Elderly Care Market By Service (Home Care, Adult Day Care, Institutional Care), By Product Type (Pharmaceuticals, Housing & Assistive Devices), By Application (Respiratory Diseases, Heart Diseases, Neurological Diseases, Kidney Diseases, Cancer Diseases, Diabetes, Osteoporosis), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

39996

-

Aug 2024

-

188

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

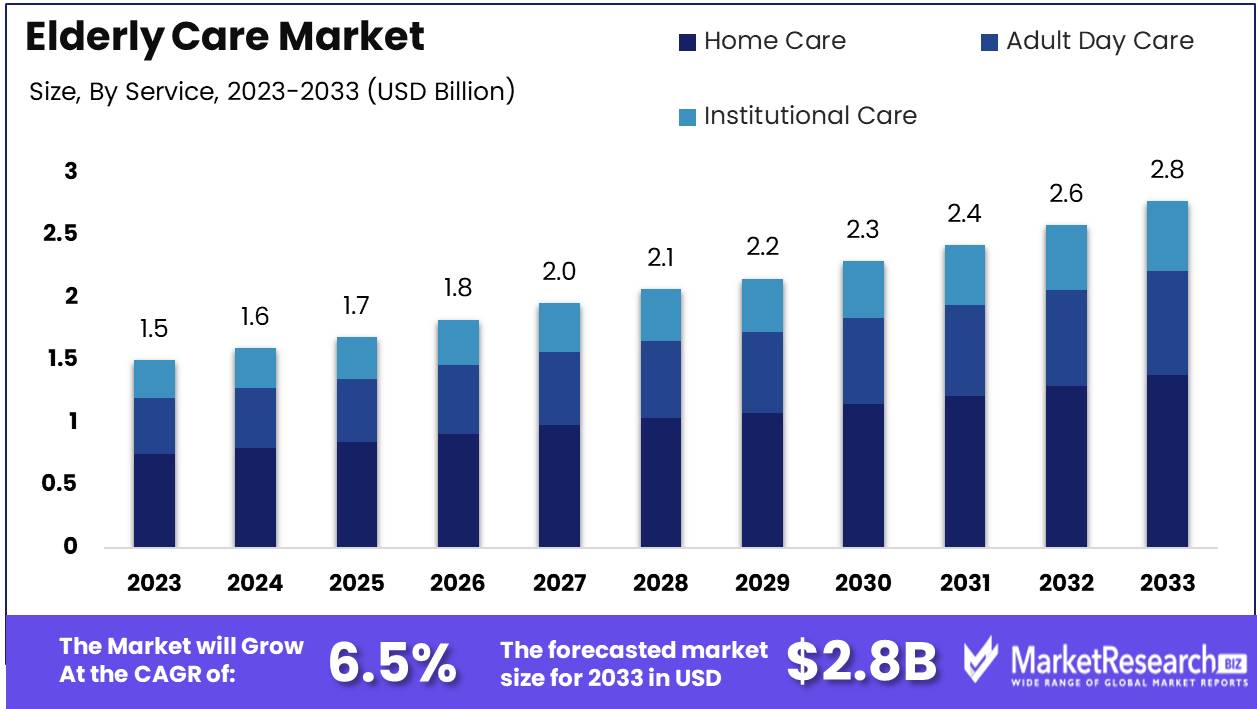

The Global Elderly Care Market was valued at USD 1.5 Bn in 2023. It is expected to reach USD 2.8 Bn by 2033, with a CAGR of 6.5% during the forecast period from 2024 to 2033.

The elderly care market encompasses a range of services and products designed to assist the aging population, including in-home care, assisted living facilities, nursing homes, and geriatric healthcare. This market is driven by demographic shifts such as increasing life expectancy and the growing number of elderly individuals. Key trends include the integration of advanced technologies for health monitoring and care delivery, as well as a rising demand for personalized and home-based care solutions. As the global population ages, the elderly care market is expected to expand significantly, presenting opportunities for innovation and investment in both developed and emerging economies.

The elderly care market is poised for substantial growth, driven by demographic trends and evolving care needs of the aging population. In 2019, nearly 50% of the EU elderly population, particularly women and those with lower educational attainment, reported moderate to severe difficulties with personal care or household activities, underscoring a significant demand for comprehensive elderly care services. This demand is further amplified by the prevalence of informal care; across 25 OECD countries, approximately one in eight people aged 50 and over provide such care, highlighting the critical need for formal support systems.

The elderly care market is poised for substantial growth, driven by demographic trends and evolving care needs of the aging population. In 2019, nearly 50% of the EU elderly population, particularly women and those with lower educational attainment, reported moderate to severe difficulties with personal care or household activities, underscoring a significant demand for comprehensive elderly care services. This demand is further amplified by the prevalence of informal care; across 25 OECD countries, approximately one in eight people aged 50 and over provide such care, highlighting the critical need for formal support systems.Technological advancements are reshaping the elderly care landscape, with innovations such as remote health monitoring, telemonitoring, and AI-driven care management solutions enhancing the quality and efficiency of care delivery. The growing preference for aging in place is boosting demand for in-home care services and smart home systems technologies tailored to elderly needs. Additionally, the market is witnessing increased investment in assisted living facilities and nursing homes, aiming to provide more personalized and high-quality care options.

As the elderly population continues to rise, particularly in developed nations with high life expectancies, the market for elderly care services is expected to expand significantly. Companies operating in this space must focus on integrating innovative technologies, enhancing service quality, and addressing the specific needs of diverse elderly populations to capture and sustain market share. Strategic partnerships, regulatory compliance, and investment in caregiver training and support will be crucial in navigating this rapidly evolving market and meeting the growing demand for elderly care solutions.

Key Takeaways

- Market Value: The Global Elderly Care Market was valued at USD 1.5 Bn in 2023. It is expected to reach USD 2.8 Bn by 2033, with a CAGR of 6.5% during the forecast period from 2024 to 2033.

- By Service: Home Care represents 50% of the market, offering personalized care services in the comfort of patients' homes.

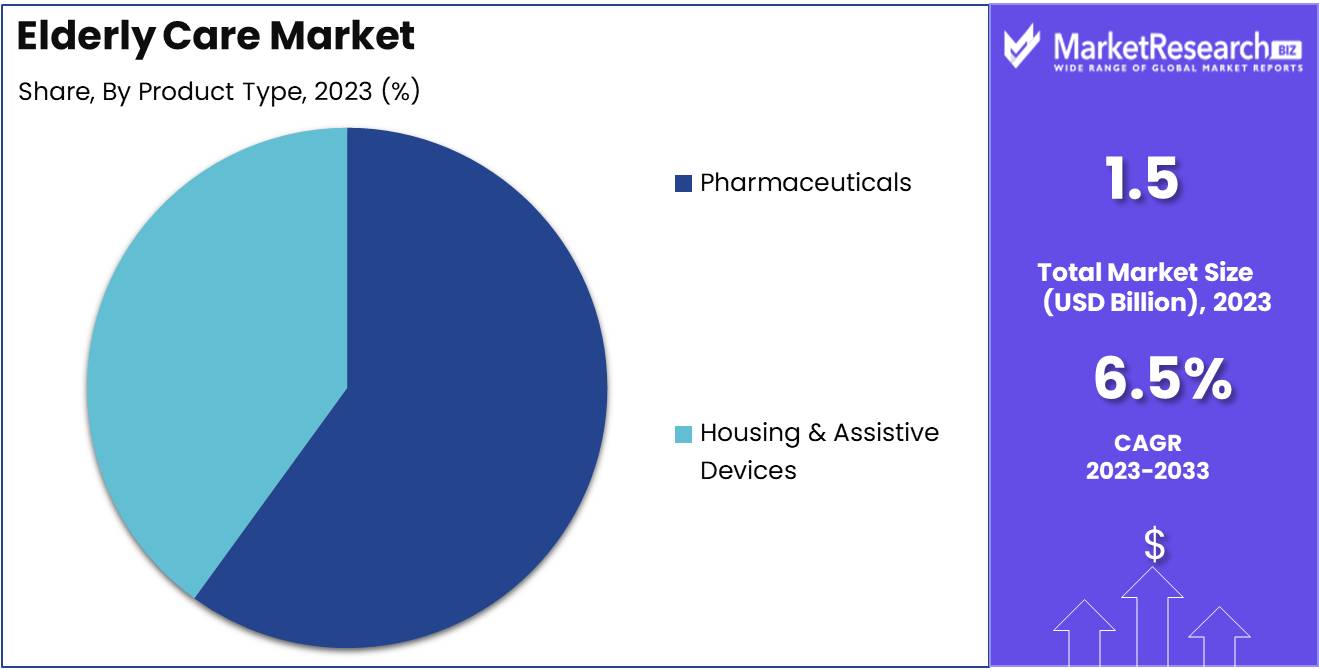

- By Product Type: Pharmaceuticals dominate with 60%, crucial for managing chronic conditions prevalent among the elderly.

- By Application: Heart Diseases account for 25%, highlighting the need for specialized care and medication.

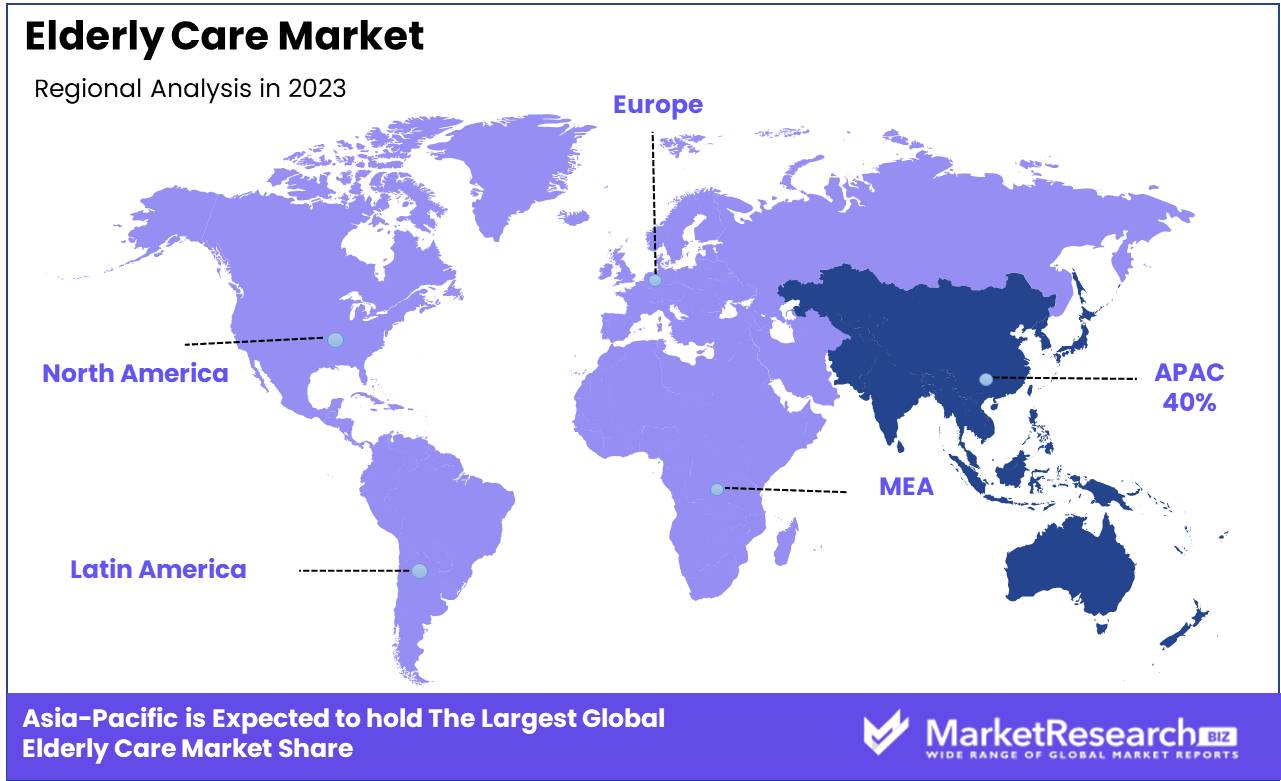

- Regional Dominance: Asia-Pacific holds a 40% market share, driven by an aging population and increasing healthcare awareness.

- Growth Opportunity: Expanding telehealth services and remote monitoring solutions can enhance care accessibility and efficiency for the elderly population.

Driving factors

Growing Aging Population

The elderly care market's growth is primarily driven by the rapidly increasing aging population. Global demographics indicate a significant rise in the number of individuals aged 65 and older, a trend expected to continue in the coming decades. According to the World Health Organization (WHO), the global population aged 60 and above is projected to reach 2.1 billion by 2050.

This demographic shift creates a larger base of elderly individuals requiring various levels of care, ranging from basic daily assistance to intensive medical support. The expanding elderly population directly translates to higher demand for specialized care services, driving the market's growth.

Increasing Prevalence of Chronic Diseases Among the Elderly

Another critical factor contributing to the growth of the elderly care market is the increasing prevalence of chronic diseases among the elderly. Conditions such as diabetes, cardiovascular diseases, arthritis, and dementia are more common in older adults, necessitating ongoing medical attention and long-term care.

The Centers for Disease Control and Prevention (CDC) estimates that about 85% of older adults have at least one chronic health condition, and 60% have at least two. The need for continuous monitoring, medication management, and specialized treatments for these chronic conditions significantly boosts the demand for elderly care services, including both residential facilities and in-home care solutions.

Rising Demand for Home Healthcare Services

The rising demand for home healthcare services is another pivotal driver of the elderly care market. As elderly individuals and their families increasingly prefer the comfort and familiarity of home over institutional settings, the home healthcare segment has seen substantial growth. Home healthcare equipment services encompass a wide range of offerings, including medical care, physical therapy, personal care, and companionship.

This trend is supported by advancements in telemedicine and remote monitoring technologies, which enable healthcare providers to deliver high-quality care in the home environment. The convenience, personalized attention, and cost-effectiveness of home healthcare make it an attractive option, further propelling market growth.

Restraining Factors

High Cost of Elderly Care Services

The elderly care market faces significant retraining factors, prominently the high cost of services. Elderly care, whether in residential facilities or through home healthcare, involves substantial expenses related to medical care, personal assistance, and specialized support. Long-term care facilities often charge premium rates due to the comprehensive services they offer, including 24/7 medical supervision, personalized care plans, and various amenities.

According to a report by Genworth, the average cost of a private room in a nursing home in the United States exceeds $100,000 per year. These high costs can be prohibitive for many families, limiting access to necessary care and potentially slowing market growth as affordability remains a critical concern.

Shortage of Skilled Healthcare Professionals

Another major retraining factor in the elderly care market is the shortage of skilled healthcare professionals. The demand for qualified caregivers, nurses, and medical practitioners is rising in tandem with the growing elderly population, but the supply of these professionals is not keeping pace. According to the World Health Organization (WHO), there is a global shortfall of 18 million health workers, including nurses and caregivers, particularly in low- and middle-income countries.

This shortage impacts the quality and availability of elderly care services, as facilities and home care providers struggle to recruit and retain healthcare staffing. The lack of skilled professionals can lead to increased workloads, burnout, and higher turnover rates, further exacerbating the issue. This staffing challenge hinders the ability of the market to expand and meet the escalating demand for elderly care services

By Service Analysis

Home Care held a dominant market position in the By Service segment of the Elderly Care Market, capturing more than a 50% share.

In 2023, Home Care held a dominant market position in the By Service segment of the Elderly Care Market, capturing more than a 50% share. This significant market share is driven by the growing preference among the elderly population to receive care in the comfort of their own homes. Home care services include a wide range of offerings such as personal care, medical care, and companionship, catering to the diverse needs of elderly individuals. The convenience, personalized attention, and cost-effectiveness of home care make it a popular choice. Additionally, advancements in remote monitoring technologies and telehealth services are enhancing the quality and accessibility of home care.

Adult Day Care services, which provide daytime support and social activities for seniors, are also important in the market. These services offer respite for family caregivers and a structured environment for elderly individuals, contributing to their overall well-being.

Institutional Care, including nursing homes and assisted living facilities, remains crucial for seniors who require around-the-clock medical care and supervision. While it captures a smaller share compared to home care, institutional care is essential for providing comprehensive support to those with severe health conditions or disabilities.

By Product Type Analysis

Pharmaceuticals held a dominant market position in the By Product Type segment of the Elderly Care Market, capturing more than a 60% share.

In 2023, Pharmaceuticals held a dominant market position in the By Product Type segment of the Elderly Care Market, capturing more than a 60% share. This dominance is due to the high prevalence of chronic diseases among the elderly population, which necessitates ongoing medication management and therapy. Pharmaceuticals, including prescription drugs and over-the-counter medications, are essential for managing conditions such as heart disease, diabetes, and neurological disorders. The growing elderly population and the increasing incidence of age-related health issues drive the demand for pharmaceuticals in elderly care.

Housing & Assistive Devices, which include mobility aids, home modification equipment, and assistive technologies, also play a vital role in elderly care. These products enhance the quality of life for seniors by promoting independence and safety. While they hold a smaller share compared to pharmaceuticals, their importance is growing as more elderly individuals seek to age in place.

By Application Analysis

Heart Diseases held a dominant market position in the By Application segment of the Elderly Care Market, capturing more than a 25% share.

In 2023, Heart Diseases held a dominant market position in the By Application segment of the Elderly Care Market, capturing more than a 25% share. The high prevalence of cardiovascular conditions among the elderly population drives the demand for specialized care and treatment. Heart diseases, including hypertension, coronary artery disease, and heart failure, require continuous monitoring, medication management, and lifestyle interventions. The focus on preventing and managing heart diseases is critical, given their impact on the health and quality of life of elderly individuals.

Respiratory Diseases, such as chronic obstructive pulmonary disease (COPD) and asthma, are also significant, requiring ongoing medical support and respiratory disease vaccine and therapies.

Neurological Diseases, including Alzheimer's and Parkinson's disease, necessitate specialized care for managing cognitive and motor impairments.

Kidney Diseases, which often require dialysis or transplantation, demand comprehensive medical care and support.

Cancer Diseases in the elderly require ongoing treatment, pain management, and palliative care.

Diabetes management involves regular monitoring, medication, and lifestyle adjustments, making it a crucial application in elderly care.

Osteoporosis, which increases the risk of fractures, requires preventive measures and treatment to maintain bone health in the elderly population.

Key Market Segments

By Service

- Home Care

- Adult Day Care

- Institutional Care

By Product Type

- Pharmaceuticals

- Housing & Assistive Devices

By Application

- Respiratory Diseases

- Heart Diseases

- Neurological Diseases

- Kidney Diseases

- Cancer Diseases

- Diabetes

- Osteoporosis

Growth Opportunity

Development of Innovative Home Care Solutions and Assistive Technologies

The global elderly care market in 2024 is set to experience significant growth opportunities, particularly through the development of innovative home care solutions and assistive technologies. With a growing preference for aging in place, there is a rising demand for home-based care services that provide both medical and non-medical support. Innovations such as smart home systems, wearable health monitors, and automated medication dispensers are enhancing the quality of care while ensuring the safety and independence of elderly individuals.

These technologies enable real-time health tracking, early detection of health issues, and immediate response to emergencies, thereby reducing hospitalizations and improving overall health outcomes. Companies investing in such technologies are likely to capture substantial market share by addressing the evolving needs of the elderly population and their caregivers.

Expansion of Telehealth and Remote Monitoring Services

The expansion of telehealth and remote monitoring services represents another critical opportunity for the elderly care market in 2024. Telehealth platforms facilitate virtual consultations, allowing elderly patients to access medical care without leaving their homes. This is particularly beneficial for those with mobility issues or chronic conditions requiring frequent medical attention. Remote monitoring technologies, including connected health devices and apps, enable continuous health assessment and timely intervention.

These services not only improve patient outcomes but also offer cost-effective solutions for healthcare systems burdened by the increasing demand for elderly care. The integration of telehealth and remote monitoring is expected to drive market growth by enhancing the accessibility, efficiency, and quality of care for the elderly.

Latest Trends

Use of AI and Robotics for Elderly Care

In 2024, the global elderly care market is poised to be significantly influenced by the use of Artificial Intelligence (AI) and robotics. AI-powered solutions are transforming elderly care by providing advanced health monitoring, predictive analytics, and personalized care plans. Robotics, including robotic companions and automated assistants, are increasingly being adopted to assist with daily activities, medication management, and mobility support.

These technologies not only improve the quality of life for elderly individuals but also alleviate the workload on caregivers, addressing the shortage of skilled healthcare professionals. The integration of AI and robotics is expected to enhance care efficiency, reduce operational costs, and provide a safer and more engaging environment for the elderly, thereby driving market growth.

Adoption of Smart Home Technologies for Enhanced Safety and Convenience

The adoption of smart home technologies is another major trend shaping the elderly care market in 2024. Smart home systems equipped with sensors, cameras, and automated controls enhance the safety and convenience of elderly individuals living independently. These technologies enable remote monitoring, emergency response, and environmental control, providing peace of mind to both the elderly and their caregivers.

Features such as automated lighting, smart thermostats, and voice-activated assistants contribute to a comfortable and safe living environment. The integration of smart home technologies with healthcare services ensures timely interventions and continuous support, which is particularly crucial for elderly individuals with chronic conditions or mobility issues. This trend is expected to drive the demand for home-based elderly care solutions, promoting market expansion.

Regional Analysis

Asia-Pacific led the Elderly Care Market in 2023, capturing a 40% share.

In 2023, the Asia-Pacific region led the Elderly Care Market, capturing a 40% share. The rapidly aging population in countries like Japan, China, and South Korea drives the demand for elderly care services. Governments in these countries are implementing policies and investing in infrastructure to support elderly care facilities, home care services, and advanced medical technologies. The cultural emphasis on caring for the elderly within families also contributes to the growth of home-based elderly care services.

North America is a significant market, with the U.S. and Canada experiencing a growing elderly population. The demand for assisted living facilities, nursing homes, and home care services is high, supported by advanced healthcare systems and increased awareness of elderly care needs. The availability of government programs like Medicare and Medicaid further drives the market.

Europe follows closely, with countries like Germany, France, and the UK leading in elderly care services. The region benefits from well-established healthcare systems and government support for elderly care. The increasing life expectancy and the rising number of elderly individuals living alone are significant factors driving market growth.

In the Middle East & Africa, the elderly care market is emerging, with a focus on building infrastructure and services for the aging population. Countries like the UAE and South Africa are seeing increased investment in elderly care facilities and home care services.

Latin America is witnessing growth in the elderly care market, driven by improvements in healthcare infrastructure and increasing awareness of elderly care services. Brazil and Mexico are key markets, with a rising elderly population and growing demand for both residential and home-based care services.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The elderly care market in 2024 is marked by significant advancements in healthcare technology and personalized care services. Koninklijke Philips N.V. leads with its innovative health technology solutions, offering advanced home care devices and telehealth services that enhance elderly care management. Amedisys and LHC Group Inc. in the U.S. provide comprehensive home health and hospice care services, focusing on high-quality, patient-centered care that addresses the diverse needs of the aging population.

ECON Healthcare Group and ORPEA GROUPE are prominent in Asia and Europe, respectively, offering integrated elderly care services, including nursing homes and rehabilitation centers. Their extensive network and commitment to quality care make them leaders in their regions. Encompass Health Corporation in the U.S. is notable for its rehabilitation services, which play a crucial role in elderly care, particularly for post-acute and long-term recovery.

Medtronic's medical devices and remote monitoring technologies are essential for managing chronic conditions prevalent among the elderly. Extendicare and BAYADA Home Health Care also significantly contribute to the market with their broad range of home care and assisted living services, ensuring comprehensive care solutions. Prolifico and ElderCareCanada cater to niche markets, offering specialized services tailored to regional needs.

Right at Home LLC and Interim HealthCare Inc. provide personalized in-home care, which is increasingly in demand as more seniors prefer aging in place. Trinity Health and Exceptional Living Centers focus on integrating acute and long-term care services, providing a continuum of care that enhances patient outcomes. The elderly care market in 2024 is driven by innovation, quality care services, and the integration of advanced technologies, ensuring improved quality of life for the aging population.

Market Key Players

- Koninklijke Philips N.V.

- Amedisys

- ECON Healthcare Group

- Encompass Health Corporation

- EXTENDICARE

- LHC Group Inc.

- Medtronic

- ORPEA GROUPE

- Prolifico

- ElderCareCanada

- Exceptional Living Centers

- Right at Home LLC

- BAYADA Home Health Care

- United Medicare Pte Ltd

- Trinity Health

- Rosewood Care Group

- ST LUKE'S ELDERCARE LTD

- FC Compassus LLC

- Home Instead Inc.

- Interim HealthCare Inc.

- Living Assistance Services

Recent Development

- In March 2024, Amedisys acquired a home health care agency to expand its service offerings. This acquisition is expected to increase their market reach by 20%.

- In January 2024, Koninklijke Philips N.V. launched a new remote monitoring system for elderly care. This system aims to improve patient safety and care efficiency by 30%.

Report Scope

Report Features Description Market Value (2023) USD 1.5 Bn Forecast Revenue (2033) USD 2.8 Bn CAGR (2024-2033) 6.5% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service (Home Care, Adult Day Care, Institutional Care), By Product Type (Pharmaceuticals, Housing & Assistive Devices), By Application (Respiratory Diseases, Heart Diseases, Neurological Diseases, Kidney Diseases, Cancer Diseases, Diabetes, Osteoporosis) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Koninklijke Philips N.V., Amedisys, ECON Healthcare Group, Encompass Health Corporation, EXTENDICARE, LHC Group Inc., Medtronic, ORPEA GROUPE, Prolifico, ElderCareCanada, Exceptional Living Centers, Right at Home LLC, BAYADA Home Health Care, United Medicare Pte Ltd, Trinity Health, Rosewood Care Group, ST LUKE'S ELDERCARE LTD, FC Compassus LLC, Home Instead Inc., Interim HealthCare Inc., Living Assistance Services Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Koninklijke Philips N.V.

- Amedisys

- ECON Healthcare Group

- Encompass Health Corporation

- EXTENDICARE

- LHC Group Inc.

- Medtronic

- ORPEA GROUPE

- Prolifico

- ElderCareCanada

- Exceptional Living Centers

- Right at Home LLC

- BAYADA Home Health Care

- United Medicare Pte Ltd

- Trinity Health

- Rosewood Care Group

- ST LUKE'S ELDERCARE LTD

- FC Compassus LLC

- Home Instead Inc.

- Interim HealthCare Inc.

- Living Assistance Services