Potato Chips and Crisps Market Report By Flavour (Flavored, Plain), By Type (Fried, Baked, Reduced-fat, Organic, Others), By Packaging Type (Single Serve Packets, Multipack Bags, Family-size Bags, Resealable Packs, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

11238

-

May 2024

-

325

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

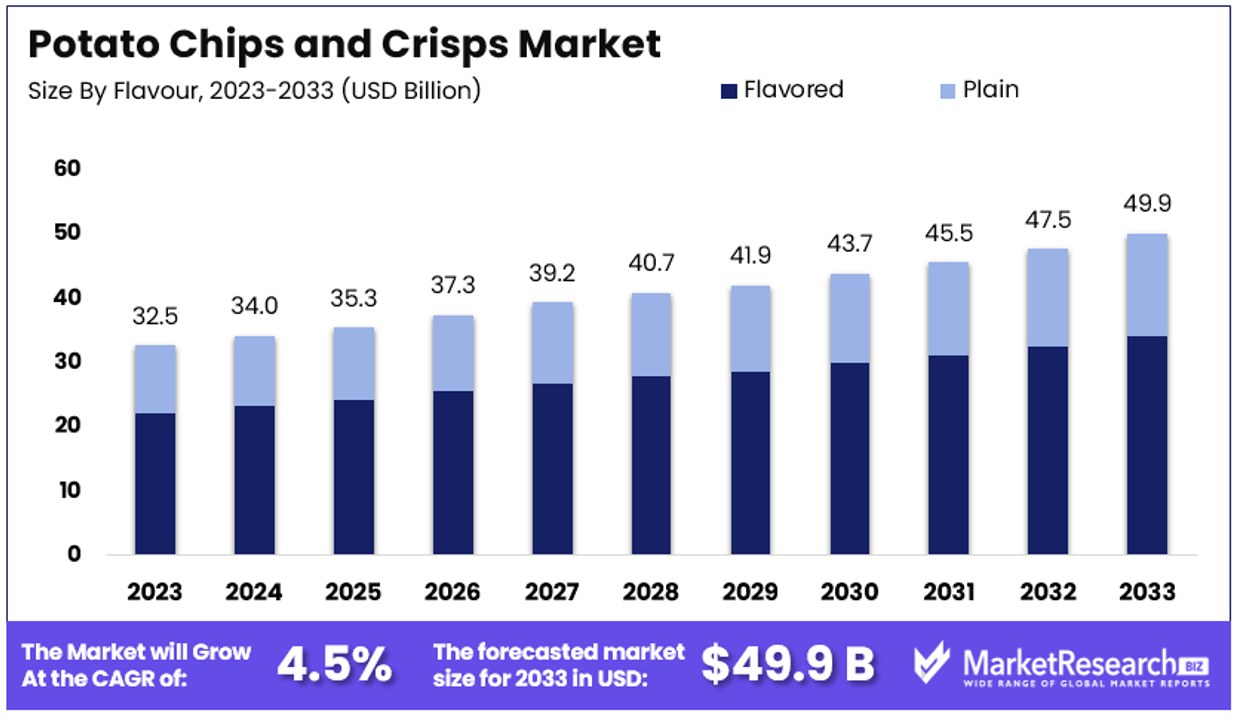

The Global Potato Chips and Crisps Market size is expected to be worth around USD 49.9 Billion by 2033, from USD 32.5 Billion in 2023, growing at a CAGR of 4.5% during the forecast period from 2024 to 2033.

The Potato Chips and Crisps Market encompasses the production, distribution, and sale of thin slices of potatoes that are either deep-fried or baked. This market caters to consumers seeking convenient, ready-to-eat snack options. Key factors driving the market include evolving consumer tastes, innovative flavor introductions, and increased snacking habits globally.

Major players in the industry focus on leveraging advanced manufacturing technologies and marketing strategies to enhance product appeal and expand their customer base. The market's growth is supported by both the retail and food service channels, making it a dynamic segment within the broader snack food industry. This market analysis is essential for executives and product managers strategizing in the consumer goods sector.

It is evident that this segment is witnessing substantial growth and transformation. China and India are pivotal in this dynamic, with China contributing 21.8% and India 14.3% of global potato production. This robust output foundation is crucial as it supports both domestic consumption and international trade.

In 2022, India demonstrated its capacity as a major player in the global market by exporting over 2.5 million metric tons of potatoes, generating revenues exceeding $1 billion. This not only underscores India's efficiency in potato cultivation but also its potential to influence global market trends through significant export volumes.

The global demand for potato chips and crisps is propelled by changing consumer preferences and a growing inclination towards convenient snack foods. Market leaders are continuously innovating in terms of flavors and healthier product options to cater to a diverse and evolving consumer base. This innovation is crucial for maintaining competitiveness in a market where consumers are increasingly looking for variety and healthier choices.

From a strategic perspective, companies in the Potato Chips and Crisps Market are advised to invest in technology to enhance production efficiency and sustainability. Emphasizing packaging innovations that extend shelf life and improve transportability can also play a critical role in tapping into new markets and segments. Given the scale of production in key countries and the evolving consumer preferences, stakeholders in the potato chips and crisps market are well-positioned to capitalize on emerging opportunities for growth and expansion.

Key Takeaways

- Market Value: The Global Potato Chips and Crisps Market is projected to reach USD 49.9 billion by 2033, experiencing steady growth from USD 32.5 billion in 2023, with a CAGR of 4.5% during the forecast period from 2024 to 2033.

- Flavour Segment Analysis: Flavored potato chips and crisps dominate with 68.2% market share, driven by diverse consumer preferences for innovative and varied taste options.

- Type Segment Analysis: Fried chips continue to dominate, appealing to consumers for their traditional appeal and satisfying crunch.

- Packaging Type Segment Analysis: Single Serve Packets lead with 35% market share, aligning with modern lifestyle needs for convenience and portion control.

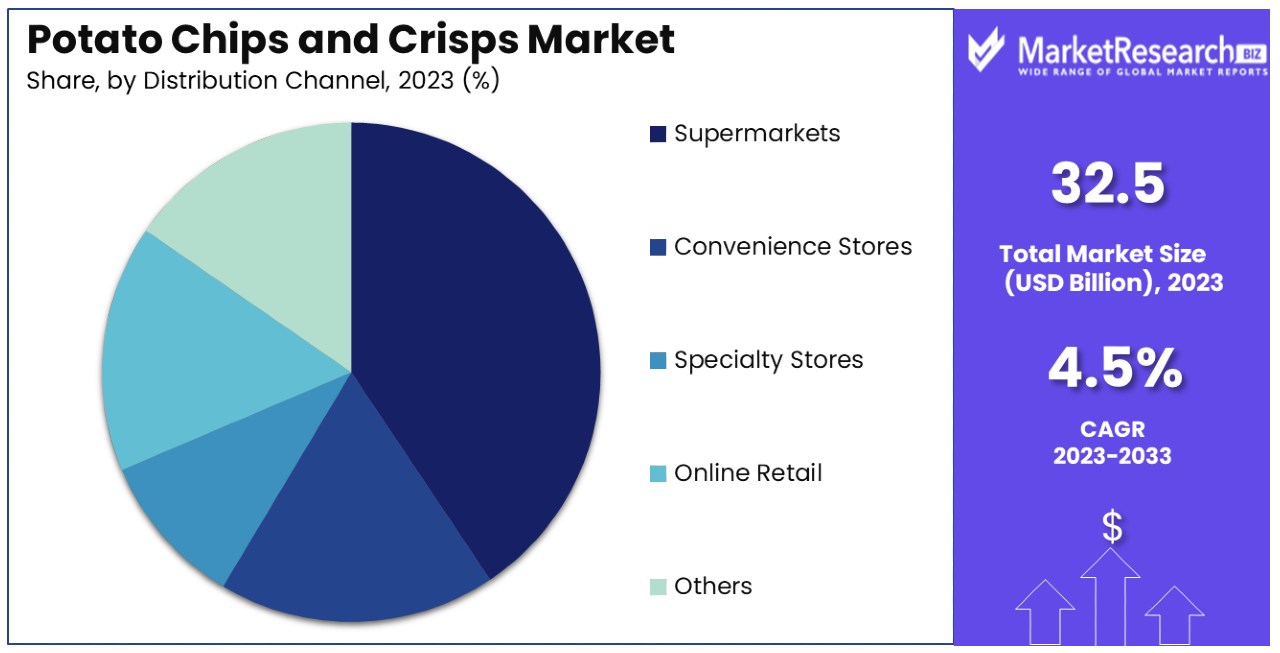

- Distribution Channel Segment Analysis: Supermarkets/Hypermarkets dominate with 40.6% market share, offering a wide product range and convenience.

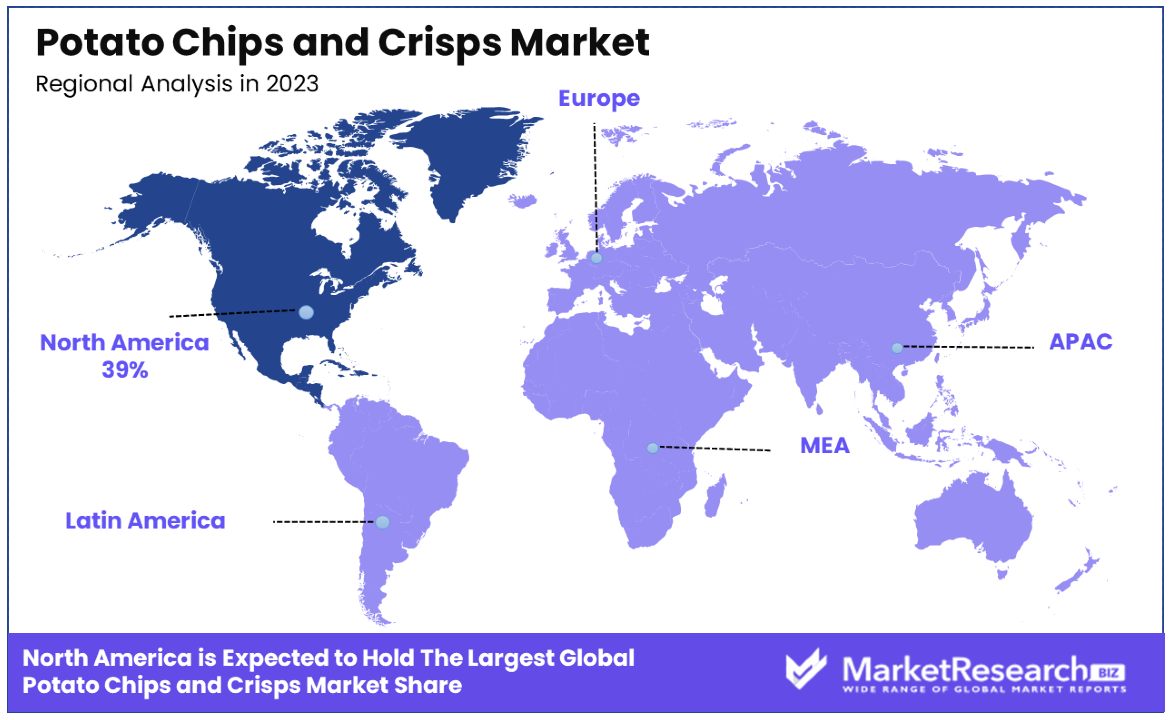

- North America: Dominates the market with a 39% market share, reflecting high consumption rates and diverse flavor preferences.

- Europe: Holds a significant 30% share of the market, driven by established snack consumption habits and growing demand for healthier snack options.

- Analyst Viewpoint: Analysts anticipate sustained growth in the Potato Chips and Crisps Market, fueled by continuous product innovation to cater to evolving consumer preferences, expanding distribution networks, and growing demand for healthier snack options.

- Growth Opportunities: Growth opportunities lie in developing new flavors and healthier variants, leveraging online retail platforms for wider market reach, and expanding into emerging markets with rising disposable incomes and changing lifestyles. Meeting the demand for convenient, tasty, and healthier snacking options will be key to capturing market share and driving future growth.

Driving Factors

Changing Consumer Preferences and Snacking Habits Drive Market Growth

The shifting consumer preferences towards convenient snacking options significantly fuel the growth of the potato chips and crisps market. The surge in urbanization and the millennial preference for quick and portable meals have catalyzed the demand for these snacks.

This trend is underpinned by a rise in on-the-go consumption, which aligns perfectly with the busy lifestyles of modern consumers. For instance, major brands like PepsiCo's Frito-Lay have responded by broadening their product offerings to include a variety of flavors and pack sizes that cater to this demand. The successful adoption of such strategies by key market players underscores the critical role of evolving consumer habits in driving market expansion.

Product Innovation and Flavor Variety Spur Market Expansion

Innovation in product flavor and variety stands as a cornerstone in the thriving potato chips and crisps market. Manufacturers' commitment to diversifying their flavor portfolios meets the consumer appetite for new and exotic tastes. The introduction of flavors like wasabi, sweet chili, and truffle not only satisfies the evolving palate but also helps in segmenting the market to cater to niche preferences.

Campaigns like Lay's "Do Us a Flavor" effectively engage customers by involving them in the flavor development process, thereby enhancing consumer relations and loyalty. This strategy of continuous product innovation and consumer engagement is instrumental in driving the market forward.

Health and Wellness Trends Shape Market Dynamics

The growing consumer inclination towards health and wellness has prompted potato chips and crisps manufacturers to innovate healthier snack options. The development of products like baked or air-fried chips, which offer lower fat and calorie content, aligns with the health-conscious trends prevailing in the market.

Moreover, the introduction of chips made from non-traditional ingredients such as legumes and ancient grains caters to the dietary preferences of health-aware consumers. Brands like Kettle Brand leverage this trend by offering chips cooked in healthier oils like avocado oil. These adaptations to health trends significantly contribute to the market's growth by broadening the consumer base to include health-focused individuals.

Convenience and Packaging Innovations Enhance Market Appeal

Advancements in packaging technology have played a pivotal role in the growth of the potato chips and crisps market. Innovations such as resealable bags and single-serve packs not only cater to the rising demand for convenience but also help in portion control, appealing to health-conscious consumers.

Moreover, the shift towards sustainable packaging solutions taps into the growing consumer awareness regarding environmental impact. These packaging improvements enhance product appeal and practicality, facilitating increased consumption and driving market growth through both product innovation and consumer-centric strategies.

Restraining Factors

Health Concerns and Regulatory Pressures Restrain Market Growth

Health concerns regarding the high fat, sodium, and calorie content of potato chips and crisps significantly restrict market growth. As awareness of diet-related health issues such as obesity and diabetes increases, consumer preference shifts towards healthier alternatives. This shift is further amplified by regulatory pressures, including stricter labeling requirements and taxation on unhealthy foods.

Such regulations, aimed at reducing consumption of high-calorie snacks, pose substantial challenges to the potato chips and crisps industry. Additionally, potential marketing restrictions aimed at protecting vulnerable groups like children further complicate the market landscape for these products. These factors collectively create a significant barrier to growth as they directly influence consumer choices and industry practices.

Competition from Alternative Snacks Limits Market Expansion

The intense competition from healthier snack alternatives like nuts, seeds, popcorn, and baked goods also limits the growth of the potato chips and crisps market. As consumer preferences evolve towards health-conscious and diverse dietary choices, the appeal of traditional potato chips and crisps diminishes. These alternative snacks not only offer nutritional benefits but also cater to a wider variety of taste preferences and dietary requirements.

This competition siphons off a portion of the potential market base for potato chips and crisps, impacting sales and limiting market expansion. The increasing availability and popularity of these healthier alternatives continue to pose a significant challenge to the traditional snack industry, driving brands to innovate further to retain consumer interest.

Flavour Segment Analysis

Flavored segment dominates with 68.2% due to diverse consumer preferences for innovative and varied taste options.

The flavour segment of the Potato Chips and Crisps Market is distinctly led by the Flavored sub-segment, which holds a substantial 68.2% of this market area. This dominance is largely driven by consumer desires for diverse and unique taste experiences. Manufacturers have tapped into this demand by introducing a variety of flavors ranging from the conventional to the exotic, continuously refreshing their product lines to capture consumer interest and remain competitive. The ongoing innovation in flavors not only meets the demand for novelty but also helps in segmenting the market more effectively, catering to specific consumer preferences and regional tastes.

Conversely, the Plain sub-segment, while smaller, maintains a significant role in the market. It appeals to traditionalists and those who prefer less complex flavors, or consumers looking for a more neutral accompaniment to dips and other foods. This segment benefits from a steady demand, especially in markets where consumers have a stronger preference for traditional tastes or where there is a cultural inclination towards simpler food products. Despite its relatively smaller size, the Plain segment is crucial for companies aiming to offer a comprehensive product range that appeals to all consumer segments.

Type Segment Analysis

Fried chips continue to dominate due to their traditional appeal and satisfying crunch, despite rising health consciousness.

In the Type segment, Fried chips remain the dominant sub-segment. Their enduring popularity stems from their classic texture and deep, satisfying taste, which are highly valued in the snack food market. This preference prevails despite the growing trend towards healthier eating habits, as many consumers still choose taste and texture as their primary criteria.

However, other sub-segments such as Baked, Reduced-fat, Organic, and others are gaining market share due to shifting consumer priorities towards health and wellness. Baked chips offer a healthier alternative to fried chips with significantly less oil and are perceived as a lighter option. Reduced-fat chips cater to health-conscious consumers looking to reduce calorie intake without giving up snacks. The Organic sub-segment attracts a niche market focused on clean eating, willing to pay a premium for snacks made from organically grown ingredients without added chemicals or preservatives. Each of these emerging sub-segments contributes to the market's diversity and broadens the consumer base by fulfilling specific dietary preferences and health considerations.

Packaging Type Segment Analysis

Single Serve Packets lead with 35% due to their convenience and portion control, aligning with modern lifestyle needs.

The Packaging Type segment is significantly shaped by the popularity of Single Serve Packets, which constitute 35% of this market. Their leading position is supported by the modern consumer’s preference for convenience and portion-controlled eating. Single-serve packets are ideal for on-the-go snacking, reducing food waste and helping in managing dietary intake, appealing particularly to busy consumers and those mindful of their eating habits.

Other packaging types such as Multipack Bags, Family-size Bags, and Resealable Packs also play essential roles in the market. Multipack Bags are popular for cost-saving and reduce the frequency of purchases, appealing to families and individuals planning for extended consumption. Family-size Bags cater to household consumption, providing a cost-effective solution for families and groups. Resealable Packs enhance product freshness and extend shelf life, adding value to purchases by maintaining quality over time. These diverse packaging options accommodate varying consumer needs and usage occasions, contributing to the overall growth and versatility of the market.

Distribution Channel Segment Analysis

Supermarkets/Hypermarkets dominate with 40.6% due to their wide product range and convenience.

Distribution Channels are crucial in the Potato Chips and Crisps Market, with Supermarkets/Hypermarkets leading the segment, holding a 40.6% share. This dominance is attributed to the one-stop shopping experience these outlets offer, providing a wide range of products under one roof. This convenience is highly valued by consumers who prefer to consolidate their shopping trips.

Other channels like Convenience Stores, Specialty Stores, Online Retail, and others also significantly contribute to the market. Convenience Stores offer quick access to snacks and are typically located in high-traffic areas, making them a frequent choice for impromptu purchases. Specialty Stores attract customers looking for premium or niche products that may not be available in mainstream outlets. Online Retail has been growing rapidly, driven by the rise in e-commerce and changing consumer shopping habits, offering the convenience of home delivery and often broader selections. These varied distribution channels ensure that potato chips and crisps are widely accessible to all segments of consumers, reinforcing the market's growth and reach.

Key Market Segments

By Flavour

- Flavored

- Plain

By Type

- Fried

- Baked

- Reduced-fat

- Organic

- Others

By Packaging Type

- Single Serve Packets

- Multipack Bags

- Family-size Bags

- Resealable Packs

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Others

Growth Opportunities

Expansion into Emerging Markets Offers Growth Opportunity

The expansion into emerging markets like India, China, and Latin America represents a substantial growth opportunity for potato chips and crisps manufacturers. These regions, characterized by rising disposable incomes and rapid urbanization, present a burgeoning consumer base eager for convenient and flavorful snacking options.

Manufacturers can capitalize on this trend by adapting their products to meet local preferences and employing strategic marketing campaigns. For instance, PepsiCo's introduction of local flavors such as Magic Masala in India has proven effective in capturing consumer interest. By customizing products and marketing efforts to align with the distinct tastes and cultural nuances of these markets, brands can significantly boost their market penetration and sales.

Premiumization and Indulgent Offerings Provide Market Expansion Potential

The trend towards premiumization and indulgence in the snack market opens new avenues for growth, particularly among affluent consumers and millennials. By offering premium potato chips and crisps that feature unique, high-quality ingredients and artisanal production methods, manufacturers can tap into a niche yet profitable segment.

Products like Kettle Brand's Avocado Oil and Jalapeño Potato Chips exemplify how using distinctive ingredients and bold flavors can attract a demographic that values both taste and quality. These premium products often command higher price points, appealing to consumers seeking an upscale snacking experience. This strategy not only enhances brand perception but also drives higher profit margins, making it a lucrative opportunity for growth within the industry.

Trending Factors

Flavor Innovations and Limited-Edition Offerings Are Trending Factors

Flavor innovations and limited-edition offerings are key trending factors in the Potato Chips and Crisps Market. This trend is driven by consumer desire for novelty and diversity in their snacks. Manufacturers leverage this by creating unique flavor combinations, often inspired by global cuisines or contemporary food trends, which tap into consumers' curiosity and desire for new experiences.

Limited-edition flavors, such as Lay's Wavy Funyuns Onion and Grilled Cheese & Tomato Soup, offer a sense of exclusivity and urgency that can boost consumer engagement and sales. This strategy not only keeps the brand dynamic and interesting but also encourages repeat purchases as consumers look forward to new releases, enhancing brand loyalty and market presence.

Sustainable and Eco-Friendly Packaging Are Trending Factors

Sustainable and eco-friendly packaging is increasingly becoming a significant trend in the Potato Chips and Crisps Market, reflecting broader consumer and regulatory shifts towards environmental responsibility. As public awareness of environmental issues grows, consumers are more inclined to choose brands that demonstrate a commitment to sustainability. This trend is prompting manufacturers to adopt packaging solutions that are recyclable, compostable, or made from renewable resources.

For instance, Kettle Brand’s adoption of plant-based, compostable bags directly addresses the market’s demand for sustainable practices and helps differentiate their products in a competitive market. This shift not only meets consumer expectations but also aligns with global sustainability goals, providing a strong impetus for brand growth and positive consumer perception.

Regional Analysis

North America Dominates with 39% Market Share

North America's 39% market share in the Potato Chips and Crisps Market is predominantly driven by high consumer spending power and a strong snacking culture. The region's established food processing infrastructure and intense marketing by leading brands further consolidate its market position. Continuous innovation in flavors and packaging by major players like PepsiCo and Kellogg's caters effectively to local tastes and preferences, reinforcing consumer loyalty and expanding market reach.

The market dynamics in North America are influenced by a preference for convenience and a variety of snack options. The presence of numerous large-scale manufacturers and a robust distribution network ensures widespread availability of products across various retail formats, from large supermarkets to convenience stores. Moreover, the trend towards healthier snack alternatives is reshaping product offerings, with an increasing number of companies introducing baked and reduced-fat options to meet consumer demand.

Regional Market Share and Growth Rates:

- Europe: Europe holds a significant share of the market at 30%. The region’s market dynamics are characterized by a high demand for healthier snack alternatives, influencing manufacturers to innovate with organic and reduced-fat options. Strong regional preferences for specific flavors also drive localized product development.

- Asia Pacific: Accounting for 20% of the market, Asia Pacific is experiencing rapid growth due to increasing urbanization and rising disposable incomes. The region is seeing a surge in demand for Western-style snacks, coupled with a preference for local flavors, which is prompting international and local brands to expand their presence.

- Middle East & Africa: This region represents a smaller share of the market at 6%, but is witnessing steady growth driven by an expanding young population and increased urbanization. The market here offers potential for expansion as consumer awareness and disposable incomes rise.

- Latin America: Holding 5% of the market, Latin America is a growing market with increasing consumer interest in snack foods. Economic stabilization and the influence of global trends are expected to boost market growth, as local companies and international players strengthen their operations in the region.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Potato Chips and Crisps market is dominated by several key players. PepsiCo Inc., through its Frito-Lay division, holds a strong market position with a broad product range and significant global presence. This gives them a high influence over market trends and consumer preferences.

Intersnack Group GmbH & Co. KG is another major player, known for its extensive European market reach and diverse brand portfolio. Their strategic acquisitions have strengthened their market influence.

Calbee Inc. focuses on innovation and health-oriented products, appealing to changing consumer preferences. Their strong position in Asia contributes to their significant market impact.

Utz Brands Inc. and Utz Quality Foods Inc. are key players in the U.S. market, known for their high-quality products and regional popularity, enhancing their market influence.

Kettle Foods, Inc. and Burts Potato Chips Ltd are recognized for their premium and artisanal product offerings, appealing to niche markets and health-conscious consumers.

Lorenz Bahlsen Snack-World GmbH has a solid presence in Europe, focusing on quality and innovation to maintain competitive positioning.

CAMPBELL SOUP COMPANY, through its snack brands, leverages its established distribution networks to enhance market reach and influence.

Overall, these companies drive market trends through innovation, strategic positioning, and extensive distribution networks, shaping the competitive landscape of the Potato Chips and Crisps market.

Market Key Players

- Burts Potato Chips Ltd

- Intersnack Group GmbH &

- PepsiCo Inc.

- Calbee Inc.

- Lorenz Bahlsen Snack-World GmbH

- Utz Quality Foods Inc.

- CAMPBELL SOUP COMPANY

- Utz Brands Inc.

- Frito-Lay North America, Inc.

- Intersnack Group GmbH& Co. KG

- Kettle Foods, Inc.

Recent Developments

- On January 2024, a British court ruled that Walkers' mini poppadoms are not exempt from VAT and must be treated as potato chips. The tribunal's ruling hinged on the fact that 40 percent of the ingredients in the poppadoms were ""potato-derived,"" including potato granules and potato starch.

- On April 2024, Utz announced the launch of its new Mike's Hot Honey Extra Hot Potato Chips, turning up the heat on the potato chip market.

- On February 2024, PepsiCo India revealed plans to capture a bigger share of the potato-based chips market in the country.

- On December 2023, Goldfish introduced potato chip-inspired crisps for the first time.

Report Scope

Report Features Description Market Value (2023) USD 32.5 Billion Forecast Revenue (2033) USD 49.9 Billion CAGR (2024-2033) 4.5% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Flavour (Flavored, Plain), By Type (Fried, Baked, Reduced-fat, Organic, Others), By Packaging Type (Single Serve Packets, Multipack Bags, Family-size Bags, Resealable Packs, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Burts Potato Chips Ltd, Intersnack Group GmbH &, PepsiCo Inc., Calbee Inc., Lorenz Bahlsen Snack-World GmbH, Utz Quality Foods Inc., CAMPBELL SOUP COMPANY, Utz Brands Inc., Frito-Lay North America, Inc., Intersnack Group GmbH& Co. KG, Kettle Foods, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Calbee Foods

- Herr

- Intersnack Group

- PepsiCo

- Snyder’s-Lance

- UTZ Quality foods

- Lay’s

- Pringles

- Ruffels

- Kettle,

- Utz