Advanced Wound Care Market Size, Share & Trends Analysis Report By Product (Moist, Antimicrobial), By Application (Chronic Wounds, Acute Wounds), By End-use (Hospitals, Home Healthcare), By Region, And Segment Forecasts, 2023 – 2032

-

3702

-

May 2023

-

168

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

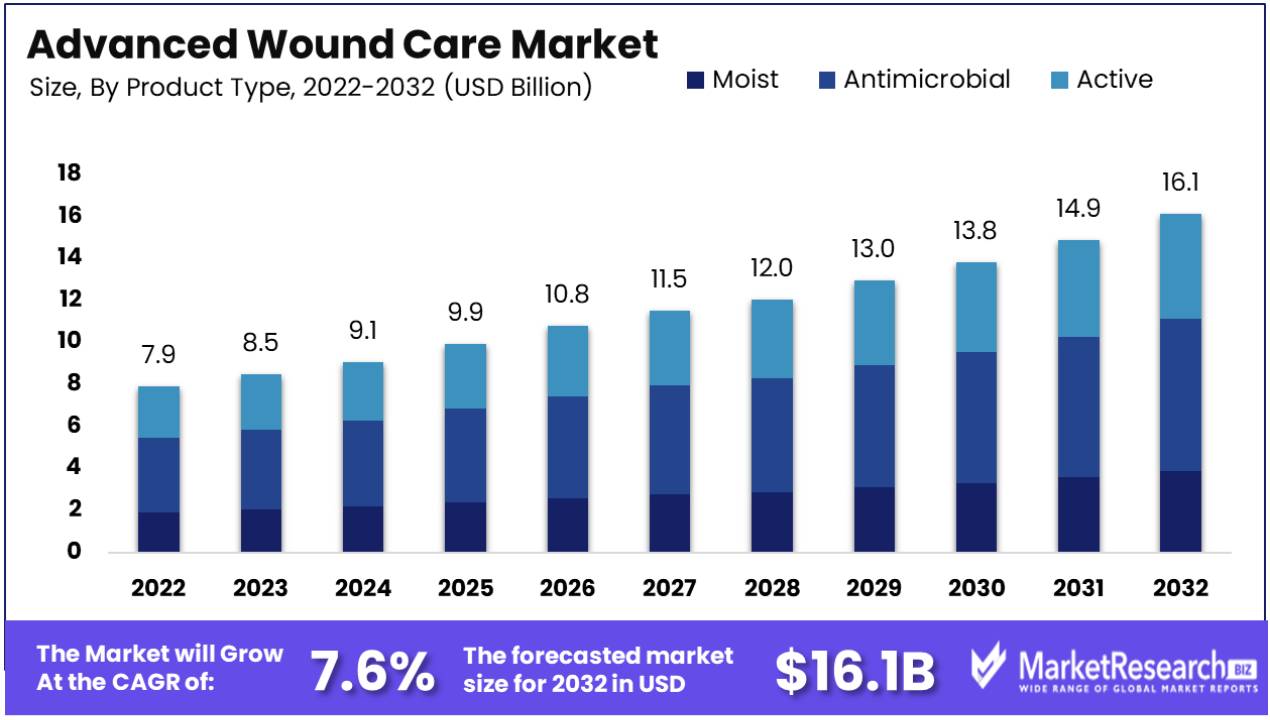

The Global Advanced Wound Care Market size is projected to experience significant growth over the forecast period of 2023-2032. It is anticipated that the market will expand from USD 7.9 billion in 2022 to USD 16.1 billion by 2032, reflecting a CAGR of approximately 7.6%.

The increasing prevalence of infections and viruses globally is a key factor driving the demand for wound care products. Furthermore, the growing geriatric population, who often have reduced healing capabilities, is expected to contribute to the market's development.

The latest statistics and research on wound care issues in 2023 indicate that chronic wounds continue to be a significant clinical, social, and economic challenge. In the United States, approximately 2% of the total population are estimated to be affected by chronic wounds, with 10.5 million U.S. Medicare beneficiaries being impacted by chronic wounds. These wounds also affect the quality of life of nearly 2.5% of the total population, with a larger impact on the elderly.

With rising prevalence along with the challenges of associated treatment costs and comorbidities, investment in advanced wound solutions is likely to surge. Technological and product innovations that can accelerate healing in chronic wounds while lowering risks of infection and amputation can tap into urgent, expanding demand. Companies at the cutting edge of wound biologics, skin substitutes, NPWT devices and sophisticated dressings are well-positioned to see significant near-term growth.

Recent research also highlights promising potential in leveraging the natural properties of shark skin for next-gen wound care. As studies from the Karolinska Institute reveal, the skin's unique structure and composition could inspire new biomimetic materials to profoundly impact patient healing and recovery. Such innovations signify the range of advanced wound care advancements still yet to emerge.

A research paper published on Oct 2023 in Science Translational Medicine shows breakthrough in bioprinting full-thickness human skin has opened up exciting possibilities for advanced wound care.

The bioprinted skin developed by researchers at the Wake Forest Institute for Regenerative Medicine (WFIRM) showed significantly faster healing rates and improved tissue regeneration compared to traditional skin grafts. The successful development of full-thickness human bioprinted skin opens up new possibilities for treating chronic wounds, such as diabetic foot ulcers, which often resist traditional healing methods.

These products are commonly used in the treatment of wounds and have contributed to improved outcomes. In particular, slivers and alginates are utilized in dressings for surgical and chronic wounds to prevent infection. Additionally, skin grafts and biomaterials are employed to treat wounds that are unable to heal naturally.

Growth Drivers

Increasing Geriatric Population

The aging population is a significant driver behind the Advanced Wound Care Market growth. As individuals grow older, they become more susceptible to chronic conditions like diabetes, surgical wounds, peripheral artery disease, and pressure and diabetic ulcers. These conditions often lead to complex and non-healing wounds, necessitating advanced wound care solutions.

With global life expectancy on the rise, the demand for advanced wound care products and services is projected to continually increase. This demographic shift underscores the importance of addressing the unique wound care needs of the elderly, thereby fueling the expansion of the Advanced Wound Care Market.

Technological Advancements

Technological innovations have ushered in a new era of wound care, greatly benefiting the Advanced Wound Care Market. These advancements have led to the creation of cutting-edge wound care products and therapies.

A team of researchers from the National University of Singapore (NUS) has developed an innovative magnetic wound-healing gel that promises to heal diabetic wounds three times faster, reduce the rates of recurrence, and in turn, lower the incidents of limb amputations. The gel contains skin cells for healing as well as magnetic particles, and is used in conjunction with a wireless external magnetic device to activate skin cells and accelerate the wound healing process.

Hyperbaric oxygen therapy enhances tissue repair through increased oxygen supply. Bioengineered skin substitutes offer a promising alternative for patients with extensive tissue loss. These technological breakthroughs have not only improved patient outcomes but also driven the growth of the Advanced Wound Care Market as healthcare providers seek these innovative solutions to enhance their wound care practices.

Rising Awareness and Education

The growth of the Advanced Wound Care Market is also propelled by major factors like increasing awareness and education among healthcare professionals and patients alike. Recognizing the benefits of advanced wound care, healthcare practitioners are more inclined to adopt these advanced techniques and products. Educational initiatives, conferences, and research publications play a pivotal role in disseminating knowledge and promoting best practices in wound management.

Healthcare professionals attending conferences and workshops gain insights into the latest advancements, enabling them to provide superior care. Patients are also becoming more informed about their treatment options, leading to greater demand for advanced wound care solutions. This growing awareness within the healthcare community and among patients contributes significantly to the expansion of the Advanced Wound Care Market.

Increase in Diabetic Population

Advanced wound care products are essential for treating diabetic foot ulcers, a common condition among diabetic patients. According to Science Direct, diabetic foot ulcers affect more than 25.0% of the diabetic population and can result in foot amputation for 20.0% of patients.

As the diabetic population continues to grow, the demand for advanced wound care products is expected to increase. These products offer benefits such as moisture retention and accelerated wound healing, both internally and externally. They also aid in the absorption of necrotic tissues, making them effective for surgical site infections. Healthcare professionals prefer to use advanced wound care products, driving market growth in the foreseeable future.

Restraints

High Costs and the Impact

The Advanced Wound Care Market faces a significant challenge related to the cost of its products and treatments. Advanced wound care solutions often come with a higher price tag compared to traditional wound care methods.

While these advanced therapies offer superior outcomes, the cost factor can limit their accessibility for certain patient populations. This issue is particularly pronounced in regions with limited healthcare resources or where patients have inadequate insurance coverage. Consequently, addressing the affordability of advanced wound care is essential to ensure equitable access and sustained growth of the Advanced Wound Care Market.

Regulatory Challenges

The development and commercialization of advanced wound care products are subject to rigorous regulatory approvals, and this presents a notable hurdle for the Advanced Wound Care Market. Obtaining regulatory clearance or approval can be a time-consuming and expensive process.

Additionally, ensuring compliance with various regulations and standards is paramount for manufacturers, as non-compliance can lead to delays or even product recalls. These challenges can hinder the introduction of new and innovative advanced wound care products into the market. Addressing these regulatory complexities is crucial for promoting innovation and growth in the Advanced Wound Care Market.

By Product

In terms of revenue, antimicrobial wound care products are projected to experience the highest CAGR during the forecast period, at 6.8% in the advanced wound care market share. These products are specifically designed to reduce microbial burden in wound beds, and commonly used for the treatment of partial and full-thickness wounds, including surgical incisions, pressure ulcers, venous foot ulcers etc.

Recent innovations in advanced wound care like antimicrobial wound matrices and magnetically-stimulated healing gels signify the robust pace of progress in this market. As evidenced by new offerings like Organogenesis' PuraPly and the magnetic gel from the National University of Singapore, product development is addressing key unmet needs around infection control and healing times.

Antimicrobial solutions like PuraPly aim to limit biofilm formation and bacterial growth within the wound site, which remains a major impediment to recovery progress and a driver of adverse outcomes. With signs of improved healing trajectories and infection prevention, antimicrobial wound matrices are likely to see strong clinical adoption and market success.

While the Antimicrobial segment is a cornerstone of the wound care market, the Active segment also plays a significant role. This segment includes products such as Biomaterials and Skin-substitutes, which offer advanced wound healing solutions.

Whereas Moist segment of the Antimicrobial wound care products market is dedicated to advanced wound dressings that create a moist environment to facilitate the healing process. These wound dressings are critical for managing a variety of wounds and promoting optimal conditions for tissue repair.

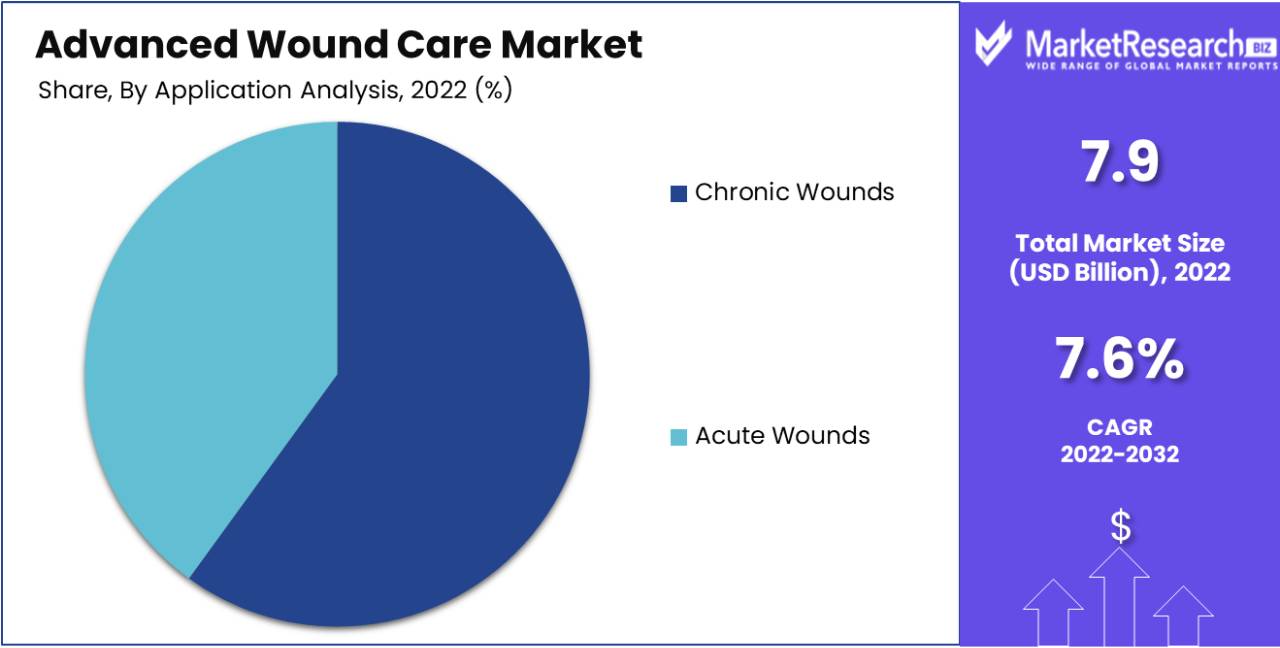

By Application

Chronic Wounds Segment is expected to experience the highest CAGR during its forecast period: 5.4%. This segment encompasses various forms of persistent wounds such as diabetic foot ulcers, venous pressure ulcers, and other chronic wounds. The increasing incidence of pressure ulcers is one of the key drivers behind this sector's expansion.

According to estimates by the Agency for Healthcare Research and Quality that more than 2.5 million individuals in the U.S. develop them annually. According to the American Diabetes Association, approximately 34.2 million U.S. residents -- or 10.5% of population -- had diabetes as of 2018. As diabetic populations increase, foot ulcers will likely increase as a result, driving market growth for advanced wound treatment products in chronic injuries or wounds over the forecast period.

While the Chronic Wounds Segment focuses on persistent wounds, the Acute Wounds Segment is equally crucial, addressing a distinct category of wounds that necessitate rapid intervention and specialized care. Acute wounds encompass a wide range of injuries, including surgical incisions, traumatic wounds, burns, and acute lacerations. As medical procedures and emergency cases continue to rise, the Acute Wounds Segment remains a crucial component of the advanced wound care market, complementing the efforts to provide comprehensive wound care solutions across a spectrum of clinical scenarios.

By End-Use

Home healthcare is projected to experience the highest CAGR during its forecast period: 6.17%. This can be attributed to many factors, including increased demand for advanced wound care products during COVID-19 pandemic outbreak. Additionally, an increasing geriatric population should fuel demand for advanced wound care products in home healthcare settings.

Research indicates that older individuals tend to experience chronic wounds more readily; as we get older our bodies' ability to heal wounds decreases accordingly. Wound Care Learning Network data demonstrates that elderly populations are at increased risk of suffering pressure ulcers; thus contributing to growth of advanced wound care market in home healthcare segment.

Hospitals, equipped with state-of-the-art facilities and a comprehensive range of medical expertise, serve as the frontline institutions for acute wound care, surgical procedures, and trauma management. Specialty clinics, on the other hand, offer specialized wound care services for patients with specific needs, such as wound care centers focused on diabetic foot ulcers or burn clinics catering to severe burn injuries.

Key Market Segment

By Product

Moist

- Foam Dressings

- Hydrocolloid Dressings

- Film Dressings

- Alginate Dressings

- Hydrogel Dressings

- Collagen Dressings

- Other Advanced Dressings

Antimicrobial

- Silver

- Non-silver

Active

- Biomaterials

- Skin-substitute

By Application

Chronic Wounds

- Diabetic Foot Ulcers

- Pressure Ulcers

- Venous Leg Ulcers

- Other

Acute Wounds

- Surgical & Traumatic Wounds

- Burns

By End-use

- Hospitals

- Specialty Clinics

- Home Healthcare

- Others

Growth Opportunities

Emerging Markets

Advanced wound care products and treatments have a promising future in emerging markets. These are developing countries where the healthcare infrastructure is steadily growing. As economies in these regions improve, and healthcare accessibility becomes more widespread, the demand for advanced wound care products and treatments is poised to surge.

In the context of the Advanced Wound Care Market, emerging markets represent a significant growth opportunity. As more people gain access to healthcare facilities and services, there will be an increased need for innovative wound care solutions to address various acute and chronic wounds. This growing demand can attract investments and market expansion efforts from global players in the advanced wound care industry.

Research and Development

Continuous investment in research and development (R&D) is crucial for the Advanced Wound Care Market's growth. This field relies on cutting-edge technologies and therapies to improve patient outcomes and reduce healing times. Collaborations between academia, industry, and healthcare organizations are essential drivers of innovation in advanced wound care.

The Advanced Wound Care Market constantly seeks novel wound care therapies, which may include advanced dressings, regenerative medicine approaches, and smart wound care technologies. R&D efforts can lead to breakthroughs in these areas, creating new growth opportunities and competitive advantages for companies in the market. Additionally, R&D investments can help address unmet medical needs and improve the overall quality of wound care.

Telemedicine and Digital Health

The integration of telemedicine and digital health platforms is revolutionizing wound care management within the Advanced Wound Care Market. These technologies provide healthcare professionals with powerful tools to optimize treatment plans, improve patient outcomes, and reduce healthcare costs.

- Remote Patient Monitoring: Advanced wound care often requires continuous monitoring of wounds, and telemedicine enables healthcare providers to remotely monitor patients' progress. This real-time data helps in making timely adjustments to treatment plans.

- Teleconsultations: Patients can consult with wound care specialists via teleconsultation, regardless of their geographical location. This ensures that patients have access to expert advice and guidance.

- Data Analytics: Digital health platforms can collect and analyze data from various sources, including wearable devices and electronic health records. This data-driven approach enables personalized wound care strategies and predictive analytics for better patient management.

Latest Trends

Bioactive Dressings

Bioactive dressings represent a significant advancement in the Advanced Wound Care Market. These dressings are engineered to actively promote wound healing by incorporating various bioactive substances, including growth factors, enzymes, and antimicrobial agents. They create an optimal environment for wound healing, which can significantly accelerate the healing process.

Bioactive dressings not only protect the wound but also actively support the body's natural healing mechanisms. Their increasing popularity underscores their potential to transform the Advanced Wound Care Market by offering more efficient and targeted wound care solutions.

Smart Wound Monitoring and Its Impact

The integration of digital health technologies has led to the emergence of smart wound monitoring systems, which are revolutionizing the Advanced Wound Care Market. These systems employ a combination of sensors, imaging technologies, and digital platforms to continuously monitor the status of wounds. They track the progress of healing in real-time and provide valuable feedback to healthcare providers.

Smart wound monitoring enhances wound assessment accuracy, facilitates early intervention when needed, and ultimately leads to improved patient outcomes. The adoption of these technologies is reshaping the way wounds are managed, making them a key driver of innovation in the Advanced Wound Care Market.

Regenerative Therapies and Their Potential

Regenerative therapies, such as stem cell therapy and tissue engineering, are gaining prominence within the Advanced Wound Care Market. These cutting-edge approaches aim to stimulate the body's innate healing processes and promote the regeneration of damaged tissues. By harnessing the power of regenerative medicine, these therapies offer the potential to revolutionize wound care, especially for chronic and complex wounds that have proven challenging to treat with traditional methods.

Stem cell therapy, for example, can encourage the formation of new blood vessels and tissue, while tissue engineering can provide customized solutions for tissue loss. The development and adoption of regenerative therapies represent a significant stride towards more effective and enduring wound care solutions within the Advanced Wound Care Market.

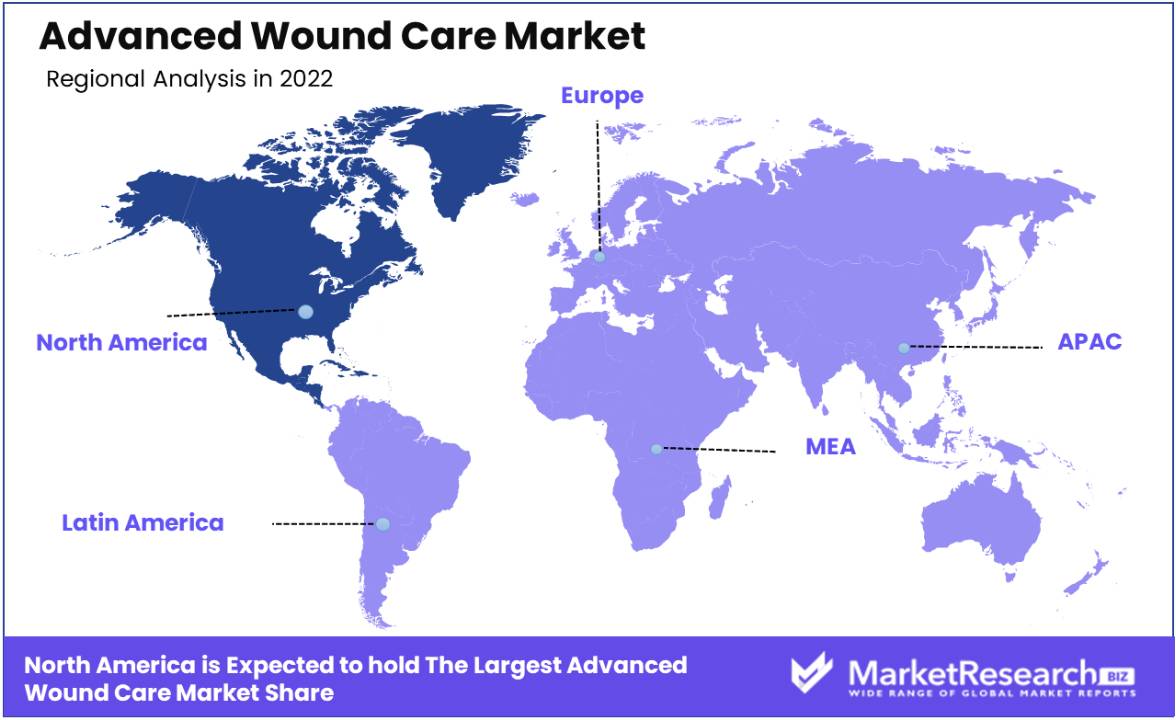

Regional Analysis

North America is currently the leading region in the global Advanced Wound Care Market share and is expected to maintain this position during the forecast period. This is primarily due to the increasing number of surgical procedures and the well-established healthcare infrastructure in the region. The presence of numerous players in the market and the growth in acquisitions have also contributed to the significant growth of the Advanced Wound Care Market in North America.

Moreover, there has been a noticeable increase in the adoption of Advanced Wound Care Market products and a rise in patient awareness across emerging regions, which is expected to drive regional market growth. In the upcoming years, the rise in accident rates, such as road accidents, burns, and trauma events in North America, will further boost the demand for Advanced Wound Care Market products in the region.

Overall, North America's dominance in the Advanced Wound Care Market presents substantial opportunities for investors and industry players in the region. It is crucial to stay updated about the latest trends and developments in the industry to make well-informed decisions as the market continues to grow.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

The global market for advanced wound care is characterized by a high level of fragmentation, with the presence of numerous small and major companies. This leads to intense competitive rivalry in the market, which is expected to increase over the forecast period. To strengthen their product portfolios, leading players in the market are actively engaging in collaborations, product launches, mergers, and acquisitions.

For example, in September 2022, PolyNovo Limited received FDA 510(k) clearance for its product called 'NovoSorb MTX', which is designed for the management of complex chronic wounds. This clearance allows PolyNovo Limited to further establish its presence in the advanced wound care market.

Some of the key players in the global advanced wound care market include

- Smith & Nephew

- Mölnlycke Health Care AB

- ConvaTec Group PLC

- Baxter International

- URGO Medical

- Coloplast Corp.

- Medtronic

- 3M

- Derma Sciences Inc. (Integra Life Sciences)

- Medline Industries

Recent Development

- In July 2023, Medline Industries has introduced slow-release iodine dressings to address the challenge of slow wound healing. These dressings release iodine slowly over a three-day period, effectively combating biofilm, a bacterial structure that hinders wound healing. Iodine's multiple modes of action also help prevent bacterial resistance.

- In June 2023, The Central Drugs Standard Control Organisation (CDSCO) has granted approval to Cholederm, an advanced wound care product developed by the Sree Chitra Tirunal Institute for Medical Sciences and Technology (SCTIMST). It's a Class D medical device derived from the extracellular matrix of a pig's gall bladder.

- In November 2022, RedDress made a significant announcement in the field of advanced wound care by introducing their innovative ActiGraft+® system to Puerto Rico. This development is poised to revolutionize wound management in the region, offering patients access to cutting-edge technology for improved healing.

- In October 2022, Bengaluru-based Healthium Medtech has introduced a revolutionary wound dressing portfolio known as Theruptor Novo. This advanced wound dressing is designed specifically for managing chronic wounds like diabetic foot ulcers and leg ulcers. It is patented in the US, India, EU, and Canada.

- In January 2022, Hygiene and health company Essity has made a significant move in the advanced wound care sector by acquiring Hydrofera. This acquisition, valued at $116 million, aligns with Essity's strategic priority to expand through acquisitions in the medical solutions sector.

Report Scope

Report Features Description Market Value (2022) USD 7.9 Bn Forecast Revenue (2032) USD 16.1 Bn CAGR (2023-2032) 7.6% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Moist, Antimicrobial), By Application (Chronic Wounds, Acute Wounds), By End-use (Hospitals, Home Healthcare) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Smith & Nephew, Mölnlycke Health Care AB, ConvaTec Group PLC, Baxter International, URGO Medical, Coloplast Corp., Medtronic, 3M, Derma Sciences Inc. (Integra Life Sciences), Medline Industries. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Smith & Nephew

- Mölnlycke Health Care AB

- ConvaTec Group PLC

- Baxter International

- URGO Medical

- Coloplast Corp.

- Medtronic

- 3M

- Derma Sciences Inc. (Integra Life Sciences)

- Medline Industries