Generic Drugs Market Report By Type of Drug (Simple Generics, Complex Generics, Biosimilars), By Therapeutic Area (Cardiovascular, Central Nervous System, Oncology, Diabetes, Immunology, Respiratory, Others), By Route of Administration (Oral, Parenteral (Injectable), Topical, Others), By Distribution Channel (Retail Pharmacies, Hospital Pharmacies, Online Pharmacies, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

47333

-

June 2024

-

321

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

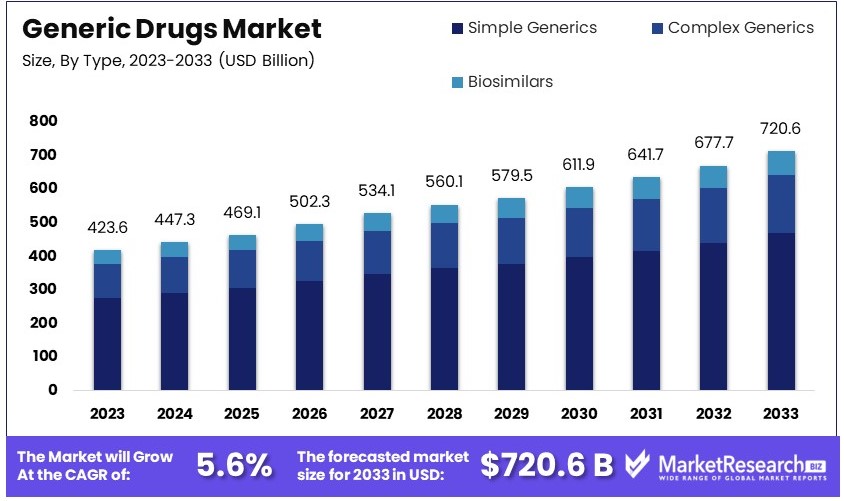

The Global Generic Drugs Market size is expected to be worth around USD 720.6 Billion by 2033, from USD 423.6 Billion in 2023, growing at a CAGR of 5.6% during the forecast period from 2024 to 2033.

The Generic Drugs Market comprises pharmaceuticals that are identical, or bioequivalent, to brand-name drugs but are available at a reduced cost. These drugs are marketed after the original patents expire and are regulated to ensure they meet rigorous safety, quality, and performance standards.

This market is crucial for reducing healthcare expenditures, increasing access to treatment, and supporting healthcare sustainability. Generic drugs typically enter the market at significantly lower prices, making them an essential choice for healthcare systems and consumers aiming to manage budget constraints while maintaining high-quality care standards.

The Generic Drugs Market is central to the global pharmaceutical industry, driven by a compelling need for cost-effective healthcare solutions. In the United States alone, generic drugs represent over 90% of all prescriptions dispensed, underscoring their critical role in making medicines accessible and affordable. Despite their widespread use, generics account for only 20-30% of total drug spending in the U.S., highlighting their significant impact on reducing healthcare costs.

The market dynamics are influenced by the predominant share of the U.S., which holds approximately 47.5% of the global market. This is largely attributed to a substantial patient base and a regulatory framework that favors generics through measures like the Hatch-Waxman Act, which encourages the introduction of generic competition to brand-name drugs. Other leading markets include China, Germany, India, and Japan, which collectively contribute to the global accessibility and affordability of pharmaceuticals.

Strategically, major players in this sector are leveraging expansive product portfolios and robust distribution networks to capitalize on these high-volume, lower-margin opportunities. Companies like Teva, Sandoz, and Mylan are at the forefront, continuously expanding their global footprint through strategic mergers, acquisitions, and partnerships. They are not only enhancing their market presence but are also investing in research and development to bring more complex generics and biosimilars to the market, aiming to offset the thinning pipelines of novel drugs.

In conclusion, the Generic Drugs Market is poised for sustained growth, fueled by the escalating demand for affordable medication and supportive governmental policies across key global markets. These factors, combined with strategic industry movements, suggest a robust outlook for the generics sector, making it a pivotal element of the broader pharmaceutical landscape.

Key Takeaways

- Market Value: The global generic drugs market is valued at USD 423.6 billion in 2023, projected to grow at a CAGR of 5.6%, reaching USD 720.6 billion by 2033.

- Type of Drug Analysis: Simple Generics hold a 65% market share, dominating due to their lower cost and broad acceptance, crucial for reducing healthcare expenses.

- Therapeutic Area Analysis: Cardiovascular drugs lead with a 30% share, essential for managing widespread cardiovascular conditions affordably.

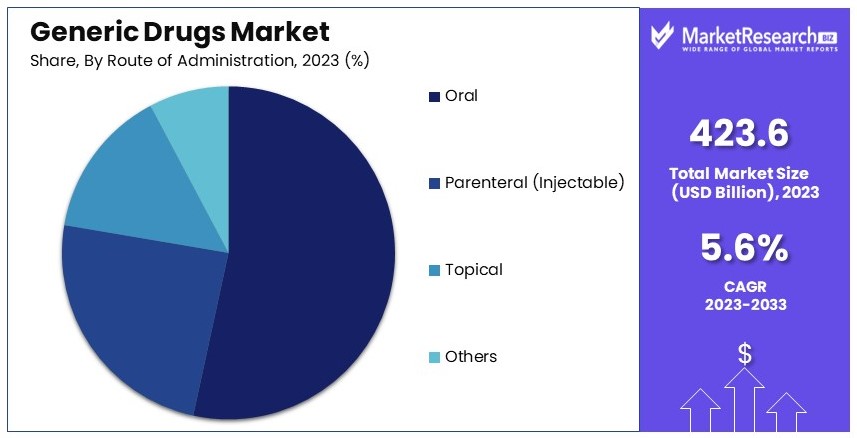

- Route of Administration Analysis: Oral administration dominates with a 55% share, favored for its ease and compliance, supporting widespread use in multiple therapies.

- Distribution Channel Analysis: Retail Pharmacies are predominant, accounting for 50% of the market, essential for their accessibility and extensive network.

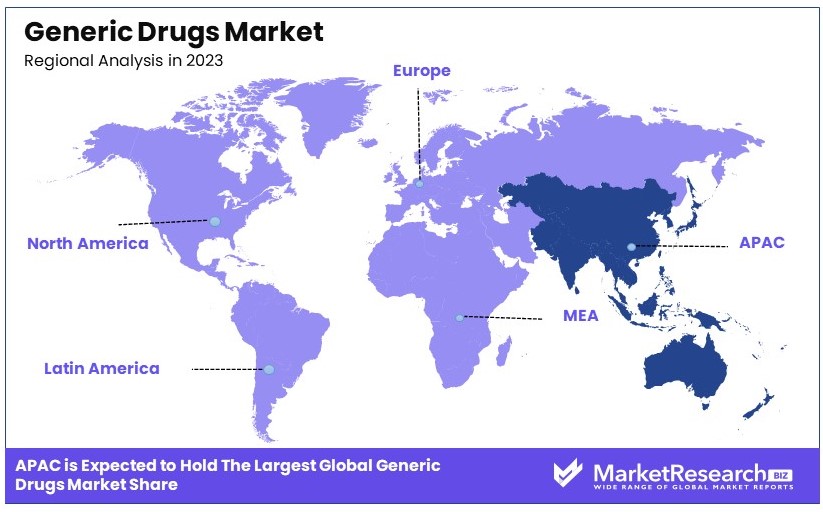

- Dominant Region: Asia Pacific holds a 45% share of the market, leading due to advanced healthcare infrastructure and high drug adoption rates.

- Analyst Viewpoint: The market exhibits moderate competition and saturation; future growth will depend on regulatory approvals and market penetration in developing regions.

- Growth Opportunities: Key players can differentiate by focusing on underserved therapeutic areas and expanding into emerging markets to capitalize on local growth dynamics.

Driving Factors

Patent Expiration Drives Market Growth

Patent expirations of branded drugs play a crucial role in the growth of the generic drugs market. When patents expire, generic manufacturers can produce and market less expensive versions of these drugs. This increased competition leads to more options for consumers and significant market expansion. For instance, the expiration of patents for blockbuster drugs like Lipitor (atorvastatin) and Nexium (esomeprazole) created substantial opportunities for generic drug companies. The availability of cheaper alternatives to these high-demand medications has led to a surge in market demand.

This growth is directly tied to the influx of generic versions of previously patented drugs. Additionally, the competitive pricing of generic drugs has made them a preferred choice among consumers, healthcare providers, and insurance companies, further driving market growth.

Rising Healthcare Costs Drive Market Growth

The rise in healthcare costs and the implementation of cost-containment measures have significantly driven the growth of the generic drugs market. Governments, insurance companies, and consumers are increasingly burdened by high healthcare expenses, prompting a demand for more affordable alternatives. Generic drugs offer a cost-effective solution, helping to reduce the financial strain on healthcare systems. Many healthcare providers and payers actively promote the use of generic drugs as a means to save costs.

This trend has led to a substantial increase in the adoption of generic medications. For example, the U.S. healthcare system saved approximately $313 billion in 2020 by using generic drugs. The promotion of generics as a cost-saving measure has resulted in a steady rise in market share.

Increasing Prevalence of Chronic Diseases Drives Market Growth

The rising prevalence of chronic diseases significantly contributes to the growth of the generic drugs market. Chronic disease management such as diabetes, cardiovascular disorders, and cancer require long-term medication, creating a steady demand for affordable treatment options. Generic drug manufacturers are well-positioned to meet this demand by offering cost-effective alternatives to branded medications.

As the incidence of chronic diseases continues to rise globally, the need for accessible and affordable medications has become more critical. In 2021, it was reported that around 463 million adults were living with diabetes, a number expected to reach 700 million by 2045. This growing patient population drives the demand for generic drugs, as patients seek sustainable and affordable treatment options. This trend underscores the importance of generic drugs in managing long-term health conditions and reducing overall healthcare costs.

Restraining Factors

Pricing Pressures and Competition Restrain Market Growth

Intense competition in the generic drug market creates significant pricing pressures. As more manufacturers enter the market, the increased supply of generic drugs leads to price erosion. This competition drives prices down, squeezing profit margins for manufacturers. Lower profits can limit the funds available for investment in research and development of new generic products.

According to recent industry reports, the price of many generic drugs has dropped by up to 90% once multiple competitors enter the market. This decline in prices makes it difficult for manufacturers to sustain high-quality production and invest in developing new generics. Consequently, this factor significantly restrains the growth potential of the market.

Challenges in Complex Generics Restrain Market Growth

Developing generic versions of complex drugs, including biologics and drug-device combinations, poses significant technical and regulatory challenges. These complexities slow down the introduction of new generic products in these segments. Biologics, which are made from living organisms, require intricate manufacturing processes and stringent regulatory approval.

The high cost and difficulty of producing these complex generics limit their market availability. For example, the biosimilars market, a subset of biologics, is projected to grow at a slower pace of 4.5% CAGR from 2023 to 2030 compared to simpler generics. Regulatory hurdles further complicate the market entry for complex generics, delaying their availability and limiting market growth. These challenges hinder the expansion of the generic drugs market, particularly in advanced drug categories.

Type of Drug Analysis

Simple Generics dominate with 65% due to lower costs and wide acceptance.

The Generic Drugs Market can be segmented by type into Simple Generics, Complex Generics, and Biosimilars. Among these, Simple Generics dominate the market, holding the largest share due to their lower cost and wide acceptance. Simple Generics, which are bioequivalent to branded drugs, are preferred for their affordability and availability. The market for Simple Generics is driven by the need to reduce healthcare costs and increase access to essential medicines. The widespread adoption of these drugs, especially in emerging markets, further boosts their demand.

Complex Generics, though a smaller segment, are gaining traction due to their ability to treat more complex conditions. These drugs are harder to develop and manufacture, but they offer higher profitability margins and face less competition. The segment's growth is propelled by advancements in drug formulation technologies and the expiration of patents for complex drugs.

Biosimilars, a nascent yet rapidly growing segment, represent generic versions of biologic drugs. Their market expansion is driven by the rising incidence of chronic diseases and the increasing acceptance of biologics in treatment protocols. The stringent regulatory pathway and higher development costs pose challenges, but the potential for cost savings and improved patient outcomes drive their adoption.

Therapeutic Area Analysis

Cardiovascular dominates with 30% due to high disease prevalence and affordability.

The Generic Drugs Market is also segmented by therapeutic area, including Cardiovascular, Central Nervous System, Oncology, Diabetes, Immunology, Respiratory, and Others. The Cardiovascular segment holds a dominant position, primarily due to the high prevalence of cardiovascular diseases globally. The aging population and rising incidence of lifestyle-related conditions such as hypertension and hyperlipidemia contribute to the sustained demand for cardiovascular generics. The affordability of these drugs ensures their continued use in managing chronic cardiovascular conditions.

Central Nervous System (CNS) drugs form another significant segment, driven by the increasing incidence of mental health disorders and neurological conditions. The demand for generic CNS drugs is boosted by the need for long-term treatment options and cost-effective therapies. Oncology drugs, though currently a smaller segment, are witnessing rapid growth due to the rising cancer burden and the high cost of branded oncology drugs. The introduction of generic oncology drugs has significantly reduced treatment costs, making cancer care more accessible. Diabetes, Immunology, and Respiratory segments also play crucial roles in the market, driven by the increasing prevalence of related conditions and the need for cost-effective treatment options.

Route of Administration Analysis

Oral dominates with 55% due to ease of administration and patient compliance.

Generic drugs are administered through various routes, including Oral, Parenteral (Injectable), Topical, and Others. The Oral route of administration dominates the market, accounting for the largest share due to ease of administration, patient compliance, and cost-effectiveness. Oral generics, available in forms such as tablets and capsules, are widely used for various therapeutic indications, making them the most preferred choice among patients and healthcare providers.

Parenteral generics, administered through injections, form the second-largest segment. These drugs are crucial for conditions requiring rapid onset of action or when oral administration is not feasible. The segment's growth is driven by the increasing prevalence of chronic diseases and the rising demand for injectable generics in hospital settings. Topical generics, used for skin conditions and localized treatments, are also significant, with growing demand driven by the increasing incidence of dermatological conditions and the preference for non-invasive treatment options.

Distribution Channel Analysis

Retail Pharmacies dominate with 50% due to widespread presence and convenience.

The distribution channels for generic drugs include Retail Pharmacies, Hospital Pharmacies, Online Pharmacies, and Others. Retail Pharmacies hold the largest market share, driven by their widespread presence and convenience for patients. Retail pharmacies play a crucial role in ensuring the availability and accessibility of generic drugs to the general population. The segment's dominance is also supported by the strong network of community pharmacies and the trust patients place in these establishments.

Hospital Pharmacies form the second-largest segment, driven by the high volume of generic drugs used in hospital settings for acute and chronic conditions. The increasing number of hospital admissions and the emphasis on cost-effective treatment options contribute to the growth of this segment. Online Pharmacies, though a smaller segment, are rapidly growing due to the convenience of home delivery, competitive pricing, and the increasing adoption of e-commerce. The COVID-19 pandemic has further accelerated the shift towards online pharmacies, highlighting their importance in the distribution of generic drugs.

Key Market Segments

By Type of Drug

- Simple Generics

- Complex Generics

- Biosimilars

By Therapeutic Area

- Cardiovascular

- Central Nervous System

- Oncology

- Diabetes

- Immunology

- Respiratory

- Others

By Route of Administration

- Oral

- Parenteral (Injectable)

- Topical

- Others

By Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies

- Others

Growth Opportunities

Biosimilars and Complex Generics Offer Growth Opportunity

As patents on biologic drugs and complex drug-device combinations expire, there is significant growth potential for biosimilars and complex generics. This segment requires substantial investment and technical expertise, but the rewards are promising.

Complex generics, which include extended-release formulations and drug-device combinations, also present a lucrative opportunity. The technical challenges associated with these drugs can lead to higher barriers to entry, allowing manufacturers with the necessary expertise to capture significant market share. This growth potential is further supported by regulatory agencies' efforts to streamline approval processes for complex generics and biosimilars.

Specialty Generics Offer Growth Opportunity

Developing generic versions of specialty pharmacy services presents a significant growth opportunity. Specialty drugs, used to treat rare or complex conditions, are typically high-cost medications. As patents for these drugs expire, the market opens up for generic manufacturers willing to navigate the technical and regulatory challenges.

The specialty generics market is projected to grow at a CAGR of 6.5% from 2023 to 2030. This growth is driven by the increasing prevalence of rare diseases and the rising cost of specialty medications, which create a demand for more affordable alternatives. Manufacturers that successfully develop and market specialty generics can benefit from reduced competition and potentially higher profit margins.

Trending Factors

Vertical Integration Are Trending Factors

Vertical integration is a trending factor in the generic drugs market. Some manufacturers are acquiring or partnering with active pharmaceutical ingredient (API) suppliers to improve supply chain efficiency and reduce costs.

This strategy allows for greater control over the production process and ensures a stable supply of high-quality APIs. The move towards vertical integration is driven by the need to mitigate risks associated with API shortages and price volatility. By integrating vertically, generic drug manufacturers can enhance their competitive advantage, reduce dependency on third-party suppliers, and achieve cost savings, which can be passed on to consumers.

Innovative Drug Delivery Systems Are Trending Factors

Innovative drug delivery systems are a trending factor in the generic drugs market. Manufacturers are exploring advanced delivery technologies, such as extended-release formulations and novel dosage forms, to differentiate their products. These innovations can improve patient compliance, enhance therapeutic outcomes, and potentially command higher prices.

The global market for advanced drug delivery systems is projected to grow at a CAGR of 8.4% from 2023 to 2030. By incorporating these technologies, generic drug manufacturers can expand their product portfolios and capture new market segments. Innovations in drug delivery also allow for the development of more effective and patient-friendly generics.

Sustainable Manufacturing Practices Are Trending Factors

Sustainable manufacturing practices are becoming a trending factor in the generic drugs market. With increasing environmental concerns, manufacturers are adopting sustainable practices to improve operational efficiency and reduce costs while promoting environmental responsibility. This trend is driven by regulatory requirements, consumer demand for greener products, and the potential for cost savings through energy efficiency and waste reduction.

The adoption of sustainable practices can enhance a company's reputation and competitive positioning. According to industry reports, companies that implement sustainable manufacturing practices can achieve cost reductions of up to 20% and improve their market appeal to environmentally conscious consumers.

Regional Analysis

Asia Pacific Dominates with 45% Market Share in the Generic Drugs Market

Asia Pacific's leadership in the generic drugs market can be attributed to several factors. Primarily, the region benefits from robust manufacturing capabilities and a favorable regulatory environment, which streamline the production and approval of generic drugs. Furthermore, large pharmaceutical companies in countries like India and China capitalize on lower production costs compared to Western counterparts. The rising healthcare needs of a growing population also fuel demand for affordable medication options, reinforcing the region's dominance.

The dynamics of the Asia Pacific region are characterized by extensive collaborations between local manufacturers and global pharmaceutical giants, which enhance production capacities and market reach. Strategic initiatives, including partnerships for technology transfer and joint ventures, significantly boost the region's output and distribution networks. The proliferation of chronic diseases and increased healthcare expenditure also play a crucial role in shaping the industry's landscape, perpetuating the high consumption of generic drugs.

Looking ahead, Asia Pacific is poised to maintain, if not increase, its influence in the generic drugs market. Continuous improvements in healthcare infrastructure and policies aimed at promoting generic drug uptake are expected to drive further growth. Additionally, as patent cliffs loom for numerous blockbuster drugs, Asia Pacific manufacturers are well-positioned to capitalize on new opportunities, potentially increasing their market share.

Europe Holds 30% Market Share

Europe is another significant region, holding a 30% market share. The region's market is supported by government initiatives promoting generic drug use and stringent regulatory frameworks ensuring quality and safety. Countries like Germany, the UK, and France lead in generic drug consumption. The market is expected to grow at a CAGR of 5.3% from 2023 to 2030, driven by increasing healthcare expenditure and an aging population.

Middle East & Africa Capture 5% Market Share

The Middle East and Africa hold a smaller market share at 5%. The market in this region is driven by improving healthcare access and rising demand for affordable medications. Countries like Saudi Arabia and South Africa are leading the growth. The market is expected to grow at a CAGR of 6.2% from 2023 to 2030, supported by increasing healthcare investments and the adoption of generic drugs.

Latin America Maintains 5% Market Share

Latin America also holds a 5% market share. The region's market is driven by the growing prevalence of chronic diseases and efforts to reduce healthcare costs. Brazil and Mexico are key markets in the region. The market in Latin America is projected to grow at a CAGR of 6.0% from 2023 to 2030, fueled by government initiatives and increasing demand for cost-effective medications.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Generic Drugs Market features a competitive landscape dominated by several key players who influence the industry through strategic positioning and expansive product portfolios. Teva Pharmaceutical Industries Ltd. leads with a robust global presence, backed by extensive manufacturing capabilities and a diverse generics portfolio. Sandoz, a division of Novartis, closely follows, known for pioneering biosimilars and being at the forefront of innovation in generic medications.

Mylan N.V., now part of Viatris, has enhanced its market position through strategic mergers, broadening its geographical footprint and therapeutic range. Pfizer Inc., while primarily known for its branded pharmaceuticals, also plays a significant role in the generics market through its subsidiary Greenstone.

Sun Pharmaceutical Industries Ltd., the largest pharma company in India, leverages its extensive R&D capabilities to maintain a strong position in generics. Fresenius Kabi AG focuses on injectable generics, critical care, and oncology, catering to a niche yet vital market segment. Lupin Limited and Dr. Reddy's Laboratories Ltd. are distinguished by their focus on complex generics, biologics, and active pharmaceutical ingredients, driving their growth in both developed and emerging markets.

Cipla Ltd. and Aurobindo Pharma Ltd. are noted for their comprehensive portfolio of generics, including respiratory and antiretroviral therapies, which are critical in global health contexts. Stada Arzneimittel AG and Hikma Pharmaceuticals PLC enhance their market reach through targeted acquisitions and a focus on underserved markets. Endo International plc, Torrent Pharmaceuticals Ltd., and Zydus Cadila are recognized for their strategic market adaptations and consistent investment in generic product development.

Collectively, these companies drive the competitive dynamics of the Generic Drugs Market, contributing to its robust growth and resilience by focusing on cost-effective solutions, strategic global expansion, and addressing complex health challenges.

Market Key Players

- Teva Pharmaceutical Industries Ltd.

- Sandoz (a Novartis division)

- Mylan N.V. (part of Viatris)

- Pfizer Inc.

- Sun Pharmaceutical Industries Ltd.

- Fresenius Kabi AG

- Lupin Limited

- Dr. Reddy's Laboratories Ltd.

- Cipla Ltd.

- Aurobindo Pharma Ltd.

- Stada Arzneimittel AG

- Hikma Pharmaceuticals PLC

- Endo International plc

- Torrent Pharmaceuticals Ltd.

- Zydus Cadila

Recent Developments

- June 2024: Lupin received US FDA approvals for Doxycycline for Injection USP (generic equivalent of Pfizer's Vibramycin) and Letermovir Tablets (generic equivalent of Merck's Prevymis). The products are used to treat bacterial infections and prevent diseases caused by cytomegalovirus (CMV), respectively.

- April 2024: Zydus Lifesciences launched a generic drug for overactive bladder in the US market. The product is a generic equivalent of Myrbetriq (mirabegron extended-release tablets) and is used to treat overactive bladder with symptoms of urge urinary incontinence, urgency, and frequency.

- February 2024: Biocon Limited received US FDA approval to market a generic anti-cancer medication, expanding its portfolio of affordable medicines for patients worldwide. The company's commitment to innovative R&D and strategic partnerships drives its growth in the global biopharmaceutical industry.

- January 2024: Cosmos Health acquired a portfolio of 10 generic drugs for €3.2 million, enhancing its pharmaceutical portfolio and solidifying its status as a vertically integrated entity. The selected drugs address various health issues, including diabetes, cholesterol, and cardiac conditions.

Report Scope

Report Features Description Market Value (2023) USD 423.6 Billion Forecast Revenue (2033) USD 720.6 Billion CAGR (2024-2033) 5.6% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type of Drug (Simple Generics, Complex Generics, Biosimilars), By Therapeutic Area (Cardiovascular, Central Nervous System, Oncology, Diabetes, Immunology, Respiratory, Others), By Route of Administration (Oral, Parenteral (Injectable), Topical, Others), By Distribution Channel (Retail Pharmacies, Hospital Pharmacies, Online Pharmacies, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Teva Pharmaceutical Industries Ltd., Sandoz (a Novartis division), Mylan N.V. (part of Viatris), Pfizer Inc., Sun Pharmaceutical Industries Ltd., Fresenius Kabi AG, Lupin Limited, Dr. Reddy's Laboratories Ltd., Cipla Ltd., Aurobindo Pharma Ltd., Stada Arzneimittel AG, Hikma Pharmaceuticals PLC, Endo International plc, Torrent Pharmaceuticals Ltd., Zydus Cadila Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Teva Pharmaceutical Industries Ltd.

- Sandoz (a Novartis division)

- Mylan N.V. (part of Viatris)

- Pfizer Inc.

- Sun Pharmaceutical Industries Ltd.

- Fresenius Kabi AG

- Lupin Limited

- Dr. Reddy's Laboratories Ltd.

- Cipla Ltd.

- Aurobindo Pharma Ltd.

- Stada Arzneimittel AG

- Hikma Pharmaceuticals PLC

- Endo International plc

- Torrent Pharmaceuticals Ltd.

- Zydus Cadila