Generative AI in IoT Market By Industry Vertical(Manufacturing, Healthcare, Transportation, Agriculture, Other Industries), By Deployment Mode(On-device, Cloud-based), By Technology Providers(Established AI Technology Companies, IoT Platform Providers, Cloud Service Providers, Specialized Generative AI Startups), By Application Areas(Anomaly Detection, Predictive Maintenance, Adaptive Control, Resource Optimization, Personalized Services, Contextual Decision-making), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition

-

38369

-

April 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

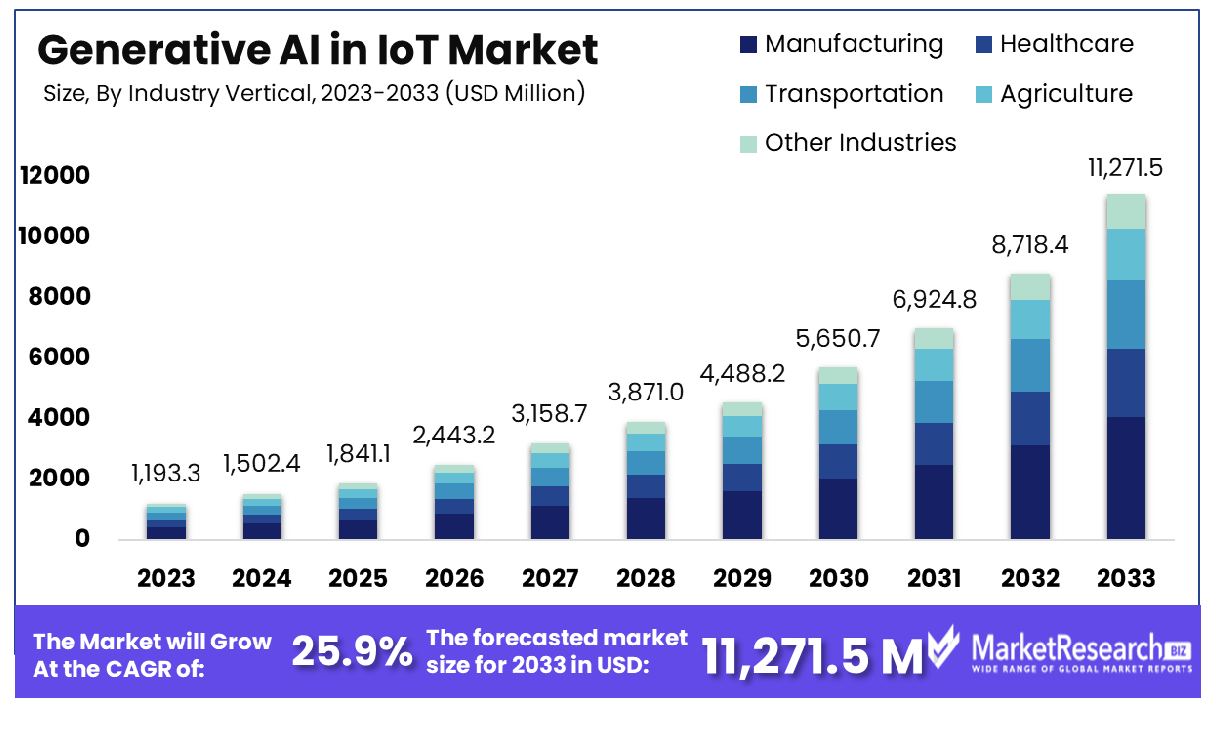

The Generative AI in IoT Market was valued at USD 1,193.3 Million in 2023. It is expected to reach USD 11,271.5 Million by 2033, with a CAGR of 25.9% during the forecast period from 2024 to 2033. The surge in demand for advanced technologies and the rise in different types of applications are some of the main key driving factors for the generative AI in IoT.

The generative AI in IoT is defined as the combination of artificial intelligence methods which are particularly generative models in the Internet of Things ecosystems. Such an approach makes the IoT equipment autonomously produce new data, forecasts, and responses based on learned structures from existing information streams. By implementing generative AI, IoT systems can adapt dynamically to transforming environmental situations by enhancing resource usage and augmenting the whole system's performance.

This technology encourages IoT devices to produce synthetic information for training and improving machine learning models, thereby decreasing the requirement for extensive real-world data collection. Generative AI in IoT also enables glitch detection, fault predictions, and proactive maintenance by improving the dependability and efficacy of IoT deployments. Moreover, it reveals new opportunities and capabilities for IoT systems by making them change from passive data collectors to active participants in decision-making methods by driving new innovations across different IoT applications and sectors.

According to statistics in October 2023, highlights that more than 80% of enterprises have been used for generative AI applications programming interfaces deploys Gen Ai-based applications in production surroundings which is up from less than 5% in 2023. By 2027, the foundation models will underpin 60% of the natural language processing use cases which is the main growth from less than 5% in 2021. By 2026, many firms that operationalize AI transparency, trust, and security witness their AI models will get a 50% enhancement in terms of adoption, business goals, and user acceptance.

Moreover, IoT business news in December 2023, highlights that NVIDIA leads the data center GPU segment with a 92% market share, while OpenAI and Microsoft have a collective share of 69% in the foundational models and platforms market. The services market is more uneven, with Accenture currently seen as the leader with a 6% market share. NVIDIA has managed to increase its data center GPU sales from $3.6 billion in Q4 2022 to an expected $16 billion in Q4 2023. In July 2023, startup chipmaker, Cerebras announced it had built its 1 of 9 AI supercomputers to provide alternatives to systems using NVIDIA technology.

The generative AI in IoT enhances data efficiency by synthesizing realistic information by augmenting irregular detection and making dynamic adaptability. It decreases bandwidth usage by conserving privacy and makes robustness to data scarcity. It provides cost efficacy by endowing IoT systems with improved potentialities for new innovations and dependability. The demand for generative AI in IoT will increase due to its requirement in the IT industries and other verticals that will help in market expansion in the coming years.

Key Takeaways

- Market Growth: The Generative AI in IoT Market was valued at USD 1,193.3 Million in 2023. It is expected to reach USD 11,271.5 Million by 2033, with a CAGR of 25.9% during the forecast period from 2024 to 2033.

- By Industry Vertical: Manufacturing led industry verticals with a 34% dominance.

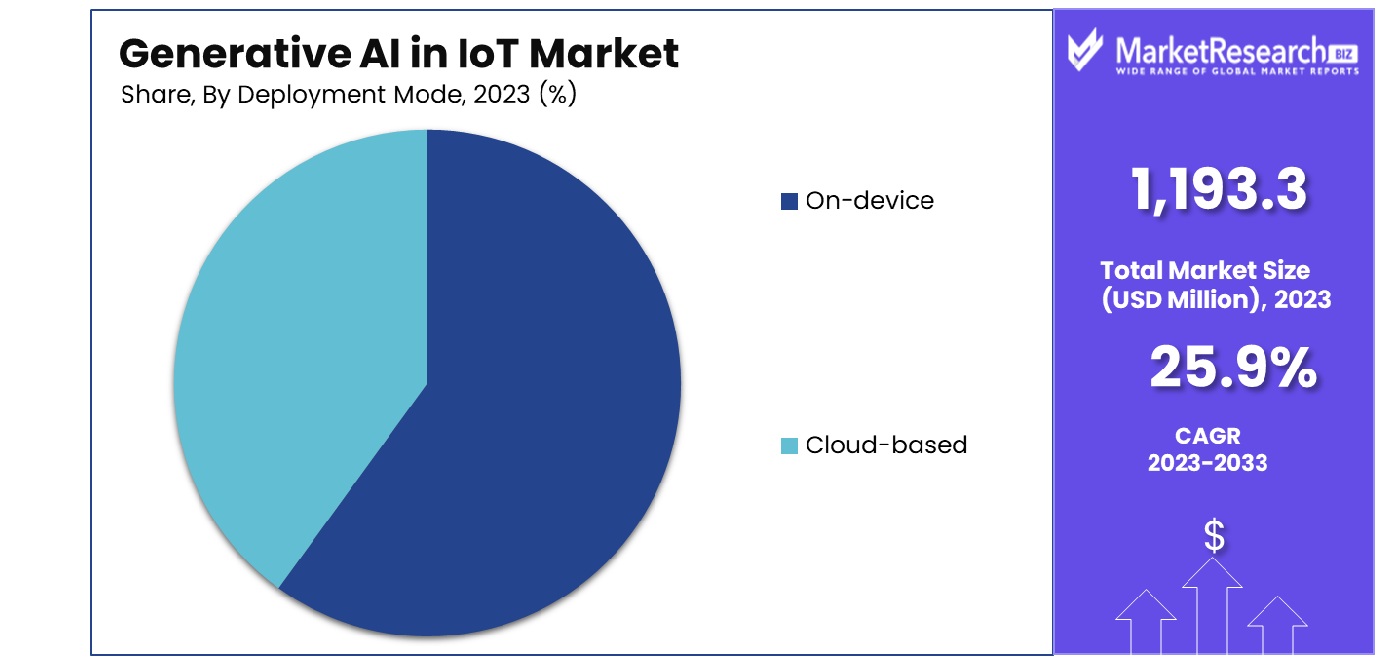

- By Deployment Mode: On-device deployment mode prevailed at 61% in market share.

- By Technology Providers: Established AI technology companies held a 40% market majority.

- By Application Areas: Anomaly detection dominated application areas, achieving 32% prominence.

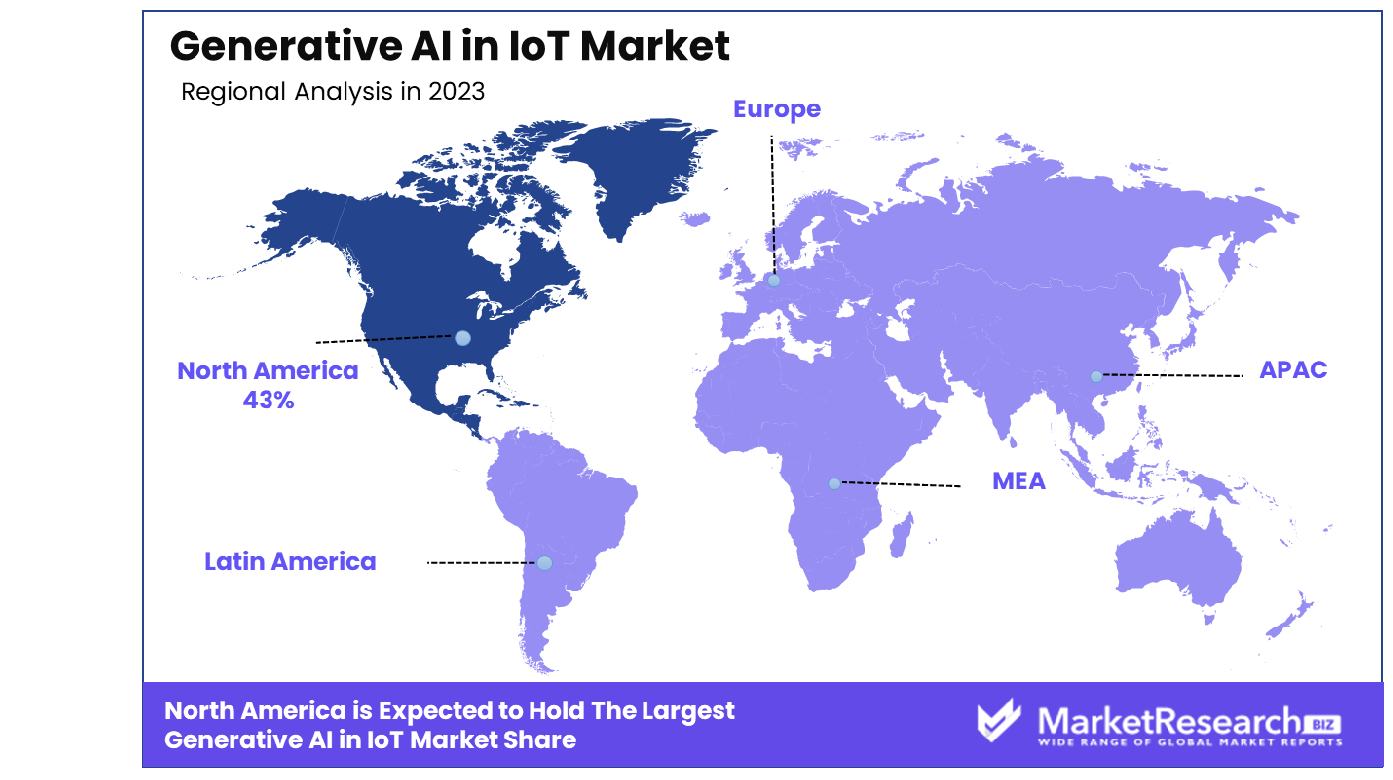

- Regional Dominance: North America holds a 43% share in the Generative AI in IoT market.

- Growth Opportunity: The integration of generative AI with IoT enhances industry solutions, driving growth through advanced analytics and operational efficiencies but is hindered by security concerns and high costs.

Driving factors

Advancements in AI Algorithms and Machine Learning Techniques

The continual advancement in artificial intelligence (AI) algorithms and machine learning techniques constitutes a critical catalyst for the expansion of the Generative AI in IoT market. These technological improvements enable more sophisticated data analysis and decision-making capabilities within IoT systems. For instance, enhanced algorithms can optimize the efficiency of operations and enable the development of new IoT applications that were previously unfeasible due to computational limitations.

As AI models become more adept at processing large datasets, they can predict outcomes with higher accuracy, thus increasing the utility and deployment of IoT devices across various industries. The evolution of AI technologies not only fuels the growth of existing markets but also paves the way for the creation of novel applications in sectors such as healthcare, manufacturing, and urban planning.

Growing Need for Predictive Maintenance and Anomaly Detection in IoT Networks

The escalating demand for predictive maintenance and anomaly detection significantly drives the Generative AI in IoT market. In sectors like manufacturing and utilities, the ability to predict equipment failures before they occur can save substantial costs and prevent downtime.

Generative AI enhances the capability of IoT systems to identify patterns that signify potential issues or inefficiencies, leading to proactive rather than reactive management. This shift to a more predictive maintenance model is facilitated by the integration of AI with IoT, which enhances data collection accuracy and analysis, resulting in improved operational reliability and reduced maintenance costs.

Integration of AI with IoT Platforms for Automation and Optimization of Processes

The integration of AI with IoT platforms dramatically transforms process automation and optimization. This synergy between AI and IoT not only automates routine tasks but also enhances the decision-making process by providing insights derived from the extensive data collected by IoT sensors.

In industries where precision and efficiency are paramount, such as logistics and supply chain management, AI-enabled IoT devices can optimize routing, inventory management, and supply chain operations, thereby increasing overall productivity. This integration effectively reduces human error and operational costs while enhancing speed and accuracy across processes, leading to significant market growth.

Restraining Factors

Data Security Concerns in Generative AI and IoT Integration

Data security concerns significantly impact the growth trajectory of the Generative AI in IoT market. As IoT devices proliferate, capturing and processing an ever-increasing volume of potentially sensitive information, the integration of generative AI amplifies concerns around data privacy and security. The capability of these AI systems to generate new data and insights from existing datasets introduces additional risks, including the potential for data breaches and unauthorized data synthesis.

Industries such as healthcare and finance, which handle particularly sensitive information, are especially wary of adopting new technologies that may compromise data integrity. These security challenges necessitate stringent data protection measures, potentially slowing the adoption rate of generative AI technologies in IoT applications as organizations grapple with compliance and risk management strategies.

High Resource Demands of Generative AI in IoT Applications

The high computational and memory requirements of generative AI models pose another significant barrier to their widespread integration into IoT devices. Generative AI applications, known for their deep neural networks, require substantial processing power, which can exceed the capabilities of many existing IoT devices designed for low power consumption and minimal processing.

This mismatch can restrict the deployment of generative AI applications in environments where resources are limited or where upgrading infrastructure to meet these demands is cost-prohibitive. Consequently, the growth of generative AI in IoT market is tempered by the need for advancements in hardware that can support more intensive computations without sacrificing the efficiency and cost-effectiveness that are hallmarks of IoT solutions.

By Industry Vertical Analysis

In the industry vertical sector, manufacturing leads with a dominant share of 34%.

In 2023, the Generative AI in IoT Market saw significant activity across various industry verticals, prominently led by the Manufacturing sector. This segment held a dominant market position, capturing more than 34% of the market share. Following closely, other key sectors include Healthcare, Transportation, Agriculture, and Other Industries, each contributing uniquely to the market dynamics.

The Manufacturing sector's leading share can be attributed to its rapid adoption of AI-driven technologies aimed at enhancing operational efficiency and reducing production costs. Generative AI applications in manufacturing are primarily focused on optimizing supply chains, predictive maintenance, and the customization of production processes. These applications not only streamline operations but also significantly minimize downtime and resource wastage, driving substantial cost savings.

In the Healthcare sector, Generative AI is increasingly being utilized for patient data management, treatment simulation, and personalized medicine, leveraging vast amounts of data to generate insights and predictive models that improve patient outcomes and operational efficiencies.

Transportation has also seen the integration of Generative AI in the management of logistics and fleet operations, as well as in the development of autonomous vehicles. This technology's ability to analyze and generate predictive insights from real-time data enhances decision-making processes and safety measures.

Agriculture benefits from Generative AI through optimized resource management and crop yield predictions, which are crucial for sustainable farming practices. This sector's use of IoT devices equipped with AI capabilities supports precision agriculture initiatives, thereby maximizing yields and reducing environmental impact.

By Deployment Mode Analysis

By deployment mode, on-device configurations command a majority at 61%.

In 2023, the By Deployment Mode segment of the Generative AI in IoT Market was led strongly by On-device deployment, which held a dominant market position with more than a 61% share. The remainder of the market was captured by Cloud-based deployment solutions.

The preference for On-device deployment stems from its ability to offer enhanced data security and real-time processing without the latency associated with data transmission to and from cloud computing. On-device AI is particularly advantageous in applications requiring immediate data processing and decision-making, such as in autonomous vehicles, smart manufacturing equipment, and mobile healthcare devices, where split-second calculations can be critical.

On-device deployment minimizes the dependency on continuous learning internet connectivity, which can be beneficial in remote or unstable environments. This approach also reduces bandwidth demands and mitigates potential data privacy concerns by processing sensitive information locally, rather than transmitting it to the cloud.

Conversely, Cloud-based deployment continues to be relevant, particularly in scenarios where computational demands exceed the local device's processing capabilities or where collaborative AI tasks are necessary. Cloud platforms can provide more powerful computational resources and facilitate larger data analyses, which are essential for training more complex AI models. This model is particularly prevalent in enterprise-level applications where integration with existing cloud infrastructure is already in place.

By Technology Providers Analysis

Among technology providers, established AI companies hold the largest segment at 40%.

In 2023, the By Technology Providers segment of the Generative AI in IoT Market was predominantly led by Established AI Technology Companies, which captured more than a 40% share. The rest of the market was distributed among IoT Platform Providers, Cloud Service Providers, and Specialized Generative AI Startups.

Established AI Technology Companies have leveraged their robust technological foundations, extensive market reach, and substantial R&D capabilities to secure their leading position. These companies typically offer advanced AI solutions that are well-integrated with IoT applications, providing comprehensive analytics and real-time decision-making tools. Their longstanding industry presence has fostered strong customer trust and a reliable reputation, which are critical in encouraging the adoption of new technologies.

IoT Platform Providers have also played a crucial role in this market, offering platforms that seamlessly connect various IoT devices with Generative AI capabilities. These platforms facilitate the collection, analysis, and actionable use of data generated from connected devices, thus enhancing the efficiency of IoT ecosystems.

Cloud Service Providers contribute by offering scalable edge computing resources and vast data storage solutions. Their cloud environments are pivotal for training sophisticated AI models and deploying AI applications at scale, which is indispensable for handling the expansive data produced by IoT devices.

Specialized Generative AI Startups, while holding a smaller share, inject innovation and agility into the market. These startups often pioneer cutting-edge applications of AI in IoT, focusing on niche markets or developing novel solutions that address specific industry key challenges.

By Application Areas Analysis

In application areas, anomaly detection prominently figures with a 32% market share.

In 2023, the By Application Areas segment of the Generative AI in the IoT Market was prominently dominated by Anomaly Detection, which captured more than a 32% share. Other significant application areas included Predictive Maintenance, Adaptive Control, Resource Optimization, Personalized Services, and Contextual Decision-making.

Anomaly Detection's leading position can be attributed to its critical role in identifying irregular patterns and potential failures across various industries, thereby preventing costly downtime and ensuring system integrity. Generative AI enhances this application by simulating potential anomalies and learning from vast datasets to detect and alert deviations more efficiently than traditional methods. This capability is essential in sectors such as manufacturing, cybersecurity, and financial services, where early detection of irregularities can prevent significant financial losses and operational disruption.

Predictive Maintenance follows closely, utilizing AI to forecast equipment failures and schedule timely maintenance, thus minimizing unplanned outages and extending asset life. This application is particularly valuable in industries with heavy machinery and extensive manufacturing lines.

Adaptive Control and Resource Optimization are also vital, focusing on optimizing processes and resource allocation dynamically. These applications are increasingly important in energy management and logistics, where efficiency is paramount.

Personalized Services and Contextual Decision-making are growing areas where Generative AI tailors interactions and decisions based on real-time data and user context, enhancing customer experiences and business decision-making across sectors like retail, healthcare, and telecommunications.

Key Market Segments

By Industry Vertical

- Manufacturing

- Healthcare

- Transportation

- Agriculture

- Other Industries

By Deployment Mode

- On-device

- Cloud-based

By Technology Providers

- Established AI Technology Companies

- IoT Platform Providers

- Cloud Service Providers

- Specialized Generative AI Startups

By Application Areas

- Anomaly Detection

- Predictive Maintenance

- Adaptive Control

- Resource Optimization

- Personalized Services

- Contextual Decision-making

Growth Opportunity

Unlocking New Possibilities for IoT-Enabled Industry Solutions

The integration of Generative Artificial Intelligence (AI) with the Internet of Things (IoT) presents substantial growth opportunities across various sectors. By enhancing IoT with generative AI, businesses can generate innovative solutions that significantly improve decision-making processes, optimize operational efficiencies, and create personalized customer experiences.

This convergence is expected to drive the development of smarter IoT devices that can predict maintenance needs, optimize energy consumption, and automate complex processes. As generative AI continues to evolve, its ability to process and analyze vast amounts of IoT-generated data in real time can transform industries by enabling more dynamic and adaptive systems.

Growth Drivers and Restraints

The growth of the generative AI in the IoT market can be attributed to several key drivers. Firstly, the increasing demand for AI-driven insights in industries such as manufacturing, healthcare, and retail fuels the adoption of intelligent IoT systems. Secondly, advancements in machine learning models that improve the autonomy and efficiency of IoT devices serve as a crucial growth driver. However, this market faces significant restraints, including concerns regarding data privacy and security.

Additionally, the high costs associated with implementing advanced AI solutions and the lack of skilled AI professionals may hinder market growth. Understanding these drivers and restraints is vital for stakeholders to navigate the market landscape effectively and harness the potential of generative AI in IoT solutions.

Latest Trends

Adoption of Generative AI for Optimizing Energy Consumption in IoT Networks

In 2023, the adoption of generative AI technologies within IoT networks has become a prominent trend, particularly for optimizing energy consumption. This application of AI is crucial in sectors where energy efficiency is a priority, such as manufacturing and smart city developments.

Generative AI enables IoT devices to not only monitor energy usage but also predict and adjust operations to minimize waste. This capability is transforming energy management practices by providing more accurate, real-time interventions that significantly reduce unnecessary energy consumption and cost, thereby enhancing overall sustainability efforts.

Growth of AI-Driven Autonomous IoT Devices and Systems

Another significant trend in the global generative AI in IoT market is the growth of AI-driven autonomous devices and systems. These systems are increasingly capable of self-management, learning from their environments to make independent decisions without human intervention. The evolution of autonomous IoT devices is particularly evident in the automotive and industrial sectors, where precision and efficiency are paramount.

Such devices streamline processes and improve safety by quickly responding to operational variables and potential hazards. The expansion of autonomous IoT solutions is expected to continue, driven by advancements in AI algorithms that enhance device intelligence and decision-making capabilities.

Regional Analysis

North America holds a 43% share in the global generative AI in IoT market.

In the global Generative AI in IoT market, regional dynamics significantly influence growth trends and market penetration. North America emerges as the dominating region, holding a substantial 43% market share. This leadership is driven by robust technological infrastructure, significant investments in AI and IoT from both private and public sectors, and a strong presence of leading technology companies.

Europe follows with strong growth potential, supported by stringent data regulations that promote advanced security measures in AI implementations. The European market is also benefiting from substantial government initiatives aimed at digital transformation and smart city projects, which incorporate IoT solutions extensively.

The Asia Pacific region is witnessing rapid growth in the generative AI in IoT market, spurred by increasing industrial automation, particularly in manufacturing hubs such as China, Japan, and South Korea. The region's market expansion is further fueled by the rising adoption of smart technologies in the healthcare and retail sectors.

The Middle East & Africa region, though still in nascent stages, shows promising growth, primarily due to the increasing adoption of smart city solutions across Gulf Cooperation Council (GCC) countries, which are heavily investing in transforming urban infrastructures through technology.

Latin America, although the smallest market, is gradually adopting generative AI in IoT, with Brazil and Mexico leading in technological advancements and deployment. The region's growth is primarily driven by the need for improved business operations and enhanced connectivity solutions.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the landscape of the global Generative AI in IoT market will be significantly shaped by a diverse array of key players, each contributing to the technological advancements and market dynamics in unique ways.

OpenAI has positioned itself as a frontrunner in generative AI, primarily due to its groundbreaking AI models that seamlessly integrate with IoT systems to enable smarter decision-making processes. IBM Watson and Microsoft continue to expand their cloud-based IoT services, which are enhanced with AI capabilities, thus offering robust platforms for data analysis and operational efficiency.

Google and Amazon Web Services (AWS) dominate with their scalable and secure IoT solutions that incorporate advanced AI tools to facilitate device management and data analytics at scale. Intel Corporation and NVIDIA Corporation are critical in providing the necessary hardware, with powerful chipsets designed to support the high-performance requirements of AI algorithms in IoT applications.

Siemens AG and General Electric (GE) are leveraging their industrial expertise to incorporate AI into their IoT offerings, enhancing automation and predictive maintenance in sectors like manufacturing and energy. Cisco Systems and Honeywell International Inc. are notable for their contributions to building smarter, AI-driven security and building management systems.

Schneider Electric, Bosch, and Qualcomm Technologies, Inc. focus on the operational technology side, integrating generative AI to optimize everything from energy systems to automotive components. Accenture, Fujitsu Limited, and Huawei Technologies Co., Ltd. provide tailored AI solutions that enhance IoT deployments across various industries.

Hitachi, Ltd., SAP SE, and other key players such as Huawei and Fujitsu are instrumental in integrating generative AI into diverse industrial applications, thereby driving efficiency and innovation. These companies, through their innovative approaches and global reach, continue to drive forward the integration of AI and IoT, shaping a future where intelligent systems redefine possibilities across industries.

Market Key Players

- OpenAI

- IBM Watson

- Microsoft

- Amazon Web Services (AWS)

- Intel Corporation

- NVIDIA Corporation

- Siemens AG

- General Electric (GE)

- Cisco Systems

- Honeywell International Inc.

- Schneider Electric

- Bosch

- Qualcomm Technologies, Inc.

- Accenture

- Fujitsu Limited

- Huawei Technologies Co., Ltd.

- Hitachi, Ltd.

- SAP SE

- Other Key Players

Recent Development

- In April 2024, Cloud Software Group Inc. and Microsoft Corp. deepened their collaboration in an eight-year strategic partnership, focusing on enhancing Citrix solutions with Microsoft Azure and AI capabilities to drive enterprise services innovation.

- In April 2024, TechRadarPro explores the dual impact of AI in industrial IoT, highlighting its transformative potential while addressing complex security and ethical challenges.

- In February 2024, Fujitsu unveils an AI strategy focusing on human-AI collaboration, launching Fujitsu Data Intelligence PaaS and consulting services. Advances in generative AI include models surpassing GPT-4V accuracy. Internal adoption fosters innovation.

Report Scope

Report Features Description Market Value (2023) USD 1,193.3 Million Forecast Revenue (2033) USD 11,271.5 Million CAGR (2024-2032) 25.9% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Industry Vertical(Manufacturing, Healthcare, Transportation, Agriculture, Other Industries), By Deployment Mode(On-device, Cloud-based), By Technology Providers(Established AI Technology Companies, IoT Platform Providers, Cloud Service Providers, Specialized Generative AI Startups), By Application Areas(Anomaly Detection, Predictive Maintenance, Adaptive Control, Resource Optimization, Personalized Services, Contextual Decision-making) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape OpenAI, IBM Watson, Microsoft, Google, Amazon Web Services (AWS), Intel Corporation, NVIDIA Corporation, Siemens AG, General Electric (GE), Cisco Systems, Honeywell International Inc., Schneider Electric, Bosch, Qualcomm Technologies, Inc., Accenture, Fujitsu Limited, Huawei Technologies Co., Ltd., Hitachi, Ltd., SAP SE, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- OpenAI

- IBM Watson

- Microsoft

- Amazon Web Services (AWS)

- Intel Corporation

- NVIDIA Corporation

- Siemens AG

- General Electric (GE)

- Cisco Systems

- Honeywell International Inc.

- Schneider Electric

- Bosch

- Qualcomm Technologies, Inc.

- Accenture

- Fujitsu Limited

- Huawei Technologies Co., Ltd.

- Hitachi, Ltd.

- SAP SE

- Other Key Players