects shifting menstrual hygiene trends in these regions.

- In April 2024, Health Shots, Maintain vaginal hygiene with ease using these top 6 menstrual cup sterilizers in India. Options include Sirona, Senziwash, SAFECUP, Carmesi, Azah Clean, and Lemme Be. Keep your menstrual cup clean and germ-free for safe and comfortable periods.

- In January 2024, the University of Nottingham's Project Period initiative distributed over 300,000 free pads and tampons across its seven UK campus sites to combat period poverty.

Report Scope

Report Features Description Market Value (2023) USD 894.4 Million Forecast Revenue (2033) USD 1,593.2 Million CAGR (2024-2032) 6.1% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type( Disposable Menstrual Cups and Reusable Menstrual Cups), By Material( Medical Grade Silicone, Thermoplastic Isomer, Rubber and Latex) By Shape (Cylindrical, V-Shaped, Disc-Shaped, Bell-Shaped, Collapsible ), By Distribution Channel( Supermarkets and Hypermarkets, Pharmacy Stores and E-commerce) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Mooncup Ltd, The Keeper, Inc., Irisana Group, Diva International Inc., LadyCup, SckoonCup, Anigan, YUUKI Company s.r.o., Lunette Menstrual Cups, Femmycycle Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Mooncup Ltd

- The Keeper, Inc.

- Irisana Group

- Diva International Inc.

- LadyCup

- SckoonCup

- Anigan

- YUUKI Company s.r.o.

- Lunette Menstrual Cups

- Femmycycle