Obesity Surgery Devices Market Report By Surgery Device Type (Gastric Bands, Gastric Balloons, Gastric Stapling Devices, Gastric Plication Systems, Gastric Electrical Stimulation Devices, Others), By Surgical Approach (Laparoscopic Surgery, Endoscopic Surgery), By End Users (Hospitals, Specialty Clinics, Ambulatory Surgical Centers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

45394

-

May 2024

-

290

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

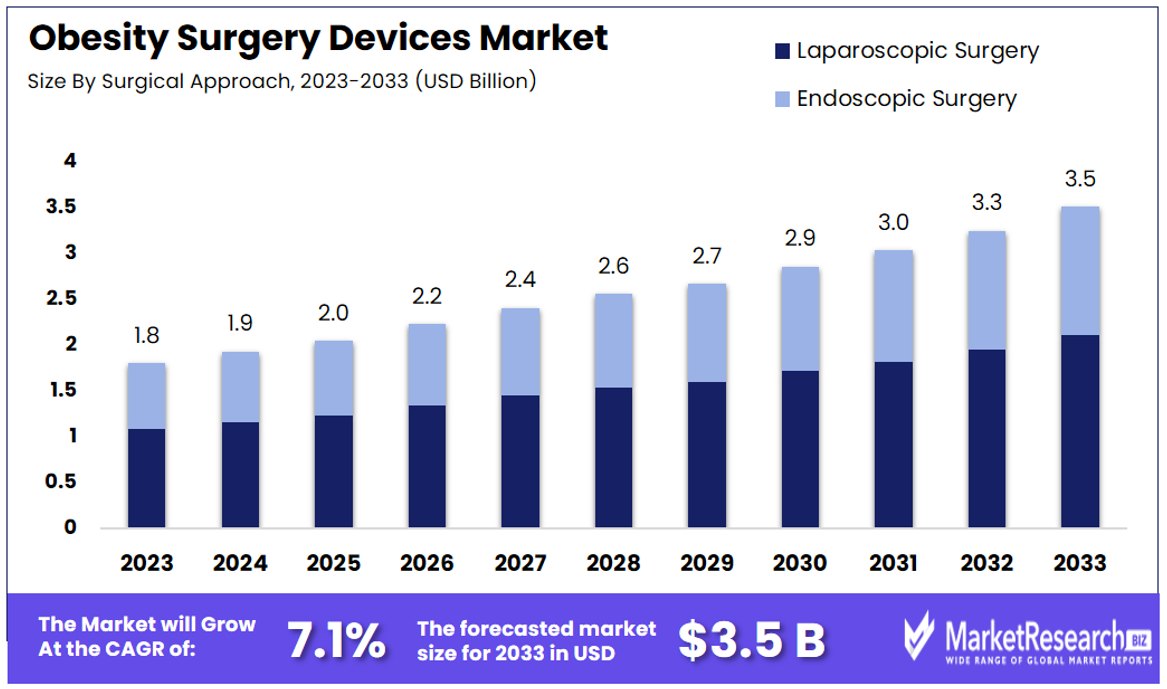

The Global Obesity Surgery Devices Market size is expected to be worth around USD 3.5 Billion by 2033, from USD 1.8 Billion in 2023, growing at a CAGR of 7.1% during the forecast period from 2024 to 2033.

The Obesity Surgery Devices Market encompasses a range of medical devices specifically designed for bariatric surgery procedures aimed at weight loss. These devices include gastric bands, gastric balloons, and surgical staplers. This market is critical for healthcare providers focusing on surgical solutions to combat severe obesity. Key drivers of growth in this market include rising global obesity rates and increasing preference for minimally invasive surgical techniques.

As obesity prevalence escalates, demand for these devices is expected to grow, presenting significant investment opportunities for manufacturers and healthcare sectors. The market's evolution is closely watched by executives and product managers seeking to innovate and capture market share in the medical device sector.

The Obesity Surgery Devices Market is poised for substantial growth, driven by escalating global obesity rates. In 2022, a striking 38% of the world's population, amounting to 2.6 billion people, were classified as overweight or obese. This trend is not only prevalent among adults but is increasingly affecting children, with projections from the World Obesity Federation's 2023 report indicating that childhood obesity could more than double by 2035, affecting 208 million boys and 175 million girls.

Given these statistics, the market for obesity surgery devices, which includes tools and technologies used in bariatric surgeries such as gastric bands, balloons, and surgical staplers, is expected to experience robust demand. The rising preference for minimally invasive procedures further catalyzes this growth, as these technologies offer fewer complications and shorter recovery times, appealing to a broader range of patients and healthcare providers.

The future landscape of this market is heavily influenced by the need for effective long-term solutions for weight management and obesity treatment. As the global prevalence of obesity is projected to surpass 51% by 2035, encompassing more than 4 billion individuals, the urgency for advanced surgical interventions escalates. This surge necessitates significant innovation and investment in the development of more efficient and patient-friendly surgical solutions.

For stakeholders, including healthcare providers, device manufacturers, and investors, the expanding obesity surgery devices market presents vital opportunities. Strategic investments in R&D, along with collaborations with healthcare institutions, could enhance product portfolios and reinforce market positions. Understanding these dynamics is crucial for industry leaders and product managers aiming to capitalize on the growth prospects of this evolving market.

Key Takeaways

- Market Value: The Global Obesity Surgery Devices Market is anticipated to reach a substantial value of USD 3.5 billion by 2033, showing significant growth from USD 1.8 billion in 2023, with a strong CAGR of 7.1% during the forecast period from 2024 to 2033.

- Surgery Device Type Analysis: Gastric Stapling Devices lead with 86.5% dominance due to their efficiency and safety in procedures like gastric bypass and sleeve gastrectomy. Other sub-segments, such as Gastric Bands, Gastric Balloons, Gastric Plication Systems, and Gastric Electrical Stimulation Devices, cater to niche patient groups and offer alternative options for obesity surgery.

- Surgical Approach Analysis: Laparoscopic Surgery is preferred for its minimal invasiveness, quicker recovery, and reduced post-operative complications. Endoscopic Surgery, although less prevalent, is gaining attention for its ultra-minimally invasive approach.

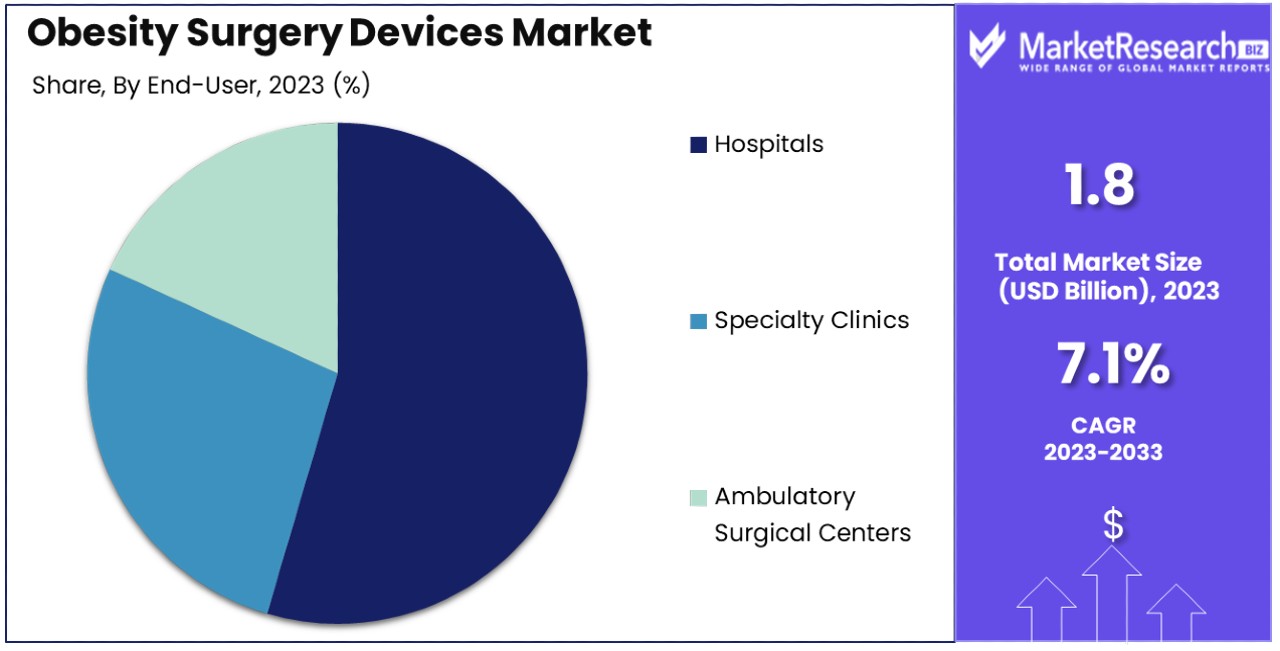

- End Users Analysis: Hospitals dominate with 60.4% market share due to their comprehensive care facilities and high patient volume. Specialty Clinics and Ambulatory Surgical Centers (ASCs) provide alternative options, especially for specialized or cost-effective care.

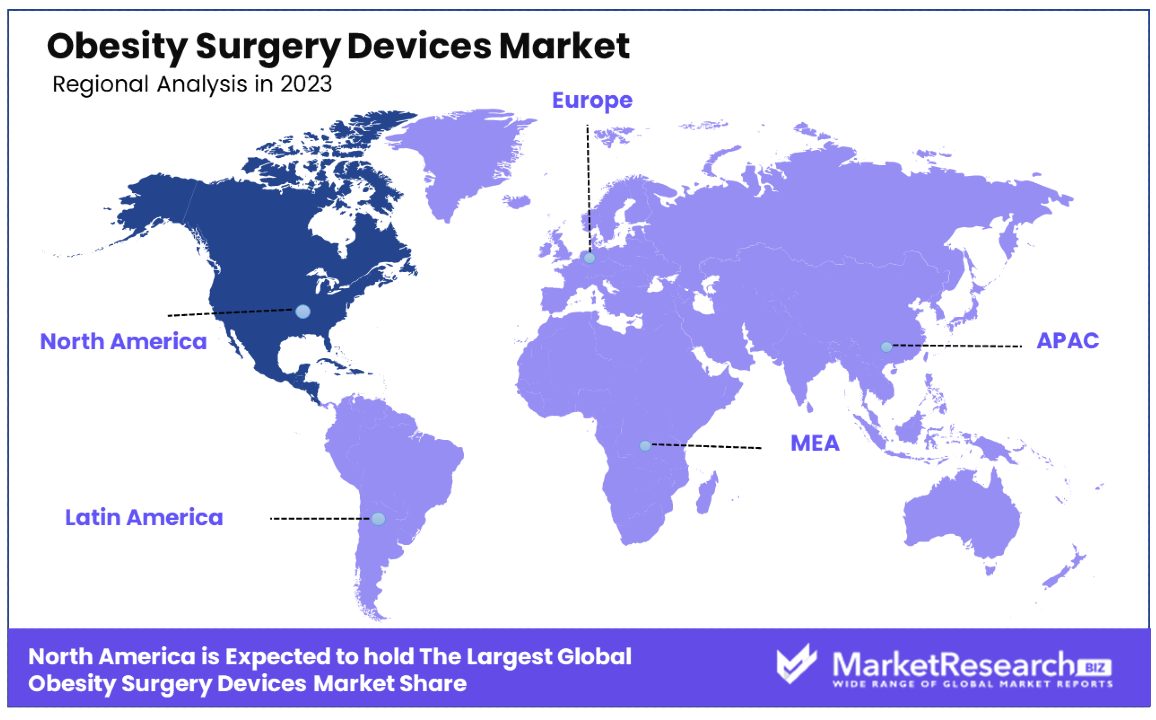

- North America: Dominates the market with a 47.2% share, showcasing advanced healthcare systems and rising obesity rates driving demand for obesity surgery devices.

- Europe: Holds a significant position in the global market, with around 29.5% market share, supported by advanced healthcare systems and increasing obesity rates.

- Growth Opportunities: Opportunities exist for continued innovation and advancement in obesity surgery devices, focusing on enhancing efficacy, safety, and patient outcomes. The growing prevalence of obesity globally presents a significant market opportunity for obesity surgery devices, especially in regions with rising obesity rates and advanced healthcare infrastructure.

Driving Factors

Rising Prevalence of Obesity Drives Market Growth

The escalating global obesity rates serve as a primary catalyst for the expansion of the Obesity Surgery Devices Market. As of 2022, the World Health Organization reported that over 1.9 billion adults were overweight, with more than 650 million classified as obese. This increasing prevalence of obesity, propelled by factors such as sedentary lifestyles, poor dietary habits, and genetic predispositions, is significantly boosting the demand for surgical interventions.

The surge in obesity necessitates effective, long-term medical solutions, making obesity surgery devices essential for bariatric procedures. As obesity continues to be a pressing health issue worldwide, the market for these devices is expected to grow correspondingly, driven by the urgent need for effective weight management solutions in the healthcare sector.

Increasing Awareness and Acceptance of Bariatric Surgeries Drives Market Growth

The growing awareness and acceptance of bariatric surgeries as viable treatments for obesity and its related comorbidities are markedly influencing the Obesity Surgery Devices Market. Educational efforts by organizations like the American Society for Metabolic and Bariatric Surgery (ASMBS) have heightened awareness among healthcare professionals and the general public, leading to increased adoption of these procedures.

This shift is directly stimulating demand for obesity surgery devices, as more individuals are considering and undergoing bariatric surgeries. The informed acceptance of these surgeries supports a robust market environment, encouraging continuous investments and innovations in the sector.

Technological Advancements Drives Market Growth

Technological advancements in the field of obesity surgery devices, such as the development of minimally invasive techniques and robotic-assisted surgeries, are pivotal in shaping market growth. Innovations like the da Vinci Surgical System have revolutionized bariatric procedures, making them more effective, safer, and less invasive.

These enhancements increase patient confidence and widen the acceptance of bariatric surgeries, thereby fueling market expansion. As technologies continue to evolve, offering improved safety and efficiency, the market is likely to see sustained growth driven by enhanced patient outcomes and reduced procedural risks, aligning with broader healthcare goals of improving quality of life while minimizing surgical complications.

Restraining Factors

High Cost of Obesity Surgery Devices and Procedures Restrains Market Growth

The substantial cost associated with obesity surgery devices and the surgeries themselves represents a significant barrier to market expansion. In the United States, for instance, the average cost for a gastric bypass surgery ranges from $20,000 to $25,000. This high expenditure makes these treatments less accessible, particularly in regions with inadequate healthcare coverage or limited reimbursement policies.

As a result, a significant portion of the population may find these potentially life-saving treatments financially out of reach. The financial burden not only limits individual access but also restricts overall market growth as fewer patients can afford to undergo these surgeries, despite their potential benefits.

Risks and Complications Associated with Bariatric Surgeries Restrains Market Growth

Despite technological progress, bariatric surgeries still pose significant risks and potential complications, which can deter patients from opting for these procedures. Complications can include bleeding, infection, nutritional deficiencies, and hernias. According to a study published in the Journal of the American Medical Association (JAMA), the complication rates within 30 days of surgery can range from 2% to 6%.

These risks contribute to patient hesitancy, impacting the decision to undergo surgery and, consequently, the demand for obesity surgery devices. The presence of these medical risks restrains the growth of the market by reducing the number of potential surgeries performed annually.

Surgery Device Type Analysis

Gastric Stapling Devices dominate with 86.5% due to their efficiency and safety.

Gastric Stapling Devices currently hold a commanding lead in the Obesity Surgery Devices Market, capturing 86.5% of the segment. This dominance is primarily due to the efficacy and safety of these devices, which are integral to bariatric surgeries such as gastric bypass and sleeve gastrectomy. These procedures are highly favored for their long-term results in significant weight reduction and management of related comorbidities like diabetes and hypertension. The reliability and positive patient outcomes associated with gastric stapling have bolstered their acceptance among surgeons and patients alike, fostering strong market growth.

Other sub-segments, though less dominant, also contribute to the market dynamics. Gastric Bands and Gastric Balloons offer less invasive options for patients, suitable for those who may not be candidates for more intensive surgeries. Gastric Plication Systems and Gastric Electrical Stimulation Devices are newer innovations that are slowly gaining traction due to their potential benefits in reducing the complexities and risks associated with traditional bariatric surgeries. These devices cater to niche patient groups and are expected to see growth as technology advances and more clinical efficacy data becomes available. Each of these sub-segments plays a crucial role in diversifying the options available in obesity surgery, catering to varying patient needs and preferences.

Surgical Approach Analysis

Laparoscopic Surgery dominates due to minimal invasiveness and quicker recovery.

In the Obesity Surgery Devices Market, Laparoscopic Surgery is the preferred surgical approach, chosen for its minimally invasive nature, which leads to quicker patient recovery and reduced post-operative complications. This approach uses small incisions and specialized equipment, like the gastric stapling devices, to perform the surgery, which significantly decreases the hospital stay and post-surgery recovery time. The advantages of Laparoscopic Surgery, such as reduced scarring and lower risk of infections, make it a favorable choice for both patients and healthcare providers.

Endoscopic Surgery, although less prevalent than Laparoscopic, is gaining attention for its ultra-minimally invasive approach, which involves no external incisions by using natural body openings. This technique is typically used for less complex bariatric procedures, such as the insertion of gastric balloons. As technological advancements continue to evolve, Endoscopic Surgery may see increased adoption due to its potential to further minimize surgical risks and enhance patient comfort.

End Users Analysis

Hospitals dominate with 60.4% due to comprehensive care facilities and high patient volume.

Hospitals are the primary end users in the Obesity Surgery Devices Market, accounting for 60.4% of it. This segment’s dominance is largely due to the comprehensive care facilities hospitals offer, which are essential for complex bariatric surgeries that require multidisciplinary teams and extensive post-operative monitoring. Hospitals are often the most equipped to handle the various risks associated with obesity surgery, from pre-surgical assessments to long-term follow-up care. The high volume of patients treated at hospitals also contributes to their leading position in the market.

Specialty Clinics and Ambulatory Surgical Centers (ASCs) serve as important alternatives to hospitals, especially for patients seeking more specialized or cost-effective care. Specialty clinics often focus on a personalized approach to obesity treatment, which can attract patients looking for tailored surgical options. ASCs appeal to patients through their efficiency and reduced cost of procedures compared to hospitals. As healthcare systems continue to evolve, the roles of Specialty Clinics and ASCs are expected to grow, especially in regions where access to large hospital facilities might be limited.

Key Market Segments

By Surgery Device Type

- Gastric Bands

- Gastric Balloons

- Gastric Stapling Devices

- Gastric Plication Systems

- Gastric Electrical Stimulation Devices

- Others

By Surgical Approach

- Laparoscopic Surgery

- Endoscopic Surgery

By End Users

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

Growth Opportunities

Development of Minimally Invasive and Non-Surgical Devices Offers Growth Opportunity

The push for minimally invasive and non-surgical obesity treatment devices opens substantial growth avenues within the Obesity Surgery Devices Market. Innovations such as the EndoBarrier by GI Dynamics and the OverStitch Endoscopic Suturing System by Apollo Endosurgery highlight this trend. These devices provide effective obesity management with benefits including shorter recovery times, fewer post-operative complications, and greater patient compliance due to the less daunting nature of the procedures compared to traditional surgery.

As technology progresses, the demand for these less invasive alternatives is expected to rise, driven by patient preference for simpler, safer, and more cost-effective solutions. This shift not only broadens the market's base but also enhances the scope for technological advancements in device manufacturing.

Expansion in Emerging Markets Offers Growth Opportunity

Emerging markets present lucrative opportunities for the Obesity Surgery Devices Market, fueled by escalating obesity rates and improving healthcare infrastructures. Countries like China, India, and Brazil are experiencing significant increases in obesity due to lifestyle changes and urbanization. For instance, China's obesity prevalence skyrocketed from 3.8% in 1992 to 16.3% in 2019.

Alongside rising healthcare spending, these regions offer a fertile ground for market expansion as they continue to develop their medical facilities and increase accessibility to advanced healthcare solutions. Companies entering these markets can capitalize on the growing need for obesity treatment options, thereby driving up sales and expanding their global footprint in the healthcare sector.

Trending Factors

Robotic-Assisted Bariatric Surgeries Are Trending Factors

The growing use of robotic-assisted surgical systems in bariatric surgery is a prominent trend in the Obesity Surgery Devices Market. Systems like Intuitive Surgical's da Vinci Surgical System exemplify this trend with their ability to offer improved precision, enhanced visualization, and generally shorter recovery times for patients.

These benefits are compelling reasons for both surgeons and patients to prefer robotic-assisted approaches, driving up the demand for specific devices and instruments that are compatible with robotic technologies. The continuous improvements and innovations in these systems further fuel their adoption, making robotic-assisted surgeries a key factor in the market's expansion. This trend not only enhances surgical outcomes but also sets new standards in the precision and efficiency of obesity surgery techniques.

Digital Technologies and Telemedicine Are Trending Factors

The integration of digital technologies and telemedicine within the Obesity Surgery Devices Market is a significant trending factor. Tools such as mobile apps, wearable devices, and telemedicine platforms are revolutionizing the way post-operative care and patient monitoring are conducted. Companies like Medtronic and ReShape Lifesciences are at the forefront, offering connected devices and apps that enable real-time data monitoring and patient support.

This trend is enhancing patient engagement and adherence to post-surgery protocols, leading to better health outcomes and increased patient satisfaction. The adoption of these technologies is rapidly becoming a standard practice in bariatric surgery, significantly influencing the market by improving the overall treatment and care continuum for obesity.

Regional Analysis

North America Dominates with 47.2% Market Share

North America’s dominance in the Obesity Surgery Devices Market, with a market share of 47.2%, is driven by several factors. High obesity rates, advanced healthcare infrastructure, and a strong presence of leading medical device companies are key contributors. The region's focus on innovative healthcare solutions, such as robotic-assisted surgeries and minimally invasive techniques, also plays a critical role. Additionally, favorable reimbursement policies and substantial healthcare spending enable wider access to bariatric procedures, further boosting the market.

The regional characteristics of North America, including its wealthy economy and high standard of medical care, significantly enhance the performance of the Obesity Surgery Devices Market. The region's emphasis on research and development leads to rapid adoption of the latest technologies. Moreover, public awareness campaigns and preventive health measures keep the focus on tackling obesity, sustaining the demand for surgical interventions.

Looking ahead, North America is expected to maintain its leadership in the Obesity Surgery Devices Market due to ongoing technological advancements and increasing investments in healthcare. The growing prevalence of obesity and rising patient awareness about the availability of surgical options are likely to continue driving the market's growth in this region.

Regional Market Share:

- Europe: Europe holds a significant position in the global market, with a robust growth rate and a market share of around 29.5%. The region's advanced healthcare systems and rising obesity rates contribute to the steady demand for obesity surgery devices.

- Asia Pacific: This region is rapidly growing, currently holding approximately 21% of the market share. Increasing obesity rates, improving healthcare infrastructure, and rising disposable incomes in countries like China and India are key growth drivers.

- Middle East & Africa: With a smaller market share of about 2%, this region is gradually advancing in terms of adopting obesity surgery devices due to slowly improving healthcare facilities and increasing health awareness.

- Latin America: Holding close to 1.3% of the market, Latin America shows potential for growth driven by escalating obesity rates and enhancements in healthcare infrastructure.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the Obesity Surgery Devices Market, key players like Johnson & Johnson Services Inc., through its Ethicon Inc. subsidiary, and Intuitive Surgical Inc. lead in market influence with their advanced surgical solutions and robust global networks. These companies, alongside Stryker Corporation and Boston Scientific Corporation, are pivotal due to their extensive product lines and technological innovations.

Transenterix Surgical Inc. and Apollo Endosurgery Inc. distinguish themselves with specialized offerings that cater to niche segments of the market, focusing on less invasive technologies that enhance patient recovery. Mediflex Surgical Products and Richard Wolf GmbH contribute with their precision instruments and customization options, meeting diverse surgical needs.

Emerging players like Allurion Technologies and Leptos Biomedical are gaining traction by introducing innovative devices that promise less invasive procedures and better outcomes. ReShape Lifesciences Inc. and ReShape Medical, known for their pioneering approaches in device therapy for weight management, bolster the market's evolution toward integrated solutions.

Collectively, these companies drive forward the obesity surgery devices industry, shaping its future through innovation, quality, and accessibility.

Market Key Players

- Johnson & Johnson Services Inc.

- Boston Scientific Corporation

- Transenterix Surgical Inc.

- Asenus Surgical US, Inc.

- Leptos Biomedical

- Stryker Corporation

- ReShape Medical

- Apollo Endosurgery Inc.

- Intuitive Surgical Inc.

- ReShape Lifesciences Inc.

- Mediflex Surgical Product

- Richard Wolf GmbH

- Allurion Technologies

- Ethicon Inc.

Recent Developments

- On April 2024, Yale's obesity experts integrated mental health care into standard patient treatment for obesity. Patients undergo multiple consultations with surgeons, nurses, nutritionists, and psychiatrists to establish rapport and screen for mental health challenges before bariatric surgery.

- On April 2024, Labcorp introduced its Weight Loss Management portfolio, providing educational resources and testing solutions to guide weight loss decisions. The offering includes tests to inform treatment options like lifestyle modifications, GLP-1 medications, or bariatric surgery, aiming to support individuals and physicians in managing weight effectively.

- On February 2024, Transcarent launched the One Place for Weight Health, offering a comprehensive weight health care experience for self-insured employers. This platform combines pharmaceutical treatments, lifestyle management, behavioral coaching, and surgical care to provide personalized care plans tailored to individuals' weight health journeys, enhancing access to quality and cost-effective treatment paths.

Report Scope

Report Features Description Market Value (2023) USD 1.8 Billion Forecast Revenue (2033) USD 3.5 Billion CAGR (2024-2033) 7.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Surgery Device Type (Gastric Bands, Gastric Balloons, Gastric Stapling Devices, Gastric Plication Systems, Gastric Electrical Stimulation Devices, Others), By Surgical Approach (Laparoscopic Surgery, Endoscopic Surgery), By End Users (Hospitals, Specialty Clinics, Ambulatory Surgical Centers) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Johnson & Johnson Services Inc., Boston Scientific Corporation, Transenterix Surgical Inc., Asenus Surgical US, Inc., Leptos Biomedical, Stryker Corporation, ReShape Medical, Apollo Endosurgery Inc., Intuitive Surgical Inc., ReShape Lifesciences Inc., Mediflex Surgical Product, Richard Wolf GmbH, Allurion Technologies, Ethicon Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Johnson & Johnson Services Inc.

- Boston Scientific Corporation

- Transenterix Surgical Inc.

- Asenus Surgical US, Inc.

- Leptos Biomedical

- Stryker Corporation

- ReShape Medical

- Apollo Endosurgery Inc.

- Intuitive Surgical Inc.

- ReShape Lifesciences Inc.

- Mediflex Surgical Product

- Richard Wolf GmbH

- Allurion Technologies

- Ethicon Inc.