Generative AI in Construction Market By Type (Residential Construction, Commercial Construction, Industrial Construction, and Others), By Technology (Machine Learning, Natural Language Processing, and Others), By Application (Design and Planning, Construction Optimization, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

-

37824

-

May 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Report Overview

- Key Takeaways

- Driving factors

- Restraining Factors

- By Type Analysis

- By Technology Analysis

- By Application Analysis

- Key Market Segments

- Growth Opportunity

- Latest Trends

- Automated Design Generation: Revolutionizing Architectural Innovation

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

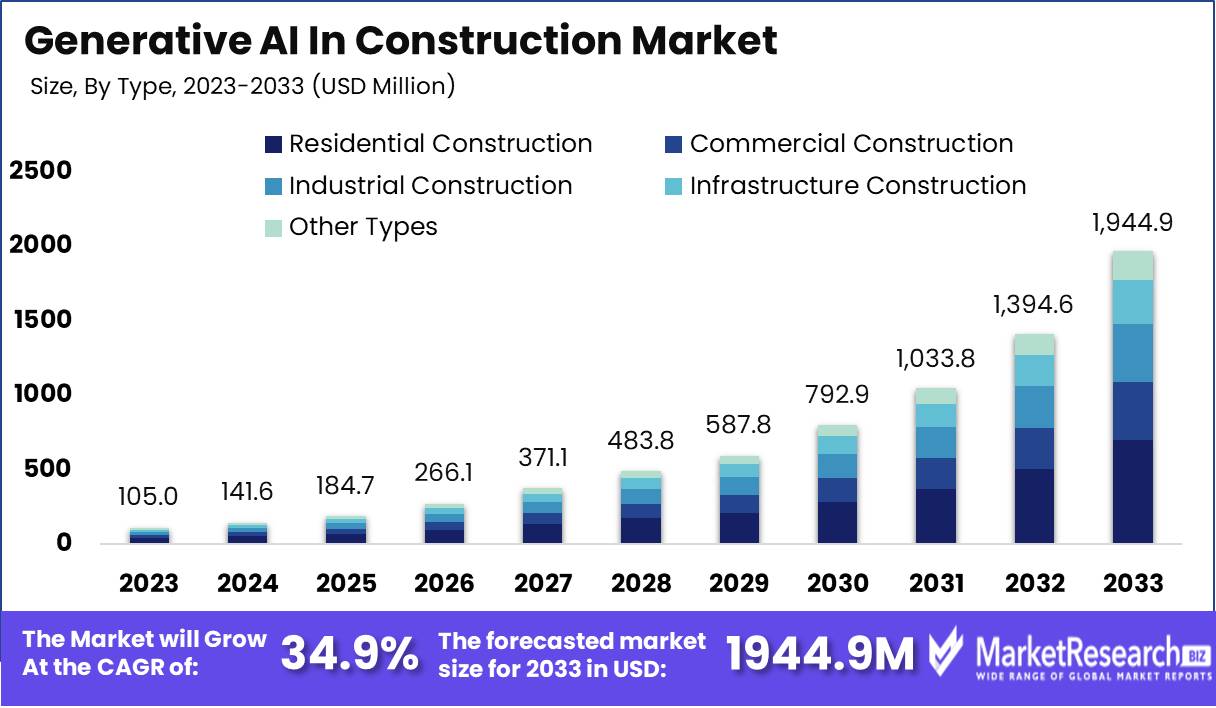

The generative AI in Construction Market size is expected to be worth around USD 1944.9 Mn by 2033 from USD 105.0 Mn in 2023, growing at a CAGR of 34.9% during the forecast period from 2024 to 2033. The surge in demand for advanced technologies and the rise in the construction sector are some of the main key driving factors for generative AI in construction.

Generative AI in construction is defined as the applications of artificial methods, specifically generative models such as generative adversarial networks and variational autoencoders to transform different aspects of the construction sector. This technology makes automated design generation, augmentation of building layouts, and forecasting modeling for project designing and risk management. Generative AI algorithms examine huge datasets of architectural designs, construction materials, and site conditions to produce new innovative building designs and construction plans that fulfill particular criteria like cost-effectiveness, safety, and sustainability.

Moreover, gen AI permits the enhancement of construction methods, scheduling, and resource allocations by leading to augment efficacy and decrease project timelines. It helps in the simulation of construction situations by permitting better decision-making and risk mitigation tactics. Gen AI in construction streamlines workflow productivity improves design innovations and contributes to the development of more resilient and sustainable built surroundings.

A report published by Invonto in 2024, highlights that USD 50 billion was invested in architecture, engineering, and construction tech, more than 85% higher than in the past 3 years. Gen AI in construction has changed the way construction projects are planned, designed, and executed. With its capability to examine huge amounts of data, AI is enhancing efficiency, safety, and productivity in the construction sector.

Generative AI technology provides an exceptional benefit to the construction sector by effectively analyzing and summarizing extensive documents like contracts, reports, and specifications. It can accelerate methods of complex materials and offer significant time-saving advantages by relieving project managers and stakeholders from the burdensome task of manual document analysis. The scrupulous examination makes sure that all relevant information is readily accessible, thereby decreasing errors and permitting well-informed decision-making. As technology increases, generative AI is important to play a growing vital role in the construction sector by propelling efficacy and success in projects. The demand for the gen AI in construction will increase due to the growing population and requirement for homes and other facilities that will help in market expansion in the coming years.

Key Takeaways

- Market Growth: The generative AI in Construction Market size is expected to be worth around USD 1944.9 Mn by 2033 from USD 105.0 Mn in 2023, growing at a CAGR of 34.9% during the forecast period from 2024 to 2033.

- By Type: Generative AI dominates, enhancing efficiency across diverse construction sectors in 2023.

- By Technology: Machine Learning dominates Generative AI in the Construction Market, while NLP and AR/VR show promising growth potential.

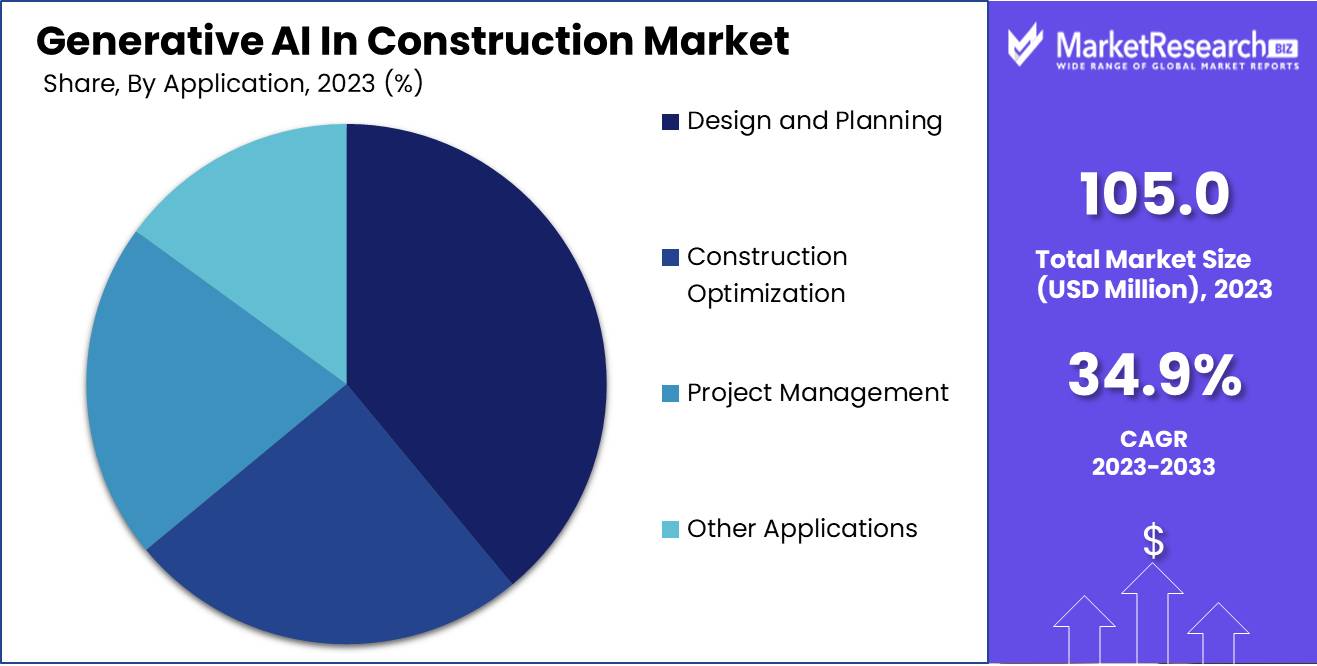

- By Application: Design and Planning dominates 2023's Generative AI in Construction Market.

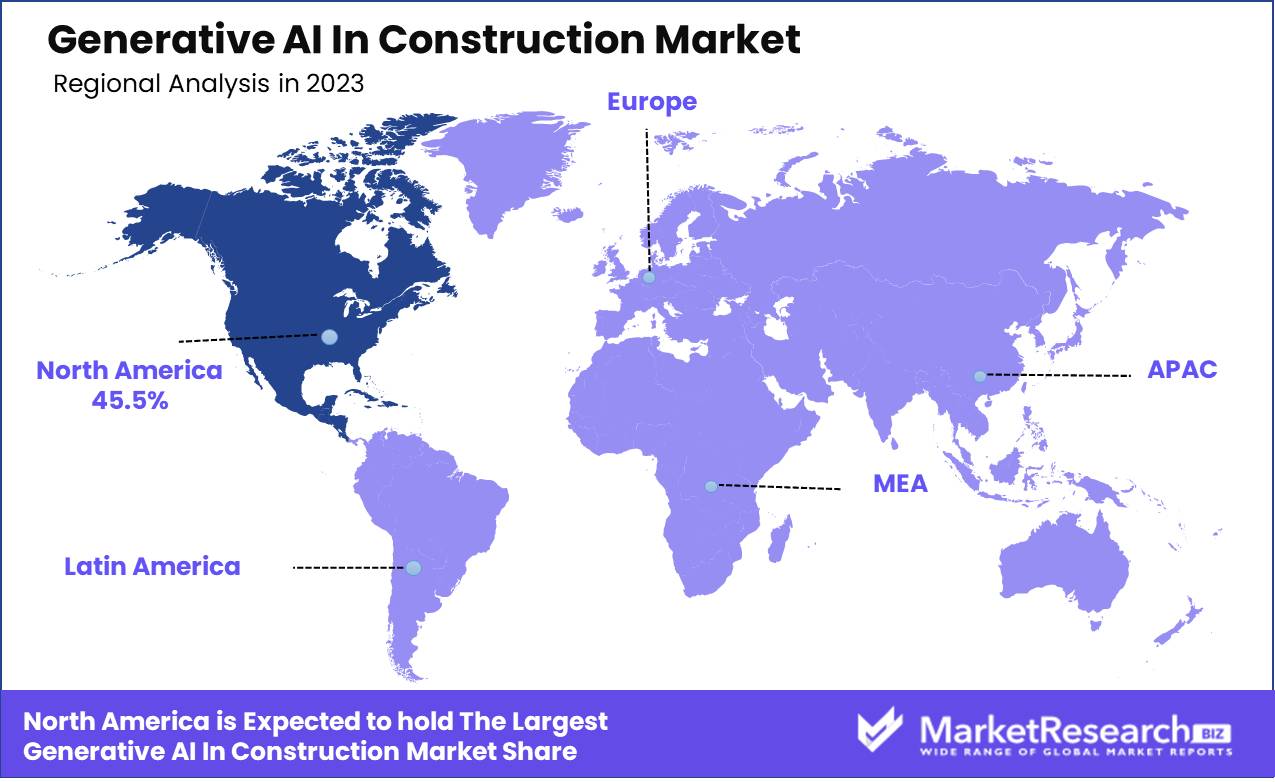

- Regional Dominance: North America Dominates with a 45.5% Market Share in Generative AI in the ERP market.

- Growth Opportunity: Generative AI revolutionizes construction, enhancing planning precision and boosting productivity, reshaping industry standards.

Driving factors

Technological Advancements: Catalyzing Innovation and Competitive Edge

Technological advancements in generative AI are pivotal in reshaping the construction industry. This evolution is marked by the integration of AI-driven tools that can design, plan, and simulate construction projects with unprecedented precision and speed. For example, generative AI can rapidly produce multiple design iterations based on specified parameters, significantly reducing the time architects and engineers spend on the initial planning stages. This capability not only enhances productivity but also drives innovation by enabling professionals to explore a broader range of design solutions and optimizations without the traditional constraints of time or resources.

The development of AI algorithms capable of learning from vast datasets including past construction projects, weather information, and regulatory standards, further refines the accuracy and applicability of generated designs. This technological push not only increases the adoption rate of AI tools in construction but also encourages continuous improvements in AI systems, creating a cycle of innovation and enhancement. As AI technologies become more sophisticated, their ability to handle complex, large-scale projects increases, making them indispensable in modern construction environments.

Increased Efficiency: Streamlining Operations and Reducing Costs

The impact of generative AI on operational efficiency in construction is profound. By automating design and planning processes, AI significantly reduces the manual labor involved, thereby lowering the costs and timelines associated with project development. For instance, generative AI can optimize material usage and logistics based on predictive analytics, which minimizes waste and ensures the timely availability of resources. This optimization direct costs and also mitigates the risk of project delays and budget overruns.

Moreover, the application of generative AI in scheduling and resource management enhances the efficiency of construction projects. AI algorithms can predict potential bottlenecks and suggest real-time adjustments, which helps maintain the flow of operations and reduces downtime. The overall enhancement in project management driven by AI leads to more projects being completed on time and within budget, thereby increasing profitability for construction firms and boosting client satisfaction.

Market Expansion: Broadening Horizons and Fostering Growth

Generative AI is instrumental in expanding the market reach of the construction industry. AI technologies play a crucial role by facilitating the entry of construction firms into new markets, particularly those that were previously considered too complex or not cost-effective. For instance, the ability of generative AI to adapt designs to different environmental conditions and local regulations allows firms to undertake projects in diverse geographical areas with confidence.

Furthermore, the scalability offered by AI tools means that companies can take on multiple projects simultaneously with consistent quality and efficiency, leveraging economies of scale. As these technologies become more accessible and their benefits more widely recognized, small to medium-sized enterprises (SMEs) in the construction sector can also adopt AI solutions, thereby democratizing advanced technological tools and fostering a more competitive market environment.

Restraining Factors

High Initial Investment: A Significant Barrier to Entry and Adoption

The requirement for high initial investment is a principal restraining factor for the growth of Generative AI in the construction market. This high capital outlay can be attributed to the need for advanced hardware and software, as well as the expenses associated with training personnel to effectively utilize these AI tools. For many construction companies, particularly small to medium-sized enterprises (SMEs), these costs are prohibitive, limiting the diffusion of generative AI technologies within the industry.

Statistical insights, when available, typically highlight a stark disparity in technology adoption rates between large firms and their smaller counterparts, primarily driven by differing financial capabilities. Larger firms often have the capital to invest in cutting-edge technologies, expecting long-term efficiency gains and cost savings, whereas SMEs might struggle with the immediate financial impact of such investments.

Integration with Existing Design Tools and Workflows: A Challenge to Seamless Adoption

The integration of Generative AI with existing design tools and workflows in the construction industry presents another critical challenge. The construction sector often relies on legacy systems and established protocols, making the integration of new, AI-driven solutions a complex task. This difficulty is compounded by the variability in software infrastructure between different construction companies, which can hinder the standardized deployment of new technologies across the sector.

For Generative AI to be effective, it must not only be compatible with existing software but also must enhance or streamline current workflows without disrupting them. Any disruption can lead to significant downtime, loss of productivity, and potentially even project outcomes that are highly undesirable in this industry.

By Type Analysis

Generative AI dominates, enhancing efficiency across diverse construction sectors in 2023.

In 2023, Commercial Construction held a dominant market position in the Generative AI in the Construction Market, particularly distinguishing itself across various construction types including Residential, Industrial, Infrastructure, and others.

Starting with Residential Construction, Generative AI significantly enhanced design and planning processes, enabling developers to optimize space usage and incorporate sustainable building practices efficiently. This technology facilitated the creation of cost-effective, innovative housing solutions that cater to growing urban populations.

Commercial Construction, the segment leader, leveraged Generative AI to streamline project management and operational efficiency. AI tools were instrumental in crafting complex commercial structures such as malls and office buildings, optimizing everything from material procurement to energy management, thus reducing costs and project timelines.

In Industrial Construction, Generative AI played a critical role in the design and maintenance of facilities. It provided predictive analytics for machinery maintenance and layout optimization, crucial for ensuring uninterrupted production lines and enhancing safety standards.

Infrastructure Construction benefited from AI’s capabilities in large-scale project management and regulatory compliance, particularly in the transportation and utilities sectors. Generative AI-enabled more precise risk assessment and resource allocation, significantly improving the longevity and reliability of infrastructure projects.

By Technology Analysis

Machine Learning dominates Generative AI in the Construction Market, while NLP and AR/VR show promising growth potential.

In 2023, the Generative AI in Construction Market witnessed Machine Learning (ML) holding a dominant position in the "Based on Technology" segment. This prominence stems from ML's robust capabilities in processing and analyzing vast datasets, essential for predictive modeling and automation in construction projects. Machine Learning models algorithms optimize resource allocation, cost estimation, and project scheduling, significantly enhancing operational efficiencies.

Adjacent to ML, Natural Language Processing (NLP) has carved out a crucial niche within this market. NLP technologies facilitate improved communication between stakeholders and enhance the usability of digital assistants in construction management. By interpreting and processing human language, NLP tools streamline reporting procedures, and compliance tracking, and even aid in the drafting and analysis of legal and project documents.

Other emerging technologies are also making inroads into this sector, including augmented and virtual reality (AR/VR), which offer profound implications for efficient designs visualization and safety training. Although these technologies currently occupy a smaller share of the market, their potential to transform traditional construction methodologies promises substantial growth opportunities in the coming years.

By Application Analysis

"Design and Planning" dominates 2023's Generative AI in Construction Market.

In 2023, the Generative AI in Construction Market experienced notable advancements across various applications, with "Design and Planning" holding a dominant market position. This segment leveraged AI's capability to revolutionize architectural design, enhance precision, and optimize resource allocation, making it integral for pre-construction processes.

AI-driven tools in this area facilitated the creation of complex, cost-effective, and environmentally sustainable building AI-Powered generative designs by simulating numerous scenarios and optimizing design parameters based on predetermined objectives. This not only reduced the time spent on iterative design processes but also improved the overall efficiency and effectiveness of construction projects.

Other significant segments included "Construction Optimization" and "Project Management," where AI applications focused on real-time decision-making, resource management, and workflow optimization to reduce waste and increase operational efficiency. The "Construction Optimization" segment utilized generative AI for logistics planning, materials management, and labor allocation, directly impacting cost savings and project timelines.

Meanwhile, "Project Management" benefited from AI's predictive capabilities, which helped in risk assessment, scheduling, and compliance monitoring, ensuring projects stayed on track and within budget. The "Other Applications" segment, though less defined, included emerging uses such as maintenance prediction and automated compliance checks, pointing to a broader potential application spectrum of generative AI in future construction landscapes.

Key Market Segments

Based on Type

- Residential Construction

- Commercial Construction

- Industrial Construction

- Infrastructure Construction

- Other Types

Based on Technology

- Machine Learning

- Natural Language Processing

- Other Technologies

Based on Application

- Design and Planning

- Construction Optimization

- Project Management

- Other Applications

Growth Opportunity

Revolutionizing Project Management

The construction industry stands on the brink of a transformative era as it begins to integrate Generative AI technologies. These technologies are poised to significantly enhance the efficiency and accuracy of project planning. By leveraging AI's capability to analyze vast datasets and generate predictive outcomes, construction managers can anticipate potential issues, optimize resource allocation, and streamline project timelines. This improved project planning capability not only reduces the risk of costly delays and budget overruns but also allows for more innovative project designs by simulating various scenarios and outcomes before physical work begins.

Enhancing On-Site Efficiency

Beyond planning, Generative AI is set to revolutionize on-site operations, thereby increasing productivity. AI tools can automate routine tasks such as scheduling, logistics, and compliance management, freeing up human workers to focus on more complex and critical aspects of construction. Moreover, real-time data analysis provided by AI will enable immediate adjustments to work schedules and resource distribution based on evolving site conditions. This capability ensures that projects progress as efficiently as possible, reducing downtime and boosting overall productivity.

Latest Trends

Optimization of Construction Processes: Leveraging AI for Enhanced Efficiency

In 2024, the global construction industry continues to witness a paradigm shift with the integration of generative artificial intelligence (AI) technologies. One prominent trend shaping this landscape is the optimization of construction processes through AI-driven solutions. Companies are increasingly adopting generative AI to streamline various aspects of construction, ranging from project planning to execution. By harnessing the power of machine learning algorithms, stakeholders can analyze vast datasets to identify inefficiencies, mitigate risks, and optimize resource allocation. This trend not only accelerates project timelines but also minimizes costs, ultimately enhancing overall productivity and profitability within the construction sector.

Automated Design Generation: Revolutionizing Architectural Innovation

Another key trend driving the evolution of the global generative AI in the construction market is the emergence of automated design generation tools. Traditional architectural design processes often entail extensive manual labor and iterative revisions. However, with the integration of generative AI, architects, and engineers can automate the design exploration phase, generating countless design iterations based on specified parameters and constraints. This trend fosters creativity, allowing professionals to explore innovative design solutions efficiently. Moreover, AI-powered design generation facilitates rapid prototyping and iteration, enabling stakeholders to quickly assess and refine design optimization concepts before implementation. As a result, the construction industry is experiencing a paradigm shift towards more sustainable, cost-effective, and aesthetically pleasing architectural solutions.

Regional Analysis

In the Generative AI in Construction market, North America stands as a pivotal region, commanding a significant market share of 45.5%. This dominance is attributed to the region's robust technological infrastructure, widespread adoption of advanced construction methods, and substantial investments in AI research and development. With a burgeoning demand for sustainable and efficient construction practices, North America continues to witness steady growth in generative AI applications across the sector.

In Europe, the market showcases promising growth prospects fueled by initiatives promoting smart city development and infrastructure modernization. The Asia Pacific region emerges as a key contender, driven by rapid urbanization, infrastructure projects, and government initiatives promoting digital transformation in construction. Similarly, the Middle East & Africa region experiences notable traction, propelled by infrastructural developments and investments in smart cities across Gulf Cooperation Council (GCC) countries. Latin America, while displaying a nascent market landscape, exhibits potential for growth owing to increasing construction activities and technological advancements. As the market evolves, these regions are anticipated to witness further expansion, driven by innovative applications and strategic collaborations within the construction ecosystem.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

Market Key Players

- Autodesk Inc.

- Dassault Systemes

- Trimble

- Bentley Systems

- Katerra

- Oracle Corporation

- Aurora Computer Services

- Building System Planning Inc.

- IBM Corporation

- Microsoft Corporation

- Other Market Players

Recent Development

- In March 2024, a Microsoft News Center article highlighted John Holland, GHD, and MinterEllison are leading the charge in Australia's construction, engineering, and legal sectors by embracing generative AI through Copilot for Microsoft 365, demonstrating significant time savings and fostering a culture of experimentation and knowledge sharing.

- In March 2024, Capgemini Research Institute's World Retail Banking Report that only 4% of retail banks are fully prepared for generative AI-led intelligent automation, with significant gaps in technology readiness highlighted across the industry.

- In February 2024, IBM's global study highlights that while many organizations recognize sustainability's importance, struggles with funding, skilling, and operationalizing actions persist, urging the integration of sustainability objectives within construction business strategy, aided by technologies like AI, for greater progress and profitability.

Report Scope

Report Features Description Market Value (2023) USD 105.0 Million Forecast Revenue (2033) USD 1944.9 Million CAGR (2024-2032) 34.9% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Based on Type (Residential Construction, Commercial Construction, Industrial Construction, Infrastructure Construction, Other Types), Based on Technology (Machine Learning, Natural Language Processing, Other Technologies), Based on Application (Design and Planning, Construction Optimization, Project Management, Other Applications) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Autodesk Inc., Dassault Systemes, Trimble, Bentley Systems, Katerra, Oracle Corporation, Aurora Computer Services, Building System Planning Inc., IBM Corporation, Microsoft Corporation, Other Market Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Autodesk Inc.

- Dassault Systemes

- Trimble

- Bentley Systems

- Katerra

- Oracle Corporation

- Aurora Computer Services

- Building System Planning Inc.

- IBM Corporation

- Microsoft Corporation

- Other Market Players