Post-Acute Care Market Report By Services (Skilled Nursing Facilities, Inpatient Rehabilitation Facilities, Long-term Care Hospitals, Home Health Agencies, and Others), By Age (elderly, adult, and others), By Disease Conditions, By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

41823

-

Oct 2023

-

130

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

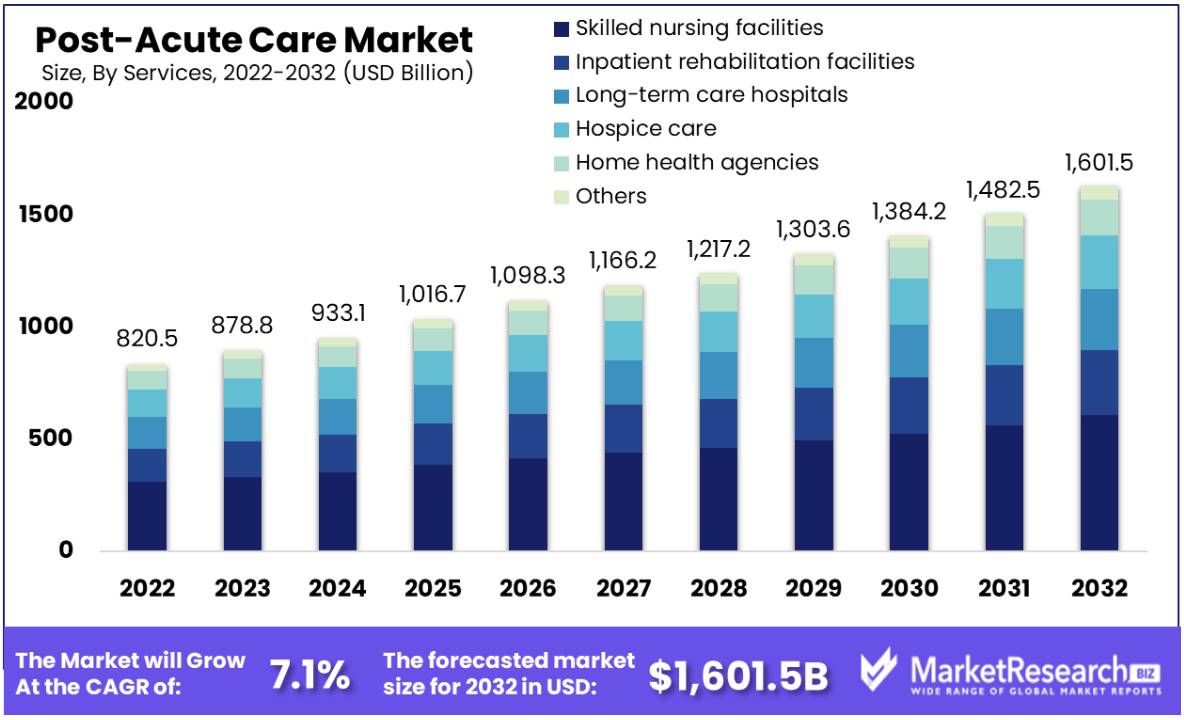

Post-acute care market size is projected to grow from US$ 820.5 billion in 2022 to US$ 1,601.5 billion by 2032; it is estimated to record a CAGR of 7.1% during 2023–2032.

Post-acute care hospitals play an important role in assisting patients in their recovery journey, facilitating their return home from an injury, or a period of hospitalization due to a surgery. Hospital facilities and acute care providers are recognizing the importance of this phase of patient recovery. Post-traumatic care strategic partnerships include a wide range of services designed to manage inpatient aftercare-specific needs.

Depending on the nature of illness or injury, these services may function as alternatives to intensive care facility discharge, acute care facility, home health care, or continuous inpatient medicine. The severity of a condition that can lead to tenure guides service choice.

Several factors positively contribute to the growth of the aftercare market. The increasing prevalence of chronic diseases has led to a demand for intensive care following acute illness. Furthermore, investment in this area has increased with increased strategic collaboration among providers of post-acute care services and a rising geriatric population demanding elderly care.

Long-term care encompasses a variety of settings, such as home health and hospitals, skilled nursing facilities (SNFs), inpatient rehabilitation facilities (IRFs), and acute care hospitals (LTACs), which are being modified to refer to those whose conditions are further severe but who still need careful care and services. In today’s healthcare environment, hospitals and health systems integrate post-acute services and programs that fall within the post-acute care category.

Specifically, aftercare is an important bridge in a patient’s recovery journey, providing the supports and services needed to ensure a smooth transition back to their usual activities after a period of therapy. This stands as evidence of a patient-centered approach adopted by modern health care systems.

Driving Factors

Rising Prevalence of Chronic Diseases

The escalating incidence of chronic diseases, such as diabetes, cardiovascular conditions, and respiratory ailments, is a primary driver for the post-acute care market. These conditions often necessitate extended recovery and rehabilitation, creating a growing demand for specialized post-acute care services. This trend underscores the vital role post-acute care plays in the continuum of patient care.

Aging population and increased life expectancy

With advancements in healthcare, life expectancy has risen, leading to a larger elderly population. This demographic shift requires more tailored care solutions, as seniors often face complex health issues that demand specialized attention. Post-acute care facilities, equipped with the expertise and resources to address the unique needs of seniors, become instrumental in ensuring a higher quality of life.

Technological Advancements in Healthcare

Technological innovations have revolutionized post-acute care, enabling more effective and efficient delivery of services. Telehealth, wearable monitoring devices, and electronic health records have significantly enhanced patient monitoring and communication, allowing for proactive interventions and more personalized care plans. This tech-driven approach not only improves patient outcomes but also optimizes resource utilization.

Restraining Factors

Reimbursement and funding challenges

Adequate reimbursement for post-acute care services remains a persistent challenge. Navigating complex reimbursement policies and securing funding for these specialized services can be intricate for both providers and patients. This financial hurdle can limit access to essential post-acute care, particularly for those without comprehensive insurance coverage.

Workforce shortages and skill gaps

The post-acute care sector often grapples with shortages of skilled healthcare professionals. This scarcity, coupled with the need for specialized training in areas like geriatric care and rehabilitation, can hinder the delivery of high-quality post-acute care services. Bridging this skill gap and ensuring an ample workforce are crucial for meeting the escalating demand in this field.

Growth Opportunities

Recognition of Technological Advances

The incorporation of sophisticated technologies offers significant growth opportunities for the post-acute care sector. Patient care can be greatly enhanced through the integration of telemedicine solutions, remote monitoring devices, and electronic health records. This new technology provides a real-time location between newly healthy individuals and patients, with the ability to proxy and personalize more personalized treatment plans. Artificial intelligence (AI) and qualifying algorithms through devices and systems recognition recognize not only improvements in attendance but also improved efficiencies in post-acute care facilities.

Expansion of Home Care Services

A notable growth trend is expanding outside of acute care into the comfort of patients’ homes. The provision of home health support, rehabilitation, skilled nursing care, etc. can provide patients with increased satisfaction and improved outcomes. This approach is not only for more patients. It is in line with preferences but also helps reduce the costs associated with inpatient care. Leveraging the power of home care enables providers to expand their reach and impact, especially in areas with limited access to a broad range of health services.

Implementing personalized care plans and chronic disease management

Designing care plans to meet the specific needs of patients, especially those struggling with chronic conditions, offers promising growth opportunities. Implementing standardized treatment strategies increases patient engagement and compliance, improving outcomes. Chronic disease specialists positioned outpatient intensive care units to play a vital role in addressing the growing number of conditions such as diabetes, heart disease, and respiratory problems. Providing comprehensive care with a patient-centered approach can not only improve individual health and well-being but also contribute to the efficiency of the health care system as a whole.

By Service Type

The skilled nursing facilities segment dominates, and the market share is expected to exhibit a CAGR from 2023 to 2032. It plays a key role in post-acute care, focusing on patients' daily activities after injury, medical procedures, or illness. Supporting rehabilitation. It can be tailored to meet patients’ specific needs, even in remote locations.

Skilled nursing facilities provide care and treatment to individuals and residents who may not be able to care for themselves. The range of post-acute care services provided by SNFs includes wound care, pain management, medication administration, intravenous (IV) therapy, dietary guidance and support, physical therapy, occupational therapy, speech therapy, and psychotherapy, including behavioral health care.

An important aspect of post-acute care is the coordinated efforts of hospitals and skilled nursing facilities to develop patient-centered care plans aimed at preventing re-admissions. This industry will have a significant share of the post-acute care market, which emphasizes the critical role played by decision-makers through skilled nursing facilities in the continuum of patient care.

By Age Type

The elderly population will account for the largest market share by 2022 and is expected to grow at the fastest rate from 2023 to 2032. The largest share of hospitalized clients are individuals aged 65 years and older. Thus, this group is more likely to exhibit comorbid chronic conditions and other disabilities. Age: need for care. Up-to-date Journal data shows that older adults are more than twice as likely to need hospitalization as older adults in the middle. About 19% of Americans age 60 or older are hospitalized at least once a year, as opposed to only 10% of adults ages 43 to 62.

Cardiovascular disease and sepsis are among the prominent causes of hospitalization in the elderly population. Elder patients share the average length of stay (about a week) with adults between the ages of 43 and 62. However, older patients are generally more likely to need more support after discharge, possibly due to factors such as increased functional disability and medical complications that require acute care, such as skilled nursing facility (SNF) care or home health services, approximately upon discharge. This is middle-aged adults (ages 43 to 62) who require acute care after only 25% contradict. As a result, the older cohort is poised for significant growth due to increased demand for post-discharge support.

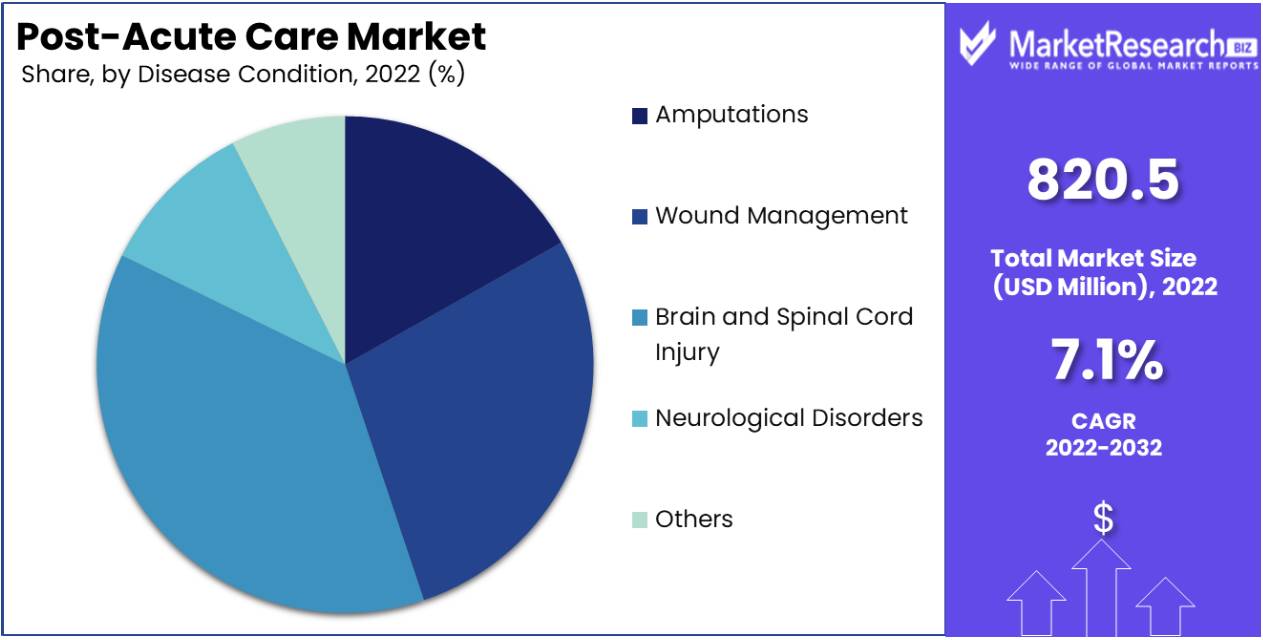

By Disease Condition Type

The category dedicated to brain and spinal cord injuries accounted for the largest market share. However, the online medicine segment is also expected to exhibit a CAGR during the period from 2023 to 2032. Post-acute care plays an important role in the recovery process for brain injury, post-traumatic stress disorder (TBIs), or spinal cord injury (SCIs), helping to restore neurologic function. Patients with such injuries require specialized treatment outside of acute care, including speech therapy, occupational therapy, physical therapy, and rehabilitation techniques, all of which are critical to their recovery journey among

The increased demand for post-traumatic care tailored to individuals with brain and spinal cord injuries strongly supports the expected growth in this segment. This indicates a positive trend towards identifying and providing internal care, which is difficult to prioritize to enhance the quality of life and outcomes for individuals dealing with such severe injuries.

Key Market Segments

By Services

- Skilled nursing facilities

- Inpatient rehabilitation facilities

- Long-term care hospitals

- Hospice care

- Home health agencies

- Others

By Age

- Elderly

- Adults

- Others

By Disease Condition

- Amputations

- Wound Management

- Brain and spinal cord injuries

- Neurological Disorders

- Others

Latest Trends

Virtual Care Integration

A prominent trend in the post-acute care market is the seamless incorporation of virtual care solutions. This empowers healthcare providers to extend their services remotely, granting patients the convenience of receiving necessary care within their own homes. Through telemedicine, patients can engage with healthcare professionals for consultations, follow-up appointments, and even real-time monitoring. This trend has proven invaluable, particularly during times of crisis, as it offers a secure and efficient means of healthcare delivery. It not only improves accessibility for patients but also optimizes resource utilization for healthcare providers.

Focus on patient-centered care

The post-acute care market is experiencing a notable shift towards patient-centric care models. This approach centers the patient in their care journey, customizing treatment plans to their specific needs and preferences. It entails active participation from the patient in decision-making, ensuring that their voice is valued and their concerns are addressed. By prioritizing patient-centered care, post-acute care facilities aim to enhance patient satisfaction, adherence to treatment, and overall outcomes. This trend signifies a fundamental change towards more individualized and comprehensive healthcare delivery.

Data-Driven Decision Making

The post-care provider is increasingly using the power of data analytics and advanced technology to make informed decisions. With data from electronic health records, wearable devices, and remote monitoring systems in practice, healthcare professionals gain valuable insight into patient progress and outcomes. It can be possible to be empowered to make accurate predictions, optimize treatment plans in real time, and monitor complications. Adopting data-driven strategies improves the quality of care and supports evidence-based practice, ultimately improving patient outcomes.

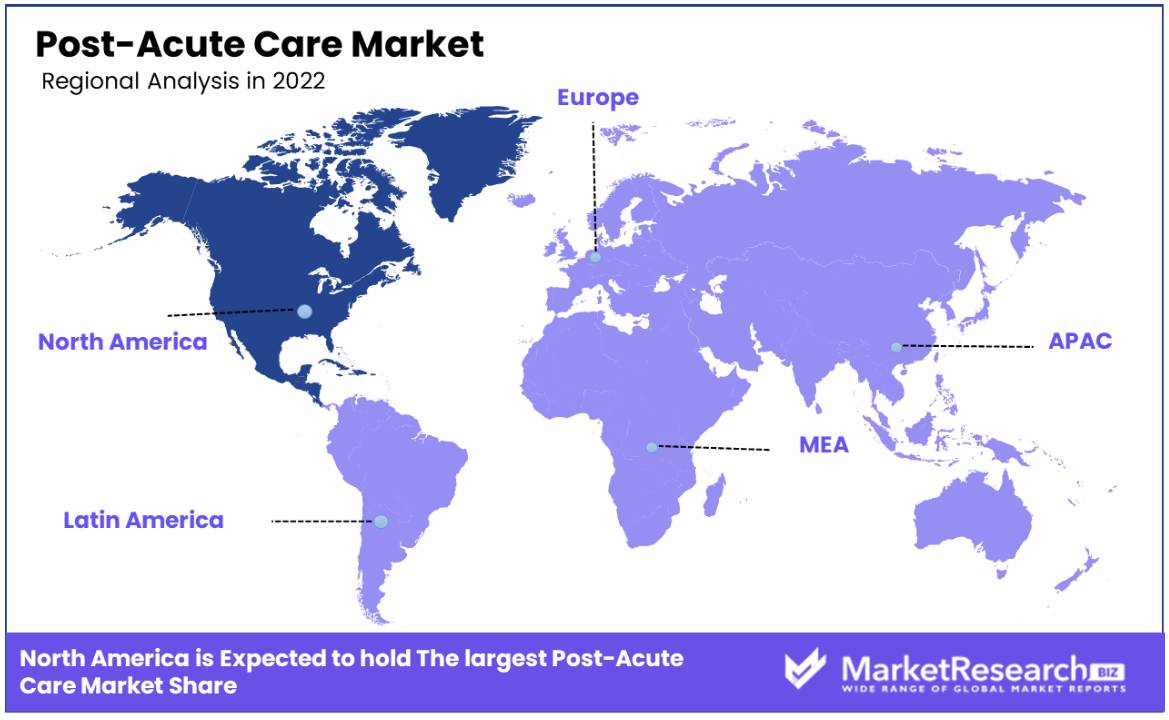

Regional Analysis

North America is poised to capture an important share of the global market. This upsurge can be attributed to the growing incidence of chronic diseases such as diabetes, cardiovascular diseases, and arthritis, among others. This surge in chronic conditions has amplified the demand for post-acute care services, further augmented by funding from strategic investors and private equity firms.

Additionally, a multitude of market participants are actively broadening their presence in various North American nations, reflecting the region's significance in the global landscape of post-acute care. This expansion signifies a concerted effort to meet the burgeoning healthcare needs of the North American populace.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- The rest of MEA

Key Player Analysis

The post-acute care market is characterized by a diverse array of companies, encompassing both small, medium, and large enterprises. Among the prominent players in this market are Kindred Healthcare, Genesis Healthcare, Inc., Brookdale Senior Living Inc., Sante, Amedisys, Inc., and LHC Group Inc. Additionally, companies like Alden Network, Athena Health Care Systems, CareCentrix, Inc., FutureCare, Spring Hills, and NaviHealth play significant roles in shaping the landscape.

These entities are actively investing in the market, channeling their efforts into the development of various technologies aimed at enhancing patient experiences. Moreover, they engage in collaborative ventures and pursue mergers and acquisitions to strengthen their market positions.

Key Players in the Post-Acute Care Market

- Vitas Healthcare

- AMITA Health

- Kindred Healthcare

- Covenant Care

- Brookdale Senior Living

- South Bay Post-Acute Care

- Symphony Care Network

- Alden Network

- Benchmark Senior Living

- Sonoma Post-Acute

- Amedisys Inc.

- Lincoln Square Post-Acute Care

- DomusVi

- Genesis Healthcare

- Evernorth Health, Inc.

- LHC Group

- Vineyard Post-Acute

- CareCentrix, Inc.

- Spring Hills

- Mission Hills Post-Acute

- Athena Health Care Systems

- FutureCare

- Post-Acute Medical

- naviHealth, Inc.

- Victoria Post-Acute Care

- Post-Acute Partners

- KORIAN

- ORPEA

Recent Developments

- In September 2023, Medline expanded its tech solutions for post-acute care. Partnering with SNF Metrics, they offer a business intelligence tool for comprehensive insights in areas like risk assessment and clinical care, boosting operational efficiency in nursing homes.

- In July 2023, Innovaccer Inc. forged a strategic alliance with Post-Acute Analytics (PAA) with the aim of enabling health systems to excel in delivering patient-centric, value-based care.

- In May 2023, Trella Health unveiled its highly anticipated Annual Report on Industry Trends in Post-Acute Care. This comprehensive report offers invaluable insights and analysis into the evolving landscape of post-acute care, providing stakeholders with crucial information to navigate this dynamic sector effectively.

- During a HIMSS23 listening session on long-term and post-acute care in April 2023, a consortium of Post-Acute Care (PAC) leaders conveyed that achieving interoperability in this setting remains a significant challenge, as they communicated their concerns to the Centers for Medicare and Medicaid Services.

Report Scope

Report Features Description Market Value (2022) US$ 820.5 Bn Forecast Revenue (2032) US$ 1,601.5 Bn CAGR (2023-2032) 7.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Services (Skilled Nursing Facilities, Inpatient Rehabilitation Facilities, Long-term Care Hospitals, Home Health Agencies, and Others), By Age (elderly, adult, and others), By Disease Conditions (Amputations, Wound Management, Brain Injury and Spinal Cord Injury, Neurological Disorders, and Others) Regional Analysis North America – The US, Canada, Mexico, Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America, Eastern Europe – Russia, Poland, The Czech Republic, Greece, Rest of Eastern Europe, Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, Rest of Western Europe, APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC, Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, Rest of MEA Competitive Landscape Vitas Healthcare, AMITA Health, Kindred Healthcare, Covenant Care, Brookdale Senior Living, South Bay Post-Acute Care, Symphony Care Network, Alden Network, Benchmark Senior Living, Sonoma Post-Acute, Amedisys Inc., Lincoln Square Post-Acute Care, DomusVi, Genesis Healthcare, Evernorth Health, Inc., LHC Group, Vineyard Post-Acute, CareCentrix, Inc., Spring Hills, Mission Hills Post-Acute, Athena Health Care Systems, FutureCare, Post-Acute Medical, naviHealth, Inc., Victoria Post-Acute Care, Post-Acute Partners, KORIAN, ORPEA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Vitas Healthcare

- AMITA Health

- Kindred Healthcare

- Covenant Care

- Brookdale Senior Living

- South Bay Post-Acute Care

- Symphony Care Network

- Alden Network

- Benchmark Senior Living

- Sonoma Post-Acute

- Amedisys Inc.

- Lincoln Square Post-Acute Care

- DomusVi

- Genesis Healthcare

- Evernorth Health, Inc.

- LHC Group

- Vineyard Post-Acute

- CareCentrix, Inc.

- Spring Hills

- Mission Hills Post-Acute

- Athena Health Care Systems

- FutureCare

- Post-Acute Medical

- naviHealth, Inc.

- Victoria Post-Acute Care

- Post-Acute Partners

- KORIAN

- ORPEA