Antibody Drug Conjugate Market By Application(Breast Cancer, Blood Cancer, Urothelial Cancer, Bladder Cancer), By Technology(Cleavable, Non-cleavable), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

42660

-

Dec 2023

-

179

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Antibody Drug Conjugate Market Size, Share, Trends Analysis

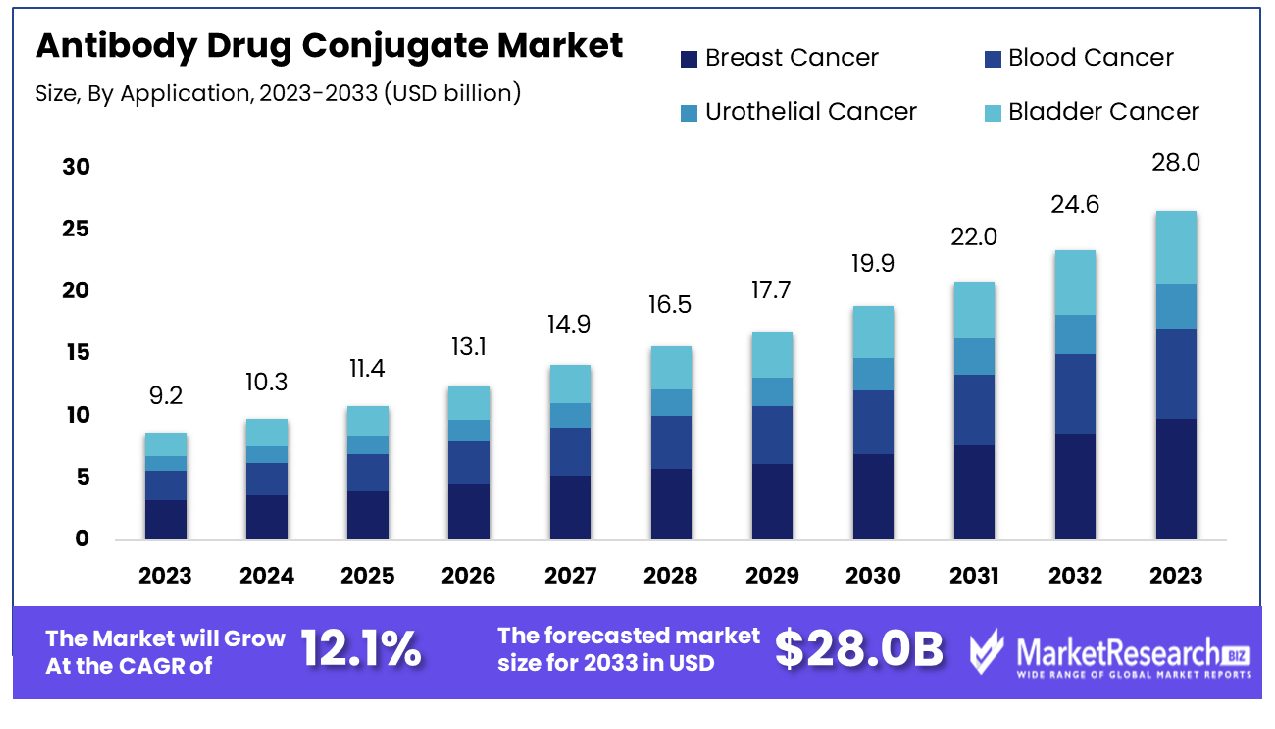

The antibody-drug conjugate market was valued at USD 9.2 billion in 2023. It is expected to reach USD 28.0 billion by 2033, with a CAGR of 12.1% during the forecast period from 2024 to 2033.

According to The American Cancer Society, cancer-related cases and treatment options continue to increase, driving demand for anti-cancer drug conjugates. Their report indicated there were 1,958,310 reported cases and 609,820 deaths related to cancer in 2023 alone in the US alone.

Antibody-drug conjugates (ADC) are medications comprised of monoclonal antibodies designed to target antigens found on tumor cells and combine this targeting ability with anticancer drugs linked by chemical linkers for intravenous therapy. Their frequency varies depending on the treatment regimen; often used to treat metastatic diseases that require infusions over a longer period, but recent research suggests they could also prove useful against early-stage diseases.

Antibody-drug conjugates (ADCs) are one type of chemotherapy drug used to treat multiple kinds of cancer, including bladder cancer, breast cancer, and blood cancer. According to American Association for Cancer Research's observations between August 2022 and July 2023 across the clinical cancer treatments spectrum; FDA has approved fourteen innovative cancer-fighting treatments as well as granted access to twelve existing cancer-fighting therapies; ADCs may also be utilized.

There were several clinical medication trials taking place for treating cancer such as the Ascent trial, where the individuals who have metastatic triple-negative breast cancer were provided either standard chemotherapy or trolley. The outcome was that the people who took taken trolley lived longer in comparison to those people who had received only the standard treatment.

Another example is the Emilia trial compared Kadcyla with the combination of Tykerb and Xeloda in individuals with advanced Her2+ breast cancer. The outcome was individuals who consumed the Kayla lived longer but had some side effects than the people who opted for the treatment of Tykerb and Xeloda, the standard treatment at that time. The demand for the ADC will increase due to the cancer treatments as well as ADC in chemotherapy, this will contribute to the market expansion in the coming years.

Antibody Drug Conjugate Market Dynamics

Demand for Targeted Cancer Therapies Enhances Market

Antigen drug conjugate (ADC) therapies based on antibodies are one of the primary drivers behind the ADC market growth rate. By combining the specificity of antibodies with the effectiveness of cytotoxic drugs, ADCs provide targeted cancer therapy while simultaneously protecting healthy cell lines from harm - making this particularity especially attractive in oncology, where adverse side effects associated with traditional chemotherapy treatments pose major hurdles to treatment success.

A shift toward personalized medicine for the treatment of cancer has spurred ADC sales as it provides more targeted methods of fighting different types of cancer. The trend towards targeted cancer therapies is expected to continue growing and will further propel ADC sales growth. ADC market.

R&D Investment Spurs ADC Innovations

Increased investments in research and development processes are integral to driving innovations in the antibody-drug conjugate (ADC) market. R&D efforts aim at increasing ADC effectiveness, decreasing toxicities, and expanding their application across more cancer types - which will ultimately lead to the creation of improved ADCs with enhanced performance and safety that extend clinical trials further.

While research and development of ADCs continue to uncover new applications and possibilities, the market should expect steady expansion due to technological advances and new product releases.

Cancer Prevalence Drives ADC Demand

Anti-drug compounds (ADCs) have become an indispensable asset in fighting cancer worldwide due to their rising incidence and widespread death rate, making effective treatments all the more necessary. ADCs' ability to deliver targeted therapy with few side effects makes them invaluable tools against cancer.

Cancer's rising incidence rate will likely bolster demand for innovative and effective therapies like ADCs and ADCs, suggesting an expanding industry that addresses this pressing health concern in our world.

Limited Penetration Capability Restrains Antibody Drug Conjugate Market Growth

Antibody-drug conjugates (ADCs) have certain limitations when penetrating tumor tissue deeply enough, hampering their effectiveness in treating solid tumors. Although ADCs were intended to specifically target cancerous cells, their effectiveness can be diminished if they cannot penetrate deep enough into tumor tissues - potentially undercutting any treatment effectiveness these ADCs have for solid tumors.

Problems in ADC production and use include making sure drugs reach all cells targeted within tumors. Without full realization of therapeutic benefits in the clinical setting, ADCs could suffer in terms of both growth and market acceptance.

Supply Chain Disruptions Impact Antibody Drug Conjugate Market Expansion

Supply chain disruptions are another significant barrier to growth for antibody-drug conjugates (ADCs). Their production requires complex manufacturing processes requiring multiple components - including the antigen itself and antibodies as well as linking molecules - as well as multiple steps and components needed.

Disruptions to supply chains can have serious repercussions for production processes and costs, including delays in the manufacturing process, shortages in key components, or increased expenses. Political tensions as well as regulatory changes or global events like pandemics may create such interruptions that make manufacturing ADCs in an efficient and timely fashion more challenging, thus negatively affecting their growth and stability in the market.

Antibody Drug Conjugate Market Segmentation Analysis

By Application Analysis

Breast cancer treatment has long been one of the top applications of ADCs, given their rising global incidence rate and efficacy at diagnosing and treating it effectively. Antibody-drug conjugates (ADCs) have gained popularity as an anticancer agent thanks to their use in this market segment.

Antibody-drug conjugates (ADCs), such as trastuzumab-emtansine (T-DM1) have revolutionized breast cancer treatments with HER2 ADC-positive mutations by directly targeting cancerous cells while simultaneously protecting healthy ones from chemotherapy drugs' harmful side effects. Due to their effectiveness, ADCs for breast cancer treatment have seen increased research and investment resulting in their leading position in the market.

Other forms of cancer could also benefit from ADC treatments, including Urothelial cancer, blood cancer, and bladder cancer. With blood cancer specifically, ADCs are being developed to target specific antigens found on cancerous cells - offering new alternatives in cases when conventional chemotherapy may not work as effectively; similarly, bladder treatment and urothelial cancer patients are seeing improvements regarding their ADC therapies through ongoing studies and clinical trials dedicated to improving outcomes of those suffering from these types of cancers.

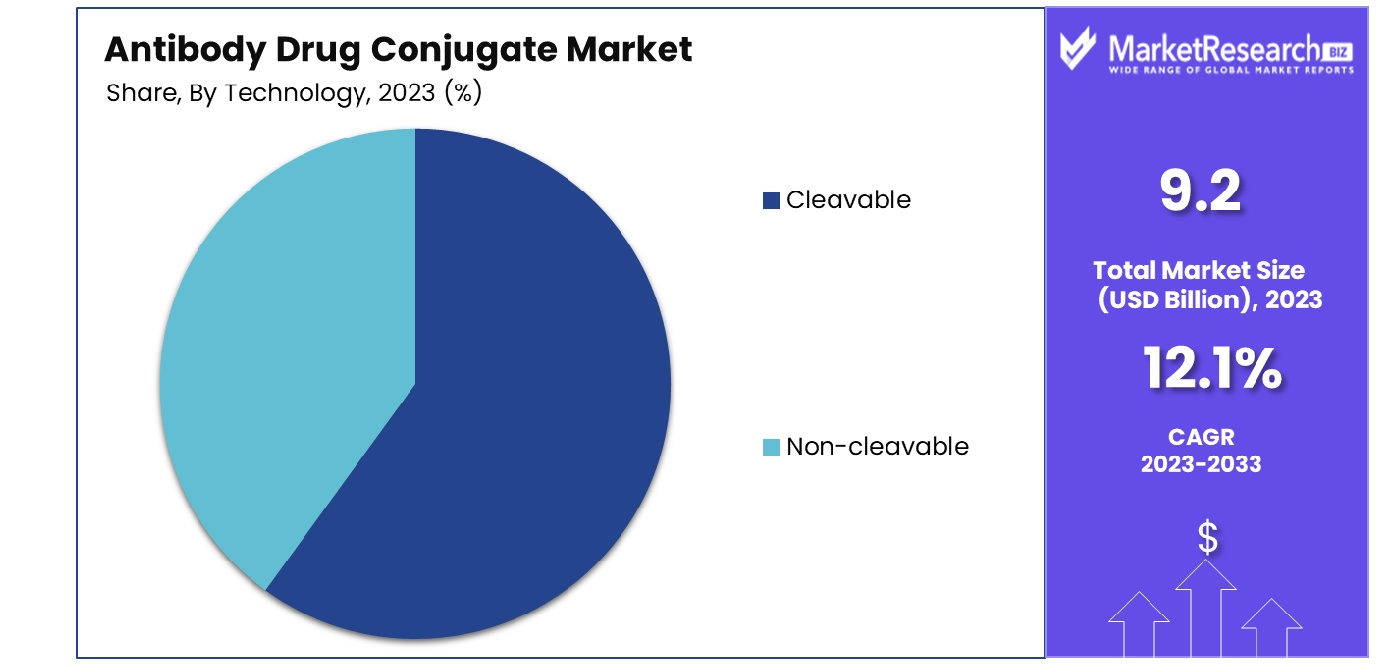

By Technology Analysis

Cleavable technology holds the largest market share within the ADC market. This category of ADCs contains ADCs that release toxic agents when entering targeted cancer cells; such triggers include pH changes and enzyme presence within their target cell's environment, permitting delivery and increasing efficacy against cancer while simultaneously decreasing harmful side effects on healthy cells.

Cleavable category development is driven by continual research and development efforts aimed at increasing efficiency and precision; plus an increase in clearable ADC clinical trials being approved by FDA.

Non-cleavable ADCs may not be as common, yet they remain important tools in certain cases where the stability of the connection between antibody components and cytotoxic drugs is key. Non-cleavable ADCs ensure that drugs stay attached until reaching their intended targets - this feature may prove especially valuable for treating certain cancers where other linkers might not work as efficiently.

Antibody Drug Conjugate Industry Segments

By Application

- Breast Cancer

- Blood Cancer

- Urothelial Cancer

- Bladder Cancer

By Technology

- Cleavable

- Non-cleavable

Antibody Drug Conjugate Market Growth Opportunity

Increasing Investments Propel ADC Development and Market Growth

Increased investments in antibody-drug conjugates (ADCs) research and development are driving market expansion. Pharma companies and investors alike are investing significant funds in ADC research due to its potential use as a cancer therapy treatment.

Financial support plays an integral role in ADC technology development, from research through clinical trials and ultimately commercialization. A surge of investments illustrates confidence in their effectiveness as well as marketability; which highlights market expansion driven by solid financial backing.

Collaborations and Expansion Accentuate ADC Market Opportunities

Collaborations among pharmaceutical, research institutions, biotech, and other entities have increased opportunities in the ADC industry. Collaboration between pharmaceutical, research institutions, biotech, and other companies is vital in sharing information, resources, and technologies between entities involved with developing ADCs from discovery to production, distribution, and beyond.

Collaborations can also facilitate market expansion by using unique talents to gain access to new geographic markets. The growing trend towards strategic partnerships and ADC market expansion indicates an industry poised for expansion as businesses utilize their combined strengths for product creation and commercialization of ADCs.

Antibody Drug Conjugate Market Regional Analysis

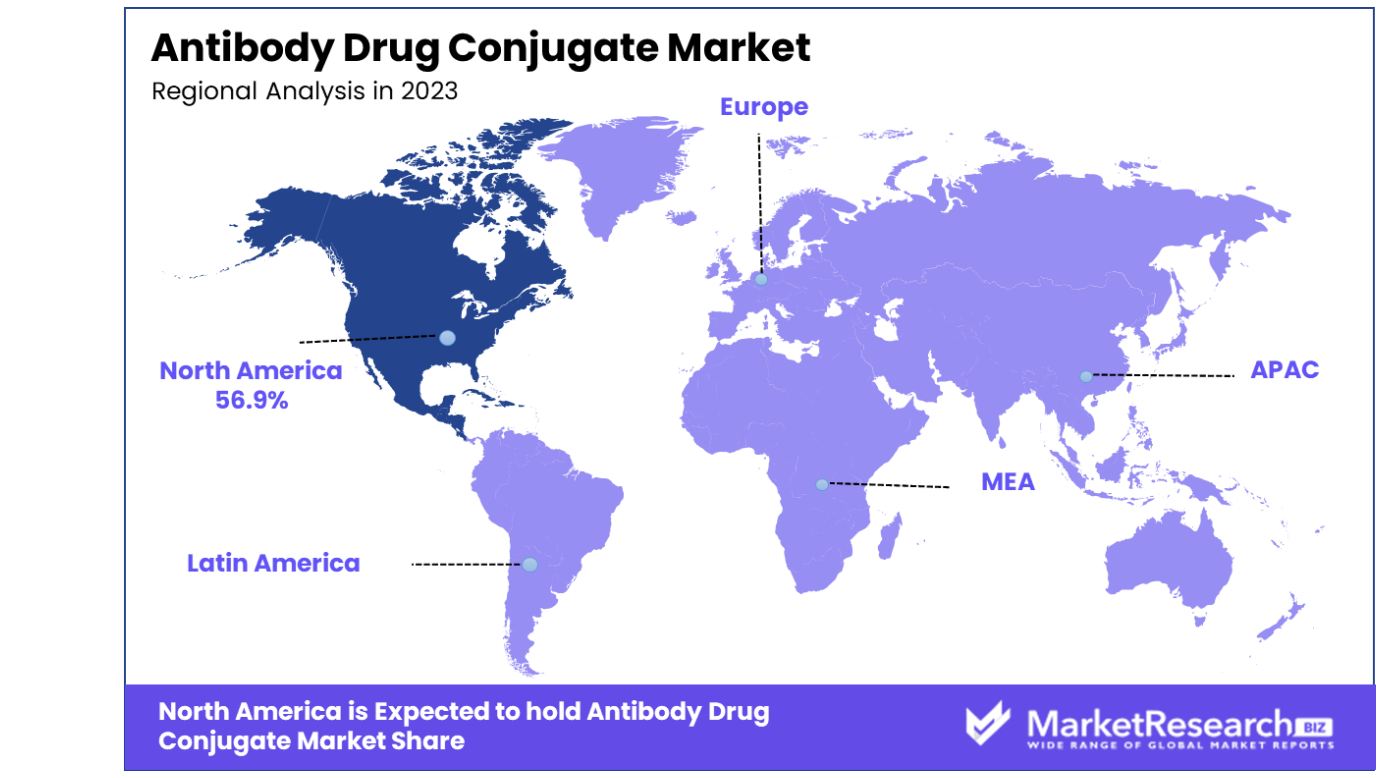

North America Dominates with 56.9% Market Share in Antibody Drug Conjugate Market

North America holds an estimated 56.9 % market share for the antibody-drug conjugates (ADCs) market due to its advanced biopharmaceutical development and research capabilities, especially within the US. Major pharmaceutical and biotechnology firms specializing in cancer research play a vital role in this regional dominance; coupled with an excellent healthcare infrastructure as well as substantial spending for the healthcare sector, North America boasts one of the strongest ADC markets globally.

North America's current market dynamics can be summarized as follows: increasing spending on R&D initiatives for developing novel ADCs as well as an emphasis placed on precision medicines; its stringent but tolerant regulatory environment is overseen by agencies like the FDA allowing swift acceptance and commercialization of novel cancer treatments; collaborations among research institutions, academic institutions and biopharma companies are critical in progressing ADC technologies and expanding their therapeutic applications.

Europe: Strong R&D and Regulatory Framework

European ADC industry is driven by robust research and development infrastructure in oncology as well as an accommodating regulatory framework. World-class drug companies as well as research institutes that specialize in cancer research provide support to promote the growth of this ADC market. Furthermore, Europe's commitment to personalized medicine combined with its high standards in medical research helps shape market dynamics.

Asia-Pacific: Growing Biotech Sector and Market Potential

Asia-Pacific ADC market growth is being spurred on by both an expanding biotechnology industry and increased investments in healthcare. Countries like Japan, China, and South Korea have shown great enthusiasm for advanced cancer treatments - ADCs being just one example - with investment going towards research and development as well as increased interest from rising healthcare demand across this region providing ample growth potential in this ADC market.

Antibody Drug Conjugate Industry By Region

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of the Middle East & Africa

Antibody Drug Conjugate Market Share Analysis

The Antibody Drug Conjugate (ADC) Market is an exciting and rapidly expanding sector of cancer treatments, and the companies involved are essential in its development. Seagen Inc. is one of the leaders in this space through their revolutionary ADC treatments; their strategy focusing on specific cancer therapies sets standards in terms of efficacy and security for effective care.

Gilead Sciences, Inc. and Daiichi Sankyo Company Limited have long been respected for their innovative approaches to oncology research and treatment development, including ADC development for clinical environments. Their emphasis on new conjugation strategies and targets helps ensure ADCs have maximum efficacy.

GlaxoSmithKline plc and Astellas Pharma, Inc.'s strong pipelines and strategic alliances play an instrumental role in ADC development. ADC market addresses unmet medical requirements in oncology; ADC Therapeutics SA's focus on ADCs highlights the market's potential for niche-specific therapeutic advancements.

Antibody Drug Conjugate Industry Key Players

- Seagen, Inc.

- Takeda Pharmaceutical Company Limited

- AstraZeneca

- F. Hoffmann-La Roche Ltd.

- Pfizer, Inc.

- Gilead Sciences, Inc.

- Daiichi Sankyo Company Limited

- GlaxoSmithKline plc

- Astellas Pharma, Inc.

- ADC Therapeutics SA

- ImmunoGen Inc.

- Abbvie Inc.

Antibody Drug Conjugate Market Recent Development

- In 2023, AbbVie, a multinational pharmaceutical company, proposed a $10.1 billion acquisition of ImmunoGen, an American ADC company. This acquisition is a significant indicator of the growing interest in ADCs, especially in the field of oncology. ImmunoGen's FDA-approved ADC, Elahere, targets folate receptor alpha (FRα) and is used in the treatment of ovarian cancer, fallopian tube cancer, and primary peritoneal cancer.

- In October 2023, Daiichi Sankyo's Head of Oncology Clinical Development, Dr. Mark Rutstein, highlights key data about the company's ADC, datopotamab deruxtecan (Dato-DXd), being investigated for breast and lung cancer.

- In September 2023, Samsung Biologics made a significant investment in AimedBio, a local biotech company specializing in antibody-drug conjugates (ADCs). This move is part of Samsung's strategy to expand into the next-generation drug business. AimedBio, established in 2018, focuses on ADC development using AI-based clinical and genomic information analysis.

- In 2023, One of the major recent developments in breast cancer treatment is the recognition of HER2-low as a sub-category of breast cancer. This is significant because it identifies a population of patients who have some expression of HER2 but do not qualify as HER2-positive. Previously, treatment options for such patients were limited. However, the introduction of potent antibody-drug conjugates (ADCs) has opened up new treatment opportunities.

Report Scope

Report Features Description Market Value (2023) USD 9.2 Billion Forecast Revenue (2033) USD 28.0 Billion CAGR (2024-2032) 12.1% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Application(Breast Cancer, Blood Cancer, Urothelial Cancer, Bladder Cancer), By Technology(Cleavable, Non-cleavable) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Seagen, Inc., Takeda Pharmaceutical Company Limited, AstraZeneca, F. Hoffmann-La Roche Ltd., Pfizer, Inc., Gilead Sciences, Inc., Daiichi Sankyo Company Limited, GlaxoSmithKline plc, Astellas Pharma, Inc., ADC Therapeutics SA, ImmunoGen Inc., Abbvie Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Seagen, Inc.

- Takeda Pharmaceutical Company Limited

- AstraZeneca

- F. Hoffmann-La Roche Ltd.

- Pfizer, Inc.

- Gilead Sciences, Inc.

- Daiichi Sankyo Company Limited

- GlaxoSmithKline plc

- Astellas Pharma, Inc.

- ADC Therapeutics SA

- ImmunoGen Inc.

- Abbvie Inc.