Plasticizers Market By Type (Phthalates, Non-Phthalates), By Application (Automotive, Cables and Wires, Flooring, Roofing & Cladding, Coated Fabrics, Film & Sheet, Packaging, Healthcare & Personal Care, Others End-Uses), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

23571

-

Jul 2023

-

155

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

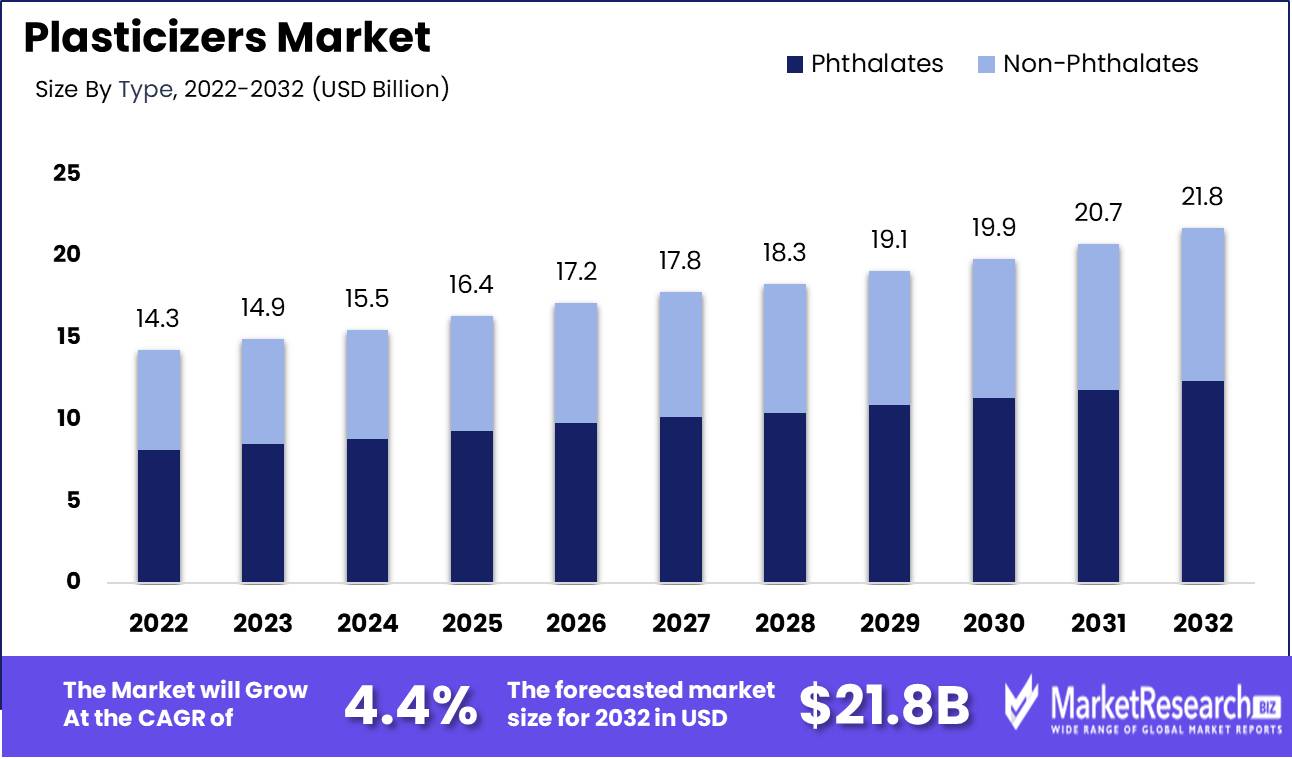

The plasticizers market size is expected to be worth around USD 21.8 Bn by 2032 from USD 14.3 Bn in 2022, growing at a CAGR of 4.4% during the forecast period from 2023 to 2032.

Plasticizers are chemical additives with the extraordinary ability to increase the flexibility, durability, and workability of plastics, especially polyvinyl chloride (PVC), which is widely used. These remarkable agents are utilized in the production of a vast multitude of products, including cables, flooring, medical devices, and automobile parts. As demand for PVC products continues to rise across multiple industries, the plasticizers market has emerged as a rapidly expanding subsegment of the global chemicals industry, ripe with future growth potential and opportunities.

PVC is an unrivalled material for a vast array of applications, particularly in the electrical and automotive industries, as a result of the incorporation of plasticizers in its production. Among these commendable advantages are the enhancement of flexibility, the improvement of resistance to temperature fluctuations, and the improvement of product durability. Therefore, PVC products infused with plasticizers have become an indispensable option for numerous industries seeking adaptable and reliable solutions.

Driving factors

Plasticizers are adaptable solutions that are powering a variety of industries.

Plasticizers find widespread application across a variety of sectors, including the automotive, construction, packaging, and healthcare industries. The plasticizers market demonstrates the steadily increasing need for plasticizers in these many industries. The building and construction sector is also growing, which means there are more chances than ever before for the use of plasticizers in various building and construction materials. A further element propelling the plasticizers market is the rise in demand for products made of plastic, which is a direct result of both the population boom and the accompanying urbanization trend.

The plasticizers market is ripe for innovation thanks to recent technological advances.

The creation of new product options has been facilitated by developments in the technology and production processes related to plasticizers. This will have a beneficial impact on the plasticizers market because it demonstrates the possibility for growth and expansion. On the other hand, there is a possibility that there will be modifications to rules in the future, which may have an effect on the plasticizers market. Because of this, it is essential for makers of plasticizers to be current on any regulatory changes that may occur in order to prevent adverse effects on the industry.

The Emerging Technologies and Game-Changing Innovations That Will Shape the Future of Plasticizers

Emerging technologies may also have an effect on the plasticizers market in the foreseeable future. For instance, the development of ecologically acceptable and sustainable bio-based plasticizers might become a potential disruptor in the business. These plasticizers would be derived from biological sources. In order to maintain its level of competitiveness in the face of rapidly developing technology, the plasticizers market will have to demonstrate a capacity for adaptation and innovation.

Restraining Factors

Conquering Obstacles for a Brighter Future

The plasticizer market has been confronted by a number of restraints that pose serious threats to its growth and prosperity. These factors include stringent government regulations regarding plastic products, highly volatile prices of raw materials, rising concerns regarding the use of phthalates, and a labor-intensive manufacturing process that drives up costs. In this article, we will examine these obstacles and discuss strategies for overcoming them for a brighter future.

Government Regulations Regarding Plastic Products Are Strict

Governments, particularly in developed countries, have imposed stricter regulations on the plasticizers market. The primary objective is to reduce the negative effects of plastic pollution on the environment and human health. Therefore, manufacturers are required to adhere to stringent regulations regarding the use of plasticizers in their products. While this is a positive development, it presents the industry with a significant challenge.

To surmount this obstacle, manufacturers must investigate new, more eco-friendly alternatives to conventional plasticizers. Companies and regulatory bodies can work together to identify acceptable alternatives that satisfy the required quality and safety standards. In this regard, manufacturers can gain a competitive edge and remain ahead of the curve by taking proactive measures.

Type Analysis

The Phthalates Segment Dominates the Plasticizers Market.

The primary segments of the plasticizers market are phthalates and non-phthalates. Among these, the phthalates segment has the largest market share due to its wide spectrum of applications in industries such as furniture, flooring, and automobiles. Phthalates are widely used in the plasticizers market due to their durability, flexibility, and simplicity of processing.

The segment of the plasticizers market comprised of phthalates is primarily propelled by economic growth in emerging economies. Industrialization and urbanization in developing nations such as China and India have increased demand for plasticizers used in the construction, automotive, and electrical industries. These nations have also experienced an increase in disposable income, which has led to a rise in consumer expenditure on a variety of goods, including plastics.

Application Analysis

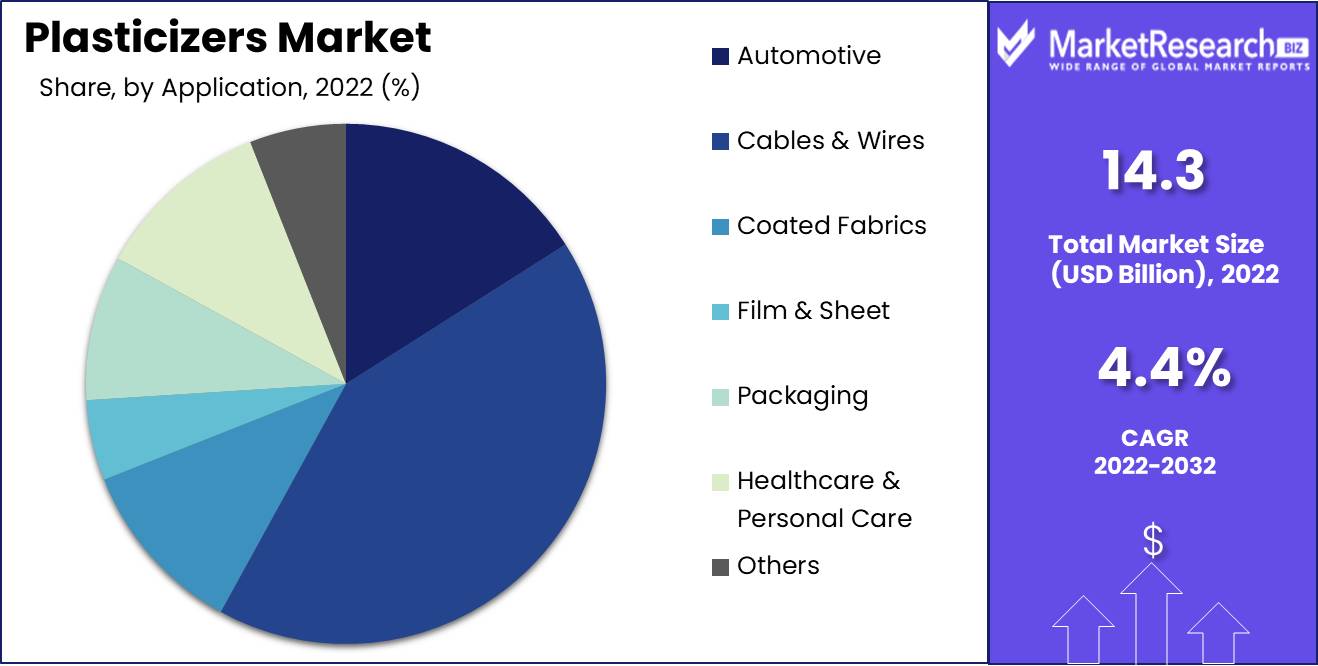

The wires and cables segment is the greatest application segment on the market for plasticizers. Plasticizers are added to wires and cables in order to increase their flexibility, durability, and resistance to heat and impact. Plasticizers are added to wires and cables to increase their flame-retardant properties, making them suitable for use in a variety of applications.

The wires and cables segment of the plasticizers market is primarily propelled by economic growth in developing nations. Increased production of wires and cables has resulted from the increasing demand for electricity in countries such as India and China. Major infrastructure projects also necessitate a substantial quantity of wires and cables, resulting in a rise in demand for plasticizers.

The demand for plasticizers in wires and cables has increased as a result of consumers' desire for higher quality and safer products. The automotive industry utilizes wires and cables that are durable and resistant to high temperatures. In the medical industry, wires and cables must possess characteristics like flexibility and biocompatibility. These developments have increased the demand for plasticizers.

Key Market Segments

By Type

- Phthalates Plasticizers

- DOP

- DINP/DIDP/DPHP

- Others

- Non-Phthalates Plasticizers

- DOTP

- Adipates

- Trimellitates

- Epoxies

- Benzoates

By Application

- Automotive

- Cables & Wires

- Flooring, Roofing & Cladding

- Coated Fabrics

- Film & Sheet

- Packaging

- Healthcare & Personal Care

- Other End-Uses

Growth Opportunity

A rising prevalence of the application of plasticizers in the medical sector

Products made of flexible PVC are gaining popularity in a wide range of different industries. From the upholstery of automobiles to the insulation of electrical cables, there has been a consistent rise over the years in the demand for materials that are both flexible and long-lasting. It is anticipated that this pattern will continue as more businesses become aware of the advantages offered by flexible PVC goods. Plasticizers are an essential component of these materials since they lend the materials a greater degree of flexibility while also enhancing their resistance to wear and tear.

Demand on the rise for plasticizers that do not include phthalates

The increasing popularity of plasticizers that do not include phthalates is one trend that is helping to drive demand for plasticizers. Phthalates have been associated with a wide range of health problems, and consumers are gaining a greater awareness of the potential hazards that are associated with the use of products containing these chemicals. Plasticizers that do not include phthalates present a safer alternative, which is why an increasing number of businesses are looking into making the move.

Increasing use of plasticizers derived from biological sources

Additionally gaining in popularity are plasticizers that are derived from biological sources. When compared to conventional plasticizers, these are a more environmentally responsible choice due to the fact that they are manufactured using renewable resources such as vegetable oils and starches. It is anticipated that there will be a greater need for plasticizers made from bio-based materials as the issue of sustainability becomes a more urgent concern.

Latest Trends

The growth of the plasticizer industry is being driven by various market trends.

In recent years, the worldwide plasticizers market has been expanding at a consistent rate, driven by a variety of market trends that influence both demand- and supply-side variables. This growth has been fueled by an increase in the production of plastics. These include an increase in investments made in the research and development of eco-friendly and bio-based plasticizers; government regulations supporting the use of sustainable alternatives; fluctuations in the price of crude oil; changing consumer preferences; a growing awareness of the benefits of plasticizers; and new applications such as 3D printing and medical devices.

Variations in the Price of Crude Oil Have an Influence on the Price of Plasticizers Derived from Petroleum

The demand for plasticizers derived from petroleum is a significant factor in the growth of the petrochemical market. The cost of manufacturing these plasticizers, however, can be affected by shifts in the price of crude oil. The cost of creating petroleum-based plasticizers goes up when crude oil prices are high, which is one of the factors that contributes to the increase in price of these goods. This has an effect on the demand for these plasticizers, which may result in adjustments in the market towards alternatives that are based on biomaterials.

Alterations in the Preferences of Consumers Towards Products Made of Flexible and Lightweight Plastic

The preferences of consumers have evolved towards products made of plastic that are flexible and lightweight; nevertheless, in order to improve their qualities, these plastics require the addition of plasticizers. Consumers are searching for items that are simple to handle and move, while yet keeping a high level of durability and adaptability. As a consequence of this, market participants are increasing their spending on research and development in order to develop plasticizers that are in line with the evolving trends in consumer demand, which ultimately results in increased sales of these products.

Regional Analysis

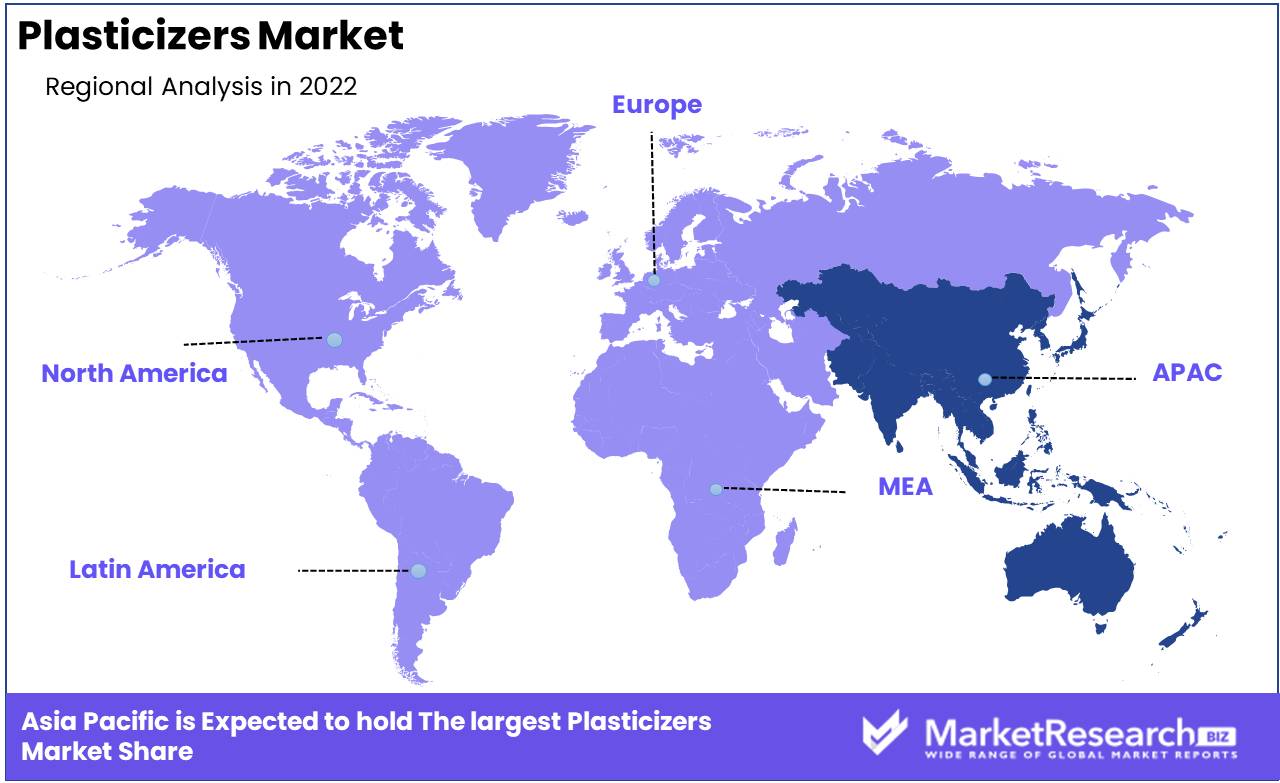

The Asia-Pacific region dominated the plasticizers market, with the highest market share. With rising demand for flexible PVC products and the expansion of the construction industry, the plasticizers market in the region is anticipated to expand in the coming years.

We will investigate the factors propelling the growth of the plasticizers market in the Asia-Pacific region, as well as the industry's future outlook. From 2020 to 2025, the Asia-Pacific plasticizers market is anticipated to expand at a CAGR of 4.1%. This expansion is driven by the rising demand for plasticizers resulting from the expansion of the construction industry and the demand for flexible PVC products, such as wires and cables, flooring, and wall coverings. During the forecast period, the Asia-Pacific region is anticipated to dominate the plasticizers market. This is because countries such as China, India, and Japan have a growing demand for PVC products.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the coming years, the demand for flexible PVC products in a variety of end-use industries is anticipated to propel the plasticizers market to significant expansion. Eastman Chemical Company, BASF SE, Exxon Mobil Corporation, LANXESS AG, and Evonik Industries AG are among the prominent companies operating in the global plasticizers market.

Eastman Chemical Company is a prominent player in the plasticizers market, offering a vast array of products such as Benzoflex, Admex, and VersaMax. These goods are predominantly employed in the production of PVC goods, such as flooring, wall coverings, and medical tubing.

BASF SE is another significant player in the global plasticizers market, with a focus on providing the industry with sustainable solutions. Its product line includes the non-phthalate plasticizer Hexamoll DINCH, which is appropriate for use in food-contact applications.

Overall, the plasticizers market is highly competitive, with a variety of companies offering a diverse portfolio of products to meet the requirements of consumers in a variety of industries. For success in this market, the ability to develop sustainable solutions and provide exceptional customer service will be crucial.

Top Key Players in the Plasticizers Market

- Arkema S.A.

- BASF SE

- Daelim Industrial Co. Ltd.

- Dow Chemical Company

- LG Chem Ltd.

- Evonik Industries AG

- ExxonMobil Chemical

- Eastman Chemical Company

- Ineos Group

- UPC Group

- Other Key Players

Recent Development

- In 2021, BASF SE introduced Hexamoll DINCH BIO, a new bio-based plasticizer. The plasticizer is derived from renewable resources, which reduces the carbon footprint of plastic production. BASF SE positions itself as an organisation committed to eco-friendly and sustainable solutions.

- ExxonMobil announced the 2021 introduction of its premium plasticizer, Jayflex L11P. The product is designed for the medical and food packaging industries, ensuring the flexibility and durability of FDA-compliant plastic products.

- In 2020, Eastman Chemical Company acquired INACSA, a Spanish plasticizers company, thereby strengthening its market position. The addition of new products and technologies to the company's product portfolio was the result of the acquisition.

- In 2020, Arkema intends to construct a new production facility in France to increase its plasticizer production capacity in Europe. The project seeks to meet the region's growing demand for high-performance plasticizers.

- In 2019, Evonik Industries AG introduced ELATUR CH, a high-performance plasticizer. The product offers exceptional cold-temperature flexibility for PVC and thermoplastic materials and is ideal for cable coating, automotive interiors, and flooring applications.

Report Scope

Report Features Description Market Value (2022) USD 14.3 Bn Forecast Revenue (2032) USD 21.8 Bn CAGR (2023-2032) 4.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type: Phthalates, Non-Phthalates, By Application: Automotive, Cables & Wires, Flooring, Roofing & Cladding, Coated Fabrics, Film & Sheet, Packaging, Healthcare & Personal Care, Others End-Uses Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Arkema S.A., BASF SE, Daelim Industrial Co. Ltd., Dow Chemical Company, LG Chem Ltd., Evonik Industries AG, ExxonMobil Chemical, Eastman Chemical Company, Ineos Group, UPC Group, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) - Phthalates Plasticizers

-

-

- Arkema S.A.

- BASF SE

- Daelim Industrial Co. Ltd.

- Dow Chemical Company

- LG Chem Ltd.

- Evonik Industries AG

- ExxonMobil Chemical

- Eastman Chemical Company

- Ineos Group

- UPC Group

- Other Key Players