Global Refurbished Medical Equipment Market By Type(Operating room equipment & surgical equipment, Patient monitors and defibrillators, Medical imaging equipment, Cardiovascular & cardiology equipment, Neurology equipment, IV therapy systems, Others), By Application(Hospitals, Clinical Centers, Group Purchasing Organizations (GPOs), Medical Research Laboratories, Academic Medical Centers and Universities), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

2220

-

June 2024

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

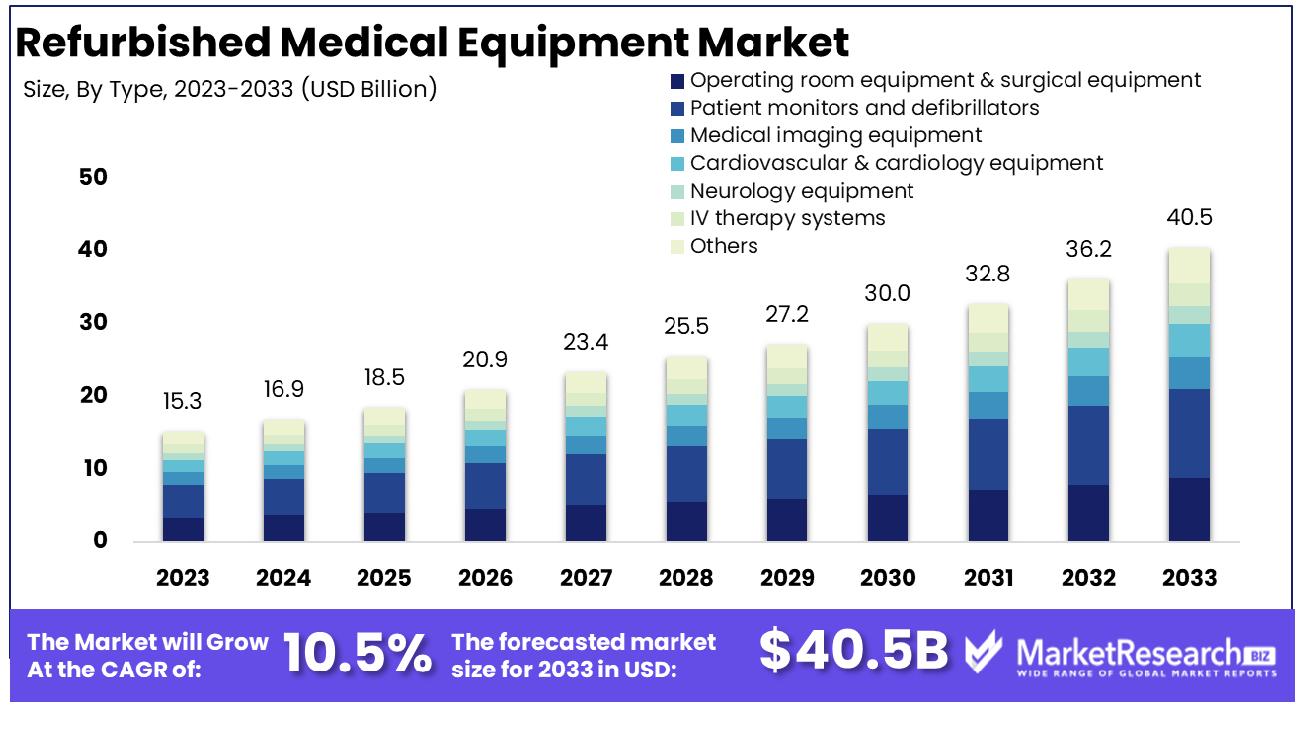

The Global Refurbished Medical Equipment Market was valued at USD 15.3 billion in 2023. It is expected to reach USD 40.5 billion by 2033, with a CAGR of 10.5% during the forecast period from 2024 to 2033.

The Refurbished Medical Equipment Market encompasses the buying, selling, and servicing of pre-owned medical devices that have been restored to meet original manufacturer specifications. This market offers cost-effective solutions for healthcare facilities aiming to upgrade their equipment while managing budget constraints. It includes a range of products such as imaging systems, patient monitors, surgical instruments, and diagnostic devices.

The growth of this market is driven by increasing healthcare expenditure, technological advancements in refurbishing processes, and rising demand for affordable medical devices in emerging economies. Key stakeholders include hospitals, clinics, diagnostic centers, and refurbishing companies, ensuring high standards of quality and compliance.

The refurbished medical equipment market is poised for significant growth, driven by several key factors in the broader healthcare and medical technology landscape. The global smart medical devices market, valued at $456.80 billion in 2020, is projected to expand to $671.49 billion by 2027, reflecting robust demand for medical technology solutions. Within this context, the refurbished medical equipment sector benefits from increased cost-consciousness among healthcare providers and the rising demand for affordable medical solutions.

North America, which holds 39% of the total medical technology market, remains a critical region for growth due to its substantial healthcare expenditure and technological advancements. Furthermore, the notable 11.5% boost in R&D investment by MedTech companies in the US and UK underscores the sector's commitment to innovation and development, indirectly supporting the refurbished equipment market by ensuring a steady influx of newer models that eventually enter the refurbishment cycle.

This trend is anticipated to enhance the availability and quality of refurbished medical devices, making them an increasingly attractive option for healthcare facilities aiming to optimize budgets without compromising on technology and care standards. Overall, the refurbished medical equipment market is set to benefit from the confluence of rising healthcare costs, continuous technological advancements, and the growing acceptance of sustainable and cost-effective healthcare solutions.

Key Takeaways

- Market Growth: The Global Refurbished Medical Equipment Market is projected to grow from USD 15.3 billion in 2023 to USD 40.5 billion by 2033, with a CAGR of 10.5%.

- By Type: Patient monitors and defibrillators comprise 25% of the market by type.

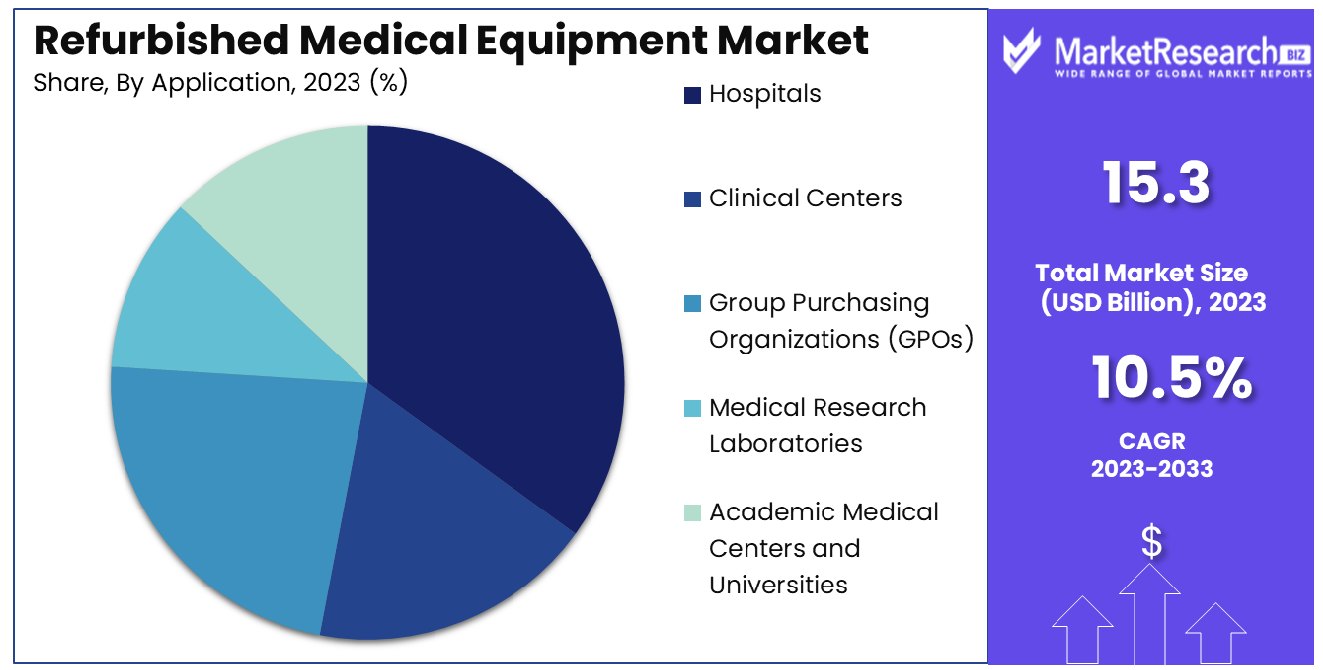

- By Application: Hospitals lead in application dominance, accounting for 42% of usage.

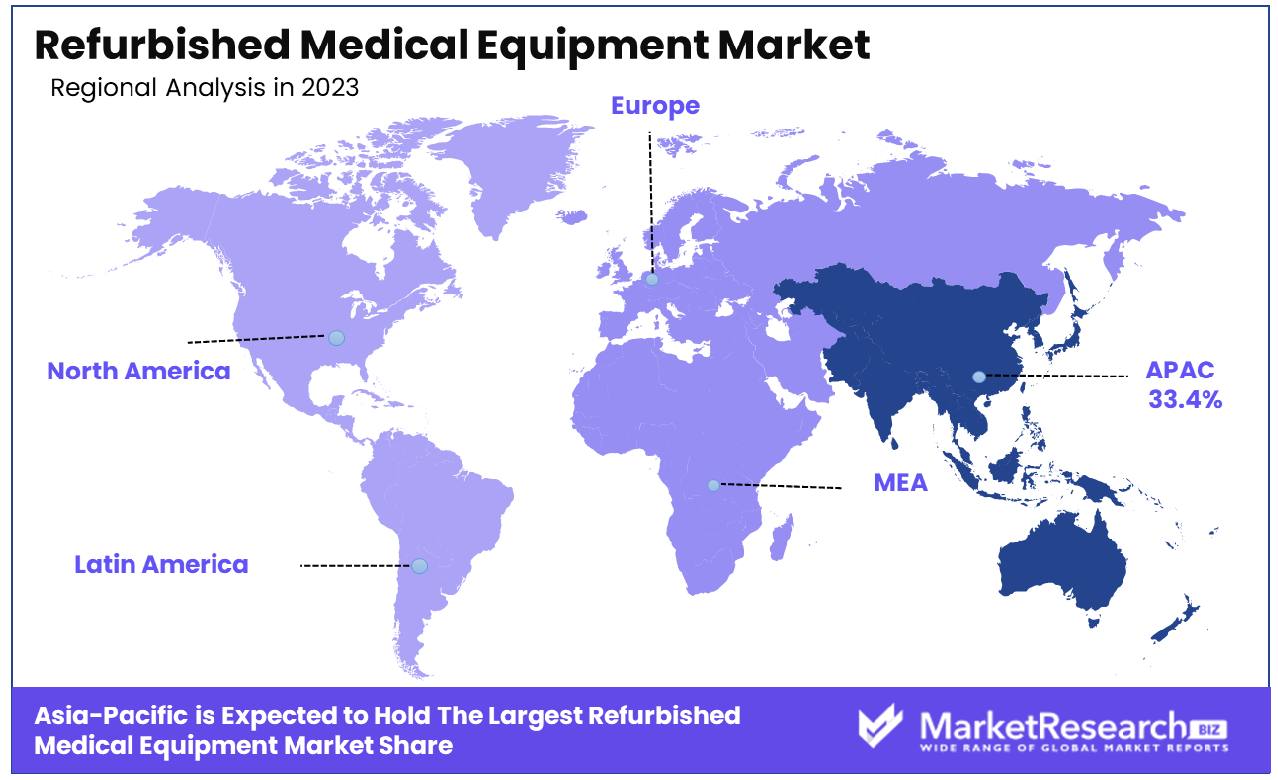

- Regional Dominance: The Asia Pacific refurbished medical equipment market grew by 33.4%.

- Growth Opportunity: The global refurbished medical equipment market in 2023 is set for growth through expanding service facilities and rising private healthcare, driven by cost-effective solutions and increased support infrastructure.

Driving factors

Rising Demand for Capital-Intensive Diagnostic Imaging Equipment

The refurbished medical equipment market is experiencing significant growth due to the rising demand for capital-intensive diagnostic imaging equipment. Hospitals and diagnostic centers increasingly seek to acquire high-quality imaging technologies such as MRI machines, CT scanners, and ultrasound systems. However, the high cost of new equipment presents a barrier.

Refurbished equipment offers a cost-effective alternative, providing nearly identical functionality at a fraction of the price. This demand is driven by the need to upgrade and expand diagnostic capabilities while managing budget constraints. Consequently, the market for refurbished diagnostic imaging equipment is projected to expand as healthcare providers aim to enhance diagnostic precision without incurring prohibitive expenses.

Increasing Number of Diagnostic Centers and Hospitals

The proliferation of diagnostic centers and hospitals globally has a direct impact on the demand for refurbished medical equipment. As new healthcare facilities are established, there is a simultaneous need for equipping them with advanced medical technologies. Refurbished equipment becomes an attractive option for these centers to quickly operationalize their services while adhering to budgetary limitations.

This trend is particularly notable in emerging economies where healthcare infrastructure is rapidly developing. The surge in the number of diagnostic facilities fosters a robust market for refurbished equipment, ensuring that healthcare providers can meet patient needs promptly and efficiently.

Growing Demand for Low-cost Medical Devices

The overarching need for affordable healthcare solutions is propelling the demand for low-cost medical devices, including refurbished medical equipment. Economic pressures and healthcare reforms are prompting institutions to seek cost-effective alternatives without compromising quality. Refurbished medical devices cater to this need by offering substantial cost savings—up to 50% compared to new equipment—making advanced healthcare accessible to a broader population.

This trend is further amplified by government initiatives and insurance policies that favor the use of cost-effective medical solutions. As a result, the market for refurbished medical equipment is poised for growth, driven by the continuous quest for reducing healthcare costs while maintaining high standards of care.

Restraining Factors

Reluctance to Purchase Due to Lack of Awareness

One significant restraining factor for the refurbished medical equipment market is the reluctance to purchase due to a lack of awareness. Many healthcare providers are unaware of the benefits and quality standards of refurbished equipment, leading to hesitation in procurement. This lack of awareness stems from misconceptions about the reliability and performance of refurbished devices, as well as uncertainty about warranty and service support.

Educational initiatives and marketing efforts by manufacturers and suppliers are essential to address these concerns. Increasing awareness about the stringent refurbishment processes, quality certifications, and cost savings can mitigate this reluctance and promote acceptance of refurbished equipment in the market.

Increase in Low-Cost New Medical Devices

The influx of low-cost new medical devices in the market poses a substantial challenge to the growth of refurbished medical equipment. Manufacturers, particularly from emerging economies, are producing new medical devices at competitive prices, which diminishes the cost advantage of refurbished equipment. These low-cost new devices often come with modern features and technology, making them more appealing to healthcare providers looking for both affordability and advanced functionality.

This competition from inexpensive new equipment can limit the market penetration of refurbished devices, as potential buyers may prefer new products over refurbished ones, despite the latter's cost benefits. The market for refurbished medical equipment must therefore emphasize its value proposition through improved quality assurance and extended warranties to remain competitive against low-cost new devices.

By Type Analysis

Patient monitors and defibrillators accounted for 25% market share by type in a recent analysis.

In 2023, Patient monitors and defibrillators held a dominant market position in the By Type segment of the Refurbished Medical Equipment Market, capturing more than a 25% share. This segment's robust performance reflects the increasing demand for reliable and cost-effective medical equipment across healthcare facilities globally. Patient monitors and defibrillators are critical components in medical settings, essential for continuous patient monitoring and emergency response, thereby driving their substantial market presence.

Operating room equipment & surgical equipment followed closely, demonstrating significant uptake within the refurbished medical equipment landscape. This category encompasses a wide array of tools and devices essential for surgical procedures and operating room management. The segment's steady growth underscores healthcare providers' preference for refurbished solutions that offer quality assurance and compliance with stringent healthcare standards, while also managing operational costs effectively.

Medical imaging equipment constituted another pivotal segment, highlighting its integral role in diagnostic procedures across various medical specialties. The demand surge for refurbished medical imaging technologies, such as MRI, CT scanners, and ultrasound machines, underscores the industry's shift towards sustainable healthcare practices without compromising diagnostic accuracy.

Cardiovascular & cardiology equipment emerged as a prominent segment within the market, driven by escalating incidences of cardiovascular diseases and the need for advanced diagnostic and treatment solutions. Refurbished options in this category offer healthcare facilities access to state-of-the-art equipment at reduced costs, facilitating enhanced patient care and management of cardiovascular conditions.

Neurology equipment witnessed notable adoption, supported by advancements in neuroimaging technologies and rising neurological disorders globally. The availability of refurbished EEG machines, EMG devices, and neurosurgical tools cater to the specialized needs of neurology departments, fostering improved patient outcomes and diagnostic precision.

IV therapy systems also experienced steady growth, reflecting their indispensable role in delivering fluids, medications, and nutrients directly into patients' veins. Refurbished IV pumps and infusion systems provide healthcare providers with reliable, cost-efficient alternatives, ensuring uninterrupted patient care and operational efficiency.

Other segments, including respiratory protective equipment, dental equipment, and rehabilitation devices, contributed collectively to the diversified landscape of the refurbished medical equipment market. These segments address niche healthcare needs while aligning with sustainable healthcare practices and cost-effective operational strategies.

By Application Analysis

Hospitals held a dominant position with a 42% market share based on application findings.

In 2023, Hospitals held a dominant market position in the By Application segment of the Refurbished Medical Equipment Market, capturing more than a 42% share. This segment's leadership underscores hospitals' pivotal role as primary users and buyers of refurbished medical equipment globally. Hospitals rely extensively on refurbished equipment to manage costs while maintaining high standards of patient care and operational efficiency.

Clinical Centers emerged as another significant segment, reflecting specialized medical facilities' increasing reliance on cost-effective yet reliable refurbished medical equipment. These centers, focusing on specific medical disciplines or patient populations, benefit from refurbished solutions that enable them to offer advanced diagnostics and treatments without compromising quality.

Group Purchasing Organizations (GPOs) also played a critical role in the market, leveraging their collective buying power to procure refurbished medical equipment for member healthcare facilities. GPOs facilitate streamlined procurement processes and negotiate favorable terms with suppliers, thereby driving adoption across a broad spectrum of healthcare providers.

Medical Research Laboratories demonstrated notable uptake of refurbished equipment, essential for conducting research and development activities in various medical fields. Refurbished laboratory instruments and specialized equipment enable research institutions to stretch their budgetary allocations while advancing scientific discoveries and medical innovations.

Academic Medical Centers and Universities constituted a significant segment, integrating teaching, research, and clinical care. These institutions benefit from refurbished medical equipment that supports educational initiatives, enhances clinical training opportunities, and facilitates cutting-edge research in healthcare sciences.

Key Market Segments

By Type

- Operating room equipment & surgical equipment

- Patient monitors and defibrillators

- Medical imaging equipment

- Cardiovascular & cardiology equipment

- Neurology equipment

- IV therapy systems

- Others

By Application

- Hospitals

- Clinical Centers

- Group Purchasing Organizations (GPOs)

- Medical Research Laboratories

- Academic Medical Centers and Universities

Growth Opportunity

Expansion of Service and Repair Facilities

The global refurbished medical equipment market in 2023 presents significant growth opportunities, particularly through the expansion of service and repair facilities. As the market for refurbished equipment grows, so does the demand for comprehensive after-sales support and maintenance services. Establishing more service and repair facilities ensures that healthcare providers can maintain the functionality and reliability of their refurbished equipment, thereby increasing their confidence in opting for such devices.

This expansion not only enhances customer satisfaction but also extends the lifecycle of medical equipment, making it a more attractive investment. Companies that invest in robust service networks and partnerships with local repair centers will likely see increased market share and customer loyalty, as they address one of the critical concerns of potential buyers—ongoing support and maintenance.

Growth of Private Healthcare

The growth of private healthcare globally also serves as a substantial opportunity for the refurbished medical equipment market. Private healthcare facilities, particularly in emerging economies, are rapidly expanding to meet the rising demand for quality healthcare services. These facilities often operate on tighter budgets compared to public healthcare systems and are more inclined towards cost-effective solutions. Refurbished medical equipment offers a practical alternative, providing high-quality, reliable devices at reduced costs.

As private healthcare providers seek to equip their facilities with advanced medical technologies while managing expenses, the demand for refurbished equipment is expected to rise. Additionally, private healthcare's focus on patient satisfaction and operational efficiency aligns well with the value proposition of refurbished equipment, further driving market growth.

Latest Trends

Demand for Cost-effective Imaging Equipment

The global refurbished medical equipment market is witnessing a significant trend in the growing demand for cost-effective imaging equipment. Healthcare providers, particularly in emerging markets, are under increasing pressure to deliver high-quality diagnostic services while managing tight budgets. Refurbished imaging equipment, such as MRI machines, CT scanners, and ultrasound systems, provides a viable solution by offering advanced technology at reduced costs.

This trend is driven by the need to expand diagnostic capabilities without the substantial capital outlay required for new equipment. The cost-effectiveness of refurbished equipment allows smaller hospitals and clinics to access high-end diagnostic tools, improving patient care and expanding their service offerings. As awareness of the reliability and performance of refurbished imaging equipment increases, this demand is expected to continue rising, significantly contributing to market growth.

Regulatory Support and Guidelines

Regulatory support and guidelines are playing a crucial role in shaping the landscape of the refurbished medical equipment market. Governments and healthcare regulatory bodies are increasingly recognizing the value of refurbished equipment in enhancing healthcare accessibility and affordability. Recent guidelines and standards have been established to ensure the quality, safety, and efficacy of refurbished medical devices.

These regulations help build trust among healthcare providers and patients, addressing concerns about the reliability and performance of refurbished equipment. For instance, stringent quality control processes and certification requirements ensure that refurbished devices meet high standards comparable to new equipment. Regulatory support not only facilitates market growth by legitimizing refurbished products but also encourages more healthcare providers to adopt these cost-effective solutions.

Regional Analysis

The Asia Pacific region accounts for 33.4% of the Refurbished Medical Equipment Market's global share.

In the global refurbished medical equipment market, regional dynamics play a crucial role in shaping industry trends and growth patterns. North America, a mature market, maintains a robust demand owing to stringent regulatory frameworks encouraging healthcare facilities to adopt cost-effective refurbished equipment. The region's prominent market position is underscored by a substantial healthcare expenditure and a growing trend among hospitals to replace outdated equipment with refurbished alternatives.

Europe, similarly, exhibits a strong presence driven by favorable reimbursement policies and the presence of established healthcare infrastructure. The region's emphasis on sustainability and cost-efficiency in healthcare drives substantial adoption of refurbished medical devices. Europe held a significant market share of approximately 30%, consolidating its position as a key player in the global refurbished medical equipment market.

Asia Pacific emerges as the fastest-growing region, propelled by expanding healthcare access in populous countries like China and India. The region's healthcare modernization efforts, coupled with increasing investments in healthcare infrastructure, contribute to its rapid market expansion. Asia Pacific commanded a notable 33.4% of the global market share in 2023, marking it as the dominant region in terms of growth and market size.

In contrast, the Middle East & Africa, and Latin America regions are witnessing steady growth supported by rising healthcare investments and initiatives to enhance healthcare accessibility. These regions collectively contributed to the remaining market share, with potential for further expansion driven by increasing healthcare expenditure and adoption of refurbished medical equipment.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global market for refurbished medical equipment continues to be influenced significantly by key players such as Johnson & Johnson Services, Inc., General Electric Company, Koninklijke Philips N.V., Canon Medical Systems Corporation, Siemens Healthcare Private Limited, and Block Imaging. Each of these companies plays a pivotal role in shaping the landscape of the refurbished medical equipment sector through their extensive product offerings, strategic initiatives, and market penetration strategies.

Johnson & Johnson Services, Inc., renowned for its comprehensive healthcare solutions, leverages its robust global presence to enhance the availability of high-quality refurbished medical equipment across diverse markets. This approach not only supports cost-effective healthcare delivery but also promotes sustainability by reducing medical waste.

General Electric Company (GE), a stalwart in healthcare technology, continues to innovate within the refurbished equipment segment. Its broad portfolio, spanning imaging systems, diagnostic tools, and patient monitoring devices, underscores its commitment to advancing healthcare accessibility and affordability worldwide.

Koninklijke Philips N.V. excels in integrating cutting-edge technology into refurbished medical equipment, ensuring reliability and performance akin to new devices. This positions Philips as a leader in driving technological advancements that redefine healthcare standards.

Canon Medical Systems Corporation, with its precision-engineered imaging systems and diagnostic solutions, contributes significantly to enhancing diagnostic capabilities in healthcare facilities globally. Its focus on quality refurbishment extends the lifecycle of medical equipment, making advanced healthcare more accessible.

Siemens Healthcare Private Limited emphasizes sustainability and innovation, offering refurbished equipment that meets stringent quality standards. This commitment supports healthcare providers in delivering superior patient care while optimizing operational efficiency.

Block Imaging specializes in refurbishing and distributing medical imaging equipment, providing cost-effective solutions without compromising on quality or performance. Its customer-centric approach and technical expertise reinforce its status as a trusted partner in the healthcare industry.

Market Key Players

- Johnson & Johnson Services, Inc. (US)

- GENERAL ELECTRIC COMPANY (US)

- Koninklijke Philips N.V. (Netherland)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Siemens Healthcare Private Limited (Germany)

- Block Imaging (US)

Recent Development

- In August 2023, The Ministry of Environment, Forest and Climate Change permitted the import of refurbished medical equipment, sparking debate between domestic and global medtech companies. MTaI advocates affordability, while AiMeD emphasizes self-sufficiency.

- In October 2023, Circularity in MedTech is driven by purposeful design, collaborative ecosystems, and alternative business models. MedTech waste primarily consists of single-use devices, prompting innovation and regulatory support for product take-back initiatives.

Report Scope

Report Features Description Market Value (2023) USD 15.3 Billion Forecast Revenue (2033) USD 40.5 Billion CAGR (2024-2032) 10.5% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Operating room equipment & surgical equipment, Patient monitors and defibrillators, Medical imaging equipment, Cardiovascular & cardiology equipment, Neurology equipment, IV therapy systems, Others), By Application(Hospitals, Clinical Centers, Group Purchasing Organizations (GPOs), Medical Research Laboratories, Academic Medical Centers and Universities) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Johnson & Johnson Services, Inc. (US), GENERAL ELECTRIC COMPANY (US), Koninklijke Philips N.V. (Netherland), CANON MEDICAL SYSTEMS CORPORATION (Japan), Siemens Healthcare Private Limited (Germany), Block Imaging (US) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) - Market Growth: The Global Refurbished Medical Equipment Market is projected to grow from USD 15.3 billion in 2023 to USD 40.5 billion by 2033, with a CAGR of 10.5%.

-

-

- Johnson & Johnson Services, Inc. (US)

- GENERAL ELECTRIC COMPANY (US)

- Koninklijke Philips N.V. (Netherland)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Siemens Healthcare Private Limited (Germany)

- Block Imaging (US)