Healthcare Reimbursement Market By Claim (Underpaid and Fully Paid), By Payers (Private and Public), By Service Provider (Hospitals, Diagnostic Labs, Physician Office, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

47957

-

Feb 2025

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

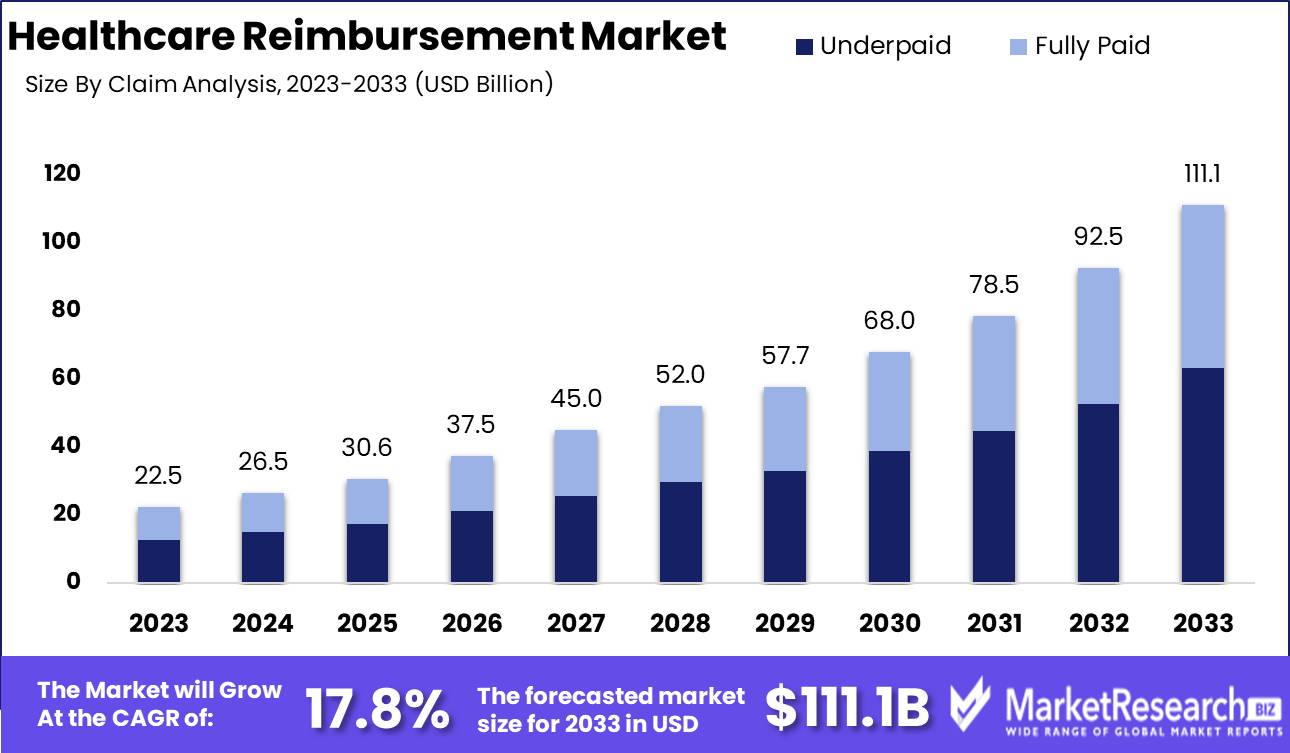

The Healthcare Reimbursement Market was valued at USD 22.5 billion in 2023. It is expected to reach USD 111.1 billion by 2033, with a CAGR of 17.8% during the forecast period from 2024 to 2033.

The healthcare reimbursement market encompasses the systems and processes by which healthcare providers receive payment for services rendered, primarily through government programs, private insurers, and patients. It includes various models such as fee-for-service, value-based care, and bundled payments, each designed to incentivize quality care and cost efficiency.

The healthcare reimbursement market is undergoing a transformative phase, driven by the relentless rise in healthcare expenses which necessitates efficient reimbursement processes to manage and mitigate these costs. As healthcare costs continue to surge, payers and providers are increasingly focusing on refining reimbursement mechanisms to ensure financial sustainability and operational efficiency. This dynamic is compelling market participants to invest in advanced technologies and streamlined processes to enhance claim accuracy and reduce administrative burdens. However, a major hurdle remains in navigating the intricate and varying reimbursement regulations across different regions. These regulatory complexities necessitate robust compliance strategies and adaptable systems capable of handling diverse regional requirements seamlessly.

Moreover, the shift towards value-based reimbursement models marks a significant paradigm shift in the market. Unlike traditional fee-for-service models, value-based models prioritize patient outcomes and the quality of care over the volume of services rendered. This transition is expected to incentivize healthcare providers to adopt practices that improve patient health outcomes, ultimately leading to better cost management and enhanced patient satisfaction. As a result, market players are increasingly aligning their strategies to support this model, investing in data analytics, and patient management systems that facilitate outcome-based reimbursements.

In summary, the healthcare reimbursement market is poised for substantial growth, driven by the dual imperatives of cost containment and quality improvement, although success will largely depend on the ability to adeptly navigate regulatory landscapes and implement value-based reimbursement systems effectively.

Key Takeaways

- Market Growth: The Healthcare Reimbursement Market was valued at USD 22.5 billion in 2023. It is expected to reach USD 111.1 billion by 2033, with a CAGR of 17.8% during the forecast period from 2024 to 2033.

- By Claim: "Underpaid" dominated the Healthcare Reimbursement Market's "By Claim" segment.

- By Payers: Private payers dominated, while Public payers remained crucial.

- By Service Provider: Hospitals dominated the Healthcare Reimbursement Market by service provider.

- Regional Dominance: North America dominates the global healthcare reimbursement market at 40%.

- Growth Opportunity: In leveraging telehealth expansion APMs can enhance service delivery, improve outcomes, and achieve cost savings in healthcare reimbursement.

Driving factors

Integrated Healthcare Approach: Streamlining Patient Care and Cost Management

The integrated healthcare approach is a key driver of growth in the healthcare reimbursement market. This model emphasizes coordinated care across various healthcare providers and services, which enhances patient outcomes and operational efficiencies. By integrating services such as primary care, specialist consultations, and hospital care, healthcare systems can reduce redundancies and avoid unnecessary procedures, ultimately lowering overall healthcare costs. This approach not only improves patient satisfaction but also supports payers by aligning reimbursement structures with value-based care. According to a study, integrated care models can lead to cost savings of up to 20% due to reduced hospital admissions and better chronic disease management. These efficiencies drive demand for advanced reimbursement solutions that can handle complex billing scenarios, thus fostering market growth.

Lack of Healthcare Cost Transparency: Driving Demand for Better Reimbursement Solutions

The lack of transparency in healthcare costs significantly impacts the healthcare reimbursement market. Patients and payers often face challenges in understanding the true cost of healthcare services due to opaque pricing structures and inconsistent billing practices. This uncertainty can lead to disputes over reimbursements and delays in payment processing. To address these issues, there is a growing demand for reimbursement solutions that offer greater clarity and accuracy in billing. Enhanced transparency tools and systems can help demystify healthcare costs, allowing patients to make more informed decisions and ensuring payers can verify charges efficiently. A report highlighted that improving price transparency could reduce healthcare spending by $100 billion annually, underscoring the potential for substantial market growth in this area.

Hospitals and Providers Ability to Demand Higher Prices: Enhancing Reimbursement Complexity

The ability of hospitals and providers to demand higher prices is a crucial factor influencing the healthcare reimbursement market. As healthcare providers consolidate and gain market power, they can negotiate higher reimbursement rates from insurers. This trend is particularly evident in markets where a few large health systems dominate. According to a study, hospital prices have increased by approximately 42% over the past decade, largely due to market consolidation. This escalation in prices increases the complexity of reimbursement processes, necessitating more sophisticated and adaptable reimbursement solutions. Insurers and payers need advanced systems capable of handling varied and high-cost claims, driving demand for innovative reimbursement technologies and services.

Restraining Factors

Complex and Changing Regulations: A Significant Barrier to Market Fluidity and Adaptation

The healthcare reimbursement market is intricately linked to the regulatory landscape, which is marked by its complexity and frequent changes. These regulations often encompass various aspects such as billing procedures, coding standards, and compliance requirements. The constant evolution of these regulations poses a substantial challenge for healthcare providers and payers alike, as they must continually update their practices to remain compliant.

According to industry reports, the regulatory burden is a significant cost driver, with administrative costs related to compliance constituting approximately 25% of total healthcare spending in the United States. This complexity leads to increased operational costs, requiring investments in specialized staff and technology to manage regulatory compliance effectively. Moreover, frequent changes in regulations create an environment of uncertainty, making it difficult for organizations to plan long-term strategies and investments in the reimbursement sector.

This regulatory volatility also impacts smaller healthcare providers disproportionately, as they often lack the resources to swiftly adapt to new requirements compared to larger organizations with dedicated compliance departments. Consequently, this hampers their ability to participate effectively in the reimbursement market, potentially leading to market consolidation where only the largest and most resource-rich entities can thrive.

Resistance to Value-Based Care: A Challenge to Innovation and Efficiency

The shift from fee-for-service models to value-based care (VBC) is designed to improve healthcare outcomes and cost efficiency. However, there is considerable resistance to this shift among providers and payers, which significantly restrains the growth of the healthcare reimbursement market.

One of the primary reasons for this resistance is the substantial upfront investment required to transition to VBC models. These investments include adopting new technologies for data collection and analysis, retraining staff, and restructuring care delivery models. Despite the long-term benefits of value-based care, including potentially lower costs and improved patient outcomes, the immediate financial burden can be prohibitive.

Furthermore, there is significant cultural resistance within the healthcare industry. Many providers are accustomed to the traditional fee-for-service model, where revenue is tied directly to the volume of services provided rather than the quality of outcomes. Transitioning to a model that emphasizes patient outcomes over service quantity requires a fundamental change in practice management and mindset, which is often met with reluctance.

By Claim Analysis

In 2023, "Underpaid" dominated the Healthcare Reimbursement Market's "By Claim" segment.

In 2023, The "Underpaid" segment held a dominant market position in the "By Claim" segment of the Healthcare Reimbursement Market. This prominence is attributed to several factors. First, increasing healthcare costs have led to a higher incidence of underpaid claims, as insurance companies frequently dispute or reduce reimbursements. Additionally, the complexity of medical billing and coding often results in errors or discrepancies that contribute to underpaid claims. Healthcare providers are thus compelled to invest in robust revenue cycle management solutions to identify, appeal, and rectify these underpaid claims, driving significant market activity in this segment.

In contrast, the "Fully Paid" segment, while essential, occupies a smaller share of the market. This segment benefits from streamlined billing processes, accurate coding, and proactive claim management strategies that ensure claims are fully reimbursed. Although representing operational efficiency and reduced administrative burden, fully paid claims are less common due to stringent payer policies and intricate reimbursement guidelines. As the industry continues to evolve with advancements in healthcare IT and policy reforms, the balance between underpaid and fully paid claims is likely to shift, yet the need for effective management of underpaid claims remains crucial for financial sustainability in healthcare organizations.

By Payers Analysis

In 2023, Private Payers dominated, while Public payers remained crucial.

In 2023, Private held a dominant market position in the By Payers segment of the Healthcare Reimbursement Market. The private payer sector, comprising commercial insurance companies and employer-sponsored health plans, demonstrated robust growth driven by increased consumer demand for comprehensive coverage and innovative care options. This segment capitalized on its ability to offer more personalized and flexible reimbursement plans, catering to a diverse patient demographic. Advanced analytics and technology integration further enhanced their operational efficiencies and customer satisfaction rates, solidifying their market dominance.

Conversely, the public payer segment, which includes government-sponsored programs such as Medicare and Medicaid, continued to play a crucial role in providing essential healthcare services to vulnerable populations. Despite facing challenges related to budget constraints and regulatory changes, public payers maintained significant market share by focusing on expanding coverage and improving access to healthcare services for lower-income groups and the elderly. Initiatives to streamline reimbursement processes and adopt value-based care models also contributed to their sustained relevance in the healthcare reimbursement landscape. Together, these dynamics underscore the pivotal roles of both private and public payers in shaping the future of healthcare reimbursement.

By Service Provider Analysis

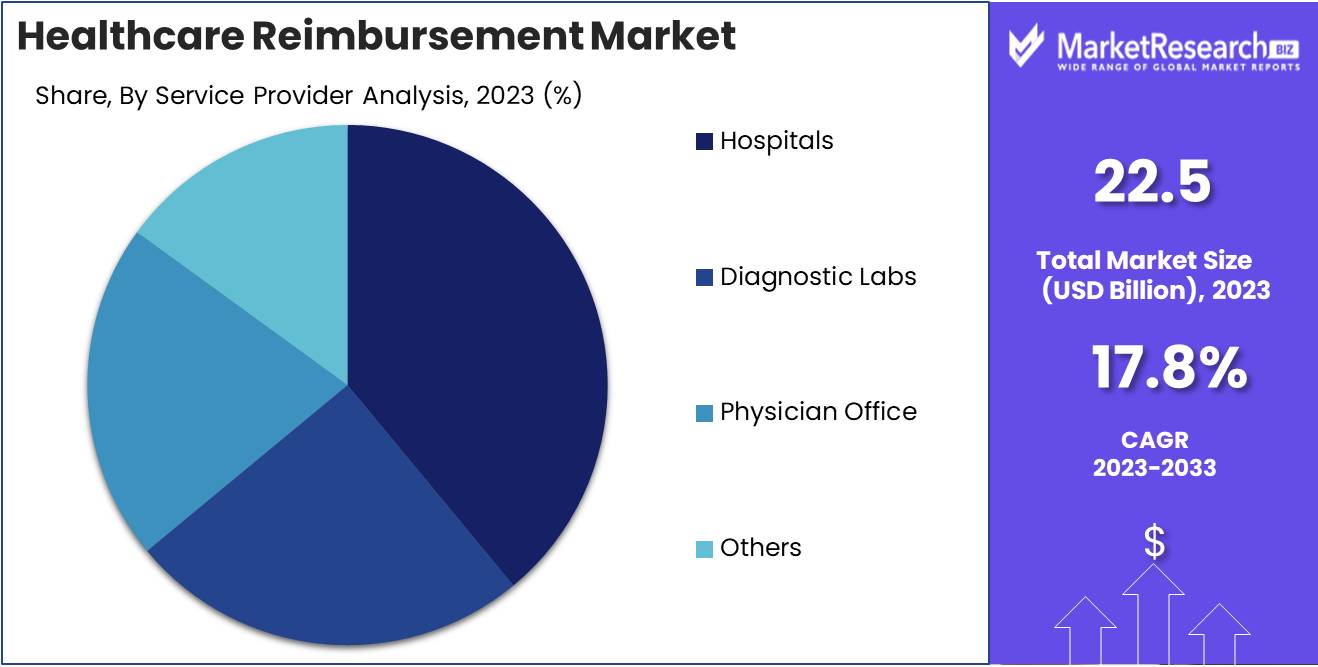

In 2023, Hospitals dominated the Healthcare Reimbursement Market by service provider.

In 2023, Hospitals held a dominant market position in the Healthcare Reimbursement Market's By Service Provider segment. Hospitals, as primary providers of comprehensive healthcare services, benefit from extensive insurance networks and reimbursement policies. Their dominance is driven by the vast array of services they offer, which include emergency care, specialized surgeries, and inpatient services, ensuring a steady flow of reimbursable claims.

Diagnostic labs, although critical, operate on a smaller scale, primarily providing diagnostic services that support hospitals and physician offices. Their market position is significant but secondary due to the limited scope of services that attract reimbursement. Physician offices, on the other hand, cater to outpatient care and chronic disease management. Their strategic partnerships with insurance providers enhance their reimbursement processes, yet they lack the extensive service range of hospitals.

Lastly, the "Others" category encompasses various outpatient clinics, ambulatory surgery centers, and home healthcare providers. These entities, while essential, often face more stringent reimbursement policies and lower volumes of high-cost procedures compared to hospitals. Collectively, these segments form a diverse yet interconnected landscape within the healthcare reimbursement ecosystem, each playing a pivotal role but with hospitals at the forefront.

Key Market Segments

By Claim

- Underpaid

- Fully Paid

By Payers

- Private

- Public

By Service Provider

- Hospitals

- Diagnostic Labs

- Physician Office

- Others

Growth Opportunity

Expansion of Telehealth and Virtual Care

The global healthcare reimbursement market is poised for significant growth, driven by the rapid expansion of telehealth and virtual care. The COVID-19 pandemic has accelerated the adoption of these technologies, creating a paradigm shift in how healthcare services are delivered. Telehealth visits increased by 38 times from the pre-pandemic baseline, demonstrating a clear demand for remote healthcare solutions. This expansion presents a substantial opportunity for the reimbursement market, as insurers adapt to cover a broader range of telehealth services, enhancing accessibility and convenience for patients. Payers and providers are likely to negotiate new reimbursement rates and models, ensuring the sustainability of telehealth services beyond the pandemic. The integration of telehealth into mainstream healthcare systems will necessitate updated policies and billing practices, creating a dynamic environment ripe for innovation and investment.

Increased Utilization of Alternative Payment Models (APMs)

Another key growth opportunity for the healthcare reimbursement market is the increased utilization of alternative payment models (APMs). APMs, which include bundled payments, accountable care organizations (ACOs), and patient-centered medical homes (PCMHs), aim to improve healthcare outcomes while controlling costs. According to the Health Care Payment Learning & Action Network (LAN), 40% of healthcare payments in 2023 were tied to APMs, a figure expected to rise as stakeholders seek value-based care solutions. The shift towards APMs necessitates sophisticated reimbursement strategies that align financial incentives with patient outcomes. This transition offers a lucrative opportunity for market players to develop innovative reimbursement frameworks that support value-based care. Enhanced data analytics and interoperability will be critical in this evolution, enabling more precise tracking of outcomes and cost-efficiency.

Latest Trends

Leveraging Artificial Intelligence to Transform Reimbursement Processes

Artificial intelligence (AI) is set to revolutionize the healthcare reimbursement landscape. AI's capabilities in data analytics and machine learning can streamline claims processing, reduce administrative burdens, and enhance accuracy. By automating repetitive tasks and identifying patterns in large datasets, AI enables faster and more precise reimbursement decisions. This technological advancement minimizes human error, accelerates claim approvals, and reduces the incidence of fraudulent claims.

Additionally, AI-driven predictive analytics can offer insights into future reimbursement trends, allowing healthcare providers and payers to optimize their strategies. As AI continues to evolve, its integration into reimbursement processes is expected to enhance efficiency, reduce costs, and improve overall financial management in the healthcare sector.

Expansion of Government Healthcare Programs: Implications for Reimbursement

The expansion of government healthcare programs is another significant trend shaping the healthcare reimbursement market. Initiatives such as the extension of Medicaid and Medicare services and the introduction of new healthcare policies are increasing the number of individuals covered under government programs. This expansion leads to higher reimbursement volumes and necessitates adjustments in reimbursement rates and policies. Providers must navigate the complexities of government reimbursement structures, which often involve stringent regulatory requirements and lower reimbursement rates compared to private insurers.

However, this trend also opens opportunities for providers to expand their patient base and secure more stable revenue streams. Strategic partnerships with government agencies and a thorough understanding of evolving regulations will be crucial for providers to effectively manage reimbursements and maintain financial health in this changing landscape.

Regional Analysis

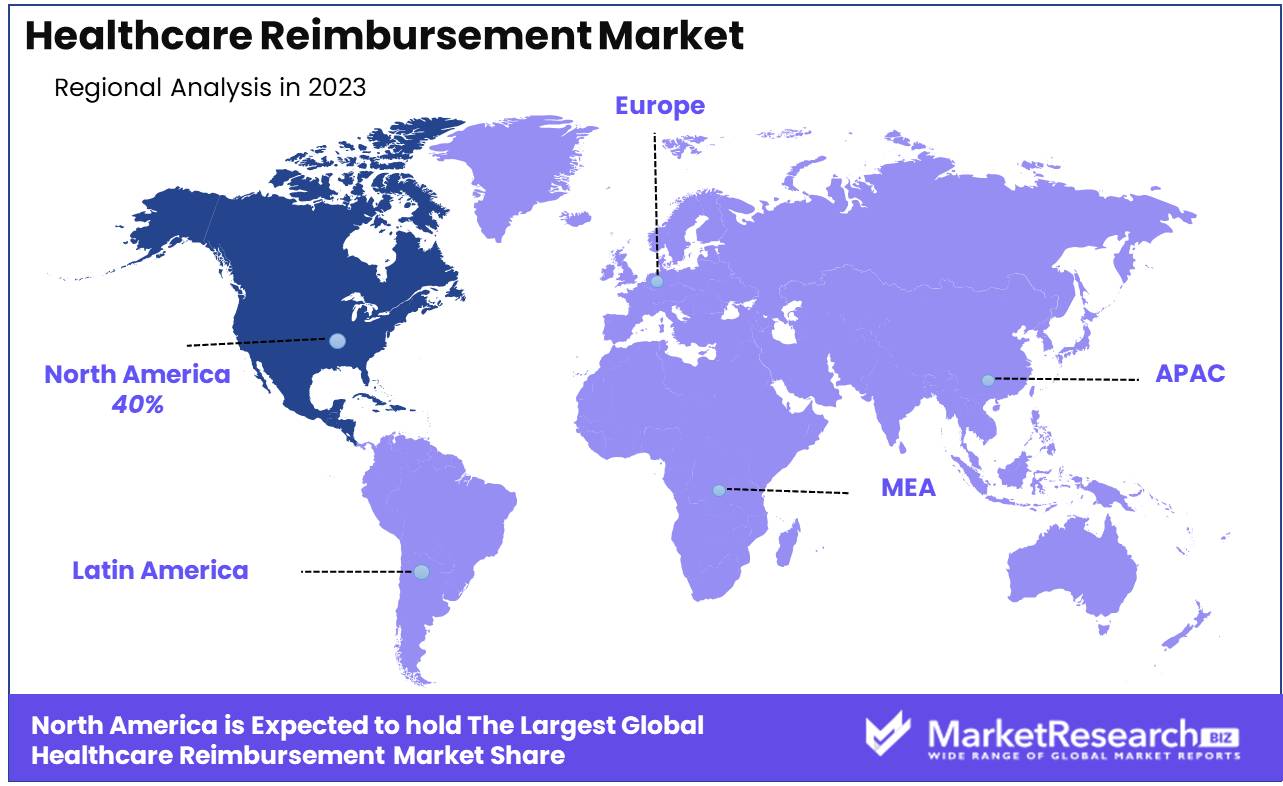

North America dominates the global healthcare reimbursement market at 40%.

The healthcare reimbursement market exhibits varied dynamics across different regions, reflecting the diverse healthcare systems and economic landscapes. North America, particularly the United States, dominates the market, accounting for approximately 40% of the global healthcare reimbursement market. This dominance is attributed to the high healthcare expenditure, advanced infrastructure, and extensive insurance coverage mechanisms like Medicare and Medicaid. The region's strong regulatory framework and the significant presence of private insurers further bolster market growth.

Europe follows with robust reimbursement frameworks driven by universal healthcare systems in countries like Germany, France, and the United Kingdom. The region benefits from comprehensive public health insurance programs and substantial government funding, ensuring widespread access to healthcare services.

In the Asia Pacific, the market is expanding rapidly due to increasing healthcare spending, growing insurance penetration, and rising awareness about health insurance. Countries such as China, Japan, and India are leading this growth, with China experiencing the fastest expansion due to significant policy reforms and economic growth.

The Middle East & Africa region shows a slower growth rate but is gradually improving due to ongoing healthcare reforms and increased investment in healthcare infrastructure. Key markets include the UAE and Saudi Arabia, where government initiatives are enhancing reimbursement frameworks.

Latin America presents a mixed picture with significant variation between countries. Brazil and Mexico are the primary markets, driven by efforts to expand insurance coverage and improve healthcare services. However, economic instability and disparities in healthcare access remain challenges.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In 2024, the global Healthcare Reimbursement Market is shaped by several key players who drive innovation, efficiency, and accessibility within the sector. Among these, UnitedHealth Group stands out due to its comprehensive portfolio and integration of advanced analytics to streamline reimbursement processes. Aviva and Allianz are notable for their strong presence in Europe, leveraging robust digital platforms to enhance customer experience and expedite claims processing.

CVS Health, following its vertical integration with Aetna, exemplifies a model where healthcare delivery and reimbursement converge, optimizing cost management and improving patient outcomes. Similarly, BNP Paribas is enhancing its footprint in the healthcare reimbursement sector by incorporating fintech solutions, thereby increasing transaction speed and transparency.

Nippon Life Insurance and WellCare Health Plans focus on demographic-specific strategies, catering to the aging populations in Asia and the Medicaid market in the U.S., respectively. These tailored approaches help them manage risks effectively while addressing unique market needs.

Agile Health Insurance and the Blue Cross Blue Shield Association leverage technology-driven solutions to enhance their competitive edge. Agile Health Insurance’s flexible, consumer-centric plans appeal to a broad spectrum of customers, whereas Blue Cross Blue Shield’s expansive network ensures comprehensive coverage and streamlined reimbursements.

Collectively, these players are pivotal in advancing the healthcare reimbursement landscape, utilizing technology, strategic partnerships, and customer-centric approaches to meet the evolving demands of the global market.

Market Key Players

- UnitedHealth Group

- Aviva

- Allianz

- CVS Overall health

- BNP Paribas

- Aetna

- Nippon Life Insurance policies

- WellCare Health Ideas

- Agile Health Insurance

- Violet Cross Blue Cover Association.

Recent Development

- In April 2024, Anthem Inc. introduced a new reimbursement model for mental health services. This model includes increased reimbursement rates for mental health providers and covers a wider range of services, including digital mental health platforms. This move underscores the growing recognition of mental health as a critical component of overall healthcare.

- In February 2024, UnitedHealth Group launched a new value-based care initiative designed to tie reimbursement more closely to patient outcomes rather than services provided. This initiative aims to enhance the quality of care while reducing overall healthcare costs, aligning with the broader industry shift towards value-based healthcare.

- In January 2024, CMS announced a significant policy update aimed at streamlining the reimbursement process for telehealth services. This update expands coverage for a broader range of telehealth services and simplifies the billing process, reflecting the continued growth and importance of telehealth in the healthcare landscape.

Report Scope

Report Features Description Market Value (2023) USD 22.5 Billion Forecast Revenue (2033) USD 111.1 Billion CAGR (2024-2032) 17.8% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Claim (Underpaid and Fully Paid), By Payers (Private and Public), By Service Provider (Hospitals, Diagnostic Labs, Physician Office, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape UnitedHealth Group, Aviva, Allianz, CVS Overall Health, BNP Paribas, Aetna, Nippon Life Insurance policies, WellCare Health Ideas, Agile Health Insurance, Violet Cross Blue Cover Association. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- UnitedHealth Group

- Aviva

- Allianz

- CVS Overall health

- BNP Paribas

- Aetna

- Nippon Life Insurance policies

- WellCare Health Ideas

- Agile Health Insurance

- Violet Cross Blue Cover Association.