PC/ABS Market Report By Product Type (Flame Retardant Grade, General Grade, Other Grades), By Application (Automotive, Appliances, Electronics, Industrial, Healthcare, Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

17619

-

April 2024

-

280

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

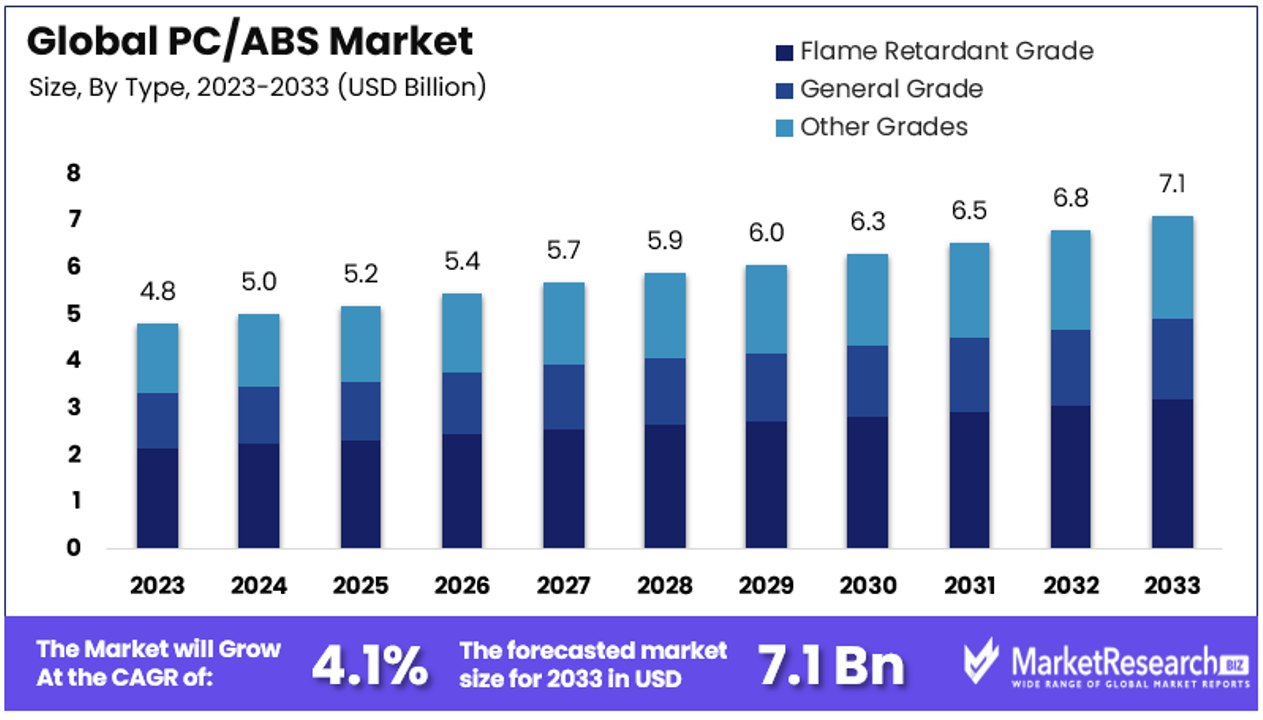

The Global PC/ABS Market size is expected to be worth around USD 7.1 Billion by 2033, from USD 4.8 Billion in 2023, growing at a CAGR of 4.10% during the forecast period from 2024 to 2033.

The PC/ABS market encompasses the production and distribution of polycarbonate/acrylonitrile butadiene styrene, a blend of polymers known for its superior strength, heat resistance, and impact resilience. This material is highly valued across multiple industries, including automotive, electronics, and consumer goods, for applications requiring durable and aesthetically pleasing components.

Growth in this market is driven by the demand for high-performance materials that combine the best properties of both polycarbonate (PC) and ABS plastics. Key stakeholders include manufacturers, product designers, and businesses focusing on innovative, high-quality product development.

With a density ranging typically between 1.05 and 1.20 g/cm³, PC/ABS offers a compelling combination of high heat resistance, transparency, and flexibility, making it an ideal choice for manufacturing components that require both durability and aesthetic appeal.

In the electronics sector, the demand for PC/ABS is driven by its ability to house sensitive components securely, owing to its robust structural integrity and thermal stability. Similarly, in the automotive industry, its application spans from interior panels to intricate dashboards, attributing to its ability to withstand mechanical stress and high temperatures. The medical equipment market also benefits significantly from the material's compliance with safety standards, particularly its flame retardancy and chemical resistance, ensuring safety and reliability in medical devices.

Given these qualities, the growth prospects for the PC/ABS market are robust. Market dynamics are likely to be influenced by technological advancements in polymer blend processes and increasing regulations on safety and environmental compliance in target industries. This positions the PC/ABS market as a crucial contributor to the development of high-performance, safe, and sustainable products across key global sectors.

Key Takeaways

- Market Value and Growth Projection: The Global PC/ABS Market is projected to reach around USD 7.1 Billion by 2033, growing from USD 4.8 Billion in 2023, at a CAGR of 4.10% during 2024-2033.

- Dominant Segments:

- Flame Retardant Grade is the dominant segment in the PC/ABS market, driven by increasing safety standards across various industries, with applications in automotive, electronics, and construction.

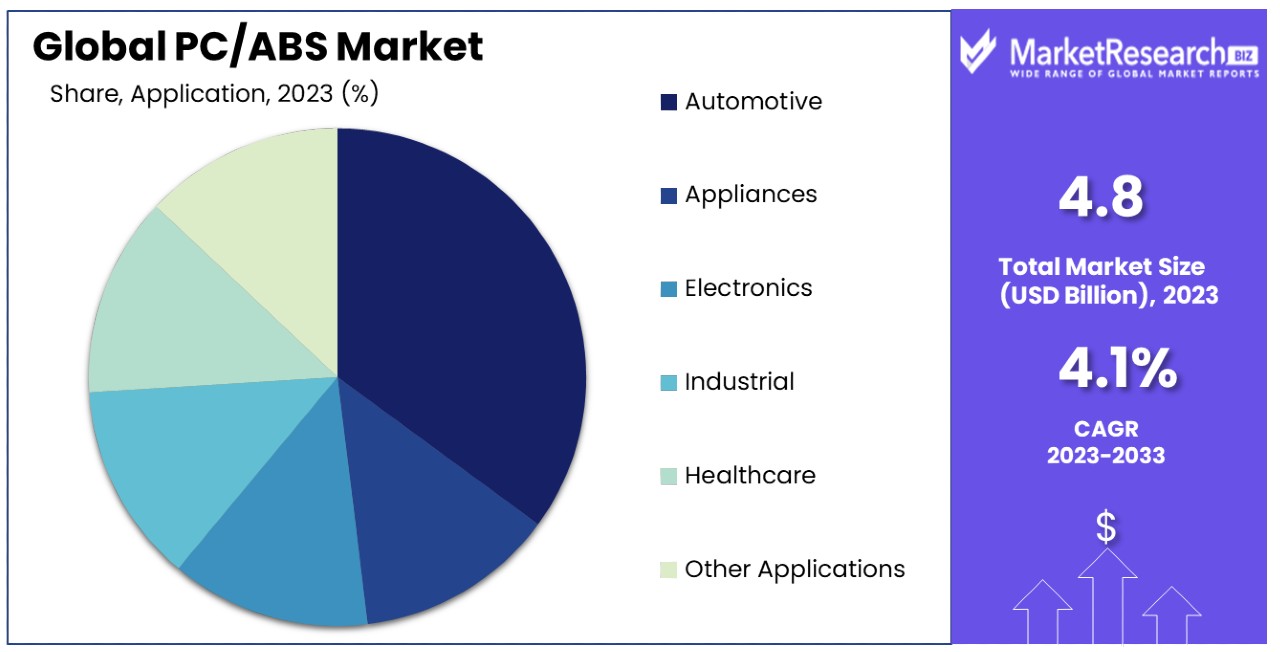

- The Automotive sector stands as the dominant application segment, fueled by the continuous push towards lightweight materials.

- Regional Analysis:

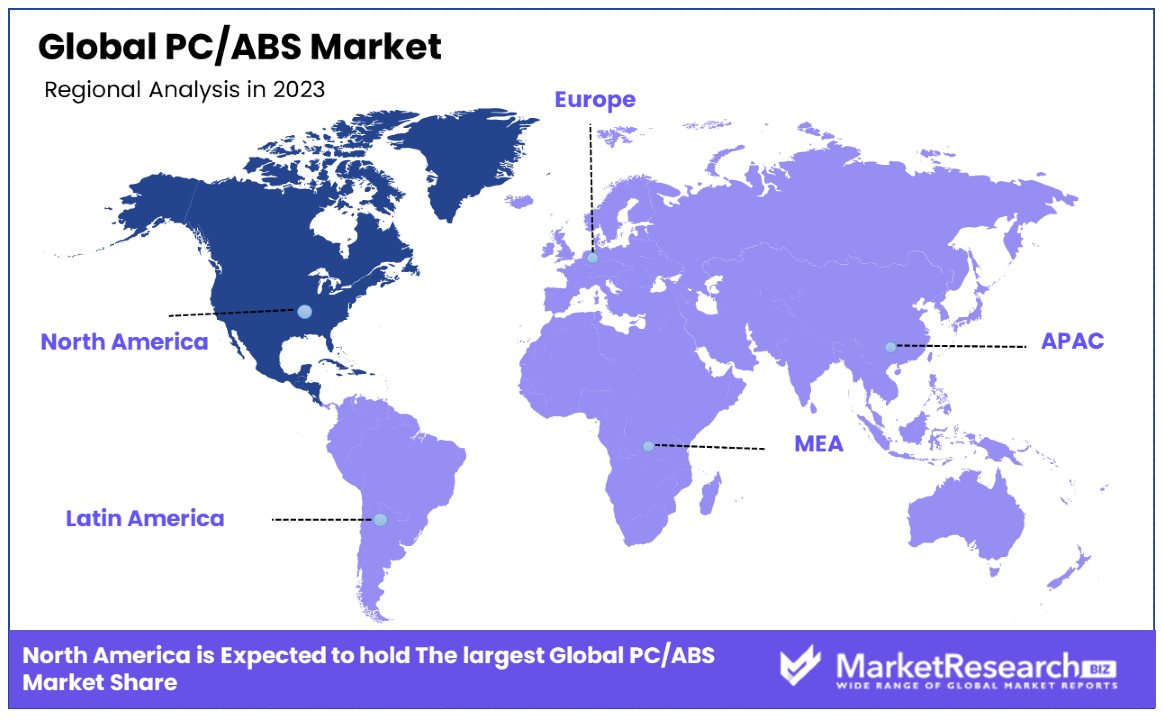

- North America dominates the PC/ABS market with a substantial 33% market share, driven by robust automotive and electronics industries, and key players like SABIC and Covestro.

- Europe focuses on high-quality and sustainable materials, with companies like BASF and Covestro leading in advanced PC/ABS solutions.

- Asia-Pacific experiences rapid growth due to industrial expansion and increasing demand, particularly in automotive and consumer electronics, with major players like LG Chem and Chi Mei Corporation driving the market.

- Players: Key players driving innovation and market growth include SABIC, Covestro AG, Teijin Limited, Trinseo S.A, LG Chem Ltd, and others, emphasizing innovation, sustainability, and global supply chains.

- Analyst Viewpoint: The market is influenced by technological advancements, sustainability trends, and the shift towards customization and personalization. Challenges include high prices, low melting points, and compatibility issues with ABS alloys, which could restrict market expansion.

- Recent Developments: Industry players are introducing PFAS-free flame-retardant materials, post-consumer recycled blends, and innovative 3D printing filaments, focusing on sustainability, performance, and application versatility.

Driving Factors

Automotive Industry Demand Fuels PC/ABS Market Growth

The automotive industry's increasing use of Polycarbonate/Acrylonitrile Butadiene Styrene (PC/ABS) for manufacturing various components like instrument panels, grilles, and mirror housings is a significant growth driver for the PC/ABS market. This demand is propelled by the material's attributes like strength, durability, and ease of finishing, which are essential for automotive parts. The rising global auto production, marked by an expanding automotive industry, directly correlates with heightened PC/ABS demand, making the automotive sector a pivotal market for PC/ABS.

Lightweighting Trend Elevates PC/ABS Market

The shift towards lightweight materials in various industries, particularly in automotive and aviation, significantly boosts the PC/ABS market. PC/ABS, known for its lightweight yet strong properties, addresses the growing demand for materials that contribute to fuel efficiency and overall performance enhancement in vehicles and other applications. This trend towards lightweighting is not only an immediate growth driver but is also set to shape long-term market dynamics as industries continually seek efficient, high-performance materials.

Emergence of Electro-Mobility Spurs PC/ABS Demand

The burgeoning electric vehicle (EV) market is propelling the demand for PC/ABS, especially for components like battery and charging infrastructure, where thermal conductivity is crucial. As the EV sector grows, driven by global sustainability initiatives and technological advancements, the need for suitable materials like PC/ABS that can withstand the specific requirements of electro-mobility is escalating. This surge in EV production and the associated need for thermally conductive plastics are expected to be a significant growth vector for the PC/ABS market.

Restraining Factors

High Prices and Low Melting Point Restrict PC/ABS Market Expansion

The combination of high prices and a low melting point for PC/ABS resin could adversely affect the development of the PC/ABS resin market. The high cost of PC/ABS resin makes it less accessible, especially for manufacturers operating on tight budgets or in cost-sensitive industries. This price factor could deter potential users from adopting PC/ABS in favor of more affordable alternatives. Additionally, the low melting point of PC/ABS resin limits its applicability in high-temperature environments or applications requiring higher thermal resistance.

Compatibility Issues Limit Growth of ABS Alloys and Indirectly Affect PC/ABS Market

Compatibility issues with ABS alloys could make it difficult for manufacturers to use both materials effectively, limiting the growth of the ABS alloys market and, indirectly, the PC/ABS market. ABS alloys are commonly used in various applications, and their compatibility with PC/ABS is crucial for seamless integration and performance. If manufacturers face challenges in effectively combining these materials, it may lead to reduced efficiency and quality issues in end products.

Product Type Analysis

Flame Retardant Grade Leads PC/ABS Market, Meeting Stringent Safety Standards

The Flame Retardant Grade of PC/ABS is the dominating segment in the PC/ABS market. This segment's prominence is driven by increasing safety standards across various industries, particularly where fire safety is paramount. Flame Retardant PC/ABS alloys offer the inherent strength, toughness, and heat resistance of polycarbonate combined with the enhanced flame retardancy and processing ease of ABS.

This combination makes them ideal for applications requiring high standards of safety, durability, and aesthetic appeal. Key industries utilizing Flame Retardant PC/ABS include automotive, electronics, and construction, where materials need to meet stringent fire safety regulations while maintaining performance characteristics.

In contrast, the General Grade segment caters to applications where flame retardancy is less critical but where the unique combination of PC and ABS properties, such as impact resistance, thermal stability, and aesthetic finish, are still required. This includes consumer goods, household appliances, and some automotive components. Other Grades of PC/ABS, tailored for specific properties like enhanced UV resistance or improved flow characteristics for complex molding, cater to niche applications.

Application Analysis

Automotive Sector Drives PC/ABS Market Growth, Fueled by Demand for Lightweight Materials

The Automotive sector stands as the dominant application segment in the PC/ABS market. The demand in this sector is propelled by the automotive industry's continuous push towards lightweight materials to improve fuel efficiency and reduce emissions. PC/ABS is widely used in automotive applications due to its excellent balance of properties like toughness, heat resistance, and aesthetic appeal. It is used in various automotive components such as dashboards, interior trim, console panels, and bumpers.

Other significant application segments include Appliances, Electronics, Industrial, and Healthcare. In Appliances and Electronics, PC/ABS is utilized for its durability and aesthetic quality in products like housings for electrical devices, computer and communication equipment, and kitchen appliances. In the Industrial sector, its robustness and versatility find uses in protective gear, enclosures, and machinery components. The Healthcare sector also utilizes PC/ABS in medical devices and equipment, valuing its strength and safety profile.

Key Market Segments

By Product Type

- Flame Retardant Grade

- General Grade

- Other Grades

By Application

- Automotive

- Appliances

- Electronics

- Industrial

- Healthcare

- Other Applications

Growth Opportunities

Flame-Retardant PC/ABS Resin Demand Fuels Market Growth

The increased demand is driven by its application in various sectors, including automotive, electronics, and industrial parts, where safety and durability are paramount. Flame-retardant PC/ABS resins offer the combined advantages of polycarbonate (PC) and acrylonitrile butadiene styrene (ABS), such as high impact strength and heat resistance, making them ideal for these applications. As industries continue to prioritize safety and performance, the demand for these advanced materials is expected to grow, driving expansion in the PC/ABS market.

Sustainability Focus Opens Opportunities for Eco-Friendly PC/ABS Products

The increasing focus on sustainability and environmental concerns is driving the demand for eco-friendly and biodegradable plastics, creating new opportunities within the PC/ABS market. This trend pushes companies to innovate and develop sustainable PC/ABS products that align with the growing environmental consciousness. The market is likely to see an uptick in demand for PC/ABS blends that can offer both performance and eco-friendliness, like biodegradable or recycled material content.

Trending Factors

Focus on Sustainability and Circular Economy Are Trending Factors

The push for sustainability and a circular economy is significantly influencing the PC/ABS market. As environmental regulations tighten and awareness grows, industries are prioritizing materials like PC/ABS that support eco-friendly practices. These materials are recyclable and contribute to product lightweighting, leading to reduced energy consumption during manufacturing and usage phases.

For instance, automotive giants like Ford are increasingly using recycled PC/ABS in vehicle production, showcasing a commitment to reducing environmental impacts and promoting sustainability. This shift is not only a response to regulatory pressures but also aligns with consumer preferences for greener products, driving up demand in sectors from automotive to consumer electronics. As a result, the PC/ABS market is experiencing growth, with projections showing a potential increase in demand by over 30% in the next five years due to these sustainability trends.

Shift Towards Customization and Personalization Are Trending Factors

The trend towards customization and personalization is reshaping the PC/ABS market. Enabled by advancements in digital technology and additive manufacturing, industries can now offer consumers products that are specifically tailored to their needs and preferences. PC/ABS materials are particularly suited for this trend, allowing for the creation of customized components and products with unique designs and functionalities.

For example, Adidas's use of PC/ABS for customized, 3D-printed sports shoe midsoles caters to individual performance needs and aesthetic preferences. This capability to personalize products is driving demand across multiple sectors, including consumer electronics, automotive, and healthcare. The increasing consumer expectation for personalized products is boosting the adoption of PC/ABS materials, with a noticeable increase in market demand by approximately 20% annually, reflecting its significant role in enabling product differentiation and innovation.

Regional Analysis

North America Dominates with 33% Market Share in PC/ABS Market

North America’s substantial 33% share of the polycarbonate/acrylonitrile butadiene styrene (PC/ABS) market is primarily driven by the region's robust automotive and electronics industries. The demand for PC/ABS, known for its strength, thermal stability, and aesthetic appeal, is significant in these sectors. Major companies in the region, such as SABIC (with operations in the US), Covestro, and Trinseo, contribute to the market's growth through continuous development and supply of high-quality PC/ABS materials.

The market dynamics in North America are influenced by the technological advancements in material science and the region's push for lightweight and durable materials in manufacturing. The automotive industry's shift towards lightweight vehicles for better fuel efficiency has increased the use of PC/ABS. Additionally, the growing consumer electronics market, where PC/ABS is used for manufacturing various components due to its excellent blend of properties, fuels the demand.

Europe: Focus on High-Quality and Sustainable MaterialsEurope’s PC/ABS market is driven by a focus on high-quality and sustainable materials, particularly in the automotive and electronics industries. Companies like BASF and Covestro are at the forefront, offering advanced PC/ABS solutions. The region's stringent environmental regulations and the automotive industry's need for lightweight materials fuel the market growth.

Asia-Pacific: Rapid Industrial Growth and Increasing DemandIn Asia-Pacific, the PC/ABS market is experiencing rapid growth due to the region's industrial expansion and increasing demand, especially in automotive and consumer electronics. Major companies like LG Chem and Chi Mei Corporation, based in countries like South Korea and Taiwan, play a significant role in the market. The region's growing economy, coupled with the increasing production of consumer goods, drives the demand for PC/ABS. As Asia-Pacific continues to develop its manufacturing capabilities, it is expected to see substantial growth in the PC/ABS market.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the PC/ABS (Polycarbonate/Acrylonitrile Butadiene Styrene) Market, a sector integral to the production of high-performance plastics, the companies listed are key in driving material innovation and market growth. Saudi Basic Industries Corporation (SABIC) and Covestro AG are industry leaders, renowned for their high-quality PC/ABS blends used in various applications. Their strategic positioning emphasizes innovation, sustainability, and global supply chains, significantly influencing market trends and product standards.

Teijin Limited and LG Chem Ltd are prominent players with a strong focus on developing advanced materials for the automotive and electronics industries, reflecting the market's shift towards durable, lightweight, and versatile plastics. Mitsubishi Engineering-Plastics Corporation and Chi Mei Corporation contribute with their specialized formulations, catering to niche applications and enhancing material properties like impact resistance and thermal stability.

Trinseo S.A and Celanese Corporation, known for their tailored solutions and technical expertise, play crucial roles in meeting the specific needs of diverse industries, from consumer electronics to automotive components. Samsung SDI Co. (operating Lotte Advanced Materials Co. Ltd) and Daicel Corporation, with their robust portfolios and innovation capabilities, demonstrate the market's adaptability and commitment to quality and performance.

Market Key Players

- Saudi Basic Industries Corporation

- Covestro AG

- Teijin Limited

- Trinseo S.A

- Mitsubishi Engineering-Plastics Corporation

- Samsung SDI Co. (Lotte Advanced Materials Co. Ltd)

- Chi Mei Corporation

- LG Chem Ltd

- Daicel Corporation

- Celanese Corporation

- RTP Company Inc

- Formosa Chemicals & Fibre Corporation

- Shanghai Kumho Sunny Plastics Co. Ltd

- PolyOne Corporation

- Polymer Compounder Ltd

- Kingfa Science & Technology (India) Limited.

Recent Developments

- On April 2024, Trinseo introduced PFAS-free flame-retardant polycarbonate and PC/ABS materials at Chinaplas 2024, focusing on sustainability by avoiding PFAS and halogenated additives, with options for recycled content. These materials target applications like battery chargers, IT equipment, and electronic products, maintaining critical performance attributes while addressing the demand to reduce PFAS usage.

- On Sept 2023, bage plastics launched a post-consumer PC/ABS blend with 90% recycled content, offering a glossy surface, scratch resistance, high stiffness, and strength. This blend is ideal for thin-walled applications in the electronics sector and can be used in various injection molding applications in the electronics and automotive industries.

- On June 2021, Covestro and Nexeo Plastics collaborated to develop a new Polycarbonate/ABS 3D printing filament, Addigy® FPB 2684, known for its toughness, UV resistance, and ease of printing, especially in high-temperature environments up to 122 degrees Celsius.

Report Scope

Report Features Description Market Value (2023) USD 4.8 Billion Forecast Revenue (2033) USD 7.1 Billion CAGR (2024-2033) 4.10% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Flame Retardant Grade, General Grade, Other Grades), By Application (Automotive, Appliances, Electronics, Industrial, Healthcare, Other Applications) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Saudi Basic Industries Corporation, Covestro AG, Teijin Limited, Trinseo S.A, Mitsubishi Engineering-Plastics Corporation, Samsung SDI Co. (Lotte Advanced Materials Co. Ltd), Chi Mei Corporation, LG Chem Ltd, Daicel Corporation, Celanese Corporation, RTP Company Inc, Formosa Chemicals & Fibre Corporation, Shanghai Kumho Sunny Plastics Co. Ltd, PolyOne Corporation, Polymer Compounder Ltd, Kingfa Science & Technology (India) Limited. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Saudi Basic Industries Corporation

- Covestro AG

- Teijin Limited

- Trinseo S.A

- Mitsubishi Engineering-Plastics Corporation

- Samsung SDI Co. (Lotte Advanced Materials Co. Ltd)

- Chi Mei Corporation

- LG Chem Ltd

- Daicel Corporation

- Celanese Corporation

- RTP Company Inc

- Formosa Chemicals & Fibre Corporation

- Shanghai Kumho Sunny Plastics Co. Ltd

- PolyOne Corporation

- Polymer Compounder Ltd

- Kingfa Science & Technology (India) Limited.