Ambulatory Surgery Center Market By Type (Hospital-Based Ambulatory Surgery Centers, Free-Standing Ambulatory Surgery Centers), By Specialty (Single Specialty Centers, Multi-Specialty Centers), and By Treatment (Laceration Treatment, Bone Fracture Treatment, Emergency Care Service, Trauma or Accident Treatment, Others) and By Regions, 2023-2032

-

41865

-

Oct 2023

-

130

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

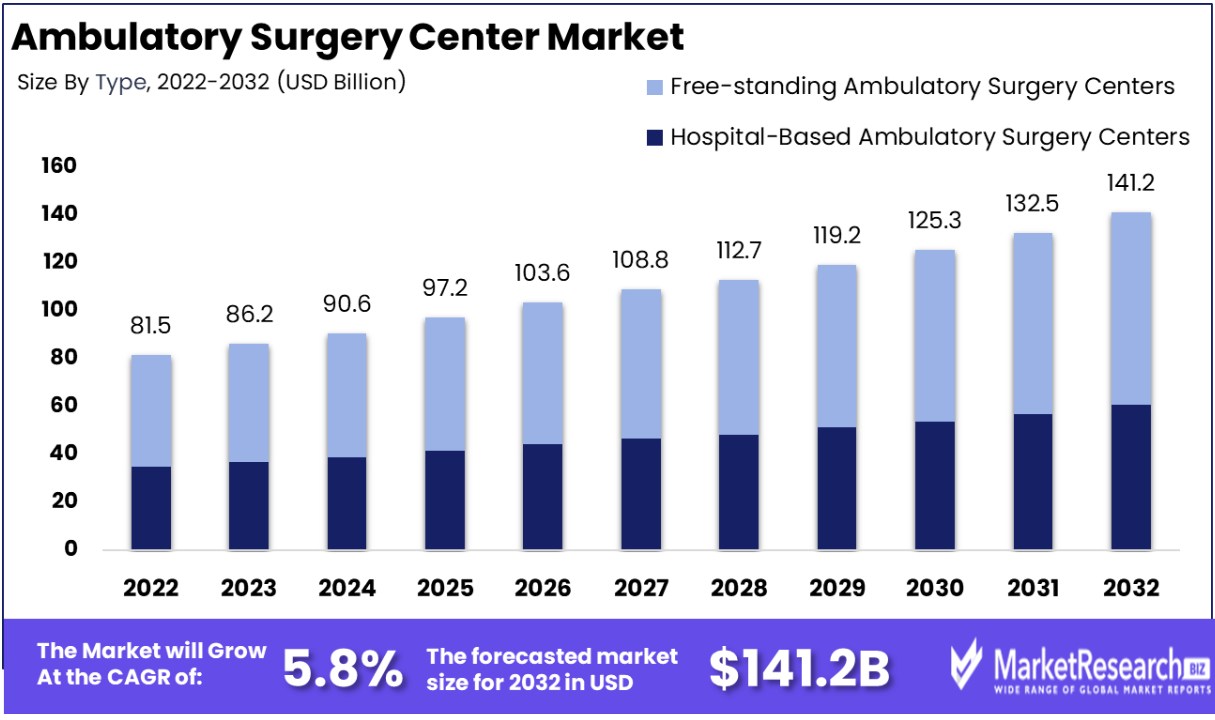

The ambulatory surgical center market was worth more than USD 81.5 billion in 2022 and is projected to expand at over 5.8% CAGR from 2023 to 2032. It is expected to be valued at USD 141.2 billion by 2032.

The global ambulatory surgery center market is poised for significant growth, driven by several key factors. A prominent driver is the escalating prevalence of chronic diseases worldwide, particularly among the geriatric population. With age, individuals face increased susceptibility to infectious and chronic ailments due to compromised immunity. Consequently, there is a surge in patient visits to ambulatory surgical centers seeking specialized care. This trend underscores the imperative for technologically advanced facilities that can deliver superior patient outcomes.

Technological advancements in diagnostic techniques and surgical procedures, including the adoption of minimally invasive approaches such as endoscopy and laparoscopy, are anticipated to be pivotal in propelling market expansion. These innovations promise more efficient and cost-effective treatment modalities, aligning with the needs of an aging population.

One of the latest trend in the market is the incorporation of telehealth into Ambulatory Surgery Centers. This is poised to have a profound impact on the ambulatory surgery center market.

The high attendance rate for scheduled video consultations in telemedicine for ambulatory surgical services indicates a strong willingness among patients and parents to utilize this technology. By integrating telehealth into their service offerings, ASCs can leverage this readiness to the benefit of patients and their own operations, potentially resulting in increased revenue and enhanced patient care.

To back this up, a mixed descriptive study showed that telemedicine achieved a high attendance rate of 94% for scheduled video consultations. This suggests that patients and parents are willing to utilize telemedicine for ambulatory surgical services, which can be advantageous for ASCs that incorporate telehealth into their service offerings.

Moreover, a Pediatric Surgery Department study conducted at Al-Azhar University highlights an impressive 92% patient satisfaction rate. This is a testament to the positive impact of telemedicine services. Satisfied patients are not only more likely to return for future procedures but also become enthusiastic advocates, recommending the ASC to others. It's clear that the ambulatory surgery center market is evolving, and those who embrace telehealth are poised for a prosperous future.

Overall, the ambulatory surgery center market is poised for tremendous expansion driven by the increasing burden of chronic diseases and the increasing aging population. Technological advancements and the adoption of less-used methods are the main drivers of this growth. Projects such as the Total Joint Program exemplify industry efforts to enhance patient experience and outcomes, further underscoring the potential for market growth.

Driving Factors

Cost Savings Potential of Ambulatory Surgical Centers is Significantly Higher

Significant cost savings are a primary driver for patients and payers choosing ASCs over HOPDs for specific medical procedures. According to a study conducted by the Department of Orthopaedic Surgery at Johns Hopkins University School of Medicine in Baltimore, Ambulatory Surgery Centers exhibited an average total cost that was 26% lower than that of Hospital Outpatient Departments (HOPDs) for the evaluated procedures.

Furthermore, ASCs demonstrated a notable 33% reduction in technical fees. This cost-effectiveness serves as a favorable aspect, as it has the potential to result in substantial cost savings for both patients and payers. This makes ASCs an appealing choice for healthcare providers and patients alike.

Increasing chronic diseases and older populations

The increasing prevalence of chronic diseases across the globe, coupled with an increasing aging population, are the major drivers for the ambulatory surgical office market. As individuals age, they are more susceptible to chronic conditions due to a weakened immune system and age-related factors. This demographic shift has led to an increase in patients attending surgical centers on foot for primary care. These centers offer a convenient and effective way to manage chronic diseases, creating demand for their services.

Technological advances in diagnostic and surgical techniques

Advances in medical technology, especially diagnostic and surgical techniques, have changed the way health care is delivered. Non-invasive surgery, endoscopy, and laparoscopy are examples of popular alternatives. These techniques offer several advantages, including reduced recovery time, fewer complications, and lower costs. As patients and healthcare providers increasingly adopt these advanced techniques, the demand for ambulatory surgery facilities equipped with state-of-the-art technology continues to grow.

Growing demand for less invasive treatments

There has been a tremendous increase in the demand for low-dose drugs. Compared to conventional open surgery, patients and physicians value these procedures due to reduced trauma, faster recovery time, and a lower risk of complications. Ambulatory surgery centers benefit from this quality, as these areas are well suited to performing such operations successfully. Surgeons also appreciate the control over a large selection of minimally invasive surgical equipment and techniques, further driving the growth of the Ambulatory Surgery Center Market.

Restraining Factors

Lack of skilled health workers

One of the major challenges facing the ambulatory surgery center market is the lack of trained and experienced healthcare professionals. Surgeons, anesthesiologists, nurses, and other specialized professionals are needed to keep these centers running smoothly. The demand for such staff often exceeds the supply, leading to recruitment problems and potential stress for existing employees. This shortcoming may hinder the expansion and efficiency of Ambulatory Surgery Center Market.

Compensation Information Issue

Health care reimbursement policies and practices can pose significant barriers to mobile surgical facilities. Rate fluctuations, delays in payment processing, and complicated payment processes can create financial challenges for these facilities. Navigating the challenges of reimbursement can be time-consuming and resource-intensive, potentially affecting the financial viability of ambulatory surgery centers. Addressing these issues and advocating fair and flexible reimbursement policies will be crucial for Ambulatory Surgery Center Market growth.

Growth Opportunities

Integration of telemedicine and digital health solutions

As mentioned above, the combination of telemedicine and digital health solutions provides an important growth platform for ambulatory surgical centers. The adoption of telehealth services has increased, especially in the wake of the COVID-19 pandemic. Ambulatory centers can use telemedicine for pre-operative care, post-operative follow-up, and even certain types of care remotely.

Not only does this expand the scope of access to the hospital, but it also increases accessibility for patients, especially those in remote or underserved areas. Additionally, incorporating digital health tools for patient engagement, remote monitoring, and electronic health records can streamline the operation and improve the overall patient experience.

Multi-Service Practice Care Center Expansion

One important growth opportunity is the expansion of multifunctional ambulatory care facilities. Offering a wide range of specialties under one roof, these facilities are gaining popularity. By diversifying their service offerings, participatory care centers can attract a wider range of patients and meet a wider range of healthcare needs.

This expansion not only provides convenience for patients but also positions intervention centers in advanced healthcare facilities. Services such as outpatient surgery, medical imaging, physical therapy, and specialty clinics can all be included in these multi-service areas. This holistic approach to healthcare can foster patient loyalty and build long-term relationships.

By Type

Free-standing ambulatory surgery centers (ASCs) hold a position in the ambulatory surgery center market. Their simplified surgery, patient handling approach, and cost contribute to this trend. Open ASCs excel in providing effective clinical care, especially for elective procedures. Their personal attention and short wait times enhance the patient experience. However, it should be noted that the choice between a hospital-based and a free-standing ASC depends on the specific procedure and patient needs, both of which play an important role in surgical care and the high delivery rate.

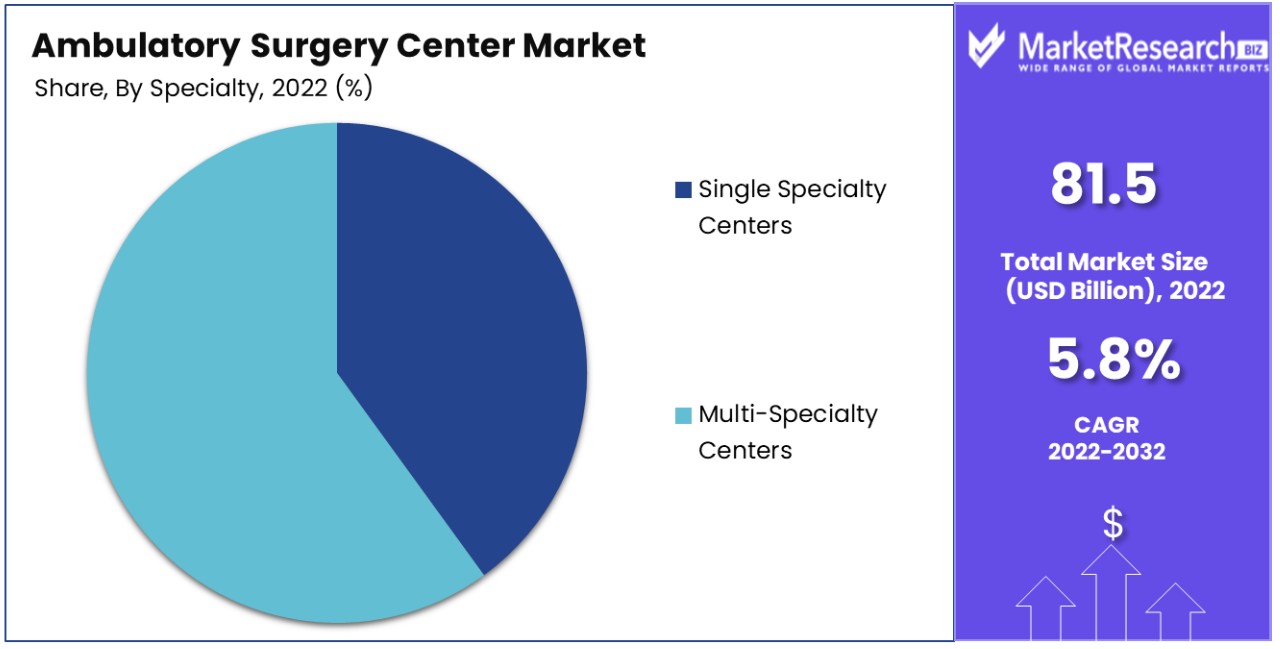

By Specialty

The dominance of the multispecialty segment in the ambulatory surgical center market is primarily due to its multifunctional capabilities and wide range of services. These centers offer a wide range of surgical procedures across various medical specialties. This wide gap allows for more operations and makes the part stand out. Furthermore, reimbursement rates for procedures performed in multispecialty ASCs further complicate their position, making them desirable to patients and healthcare providers seeking efficient and specialized care.

By Treatment

The ambulatory surgery center market is dominated by emergency care services. This is due to the urgency of emergencies, which require immediate and specialized management. Patients need immediate medical intervention for fractures, broken bones, trauma, or accidents. Equipped with specialized emergency departments, ambulatory surgical centers play a vital role in providing quick and effective medical care. This enhanced response to critical situations puts emergency services at the forefront of the market.

Key market segments

By Type

- Hospital-Based Ambulatory Surgery Centers

- Free-standing ambulatory surgery Centers

By Specialty

- Single Specialty Centers

- Multi-Specialty Centers

By Treatment

- Laceration Treatment

- Bone fracture treatment

- Emergency Care Service

- Trauma

- Accident Treatment

- Others

Latest Trends

Technology integration and digitization

A major trend in the ambulatory surgery center market is the rise of advanced technology and digital solutions. ASCs use state-of-the-art medical technology, including robotic-assisted surgical systems and advanced imaging technologies, to enhance surgical accuracy and patient outcomes to drive electronic health records (EHR) and digital platforms for scheduling, patient communication, and billing. Services have streamlined business processes. This hybrid technology not only improves operational efficiencies but also enhances the overall patient experience, making ASCs more competitive in health care.

Focus on all outpatient joint replacements.

A notable trend in the Ambulatory Surgery Center Market is the increasing adoption of outpatient approaches to total joint replacement. Traditionally, in clinical settings, advances in surgical techniques, anesthesia, and postoperative care have enabled voluntary outpatient delivery of all joint replacements.

The desire to reduce healthcare costs, reduce hospital stays, and accelerate patient recovery drives this trend. With specialty orthopaedic units, dedicated rehabilitation centers, and rehabilitation centers, ASCs are taking advantage of this trend, providing patients with a convenient and effective alternative if it is used as an alternative to joint replacement surgery.

Special Areas of Advanced Monitoring

The emergence of specialized ambulatory surgery centers for the management of complex and advanced surgical procedures is an important trend in the market. These facilities are equipped with highly specialized equipment and staffed by experienced medical teams that specialize in dealing with complex surgical procedures.

Examples include centers focused on cardiology, neurosurgery, and advanced gastrointestinal surgery. By providing specialized services, ASCs can attract patients seeking more competent primary care in a more patient-centered environment. This trend reflects a shift toward more specialized and focused health care delivery while meeting the specific needs of patients with complex medical conditions.

Regional Analysis

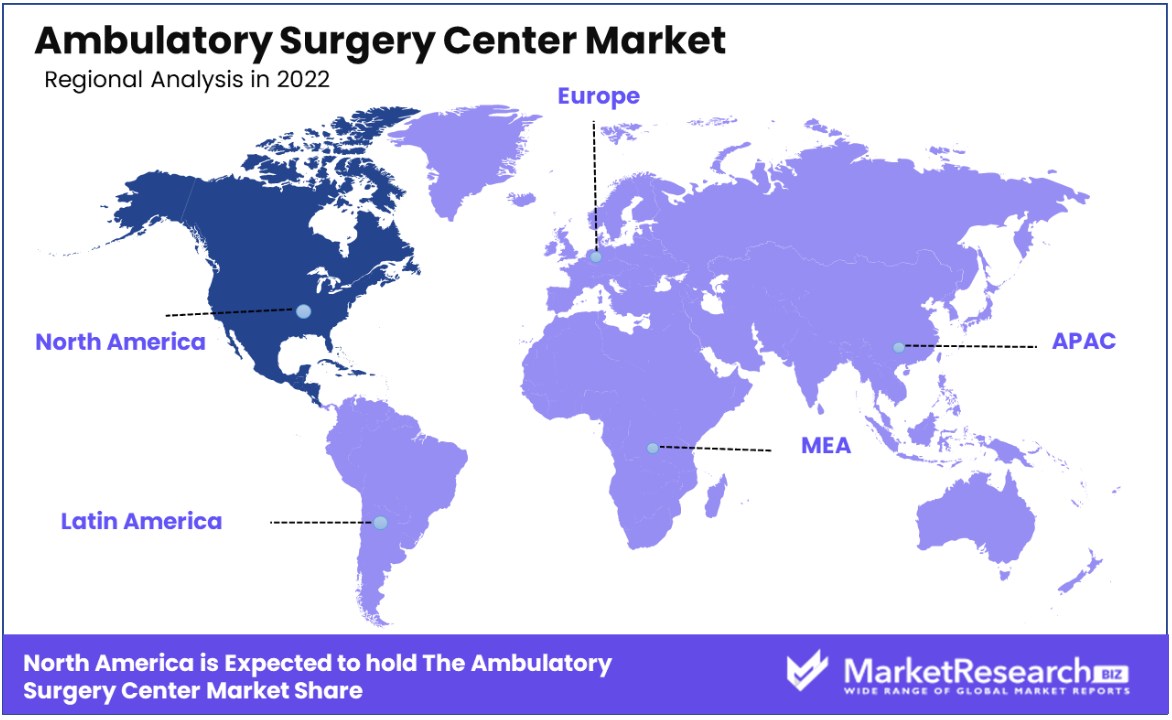

North America leads the ambulatory surgery center market, driven by the increasing demand for same-day surgical procedures and ancillary reimbursement policies associated with Asia Pacific, which is poised to witness the highest growth rate from 2023 to 2032. Reasons for this growth include yield results and health awareness.

The growth and increasing need for advanced medical technologies report analyzes the specific market impact and country regulatory changes that impact current and future trends. Detailed analyses, including objective analysis, technological trends, and Porter’s Five Forces, are used to characterize individual countries, using global and local brand trends, tax effects, and trade mechanisms.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- The rest of MEA

Key Player Analysis

The competitive landscape of the Mobile Surgery Center market includes detailed profiles of the competitors. It focuses on company profile, financial position, revenue, market potential, R&D investment, market innovation, global input, product development, capabilities, and strengths and weaknesses.

Top Key Player in the Ambulatory Surgery Center Market

- Envision Healthcare (U.S.)

- TH Medical (U.S.)

- MEDNAX Services Inc. (U.S.)

- TeamHealth (U.S.)

- UnitedHealth Group (U.S.)

- QHCCS, LLC (U.S.)

- Surgery Partners (U.S.)

- NOVENA GLOBAL HEALTHCARE GROUP, INC. (Singapore)

- CHSPSC, LLC (U.S.)

- Terveystalo (Finland)

- SurgCenter (U.S.)

- Healthway Medical Group (Singapore)

- Prospect Medical Systems (U.S.)

Recent Developments

- In October 2023, for the third consecutive year, Covenant High Plains Surgery Center received recognition from Newsweek as the leading ambulatory surgery center.

- In October 2023, Central Alabama Orthopedic Ambulatory Surgery Center, a healthcare entity based in Alabama, submitted an application to establish a multi-specialty ambulatory surgery center in Jefferson County, with a proposed investment exceeding $124 million. The application was received and is under review by the State Health Planning and Development Agency.

- In October 2023, TriasMD, a leading musculoskeletal management company and the parent company of DISC Surgery Centers, finalized the acquisition of Pinnacle Surgery Center, located in Walnut Creek. This strategic expansion brings DISC's established data-driven ambulatory surgery center (ASC) model into Northern California, marking the second acquisition of its kind within the past six months. TriasMD had previously acquired Gateway Surgery Center in Santa Clarita back in February.

- In October 2023, the State Health Planning and Development Agency's CON Review Board unanimously greenlit Cullman Regional's application for a multispecialty ambulatory surgery center (ASC) in Hartselle. This ASC is the second service expansion in Hartselle by Cullman Regional this year. The state approved plans for a freestanding emergency department a few months ago, with the facility slated to open in 2024.

- In August 2023, SurgNet Health Partners, Inc. disclosed its acquisitions of the Executive Ambulatory Surgery Center and the Lippy Surgery Center. This move is part of their strategic plan to broaden their presence in the ambulatory surgery center sector, focusing on development and management initiatives.

Report Scope

Report Features Description Market Value (2022) US$ 81.5 Bn Forecast Revenue (2032) US$ 141.2 Bn CAGR (2023-2032) 5.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Hospital-Based Ambulatory Surgery Centers, Free-Standing Ambulatory Surgery Centers), By Specialty (Single Specialty Centers, Multi-Specialty Centers), and By Treatment (Laceration Treatment, Bone Fracture Treatment, Emergency Care Service, Trauma or Accident Treatment, Others) Regional Analysis North America – The US, Canada, Mexico, Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America, Eastern Europe – Russia, Poland, The Czech Republic, Greece, Rest of Eastern Europe, Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, Rest of Western Europe, APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC, Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, Rest of MEA Competitive Landscape Envision Healthcare, TH Medical, MEDNAX Services Inc., TeamHealth, UnitedHealth Group, QHCCS, LLC, Surgery Partners, NOVENA GLOBAL HEALTHCARE GROUP, INC., CHSPSC, LLC, Terveystalo, SurgCenter, Healthway Medical Group, Prospect Medical Systems Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-