Global Personalized Cancer Treatment Market Size, Share, Growth, and Industry Analysis By Cancer Type (Breast Cancer, Lung Cancer, Others), Treatment Type (Targeted Therapy, Immunotherapy, Others), Diagnostic Techniques (Genomic Sequencing, Liquid Biopsy, Others), and By Region Forecast - 2023-2032

-

41178

-

Sep 2023

-

180

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

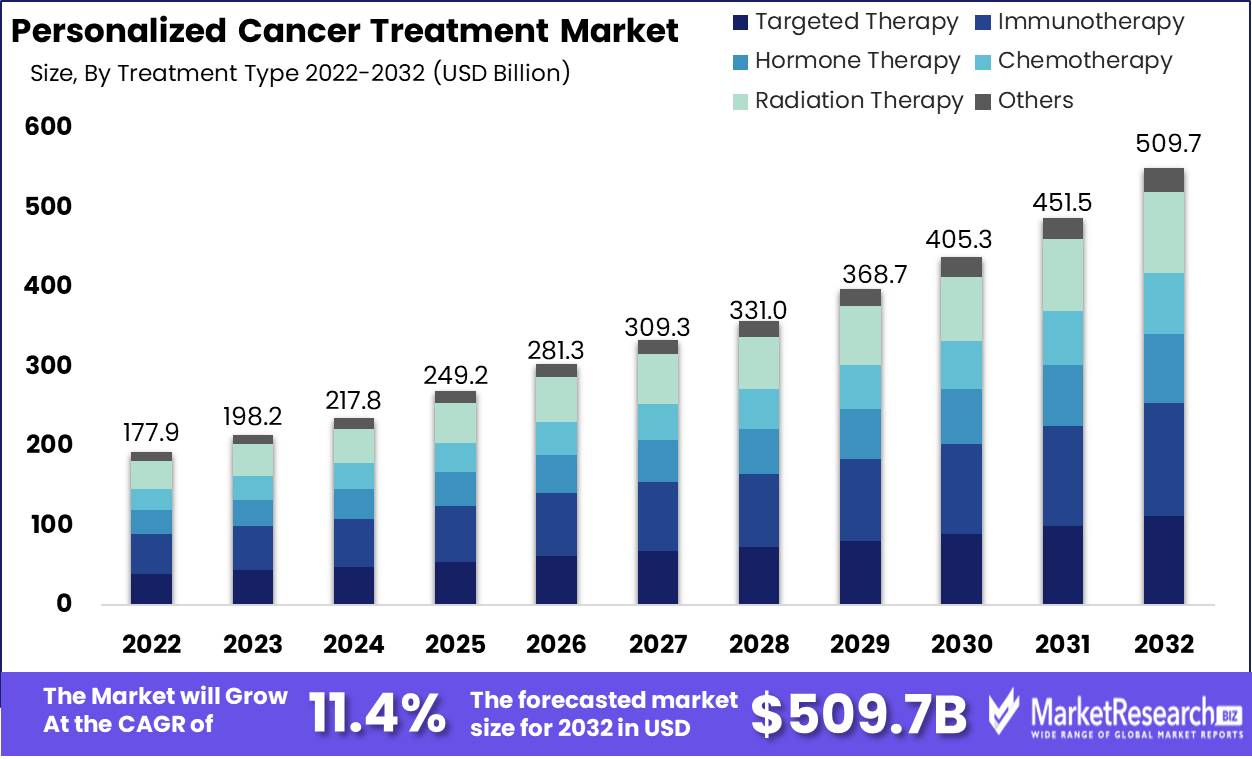

Global Personalized Cancer Treatment Market size is expected to be worth around USD 509.7 Bn by 2032 from USD 177.9 Bn in 2022, growing at a CAGR of 11.4% during the forecast period from 2023 to 2032.

Key Takeaways

- North America accounted for 49.1% of the overall global personalized cancer treatment market revenue in 2022 and is expected to reach approximately USD 249.22 billion in 2032

- Asia-Pacific currently is expected to continue to register fastest revenue CAGR of 11.1% compared to other regional markets in the global personalized cancer market over the forecast period

- The immunotherapy segment accounted for a significantly larger revenue share of USD XX.X in 2022 and is expected to maintain its dominance among the other treatment-type segments over the forecast period.

- According to Cancer Research UK, there were 18.1 million new cases of cancer worldwide in 2020, with the four most common cancers occurring worldwide being female breast, lung, bowel and prostate cancers.

- Female breast, lung, bowel and prostate cancers account for over four in 10 cancers diagnosed worldwide.

- Worldwide there will be 28 million new cases of cancer each year by 2040 and preference for novel and personalized cancer treatment and medicine is expected to increase substantially as compared to that for other treatment options.

Market Overview

Personalized cancer treatment, which is a cornerstone of modern oncology, comprises tailored therapies to an individual's unique genetic and molecular profile, thereby offering more precise and effective treatment options. Key technologies include genomic profiling to identify genetic mutations, liquid biopsies for non-invasive monitoring, and Artificial Intelligence (AI) for data analysis. Targeted therapies, immunotherapies, and hormone therapies are widely employed, often in combination, to attack cancer at source. Companion diagnostics help determine treatment suitability. Equipment such as sequencing machines and diagnostic devices are integral. Services encompass genetic counseling, clinical trials, and data interpretation. This approach revolutionizes cancer care, and serves to optimize outcomes while minimizing side effects.

The global personalized cancer treatment market registered substantial revenue growth in 2022, driven by factors such as increasing cancer prevalence and advancements in genomics driving steady adoption of personalized treatment among an expanding patient pool globally. Also, rising awareness regarding the benefits and advantages of personalized cancer treatment, coupled with favorable government initiatives and investments, continue to drive revenue growth of the market.

The adoption of personalized cancer treatment ensures patients benefit from reduced side effects and improved outcomes due to tailored therapies, such as targeted drugs and immunotherapy. Liquid biopsies and AI-driven data analysis further enhance treatment precision. Genetic counseling services also play a vital role in outcomes. In addition, continuous research and innovative companion diagnostics are revolutionizing cancer care worldwide and enabling the offering of tailored, effective, and less toxic treatments. Antibody-drug conjugates (ADCs) show promise in revolutionizing personalized cancer treatment by precisely delivering drugs to tumor cells.

Driving Factors

Advancements in Genomic Sequencing

Next-generation sequencing technologies have become more affordable and accessible in recent times, thus allowing for comprehensive genomic profiling. This not only enables oncologists to identify precise genetic mutations driving cancer but also facilitates targeted therapy selection. Increasing awareness regarding the advantages and benefits of this technology is driving revenue growth.Immunotherapy Expansion

Immunotherapies, like immune checkpoint inhibitors and CAR-T cell therapies, have gained robust prominence across the healthcare sector. These innovative treatments boost the body's immune system to fight cancer, and increasing preference is creating new revenue streams in the personalized cancer treatment market.Liquid Biopsies

Non-invasive liquid biopsies continue to transform cancer diagnostics owing to advantages such as real-time monitoring of tumor dynamics and enabling oncologists to adjust treatments as required. Liquid biopsies or CellSearch Circulating Tumor Cell (CTC) test, are used to analyze blood samples for the presence of circulating tumor cells. Monitoring using this technique can help doctors evaluate how a certain treatment is working and aid in determining what follow-up tests could be required. The increasing prevalence of cancer and patients opting for more cutting-edge treatments are expected to continue to drive revenue growth of the personalized cancer treatment market over the forecast period.AI-Driven Analytics

Artificial Intelligence (AI) and Machine Learning (ML) are enhancing data analysis, thereby enabling more accurate patient profiling and treatment predictions. AI-driven tools are steadily becoming indispensable in optimizing treatment plans, and increasing dependence is contributing significantly to revenue growth of the market.Companion Diagnostics

The development of companion diagnostics that identify biomarkers for specific therapies has become a lucrative segment. These diagnostics are multi-purpose, as the test not only gives insight into patients most likely to benefit from treatment with the corresponding drug but can also be used to determine whether the medicine will actually work during the course of treatment. This doubly ensures that patients receive the most suitable treatments, thereby increasing treatment efficacy. An increasing number of individuals and patients opting for more novel and efficient treatment options such as companion diagnostics is expected to continue to support an incline in market revenue.Restraining Factors

High Treatment Costs

The cost of personalized cancer treatment can be significantly higher than conventional therapies, which can be a restraint for patients and healthcare systems, especially in a number of developing economies.Limited Access to Advanced Healthcare

Disparities in healthcare access, particularly in lower-income regions or countries with underdeveloped healthcare infrastructure, can restrain adoption of personalized cancer treatment.Regulatory Challenges

Stringent regulatory requirements and lengthy approval processes for personalized treatments can dampen market growth, as delays in securing regulatory approval can limit the availability of new therapies, and this has an impact on revenue potential.No Payer Inclusion

Genetic testing can be expensive and is omitted by in number of insurance provider plans. In addition, the tests conducted take time to produce results and this results in a longer period to contemplate whether personalized treatment is an option that a patient can wait for, or opt for something more timely, considering what stage of the disease one has progressed to.Undesired Outcomes and Treatment Resistance

Despite the promise of personalized treatments, some patients may still develop resistance to therapies over time. This can lead to suboptimal outcomes and dissatisfaction, potentially affecting the credibility of personalized cancer treatments.Genetic Privacy Concerns

Collection and storage of sensitive genetic data raises concerns about patient privacy and data security. Breaches or misuse of this information can erode patient trust, result in hesitation to opt for such treatment options, and restrain potential market growth.Health Disparities

If personalized cancer treatments become primarily accessible to affluent populations or those in well-developed healthcare systems, it could exacerbate healthcare disparities and limit the global reach of these innovative therapies. This is another factor that can restrain revenue growth to some extent.Opportunities

Diagnostics-Centric Focus

Companies can capitalize on the rising demand for companion diagnostics, which are essential for identifying suitable patients for specific personalized cancer treatments. Developing accurate and efficient diagnostic tests that match patients with the most appropriate therapies presents a significant revenue opportunity.Data Analytics and AI Solutions

Businesses specializing in data analytics and AI can arm healthcare providers with advanced tools for analyzing patient data and optimizing treatment plans. Developing AI-driven platforms that offer insights into treatment effectiveness and personalized care pathways can generate revenue through licensing and subscription models.Clinical Trial Services

Continuous development of personalized cancer treatments is driving need for clinical trials to test safety and efficacy of these therapies. Companies that offer services related to patient recruitment, trial management, and data analysis can secure revenue streams by supporting pharmaceutical and biotech firms in their research efforts.Segment Analysis

By Treatment Type

Among the treatment types segments in the global personalized cancer treatment market report, the immunotherapy segment accounted for a significantly larger revenue share in 2022. Immunotherapy has gained prominence due to its effectiveness in enhancing patient's immune system to fight cancer cells and is highly preferred in personalized cancer treatment currently. Robust revenue growth can also be attributed to ongoing R&D efforts leading to the introduction of new immunotherapeutic agents and combination therapies. These innovations expand the range of cancers that can be treated with immunotherapy, thus attracting a larger patient pool.

Also, increasing understanding of the tumor microenvironment and biomarkers has allowed for better patient selection. Oncologists can provide more personalized treatment plans by identifying patients who are more likely to respond to immunotherapy. This enhances treatment efficacy and patient outcomes, and growing patient awareness of these aspects is contributing significantly to the revenue growth of the immunotherapy segment.

By Diagnostic Techniques

The genomic sequencing segment among the other diagnostic techniques segments accounted for the largest revenue share in 2022. Genomic sequencing is a crucial diagnostic technique and involves analyzing the genetic makeup of a patient's tumor to identify specific genetic mutations driving cancer growth. Key factors such as technological advancements and increasing adoption of the technique in personalized cancer treatment, and advances in high-throughput sequencing technologies that have made genomic profiling faster and more cost-effective, thereby widening its accessibility are driving revenue growth of this segment.

In addition, healthcare providers and patients are increasingly recognizing the benefits of tailoring cancer treatment based on genetic information, and this is driving the adoption of genomic sequencing. In addition, growing demand for accurate genetic profiling to guide treatment decisions is a key factor driving revenue growth of the genomic sequencing segment.

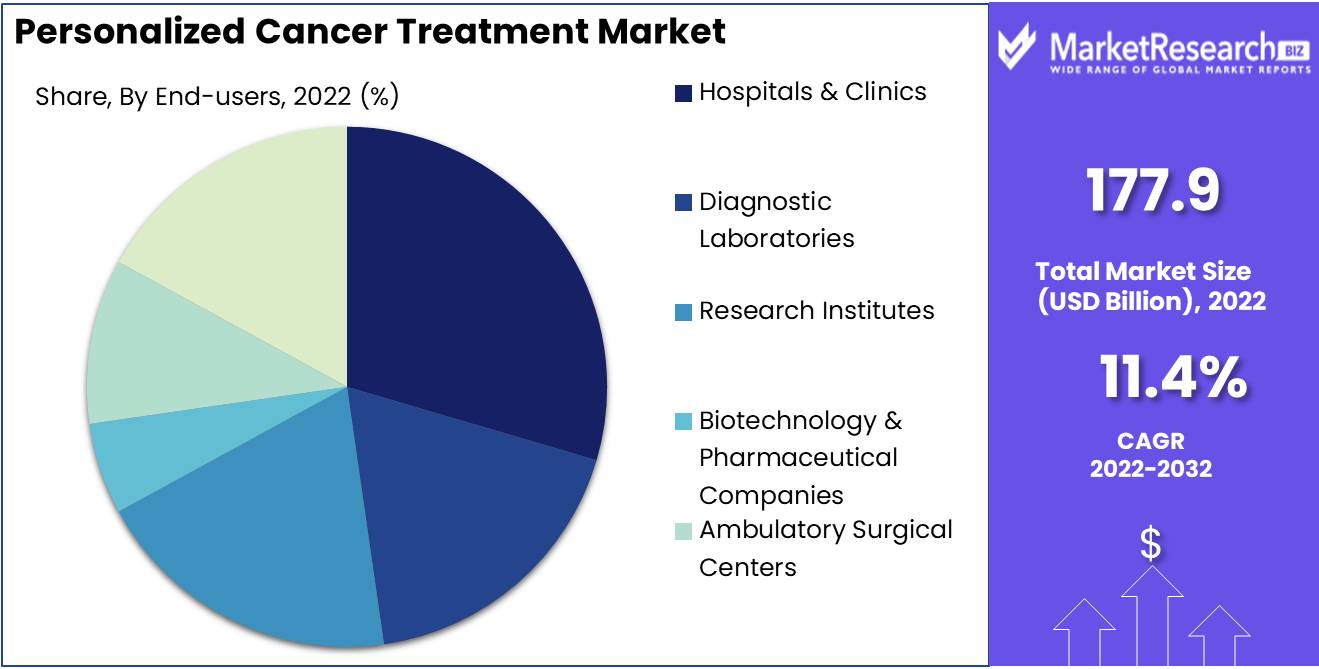

By End-User

Hospitals & Clinics segment among the end-user segments accounted for a significantly larger revenue share in the global personalized cancer treatment market in 2022. These healthcare facilities serve as the primary points of care for cancer patients, where diagnosis, treatment planning, and administration are conducted.

Increasing prevalence of cancer, steady adoption of personalized treatment approaches, rising global cancer burden resulting in a higher number of patients seeking treatment in hospitals and clinics, and shift towards personalized cancer treatment, including targeted therapies and immunotherapies, necessitates the involvement of specialized healthcare institutions equipped to deliver these advanced treatments. As personalized cancer treatments become more widespread and integral to cancer care, footfalls and patient consulting at hospitals and clinics is expected to increase substantially over the forecast period. This is also expected to drive revenue share incline of the hospitals and clinics segment to a major extent.

Market Segmentation

By Cancer Type

- Breast Cancer

- Lung Cancer

- Colorectal Cancer

- Prostate Cancer

- Melanoma

- Others

Treatment Type

- Targeted Therapy

- Immunotherapy

- Hormone Therapy

- Chemotherapy

- Radiation Therapy

- Others

Diagnostic Techniques

- Genomic Sequencing

- Liquid Biopsy

- Immunohistochemistry

- In Situ Hybridization

- Biomarker Testing

- Others

End-users

- Hospitals & Clinics

- Diagnostic Laboratories

- Research Institutes

- Biotechnology & Pharmaceutical Companies

- Ambulatory Surgical Centers

- Others

Regional Analysis

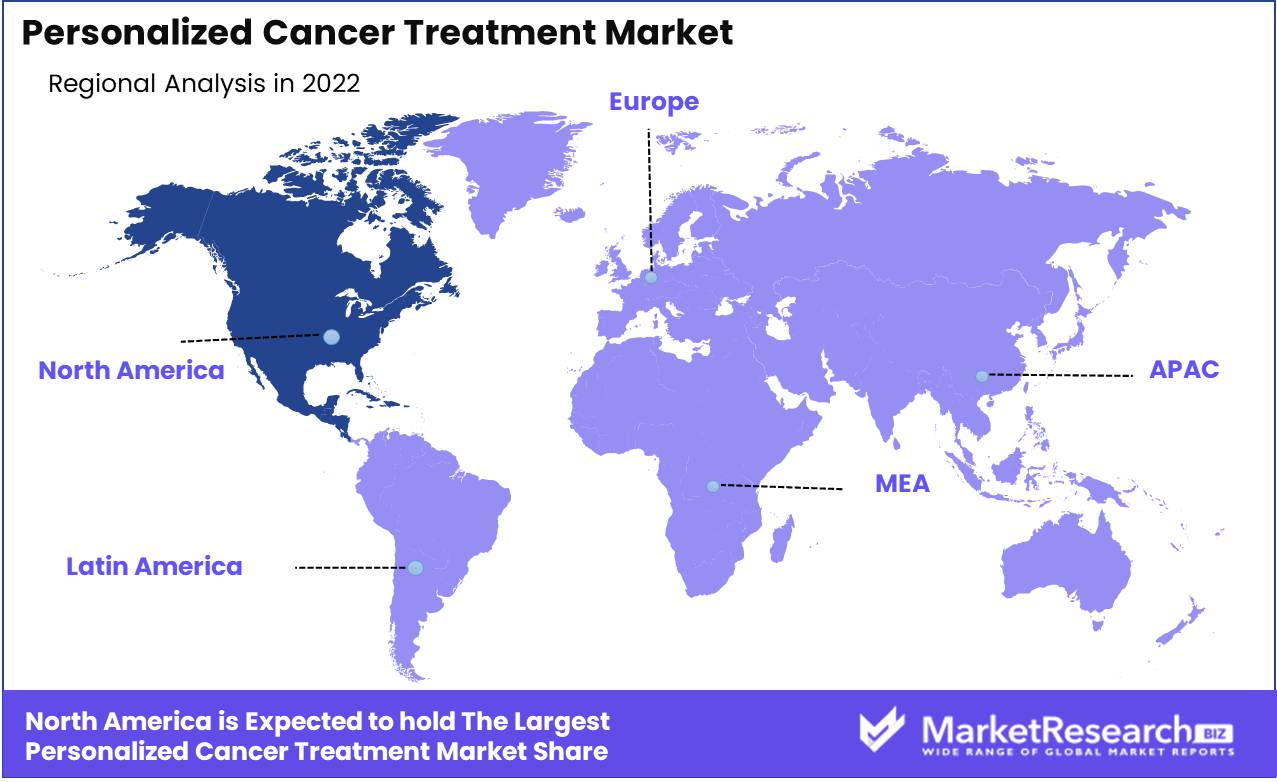

North America

North America dominates other regional markets in terms of revenue share contribution to the global personalized cancer treatment market, owing to its well-established healthcare infrastructure, significant investments in research and development, and a high prevalence of cancer in countries in the region. The United States, in particular, accounts for a substantially large market share.

Market growth is also supported by initiatives such as the Cancer Moonshot program, which encourage innovation, thereby leading to technological advancements in the field. In addition, companies in the region are investing significantly in companion diagnostics, AI-driven analytics, and immunotherapy. Moreover, the availability of advanced genomics facilities and clinical trial services further supports advancements in personalized cancer treatment. These factors, among others, are expected to continue to enable North America to maintain its dominance over other regional markets over the forecast period.

Europe

Europe personalized cancer treatment market growth is driven by factors such as increasing awareness about personalized cancer treatment and government initiatives to promote precision medicine. For instance, the European Union's Horizon 2020 program has funded several cancer research projects, and encouraged and supported technological advancements, and this coupled with a robust pharmaceutical and biotechnology sector in the region are contributing significantly to further advancements in companion diagnostics and targeted therapies. Also, countries such as Germany, France, and the United Kingdom are key players in the market in Europe in terms of market share. Advancements in genomics and immunotherapy in these countries are creating more avenues for adoption of personalized cancer treatment and this is expected to present lucrative opportunities for companies operating in the region.

Asia-Pacific

Asia-Pacific presents substantial growth opportunities for players in the personalized cancer treatment market in the region. The large population and rising prevalence of cancer in some countries in the region are key factors expected to drive demand for personalized cancer treatment over the forecast period. Initiatives such as China's Precision Medicine Initiative and Japan's Moonshot Program aim to accelerate the adoption of precision oncology, which is also expected to result in major technological advancements in the medical field.

In addition, increasing investments in genomics research, data analytics, and AI-driven solutions, as well as modernization of healthcare infrastructure and expanding access to advanced cancer treatments, including immunotherapy, are contributing significantly to the adoption of novel treatments and supporting revenue growth potential. Furthermore, major companies are actively targeting countries including China, Japan, and India to expand their geographical reach, thereby making Asia-Pacific a key region for future market expansion for other medical breakthroughs.

Segmentation By Region

North America

- United States

- Canada

Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- Association of Southeast Asian Nations (ASEAN)

- Rest of Asia Pacific

Europe

- Germany

- The U.K.

- France

- Spain

- Italy

- Russia

- Poland

- BENELUX (Belgium, the Netherlands, Luxembourg)

- NORDIC (Norway, Sweden, Finland, Denmark)

- Rest of Europe

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Egypt

- Israel

- Rest of MEA (Middle East & Africa)

Competitive Landscape Analysis

The global personalized cancer treatment market is highly competitive, with a significantly large number of pharmaceutical companies, biotechnology firms, diagnostic laboratories, and research institutions competing for market share. Leading players in these fields have adopted various strategies to maintain their robust positions and stay ahead in this rapidly evolving industry. Some trends and strategies observed in the market are presented below.

The majority of leading companies are allocating significant resources to R&D to discover and develop new targeted therapies and companion diagnostics. These companies are continuously exploring innovative ways to identify and target specific genetic mutations and biomarkers associated with different cancer types. These investments not only drive scientific advancements but also enhance the respective company’s competitive edge.

Strategic partnerships and collaborations are another major trend observed in the market. Collaboration is a common strategy among major players and partnerships with academic institutions, hospitals, and other industry leaders enable access to valuable patient data and research capabilities. Collaborations also facilitate the development and commercialization of new personalized cancer treatments and diagnostic tools. Portfolio expansion and pipeline development enable leading companies to maintain extensive portfolios of personalized cancer treatments and companion diagnostics. Companies actively seek to expand their product offerings by acquiring smaller biotech firms with promising pipelines or through in-house development as a robust pipeline ensures a continuous flow of innovative therapies to the market.

In addition, in order to maximize geographical reach, companies are focused on expanding their presence in emerging markets, where adoption of personalized cancer treatment is growing. These companies tailor their products and services to meet the specific needs and regulations prevalent in each region, thereby ensuring a competitive advantage in diverse markets. Marketing and patient education is another focus area for a number of companies operating in the market. Effective marketing and patient education campaigns are essential to create awareness about personalized cancer treatment options. Leading companies invest in patient support programs, genetic counseling services, and educational resources to empower patients and healthcare providers with knowledge about these advanced therapies.

Furthermore, market leaders harness the power of data analytics and Artificial Intelligence (AI) to enhance their diagnostic and treatment solutions. These technologies enable efficient and accurate analysis of vast datasets, predict treatment responses, and identify potential drug candidates more effectively, and this strategy creates a competitive edge in delivering precision medicine.

Regulatory compliance and quality assurance is another aspect that poses major challenges for companies in the market. Given the stringent regulatory environment in healthcare, leading companies prioritize compliance and quality assurance, as maintaining rigorous standards ensures the safety and efficacy of their personalized cancer treatments and diagnostics, as well as lends credibility and competitiveness.

Also, companies often take a leadership role in conducting clinical trials for their products. By designing and executing successful trials, companies generate valuable clinical data that can support regulatory approvals and further establish their position as key players in the personalized cancer treatment market.

Company List

- Roche Holding AG

- Novartis AG

- Bristol Myers Squibb

- Merck & Co., Inc.

- Pfizer Inc.

- AstraZeneca

- Eli Lilly and Company

- Amgen Inc.

- Illumina, Inc.

- Foundation Medicine, Inc. (a Roche company)

- Guardant Health, Inc.

- Exact Sciences Corporation

- Myriad Genetics, Inc.

- Thermo Fisher Scientific, Inc.

- Qiagen N.V.

- Agilent Technologies, Inc.

- Invitae Corporation

- Tempus Labs, Inc.

- Cancer Genetics, Inc.

- Takeda Pharmaceutical Company Limited

Recent Developments

- Biotech company Transgene, which designs and develops virus-based immunotherapies for cancer treatment, and NEC Corporation, which is a leader in IT, network and AI technologies, announced on 18 April 2023 at the American Association for Cancer Research (AACR) Annual Meeting in Orlando, Florida, that new data will be presented on TG4050. The TG4050 is based on Transgene’s myvac platform and powered by NEC’s cutting-edge AI capabilities. TG4050 has demonstrated the ability to induce strong immune responses against targeted antigens in patients, which are expected to result in extended remission periods.

- On 23 March 2022, the targeted radiodrug lutetium Lu 177 vipivotide tetraxetan (Pluvicto) was approved by the U.S. Food and Drug Administration (FDA) for patients with metastatic castration-resistant prostate cancer that is positive for a protein called Prostate-Specific Membrane Antigen (PSMA). The approval was the latest advance in the field of theranostics, which uses radioactive substances to visualize cancer cells and destroy them without harming normal cells.

- A new combination therapy has shown positive results in treating persons with metastatic bladder cancer. Results of a clinical trial that tested the effectiveness of the antibody-drug conjugate enfortumab vedotin (Padcev) combined with the checkpoint inhibitor pembrolizumab (Keytruda) were presented at the annual meeting of the European Society for Medical Oncology (ESMO) on September 12, 2022. The treatment shrank tumors in about 65% of patients.

Report Scope

Report Features Description Market Value (2022) USD 177.9 Bn Forecast Revenue (2032) USD 509.7 Bn CAGR (2023-2032) 11.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Cancer Type (Breast Cancer, Lung Cancer, Colorectal Cancer, Prostate Cancer, Melanoma, Others); Treatment Type (Targeted Therapy, Immunotherapy, Hormone Therapy, Chemotherapy, Radiation Therapy); Diagnostic Techniques (Genomic Sequencing, Liquid Biopsy, Immunohistochemistry, In Situ Hybridization, Biomarker Testing), End-users (Hospitals & Clinics, Diagnostic Laboratories, Research Institutes, Biotechnology & Pharmaceutical Companies, Ambulatory Surgical Centers) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Roche Holding AG, Novartis AG, Bristol Myers Squibb, Merck & Co., Inc., Pfizer Inc., AstraZeneca, Eli Lilly and Company, Amgen Inc., Illumina, Inc., Foundation Medicine, Inc. (a Roche company), Guardant Health, Inc., Exact Sciences Corporation, Myriad Genetics, Inc., Thermo Fisher Scientific, Inc., Qiagen N.V., Agilent Technologies, Inc., Invitae Corporation, Tempus Labs, Inc., Cancer Genetics, Inc., Takeda Pharmaceutical Company Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Roche Holding AG

- Novartis AG

- Bristol Myers Squibb

- Merck & Co., Inc.

- Pfizer Inc.

- AstraZeneca

- Eli Lilly and Company

- Amgen Inc.

- Illumina, Inc.

- Foundation Medicine, Inc. (a Roche company)

- Guardant Health, Inc.

- Exact Sciences Corporation

- Myriad Genetics, Inc.

- Thermo Fisher Scientific, Inc.

- Qiagen N.V.

- Agilent Technologies, Inc.

- Invitae Corporation

- Tempus Labs, Inc.

- Cancer Genetics, Inc.

- Takeda Pharmaceutical Company Limited