Rig and Oilfield Mats Market By Type (Wood Mats, Composite Mats, Steel Mats), By Applications (Oil and Gas, Electrical T&D Construction & Maintenance, Wind, Infrastructure Construction, Military, Helipad, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

46332

-

May 2024

-

300

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

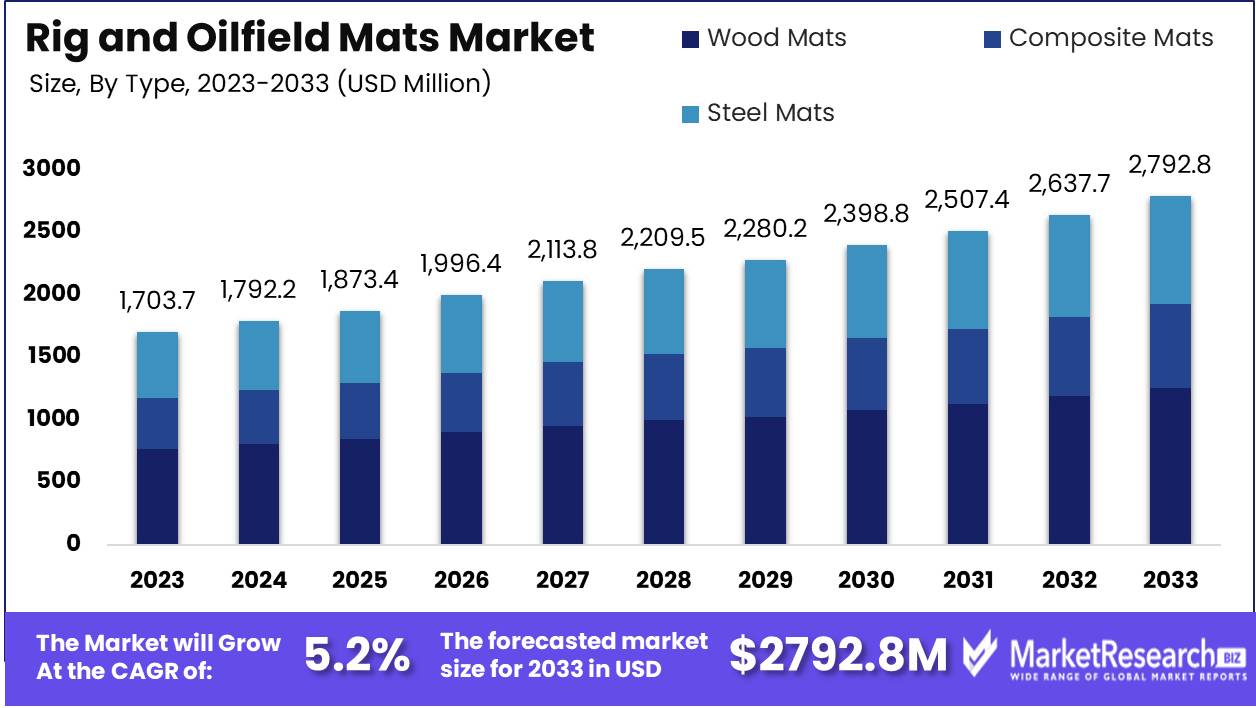

The Rig and Oilfield Mats Market size is estimated at USD 1703.7 Million in 2023 and is expected to reach USD 2792.8 Million by 2033, growing at a CAGR of 5.2% during the forecast period 2024-2033.

The Rig and Oilfield Mats Market encompasses the production and distribution of specialized ground protection solutions used in the oil and gas industry. These mats are essential for creating stable work platforms, ensuring safety, and minimizing environmental impact during drilling operations. They support heavy machinery and prevent soil contamination, enabling efficient site access in challenging terrains.

The rig and oilfield mats market is poised for substantial growth, driven by the increasing demand for stable and safe platforms in oil and gas drilling operations. Rig mats, essential for supporting heavy equipment and machinery, play a critical role in enhancing operational efficiency and safety in the sector. The primary materials used in manufacturing these mats, such as hardwood timbers reinforced with a steel frame, are designed to withstand the substantial loads and harsh conditions typical of oilfields. Notably, innovations such as cross-laminated timber (CLT) are gaining traction, offering a lighter-weight alternative without compromising strength. This advancement not only enhances ease of transport and installation but also contributes to the overall sustainability of drilling operations.

Market trends indicate a rising preference for durable and resilient rig mats that can meet the rigorous demands of oilfield environments. The integration of advanced materials and construction techniques is expected to drive product differentiation and competitiveness among manufacturers.

Furthermore, as the oil and gas industry continues to prioritize safety and efficiency, the adoption of high-quality rig mats is likely to increase. Companies that invest in innovative, robust mat solutions will be well-positioned to capitalize on this growing demand. As such, stakeholders in the rig and oilfield mats market should focus on strategic partnerships and investments in R&D to enhance their product offerings and market presence. This proactive approach will be crucial in capturing market share and achieving long-term growth in an increasingly competitive landscape.

Key Takeaways

- Market Growth: The Rig and Oilfield Mats Market size is estimated at USD 1703.7 Million in 2023 and is expected to reach USD 2792.8 Million by 2033, growing at a CAGR of 5.2% during the forecast period 2024-2033.

- By Type: In 2023, Steel Mats dominated due to superior durability and load capacity.

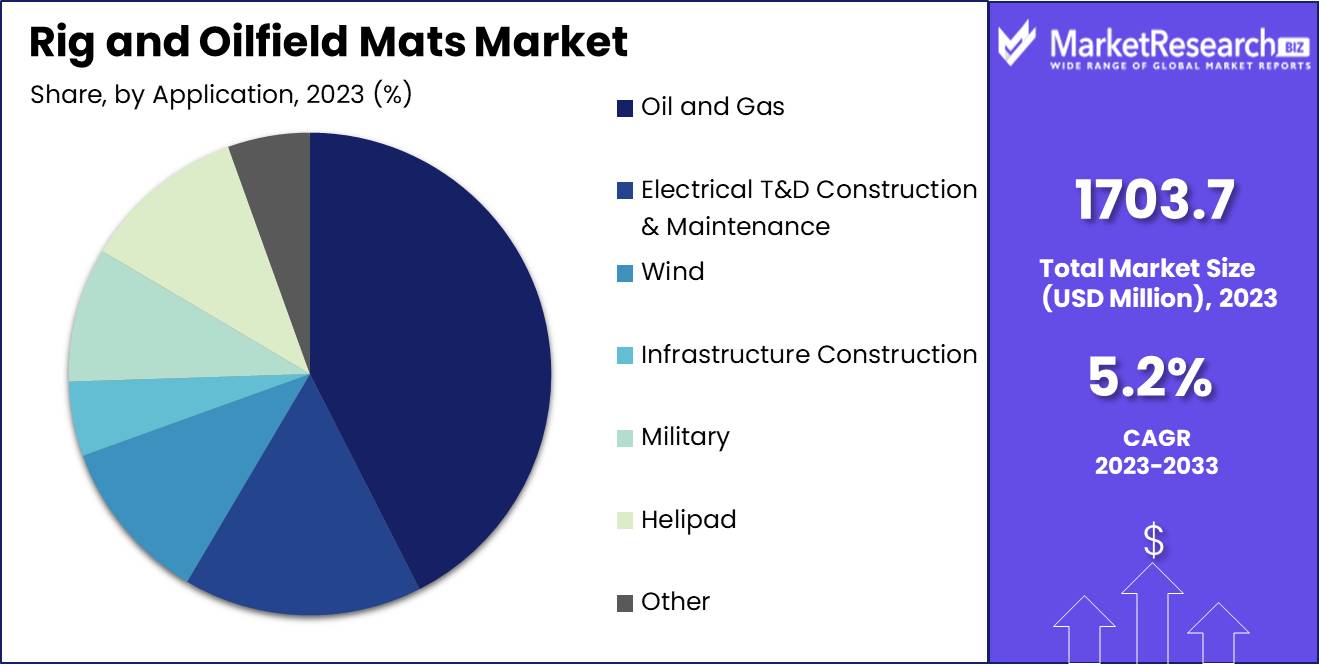

- By Application: In 2023, Oil and Gas dominated the versatile Rig and Oilfield Mats Market.

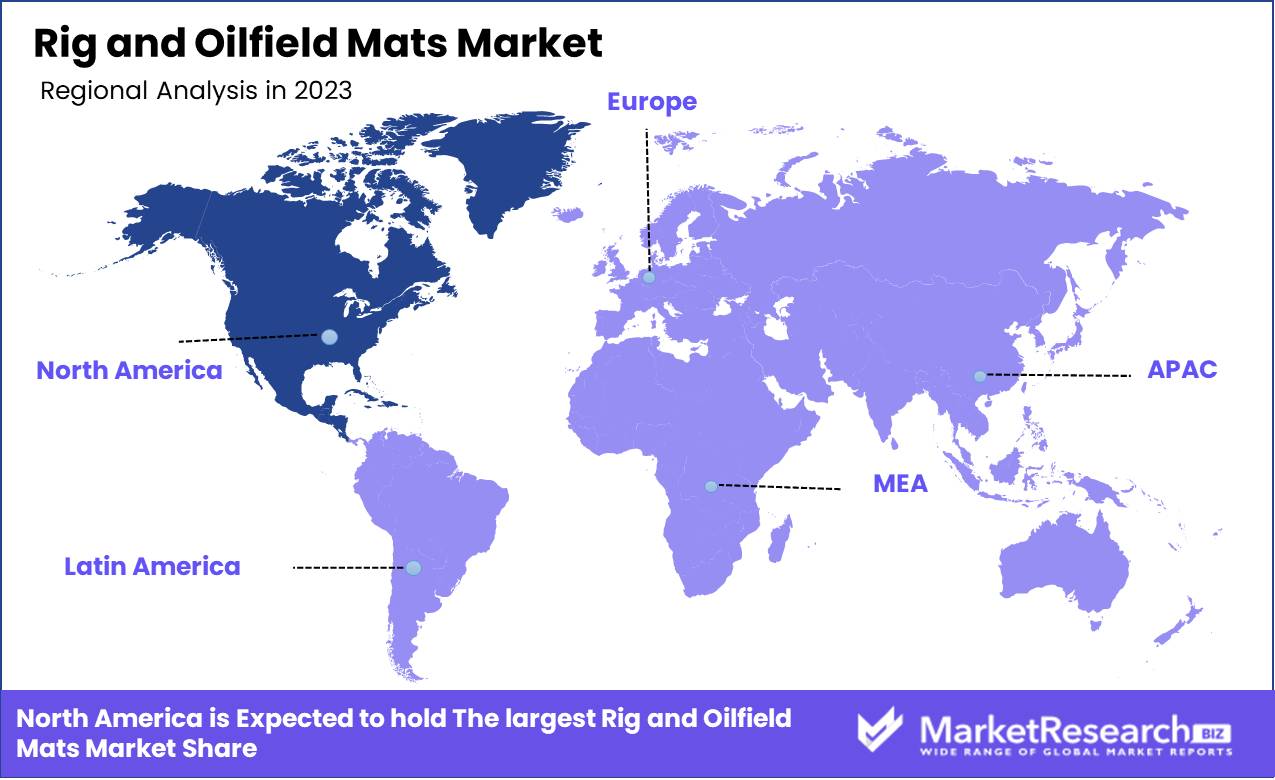

- Regional Dominance: North America leads with 40% market share; growth varies regionally.

- Growth Opportunity: Emphasizing safety and customization, the rig and oilfield mats market is set for significant growth.

Driving factors

Safety Regulations and Compliance

The increasing stringency of safety regulations and compliance standards is a pivotal factor driving the growth of the rig and oilfield mats market. Regulatory bodies worldwide, such as the Occupational Safety and Health Administration (OSHA) in the United States and similar agencies in other regions, mandate rigorous safety protocols for the oil and gas industry. These regulations necessitate the use of high-quality, reliable mats that can provide stable and secure platforms for heavy equipment and personnel. The focus on minimizing workplace accidents and environmental impacts compels companies to invest in mats that meet or exceed these safety standards.

Adherence to such regulations not only ensures operational continuity but also helps avoid substantial fines and legal repercussions. This regulatory pressure has led to an increased demand for rig and oilfield mats that are designed to comply with safety standards, thereby propelling market growth. For instance, mats that are resistant to chemical spills, non-slip, and capable of bearing heavy loads are increasingly sought after, as they contribute to safer work environments.

Material Durability and Suitability

Material durability and suitability are critical factors influencing the growth of the rig and oilfield mats market. The harsh environments of oilfields demand mats that are robust, long-lasting, and capable of withstanding extreme conditions such as heavy machinery loads, chemical exposure, and variable weather. The advancement in material technologies, including high-density polyethylene (HDPE) and composite materials, has significantly improved the lifespan and performance of these mats.

Durable mats reduce the frequency of replacements and repairs, offering a cost-effective solution for oilfield operations. This not only decreases operational downtime but also enhances overall productivity. For example, mats made from composite materials exhibit superior strength-to-weight ratios and resilience against environmental stressors, making them ideal for repeated use and long-term applications. The durability and suitability of raw materials thus directly contribute to market growth by ensuring reliable and efficient support for oilfield activities.

Customization and Industry-Specific Solutions

Customization and industry-specific solutions are key drivers of the rig and oilfield mats market. The diverse needs of various oilfield operations necessitate tailored solutions that can address specific challenges and requirements. Manufacturers are increasingly offering customizable mats that can be designed to fit unique site conditions, load requirements, and environmental factors.

Industry-specific solutions include mats that cater to different segments of the oil and gas industry, such as drilling, production, and transportation. These solutions ensure optimal performance and safety, which in turn enhances operational efficiency. For instance, custom-engineered mats can be designed with specific thicknesses, interlocking systems, and surface textures to provide enhanced stability and ease of installation in varying terrains.

Restraining Factors

High Financial Investment: A Significant Barrier to Market Expansion

The rig and oilfield mats market faces considerable growth challenges due to the high financial investment required for infrastructure development and maintenance. This factor acts as a significant barrier, particularly for small and mid-sized enterprises (SMEs) that lack the capital reserves to invest in high-quality, durable mats essential for safe and efficient operations.

Financial constraints can limit the adoption of advanced rigs and oilfield mats, which are crucial for mitigating environmental impacts and enhancing operational efficiency. For instance, high costs associated with the procurement, installation, and maintenance of these mats can deter companies from upgrading their existing systems, leading to a reliance on older, less effective technologies. This not only hampers operational efficiency but also increases the risk of environmental incidents, which can further escalate costs through fines and remediation efforts.

Technological Advancements: Double-Edged Sword for Market Dynamics

While technological advancements in the rig and oilfield mats market offer the potential for improved efficiency and environmental safety, they also present significant challenges that can restrain market growth. The development and implementation of cutting-edge technologies often require substantial upfront investment and ongoing maintenance costs, which can be prohibitive for many market participants.

The rapid pace of technological innovation can also lead to the obsolescence of existing equipment, compelling companies to continually invest in new technologies to remain competitive. This cycle of constant upgrading not only increases operational costs but also creates financial uncertainty. For example, the introduction of advanced materials and manufacturing processes can drive up the cost of production for rig and oilfield mats, which may not be immediately offset by the operational savings these new technologies promise.

By Type Analysis

In 2023, Steel Mats dominated due to superior durability and load capacity.

In 2023, Steel Mats held a dominant market position in the By Type segment of the Rig and Oilfield Mats Market. This leadership is attributed to their superior durability and load-bearing capacity, which are critical in the demanding environments of oilfield operations. Steel mats offer unparalleled strength, making them the preferred choice for heavy-duty applications and ensuring stable ground support for heavy machinery and equipment. Their long lifespan and resistance to extreme weather conditions further enhance their appeal, reducing the frequency and cost of replacements.

Wood Mats, while traditionally favored for their lower initial cost and ease of handling, are increasingly viewed as less sustainable due to their susceptibility to wear and environmental degradation. Despite this, they maintain a niche market where budget constraints and temporary use are primary considerations.

Composite Mats are gaining traction due to their blend of durability and lighter weight compared to steel. They offer a balanced solution with improved handling, ease of installation, and a reduced environmental footprint. However, their market share is still growing as industries gradually adopt these newer technologies. Steel mats' established reliability continues to secure their dominant position within this segment.

By Applications Analysis

In 2023, Oil and Gas dominated the versatile Rig and Oilfield Mats Market.

In 2023, the Oil and Gas segment held a dominant market position in the Rig and Oilfield Mats Market, driven by substantial investments in exploration and production activities. The increased focus on efficient drilling operations and minimizing environmental impact has amplified the demand for high-performance mats that ensure stability and safety in challenging terrains. Following closely, the Electrical T&D Construction & Maintenance segment has seen robust growth due to the expansion of power grids and the maintenance of aging infrastructure.

The Wind segment is experiencing rapid advancement as the renewable energy sector seeks to enhance installation efficiency and reduce ecological footprints. Infrastructure Construction is benefiting from extensive urbanization and infrastructure development projects, necessitating reliable access solutions. The Military segment utilizes these mats for temporary roadways and operational bases, emphasizing durability and quick deployment. Helipad applications are expanding in remote and offshore locations, driven by the need for safe and stable landing zones. Lastly, the Others category encompasses diverse uses in events, mining, and disaster relief operations, underscoring the versatile utility of rig and oilfield mats across various sectors.

Key Market Segments

By Type

- Wood Mats

- Composite Mats

- Steel Mats

By Applications

- Oil and Gas

- Electrical T&D Construction & Maintenance

- Wind

- Infrastructure Construction

- Military

- Helipad

- Others

Growth Opportunity

Expanding Market Driven by Increased Safety Measures

In 2024, the global rig and oilfield mats market is poised for significant growth, driven by the heightened emphasis on safety within the oil and gas industry. With stricter regulations and a growing commitment to environmental and worker safety, demand for high-quality mats that provide stability and minimize accidents on rig sites is increasing. These mats are essential in reducing slip hazards and ensuring a secure foundation for heavy machinery, which directly correlates with the industry's focus on maintaining high safety standards. Companies investing in innovative safety solutions are likely to capture larger market shares, as safety-conscious operators prioritize products that enhance operational integrity.

Growth Through Product Customization and Technological Advancements

The rising demand for customized oilfield mats tailored to specific operational needs. As exploration and production activities expand into more challenging environments, the need for mats that can withstand extreme conditions and heavy loads becomes critical. Manufacturers that offer bespoke solutions, integrating advanced materials and engineering, are well-positioned to meet these evolving requirements. Customization not only improves the functional performance of mats but also enhances their durability and lifespan, offering a better return on investment for operators.

Latest Trends

Increasing Demand for Anti-Fatigue Mats: Enhancing Worker Safety and Productivity

The Rig and Oilfield Mats Market is witnessing a notable surge in the demand for anti-fatigue mats. This trend is primarily driven by the heightened focus on worker safety and productivity within the oil and gas industry. As operational environments often involve long hours of standing and strenuous activities, the implementation of anti-fatigue mats is becoming essential. These mats are designed to reduce physical strain and improve comfort, which in turn can lead to fewer workplace injuries and increased efficiency. Companies are recognizing the dual benefits of safeguarding their workforce while also enhancing operational output, thereby making anti-fatigue mats a crucial investment in their safety protocols.

Integration of Smart Technologies: Revolutionizing Rig and Oilfield Operations

The integration of smart technologies into rig and oilfield mats represents a transformative trend for 2024. Advanced materials equipped with sensors and IoT connectivity are being developed to monitor and optimize the performance and safety of these mats in real time. Smart mats can detect changes in pressure, temperature, and wear, providing critical data that can be used to predict maintenance needs and prevent failures before they occur. This not only extends the lifespan of the mats but also ensures a higher level of operational safety and efficiency. By leveraging such innovations, companies can reduce downtime, lower maintenance costs, and improve overall site management. The adoption of smart technologies is set to drive substantial improvements in operational reliability and cost-effectiveness within the industry.

Regional Analysis

North America leads with 40% market share; growth varies regionally.

The global rig and oilfield mats market exhibits significant regional variances driven by differing levels of oil and gas exploration activities, regulatory landscapes, and infrastructural needs. North America dominates the market, accounting for approximately 40% of the global share. This dominance is propelled by substantial shale gas extraction activities and a robust oil and gas infrastructure, particularly in the United States and Canada. The region's advanced technology adoption and favorable regulatory frameworks further bolster market growth. In Europe, the market is driven by the North Sea oilfields and stringent environmental regulations that necessitate high-quality mats to minimize ecological impact.

Asia Pacific is experiencing rapid growth, driven by increasing energy demands in countries like China and India, which are investing heavily in oil and gas exploration. The Middle East & Africa, with its abundant oil reserves, represents a significant market, though political instability and fluctuating oil prices pose challenges. Latin America, particularly Brazil and Venezuela, holds potential due to offshore drilling activities, although economic instability can hamper market expansion. Each region's market dynamics are influenced by a unique blend of regulatory, economic, and technological factors, contributing to the overall growth trajectory of the rig and oilfield mats market.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

Newpark Resources Inc. stands out due to its comprehensive portfolio and innovative solutions in matting products. Their commitment to sustainability and environmental stewardship positions them favorably in a market increasingly focused on green solutions. YAK MAT, renowned for its extensive distribution network and diverse product offerings, maintains a competitive edge through strategic partnerships and a robust logistics framework. This allows them to meet the dynamic demands of the oil and gas sector efficiently.

Diamond T Services differentiates itself through customized solutions and a strong focus on customer-centricity. Their ability to adapt to client-specific requirements and provide tailored services is a significant competitive advantage. Horizon North Logistics Inc. and Signature Systems Group, LLC are also notable for their strategic expansions and product innovations. Horizon North's diversified service offerings and Signature Systems' focus on modularity and ease of deployment highlight the trend toward more versatile and scalable matting solutions.

Companies like Strad Energy Services Ltd and Checkers Safety Group emphasize safety and reliability, critical factors in maintaining operational integrity in hazardous environments. Their investments in R&D to enhance product durability and safety standards underline their commitment to quality. Smaller players such as Spartan Mat, Rig Mats of America Inc., and Quality Mat Company are gaining traction through niche market targeting and superior customer service. Meanwhile, Canada Rig Mats Ltd., Alberta Rig Mats, and Access Terrain Services leverage regional expertise to cater to specific geographical needs, contributing to the market's diverse and competitive landscape.

Market Key Players

- Newpark Resources Inc.

- YAK MAT

- Diamond T Services

- Horizon North Logistics Inc.

- Signature Systems Group, LLC

- Strad Energy Services Ltd

- Checkers Safety Group

- Spartan Mat

- Rig Mats of America Inc.

- Quality Mat Company

- Canada Rig Mats Ltd.

- Alberta Rig Mats

- Access Terrain Services

Recent Development

- In April 2024, Horizon North Logistics reported a significant contract with a major oil producer to supply rig mats for a large-scale project in the Canadian oil sands. These developments indicate a growing emphasis on innovation and sustainability within the rig and oilfield mats market.

- In March 2024, Newpark Resources announced the launch of its advanced composite matting system designed to enhance durability and reduce environmental impact in oilfield operations.

- In February 2024, Matrax, Inc. entered a strategic partnership with Dupont Sustainable Solutions to co-develop next-generation rig mats with enhanced safety features. This partnership aims to leverage Dupont's expertise in material science to innovate new solutions for the oilfield services sector.

Report Scope

Report Features Description Market Value (2023) USD 1703.7 Million Forecast Revenue (2033) USD 2792.8 Million CAGR (2024-2032) 5.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Wood Mats, Composite Mats, Steel Mats), By Applications (Oil and Gas, Electrical T&D Construction & Maintenance, Wind, Infrastructure Construction, Military, Helipad, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Newpark Resources Inc., YAK MAT, Diamond T Services, Horizon North Logistics Inc., Signature Systems Group, LLC, Strad Energy Services Ltd, Checkers Safety Group, Spartan Mat, Rig Mats of America Inc., Quality Mat Company, Canada Rig Mats Ltd., Alberta Rig Mats, Access Terrain Services Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Rig and Oilfield Mats Market Overview

- 2.1. Rig and Oilfield Mats Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Rig and Oilfield Mats Market Dynamics

- 3. Global Rig and Oilfield Mats Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Rig and Oilfield Mats Market Analysis, 2016-2021

- 3.2. Global Rig and Oilfield Mats Market Opportunity and Forecast, 2023-2032

- 3.3. Global Rig and Oilfield Mats Market Analysis, Opportunity and Forecast, By Type, 2016-2032

- 3.3.1. Global Rig and Oilfield Mats Market Analysis by Type: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type, 2016-2032

- 3.3.3. Wood Mats

- 3.3.4. Composite Mats

- 3.3.5. Steel Mats

- 3.4. Global Rig and Oilfield Mats Market Analysis, Opportunity and Forecast, By Applications, 2016-2032

- 3.4.1. Global Rig and Oilfield Mats Market Analysis by Applications: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Applications, 2016-2032

- 3.4.3. Oil and Gas

- 3.4.4. Electrical T&D Construction & Maintenance

- 3.4.5. Wind

- 3.4.6. Infrastructure Construction

- 3.4.7. Military

- 3.4.8. Helipad

- 3.4.9. Others

- 4. North America Rig and Oilfield Mats Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Rig and Oilfield Mats Market Analysis, 2016-2021

- 4.2. North America Rig and Oilfield Mats Market Opportunity and Forecast, 2023-2032

- 4.3. North America Rig and Oilfield Mats Market Analysis, Opportunity and Forecast, By Type, 2016-2032

- 4.3.1. North America Rig and Oilfield Mats Market Analysis by Type: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type, 2016-2032

- 4.3.3. Wood Mats

- 4.3.4. Composite Mats

- 4.3.5. Steel Mats

- 4.4. North America Rig and Oilfield Mats Market Analysis, Opportunity and Forecast, By Applications, 2016-2032

- 4.4.1. North America Rig and Oilfield Mats Market Analysis by Applications: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Applications, 2016-2032

- 4.4.3. Oil and Gas

- 4.4.4. Electrical T&D Construction & Maintenance

- 4.4.5. Wind

- 4.4.6. Infrastructure Construction

- 4.4.7. Military

- 4.4.8. Helipad

- 4.4.9. Others

- 4.5. North America Rig and Oilfield Mats Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.5.1. North America Rig and Oilfield Mats Market Analysis by Country : Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.5.2.1. The US

- 4.5.2.2. Canada

- 4.5.2.3. Mexico

- 5. Western Europe Rig and Oilfield Mats Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Rig and Oilfield Mats Market Analysis, 2016-2021

- 5.2. Western Europe Rig and Oilfield Mats Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Rig and Oilfield Mats Market Analysis, Opportunity and Forecast, By Type, 2016-2032

- 5.3.1. Western Europe Rig and Oilfield Mats Market Analysis by Type: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type, 2016-2032

- 5.3.3. Wood Mats

- 5.3.4. Composite Mats

- 5.3.5. Steel Mats

- 5.4. Western Europe Rig and Oilfield Mats Market Analysis, Opportunity and Forecast, By Applications, 2016-2032

- 5.4.1. Western Europe Rig and Oilfield Mats Market Analysis by Applications: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Applications, 2016-2032

- 5.4.3. Oil and Gas

- 5.4.4. Electrical T&D Construction & Maintenance

- 5.4.5. Wind

- 5.4.6. Infrastructure Construction

- 5.4.7. Military

- 5.4.8. Helipad

- 5.4.9. Others

- 5.5. Western Europe Rig and Oilfield Mats Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.5.1. Western Europe Rig and Oilfield Mats Market Analysis by Country : Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.5.2.1. Germany

- 5.5.2.2. France

- 5.5.2.3. The UK

- 5.5.2.4. Spain

- 5.5.2.5. Italy

- 5.5.2.6. Portugal

- 5.5.2.7. Ireland

- 5.5.2.8. Austria

- 5.5.2.9. Switzerland

- 5.5.2.10. Benelux

- 5.5.2.11. Nordic

- 5.5.2.12. Rest of Western Europe

- 6. Eastern Europe Rig and Oilfield Mats Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Rig and Oilfield Mats Market Analysis, 2016-2021

- 6.2. Eastern Europe Rig and Oilfield Mats Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Rig and Oilfield Mats Market Analysis, Opportunity and Forecast, By Type, 2016-2032

- 6.3.1. Eastern Europe Rig and Oilfield Mats Market Analysis by Type: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type, 2016-2032

- 6.3.3. Wood Mats

- 6.3.4. Composite Mats

- 6.3.5. Steel Mats

- 6.4. Eastern Europe Rig and Oilfield Mats Market Analysis, Opportunity and Forecast, By Applications, 2016-2032

- 6.4.1. Eastern Europe Rig and Oilfield Mats Market Analysis by Applications: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Applications, 2016-2032

- 6.4.3. Oil and Gas

- 6.4.4. Electrical T&D Construction & Maintenance

- 6.4.5. Wind

- 6.4.6. Infrastructure Construction

- 6.4.7. Military

- 6.4.8. Helipad

- 6.4.9. Others

- 6.5. Eastern Europe Rig and Oilfield Mats Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.5.1. Eastern Europe Rig and Oilfield Mats Market Analysis by Country : Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.5.2.1. Russia

- 6.5.2.2. Poland

- 6.5.2.3. The Czech Republic

- 6.5.2.4. Greece

- 6.5.2.5. Rest of Eastern Europe

- 7. APAC Rig and Oilfield Mats Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Rig and Oilfield Mats Market Analysis, 2016-2021

- 7.2. APAC Rig and Oilfield Mats Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Rig and Oilfield Mats Market Analysis, Opportunity and Forecast, By Type, 2016-2032

- 7.3.1. APAC Rig and Oilfield Mats Market Analysis by Type: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type, 2016-2032

- 7.3.3. Wood Mats

- 7.3.4. Composite Mats

- 7.3.5. Steel Mats

- 7.4. APAC Rig and Oilfield Mats Market Analysis, Opportunity and Forecast, By Applications, 2016-2032

- 7.4.1. APAC Rig and Oilfield Mats Market Analysis by Applications: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Applications, 2016-2032

- 7.4.3. Oil and Gas

- 7.4.4. Electrical T&D Construction & Maintenance

- 7.4.5. Wind

- 7.4.6. Infrastructure Construction

- 7.4.7. Military

- 7.4.8. Helipad

- 7.4.9. Others

- 7.5. APAC Rig and Oilfield Mats Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.5.1. APAC Rig and Oilfield Mats Market Analysis by Country : Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.5.2.1. China

- 7.5.2.2. Japan

- 7.5.2.3. South Korea

- 7.5.2.4. India

- 7.5.2.5. Australia & New Zeland

- 7.5.2.6. Indonesia

- 7.5.2.7. Malaysia

- 7.5.2.8. Philippines

- 7.5.2.9. Singapore

- 7.5.2.10. Thailand

- 7.5.2.11. Vietnam

- 7.5.2.12. Rest of APAC

- 8. Latin America Rig and Oilfield Mats Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Rig and Oilfield Mats Market Analysis, 2016-2021

- 8.2. Latin America Rig and Oilfield Mats Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Rig and Oilfield Mats Market Analysis, Opportunity and Forecast, By Type, 2016-2032

- 8.3.1. Latin America Rig and Oilfield Mats Market Analysis by Type: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type, 2016-2032

- 8.3.3. Wood Mats

- 8.3.4. Composite Mats

- 8.3.5. Steel Mats

- 8.4. Latin America Rig and Oilfield Mats Market Analysis, Opportunity and Forecast, By Applications, 2016-2032

- 8.4.1. Latin America Rig and Oilfield Mats Market Analysis by Applications: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Applications, 2016-2032

- 8.4.3. Oil and Gas

- 8.4.4. Electrical T&D Construction & Maintenance

- 8.4.5. Wind

- 8.4.6. Infrastructure Construction

- 8.4.7. Military

- 8.4.8. Helipad

- 8.4.9. Others

- 8.5. Latin America Rig and Oilfield Mats Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.5.1. Latin America Rig and Oilfield Mats Market Analysis by Country : Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.5.2.1. Brazil

- 8.5.2.2. Colombia

- 8.5.2.3. Chile

- 8.5.2.4. Argentina

- 8.5.2.5. Costa Rica

- 8.5.2.6. Rest of Latin America

- 9. Middle East & Africa Rig and Oilfield Mats Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Rig and Oilfield Mats Market Analysis, 2016-2021

- 9.2. Middle East & Africa Rig and Oilfield Mats Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Rig and Oilfield Mats Market Analysis, Opportunity and Forecast, By Type, 2016-2032

- 9.3.1. Middle East & Africa Rig and Oilfield Mats Market Analysis by Type: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type, 2016-2032

- 9.3.3. Wood Mats

- 9.3.4. Composite Mats

- 9.3.5. Steel Mats

- 9.4. Middle East & Africa Rig and Oilfield Mats Market Analysis, Opportunity and Forecast, By Applications, 2016-2032

- 9.4.1. Middle East & Africa Rig and Oilfield Mats Market Analysis by Applications: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Applications, 2016-2032

- 9.4.3. Oil and Gas

- 9.4.4. Electrical T&D Construction & Maintenance

- 9.4.5. Wind

- 9.4.6. Infrastructure Construction

- 9.4.7. Military

- 9.4.8. Helipad

- 9.4.9. Others

- 9.5. Middle East & Africa Rig and Oilfield Mats Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.5.1. Middle East & Africa Rig and Oilfield Mats Market Analysis by Country : Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.5.2.1. Algeria

- 9.5.2.2. Egypt

- 9.5.2.3. Israel

- 9.5.2.4. Kuwait

- 9.5.2.5. Nigeria

- 9.5.2.6. Saudi Arabia

- 9.5.2.7. South Africa

- 9.5.2.8. Turkey

- 9.5.2.9. The UAE

- 9.5.2.10. Rest of MEA

- 10. Global Rig and Oilfield Mats Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Rig and Oilfield Mats Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Rig and Oilfield Mats Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Newpark Resources Inc.

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. YAK MAT

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Diamond T Services

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Horizon North Logistics Inc.

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Signature Systems Group, LLC

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Strad Energy Services Ltd

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Checkers Safety Group

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Spartan Mat

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Rig Mats of America Inc.

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Quality Mat Company

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. Canada Rig Mats Ltd.

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 11.15. Access Terrain Services

- 11.15.1. Company Overview

- 11.15.2. Financial Highlights

- 11.15.3. Product Portfolio

- 11.15.4. SWOT Analysis

- 11.15.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

"

- List of Figures

- "

- Figure 1: Global Rig and Oilfield Mats Market Revenue (US$ Mn) Market Share by Type in 2022

- Figure 2: Global Rig and Oilfield Mats Market Market Attractiveness Analysis by Type, 2016-2032

- Figure 3: Global Rig and Oilfield Mats Market Revenue (US$ Mn) Market Share by Applicationsin 2022

- Figure 4: Global Rig and Oilfield Mats Market Market Attractiveness Analysis by Applications, 2016-2032

- Figure 5: Global Rig and Oilfield Mats Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 6: Global Rig and Oilfield Mats Market Market Attractiveness Analysis by Region, 2016-2032

- Figure 7: Global Rig and Oilfield Mats Market Market Revenue (US$ Mn) (2016-2032)

- Figure 8: Global Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 9: Global Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Figure 10: Global Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Applications (2016-2032)

- Figure 11: Global Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 12: Global Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Figure 13: Global Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Applications (2016-2032)

- Figure 14: Global Rig and Oilfield Mats Market Market Share Comparison by Region (2016-2032)

- Figure 15: Global Rig and Oilfield Mats Market Market Share Comparison by Type (2016-2032)

- Figure 16: Global Rig and Oilfield Mats Market Market Share Comparison by Applications (2016-2032)

- Figure 17: North America Rig and Oilfield Mats Market Revenue (US$ Mn) Market Share by Typein 2022

- Figure 18: North America Rig and Oilfield Mats Market Market Attractiveness Analysis by Type, 2016-2032

- Figure 19: North America Rig and Oilfield Mats Market Revenue (US$ Mn) Market Share by Applicationsin 2022

- Figure 20: North America Rig and Oilfield Mats Market Market Attractiveness Analysis by Applications, 2016-2032

- Figure 21: North America Rig and Oilfield Mats Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 22: North America Rig and Oilfield Mats Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 23: North America Rig and Oilfield Mats Market Market Revenue (US$ Mn) (2016-2032)

- Figure 24: North America Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 25: North America Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Figure 26: North America Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Applications (2016-2032)

- Figure 27: North America Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 28: North America Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Figure 29: North America Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Applications (2016-2032)

- Figure 30: North America Rig and Oilfield Mats Market Market Share Comparison by Country (2016-2032)

- Figure 31: North America Rig and Oilfield Mats Market Market Share Comparison by Type (2016-2032)

- Figure 32: North America Rig and Oilfield Mats Market Market Share Comparison by Applications (2016-2032)

- Figure 33: Western Europe Rig and Oilfield Mats Market Revenue (US$ Mn) Market Share by Typein 2022

- Figure 34: Western Europe Rig and Oilfield Mats Market Market Attractiveness Analysis by Type, 2016-2032

- Figure 35: Western Europe Rig and Oilfield Mats Market Revenue (US$ Mn) Market Share by Applicationsin 2022

- Figure 36: Western Europe Rig and Oilfield Mats Market Market Attractiveness Analysis by Applications, 2016-2032

- Figure 37: Western Europe Rig and Oilfield Mats Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 38: Western Europe Rig and Oilfield Mats Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 39: Western Europe Rig and Oilfield Mats Market Market Revenue (US$ Mn) (2016-2032)

- Figure 40: Western Europe Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 41: Western Europe Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Figure 42: Western Europe Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Applications (2016-2032)

- Figure 43: Western Europe Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 44: Western Europe Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Figure 45: Western Europe Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Applications (2016-2032)

- Figure 46: Western Europe Rig and Oilfield Mats Market Market Share Comparison by Country (2016-2032)

- Figure 47: Western Europe Rig and Oilfield Mats Market Market Share Comparison by Type (2016-2032)

- Figure 48: Western Europe Rig and Oilfield Mats Market Market Share Comparison by Applications (2016-2032)

- Figure 49: Eastern Europe Rig and Oilfield Mats Market Revenue (US$ Mn) Market Share by Typein 2022

- Figure 50: Eastern Europe Rig and Oilfield Mats Market Market Attractiveness Analysis by Type, 2016-2032

- Figure 51: Eastern Europe Rig and Oilfield Mats Market Revenue (US$ Mn) Market Share by Applicationsin 2022

- Figure 52: Eastern Europe Rig and Oilfield Mats Market Market Attractiveness Analysis by Applications, 2016-2032

- Figure 53: Eastern Europe Rig and Oilfield Mats Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 54: Eastern Europe Rig and Oilfield Mats Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 55: Eastern Europe Rig and Oilfield Mats Market Market Revenue (US$ Mn) (2016-2032)

- Figure 56: Eastern Europe Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 57: Eastern Europe Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Figure 58: Eastern Europe Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Applications (2016-2032)

- Figure 59: Eastern Europe Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 60: Eastern Europe Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Figure 61: Eastern Europe Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Applications (2016-2032)

- Figure 62: Eastern Europe Rig and Oilfield Mats Market Market Share Comparison by Country (2016-2032)

- Figure 63: Eastern Europe Rig and Oilfield Mats Market Market Share Comparison by Type (2016-2032)

- Figure 64: Eastern Europe Rig and Oilfield Mats Market Market Share Comparison by Applications (2016-2032)

- Figure 65: APAC Rig and Oilfield Mats Market Revenue (US$ Mn) Market Share by Typein 2022

- Figure 66: APAC Rig and Oilfield Mats Market Market Attractiveness Analysis by Type, 2016-2032

- Figure 67: APAC Rig and Oilfield Mats Market Revenue (US$ Mn) Market Share by Applicationsin 2022

- Figure 68: APAC Rig and Oilfield Mats Market Market Attractiveness Analysis by Applications, 2016-2032

- Figure 69: APAC Rig and Oilfield Mats Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 70: APAC Rig and Oilfield Mats Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 71: APAC Rig and Oilfield Mats Market Market Revenue (US$ Mn) (2016-2032)

- Figure 72: APAC Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 73: APAC Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Figure 74: APAC Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Applications (2016-2032)

- Figure 75: APAC Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 76: APAC Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Figure 77: APAC Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Applications (2016-2032)

- Figure 78: APAC Rig and Oilfield Mats Market Market Share Comparison by Country (2016-2032)

- Figure 79: APAC Rig and Oilfield Mats Market Market Share Comparison by Type (2016-2032)

- Figure 80: APAC Rig and Oilfield Mats Market Market Share Comparison by Applications (2016-2032)

- Figure 81: Latin America Rig and Oilfield Mats Market Revenue (US$ Mn) Market Share by Typein 2022

- Figure 82: Latin America Rig and Oilfield Mats Market Market Attractiveness Analysis by Type, 2016-2032

- Figure 83: Latin America Rig and Oilfield Mats Market Revenue (US$ Mn) Market Share by Applicationsin 2022

- Figure 84: Latin America Rig and Oilfield Mats Market Market Attractiveness Analysis by Applications, 2016-2032

- Figure 85: Latin America Rig and Oilfield Mats Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 86: Latin America Rig and Oilfield Mats Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 87: Latin America Rig and Oilfield Mats Market Market Revenue (US$ Mn) (2016-2032)

- Figure 88: Latin America Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 89: Latin America Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Figure 90: Latin America Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Applications (2016-2032)

- Figure 91: Latin America Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 92: Latin America Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Figure 93: Latin America Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Applications (2016-2032)

- Figure 94: Latin America Rig and Oilfield Mats Market Market Share Comparison by Country (2016-2032)

- Figure 95: Latin America Rig and Oilfield Mats Market Market Share Comparison by Type (2016-2032)

- Figure 96: Latin America Rig and Oilfield Mats Market Market Share Comparison by Applications (2016-2032)

- Figure 97: Middle East & Africa Rig and Oilfield Mats Market Revenue (US$ Mn) Market Share by Typein 2022

- Figure 98: Middle East & Africa Rig and Oilfield Mats Market Market Attractiveness Analysis by Type, 2016-2032

- Figure 99: Middle East & Africa Rig and Oilfield Mats Market Revenue (US$ Mn) Market Share by Applicationsin 2022

- Figure 100: Middle East & Africa Rig and Oilfield Mats Market Market Attractiveness Analysis by Applications, 2016-2032

- Figure 101: Middle East & Africa Rig and Oilfield Mats Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 102: Middle East & Africa Rig and Oilfield Mats Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 103: Middle East & Africa Rig and Oilfield Mats Market Market Revenue (US$ Mn) (2016-2032)

- Figure 104: Middle East & Africa Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 105: Middle East & Africa Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Figure 106: Middle East & Africa Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Applications (2016-2032)

- Figure 107: Middle East & Africa Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 108: Middle East & Africa Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Figure 109: Middle East & Africa Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Applications (2016-2032)

- Figure 110: Middle East & Africa Rig and Oilfield Mats Market Market Share Comparison by Country (2016-2032)

- Figure 111: Middle East & Africa Rig and Oilfield Mats Market Market Share Comparison by Type (2016-2032)

- Figure 112: Middle East & Africa Rig and Oilfield Mats Market Market Share Comparison by Applications (2016-2032)

"

- List of Tables

- "

- Table 1: Global Rig and Oilfield Mats Market Market Comparison by Type (2016-2032)

- Table 2: Global Rig and Oilfield Mats Market Market Comparison by Applications (2016-2032)

- Table 3: Global Rig and Oilfield Mats Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 4: Global Rig and Oilfield Mats Market Market Revenue (US$ Mn) (2016-2032)

- Table 5: Global Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 6: Global Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Table 7: Global Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Applications (2016-2032)

- Table 8: Global Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 9: Global Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Table 10: Global Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Applications (2016-2032)

- Table 11: Global Rig and Oilfield Mats Market Market Share Comparison by Region (2016-2032)

- Table 12: Global Rig and Oilfield Mats Market Market Share Comparison by Type (2016-2032)

- Table 13: Global Rig and Oilfield Mats Market Market Share Comparison by Applications (2016-2032)

- Table 14: North America Rig and Oilfield Mats Market Market Comparison by Applications (2016-2032)

- Table 15: North America Rig and Oilfield Mats Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 16: North America Rig and Oilfield Mats Market Market Revenue (US$ Mn) (2016-2032)

- Table 17: North America Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 18: North America Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Table 19: North America Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Applications (2016-2032)

- Table 20: North America Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 21: North America Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Table 22: North America Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Applications (2016-2032)

- Table 23: North America Rig and Oilfield Mats Market Market Share Comparison by Country (2016-2032)

- Table 24: North America Rig and Oilfield Mats Market Market Share Comparison by Type (2016-2032)

- Table 25: North America Rig and Oilfield Mats Market Market Share Comparison by Applications (2016-2032)

- Table 26: Western Europe Rig and Oilfield Mats Market Market Comparison by Type (2016-2032)

- Table 27: Western Europe Rig and Oilfield Mats Market Market Comparison by Applications (2016-2032)

- Table 28: Western Europe Rig and Oilfield Mats Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 29: Western Europe Rig and Oilfield Mats Market Market Revenue (US$ Mn) (2016-2032)

- Table 30: Western Europe Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 31: Western Europe Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Table 32: Western Europe Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Applications (2016-2032)

- Table 33: Western Europe Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 34: Western Europe Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Table 35: Western Europe Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Applications (2016-2032)

- Table 36: Western Europe Rig and Oilfield Mats Market Market Share Comparison by Country (2016-2032)

- Table 37: Western Europe Rig and Oilfield Mats Market Market Share Comparison by Type (2016-2032)

- Table 38: Western Europe Rig and Oilfield Mats Market Market Share Comparison by Applications (2016-2032)

- Table 39: Eastern Europe Rig and Oilfield Mats Market Market Comparison by Type (2016-2032)

- Table 40: Eastern Europe Rig and Oilfield Mats Market Market Comparison by Applications (2016-2032)

- Table 41: Eastern Europe Rig and Oilfield Mats Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 42: Eastern Europe Rig and Oilfield Mats Market Market Revenue (US$ Mn) (2016-2032)

- Table 43: Eastern Europe Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 44: Eastern Europe Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Table 45: Eastern Europe Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Applications (2016-2032)

- Table 46: Eastern Europe Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 47: Eastern Europe Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Table 48: Eastern Europe Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Applications (2016-2032)

- Table 49: Eastern Europe Rig and Oilfield Mats Market Market Share Comparison by Country (2016-2032)

- Table 50: Eastern Europe Rig and Oilfield Mats Market Market Share Comparison by Type (2016-2032)

- Table 51: Eastern Europe Rig and Oilfield Mats Market Market Share Comparison by Applications (2016-2032)

- Table 52: APAC Rig and Oilfield Mats Market Market Comparison by Type (2016-2032)

- Table 53: APAC Rig and Oilfield Mats Market Market Comparison by Applications (2016-2032)

- Table 54: APAC Rig and Oilfield Mats Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 55: APAC Rig and Oilfield Mats Market Market Revenue (US$ Mn) (2016-2032)

- Table 56: APAC Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 57: APAC Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Table 58: APAC Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Applications (2016-2032)

- Table 59: APAC Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 60: APAC Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Table 61: APAC Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Applications (2016-2032)

- Table 62: APAC Rig and Oilfield Mats Market Market Share Comparison by Country (2016-2032)

- Table 63: APAC Rig and Oilfield Mats Market Market Share Comparison by Type (2016-2032)

- Table 64: APAC Rig and Oilfield Mats Market Market Share Comparison by Applications (2016-2032)

- Table 65: Latin America Rig and Oilfield Mats Market Market Comparison by Type (2016-2032)

- Table 66: Latin America Rig and Oilfield Mats Market Market Comparison by Applications (2016-2032)

- Table 67: Latin America Rig and Oilfield Mats Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 68: Latin America Rig and Oilfield Mats Market Market Revenue (US$ Mn) (2016-2032)

- Table 69: Latin America Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 70: Latin America Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Table 71: Latin America Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Applications (2016-2032)

- Table 72: Latin America Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 73: Latin America Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Table 74: Latin America Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Applications (2016-2032)

- Table 75: Latin America Rig and Oilfield Mats Market Market Share Comparison by Country (2016-2032)

- Table 76: Latin America Rig and Oilfield Mats Market Market Share Comparison by Type (2016-2032)

- Table 77: Latin America Rig and Oilfield Mats Market Market Share Comparison by Applications (2016-2032)

- Table 78: Middle East & Africa Rig and Oilfield Mats Market Market Comparison by Type (2016-2032)

- Table 79: Middle East & Africa Rig and Oilfield Mats Market Market Comparison by Applications (2016-2032)

- Table 80: Middle East & Africa Rig and Oilfield Mats Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 81: Middle East & Africa Rig and Oilfield Mats Market Market Revenue (US$ Mn) (2016-2032)

- Table 82: Middle East & Africa Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 83: Middle East & Africa Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Table 84: Middle East & Africa Rig and Oilfield Mats Market Market Revenue (US$ Mn) Comparison by Applications (2016-2032)

- Table 85: Middle East & Africa Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 86: Middle East & Africa Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Table 87: Middle East & Africa Rig and Oilfield Mats Market Market Y-o-Y Growth Rate Comparison by Applications (2016-2032)

- Table 88: Middle East & Africa Rig and Oilfield Mats Market Market Share Comparison by Country (2016-2032)

- Table 89: Middle East & Africa Rig and Oilfield Mats Market Market Share Comparison by Type (2016-2032)

- Table 90: Middle East & Africa Rig and Oilfield Mats Market Market Share Comparison by Applications (2016-2032)

- 1. Executive Summary

-

- Newpark Resources Inc.

- YAK MAT

- Diamond T Services

- Horizon North Logistics Inc.

- Signature Systems Group, LLC

- Strad Energy Services Ltd

- Checkers Safety Group

- Spartan Mat

- Rig Mats of America Inc.

- Quality Mat Company

- Canada Rig Mats Ltd.

- Alberta Rig Mats

- Access Terrain Services