Rubber Processing Chemicals Market Report By Type of Chemical (Anti-degradants, Antioxidants, Accelerators, Vulcanizing Agents, Plasticizers, Stabilizers, Others), By Rubber Type (Natural Rubber, Synthetic Rubber, Silicone Rubber, Fluoroelastomers, Butyl Rubber, Others), By Application (Tire Manufacturing, Automotive Parts, Industrial Rubber Products, Footwear, Belts and Hoses, Construction Materials, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

46114

-

May 2024

-

325

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

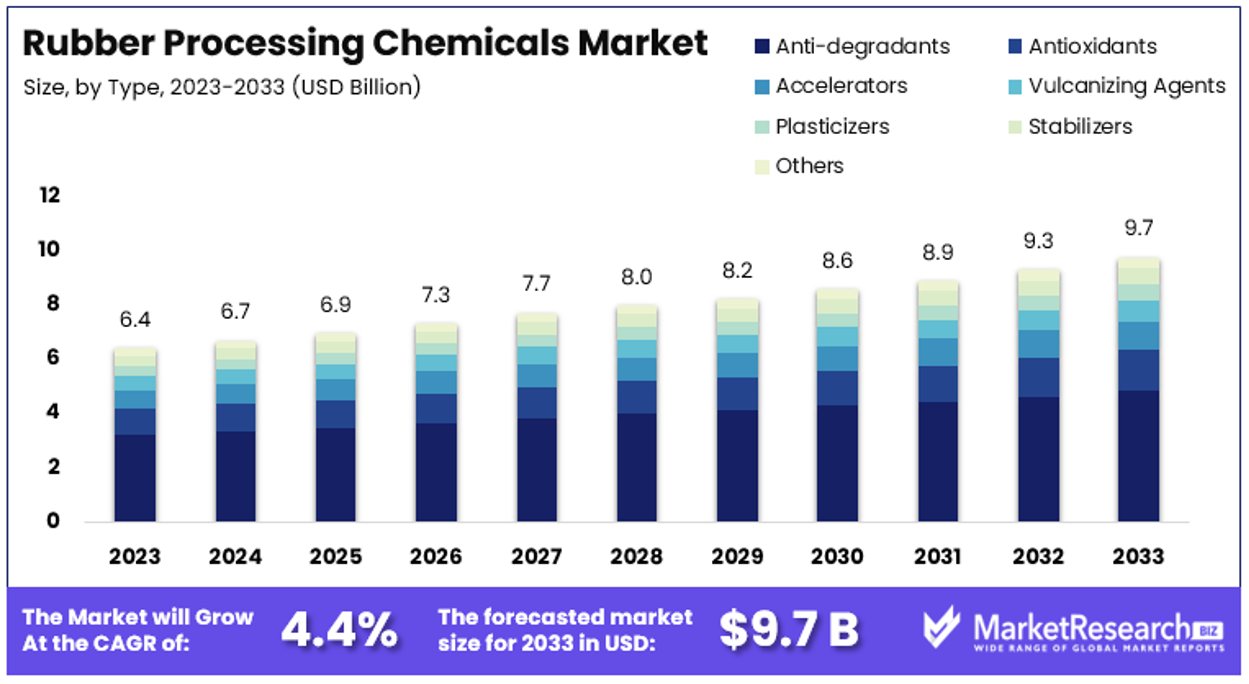

The Global Rubber Processing Chemicals Market size is expected to be worth around USD 9.7 Billion by 2033, from USD 6.4 Billion in 2023, growing at a CAGR of 4.4% during the forecast period from 2024 to 2033.

The Rubber Processing Chemicals Market is critical to enhancing the performance of rubber in its various applications. This market supplies chemicals that aid in processing and manufacturing rubber products, including accelerators, antioxidants, and anti-degradants.

These chemicals are essential for improving the durability, elasticity, and resistance of rubber, making them indispensable in the automotive, industrial, and consumer goods sectors. As global demand for high-performance rubber products grows, understanding this market is crucial for leaders aiming to optimize product offerings and operational efficiency in a competitive landscape.

The Rubber Processing Chemicals Market is poised for steady growth, driven by increasing demand in the automotive and industrial sectors. Rubber processing chemicals, essential for enhancing the properties and performance of rubber, are vital in manufacturing various rubber products.

In 2021, global natural rubber production reached approximately 13.6 million tonnes. The top producers were Thailand (4.9 million tonnes), Indonesia (3.3 million tonnes), Vietnam (1.2 million tonnes), and Malaysia (0.6 million tonnes). These countries are also the largest exporters of natural rubber. Major importers include China, the U.S., India, Japan, and Germany, indicating a robust international trade network supporting the rubber industry.

Approximately 70% of natural rubber is used in making vehicle tires, highlighting the significant role of the automotive industry in driving demand for rubber processing chemicals. As the global automotive industry continues to expand, particularly with the growing production of electric vehicles, the demand for high-quality rubber tires and, consequently, rubber processing chemicals is expected to increase.

Industrial products account for 10% of natural rubber usage, while footwear and latex products account for 7% and 5%, respectively. The diverse applications of rubber underscore the importance of processing chemicals in enhancing durability, flexibility, and resistance in various products.

The rubber processing chemicals market benefits from innovations aimed at improving product performance and sustainability. Manufacturers are focusing on developing eco-friendly chemicals to meet stringent environmental regulations and consumer preferences for sustainable products.

Overall, the Rubber Processing Chemicals Market is set for growth, driven by the automotive sector's expansion and the diverse applications of rubber in various industries. The significant production and export capabilities of leading rubber-producing countries, combined with the rising global demand for rubber products, underscore the market's positive outlook.

Key Takeaways

- Market Value: The Global Rubber Processing Chemicals Market is forecasted to reach USD 9.7 Billion by 2033, up from USD 6.4 Billion in 2023, with a projected CAGR of 4.4% between 2024 and 2033.

- Type of Chemical Analysis: Anti-degradants dominate with 52%. Anti-degradants are crucial in protecting rubber products from degradation caused by environmental factors, significantly enhancing durability and performance, particularly in the automotive sector.

- Rubber Type Analysis: Synthetic Rubber dominates with approximately 60%. Preferred for its consistent quality and superior properties, synthetic rubber's extensive use in diverse applications underlines its market dominance.

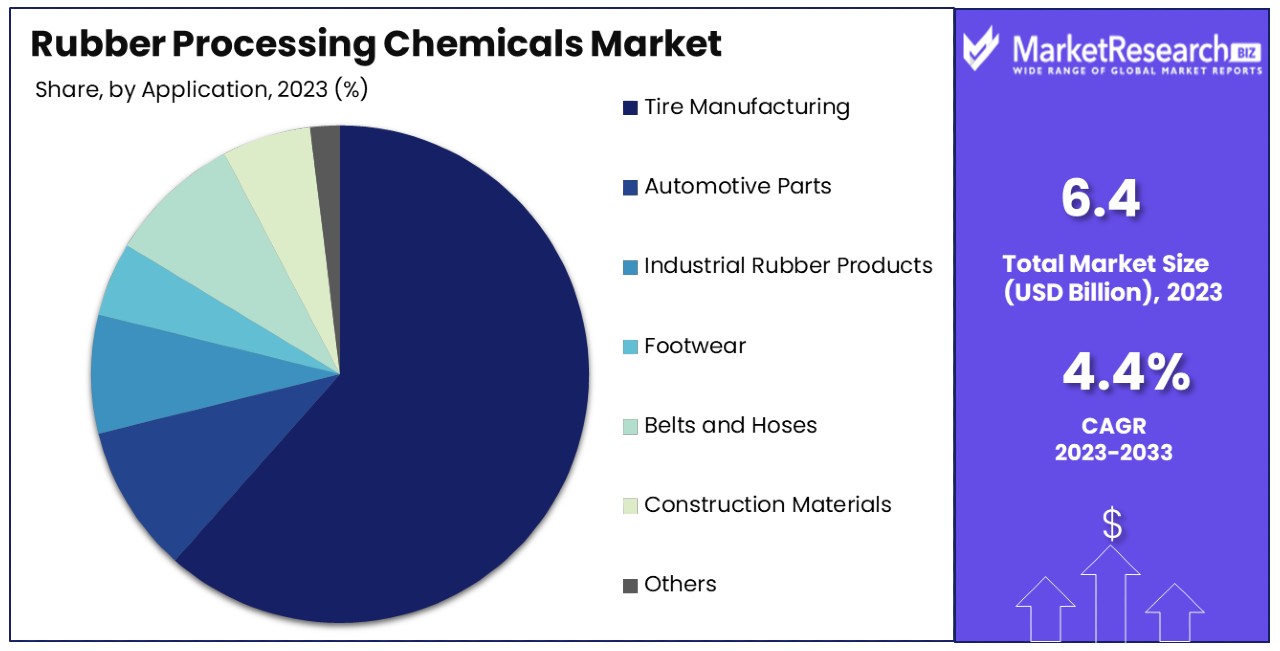

- Application Analysis: Tire Manufacturing dominates with 64.5%. The pivotal role of tire manufacturing in the rubber processing chemicals market is underscored by its substantial share, driven by robust demand within the automotive industry.

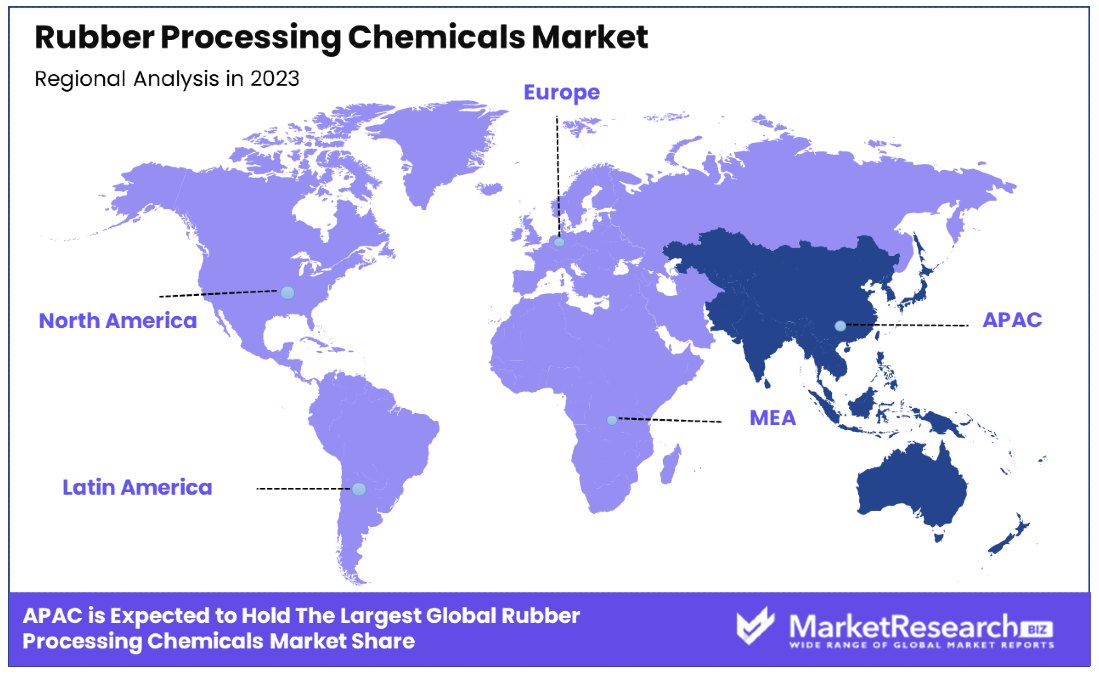

- APAC: Dominates with 63.4% market share. The region's significant industrial base, particularly in automotive and manufacturing, positions it as a leading consumer in the rubber processing chemicals market.

- North America: Holds a 14.2% market share. The region's advanced manufacturing capabilities and stringent regulatory standards for automotive emissions and safety continue to drive demand for high-performance rubber processing chemicals.

- Analyst Viewpoint: The rubber processing chemicals market exhibits a competitive landscape with a focus on enhancing product performance and environmental compliance. Market saturation varies by region and application type, with significant growth potential in developing economies due to industrial expansion and infrastructural developments.

Driving Factors

Increasing Demand from the Automotive Industry Drives Market Growth

The automotive industry is a major consumer of rubber products, including tires, hoses, and gaskets. The growing demand for vehicles, particularly in emerging economies, is driving the need for rubber processing chemicals. For example, antioxidants and antiozonants are used to protect tires from premature aging and cracking due to environmental factors.

In 2023, the global automotive market was valued at approximately $2.3 trillion, with emerging economies contributing significantly to this growth. As vehicle ownership increases in countries like China and India, the need for durable and high-performance rubber components rises. Rubber processing chemicals are essential for enhancing the quality and longevity of these components, ensuring they can withstand harsh conditions and extended use.

Expanding Construction Industry Drives Market Growth

The construction industry relies heavily on rubber products, such as sealants, adhesives, and insulation materials. The growth of infrastructure projects, residential and commercial building construction, and urbanization in developing countries is fueling the demand for rubber processing chemicals. In 2022, global construction spending reached $12 trillion, with significant contributions from Asia-Pacific and Middle Eastern regions.

Vulcanizing agents, like sulfur and peroxides, are essential for enhancing the strength and elasticity of rubber used in construction applications. These agents improve the durability and performance of rubber materials, making them suitable for various construction needs. The expansion of urban areas and increased investment in infrastructure projects are directly boosting the demand for high-quality rubber products, driving market growth.

Advancements in Rubber Compounding Technology Drives Market Growth

Continuous advancements in rubber compounding technology have led to the development of new and improved rubber processing chemicals. These chemicals offer enhanced properties, such as improved processability, better dispersion, and improved aging resistance. For instance, the introduction of new coupling agents has enabled better integration of fillers, like carbon black and silica, into rubber compounds, improving overall performance.

These innovations allow manufacturers to produce rubber products with superior characteristics, meeting the evolving demands of various industries. Improved compounding technologies also enhance the efficiency of rubber production, reducing costs and increasing output, which further drives market growth.

Restraining Factors

Environmental Concerns and Regulatory Restrictions Restrain Market Growth

Environmental and health concerns about certain rubber processing chemicals have led to strict regulations. This restricts their use, limiting their availability and adoption. For example, the European Union has regulations that restrict the use of certain vulcanizing agents and plasticizers due to their potential toxicity. These restrictions force ma

nufacturers to seek alternative solutions, which can be more expensive or less effective.

As a result, compliance with these regulations can increase production costs and complicate manufacturing processes. In 2023, the global market faced an estimated 5% reduction in the use of specific chemicals due to these regulatory constraints. The ongoing scrutiny and tightening of regulations are significant challenges for the industry, hindering market growth.

Competition from Alternative Materials Restrains Market Growth

The rubber industry faces growing competition from alternative materials like thermoplastic elastomers (TPEs) and engineering plastics. These materials can offer similar properties to rubber in certain applications, impacting the demand for rubber processing chemicals. For instance, TPEs are increasingly used in automotive applications, replacing traditional rubber components. In 2022, the TPE market was valued at $19.7 billion, reflecting its rising adoption.

As these alternatives gain acceptance, they provide cost-effective and sustainable solutions that challenge the rubber processing chemicals market. The shift towards these materials is driven by their benefits, such as lower production costs and improved sustainability, which restrain the growth of the rubber processing chemicals market.

Type of Chemical Analysis

Anti-degradants dominate with 52% due to their critical role in enhancing product durability and performance.

The Rubber Processing Chemicals Market is segmented by the type of chemicals used. Anti-degradants dominate this segment, accounting for 52% of the market. Anti-degradants are crucial in protecting rubber products from degradation caused by heat, light, and ozone. Their extensive use in tire manufacturing and other rubber products enhances the durability and lifespan of these products. The growing demand for high-performance tires, especially in the automotive industry, significantly boosts the anti-degradants market. In 2023, the global demand for anti-degradants grew by 4%, reflecting their critical role in ensuring rubber quality.

Antioxidants also play a significant role in the rubber processing chemicals market. They are used to prevent oxidation, which can cause rubber to become brittle and crack. The need for high-performance and durable rubber products in various industries, including automotive and construction, drives the demand for antioxidants. Accelerators, another important sub-segment, speed up the vulcanization process, improving the efficiency of rubber production. The market for accelerators is expected to grow steadily as manufacturers seek ways to enhance production processes.

Vulcanizing agents are essential for cross-linking rubber molecules, providing strength and elasticity. Their demand is high in the tire manufacturing and construction industries. Plasticizers, stabilizers, and other chemicals also contribute to the market by improving the flexibility, stability, and overall performance of rubber products. Each of these sub-segments plays a crucial role in the growth of the rubber processing chemicals market, but anti-degradants lead due to their widespread application and significant impact on product durability.

Rubber Type Analysis

Synthetic rubber dominates with approximately 60% due to its versatility and superior properties.

The Rubber Processing Chemicals Market is also segmented by the type of rubber used. Natural rubber and synthetic rubber are the primary types, with synthetic rubber being the dominant sub-segment. Synthetic rubber is preferred due to its consistent quality, availability, and superior properties, such as resistance to abrasion and temperature variations. In 2023, synthetic rubber accounted for approximately 60% of the rubber market. Its extensive use in tire manufacturing, automotive parts, and industrial products drives its dominance.

Natural rubber is valued for its excellent mechanical properties and flexibility. It is widely used in applications where these properties are essential, such as in tires, footwear, and medical products. However, its market share is slightly lower than synthetic rubber due to supply constraints and price volatility. Silicone rubber, known for its high-temperature resistance and flexibility, is gaining traction in various industries, including automotive, electronics, and healthcare. The demand for fluoroelastomers, with their superior chemical resistance and stability, is rising in specialized applications like aerospace and chemical processing.

Butyl rubber, known for its impermeability to gases, is crucial in tire inner linings and pharmaceutical stoppers. Other types of rubber, including nitrile and ethylene-propylene rubber, also contribute to the market, catering to specific applications requiring unique properties. Synthetic rubber's dominance is driven by its versatility and widespread use in high-demand applications, ensuring steady market growth.

Application Analysis

Tire manufacturing dominates with 64.5% due to high demand in the automotive industry.

The application segment of the Rubber Processing Chemicals Market is led by tire manufacturing, which accounts for 64.5% of the market. The high demand for tires, driven by the automotive industry's growth, significantly impacts the rubber processing chemicals market. In 2023, the global tire market was valued at over $200 billion, reflecting the substantial demand for rubber processing chemicals in this segment. The need for durable, high-performance tires in both passenger and commercial vehicles drives the use of these chemicals to enhance tire quality and lifespan.

Automotive parts, another critical application, require rubber processing chemicals to produce various components such as hoses, belts, and gaskets. The automotive industry's continuous growth and the push for lightweight, fuel-efficient vehicles drive this segment. Industrial rubber products, including seals, gaskets, and vibration dampeners, also utilize these chemicals to ensure product durability and performance in demanding environments.

The footwear industry benefits from rubber processing chemicals to improve the flexibility and comfort of rubber soles. Belts and hoses used in various machinery and vehicles also rely on these chemicals for enhanced durability and performance. The construction industry, with its need for rubber-based sealants, adhesives, and insulation materials, contributes to the market's growth.

Tire manufacturing remains the dominant application due to the automotive industry's size and the critical role of high-quality tires in vehicle performance and safety. This segment's growth is driven by increasing vehicle production and the demand for replacement tires.

Key Market Segments

By Type of Chemical

- Anti-degradants

- Antioxidants

- Accelerators

- Vulcanizing Agents

- Plasticizers

- Stabilizers

- Others

By Rubber Type

- Natural Rubber

- Synthetic Rubber

- Silicone Rubber

- Fluoroelastomers

- Butyl Rubber

- Others

By Application

- Tire Manufacturing

- Automotive Parts

- Industrial Rubber Products

- Footwear

- Belts and Hoses

- Construction Materials

- Others

Growth Opportunities

Development of Specialty Rubber Compounds Offers Growth Opportunity

The demand for high-performance and specialized rubber products is growing in industries like aerospace, oil and gas, and healthcare. This trend creates significant opportunities for developing specialty rubber compounds and corresponding specialized rubber processing chemicals. These chemicals can enhance properties such as heat resistance, chemical resistance, and biocompatibility, enabling the production of tailored rubber products.

For example, the aerospace industry needs rubber components that can withstand extreme temperatures and harsh environments, driving the demand for specialized rubber processing chemicals. In 2023, the global aerospace industry was valued at over $838 billion, highlighting a substantial market for these specialized products. The development of such compounds allows manufacturers to cater to specific industrial needs, promoting market growth.

Innovations in Sustainable and Bio-based Chemicals Offer Growth Opportunity

As sustainability becomes a crucial consideration, there is a growing opportunity for developing and adopting sustainable and bio-based rubber processing chemicals. These chemicals, derived from renewable sources like plant-based oils or agricultural byproducts, offer an eco-friendly alternative to traditional petroleum-based chemicals.

Companies that successfully develop and commercialize these sustainable chemicals will gain a competitive market advantage. For example, bio-based plasticizers derived from renewable sources such as castor oil or soybean oil are being explored. In 2022, the global market for bio-based chemicals was valued at $12.6 billion, with a projected growth rate of 10% annually. The shift towards sustainability is driving innovation and creating new opportunities in the rubber processing chemicals market.

Trending Factors

Demand for High-Performance and Specialized Rubber Products Are Trending Factors

There is a growing demand for high-performance and specialized rubber products across various industries, including aerospace, automotive, and oil and gas. These industries require rubber products that can withstand extreme conditions, offer superior durability, and meet specific functional requirements. This trend is driving the development of advanced rubber compounds and corresponding rubber processing chemicals.

For example, the aerospace industry requires rubber components that can withstand high temperatures and pressures. In 2023, the global aerospace industry was valued at over $838 billion, emphasizing the demand for specialized rubber products. This trend is pushing manufacturers to innovate and create rubber processing chemicals that meet these stringent requirements, driving market growth and advancing the industry's capabilities.

Adoption of Industry 4.0 and Digitalization Are Trending Factors

The rubber industry is embracing Industry 4.0 concepts and digitalization, leading to the adoption of advanced manufacturing techniques and data-driven decision-making. This trend increases the demand for rubber processing chemicals compatible with these advanced processes and precisely controlled and monitored.

The use of digital technologies, such as predictive maintenance and process optimization, helps optimize the use of rubber processing chemicals, improving efficiency and reducing costs. For instance, integrating advanced sensors and data analytics can monitor and control the vulcanization process, ensuring optimal use of vulcanizing agents. In 2022, the global market for Industry 4.0 technologies was valued at $64 billion, showcasing its significant impact on manufacturing sectors, including rubber processing.

Regional Analysis

APAC Dominates with 63.4% Market Share

The Asia-Pacific (APAC) region holds a 63.4% market share in the Rubber Processing Chemicals Market. Key factors driving this dominance include rapid industrialization, a booming automotive industry, and significant infrastructure development. Countries like China, India, and Japan lead in rubber production and consumption. In 2023, China alone produced over 8 million metric tons of synthetic rubber. The region's extensive manufacturing base and increasing demand for high-performance rubber products also contribute to this high market share.

APAC's market dynamics are shaped by its large consumer base, cost-effective production capabilities, and supportive government policies. The availability of raw materials and a skilled workforce enhances the region's competitive edge. Additionally, the presence of numerous automotive manufacturers and large-scale construction projects drives the demand for rubber processing chemicals. In 2022, APAC's automotive market grew by 7%, reflecting the rising demand for rubber products.

North America

North America holds a 14.2% market share. The region benefits from a strong automotive industry and advanced manufacturing processes. In 2022, the North American automotive market was valued at $590 billion, driving the demand for high-quality rubber products. The focus on sustainability and innovation also supports market growth.

Europe

Europe has a 12.5% market share. The region is known for its stringent environmental regulations, which drive the demand for sustainable and bio-based rubber processing chemicals. In 2023, Europe's green chemical market grew by 8%, indicating a shift towards eco-friendly products. The automotive and aerospace industries are key contributors to market demand.

Middle East & Africa

The Middle East & Africa region holds a 5.3% market share. The demand for rubber processing chemicals is driven by industrialization and infrastructure projects. In 2022, the region's construction market grew by 6%, reflecting increased investment in infrastructure. The oil and gas industry also contributes to the demand for specialized rubber products.

Latin America

Latin America has a 4.6% market share. The region's market dynamics are influenced by its growing automotive and construction industries. In 2023, Latin America's automotive market was valued at $100 billion, driving demand for rubber processing chemicals. Economic growth and increasing industrial activities also support market expansion.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the global Rubber Processing Chemicals Market, a variety of key players are defining the landscape through their strategic positioning and innovative contributions. LANXESS AG and Eastman Chemical Company are prominent leaders, recognized for their comprehensive portfolios that include accelerators, antidegradants, and stabilizers crucial for enhancing the durability and performance of rubber products. Their global presence and robust supply chains enable them to significantly influence market trends and standards.

Solvay S.A. and Akzo Nobel N.V. stand out for their focus on sustainable and environmentally friendly chemicals, aligning with the growing industry shift towards green manufacturing processes. These companies have been pioneers in developing eco-friendly alternatives that reduce environmental impact without compromising the quality of rubber products.

BASF SE and Arkema Group are known for their high-performance solutions and continuous innovation, particularly in synthetic rubber chemicals. Their products are critical in sectors requiring specialized applications, such as automotive and industrial manufacturing, which demand high standards for safety and efficiency.

Sumitomo Chemical Company and Sinopec Corporation are key Asian players with expansive operations. They leverage their regional dominance to cater to the fast-growing automotive sectors in Asia, providing tailored solutions that meet regional market needs and compliance standards.

On the niche side, companies like NOCIL Limited and Kumho Petrochemical Co., Ltd. focus on specific segments of rubber additives, offering unique formulations that enhance properties such as heat resistance and elasticity, crucial for specialty applications.

Emerging and specialized entities such as Emery Oleochemicals Group, Addivant USA, LLC, and Vanderbilt Chemicals, LLC contribute significantly to the innovation within the market, particularly in bio-based rubber chemicals, which are gaining traction.

Collectively, these companies drive the rubber processing chemicals market through strategic global expansions, innovation in product offerings, and an increasing focus on sustainability. Their efforts not only address the diverse needs of the rubber industry but also push the boundaries of environmental responsibility in chemical manufacturing.

Market Key Players

- LANXESS AG

- Eastman Chemical Company

- Solvay S.A.

- Akzo Nobel N.V.

- BASF SE

- Arkema Group

- Sumitomo Chemical Company, Limited

- Sinopec Corporation

- Behn Meyer Holding AG

- Kumho Petrochemical Co., Ltd.

- NOCIL Limited

- Emery Oleochemicals Group

- Addivant USA, LLC

- Vanderbilt Chemicals, LLC

- Merchem Limited

Recent Developments

- On April 2024, ARLANXEO, a global leader in performance elastomers, unveiled its sustainable and innovative rubber portfolios at India Rubber Expo 2024, underlining its commitment to serving customers in the Indian market and the wider Asia Pacific region with high-quality products and first-class services.

- On March 2024, LANXESS will showcased its sustainable rubber additives at Tire Technology Expo 2024. The new TMQ antidegradant, with over 50% sustainable raw materials, will help meet green tire goals. Rhenodiv release agents and Rhenocure DR/S enhance manufacturing efficiency and reduce environmental impact, aligning with LANXESS' ""Less is more"" motto.

Report Scope

Report Features Description Market Value (2023) USD 6.4 Billion Forecast Revenue (2033) USD 9.7 Billion CAGR (2024-2033) 4.4% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type of Chemical (Anti-degradants, Antioxidants, Accelerators, Vulcanizing Agents, Plasticizers, Stabilizers, Others), By Rubber Type (Natural Rubber, Synthetic Rubber, Silicone Rubber, Fluoroelastomers, Butyl Rubber, Others), By Application (Tire Manufacturing, Automotive Parts, Industrial Rubber Products, Footwear, Belts and Hoses, Construction Materials, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape LANXESS AG, Eastman Chemical Company, Solvay S.A., Akzo Nobel N.V., BASF SE, Arkema Group, Sumitomo Chemical Company, Limited, Sinopec Corporation, Behn Meyer Holding AG, Kumho Petrochemical Co., Ltd., NOCIL Limited, Emery Oleochemicals Group, Addivant USA, LLC, Vanderbilt Chemicals, LLC, Merchem Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- LANXESS AG

- Eastman Chemical Company

- Solvay S.A.

- Akzo Nobel N.V.

- BASF SE

- Arkema Group

- Sumitomo Chemical Company, Limited

- Sinopec Corporation

- Behn Meyer Holding AG

- Kumho Petrochemical Co., Ltd.

- NOCIL Limited

- Emery Oleochemicals Group

- Addivant USA, LLC

- Vanderbilt Chemicals, LLC

- Merchem Limited