Coil Coatings Market By Product Type(Polyester, Silicone Modified Polyester (SMP), Others), By Application Type(Construction, Automotive, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

2317

-

May 2023

-

166

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

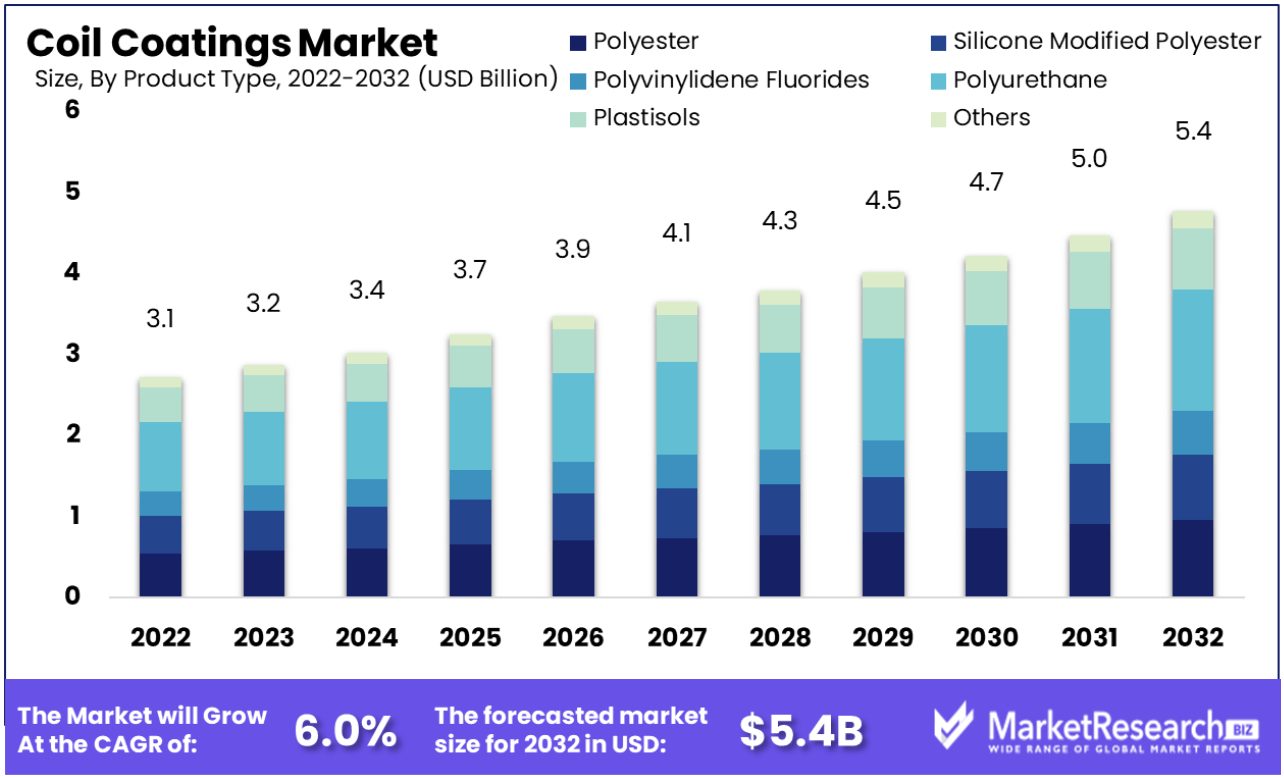

Coil Coatings Market size is expected to be worth around USD 5.4 Bn by 2032 from USD 3.1 Bn in 2022, growing at a CAGR of 6.0% during the forecast period from 2023 to 2032.

The upsurge in demand for housing and industrialization in developing countries is one of the key factors that is driving the coil coating market. Coil coating has been differentiated by its resistance capability, flexibility, and corrosion resistance. Furthermore, the coil coating market is expanding due to high requirements in the end-use industries.

The construction and infrastructure activity, especially in developing countries will witness exceptional growth for the coil coating industry. For example, in the construction sector coil coating and roofing systems are widely used. This coating offers a premium shield against any environmental calamities. The main resins that are used in construction are polyester resin, silicone-modified polyester segment, and PVDF (polyvinylidene fluorides).

With the high demand for construction codes that advertise energy-efficient structures, builders and customers are slowly moving towards construction tactics that provide quality performance and save energy for a longer duration.

Furthermore, coil coating offers infrared reflective pigment technology that aids in controlling the indoor temperature of the building. This procedure helps to consume energy for cooling, making the coil coating energy effective and the most preferred choice for all coil products that are used in building construction works.

It is also used to build the downspouts for waterproof installation. The demand for coil coating will grow rapidly due to the rise in industrialization and substantial funding made in coil coating by downstream sectors. Additionally, coil coating provides a wide range of colors, textures, and finishing that helps designers and construction engineers with multiple options to get their designed look.

Whether the construction is in wood with modern finishing, coil coating will provide different design options without compromising on high-end performance. These factors will help the coil coating market to expand exceptionally in the coming future.

Driving factors

Downstream Diversification: Broad Industrial Applications Spur Market Expansion

The growth of the coil coatings market is significantly driven by the increasing demand from various downstream industries. Coil coatings are used extensively in industries such as automotive, appliance manufacturing, and HVAC systems due to their durability, corrosion resistance, and aesthetic appeal. As these industries expand, so does the demand for coil coatings, which are essential for adding value and functionality to metal substrates.

The versatility of coil coatings in terms of color, finish, and protective properties makes them suitable for a wide range of applications, from vehicle parts to home appliances. As downstream industries innovate and grow, they drive the development of new coil coating formulations to meet specific performance requirements.

The long-term impact of this trend suggests a sustained growth trajectory for the coil coatings market, driven by continuous industrial diversification and innovation. The market is expected to evolve with advancements in coating technology and the emergence of new industrial applications.

Building(Construction) Sector’s Rising Demand Shapes Coil Coatings Market Dynamics

The coil coatings market is experiencing a significant boost from the high demand within the construction industry. Coil coatings have become an indispensable tool in the construction industry due to their weather resistance, energy efficiency, and aesthetic versatility. Their increased usage for roofing, wall cladding, and insulation panels reflects this industry's ongoing expansion, especially residential and commercial building projects which increase demand.

As urbanization and infrastructure development advances in emerging economies, so too does the need for durable and energy-saving building materials. Coil coatings meet this need by offering long-term aesthetic appeal while conserving energy usage within buildings.

This trend will have lasting ramifications on the coil coatings market, with an increasing focus on eco-friendly coating solutions becoming ever more significant. Furthermore, construction industry technological innovations - such as prefabricated components - may provide opportunities to grow the market further.

Emerging Market Momentum: Industrialization Fuels Demand

Rapid industrialization in emerging economies is a key catalyst for the growth of the coil coatings market. Countries in regions such as Asia-Pacific, Latin America, and parts of Africa are witnessing significant industrial growth, which in turn fuels the demand for coil coatings in various applications. The industrial expansion in these regions encompasses a range of sectors, from construction and automotive to appliances and energy, all of which utilize coil coatings.

This industry growth is accompanied by increased investments in infrastructure and manufacturing facilities, further driving the demand for coated metal products. The unique environmental conditions and emerging regulatory frameworks in these economies also influence the development of specific coil coating formulations.

Coil Coatings in the Roofing Industry Drive Market Growth

The use of coil coatings in the roofing industry is a significant driver of market growth. In the roofing sector, coil coatings are prized for their ability to offer protection against the elements, UV resistance, and energy efficiency. The rising demand for metal roofing systems in both residential and commercial constructions has increased the use of coil coatings.

As the roofing industry continues to evolve, with a focus on sustainability and energy efficiency, coil coatings are increasingly preferred for their ability to reflect sunlight and reduce cooling costs. Innovations in coil coatings, such as cool roof technology and enhanced aesthetic finishes, further bolster their appeal in the roofing adhesives sector. The Plastisols with Coil Coatings market is witnessing steady growth due to increasing demand from various end-use industries.

Restraining Factors

Heavy Weight of Material Restrains Coil Coatings Market Growth

The heavyweight of materials used in coil coatings can be a significant limiting factor for market growth. This heaviness can result in increased transportation and handling costs, making coil-coated products less competitive compared to lighter alternatives. In industries where weight reduction is a priority, such as in automotive or aerospace manufacturing, the preference may shift to lighter materials, which may not require or be suitable for coil coatings. This preference impacts the demand for coil coatings, as market opportunities in lightweight-focused industries become more limited.

High Cost of Processes Restrains Coil Coatings Market Growth

The high cost of coil coating processes, encompassing the expenses of raw materials, energy, and technology, poses a barrier to market growth. The investment required for setting up and maintaining coil coating lines is substantial, and the operational costs can be high due to energy consumption and the need for specialized equipment. These factors make coil coatings less attractive for manufacturers looking for cost-efficient solutions, especially in a market where reducing production costs is a key priority.

Growing Preference for Liquid Coatings Restrain Coil Coatings Market Growth

The increasing preference for liquid coatings in various applications can restrain the growth of the coil coatings market. Liquid coatings are often perceived as offering more versatility in terms of application methods and finish types. They can be applied to a broader range of substrates and are sometimes favored for their aesthetic finishes. This shift in preference towards liquid coatings can lead to reduced demand for coil coatings in certain applications, impacting the market growth.

Segmentation Analysis of the Coil Coatings Market

By Product Type Analysis

Polyester-based coil coatings lead the product type segment, primarily due to their balance of performance, cost-effectiveness, and versatility. Polyester coatings are renowned for their good mechanical properties, resistance to environmental degradation, and wide color range. This segment's growth is propelled by the demand in various applications, notably in the construction and automotive sectors, where durability and aesthetic appeal are key.

SMP coatings are valued for their enhanced weatherability. PVDF coatings are chosen due to their excellent chemical resistance and durability, making them suitable for harsher environments. The Polyurethane Adhesives coating offers outstanding finish qualities and resistance to abrasion. Each of these sub-segments caters to specific performance requirements and end-use applications, contributing to the overall market diversity.

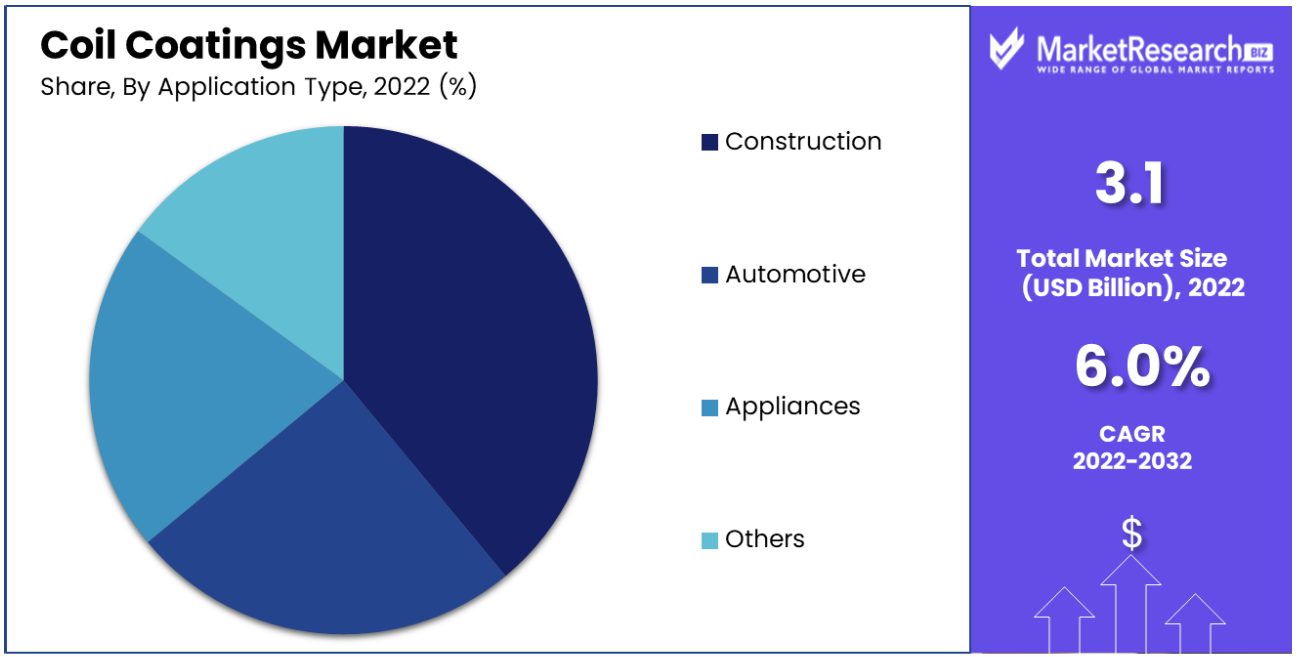

By Application Type Analysis

The construction industry is the largest consumer of coil coatings, driving the demand for aesthetically pleasing, durable, and weather-resistant materials. Coil coating technology is used in exterior building applications like metal roofing, wall panels, and gutters. Their ability to provide long-lasting color and protection against corrosion, UV light, and harsh weather conditions makes them integral to modern construction practices.

In the automotive industry, coil coating technology is used for both protection and aesthetic enhancement of vehicle components. In the appliance segment, these coatings are essential for the durability and appearance of household and commercial appliances. The 'others' category encompasses a range of industries, including furniture and industrial equipment, further expanding the market's application scope.

The coil coatings market is characterized by the dominance of polyester coatings, attributed to their widespread applications and optimal balance of performance and cost. The construction sector emerges as the primary application area, supported by the growing demand for durable and aesthetically pleasing building materials. The market's growth is also influenced by emerging applications in automotive and appliances, showcasing the versatility and adaptability of coil coatings to various industry needs.

Key Market Segments

By Product Type

- Polyester

- Silicone Modified Polyester (SMP)

- Polyvinylidene Fluorides (PVDF)

- Polyurethane (PU)

- Plastisols

- Others

By Application Type

- Construction

- Automotive

- Appliances

- Others

Growth Opportunity

Growing Demand for Eco-Friendly and Sustainable Coatings Drives Coil Coatings Market Growth

The growing demand for eco-friendly and sustainable coatings presents a significant growth opportunity in the coil coatings market. As environmental concerns and regulations continue to increase, industries are seeking coatings that offer lower VOC emissions, reduced environmental impact, and longer service life. Coil coatings that meet these sustainability criteria are in high demand. Manufacturers focusing on developing and marketing such eco-friendly solutions are poised for growth, as they align with the global shift towards environmentally responsible practices across multiple sectors.

Increasing Demand for Coil Coatings in the Appliances Industry Fuels Growth

Coil coatings have become an indispensable part of the appliance industry, driving market expansion. Used to enhance appliances' appearance, durability, and corrosion resistance - such as refrigerators, ovens, and washing machines - coil coatings offer manufacturers in this market an opportunity to produce innovative high-performance coatings to meet consumer demand for functional yet aesthetically pleasing appliances - helping further propel market expansion.

Growing Demand for Coil Coatings in the Cladding Industry Expands Market

Coil coatings have become an indispensable part of the building cladding industry, playing an instrumental role in driving market expansion. Coil coatings protect and enhance building claddings such as exterior facades, roofing materials, siding systems, and more, while architectural designs become more diverse and aesthetic-driven. With rising demands for high-quality and customizable coil coatings in this niche market, market expansion will only accelerate further. Manufacturers offering innovative and durable coatings that cater to the evolving needs of the cladding industry are poised for growth.

Regional Analysis

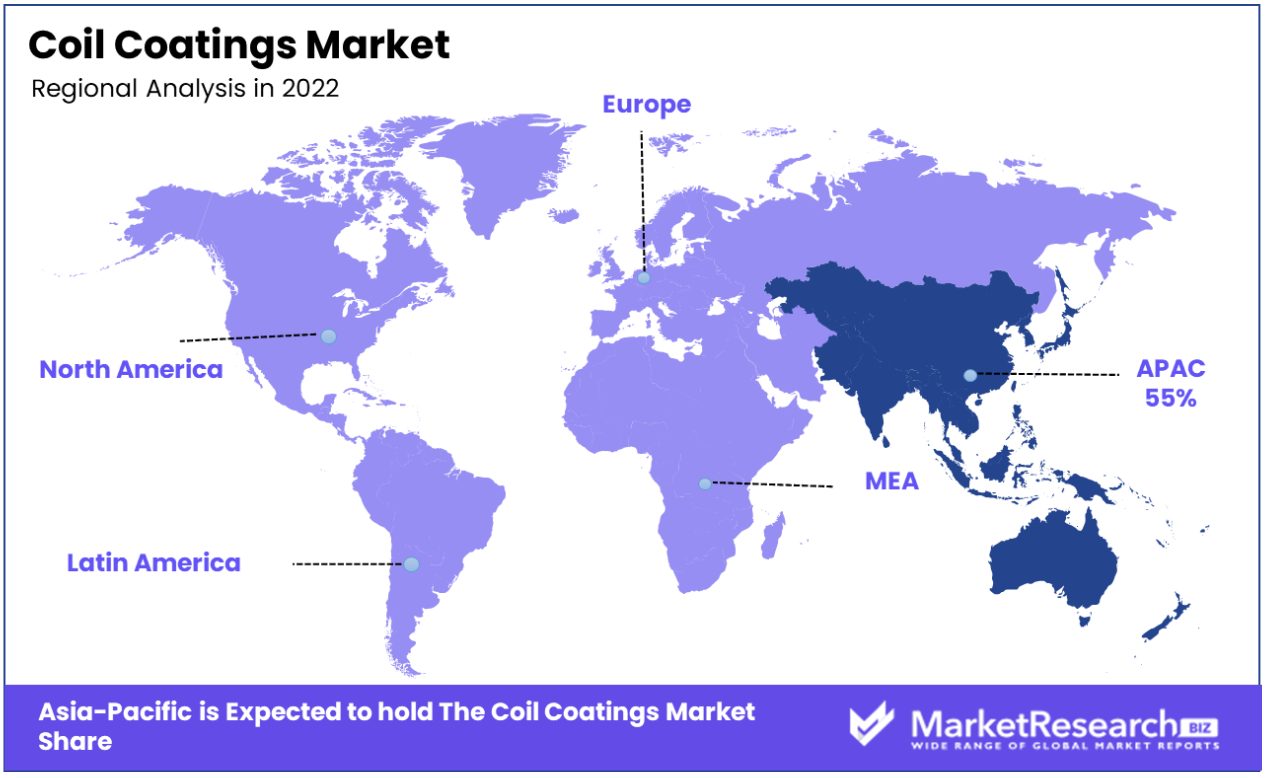

Asia Pacific Dominates with 55% Market Share in the Coil Coatings Market

Asia Pacific leads the coil coatings market with an impressive 55% share, primarily driven by the region's rapid industrialization and urbanization. Key factors contributing to this dominance include significant growth in the construction and automotive industries, which extensively use coil coatings for their durability and aesthetic properties. China and India's expanding manufacturing sectors have played an instrumental role in expanding this market.

Market dynamics in the Asia Pacific are further shaped by its cost-competitive manufacturing environment, availability of raw materials, and rising middle-class population - all factors that fuel an increase in consumer goods and infrastructure that employ coil coatings.

Forecast implications suggest that the Asia Pacific region will continue to dominate the coil coatings market. This will be fueled by ongoing urbanization, increasing investments in infrastructure, and a growing preference for environmentally friendly coatings. Moreover, advancements in technology and an emphasis on sustainable practices are likely to further propel the market's growth in this region.

North America Regional Analysis

North America holds a significant position in the coil coatings market, supported by its advanced industrial base and high demand from the construction and automotive sectors. The region's focus on quality and innovation in coil coating formulations, including the development of more environmentally friendly and efficient products, drives its market share.

Going forward, the North American region is expected to see growth, particularly driven by technological advancements and a shift towards sustainable and green building materials in the construction sector.

Europe Regional Analysis

Europe's coil coatings market is mature, characterized by high-quality production standards and stringent environmental regulations. The demand in Europe is largely driven by the region's well-established automotive and construction industries, which prioritize sustainability and energy efficiency.

The European market is expected to maintain a steady growth trajectory, with ongoing innovations in eco-friendly coatings and a strong push for reducing VOC emissions in industrial processes. Europe's focus on sustainability and the adoption of advanced technologies are likely to keep it at the forefront of the coil coatings industry.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

Key Players Analysis

The coil coatings market is characterized by the strategic positioning of key players who significantly influence market dynamics through their technological innovations, global reach, and product diversity. Akzo Nobel N.V. and PPG Industries, Inc. stand out as industry leaders, offering a wide range of high-quality coil coatings. Their global presence and strong brand reputations position them as influential figures in setting industry standards and driving innovation.

BASF SE and Henkel AG & Co. KGaA are notable for their focus on sustainable and environmentally friendly coating solutions, aligning with the market's increasing demand for green products. Kansai Paint Co., Ltd. and Nippon Paint Holdings Co., Ltd., with their strong footholds in the Asia-Pacific region, have expanded their influence globally, offering unique and customized solutions.

The Sherwin-Williams Company and The Valspar Corporation, through strategic mergers and acquisitions, have expanded their market presence, enhancing their product portfolios and customer reach. Axalta Coating Systems and Dura Coat Products, Inc. specialize in innovative and durable coil coatings, catering to specific industry needs.

Collectively, these companies drive the coil coatings market, with their strategic initiatives focused on innovation, sustainability, and global expansion, catering to the evolving needs of diverse industries and influencing the market's overall growth trajectory.

Top Key Players in the Coil Coatings Market

- AkzoNobel N.V.

- BASF SE

- Beckers Group

- Henkel AG & Co. KGaA

- Kansai Paint Co., Ltd.

- Nippon Paint Holdings Co., Ltd.

- PPG Industries Inc.

- The Sherwin-Williams Company

- The Valspar Corporation

- Axalta Coating Systems

- Dura Coat Products, Inc.

- KCC Corporation

- The Chemours Company

- Wacker Chemie AG

- The Dow Chemical Company

- Goldin Metals Inc.

- Nucor Corporation

- BDM Coil Coaters LLC

Recent Development

- In 2023, The Metal Coatings Market Association (MCMA) plans to launch an online guide on coil coating best practices and standards in Q1 2023 to promote sustainability.

- In 2023, Axalta Coating Systems plans to open a new coil coatings manufacturing plant in India by mid-2023. This will support growing construction industry demand in the region.

- In 2022, AkzoNobel opened a new coil coatings plant in Chengdu, China in March 2022 to meet growing demand in the region. The €13 million facility increases production capacity.

- In June 2022, PPG acquired Arsonsisi, an industrial coatings company specializing in coil coatings, to expand its product portfolio and manufacturing capabilities in Europe.

Report Scope:

Report Features Description Market Value (2022) USD 3.1 Bn Forecast Revenue (2032) USD 5.4 Bn CAGR (2023-2032) 6.0% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type(Polyester, Silicone Modified Polyester (SMP), Polyvinylidene Fluorides (PVDF), , Plastisols, Others), By Application Type(Construction, Automotive, Appliances, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape AkzoNobel N.V., BASF SE, Beckers Group, , Kansai Paint Co., Ltd., Nippon Paint Holdings Co., Ltd., PPG Industries Inc., The Sherwin-Williams Company, The Valspar Corporation, Axalta Coating Systems, Dura Coat Products, Inc., KCC Corporation, The Chemours Company, Wacker Chemie AG, The Dow Chemical Company, Goldin Metals Inc., Nucor Corporation, BDM Coil Coaters LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- AkzoNobel N.V.

- BASF SE

- Beckers Group

- Henkel AG & Co. KGaA

- Kansai Paint Co., Ltd.

- Nippon Paint Holdings Co., Ltd.

- PPG Industries Inc.

- The Sherwin-Williams Company

- The Valspar Corporation

- Axalta Coating Systems

- Dura Coat Products, Inc.

- KCC Corporation

- The Chemours Company

- Wacker Chemie AG

- The Dow Chemical Company

- Goldin Metals Inc.

- Nucor Corporation

- BDM Coil Coaters LLC