Orthopedic Devices Market By Product Type (Joint Reconstruction, Spinal Devices, Trauma Fixation, Orthobiologics, and Others), By Material (Metallic, Polymeric, Ceramic), By Application, By End-User, By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

5723

-

June 2023

-

170

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

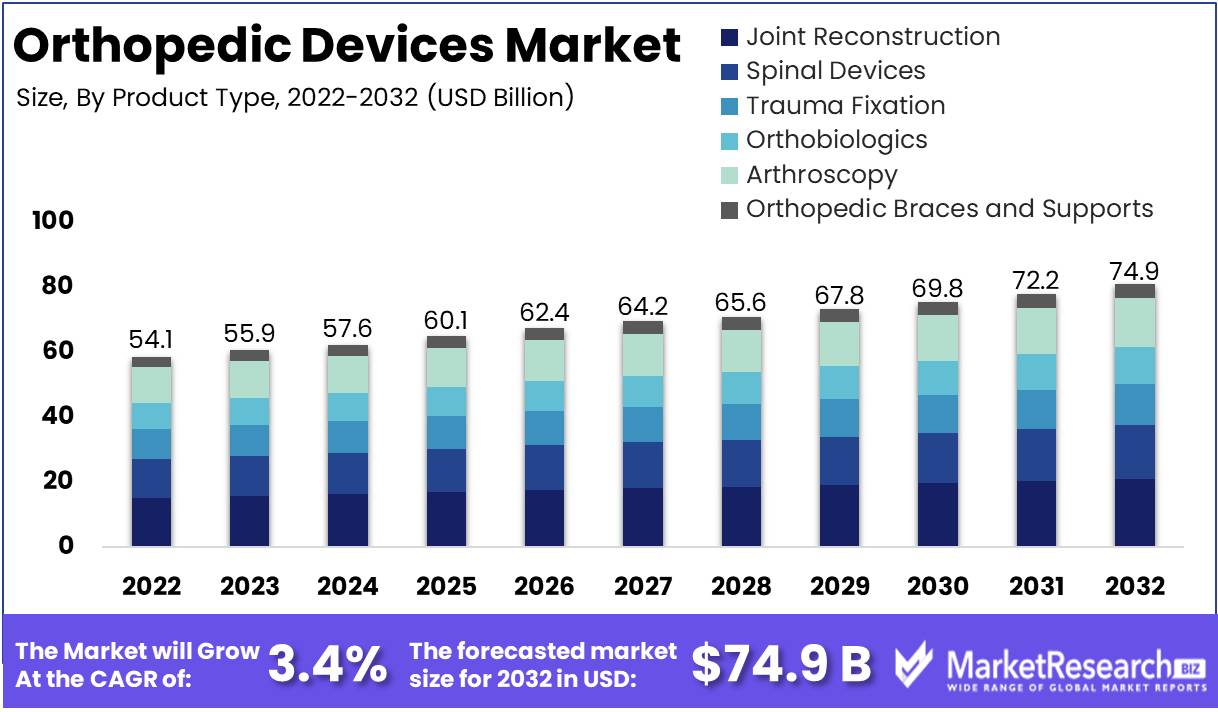

Orthopedic Devices Market size is expected to be worth around USD 74.9 Bn by 2032 from USD 54.1 Bn in 2022, growing at a CAGR of 3.4% during the forecast period from 2023 to 2032.

The Orthopedic Devices Market, a thriving industry comprising the production and distribution of surgical instruments, implants, and medical devices used in orthopedic surgery and rehabilitation, is an enthralling domain characterized by its complexity and dynamic variations. This multifaceted field incorporates a variety of devices, ranging from prosthetics and bone grafts to spinal implants, as well as cutting-edge equipment for diagnosing and treating a wide range of musculoskeletal disorders.

In the field of medicine, orthopedic devices play a significant role in helping patients recover from injuries, disabilities, and deformities. These devices improve mobility and function, allowing people to enjoy a better quality of life. They offer several advantages over traditional methods, such as speeding up recovery, shortening hospital stays, and lowering post-surgery pain.

The Orthopedic Devices Market is always evolving and continually advancing with new techniques and innovations. One noteworthy development is the use of 3D printing, which allows for the creation of implants and prosthetics customized for each patient's needs. Additionally, the use of artificial intelligence (AI) and machine learning (ML) is improving the market by predicting surgical success rates accurately and creating custom implants that fit individuals perfectly, reducing the chances of post-surgery issues.

Driving Factors

Rising Obesity Rates Leading to an Increase in Orthopedic Problems.

The escalating rates of obesity worldwide have become a significant concern for public health, with far-reaching consequences that extend beyond just the obvious health implications. One of the less-discussed yet highly impactful consequences of rising obesity rates is the substantial increase in orthopedic problems.

According to the Centers for Disease Control and Prevention (CDC), more than 42% of adults in the United States are obese. Obesity puts extra stress on the joints, which can lead to a variety of orthopedic problems, such as osteoarthritis, osteoporosis, and rheumatoid arthritis. This surge in orthopedic issues has, in turn, driven significant growth in the orthopedic devices market.

Cost-effectiveness and Long-term savings

Despite the initial expense, orthopedic devices can result in long-term cost savings. Orthopedic devices help reduce healthcare costs associated with lengthy hospital stays, rehabilitation, traumatic injuries and potential complications by providing effective treatment and reducing the need for more invasive procedures. In addition, these devices contribute to preventing or delaying the need for surgery, thereby sparing patients and healthcare systems substantial amounts of money. Orthopedic Devices Market plays a vital role in enhancing the quality of life for Duchenne Muscular Dystrophy patients.

Rising Geriatric Population

The orthopedic devices market growth is significantly influenced by several driving factors, with a growing geriatric population being a prominent one. Orthopedic diseases, such as osteoarthritis and osteoporosis, are more prevalent among the elderly, making them a key demographic for orthopedic device manufacturers.

As the geriatric population continues to expand due to longer life expectancies, the demand for orthopedic devices like joint replacements, orthopedic braces, and mobility aids rises. These devices help alleviate pain, improve mobility, and enhance the overall quality of life for older individuals suffering from orthopedic conditions.

Restraining Factors

Postoperative Complications and Long-term Outcomes

While orthopedic devices can greatly improve the quality of life for patients, there is always a risk of postoperative complications. Major factors like infections, implant failure, and other adverse events can occur, requiring additional medical interventions and potentially impacting long-term outcomes. Continuous monitoring and follow-up care are necessary to address and minimize these risks.

Surgical Expertise and Training

The successful implementation of orthopedic devices relies on the skills and expertise of surgeons and healthcare professionals. Adequate training and proficiency in the use of these devices are essential to ensure optimal patient outcomes. Access to training programs and opportunities for ongoing professional development should be prioritized to maintain a high standard of care.

Ethical Considerations

The use of orthopedic devices raises ethical considerations, particularly in cases where patient autonomy and decision-making are involved. Balancing the benefits and potential risks of these devices, as well as considering patient preferences, plays a crucial role in ethical decision-making and informed consent processes.

Environmental Impact

The manufacturing and disposal of orthopedic devices can have environmental implications. The production of these devices often involves the use of resources and energy, while their disposal can contribute to waste accumulation. Considering environmentally sustainable practices, such as recycling and reducing the ecological footprint of orthopedic devices, is important for the long-term sustainability of healthcare systems.

Product Type Analysis

With an increase in demand for orthopedic implants and devices, the Orthopedic Devices Market has experienced significant growth in recent years. The Joint Reconstruction Segment is one of the most important market segments, as it dominates the market. Implants and devices used to replace or restore damaged joints, such as the hips, knees, and shoulders, are included in the Joint Reconstruction Segment.

The adoption of the Joint Reconstruction Segment has been influenced by the expanding economic development of emerging economies. This development has led to a rise in healthcare expenditure in these nations, resulting in an increase in demand for orthopedic devices.

As global healthcare infrastructure improves, an increasing number of consumers choose joint reconstruction procedures to improve their quality of life. This trend has been driven by the aging population, which is more likely to develop joint-related conditions such as arthritis.

Material Analysis

The Orthopedic Devices Market is further segmented based on the material employed in device manufacturing. The metallic segment, which includes devices made from stainless steel, titanium, and cobalt-chromium, is the fastest-growing market segment.

Increasing discretionary income in emergent economies has led to an increase in the use of metallic orthopedic devices in these nations. Due to its durability, sturdiness, and high-quality characteristics, the metallic segment is acquiring popularity.

As more patients seek durable and long-lasting orthopedic devices, they are increasingly opting for metallic devices. In addition, technological advances such as coatings have increased the durability of metallic devices, making them an appealing option for patients.

Application Analysis

The Spine Segment is an additional important subset of the Orthopedic Devices Market. Spinal disorders such as herniated discs, spinal stenosis, and degenerative discs are treated with a variety of devices in the Spine Segment.

Also propelling the adoption of the Spine Segment are emerging economies. As the global population ages, the prevalence of spinal conditions increases in developing nations, resulting in a greater demand for spinal devices.

As orthopedic technology advances and more minimally invasive spine surgeries become available, an increasing number of patients elect to undergo these procedures to enhance their quality of life. Now, patients can anticipate shorter rehabilitation periods, less discomfort, and fewer complications.

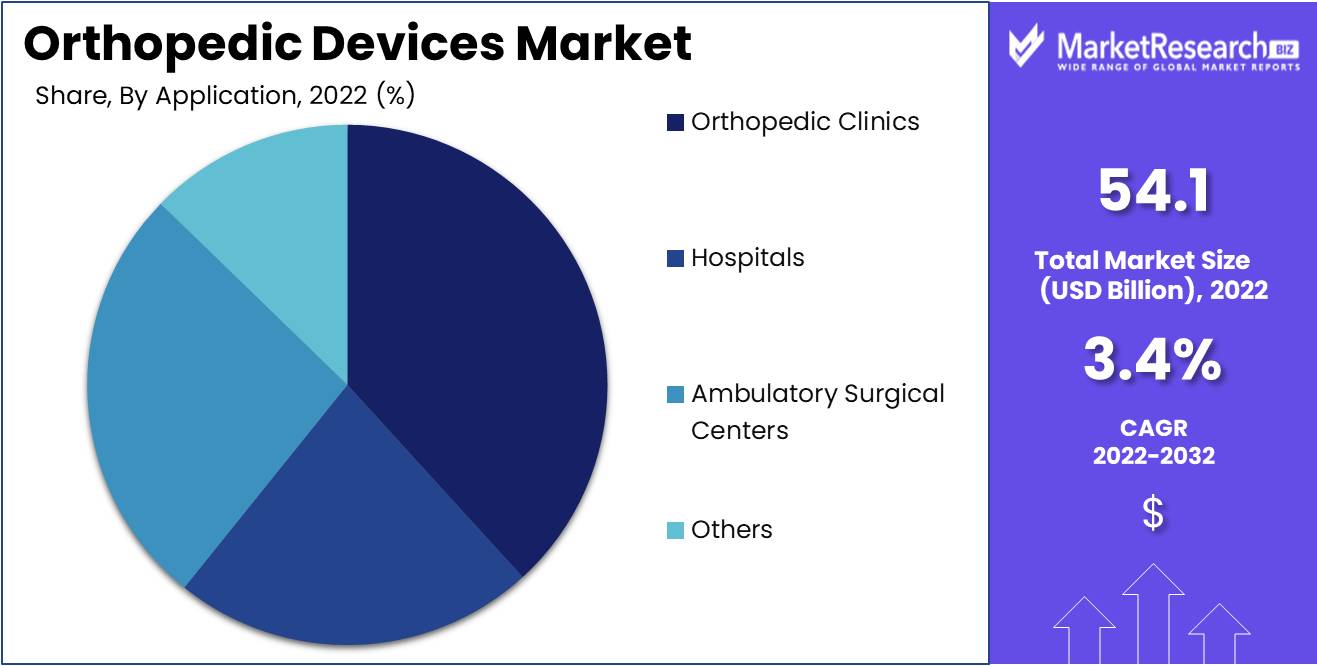

End User Analysis

Orthopedic Clinics are an additional essential element of the Orthopedic Devices Market. The Orthopedic Clinics Segment focuses on the application of orthopedic devices in clinics, hospitals, and private practices.

The increasing GDP in emerging economies has led to a rise in healthcare spending, which has led to an increase in the number of orthopedic clinics in these nations.

As patients become increasingly health-conscious, they seek more specialized services to meet their needs. As more technologically advanced orthopedic devices become available, patients seek treatment at specialized orthopedic clinics.

Key Market Segments

Product Type

- Joint Reconstruction

- Spinal Devices

- Trauma Fixation

- Orthobiologics

- Arthroscopy

- Orthopedic Braces and Supports

Material

- Metallic Implants

- Polymeric Materials

- Ceramic Materials

Applications

- Spine

- Hip

- Knee

- Craniomaxillofacial

- Dental

- Sports Injuries, Extremities, and Trauma (SET)

End-User

- Orthopedic Clinics

- Hospitals

- Ambulatory Surgical Centers

- Others(Rehabilitation Centers, Sports Medicine Centers, And Home Healthcare)

Growth Opportunity

Non-Invasive and Minimally Invasive Orthopedic Procedures

Non-invasive and minimally invasive procedures have acquired popularity in recent years due to their numerous advantages over traditional surgical procedures, including reduced pain and scarring, shorter hospital stays, faster recovery times, and fewer complications. These procedures are becoming more broadly accessible and are gaining popularity among patients.

The Growing Popularity of Outpatient Orthopedic Surgeries

Outpatient orthopedic procedures, also known as ambulatory surgical procedures, do not necessitate an overnight hospital stay. Several factors, including advancements in surgical techniques and anesthesia, enhancements in patient selection, and the cost-effectiveness of outpatient surgery, have contributed to the increasing popularity of outpatient orthopedic surgeries. According to the report, the increasing demand for ambulatory orthopedic procedures is driving the growth of the orthopedic devices market.

Increasing Robotic-Assisted Orthopedic Surgery Adoption

In orthopedics, robotic-assisted surgery is gaining popularity as it offers several advantages over conventional surgical techniques, including greater precision, increased accuracy, and decreased surgical time. Robotic-assisted surgery is especially beneficial for complex procedures such as joint replacement and spine surgery. Increasing adoption of robotic-assisted orthopedic surgeries is propelling the growth of the orthopedic devices market, according to the report.

Increasing interest in patient-specific implants

Patient-specific implants are implants that are created specifically for the patient's anatomy. They offer several advantages over conventional implants, including enhanced fit, decreased surgical time, and accelerated recovery. Increasing demand for patient-specific implants is propelling the growth of the orthopedic devices market, according to the report.

Expansion of the Orthopedic Devices Market in Emerging Economies

The orthopedic devices market in emerging economies such as India, China, and Brazil is expanding swiftly. In these nations, the rising prevalence of chronic diseases such as osteoarthritis and the aging population are fueling the demand for orthopedic devices. The expansion of the orthopedic devices market in emerging economies is fueling the growth of the global orthopedic devices market, according to the report.

Latest Trends

Increasing Focus on the Development of 3D-Printed Orthopedic Implants

The 3D printing technology is swiftly advancing and has found widespread application in the medical field. The orthopedic industry has been swift to adopt this technology, with a growing emphasis on the creation of 3D-printed orthopedic implants. One of the benefits of 3D printing is the ability to construct patient-specific, customized implants. This has resulted in enhanced outcomes and reduced recovery times for orthopedic surgery patients.

The Rise in Popularity of Outpatient Orthopedic Surgeries

The growing popularity of outpatient orthopedic surgeries is another significant market trend influencing the orthopedic devices market. Outpatient surgery centers are becoming more prevalent, and they offer patients a convenient and economical alternative to traditional hospital procedures. Outpatient orthopedic procedures have a number of benefits, including shorter recovery periods, lower costs, and fewer complications. These advantages have made ambulatory surgery centers an appealing option for both patients and medical professionals.

The Growing Adoption of Robotic Assisted Orthopedic Surgeries

Another significant trend that is shaping the future of orthopedic surgery is robotic-assisted surgery. The use of robotics in orthopedic surgery has become increasingly prevalent, with many surgeons relying on robotic systems to conduct complex procedures. The advantages of robotic-assisted surgery include increased precision, improved outcomes, and decreased recovery periods. As technology continues to develop, it is likely that robotic-assisted surgery will continue to gain popularity.

An Increasing Focus on the Development of Customized Orthopedic Implants

Customized orthopedic implants are a significant trend that is reshaping the orthopedic devices market. These implants are designed to precisely match the patient's anatomy, resulting in enhanced outcomes and reduced recovery periods. Advanced imaging technology, such as CT scans and MRIs, is used to construct orthopedic implants with a specific fit. The images are utilized to construct a three-dimensional model of the patient's anatomy, which is then used to design the implant.

Expansion of the Orthopedic Devices Market in Emerging Economies

Emerging economies are another significant trend influencing the orthopedic devices market. Due to the increasing population and demand for healthcare services, emergent economies are becoming significant markets for orthopedic devices. Numerous manufacturers of orthopedic devices are expanding their operations into emerging economies with the goal of providing affordable and high-quality devices to patients in these regions. As the markets in these regions continue to expand, it is likely that they will play a larger role in the global orthopedic devices market.

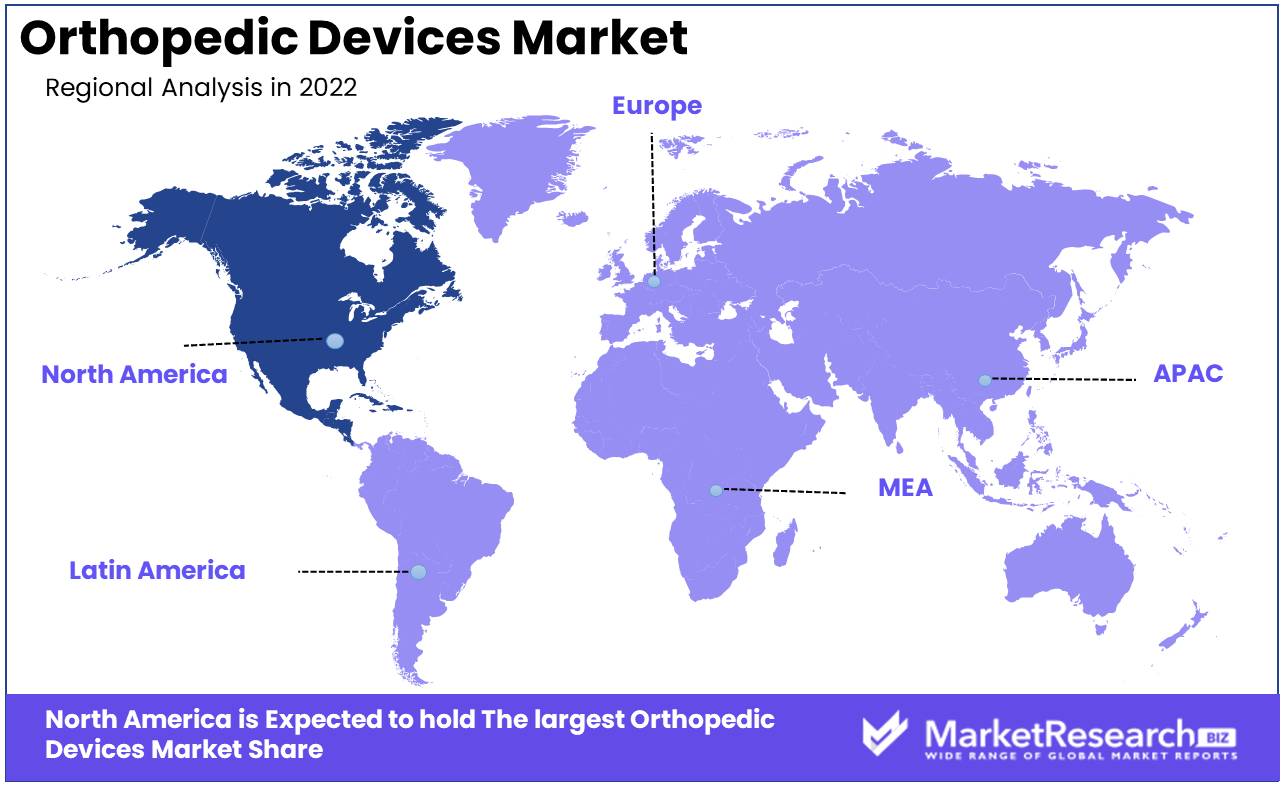

Regional Analysis

Orthopedic devices are used to support or treat the skeletal and muscular systems of the body. These devices are primarily used to treat disorders or injuries of the musculoskeletal system. Over the years, the demand for orthopedic devices has increased alongside the incidence of orthopedic disorders in North America.

Due to the high adoption of advanced orthopedic devices, favorable reimbursement policies, and the presence of key market participants, the US market dominates North America. The market is anticipated to expand significantly due to the aging population in the region.

Increasing rates of musculoskeletal disorders, an aging population, and technological advancements in devices have fueled the growth of the North American orthopedic device industry. In addition to rising disposable incomes and favorable insurance policies, other factors propelling the growth of the industry include an increase in disposable incomes.

Despite growth opportunities, the orthopedic device industry must surmount significant obstacles. The high cost of orthopedic devices, stringent government regulations, and post-surgical complications remain significant barriers to the industry's expansion.

Technology is a major growth driver for the orthopedic device market in North America. Genetic engineering, robotics, and artificial intelligence play a crucial role in the development of better materials, shorter surgical procedures, and enhanced patient outcomes. Advancements in technology, such as 3D printing and prosthetic and implantable devices, have significantly accelerated the manufacturing process and enhanced the efficacy of device outcomes.

Medical professionals, researchers, and product developers are essential to the growth of the orthopedic industry in North America. The objective of their collaborative efforts is to discover a cure for various musculoskeletal disorders by improving devices, identifying clinical applications of products, and establishing new treatments.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Stryker Corporation is a prominent player in the orthopedic devices market with a portfolio of products spanning joint reconstruction, trauma, and sports medicine. The company has prioritized investments in research and development in order to introduce innovative technologies to the market.

Another prominent player, Zimmer Biomet Holdings Inc. focuses primarily on joint reconstruction, spine, and dental implants. The company is renowned for its innovative implants and technologies for joint replacement.

Johnson & Johnson is one of the largest healthcare corporations in the world, and its subsidiary DePuy Synthes has a significant presence in the orthopedic devices market. The company provides an extensive selection of products for joint replacement, trauma, sports medicine, and spine surgery.

Smith & Nephew plc is an additional prominent player in the market with a concentration on developing innovative products that enhance patient outcomes. The organization operates in the fields of joint reconstruction, sports medicine, and wound care.

Medtronic PLC is a prominent player, offering an extensive selection of products for spine surgery and neurostimulation. The company's research and development efforts in the field of medical technology are well-known.

Top Key Players in Orthopedic Devices Market

- NuVasive Inc.

- Johnson & Johnson

- Smith & Nephew Plc

- Medtronic PLC

- DJO Global Inc.

- Zimmer-Biomet Holdings

- DePuy Synthes Companies

- Stryker Corporation

- Aesculap Implant Systems Inc.

- Donjoy Inc.

- Conmed Corporation

- Globus Medical

Recent Development

- On September 2023, CTL Amedica received Electronic Catalog (ECAT) government contract approval from the U.S. Defense Logistics Agency. This includes their innovative silicon nitride spine implants, known for promoting rapid healing and enhanced recovery.

- In September 2023, ZimVie Inc. received FDA approval to commence its Mobi-C® Cervical Disc Hybrid Investigational Device Exemption (IDE) study. This approval comes after the successful implantation of over 200,000 Mobi-C implants for cervical disc replacement, solidifying its position as a market-leading device.

- On September 2023, Enovis Corp, a company known for offering orthopedic bracing, surgical implants, and footcare solutions, confirmed its acquisition of LimaCorporate, an Italian surgical implant manufacturer. The acquisition was valued at about 800 million euros

- In September 2023, Lazurite, a leading medical device and technology company, has joined forces with Benchmark Medical, an Ohio-based distributor with extensive experience in the medical products industry. Benchmark Medical will distribute Lazurite's ArthroFree Wireless Camera System, which is designed to enhance the focus of surgeons during critical procedures.

- In March 2023 , augmented reality-driven surgical guidance systems, such as the ARVIS system, are revolutionizing orthopedic surgery. This system includes an AR headset, a belt pack, and reusable instruments specifically designed for procedures like total knee arthroplasty and other surgical interventions.

Report Scope

Report Features Description Market Value (2022) USD 54.1 Bn Forecast Revenue (2032) USD 74.9 Bn CAGR (2023-2032) 3.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Product Type (Joint Reconstruction, Spinal Devices, Trauma Fixation, Orthobiologics, Arthroscopy, Orthopedic Braces and Supports)

Material (Metallic, Polymeric, Ceramic)

Application (Spine, Hip, Knee, Craniomaxillofacial, Dental, Sports Injuries, Extremities, and Trauma (SET))

End-User (Orthopedic Clinics, Hospitals, Ambulatory Surgical Centers, Others(Rehabilitation Centers, Sports Medicine Centers, And Home Healthcare))Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape NuVasive Inc., Johnson & Johnson, Smith & Nephew Plc, Medtronic PLC, DJO Global Inc., Zimmer-Biomet Holdings, DePuy Synthes Companies, Stryker Corporation, Aesculap Implant Systems Inc., Donjoy Inc., Conmed Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- NuVasive Inc.

- Johnson & Johnson

- Smith & Nephew Plc

- Medtronic PLC

- DJO Global Inc.

- Zimmer-Biomet Holdings

- DePuy Synthes Companies

- Stryker Corporation

- Aesculap Implant Systems Inc.

- Donjoy Inc.

- Conmed Corporation