Reactive Diluent Market By Reactive Diluent Type (Aliphatic, Aromatic, Cycloaliphatic, Others), By Application (Paints and Coatings, Adhesives and Sealants, Composites, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

9733

-

July 2023

-

161

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

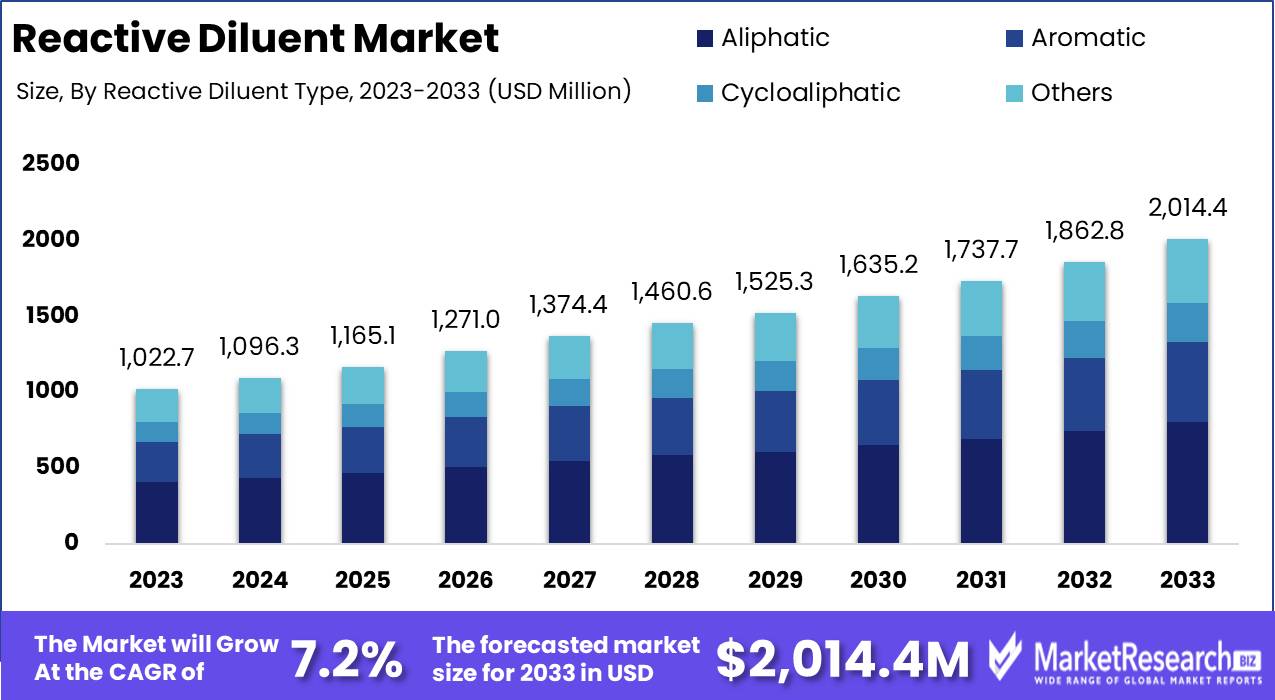

The Global Reactive Diluent Market was valued at USD 1022.7 Mn in 2023. It is expected to reach USD 2014.4 Mn by 2033, with a CAGR of 7.2% during the forecast period from 2024 to 2033.

The Reactive Diluent Market involves the production, distribution, and application of reactive diluents, which are specialized chemicals used to modify the viscosity of resins in various industrial processes. These diluents, known for their ability to participate in the curing process, enhance the performance and processing characteristics of epoxy resins, polyurethanes, and other polymer systems.

Key drivers include their critical role in producing high-performance coatings, adhesives, and sealants, alongside growing demand in automotive, construction, and electronics industries. Innovations in eco-friendly formulations and regulatory compliance further propel market growth, emphasizing the balance between performance optimization and environmental sustainability.

The Reactive Diluent Market is experiencing robust growth, driven by its essential role in enhancing the performance and processing characteristics of resins in various industrial applications. Reactive diluents, by participating in the curing process, enable the production of high-performance coatings, adhesives, and sealants, which are pivotal in sectors such as automotive, construction, and electronics.

A significant market driver is the environmental advantage offered by reactive diluents. These chemicals can reduce VOC emissions by up to 90% compared to traditional solvents, contributing to safer working environments and a lower environmental impact. This aligns well with the increasing regulatory pressures and industry shifts towards sustainable practices.

Innovations and product launches further fuel market momentum. For instance, Huntsman's introduction of the snap cure VITROX RTM 00410 resin exemplifies advancements aimed at high-volume manufacturing of lightweight and cost-effective composite parts. This product not only underscores the industry's move towards high-efficiency solutions but also highlights the potential for reactive diluents to support large-scale, sustainable manufacturing processes.

As companies prioritize eco-friendly formulations, the market is witnessing a blend of performance optimization and environmental sustainability. The demand for reactive diluents is also buoyed by their application in producing advanced materials that meet stringent industry standards. Consequently, market participants are focusing on R&D to develop innovative diluent formulations that align with evolving industry needs and environmental regulations.

Key Takeaways

- Market Value: The Global Reactive Diluent Market was valued at USD 1022.7 Mn in 2023. It is expected to reach USD 2014.4 Mn by 2033, with a CAGR of 7.2% during the forecast period from 2024 to 2033.

- By Reactive Diluent Type: Aliphatic diluents are prevalent, comprising 40% of the market, utilized extensively for their reactive properties in various formulations.

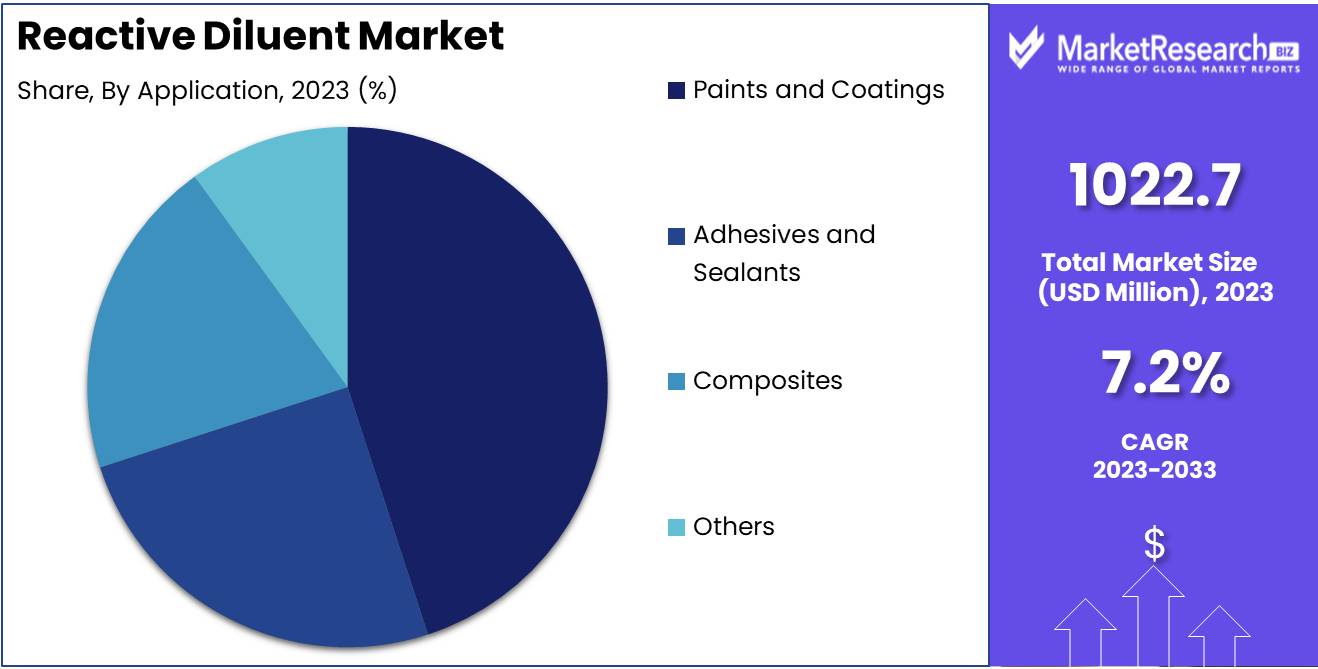

- By Application: Paints and Coatings represent the largest application segment with 45%, emphasizing the critical role of reactive diluents in improving application properties and performance.

- Regional Dominance: Asia Pacific holds a significant 40% of the market, reflecting the region's robust industrial growth and expanding manufacturing sectors.

Driving factors

Demand in Coatings and Adhesives Driving Market Growth

The burgeoning demand for coatings and adhesives is a key driver of market growth. As industries seek more advanced and specialized materials, the need for high-performance coatings and adhesives has escalated. These products are crucial in various sectors, including automotive, aerospace, packaging, and consumer goods, where durability, efficiency, and quality are paramount.

The market is witnessing significant innovation in formulations that enhance performance characteristics such as strength, flexibility, and environmental resistance. This innovation fuels the adoption of advanced coatings and adhesives, contributing to robust market expansion. Additionally, regulatory standards emphasizing eco-friendly and sustainable products are pushing manufacturers to develop more sophisticated solutions, further driving demand.

Increased Use in Electronics Boosting Market Expansion

The increased use of the product in the electronics industry is another significant growth driver. As the electronics sector advances, there is a heightened demand for materials that can meet the rigorous requirements of modern electronic devices. These materials are essential in applications ranging from semiconductors and circuit boards to displays and batteries.

The push towards miniaturization, higher performance, and greater energy efficiency in electronics has led to the adoption of advanced materials with superior electrical, thermal, and mechanical properties. This trend is particularly pronounced in the rapidly growing segments of consumer electronics, electric vehicles, and renewable energy technologies, where cutting-edge materials are critical to innovation and performance.

Growth in Construction Industry Spurring Market Demand

The construction industry’s growth significantly contributes to the market’s expansion. As urbanization accelerates and infrastructure development projects proliferate globally, there is an increasing need for high-quality construction materials. Products used in coatings and adhesives are vital for enhancing the durability, aesthetics, and safety of buildings and infrastructure.

The trend towards sustainable and energy-efficient construction practices is driving the adoption of advanced materials that meet these criteria. This includes the use of materials that offer superior insulation, fire resistance, and environmental sustainability. The construction sector’s steady growth ensures a continuous demand for these materials, underpinning their critical role in market growth.

Restraining Factors

Health and Environmental Concerns Driving Market Innovation

Health and environmental concerns are significant drivers of market growth, pushing companies towards innovation and sustainability. Consumers and regulators increasingly demand products that are safe, non-toxic, and environmentally friendly. This trend is particularly strong in industries such as coil coatings, adhesives, electronics, and construction, where the impact of materials on health and the environment is closely scrutinized.

Companies are investing heavily in research and development to create formulations that reduce or eliminate harmful substances, minimize environmental footprints, and enhance safety. For example, the development of bio-based or waterborne coatings and adhesives is gaining traction as they offer lower volatile organic compound (VOC) emissions and improved environmental profiles. This shift not only aligns with regulatory requirements but also meets the growing consumer preference for greener products, driving market growth.

Fluctuating Raw Material Prices Impacting Market Dynamics

Fluctuating raw material prices present both challenges and opportunities for the market. The volatility in the cost of raw materials, driven by factors such as supply chain disruptions, geopolitical tensions, and changing demand dynamics, can significantly impact production costs and profitability. Companies must navigate these fluctuations by implementing effective cost management strategies, such as diversifying supply sources, improving production efficiencies, and using alternative materials.

Despite the challenges, price volatility can also spur innovation as companies seek to develop more cost-effective and resilient formulations. For instance, the exploration of synthetic or recycled alternatives to traditional raw materials can reduce dependence on volatile commodities, stabilizing costs and ensuring supply chain continuity.

By Reactive Diluent Type Analysis

Aliphatic dominated the By Reactive Diluent Type segment of the Reactive Diluent Market in 2023, capturing more than a 40% share.

In 2023, Aliphatic held a dominant market position in the By Reactive Diluent Type segment of the Reactive Diluent Market, capturing more than a 40% share. This leadership is driven by the advantageous properties of aliphatic reactive diluents, which include excellent compatibility with various resins, low viscosity, and superior weathering resistance. These properties make aliphatic reactive diluents highly suitable for applications in coatings, adhesives, and sealants, where performance and durability are critical.

In parallel, the heat exchanger market has been experiencing significant advancements and growth. Gasketed Plate Heat Exchangers have seen widespread adoption due to their efficiency in handling a wide range of fluids and ease of maintenance.

Welded Plate Heat Exchangers are also gaining traction, particularly in applications requiring high pressure and temperature resistance. Their robust construction and ability to handle aggressive media make them suitable for use in petrochemical, power generation, and industrial processing sectors.

Brazed Plate Heat Exchangers, known for their compact size and high thermal efficiency, are increasingly used in residential and commercial HVAC systems, refrigeration, and renewable energy applications.

Other types of heat exchangers, such as air-cooled and shell-and-tube heat exchangers, continue to play a vital role in specific industrial applications. These heat exchangers provide tailored solutions for unique thermal management challenges, further contributing to the overall growth and diversification of the heat exchanger market.

By Application Analysis

Paints and Coatings dominated the By Application segment of the Reactive Diluent Market in 2023, capturing more than a 45% share.

In 2023, Paints and Coatings held a dominant market position in the By Application segment of the Reactive Diluent Market, capturing more than a 45% share. This dominance is attributed to the increasing demand for high-performance, durable, and environmentally friendly coatings across various industries. Reactive diluents in paints and coatings help improve the application properties, enhance the final product's performance, and reduce volatile organic compound (VOC) emissions, aligning with stringent environmental regulations and sustainability goals.

In parallel, the heat exchanger market has witnessed substantial developments across several key sectors. In HVAC & Refrigeration, the demand for efficient thermal management solutions has driven the adoption of advanced heat exchangers.

The Chemicals industry, with its diverse processing needs, relies heavily on heat exchangers for efficient thermal regulation. The ability to handle corrosive and high-temperature fluids makes heat exchangers indispensable in chemical manufacturing processes, ensuring consistent product quality and operational safety.

In the Petrochemicals, Oil & Gas sector, the need for robust and reliable heat exchange solutions is paramount. Heat exchangers are critical in refining processes, gas processing, and other applications where high-pressure and high-temperature conditions prevail. The sector's continuous exploration and production activities fuel the demand for advanced heat exchanger technologies.

Power Generation facilities utilize heat exchangers to optimize the thermal efficiency of power plant boiler, including fossil fuel, nuclear fusion, and renewable energy sources. Effective heat management is vital for maximizing energy output and reducing operational costs, driving the adoption of cutting-edge heat exchanger systems.

The Food & Beverage industry benefits from heat exchangers in processes such as pasteurization, sterilization, and refrigeration. Maintaining strict temperature control is essential for product safety and quality, making heat exchangers integral to food processing operations.

In the pulp and paper chemicals industry, heat exchangers play a critical role in energy recovery and process efficiency. The industry's focus on sustainable practices and cost reduction has led to increased use of heat exchangers to optimize thermal management and reduce energy consumption.

Key Market Segments

By Reactive Diluent Type

- Aliphatic

- Aromatic

- Cycloaliphatic

- Others

By Application

- Paints and Coatings

- Adhesives and Sealants

- Composites

- Others

Growth Opportunity

Development of Eco-Friendly Diluents

As environmental regulations tighten globally, the demand for eco-friendly products is surging. The paints and coatings industry is at the forefront of this shift, with a significant emphasis on developing eco-friendly diluents. These sustainable alternatives to traditional solvents offer reduced volatile organic compound (VOC) emissions, aligning with the increasing consumer preference for environmentally responsible products. Companies investing in green chemistry and sustainable formulations are likely to gain a competitive edge.

Innovations in bio-based and waterborne diluents not only enhance product safety but also open up new market segments, particularly in regions with stringent environmental standards such as Europe and North America. This trend presents a robust growth opportunity, as manufacturers can leverage eco-friendly credentials to differentiate their offerings and appeal to environmentally conscious consumers and regulators.

Expansion in Emerging Markets

Emerging markets represent a significant growth frontier for the global paints and coatings industry in 2024. Rapid urbanization, infrastructure development, and rising disposable incomes in regions such as Asia-Pacific, Latin America, and Africa are driving the demand for paints and coatings. These markets offer a fertile ground for expansion due to their relatively lower market penetration and high growth potential. Moreover, the increasing focus on local manufacturing and the adoption of advanced technologies in these regions further stimulate market growth.

Strategic investments in production facilities, distribution networks, and localized product offerings can enable companies to capture a substantial share of these burgeoning markets. Firms that can adapt to the unique needs and preferences of consumers in emerging economies will be well-positioned to capitalize on the substantial opportunities these markets offer.

Latest Trends

Rise in Sustainable Products

The trend towards sustainability continues to reshape the global paints and coatings market in 2024. Consumer awareness and regulatory pressures are driving demand for products that are environmentally friendly and sustainable. Companies are increasingly investing in the development of paints and coatings that minimize environmental impact, such as low-VOC, waterborne, and bio-based products.

This shift is not merely a compliance measure but a strategic imperative as brands seek to differentiate themselves through green credentials. Sustainable products are becoming a core value proposition, attracting eco-conscious consumers and meeting stringent environmental regulations. As a result, firms that prioritize sustainability in their product development are likely to gain a competitive advantage and increase market share.

Technological Advancements in Formulations

Technological innovation is another pivotal trend in the paints and coatings industry for 2024. Advances in formulation technology are enabling the creation of high-performance, multi-functional coatings that offer enhanced durability, improved aesthetics, and additional benefits such as self-cleaning, anti-microbial, and heat-reflective properties. Nanotechnology and smart coatings are at the forefront of this evolution, providing superior performance while also addressing specific application needs across various industries.

Companies that harness these technological advancements can develop differentiated products that meet the evolving demands of consumers and industrial clients. Additionally, the integration of digital tools in the R&D process is accelerating innovation cycles, allowing for quicker adaptation to market trends and customer preferences.

Regional Analysis

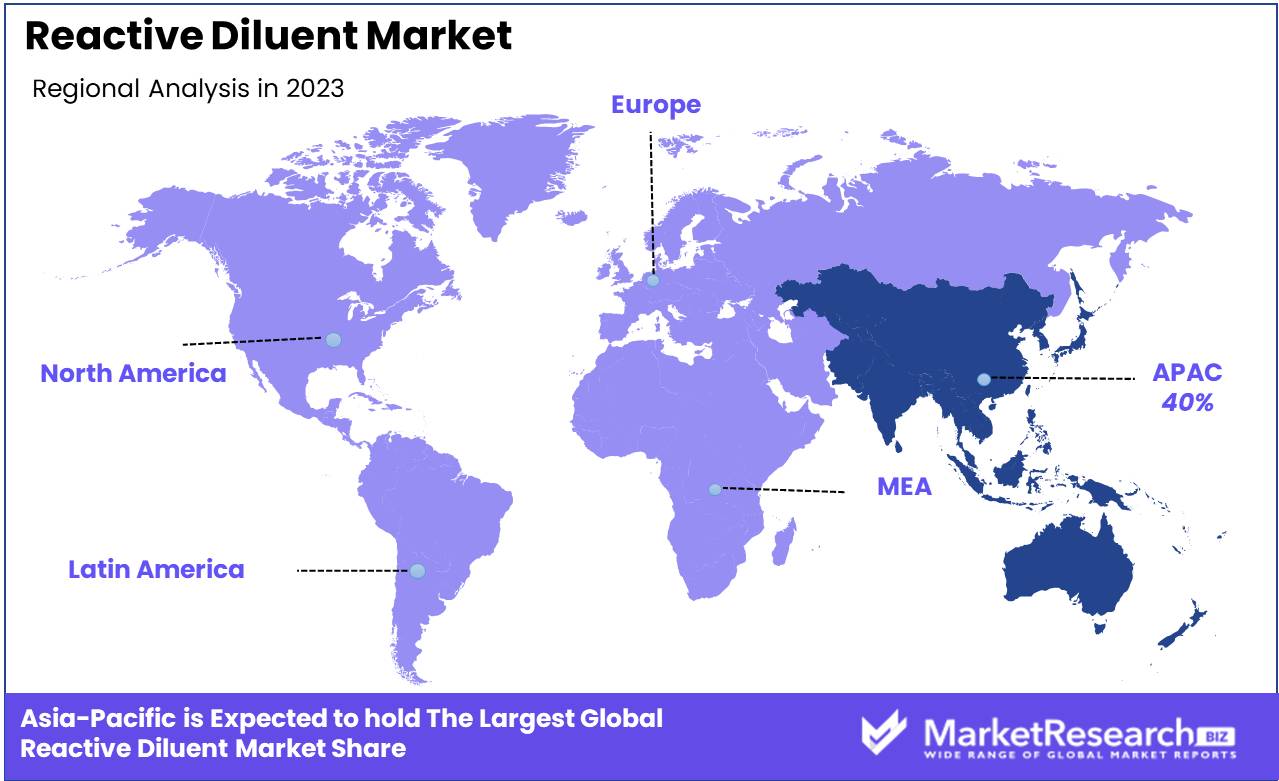

he Asia Pacific region holds 40% of the Reactive Diluent Market, fueled by its expansive industrial base and the thriving construction, automotive, and electronics sectors

Asia Pacific dominates the market, accounting for 40% of the global share. This dominance is attributed to the region's robust industrial base, particularly in countries like China, India, and Japan, where the construction, automotive, and electronics industries are thriving. The demand for high-performance coatings, adhesives, and composites, which extensively use reactive diluents, is significantly high. Additionally, the region benefits from cost-effective production and a rapidly growing economy, further propelling market growth.

North America is a significant market for reactive diluents, driven by technological innovation and stringent environmental regulations that promote the use of low-VOC and sustainable materials. The United States and Canada lead this region, with a strong focus on advanced manufacturing techniques and high-performance material applications in aerospace, automotive, and construction sectors.

Europe follows closely, with considerable market share driven by the region's stringent environmental policies and high standards for industrial applications.

Latin America shows moderate growth, with Brazil and Mexico being the primary markets. The demand is fueled by the expanding construction and automotive sectors, although market growth is somewhat tempered by economic fluctuations and lower industrial output compared to more developed regions.

Middle East & Africa present emerging opportunities for the reactive diluent market, particularly in the construction and oil & gas industries. The UAE and South Africa are notable markets, with increasing infrastructure projects and industrial activities driving demand.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the Reactive Diluent Market is characterized by the active participation and strategic initiatives of several key players who are driving innovation, sustainability, and market expansion. Leading the market, Hexion Inc. and Huntsman Corporation leverage their extensive product portfolios and strong global presence to maintain their competitive edge. Hexion's focus on low-VOC and sustainable solutions aligns with industry trends towards environmentally friendly products, while Huntsman continues to innovate with advanced formulations aimed at enhancing performance in various industrial applications.

Aditya Birla Chemicals and Kukdo Chemical Co., Ltd. are significant players in the Asia Pacific region, contributing to the market with their high-quality products and expanding production capabilities. Their strategic investments in R&D and production technology have positioned them as key suppliers in the growing markets of China and India.

Evonik Industries AG and Adeka Corporation are at the forefront of technological advancements, emphasizing the development of specialty reactive diluents that cater to niche applications in the automotive and electronics sectors. Evonik's strong focus on sustainability and innovation has enabled it to capture a significant share in the European market.

Cargill, Incorporated and EMS-Griltech are diversifying their portfolios to include bio-based reactive diluents, reflecting the industry's shift towards greener alternatives. Their efforts are aimed at reducing the environmental impact of chemical manufacturing, thus appealing to eco-conscious consumers and regulatory bodies.

Olin Corporation and SACHEM, Inc. are leveraging their chemical expertise and extensive distribution networks to expand their market reach, particularly in North America and Europe. Their focus on customer-centric solutions and high-performance products drives their market growth.

Atul Ltd. and Arkema S.A. are enhancing their market positions through strategic acquisitions and collaborations, aiming to broaden their product offerings and improve market penetration. Arkema's recent innovations in UV-curable reactive diluents highlight its commitment to technological progress.

Bluestar Wuxi Petrochemical Co., Ltd. and Cardolite Corporation are focusing on expanding their footprint in emerging markets, utilizing their strong manufacturing capabilities and expertise in specialty chemicals. Cardolite's emphasis on renewable raw materials sets it apart in the competitive landscape.

DIC Corporation continues to strengthen its market position through continuous innovation and a diverse product portfolio, catering to a wide range of industrial applications.

Market Key Players

- Hexion Inc.

- Huntsman Corporation

- Aditya Birla Chemicals

- Kukdo Chemical Co., Ltd.

- Evonik Industries AG

- Adeka Corporation

- Cargill, Incorporated

- EMS-Griltech

- Olin Corporation

- SACHEM, Inc.

- Atul Ltd.

- Arkema S.A.

- Bluestar Wuxi Petrochemical Co., Ltd.

- Cardolite Corporation

- DIC Corporation

Recent Development

- July 2024, BASF SE, a leading chemical company, launched a new eco-friendly reactive diluent for coatings, reducing VOC emissions by 30% and improving sustainability in industrial applications.

- May 2024, Evonik Industries AG, specializing in specialty chemicals, introduced a high-performance reactive diluent for adhesives, enhancing product durability and flexibility.

Report Scope

Report Features Description Market Value (2023) USD 1022.7 Mn Forecast Revenue (2033) USD 2014.4 Mn CAGR (2024-2033) 7.2% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Reactive Diluent Type (Aliphatic, Aromatic, Cycloaliphatic, Others), By Application (Paints and Coatings, Adhesives and Sealants, Composites, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Hexion Inc., Huntsman Corporation, Aditya Birla Chemicals, Kukdo Chemical Co., Ltd., Evonik Industries AG, Adeka Corporation, Cargill, Incorporated, EMS-Griltech, Olin Corporation, SACHEM, Inc., Atul Ltd., Arkema S.A., Bluestar Wuxi Petrochemical Co., Ltd., Cardolite Corporation, DIC Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Hexion Inc.

- Huntsman Corporation

- Aditya Birla Chemicals

- Kukdo Chemical Co., Ltd.

- Evonik Industries AG

- Adeka Corporation

- Cargill, Incorporated

- EMS-Griltech

- Olin Corporation

- SACHEM, Inc.

- Atul Ltd.

- Arkema S.A.

- Bluestar Wuxi Petrochemical Co., Ltd.

- Cardolite Corporation

- DIC Corporation