Global Orthopedic Biomaterials Market By Type (Ceramics & Bioactive Glasses, Polymers, Calcium Phosphate Cement, Metal, Composites), By Application(Orthopedic Implants, Joint Replacement/Reconstruction, Orthobiologics, Viscosupplementation, Bio-resorbable Tissue Fixation), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

46608

-

May 2024

-

300

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

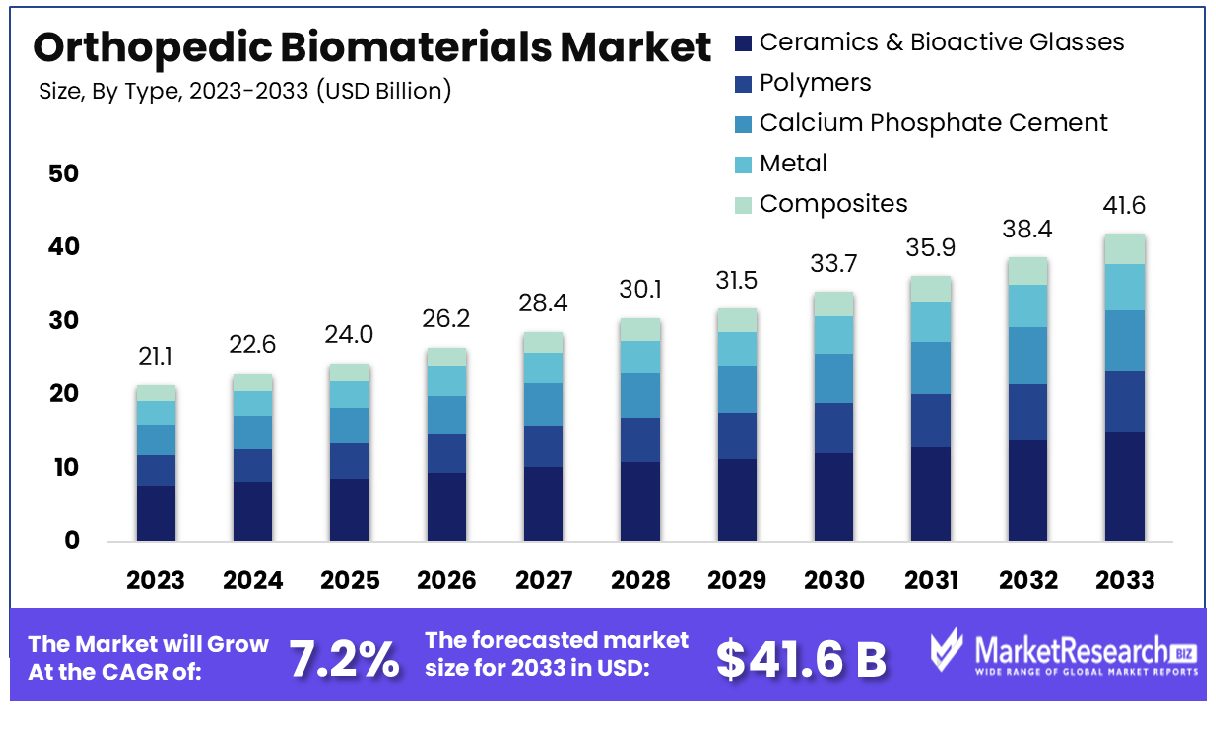

The Global Orthopedic Biomaterials Market was valued at USD 21.1 billion in 2023. It is expected to reach USD 41.6 billion by 2033, with a CAGR of 7.2% during the forecast period from 2024 to 2033.

The Orthopedic Biomaterials Market encompasses advanced materials engineered to aid in the repair and regeneration of bone and joint tissues. This market is pivotal for stakeholders aiming to capitalize on innovations tailored to enhance surgical outcomes and patient recovery rates. It includes ceramics, polymers, and composites that are integral to implants, prosthetics, and orthopedic devices.

As the global population ages and the demand for minimally invasive surgeries rises, this market is expected to expand, presenting significant growth opportunities for smart medical device manufacturers and healthcare providers. Key considerations include biocompatibility, mechanical stability, and the integration of smart technologies.

The Orthopedic Biomaterials Market is currently experiencing significant growth, driven by the increasing prevalence of musculoskeletal disorders (MSDs) among the global workforce. In the fiscal years 2021/22 and 2022/23, MSDs accounted for 27% of all work-related health issues, underscoring the critical need for advanced orthopedic solutions. During 2021/22, approximately 477,000 workers reported new or ongoing work-related MSDs, resulting in around 7.3 million lost working days.

Although a slight decrease in affected workers was observed in 2022/23—with 473,000 workers impacted—the lost working days remained substantial at 6.6 million. This consistent demand for effective treatment options highlights the importance of orthopedic biomaterials, which are pivotal in the development of implants and prostheses that enhance patient recovery and quality of life. The market's expansion is further supported by technological advancements in biomaterials, which are becoming increasingly sophisticated in mimicking natural bone structures and facilitating quicker recovery.

Consequently, the market is expected to continue its upward trajectory, propelled by both the high incidence of MSDs and the ongoing innovations in biomaterial technology. This trend suggests a robust market outlook, promising substantial opportunities for industry stakeholders to innovate and expand their market presence.

Key Takeaways

- Market Growth: The Global Orthopedic Biomaterials Market was valued at USD 21.1 billion in 2023. It is expected to reach USD 41.6 billion by 2033, with a CAGR of 7.2% during the forecast period from 2024 to 2033.

- By Type, Ceramics & Bioactive Glasses dominated with a 33.1% share.

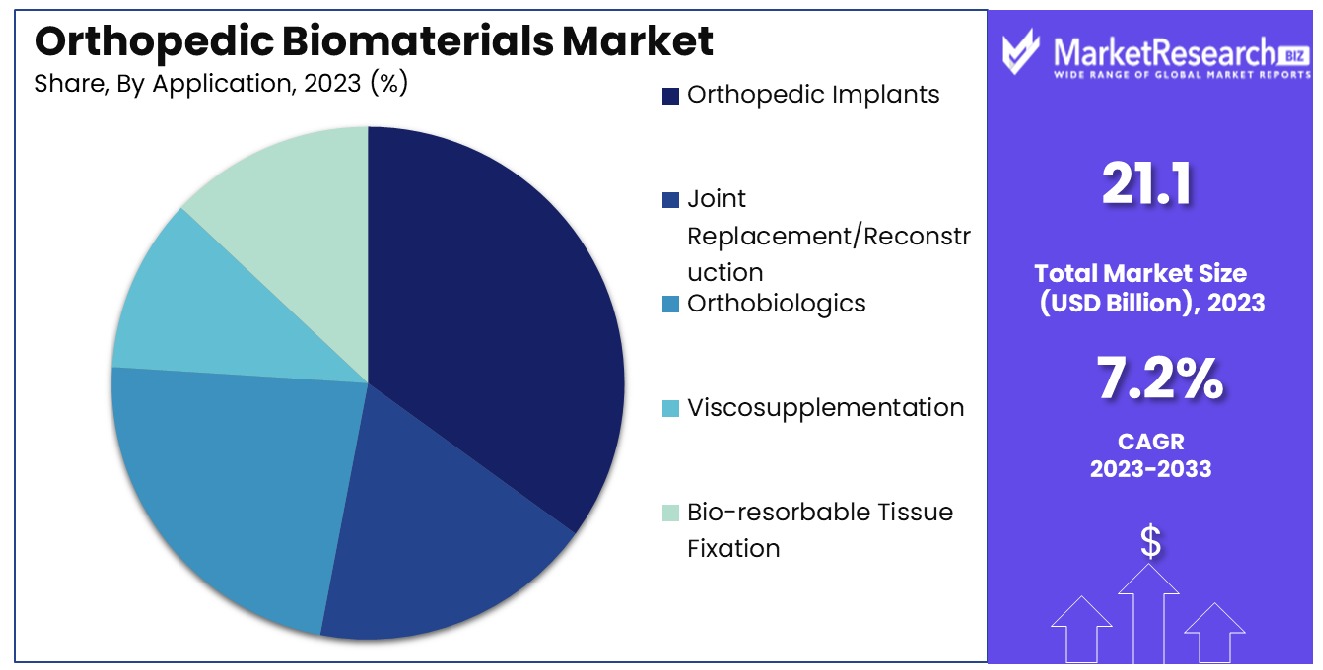

- By Application, Orthopedic Implants led, holding a 30% market share.

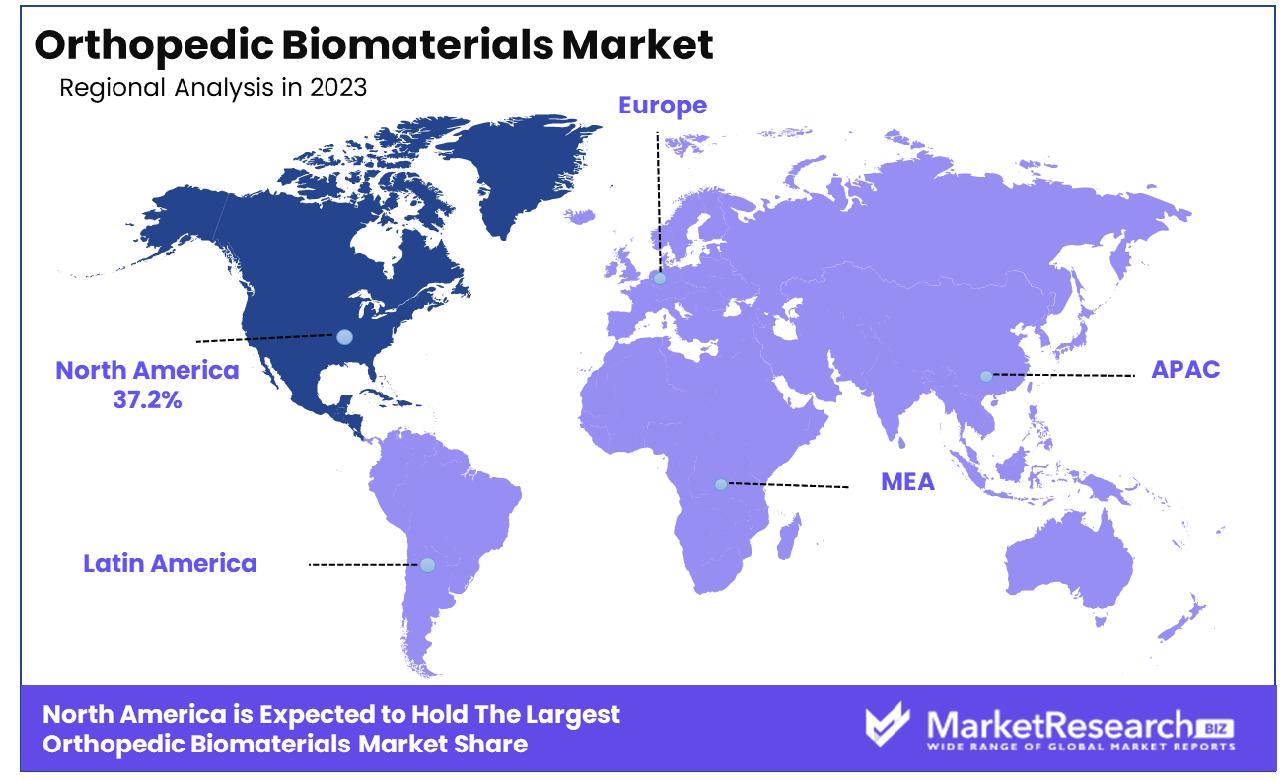

- Regional Dominance: North America holds 37.2% of the orthopedic biomaterials market.

- Growth Opportunity: In 2023, real-time communication and data integration systems will be pivotal in enhancing the global orthopedic biomaterials market, optimizing surgical outcomes, and advancing personalized patient care.

Driving factors

Growing Demand for Next-Generation Orthopedic Biomaterials

The orthopedic biomaterials market is experiencing significant growth driven by the increasing demand for next-generation materials. These advanced materials are designed to improve the outcomes of orthopedic surgeries, enhance biocompatibility, and offer superior strength and durability.

For instance, the development of smart biomaterials that can promote bone growth and self-heal minor damages is revolutionizing treatment approaches. This surge in demand reflects not only technological advancements but also a growing awareness among healthcare professionals and patients about the benefits of innovative biomaterials in orthopedic care.

Increased Prevalence of Musculoskeletal Ailments

A key factor propelling the orthopedic biomaterials market is the heightened prevalence of musculoskeletal disorders globally. According to the World Health Organization, musculoskeletal conditions are the leading contributor to disability worldwide, with more than 1.71 billion people affected.

This widespread incidence of ailments such as osteoarthritis, rheumatoid arthritis, and osteoporosis necessitates more effective and lasting orthopedic solutions, thereby driving the demand for high-quality biomaterials. As the global population ages, the incidence of these conditions is expected to increase, further bolstering market growth.

Chronic Skeletal Conditions

Chronic skeletal conditions, often intertwined with the increased prevalence of musculoskeletal ailments, significantly influence the orthopedic biomaterials market. Chronic conditions such as osteoporosis lead to decreased bone density and increased fracture risk, requiring innovative solutions that biomaterials can provide.

The push towards materials that facilitate better bone integration and faster recovery times is crucial in managing these long-term conditions, underscoring the importance of advanced biomaterials in chronic skeletal management.

Restraining Factors

High Cost of Orthopedic Biomaterials

One of the principal factors restraining the growth of the orthopedic biomaterials market is their high cost. The production of advanced biomaterials often involves sophisticated technologies and expensive raw materials, which in turn raises the cost of the final products. For patients in developing countries and those with limited financial resources, these costs can be prohibitive.

The economic barrier not only limits the accessibility of advanced orthopedic treatments but also affects market penetration in economically weaker regions. This financial aspect is crucial in determining the adoption rate of new technologies in the field of orthopedics, thus impacting the overall market growth.

Lack of Proper Reimbursement Coverage

Compounding the issue of high costs is the lack of adequate healthcare reimbursement coverage for orthopedic biomaterials. In many healthcare systems, especially those in less developed countries, insurance coverage for cutting-edge medical materials is not comprehensive. This lack of support from insurance providers means that patients must often bear a significant portion of the costs themselves, which can deter the use of advanced biomaterials in orthopedic procedures.

The absence of sufficient reimbursement policies not only restricts the accessibility of these materials but also stifles innovation in the sector, as manufacturers may be hesitant to invest in new technologies without assurance of financial returns through widespread adoption.

By Type Analysis

Ceramics and bioactive glasses led with a 33.1% share in the market.

In 2023, Ceramics & Bioactive Glasses held a dominant market position in the Type segment of the Orthopedic Biomaterials Market, capturing more than 33.1% of the market share. This segment is followed by Polymers, Calcium Phosphate Cement, Metal, and Composites in terms of market penetration. The prominence of Ceramics & Bioactive Glasses can be attributed to their superior properties, such as high biocompatibility and bioactivity, which make them ideal for applications in bone grafting and regenerative medicine.

Polymers, which are known for their flexibility and lower cost, also play a crucial role in the market, especially in the manufacturing of orthopedic devices like prosthetics and implants. The Calcium Phosphate Cement segment, notable for its osteoconductive properties, facilitates bone growth and is increasingly used in orthopedic surgeries. Metals, traditionally favored for their strength and durability, continue to be essential in load-bearing implants. Lastly, Composites are gaining traction due to their ability to combine the beneficial properties of different materials, thereby providing tailored solutions for specific orthopedic applications.

The segmentation within the Orthopedic Biomaterials Market reflects the diverse technological advancements and the growing demand for materials that offer improved outcomes and compatibility with human tissue. The ongoing research and development in this field are expected to drive further growth and innovation, particularly in Ceramics & Bioactive Glasses, which are at the forefront due to their enhanced properties that meet the critical needs of bone repair and regeneration.

As the market evolves, these materials are anticipated to see increased adoption, bolstered by technological advancements and an aging global population that demands more effective and sustainable orthopedic solutions.

By Application Analysis

Orthopedic implants dominated, holding a 30% share of the market.

In 2023, Orthopedic Implants held a dominant market position in the By Application segment of the Orthopedic Biomaterials Market, capturing more than 30% of the market share. This category was followed by Joint Replacement/Reconstruction, Orthobiologics, Viscosupplementation, and Bio-resorbable Tissue Fixation. Orthopedic Implants' leading status is largely due to the rising prevalence of osteoporosis and osteoarthritis, as well as the increasing number of sports injuries and accidents globally.

Joint Replacement/Reconstruction is another significant segment, driven by the growing elderly population and the subsequent rise in joint replacement surgeries, including hip and knee replacements. Orthobiologics, which focus on healing orthopedic injuries using biological substances, are increasingly popular due to their effectiveness in accelerating healing and reducing recovery time.

Viscosupplementation, involving the injection of hyaluronic acid into arthritic joints, is noted for its ability to alleviate pain and improve joint function, particularly in patients who are not candidates for more invasive surgeries. Lastly, the Bio-resorbable Tissue Fixation segment is gaining attention for its innovative materials that naturally dissolve in the body, thereby eliminating the need for subsequent removal surgeries.

The Orthopedic Biomaterials Market is characterized by a robust demand for advanced materials that provide effective solutions for bone and joint issues. The focus on improving patient outcomes and the technological advancements in biomaterials are key drivers for growth across all segments. With ongoing innovations and the expansion of applications in medical treatments, the market is poised for further expansion and diversification in the coming years.

Key Market Segments

By Type

- Ceramics & Bioactive Glasses

- Polymers

- Calcium Phosphate Cement

- Metal

- Composites

By Application

- Orthopedic Implants

- Joint Replacement/Reconstruction

- Orthobiologics

- Viscosupplementation

- Bio-resorbable Tissue Fixation

Growth Opportunity

Real-Time Communication Solutions

In 2023, the integration of real-time communication solutions within the global orthopedic biomaterials market is poised to significantly enhance operational efficiency and patient outcomes. The adoption of these technologies facilitates immediate consultations and collaborations among healthcare professionals, ensuring that critical patient information is shared swiftly and securely. This enhancement in communication channels can reduce procedural errors and improve the speed of patient care, which is crucial in orthopedic treatments.

As healthcare continues to evolve towards more integrated and patient-centered models, the implementation of real-time communication systems in orthopedic biomaterials applications can be seen as a vital growth opportunity. The market's capacity to support real-time data exchange directly contributes to improved surgical outcomes and optimized patient recovery paths, making this a key area for potential development and investment.

Data Integration Systems

Data integration systems stand at the forefront of transforming the orthopedic biomaterials market in 2023. By seamlessly combining data from diverse sources such as patient records, device performance, and post-operative recovery metrics, these systems enable a holistic view of patient treatment cycles. The insights gained from integrated data analytics empower healthcare providers to make more informed decisions regarding biomaterial selection and surgical approaches.

This not only tailors patient care more closely to individual needs but also enhances the overall efficacy of orthopedic implants. The strategic implementation of data integration systems can lead to advancements in personalized medicine, where biomaterials are optimized for better compatibility and performance, thus driving market growth and innovation in the sector.

Latest Trends

Shift Toward Nanophase Materials from Conventional Materials

The global orthopedic biomaterials market has observed a significant shift towards nanophase materials from conventional materials. This transition is driven by the superior properties of nanophase materials, such as enhanced mechanical strength and improved biocompatibility, which are crucial in orthopedic applications. These materials offer a finer surface architecture that mimics natural bone structures more closely, thereby promoting better cell adhesion and osteointegration.

The adoption of nanophase materials is expected to enhance the outcomes of bone grafts and implants, reducing the risk of rejection and failure rates. Market analysts predict a robust growth trajectory as research continues to advance in nano-engineering, positioning these materials as a cornerstone in the next generation of orthopedic solutions.

Growing Adoption of 3D Printed Orthopedic Implants

Concurrently, there has been a growing adoption of 3D-printed orthopedic implants in the market, fueled by rapid technological advancements in additive manufacturing. This trend is enhancing the customization of implants to fit patient-specific anatomical and physiological needs, thereby improving surgical outcomes and patient satisfaction. 3D printing allows for the creation of complex structures that were previously difficult or impossible to manufacture, offering improved osseointegration and weight distribution.

As healthcare providers increasingly recognize the benefits of these personalized implants, the demand within the orthopedic biomaterials market is expected to surge. This adoption is further supported by a parallel increase in regulatory approvals and a growing body of clinical evidence substantiating the efficacy and safety of 3D-printed implants.

Regional Analysis

The orthopedic biomaterials market in North America holds a 37.2% share of the global market.

The orthopedic biomaterials market is segmented into five major regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, each displaying distinct market dynamics and growth opportunities.

North America dominates the orthopedic biomaterials market with a 37.2% share, driven by advanced healthcare infrastructure, robust medical research activities, and high healthcare spending. The U.S. spearheads regional growth, attributed to increasing orthopedic surgeries and a rising prevalence of osteoarthritis and osteoporosis.

Europe follows, benefiting from a well-established healthcare system and ongoing investments in biocompatible materials for orthopedic applications. Countries like Germany and the UK are at the forefront, leveraging their technological prowess and innovative healthcare solutions.

The Asia Pacific region is witnessing the fastest growth in the orthopedic biomaterials market. Factors such as aging populations, improving healthcare facilities, and increasing awareness about new biomaterials contribute to this growth. China and India, with their vast populations, are expected to be major contributors, with governments increasingly investing in healthcare infrastructure.

The Middle East & Africa region shows promising growth, although it starts from a smaller base. The market expansion is helped by economic diversification efforts and increased healthcare expenditure, particularly in Gulf Cooperation Council (GCC) countries like Saudi Arabia and the UAE.

Latin America, though a smaller segment, is experiencing gradual growth in the demand for orthopedic biomaterials. Brazil leads the region, supported by its expanding healthcare sector and increasing orthopedic procedures.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global Orthopedic Biomaterials Market features a dynamic array of key players, each contributing uniquely to the industry's development and growth. DSM Biomedical stands out for its innovative approach to enhancing the biocompatibility and functionality of medical implants. Evonik Industries AG is noted for its specialty in developing biodegradable polymers, which are crucial for temporary implant applications, showing promising growth in tissue engineering.

Stryker Corp and Depuy Synthes Inc, as major entities in the market, continue to lead with robust product portfolios and significant investments in R&D to advance biomaterials technology. Their efforts are complemented by Zimmer Biomet, which consistently emphasizes material innovation to improve orthopedic device longevity and patient outcomes.

Invibio Ltd. remains a leader in the provision of PEEK (Polyether ether ketone) solutions, a high-performance thermoplastic with excellent mechanical properties and compatibility with medical imaging devices. Similarly, Globus Medical and Exactech, Inc. are advancing through technological enhancements in biomaterials that offer improved osteoconductive properties and biostability.

Lesser-known yet impactful, Matexcel, AdvanSource Biomaterials Corp, and CAM Bioceramics B.V. are critical for providing specialized biomaterial solutions that cater to niche market needs. Their focus on customized solutions helps drive innovation in specific orthopedic applications.

Heraeus Holding, with its extensive expertise in medical technology, continues to innovate in the production of high-purity biomaterials, supporting the overall market with reliable and effective materials for various orthopedic applications. Collectively, these companies are setting the pace for a future where advanced biomaterials significantly improve surgical outcomes and quality of life for patients worldwide.

Market Key Players

- DSM Biomedical

- Evonik industries AG

- Stryker Corp

- Depuy Synthes Inc

- Zimmer Biomet

- Invibo Ltd.

- Globus Medical

- Exactech, Inc.

- Matexcel

- AdvanSource

- Biomaterials Corp

- CAM Bioceramics B.V.

- Heraeus Holding

Recent Development

- In May 2024, Composite biomaterials offer tailored solutions for orthopedic surgery, overcoming the limitations of traditional materials. Studies by various institutions, including advancements in UHMWPE nanocomposites and carbon fiber innovations, showcase their potential for enhanced patient outcomes.

- In May 2024, Tel Aviv University's Professor Lihi Adler-Abramovich pioneers bone tissue regeneration research, focusing on personalized bioactive hydrogel scaffolds for bone and skin. Her team's breakthroughs include complete bone regeneration in challenging conditions.

Report Scope

Report Features Description Market Value (2023) USD 21.1 Billion Forecast Revenue (2033) USD 41.6 Billion CAGR (2024-2032) 7.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Ceramics & Bioactive Glasses, Polymers, Calcium Phosphate Cement, Metal, Composites), By Application(Orthopedic Implants, Joint Replacement/Reconstruction, Orthobiologics, Viscosupplementation, Bio-resorbable Tissue Fixation) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape DSM Biomedical, Evonik industries AG, Stryker Corp, Depuy Synthes Inc, Zimmer Biomet, Invibo Ltd., Globus Medical, Exactech, Inc., Matexcel, AdvanSource, Biomaterials Corp, CAM Bioceramics B.V., Heraeus Holding Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- DSM Biomedical

- Evonik industries AG

- Stryker Corp

- Depuy Synthes Inc

- Zimmer Biomet

- Invibo Ltd.

- Globus Medical

- Exactech, Inc.

- Matexcel

- AdvanSource

- Biomaterials Corp

- CAM Bioceramics B.V.

- Heraeus Holding