Naloxone Market Report By Strength (0.4 mg/ml, 1 mg/ml, 2 mg/2 ml, 4 mg/0.1 ml, Other Strengths), By Dosage Form (Vials, Prefilled Syringes, Nasal Spray, Auto-injectors), By Route of Administration (Parenteral (Injectable), Intranasal), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

47722

-

June 2024

-

321

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

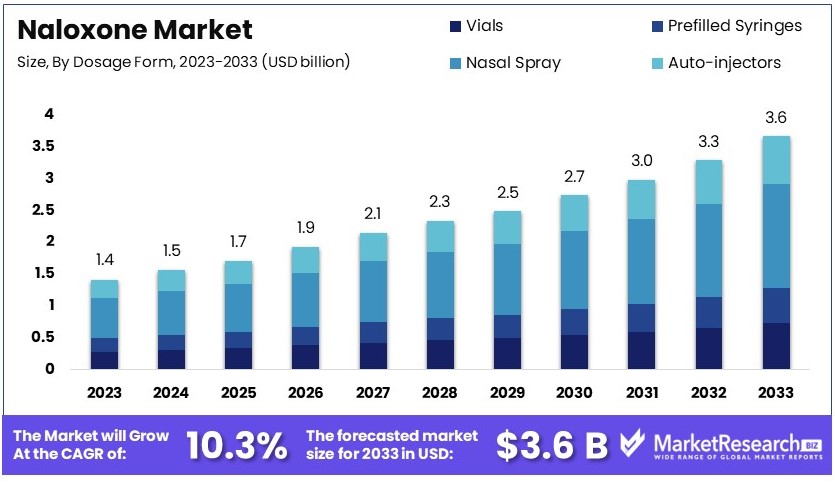

The Global Naloxone Market size is expected to be worth around USD 3.6 Billion by 2033, from USD 1.4 Billion in 2023, growing at a CAGR of 10.3% during the forecast period from 2024 to 2033.

The Naloxone market revolves around the production, distribution, and sales of Naloxone. Naloxone is a life-saving drug used to counter opioid overdoses. Its main purpose is to rapidly reverse the effects of opioid intoxication, making it crucial in emergency medical situations.

This market includes various forms of Naloxone, such as injections, nasal sprays, and auto-injectors. Key players in this market are pharmaceutical companies, healthcare providers, and emergency medical services.

The demand for Naloxone is driven by the rising incidence of opioid overdoses globally. Governments and health organizations are increasingly focusing on making Naloxone widely available. This includes over-the-counter availability and distribution through community programs.

The Naloxone market is experiencing significant transformative shifts, primarily driven by heightened governmental actions and innovative distribution strategies aimed at combating the opioid crisis. Recent initiatives by the Biden-Harris Administration in December 2023 exemplify this trend, as they have broadened access to naloxone across federal facilities nationwide. This policy expansion underscores a robust commitment to public health and safety, positioning naloxone as a critical component in emergency health responses.

Moreover, advancements in naloxone accessibility are evident with the introduction of vending machines dispensing the drug, as seen in June 2024 at the Pace Harvey bus terminal in Chicago. This deployment not only enhances the availability of this life-saving medication but also serves as a model for other urban centers grappling with high rates of opioid overdoses. These vending machines offer a discreet, stigma-free, and immediate method for individuals to obtain naloxone, potentially leading to a reduction in overdose fatalities.

The convergence of governmental support and innovative distribution mechanisms can be expected to propel the naloxone market forward. It positions the market on a trajectory of growth fueled by the ongoing public health emphasis on addressing opioid misuse.

Investors and market stakeholders should monitor these developments closely, as they may influence market dynamics and opportunities for innovation in drug delivery and public health initiatives. The strategic expansion of naloxone access points, coupled with public awareness campaigns, could significantly enhance market penetration and save lives, aligning with broader health policy objectives.

Key Takeaways

- Market Value: The Global Naloxone Market was valued at USD 1.4 Billion in 2023 and is projected to reach USD 3.6 Billion by 2033, growing at a CAGR of 10.3%.

- Strength Analysis: The 4 mg/0.1 ml strength leads with 40% due to its high efficacy and convenience in emergency scenarios.

- Dosage Form Analysis: Nasal spray dominates with 45%, favored for its simplicity and quick application in emergencies.

- Route of Administration Analysis: Intranasal administration is predominant, capturing 50% of the market due to its non-invasive, user-friendly application.

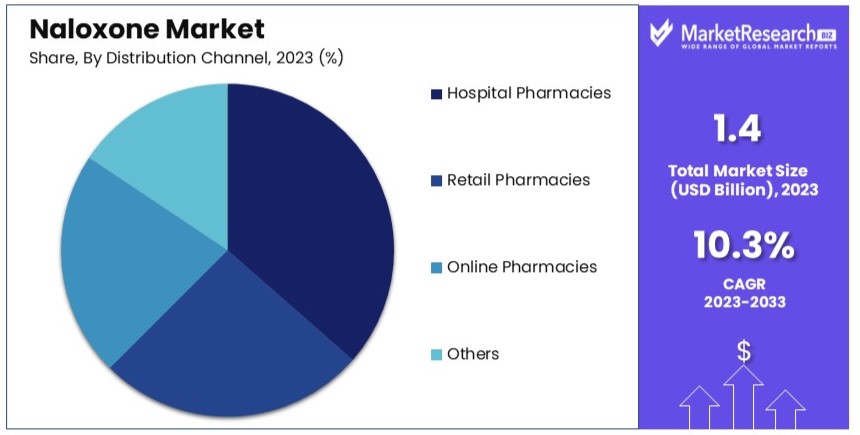

- Distribution Channel Analysis: Hospital pharmacies hold a leading 35% share, crucial for immediate access to Naloxone in urgent care.

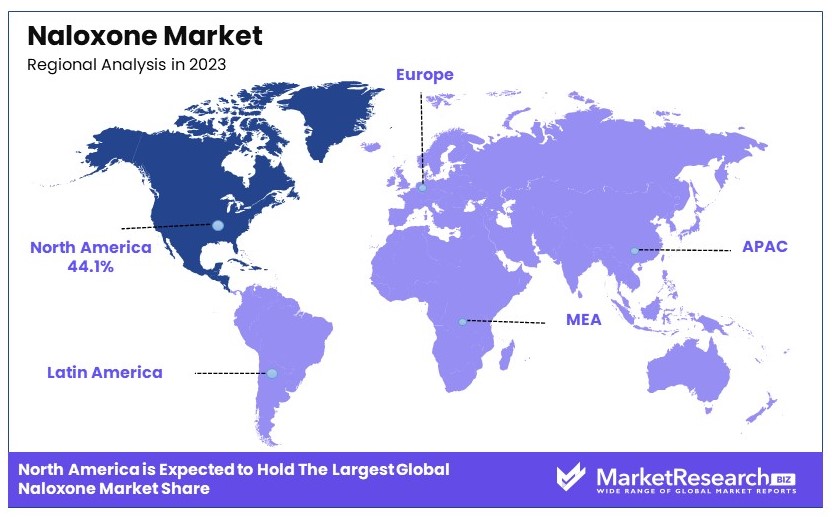

- Dominant Region: North America dominates the market with a 44.1% share, underlined by strong healthcare infrastructure and robust opioid overdose initiatives.

- High Growth Region: Europe represents a significant market with a 25% share, indicating strong growth potential and increasing awareness.

- Analyst Viewpoint: The market exhibits a competitive landscape with moderate saturation. Continued innovation and adaptation are key for future growth amidst evolving healthcare demands.

- Growth Opportunities: Key players can leverage advancements in drug delivery technologies and expand into under-served regions to enhance their market standing.

Driving Factors

Opioid Crisis Intensifies Naloxone Market Growth

The escalating opioid epidemic acts as a primary catalyst for the expansion of the Naloxone market. According to data from the Centers for Disease Control and Prevention (CDC), the United States witnessed over 81,000 drug overdose deaths in the 12 months ending in May 2020, the highest ever recorded in a year. This alarming increase directly correlates with heightened demand for Naloxone, a life-saving medication used to reverse opioid overdoses.

The market has responded with a surge in Naloxone distribution programs and increased availability in pharmacies and emergency services. This factor also harmonizes with governmental and non-governmental strategies to mitigate opioid-related fatalities, leading to legislative support for broader Naloxone access. Consequently, these dynamics foster a robust market growth environment for Naloxone as communities and healthcare systems continue to combat the opioid crisis.

Government Policies Enhance Naloxone Market Expansion

Government initiatives and regulatory support significantly bolster the Naloxone market. In recent years, federal and state authorities have enacted policies that expand the availability of Naloxone. For instance, all 50 U.S. states now have laws supporting Naloxone use, with many adopting "Good Samaritan" laws that protect individuals from liability when administering Naloxone in an overdose situation.

Such legislative measures have not only increased the accessibility of Naloxone but also encouraged pharmaceutical companies to ramp up production. This policy-driven approach is instrumental in integrating Naloxone into standard medical and emergency protocols, thereby enhancing market penetration and growth. The interaction between these government policies and public health initiatives creates a conducive environment for sustained market expansion.

Public Awareness Campaigns Propel Naloxone Accessibility

Increased public awareness about the dangers of opioid overdose and the effectiveness of Naloxone in emergency interventions drives market growth. Educational campaigns and training programs, often supported by health departments and advocacy groups, have heightened awareness of Naloxone as a critical response tool. These initiatives have led to a broader public understanding and acceptance of Naloxone, promoting its incorporation into community health strategies.

As a result, there is a marked increase in the public demand for Naloxone kits, which pharmacies and online retailers are increasingly fulfilling. This factor works well with other market drivers, such as government policy and healthcare provider endorsement, to enhance the overall market dynamics and ensure a steady growth trajectory for the Naloxone market.

Restraining Factors

Regulatory Hurdles Restrain Market Growth

The stringent regulatory environment significantly curtails the expansion of the Naloxone market. Naloxone, as a life-saving opioid antagonist, is subject to rigorous scrutiny by health authorities such as the FDA in the United States and the EMA in Europe. The approval process can be lengthy and costly, impeding new entrants and innovations.

Additionally, the classification of Naloxone in various jurisdictions affects its accessibility. In some areas, Naloxone is a prescription drugs, which limits its availability in emergency situations. This regulatory landscape not only delays the introduction of new products but also affects the distribution and use of Naloxone, thereby hampering market growth.

Cost Factors Limit Market Accessibility

High production and development costs are major obstacles to the Naloxone market's growth. The expense associated with manufacturing Naloxone, especially in formulations patented for easy use (like nasal sprays), adds a significant burden on producers. This, in turn, translates to higher market prices, making it less accessible to lower-income individuals and regions where opioid overdose crises are often most acute.

The reliance on patented delivery systems exacerbates cost issues, as generic drugs, more affordable versions are slower to reach the market. These economic barriers prevent widespread adoption and use of Naloxone, thus restraining the market's growth potential.

Strength Analysis

4 mg/0.1 ml strength dominates with 40% due to its efficacy and convenience for emergency use.

The Naloxone market can be segmented based on the strength of the medication. The 4 mg/0.1 ml segment dominates with 40% due to its efficacy and convenience for emergency use in opioid overdose situations. This high concentration allows for rapid reversal of opioid effects, which is crucial in life-threatening circumstances. The dominance of this segment is driven by its widespread use in both clinical settings and community-based programs aimed at reducing opioid-related fatalities.

Other strengths like 0.4 mg/ml, 1 mg/ml, and 2 mg/2 ml play significant roles in specific clinical scenarios, offering tailored dosing options for different patient needs. These variations in strengths allow healthcare providers to customize treatment plans, thereby enhancing patient outcomes and expanding the overall market. Despite the dominance of the 4 mg/0.1 ml segment, the availability of multiple strengths ensures that the market can address diverse clinical requirements, contributing to its robust growth.

Dosage Form Analysis

Nasal spray dominates with 45% due to its ease of use and effectiveness in emergencies.

The Naloxone market is also segmented by dosage form. Nasal spray dominates with 45% due to its ease of use and effectiveness in emergency situations. The nasal spray format is particularly popular because it can be administered quickly and easily by bystanders or first responders without the need for professional medical training. This accessibility has made it a critical tool in combating the opioid overdose crisis.

Prefilled syringes, vials, and auto-injectors also contribute significantly to the market. Prefilled syringes and auto-injectors are favored in medical settings for their precision and reliability, while vials are typically used in hospitals where professional administration is available. Each of these forms has a specific niche, ensuring that various patient and clinical needs are met. The diversification of dosage forms enhances the market's ability to provide timely and effective interventions, thereby driving growth and adoption across different healthcare settings.

Route of Administration Analysis

Intranasal administration dominates with 50% due to its non-invasive nature and ease of use.

The market for Naloxone is segmented by the route of administration. Intranasal administration dominates with 50% due to its non-invasive nature and ease of use, making it ideal for emergency situations where rapid response is critical.

This route of administration is particularly favored in community settings and by emergency responders who require a quick and effective method to reverse opioid overdoses. Parenteral (injectable) administration also holds a significant share, especially in clinical and hospital settings where medical professionals can administer precise doses.

The injectable form is crucial for severe cases and provides an alternative when intranasal administration is not feasible. Both routes of administration are essential for the comprehensive management of opioid overdoses, ensuring that Naloxone is accessible and effective in a variety of scenarios. The combination of these administration routes supports market growth by addressing the needs of both professional healthcare providers and the general public.

Distribution Channel Analysis

Hospital pharmacies dominate with 35% due to their critical role in stocking and dispensing Naloxone for emergency use.

The Naloxone market is further segmented by distribution channel. Hospital pharmacies dominate with 35% due to their role in stocking and dispensing Naloxone for in-hospital use and emergency responses. These pharmacies are a critical point of distribution, ensuring that healthcare providers have immediate access to Naloxone in life-saving situations.

Retail pharmacies also play a significant role, making Naloxone accessible to the general public and supporting community-based overdose prevention programs. Online pharmacies are increasingly contributing to market growth by providing convenient access to Naloxone, especially in areas with limited physical pharmacy presence.

Other channels, including community health organizations and public health programs, also contribute to the distribution network, ensuring widespread availability and awareness. Each distribution channel has a specific function in making Naloxone accessible to those in need, thereby supporting the overall market growth and the ongoing efforts to reduce opioid-related fatalities.

Key Market Segments

By Strength

- 0.4 mg/ml

- 1 mg/ml

- 2 mg/2 ml

- 4 mg/0.1 ml

- Other Strengths

By Dosage Form

- Vials

- Prefilled Syringes

- Nasal Spray

- Auto-injectors

By Route of Administration

- Parenteral (Injectable)

- Intranasal

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

Growth Opportunities

Personalized Medicine and Targeted Therapies Offer Growth Opportunity

Personalized medicine and targeted therapies offer significant growth opportunities in the Naloxone market. Precision medicine, which involves tailoring treatments to individual patient characteristics based on genetic markers and biomarkers, is gaining traction. This approach can improve treatment outcomes for gastrointestinal diseases.

For example, by identifying specific genetic markers linked to opioid addiction, treatments can be customized to better meet patient needs. The potential for improved patient outcomes drives market growth as more healthcare providers adopt personalized treatment plans. Additionally, the development of targeted therapies for specific subgroups of patients enhances the effectiveness of Naloxone, further expanding its market potential.

Expansion of Biologics and Biosimilars Offers Growth Opportunity

The expansion of biologics and biosimilars offers substantial growth opportunities in the Naloxone market. Biologics, such as monoclonal antibodies and therapeutic proteins, have transformed the treatment of conditions like IBD and gastrointestinal cancers.

As patents for branded biologics expire, the market for biosimilars is expected to grow. Biosimilars are follow-on versions of biologics that are similar but not identical to the original product. This expansion increases accessibility and affordability for patients, potentially driving market growth. The availability of biosimilars provides more treatment options at lower costs, making advanced therapies more accessible to a broader patient population.

Trending Factors

Training and Education Programs Are Trending Factors

The emphasis on training civilians and healthcare professionals in the use of Naloxone significantly contributes to its market expansion. Mandatory training programs for police and emergency responders are being implemented across various regions, increasing the proficiency and readiness in handling overdose situations.

This educational push enhances the community's ability to respond to opioid overdoses effectively, potentially saving more lives and increasing the demand for Naloxone. Statistics show that regions with comprehensive training programs report higher survival rates post-overdose, which not only underscores the effectiveness of such initiatives but also boosts public and governmental support for widespread Naloxone accessibility.

Innovations in Product Formulations Are Trending Factors

The development of new Naloxone formulations, such as nasal sprays, marks a significant advancement in making this life-saving medication more accessible and easier to administer. Nasal sprays, in particular, have gained popularity for their non-invasive application, which is crucial in emergency situations involving non-medical personnel.

This innovation broadens the user base beyond trained healthcare professionals to include family members and bystanders, effectively increasing its market penetration. The ease of use associated with nasal sprays leads to higher adoption rates and greater market coverage, as evidenced by the increased distribution of these formulations in emergency response kits nationwide.

Regional Analysis

North America Dominates with 44.1% Market Share

North America holds 44.1% of the Naloxone market. This dominance is driven by several key factors, including the high prevalence of opioid overdoses and robust healthcare infrastructure. The United States has implemented widespread Naloxone distribution programs, supported by government initiatives to combat the opioid crisis. Additionally, the presence of leading pharmaceutical companies in the region accelerates market growth.

North America's dominance in the Naloxone market is due to high opioid overdose rates, significant government support, and extensive public awareness campaigns. The U.S. and Canada have well-established healthcare systems that facilitate access to Naloxone. Furthermore, the strong presence of major pharmaceutical companies enhances the availability and distribution of Naloxone across the region.

The region's characteristics, such as advanced healthcare facilities and proactive government policies, positively influence the market. The increasing number of opioid addiction cases and the subsequent demand for emergency overdose treatments drive the market. Public health campaigns and community programs also contribute to higher Naloxone usage.

Other Regions Market Share

Europe: Europe holds a 25% share of the Naloxone market. This region benefits from strong healthcare systems and rising awareness about opioid overdoses. Government policies and initiatives aimed at increasing Naloxone availability are key growth drivers.

Asia Pacific: The Asia Pacific region accounts for 15% of the Naloxone market. Rapidly developing healthcare infrastructure and increasing opioid addiction rates in countries like India and China contribute to market growth. Government efforts to address the opioid crisis also play a crucial role.

Middle East & Africa: This region has a 10% share of the Naloxone market. Limited healthcare access and lower awareness levels about opioid overdoses hinder market growth. However, ongoing efforts to improve healthcare infrastructure and increase Naloxone availability present growth opportunities.

Latin America: Latin America holds a 6% share of the Naloxone market. The region faces challenges such as limited healthcare resources and lower awareness about opioid overdose treatments. Nonetheless, initiatives to improve healthcare access and public health campaigns are gradually driving market growth.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The naloxone market is led by significant players such as Pfizer Inc., Amphastar Pharmaceuticals, Inc., Kaleo, Inc., Adapt Pharma, Inc. (a subsidiary of Emergent BioSolutions Inc.), and Mundipharma International Limited. These companies leverage extensive resources, innovative products, and strong distribution networks to maintain a competitive edge.

For instance, Pfizer's broad reach and Kaleo's user-friendly auto-injector, EVZIO, highlight the strategic emphasis on accessibility and innovation. Adapt Pharma’s NARCAN Nasal Spray and Sandoz International GmbH’s focus on affordable generic naloxone further underscore the importance of diverse delivery methods and pricing strategies.

Smaller yet influential players like Hikma Pharmaceuticals PLC, Mylan N.V. (a division of Viatris Inc.), and INSYS Therapeutics, Inc. also contribute significantly by focusing on affordable and accessible naloxone products. Companies such as Indivior PLC and Akorn, Inc. enhance the market by integrating naloxone with other addiction treatments and maintaining high manufacturing standards.

Despite legal challenges, Purdue Pharma L.P.'s market influence is notable, while Teva Pharmaceutical Industries Ltd.'s emphasis on low-cost generics ensures widespread availability. Collectively, these companies shape a competitive and dynamic naloxone market, balancing innovation, affordability, and broad distribution.

Market Key Players

- Pfizer Inc.

- Amphastar Pharmaceuticals, Inc.

- Kaleo, Inc.

- Adapt Pharma, Inc. (a subsidiary of Emergent BioSolutions Inc.)

- Mundipharma International Limited

- Sandoz International GmbH (a division of Novartis AG)

- Hikma Pharmaceuticals PLC

- Mylan N.V. (a division of Viatris Inc.)

- INSYS Therapeutics, Inc.

- West-Ward Pharmaceuticals Corp.

- Akorn, Inc.

- Indivior PLC

- Purdue Pharma L.P.

- Teva Pharmaceutical Industries Ltd.

- Amphastar Pharmaceuticals, Inc.

- Other Key Players

Recent Developments

- June 2024: A naloxone vending machine has been unveiled at the Pace Harvey bus terminal in Chicago, providing easy access to the life-saving medication for those who may need it. This initiative aims to reduce overdose deaths by making naloxone more readily available.

- June 2024: In response to the preventable overdose death of a University of Victoria student, the B.C. government has promised to buy tens of thousands of nasal naloxone kits for construction sites. Trades workers are demanding this measure to ensure workplace safety and prevent future tragedies.

- May 2024: Walgreens is launching a generic version of over-the-counter Narcan, the opioid overdose reversal drug, for $34.99 per pack - a $10 price reduction compared to the brand-name version. This move aims to enhance accessibility to the life-saving medication.

- December 2023: The Biden-Harris Administration has announced a new action to increase access to naloxone, the opioid overdose reversal drug, in federal facilities across the nation. This initiative is part of the ongoing efforts to address the opioid crisis.

Report Scope

Report Features Description Market Value (2023) USD 1.4 Billion Forecast Revenue (2033) USD 3.6 Billion CAGR (2024-2033) 10.3% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Strength (0.4 mg/ml, 1 mg/ml, 2 mg/2 ml, 4 mg/0.1 ml, Other Strengths), By Dosage Form (Vials, Prefilled Syringes, Nasal Spray, Auto-injectors), By Route of Administration (Parenteral (Injectable), Intranasal), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Pfizer Inc., Amphastar Pharmaceuticals, Inc., Kaleo, Inc., Adapt Pharma, Inc. (a subsidiary of Emergent BioSolutions Inc.), Mundipharma International Limited, Sandoz International GmbH (a division of Novartis AG), Hikma Pharmaceuticals PLC, Mylan N.V. (a division of Viatris Inc.), INSYS Therapeutics, Inc., West-Ward Pharmaceuticals Corp., Akorn, Inc., Indivior PLC, Purdue Pharma L.P., Teva Pharmaceutical Industries Ltd., Amphastar Pharmaceuticals, Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Pfizer Inc.

- Amphastar Pharmaceuticals, Inc.

- Kaleo, Inc.

- Adapt Pharma, Inc. (a subsidiary of Emergent BioSolutions Inc.)

- Mundipharma International Limited

- Sandoz International GmbH (a division of Novartis AG)

- Hikma Pharmaceuticals PLC

- Mylan N.V. (a division of Viatris Inc.)

- INSYS Therapeutics, Inc.

- West-Ward Pharmaceuticals Corp.

- Akorn, Inc.

- Indivior PLC

- Purdue Pharma L.P.

- Teva Pharmaceutical Industries Ltd.

- Amphastar Pharmaceuticals, Inc.

- Other Key Players