Tea Market By Type(Green Tea,Black Tea,Oolong Tea,Fruit/Herbal Tea,Others), By Packaging(Paperboards, Plastic Containers, Loose Tea, Aluminum Tins, Tea Bags), By Application(Residential, Commercial), By Distribution Channel(Supermarkets/ Hypermarkets, Specialty Stores, Convenience Stores, Online Stores, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

43309

-

Feb 2024

-

179

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

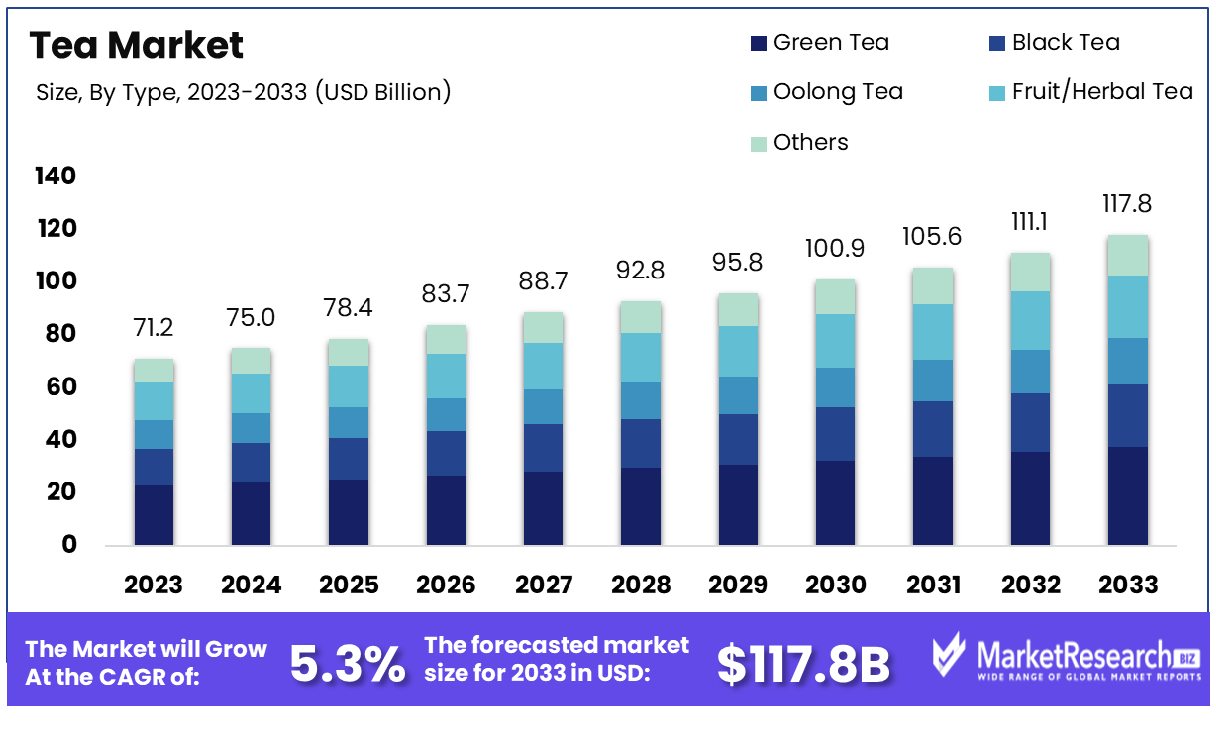

The Tea Market was valued at USD 71.2 billion in 2023. It is expected to reach USD 117.8 billion by 2033, with a CAGR of 5.3% during the forecast period from 2024 to 2033.

The surge in demand for different types of flavors and changes in customer preferences are some of the main key driving factors for the tea market. Tea is defined as a beverage developed by infusing hot water with some of the dried leaves of the camellia sinensis plant. These are typically grown in tropical and subtropical regional climates and it has flower which is evergreen shrub that can generate small white flowers.

The old and traditional tea-growing regions are China, India, Japan, and Sri Lanka. In recent years, there are new tea-manufacturing countries that have emerged, mostly Bangladesh, Kenya, and Vietnam. The origin affects the flavor features while soil type, plant type, altitude, and age of the tea plant are some of the impacting factors. Each region can generate any of the five types of tea but few regions are well-known for one or another type of tea. For example, Japan is well-known for producing green tea. China is popular for white tea and pu-erh whereas, Sri-Lanka is known for black tea.

According to an article published by Atlas Big in 2023, China is the largest tea manufacturer in the globe with 13,768,883 tonnes of production per year. India is the second largest tea producer with a production amount of 5,482,186.38 tonnes yearly. Similarly, Kenya is the third largest tea producer with 2,338,000 tonnes of production per year. As per the other report published by Worldunfolds in January 2024, China generates almost 68% of the global tea, Srilanka is the fourth tea producer and generates 18% of the global tea which is somewhere around 340,200 tonnes of production per year. This tea history has raised Sri Lanka’s GDP by 2% and strengthened its tea leadership.

Customers are changing their preferences due to the rise in various health diseases. Tea has several types of health benefits that can provide a good lifestyle to individuals as consuming black tea segment decreases cholesterol, tea also helps provide good and peaceful sleep and also lowers the chances of depression, it encourages more focus and alertness. Tea helps diminish the risk of hyperglycemia. The demand for tea will rapidly increase due to its several types of health benefits and a basic beverage that all customers look forward to in their day-to-day lives, which will help in market expansion during the forecast period.

Key Takeaways

- Market Growth: Tea Market was valued at USD 71.2 billion in 2023. It is expected to reach USD 117.8 billion by 2033, with a CAGR of 5.3% during the forecast period from 2024 to 2033.

- By Type: Green tea dominates the market, favored for its health benefits and diverse varieties.

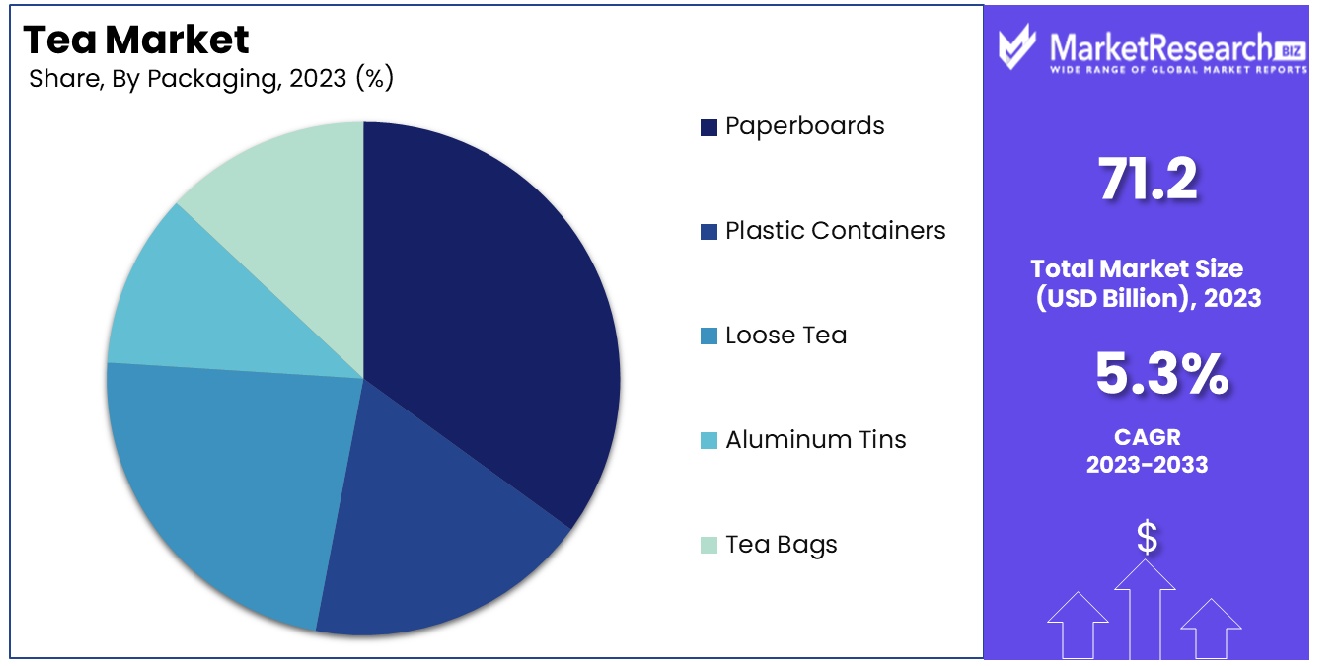

- By Packaging: Paperboards are the primary packaging choice, known for their eco-friendly appeal and versatility.

- By Application: Residential usage prevails, reflecting a trend towards home brewing and consumption.

- By Distribution Channel: Supermarkets/Hypermarkets lead in distribution, offering convenience and wide product availability to consumers.

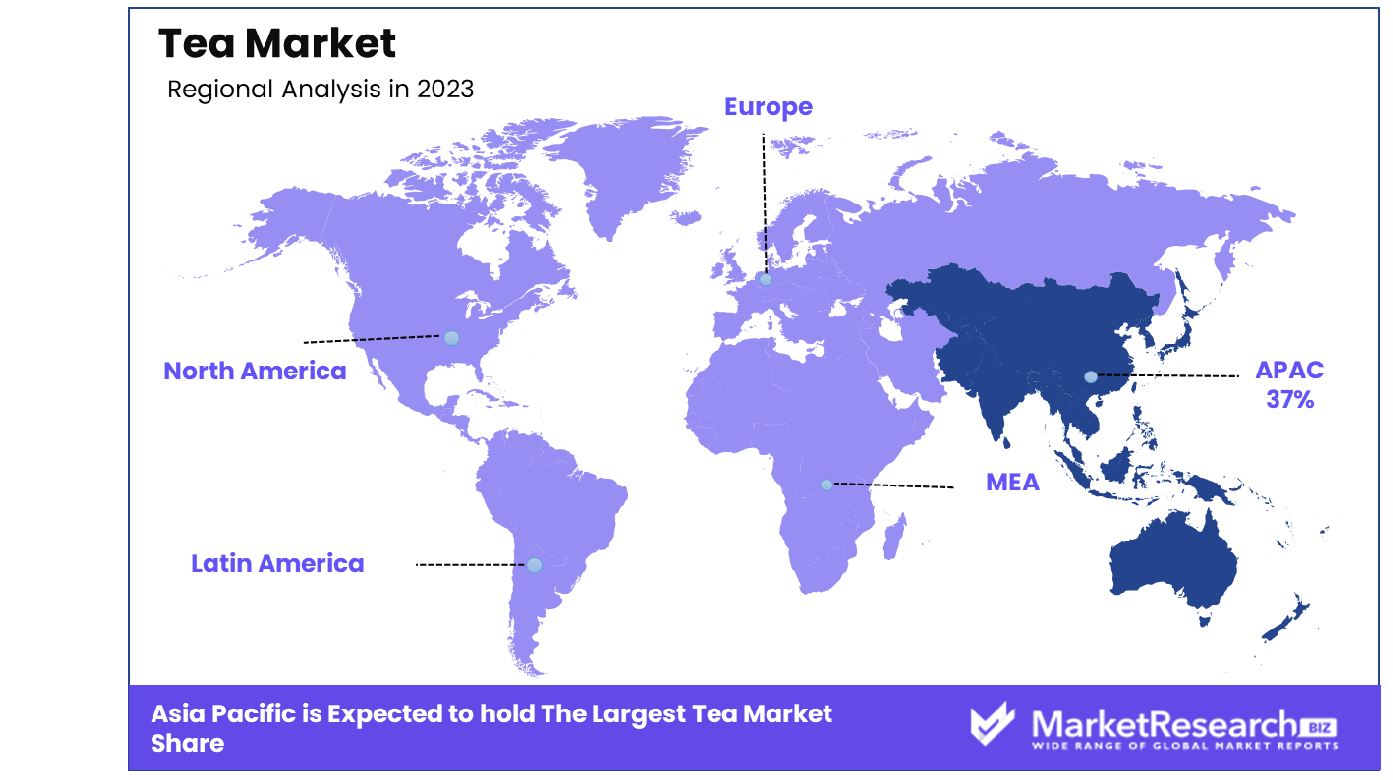

- Regional Dominance: Asia Pacific Dominates with a 37% Market Share in the Tea Industry.

- Growth Opportunity: Ethical sourcing trend boosts tea market growth; brands emphasize fair trade and organic practices. Culinary innovation expands the tea market, diversifying offerings.

Driving factors

Health and Wellness Trends Propel Tea Market Growth

The escalating focus on health and wellness significantly boosts the tea market. A study revealed that individuals who consume three or more cups of tea daily have a 21% reduced stroke risk compared to those who drink less than one cup. This growing health consciousness has magnified the appeal of tea, particularly green tea, renowned for its high antioxidant content. The perception of tea as a healthful, natural beverage is central to its market expansion, resonating with consumers' increasing pursuit of healthier lifestyles.

Premiumization Elevates Tea Consumption Dynamics

The demand for premium tea varieties is reshaping the market. Consumers exhibit a willingness to pay a premium for unique teas, organic options, and novel blends. Brands like Tazo have effectively elevated the tea experience, while Magic Hour's Wanderlust Collection exemplifies this trend, offering organic premium teas that underscore wellness and exotic appeal. This shift towards premiumization reflects a sophisticated consumer palate seeking more than just the traditional tea experience.

Ready-to-Drink Segment Accelerates Tea Market Expansion

The Ready-to-Drink (RTD) tea segment, marked by its convenience, caters to the fast-paced lifestyle of modern consumers. Brands like Lipton and Snapple have adeptly capitalized on this segment's growth rate, illustrating the market's adaptation to evolving consumer preferences. The RTD tea's rise is indicative of a broader trend where convenience, without compromising on quality, is paramount.

Restraining Factors

The Shift in Consumer Preference Challenges Black Tea Market

The tea market is seeing an impressive decline in the market for black tea of the traditional variety, a category that has traditionally been the dominant segment of the market. Consumers are increasingly gravitating toward alternative tea varieties such as green tea and herbal infusions, driven by health consciousness and diverse taste preferences.

For instance, major brands like Lipton have reported falling sales in their black tea bag segment. This shift in consumer preference poses a significant challenge to producers and marketers of traditional black tea, necessitating adaptation in product offerings and marketing strategies to align with the evolving tastes and health trends of consumers.

Private Label Competition Undercuts Established Tea Brands

The tea market is facing intense price competition from private label brands, which typically offer lower prices compared to established brands. Major retailers are increasingly promoting their private-label teas, such as Kroger's Simple Truth, which directly competes for shelf space and consumer attention.

This trend is not only squeezing the profit margins of major tea brands but also making it more challenging for them to secure prominent shelf placement in retail outlets. The rise of private labels reflects a broader market shift where cost-effectiveness and convenience are becoming pivotal in consumer purchasing decisions, thereby reshaping the competitive landscape of the tea market.

By Type Analysis

Green Tea Dominates The Market.

The Green Tea segment stands as the dominant segment in the tea market. This segment's leadership is attributed to the growing health-conscious consumer base, as green tea is renowned for its antioxidant properties and health benefits, including weight loss support and reduced risk of heart diseases. The increasing awareness of wellness and health, coupled with the global shift towards natural and organic products, has significantly bolstered the demand for green tea.

Black Tea, Oolong Tea, Fruit/Herbal Tea, and Others also form significant parts of the market. Black tea remains popular for its robust flavor and cultural significance in many regions, while oolong tea is appreciated by tea connoisseurs for its unique taste. Fruit and herbal teas have gained popularity due to their variety of flavors and perceived health benefits. The overall attraction of teas made from green due to its health benefits as well as global popularity puts it at the top of the market for tea.

By Packaging Analysis

Paperboard is the Dominant Packaging Material.

In packaging, Paperboards represent the dominant segment in the tea market. Paperboard packaging is preferred for its eco-friendly nature, as it is recyclable and biodegradable, aligning with the growing consumer demand for sustainable packaging solutions. Additionally, paperboards offer versatility in design, aiding brands in marketing and distinguishing their products on retail shelves.

Plastic Containers, Loose Tea, Aluminum Tins, and Tea Bags are also important segments. Tea bags, convenient and easy to use, have a significant market presence, particularly in Western countries. However, the environmental concerns associated with plastic and the move towards sustainable packaging underscore the leading position of paperboard packaging in the tea market.

By Application Analysis

Residential Areas Are The Primary Consumption Locations.

Residential segment use is the predominant application segment in the tea market. The widespread consumption of tea in households across the globe, driven by its role as a staple beverage in many cultures, fuels this segment. The home consumption of tea spans daily routines, and special occasions, and is often integral to social gatherings, highlighting its cultural significance.

The Commercial sector, which includes cafes, restaurants, and hotels, also significantly consumes tea, often offering specialized selections to cater to diverse consumer preferences. Despite this, the ingrained habit of tea consumption in residential settings, coupled with its role in daily life, underscores the dominance of the Residential application segment.

By Distribution Channel Analysis

Supermarkets And Hypermarkets Control Distribution Channels

Supermarkets/Hypermarkets are the leading distribution channel in the tea market. Their dominance is attributed to their wide reach, variety of choices, and convenience, offering consumers a one-stop solution for their tea purchasing needs. These retail giants cater to a broad consumer base, providing an extensive range of tea products, from premium to budget-friendly options.

Specialty Stores, Convenience Stores, Online Stores, and Others are also critical channels. Specialty stores offer curated selections, often focusing on premium and artisanal teas, while online stores have expanded the accessibility of diverse tea products. However, the comprehensive range and accessibility provided by Supermarkets/Hypermarkets solidify their status as the most significant distribution channel in the tea market.

Key Market Segments

By Type

- Green Tea

- Black Tea

- Oolong Tea

- Fruit/Herbal Tea

- Others

By Packaging

- Paperboards

- Plastic Containers

- Loose Tea

- Aluminum Tins

- Tea Bags

By Application

- Residential

- Commercial

By Distribution Channel

- Supermarkets/ Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Stores

- Others

Growth Opportunity

Ethical and Sustainable Sourcing Transforming the Tea Market

The burgeoning demand for ethical and sustainable sourcing in the tea industry presents a notable steady growth opportunity. Today's consumers, particularly millennials, are increasingly conscious of the origins and production processes of their tea. This shift in consumer behavior opens up avenues for tea companies to differentiate themselves through transparency in fair trade practices, organic farming methods, and environmentally friendly production processes.

Brands like Numi and Traditional Medicinals are leading this trend by emphasizing ethical sourcing. However, a significant challenge lies in overcoming consumer skepticism regarding the authenticity of corporate social responsibility claims.

Tea-based Culinary Innovation A New Frontier for Restaurants and Cafés

The rise of tea-based foods and beverages in cafes and restaurants provides an opportunity to grow the tea business. This trend involves the creative incorporation of tea into various culinary formats, such as tea pairings, tea-infused cocktails and mocktails, tea-flavored dishes, and tea smoothies.

This approach allows tea's diverse flavors to be explored in innovative and appealing ways, enhancing its appeal beyond traditional consumption. For instance, Starbucks' inclusion of tea lattes and tea-based refreshers showcases the potential of tea-based menu items. The challenge for the industry lies in broadening tea's appeal and availability beyond specialist tea shops to mainstream dining and café environments.

Latest Trends

Rising Demand for Functional and Specialty Teas

Consumers increasingly seek teas with health benefits and unique flavors. Functional teas infused with dried herbs, spices, and botanicals gain popularity for their wellness properties. Specialty teas, including rare blends and single-origin varieties, cater to discerning tastes, driving market robust growth and diversification.

Sustainable Practices Reshaping the Tea Industry

The tea market witnesses a shift towards sustainability, driven by consumer awareness and environmental concerns. Producers adopt eco-friendly cultivation methods, such as organic farming and regenerative agriculture. Ethical sourcing, fair trade practices, and recyclable packaging emerge as key considerations, influencing purchasing decisions and industry standards.

Regional Analysis

Asia Pacific Dominates with 37% Market Share in Tea Industry

Asia Pacific's commanding 37% share in the global tea market is largely attributable to its deep-rooted tea culture and extensive tea-growing areas. Major tea-producing countries like China, India, and Sri Lanka significantly contribute to this high market share. These regions possess ideal climatic conditions for tea cultivation, coupled with a rich history and tradition of tea consumption. Furthermore, the increasing trend of premiumization and health consciousness among consumers in the Asia Pacific bolsters the demand for diverse tea varieties, including green and herbal teas.

The market for tea within Asia Pacific is marked by the diversity of teas on offer which range in price from classic black teas to modern herbal infusions. The burgeoning café culture in urban centers, combined with the growing popularity of tea-based beverages among younger demographics, further energizes the market dynamics. Additionally, the export of high-quality teas to Western countries continues to be a significant driver of market rapid growth in this region.

Europe's Niche in the Global Tea Market

Europe's tea market, while smaller than Asia Pacific's, is distinguished by its preference for specialty and premium teas. The increasing health awareness among European consumers, along with the popularity of organic and fair-trade products, drives the market. Tea stores and online platforms are witnessing an increase in sales of specialty teas, which indicates a rising desire for diverse and premium teas.

North America's Emerging Tea Market

Within North America, the tea market is undergoing a shift, triggered by a change in preference from traditional coffee to tea. The rising awareness of health benefits associated with tea consumption, especially green tea, is propelling the market. The United States shows a growing trend in iced and ready-to-drink tea products, expanding the market beyond conventional hot tea beverages. This is a sign of a growing diversity in the tea consumption habits of the region.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

The tea market is characterized by a diverse array of major companies, each contributing unique strengths and strategic approaches. Twinings, with its British heritage, is renowned for its wide range of classic blends and flavored teas, holding a significant position in the global market opportunities. Their brand is synonymous with quality and tradition, appealing to a broad consumer base.

Tetley, under Tata Global Beverages, is a key player known for its innovation in tea products, including the introduction of round tea bags and drawstring variants. Their global presence and consistent quality make them a dominant force in the tea industry.

Harney & Sons in the USA, famed for their high-quality loose teas and unique blends, cater to a niche market that values premium and specialty teas. Their focus on craftsmanship and luxury packaging sets them apart in the premium segment.

Market Key Players

- Twinings (UK)

- Tetley (owned by Tata Global Beverages)

- Harney & Sons (USA)

- Dilmah (Sri Lanka)

- Gujarat Tea Processors & Packers Ltd (Wagh Bakri brand)

- Society Tea (India)

- Tata Tea (India)

- Red Rose Tea (owned by Teekanne - US and Unilever - Canada)

- Tim Hortons (owned by Restaurant Brands International)

- Akbar Tea (Sri Lanka)

- Alghazaleen Tea (Sri Lanka)

- Bogawantalawa (BPL Teas)

- Heladiv (Sri Lanka)

- Tazo and Teavana (Starbucks)

- Luzianne (Reily Foods Company)

Recent Development

- In December 2023, KOI Thé, the renowned milk tea brand, partnered with Suyen Corporation to enter the Philippines, opening its flagship store in Makati City. They introduced new offerings, Dark Lava Milo O and Strawberry Macchiato, to the Philippine market.

- In November 2023, Shavuot International introduced "Boost" tea, a locally manufactured blend of turmeric, ginger, and ginseng. This herbal tea aims to provide a natural energy boost as an alternative to caffeine.

- In November 2023, Heytea, a popular beverage chain in China, launched a milk-based product exclusively for new-style tea beverages, catering to the evolving tastes of tea drinkers in the competitive market.

- In November 2023, Coca-Cola India introduced Honest Tea, a ready-to-drink organic green tea-based beverage sourced exclusively from Luxmi Tea's Makaibari Tea Estate, known for its exceptional Darjeeling tea. Honest Tea offers two flavors: Lemon-Tulsi and Mango, catering to diverse consumer preferences.

Report Scope

Report Features Description Market Value (2023) USD 71.2 Billion Forecast Revenue (2033) USD 117.8 Billion CAGR (2024-2032) 5.3% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Green Tea,Black Tea,Oolong Tea,Fruit/Herbal Tea,Others), By Packaging(Paperboards, Plastic Containers, Loose Tea, Aluminum Tins, Tea Bags), By Application(Residential, Commercial), By Distribution Channel(Supermarkets/ Hypermarkets, Specialty Stores, Convenience Stores, Online Stores, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Twinings (UK), Tetley (owned by Tata Global Beverages), Harney & Sons (USA), Dilmah (Sri Lanka), Gujarat Tea Processors & Packers Ltd (Wagh Bakri brand), Society Tea (India), Tata Tea (India), Red Rose Tea (owned by Teekanne - US and Unilever - Canada), Tim Hortons (owned by Restaurant Brands International), Akbar Tea (Sri Lanka), Alghazaleen Tea (Sri Lanka), Bogawantalawa (BPL Teas), Heladiv (Sri Lanka), Tazo and Teavana (Starbucks), Luzianne (Reily Foods Company) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Twinings (UK)

- Tetley (owned by Tata Global Beverages)

- Harney & Sons (USA)

- Dilmah (Sri Lanka)

- Gujarat Tea Processors & Packers Ltd (Wagh Bakri brand)

- Society Tea (India)

- Tata Tea (India)

- Red Rose Tea (owned by Teekanne - US and Unilever - Canada)

- Tim Hortons (owned by Restaurant Brands International)

- Akbar Tea (Sri Lanka)

- Alghazaleen Tea (Sri Lanka)

- Bogawantalawa (BPL Teas)

- Heladiv (Sri Lanka)

- Tazo and Teavana (Starbucks)

- Luzianne (Reily Foods Company)