Ready Drink Tea Coffee Market By Product (Tea and Coffee), By Packaging Type (Glass Bottle, PET Bottle, Canned, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

49190

-

July 2024

-

300

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

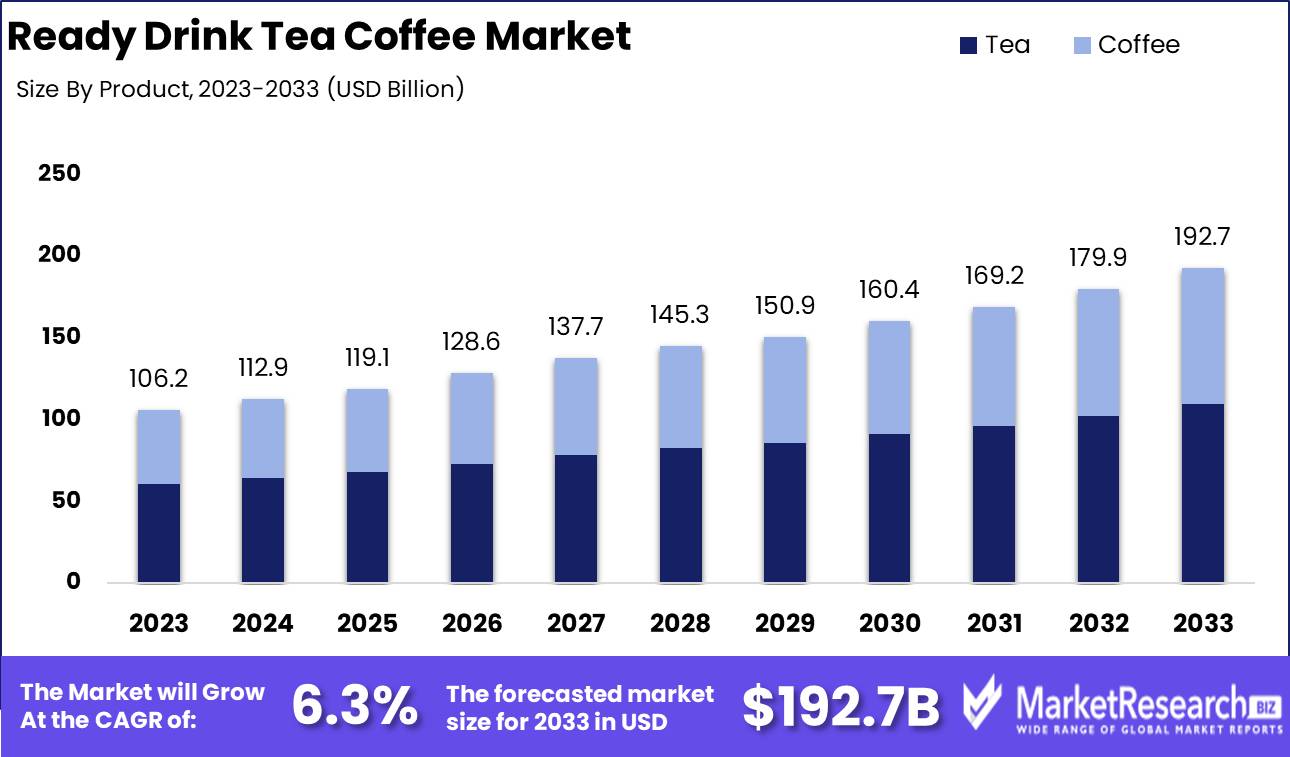

The Ready Drink Tea Coffee Market was valued at USD 106.2 billion in 2023. It is expected to reach USD 192.7 billion by 2033, with a CAGR of 6.3% during the forecast period from 2024 to 2033.

The Ready-to-Drink (RTD) Tea and Coffee Market encompasses pre-packaged beverages that provide consumers with the convenience of enjoying tea and coffee flavors without the need for brewing or preparation. This market segment is driven by a growing demand for on-the-go lifestyle products that offer both refreshment and functional benefits such as energy boosts and health-oriented ingredients. RTD tea and coffee products vary widely, ranging from sweetened and flavored options to organic and low-calorie alternatives, catering to a diverse palette of consumer preferences.

The Ready-to-Drink (RTD) Tea and Coffee market continues to capture the attention of health-conscious consumers, aligning with broader trends that favor wellness-oriented beverage choices. These products offer a healthier alternative to traditional carbonated drinks by integrating functional ingredients that appeal to those seeking nutritional benefits. The market's expansion is notably driven by the increasing consumer inclination towards beverages that support a wellness-oriented lifestyle, coupled with the convenience these products offer. RTD tea and coffee perfectly cater to the on-the-go lifestyle prevalent among modern consumers, providing an easy and efficient way to enjoy a beverage without the time-consuming preparation process.

However, the Ready-to-Drink Tea and Coffee sector is not without its challenges. The market is currently navigating the complexities of fluctuating raw material costs, such as tea leaves and coffee beans, which introduce a layer of unpredictability to product pricing. This volatility can complicate budgeting and pricing strategies for manufacturers, potentially affecting overall market stability.

Moreover, there is a pronounced shift towards sustainable packaging solutions within the industry. Consumers increasingly prefer environmentally friendly packaging options, such as recyclable PET bottles and glass, which not only align with ecological values but also preserve the taste and quality of the product. This trend towards sustainability is prompting companies to innovate in their packaging solutions, ensuring they meet consumer expectations and regulatory standards while maintaining product integrity.

Key Takeaways

- Market Growth: The Ready Drink Tea Coffee Market was valued at USD 106.2 billion in 2023. It is expected to reach USD 192.7 billion by 2033, with a CAGR of 6.3% during the forecast period from 2024 to 2033.

- By Product: Tea dominated the Ready-to-Drink Market, outpacing coffee significantly.

- By Packaging Type: Glass bottles dominate the RTD tea and coffee market, valued for sustainability.

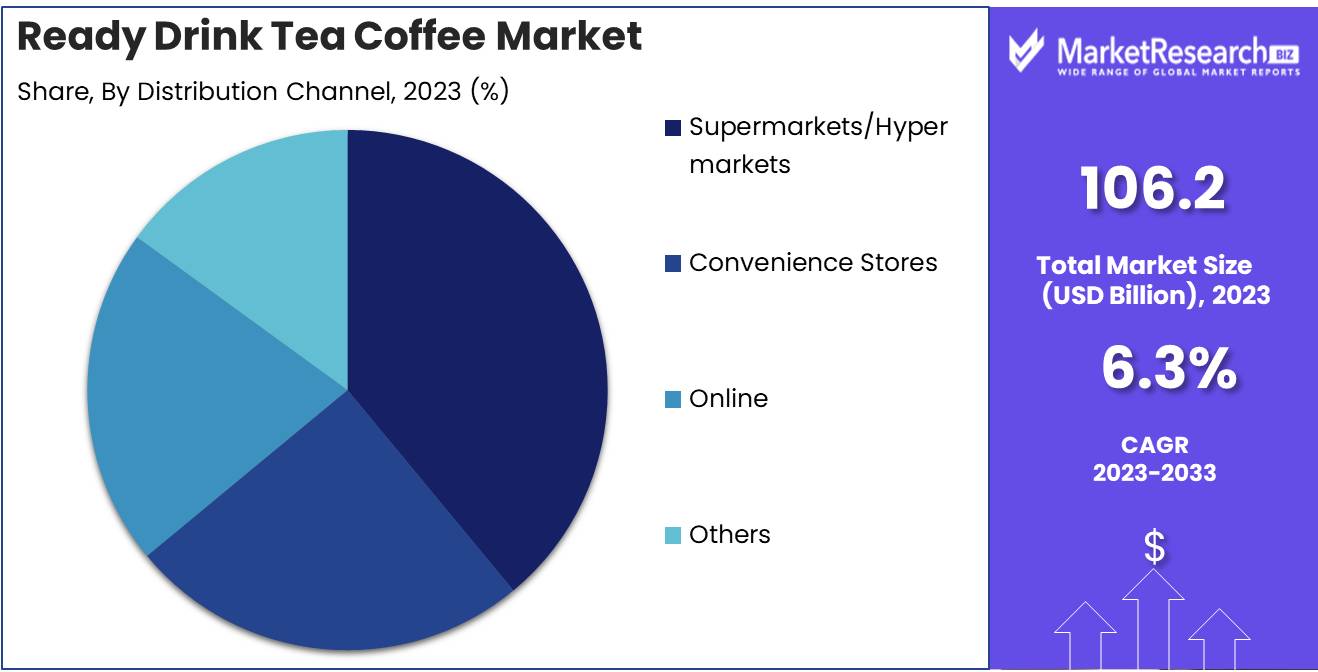

- By Distribution Channel: Supermarkets/hypermarkets dominate Ready-to-Drink Tea and Coffee Market distribution in 2023.

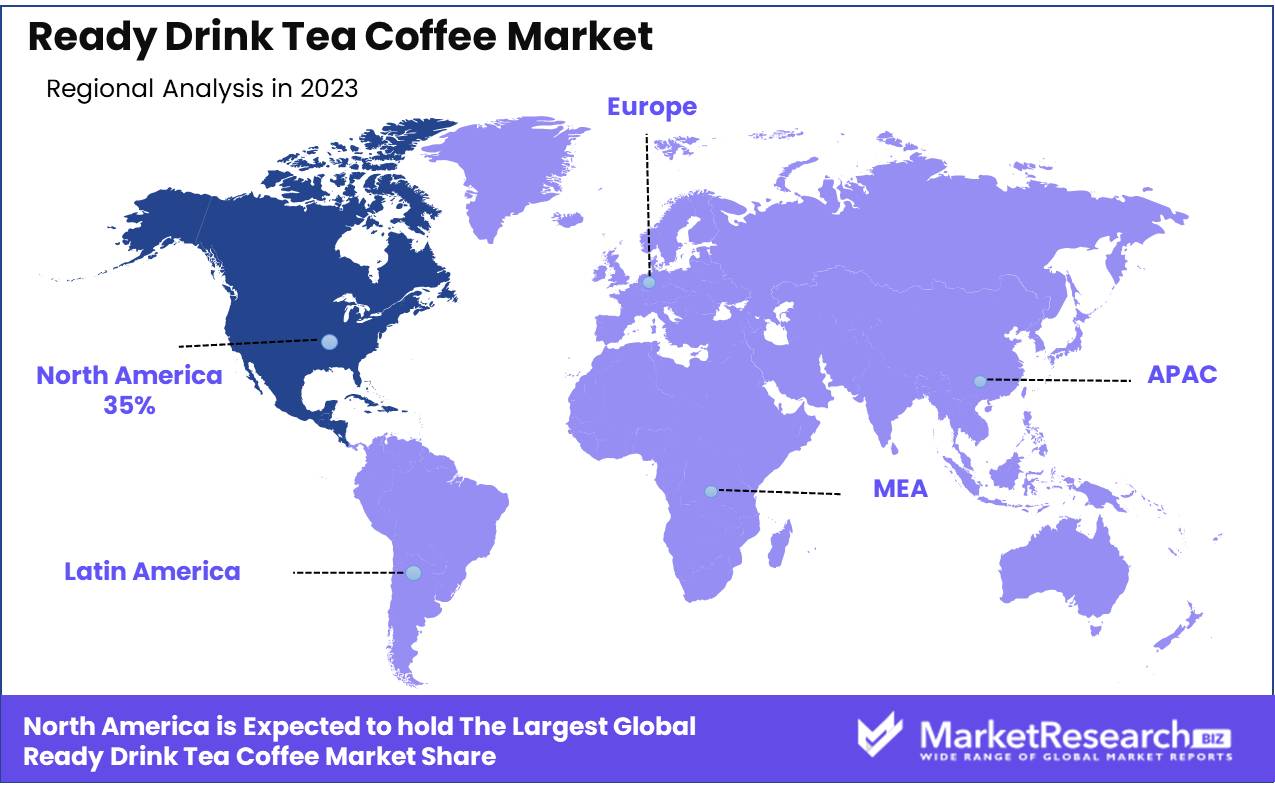

- Regional Dominance: North America dominates the Ready Drink Tea and Coffee Market at a 35% largest share.

- Growth Opportunity: The RTD tea and coffee market in 2024 is set to capitalize on these key trends. By leveraging the growing preference for natural ingredients and the need for portable drink solutions, industry players can unlock substantial growth opportunities, enhancing their market presence and profitability.

Driving factors

Growing Demand for Healthy Substitutes for Carbonated Drinks

The increasing health consciousness among consumers globally has been a significant catalyst in propelling the demand for ready-to-drink (RTD) tea and coffee. These beverages are often perceived as healthier alternatives to carbonated drinks, which are typically high in sugar and calories. This shift is reflected in the market data, where health-driven choices are directly contributing to the growth of the RTD tea and coffee sector. For instance, consumers are now more aware of the benefits associated with tea such as antioxidants and reduced caffeine content compared to traditional coffee or carbonated beverages. Similarly, RTD coffee is often marketed as a natural and preservative-free option, appealing to health-conscious consumers seeking convenience without compromising on health.

Convenience, Easy Availability, and Portability of RTD Tea and Coffee

The convenience factor of RTD tea and coffee significantly drives their market appeal. These products cater to the busy lifestyles of modern consumers who prioritize quick and accessible options. The availability of these beverages in various distribution channels, including supermarkets, convenience stores, and e-commerce platforms, enhances their accessibility, thus boosting market growth. Portability also plays a crucial role, as RTD beverages are typically packaged in user-friendly formats that support on-the-go consumption, aligning with the increasing mobility of the consumer base.

Gradual Shift in Consumer Preferences

There has been a notable shift in consumer preferences toward more diverse and sophisticated beverage options. RTD tea and coffee have benefited from this trend as they offer a wide range of flavors, from traditional to exotic, catering to a broad palette. This diversity attracts a wider audience, driving market expansion. Additionally, the integration of cultural tea-drinking habits and the rising popularity of coffee culture across various regions have further entrenched RTD tea and coffee as staple beverages in daily consumption patterns. This alignment with consumer lifestyle and cultural trends underscores the growth trajectory of the RTD tea and coffee market.

Restraining Factors

Preference for Fresh/Ground Coffee: A Challenge to Market Penetration

The growing consumer preference for fresh and ground coffee poses a significant challenge to the expansion of the Ready-to-Drink (RTD) Tea and Coffee market. This trend reflects a broader consumer shift towards premiumization in beverage choices, where individuals seek higher quality, freshly prepared options over pre-packaged alternatives. Fresh and ground coffee are often perceived as offering superior taste and a more authentic experience compared to RTD counterparts. Market statistics indicate that the global coffee market, emphasizing fresh and specialty coffees, has been growing steadily, suggesting a competitive landscape where RTD products may struggle to increase their market share without innovative strategies that align with consumer preferences for quality and freshness.

Raw Material Price Volatility: Impact on Cost Structure and Pricing Strategy

The volatility in raw material prices significantly impacts the RTD Tea and Coffee market, particularly concerning the cost of key ingredients such as coffee beans and tea leaves. Fluctuations in these prices can lead to unpredictable costs, challenging manufacturers to maintain consistent pricing and profit margins. For instance, any increase in coffee bean prices directly affects the production costs of RTD coffee products, potentially leading to higher retail prices that could deter price-sensitive consumers. This economic dynamic necessitates agile supply chain strategies and effective risk management practices to mitigate the adverse effects of price volatility on market growth. Additionally, manufacturers might need to explore alternative sourcing strategies or hedge commodity prices to stabilize their cost base in the face of such fluctuations.

By Product Analysis

In 2023, Tea dominated the Ready-to-Drink Market, outpacing coffee significantly.

In 2023, Tea held a dominant market position in the "By Product" segment of the Ready-to-Drink Tea and Coffee Market. Tea's supremacy can be attributed to its widespread cultural acceptance and the growing consumer inclination towards healthier beverages. Its market dominance is reinforced by innovations in flavor and packaging, alongside its perceived health benefits, which resonate well with health-conscious consumers globally. Meanwhile, coffee continues to secure a substantial share, driven by an increasing demand for convenience and a surge in coffee consumption among younger demographics.

Coffee's market presence is bolstered by the introduction of specialty coffee drinks and the expansion of coffee chains offering ready-to-drink options. Both segments benefit from the rise in consumer preferences for on-the-go drink options and the expanding retail distribution channels, which facilitate easy access to these beverages. Furthermore, advancements in product preservation and sustainability practices are expected to propel the growth of both tea and coffee segments, although tea currently enjoys a slight advantage in market preferences.

By Packaging Type Analysis

Glass bottles dominate the RTD tea and coffee market, valued for sustainability.

In 2023, The Glass Bottle held a dominant market position in the By Packaging Type segment of the Ready-to-Drink Tea and Coffee Market. This preference can be attributed to the consumer perception of glass as a premium, environmentally friendly packaging solution that preserves flavor and freshness more effectively than other materials. Glass bottles are highly recyclable, which aligns with the growing consumer trend towards sustainable and eco-conscious choices. Furthermore, the aesthetic appeal of glass bottles enhances brand visibility and consumer attraction, particularly in the premium product lines.

Following closely, PET bottles also command a significant market share, driven by their lightweight nature and cost-effectiveness, which reduces shipping costs and overall carbon footprint. PET bottles are favored for their versatility in design and robustness, which makes them suitable for a wide range of beverages.

Canned packaging, while less popular than glass and PET, remains relevant due to its convenience, long shelf life, and strong barrier properties. It appeals particularly to younger demographics who prioritize convenience and portability.

The Others category, which includes various innovative and niche packaging types such as cartons and pouches, caters to specific market segments looking for unique and differentiated packaging solutions. These alternatives often focus on portability and sustainability, albeit with a smaller market penetration compared to the leading types.

By Distribution Channel Analysis

Supermarkets/Hypermarkets dominate Ready-to-Drink Tea and Coffee Market distribution in 2023.

In 2023, Supermarkets/Hypermarkets held a dominant market position in the By Distribution Channel segment of the Ready-to-Drink Tea and Coffee Market. This distribution channel captured the largest market share due to its widespread accessibility and the ability to stock a diverse array of brands and product types, appealing to a broad consumer base. The convenience offered by supermarkets/hypermarkets, coupled with their promotional strategies, significantly drives consumer traffic and sales volumes in this category.

Following Supermarkets/Hypermarkets, Convenience Stores represent a vital distribution channel, favored for their ease of access and quick purchase options. These stores cater to on-the-go consumers looking for immediate refreshment options, thus supporting the steady demand for ready-to-drink tea and coffee products in various demographic segments.

The Online distribution channel has seen a robust growth trajectory, driven by the rise in e-commerce and changing consumer shopping behaviors. Online platforms offer the advantage of direct-to-consumer delivery services, which has been particularly appealing due to the convenience and often competitive pricing.

Lastly, the Others category encompasses various additional retail formats, including specialty stores and vending machines, which, although smaller in scale, play a niche role in market penetration and accessibility in less urbanized areas. This diverse distribution strategy ensures comprehensive market coverage and availability to all consumer segments.

Key Market Segments

By Product

- Tea

- Coffee

By Packaging Type

- Glass Bottle

- PET Bottle

- Canned

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online

- Others

Growth Opportunity

Embracing Natural Ingredients: A Key Driver for Market Expansion

The global market for ready-to-drink (RTD) tea and coffee is poised for significant growth, largely fueled by the increasing consumer preference for natural ingredients. This shift is not just a trend but a fundamental change in consumer behavior, as health-conscious buyers are actively seeking products with organic, natural compositions. This demand is catalyzing manufacturers to innovate and expand their product lines to include beverages that are not only convenient but also align with healthier lifestyle choices. The integration of natural ingredients is expected to open new avenues for market players, enhancing product appeal and fostering consumer loyalty.

Portable Drinks: Catering to the On-the-Go Consumer

Another pivotal growth opportunity in the RTD tea and coffee market is the rising demand for portable drink options. In today's fast-paced world, convenience plays a crucial role in consumer choices. RTD beverages, with their easy-to-carry nature, meet this need effectively, enabling consumers to enjoy a range of teas and coffees while on the move. The availability of these portable options is crucial in attracting a broader customer base, from commuters to outdoor enthusiasts, thereby expanding the market's reach and potential.

Latest Trends

Diversification of Flavors and Varieties

The Ready-to-Drink (RTD) Tea and Coffee Market is experiencing a significant shift toward the diversification of flavors and varieties, catering to an increasingly sophisticated consumer palate. This trend is driven by the growing demand for unique and exotic beverage options that offer a departure from traditional tastes. Manufacturers are responding by broadening their portfolios to include a wider range of herbal, fruit-infused, and spiced teas, as well as artisanal and single-origin coffees. This expansion not only attracts a broader customer base but also enhances brand visibility and market penetration. As consumers continue to seek novel experiences and personalized options, the introduction of innovative flavors is pivotal for brands aiming to differentiate themselves in a competitive landscape.

Premiumization and Specialty Offerings

Parallel to flavor diversification, there is a clear trend toward premiumization and specialty offerings within the RTD tea and coffee market. This movement is characterized by an emphasis on high-quality, ethically sourced ingredients and sophisticated packaging. Consumers are increasingly willing to pay a premium for products that promise superior taste and offer transparency regarding their origin and production processes. Specialty products such as cold brew coffees and matcha or yerba mate teas are gaining traction, reflecting a shift towards more health-conscious and environmentally aware consumption. This trend not only elevates consumer expectations but also pushes companies towards innovation and sustainability, factors that are becoming critical for maintaining competitiveness and fostering consumer loyalty in the RTD beverage sector.

Regional Analysis

North America dominates the Ready Drink Tea and Coffee Market at a 35% largest share.

The Ready Drink Tea and Coffee Market is experiencing varied levels of growth across different global regions, with North America emerging as the dominant player. In North America, the market has captured approximately 35% of the global share, driven by a growing consumer preference for convenience and healthier beverage options. The increasing presence of major market players and the introduction of a variety of new flavors and fortified options are significant contributors to this trend.

In Europe, the market is also robust, influenced by a strong café culture and the high demand for organic and premium products. The Asia Pacific region shows the fastest growth rate due to rising urbanization and changing lifestyles, particularly in countries like China and India, which are becoming huge markets for ready-to-drink beverages.

Meanwhile, Latin America and the Middle East & Africa are experiencing moderate growth. In Latin America, the expansion is partly due to the increasing young population and urbanization, whereas in the Middle East & Africa, the market is just beginning to explore the potential of ready-drink tea and coffee amidst traditional tea-consuming cultures. Each region's market dynamics are shaped by local consumer preferences, regulatory environments, and the strategic initiatives of regional and global players.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In the dynamic landscape of the global Ready-to-Drink (RTD) Tea and Coffee market, the year has seen substantial contributions from major corporations that are pivotal in shaping the industry's trajectory. Among these, PepsiCo and Coca-Cola continue to dominate, leveraging extensive distribution networks and strong brand portfolios to expand their market share. These giants excel in innovation, frequently introducing new flavors and health-oriented products to cater to evolving consumer preferences.

Nestlé capitalizes on its global presence and robust research and development capabilities to enhance its product offerings, particularly in coffee-based RTD beverages. Meanwhile, Ting Hsin International Group and Uni-President Enterprises, significant in the Asia Pacific market, focus on local consumer tastes to drive growth, often integrating traditional flavors in their offerings.

Suntory Beverage & Food and Monster Beverage Corporation are aggressively pursuing market expansion strategies, with Suntory enhancing its focus on sustainability and Monster leveraging aggressive marketing techniques to boost its energy drink line. Starbucks Corporation, with its premium branding, continues to excel in coffee-based RTD products, offering a seamless experience from café to can.

Other notable players such as Asahi Group Holdings and Dr Pepper Snapple Group have focused on diversified portfolios and strategic partnerships to secure their positions in the market. Emerging trends indicate a growing preference for healthier, low-sugar options, pushing companies like Danone and San Benedetto to innovate in herbal and fruit-infused RTD teas.

Market Key Players

- PepsiCo

- Coca-Cola

- Nestle

- Ting Hsin International Group

- Uni-President Enterprises

- Suntory Beverage & Food

- Monster Beverage Corporation

- Starbucks Corporation

- Asahi Group Holdings

- Dr Pepper Snapple Group

- Danone

- San Benedetto

- Hangzhou Wahaha Group

- Lotte Chilsung Beverage

- Amul

- Monster Energy Company

- Arizona Beverage Company

- JAB Holding Company

- Keurig Dr Pepper

- Illycaffè

- The Coca-Cola Company

- F&N Foods

Recent Development

- In March 2024, Beam's health and wellness brand, "Be Amazing," introduced "Greens On The Go," a new RTD nutritional beverage. This product is designed for health-conscious consumers and includes 10 organic vegetables and fruits, emphasizing the brand's commitment to healthy, convenient options for on-the-go consumption.

- In January 2024, The RYL Company, known for its wellness-focused RTD tea, expanded its presence to Wegmans and select Whole Foods Market stores across the Northeastern U.S. This brand is distinctive for its "Ryl Polyphenol Technology," which ensures each can contain a consistent 200mg of tea polyphenols. The products are also noted for being zero sugar, zero calories, and packaged in recyclable aluminum cans.

- In November 2023, Coca-Cola India expanded into the RTD tea beverage sector with its "Honest Tea" brand, which is set to offer new variants such as Mango and Lemon-Tulsi iced green tea. This move signifies Coca-Cola's strategy to diversify its beverage options and cater to a broader range of consumer tastes.

Report Scope

Report Features Description Market Value (2023) USD 106.2 Billion Forecast Revenue (2033) USD 192.7 Billion CAGR (2024-2032) 6.3% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Tea and Coffee), By Packaging Type (Glass Bottle, PET Bottle, Canned, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape PepsiCo, Coca-Cola, Nestle, Ting Hsin International Group, Uni-President Enterprises, Suntory Beverage & Food, Monster Beverage Corporation, Starbucks Corporation, Asahi Group Holdings, Dr Pepper Snapple Group, Danone, San Benedetto, Hangzhou Wahaha Group, Lotte Chilsung Beverage, Amul, Monster Energy Company, Arizona Beverage Company, JAB Holding Company, Keurig Dr Pepper, Illycaffè, The Coca-Cola Company, F&N Foods Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- PepsiCo

- Coca-Cola

- Nestle

- Ting Hsin International Group

- Uni-President Enterprises

- Suntory Beverage & Food

- Monster Beverage Corporation

- Starbucks Corporation

- Asahi Group Holdings

- Dr Pepper Snapple Group

- Danone

- San Benedetto

- Hangzhou Wahaha Group

- Lotte Chilsung Beverage

- Amul

- Monster Energy Company

- Arizona Beverage Company

- JAB Holding Company

- Keurig Dr Pepper

- Illycaffè

- The Coca-Cola Company

- F&N Foods