Medical Tourism Market Report By Treatment Type (Cosmetic Surgery, Dental Treatment, Orthopedic Treatment, Cardiovascular Treatment, Fertility Treatment, Cancer Treatment, Neurological Treatment, Bariatric Surgery, Others), By Purpose of Travel (Medical Treatment, Wellness and Spa, Others), By Service Provider Type (Hospitals, Specialty Clinics, Medical Tourism Agencies, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

1249

-

May 2024

-

290

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

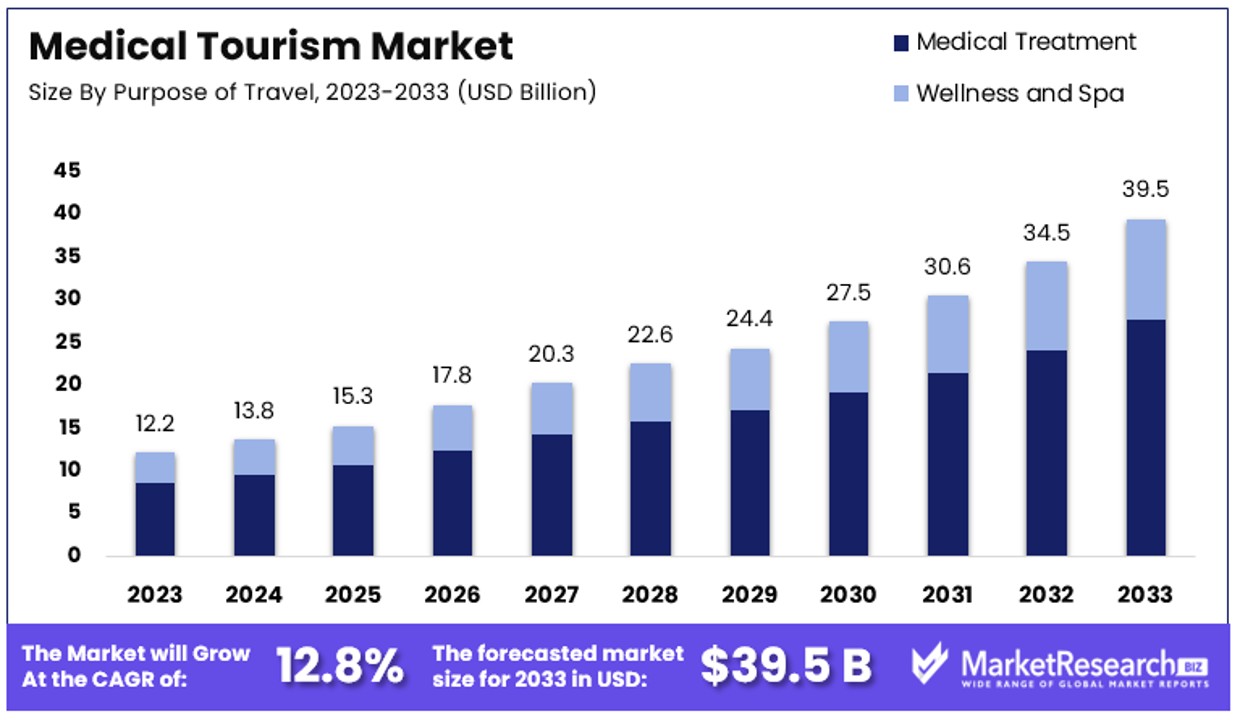

The Global Medical Tourism Market size is expected to be worth around USD 39.5 Billion by 2033, from USD 12.2 Billion in 2023, growing at a CAGR of 12.8% during the forecast period from 2024 to 2033.

The Medical Tourism Market refers to the global industry where people travel to other countries to receive medical treatment. This market includes a wide range of services, from essential procedures like surgeries to elective treatments such as cosmetic surgeries. It appeals to patients seeking high-quality medical care at lower costs than in their home countries.

Factors driving this market include the rising costs of healthcare in developed nations, long wait times, and the availability of advanced medical technologies in other countries. The market is growing rapidly, with significant opportunities for hospitals, clinics, and healthcare providers worldwide.

The Medical Tourism Market is experiencing substantial growth, with approximately 14 million people traveling globally each year for medical care. This market is driven by several key factors, including advancements in healthcare technologies and the availability of low-cost treatments in emerging economies such as Singapore, Thailand, and Dubai. These countries have positioned themselves as leading destinations for high-quality, affordable medical services. Additionally, the demand for both medical and cosmetic procedures is rising worldwide, contributing to the market's expansion.

For instance, Turkey has emerged as a notable player in this market. In 2021, Turkey attracted over 670,000 foreign patients for medical treatments, and this number increased significantly to over 1.25 million in the following year. This surge is indicative of the broader trend where patients are seeking cost-effective yet advanced medical solutions outside their home countries.

The variance in the number of people traveling for cosmetic surgery, ranging from 60,000 to 50 million globally, highlights the diverse and expanding nature of the market. The medical tourism sector not only offers opportunities for healthcare providers and hospitals but also for ancillary services such as travel agencies and insurance companies, which can cater to the needs of medical tourists.

In summary, the Medical Tourism Market is set for continued growth, driven by technological advancements, cost advantages in emerging economies, and increasing global demand for medical and cosmetic procedures. This dynamic market presents significant opportunities for stakeholders across the healthcare and travel industries, making it a crucial area of focus for strategic investment and development.

Key Takeaways

- Market Value: The Global Medical Tourism Market is poised to reach approximately USD 39.5 Billion by 2033, experiencing a substantial surge from USD 12.2 Billion in 2023. This growth trajectory is propelled by a robust CAGR of 12.8% during the forecast period spanning from 2024 to 2033.

- Treatment Type Analysis: Cosmetic Surgery emerges as the dominant sub-segment within the Medical Tourism Market, commanding a significant 32% share.

- Purpose of Travel Analysis: Medical Treatment stands out as the primary purpose of travel in the Medical Tourism Market, capturing a commanding 70% share.

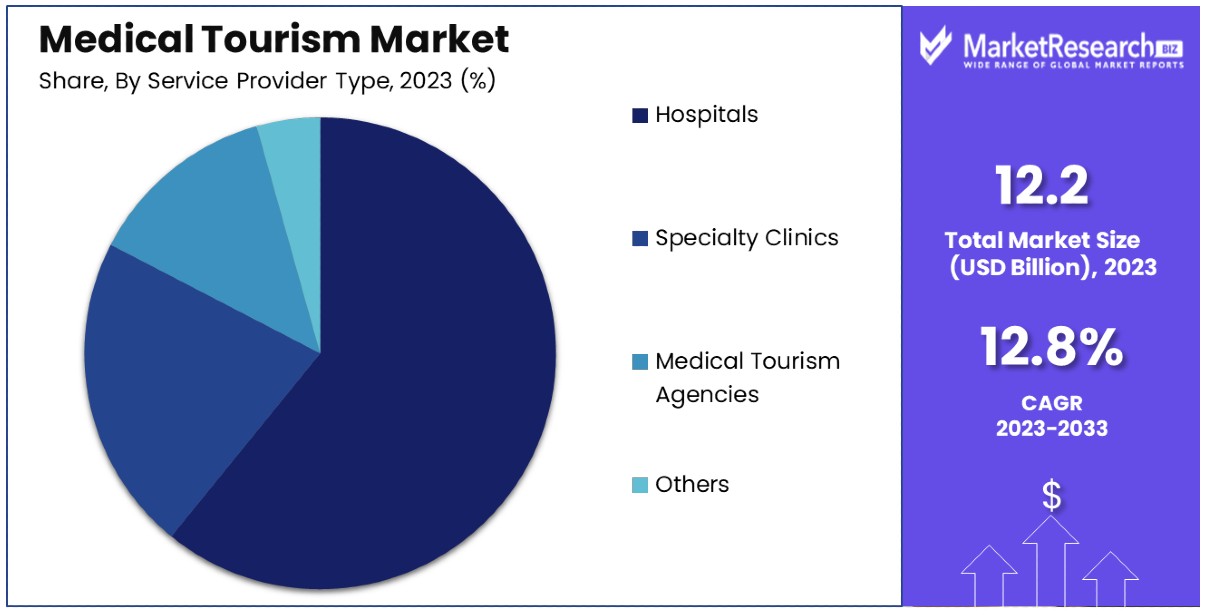

- Service Provider Analysis: Hospitals occupy a central position in the Medical Tourism Market, holding a substantial 80% share.

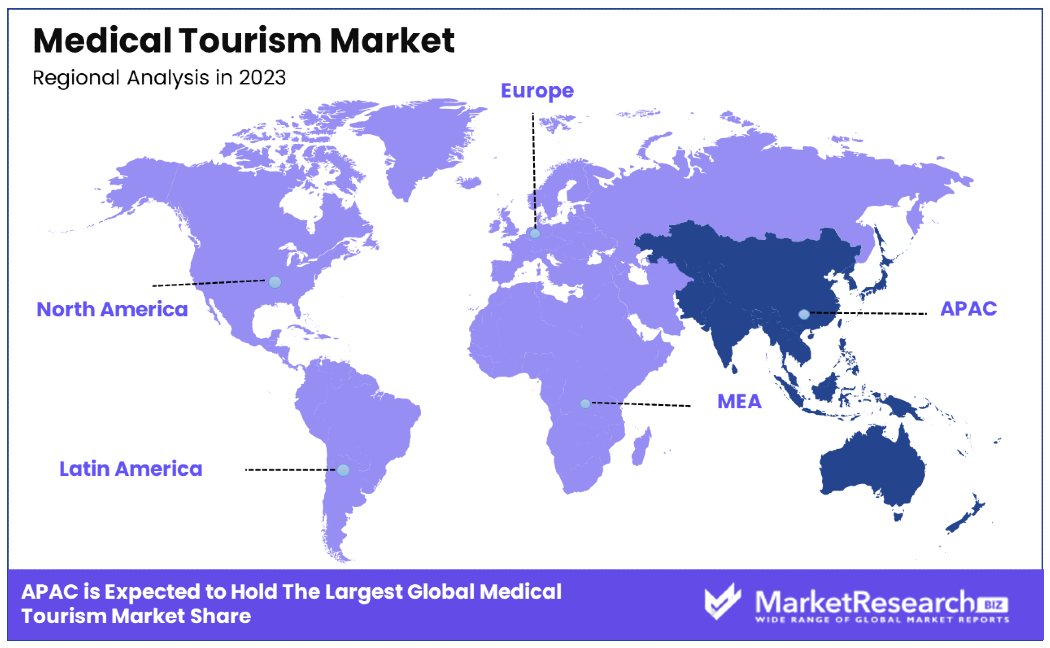

- APAC emerges as the dominant region in the Medical Tourism Market, commanding a significant 42.5% market share.

- North America holds approximately 15% of the Medical Tourism Market, reflecting its contribution to the global medical tourism landscape despite being overshadowed by APAC.

Driving Factors

Affordable Medical Costs Drive Market Growth

Affordable medical costs are a significant driver of the Medical Tourism Market. Patients from countries with high healthcare expenses are increasingly seeking treatments abroad where the same procedures are available at a fraction of the cost. For instance, in countries like India, Thailand, and Mexico, medical procedures such as heart surgery, orthopedic treatments, and cosmetic surgeries can be up to 70% cheaper than in Western nations. This cost disparity is particularly appealing to patients facing high out-of-pocket expenses or inadequate insurance coverage at home.

The substantial savings in medical expenses are a primary attraction for medical tourists. For example, a heart bypass surgery that might cost around $150,000 in the United States could be available for approximately $25,000 in India. This affordability extends beyond major surgeries to include a wide range of treatments, making these destinations highly competitive.

Moreover, this cost advantage is complemented by the availability of package deals that include travel, accommodation, and even post-treatment recovery plans, further enhancing the appeal of medical tourism. The interaction of cost savings with the convenience of bundled services amplifies the attractiveness of these destinations, fostering a robust growth trajectory for the market.

Availability of Advanced Medical Facilities Drives Market Growth

The availability of advanced medical facilities is a crucial factor in the growth of the Medical Tourism Market. Countries like Singapore, India, and Thailand have invested significantly in state-of-the-art hospitals and clinics that are equipped with cutting-edge technologies and staffed by highly skilled medical professionals. These facilities often provide medical care that meets or exceeds the standards found in many developed nations, making them attractive destinations for international patients.

These advanced medical centers offer a wide range of treatments, from complex surgeries to specialized care for conditions like cancer and cardiovascular diseases. For instance, hospitals in Singapore and Thailand are known for their expertise in cardiology and oncology, drawing patients seeking high-quality care at competitive prices.

The presence of internationally accredited hospitals and the availability of advanced treatment options enhance the credibility of these destinations. This credibility is further reinforced by positive patient testimonials and global health accreditations, which assure prospective patients of the quality and safety of the medical services offered.

The combination of cutting-edge technology, highly trained medical staff, and international accreditation positions these destinations as top choices for medical tourists, thereby driving market growth.

Shorter Wait Times Drive Market Growth

Shorter wait times are a key factor contributing to the growth of the Medical Tourism Market. In countries with overburdened public healthcare systems, patients often endure long wait times for non-emergency procedures, which can lead to increased stress and potential health risks. Medical tourism destinations like Costa Rica and Mexico offer significantly shorter wait times, providing timely access to treatments such as dental work, cosmetic surgeries, and fertility treatments.

For example, in the UK and Canada, patients might wait several months for procedures like hip replacements or cataract surgeries. In contrast, medical tourists can access these treatments much more quickly in destinations like Mexico, where the healthcare system is designed to accommodate international patients with minimal delays.

The appeal of reduced waiting periods is particularly strong among patients with conditions that, while not immediately life-threatening, significantly impact their quality of life. Faster access to medical care allows these patients to achieve better health outcomes sooner, enhancing their overall quality of life.

This factor interacts with the availability of advanced medical facilities and affordable costs, creating a compelling value proposition for medical tourists. The combined effect of shorter wait times, high-quality care, and cost savings significantly boosts the attractiveness of medical tourism, driving market growth.

Restraining Factors

Patient Safety and Quality Concerns Restrain Market Growth

Patient safety and quality concerns significantly limit the growth of the Medical Tourism Market. Despite efforts to maintain high standards, some patients worry about the quality of care, hygiene, and safety protocols in foreign healthcare facilities.

Language barriers and cultural differences can further exacerbate these concerns, making patients hesitant to travel for medical treatment. Unfamiliar healthcare systems may also lead to anxiety about receiving adequate post-operative care and support. These apprehensions can deter potential medical tourists, even in the presence of accredited and reputable healthcare institutions, thereby restraining market expansion.

Legal and Ethical Considerations Restrain Market Growth

Legal and ethical considerations pose substantial challenges to the Medical Tourism Market. Issues such as informed consent, malpractice liability, and follow-up care are significant concerns for patients seeking treatment abroad. The difficulty in pursuing legal recourse for medical malpractice in a foreign country can deter patients.

Moreover, obtaining proper follow-up care in their home countries after undergoing procedures abroad can be problematic. Ethical issues, particularly with procedures like organ transplants and stem cell therapies, also pose challenges, as these treatments may be subject to legal restrictions or ethical debates in various countries. These factors collectively hinder the growth of the medical tourism market.

Treatment Type Analysis

Cosmetic Surgery dominates with 32% due to increasing global aesthetic awareness and affordability.

Cosmetic surgery represents the largest sub-segment within the Medical Tourism Market, driven by a growing global interest in aesthetic enhancements and the availability of cost-effective procedures in countries traditionally known for medical tourism. The prevalence of cosmetic surgery is bolstered by technological advancements in surgical techniques, which improve safety and results, attracting patients worldwide.

The appeal of cosmetic surgery in the medical tourism sector is enhanced by significant cost savings offered in countries like Thailand, Brazil, and South Korea, combined with high standards of care. These destinations are renowned for their specialized clinics that offer a wide range of cosmetic procedures, from minimally invasive treatments like Botox and fillers to more complex surgeries such as rhinoplasty and liposuction.

Other treatment types such as Dental Treatment, Orthopedic Treatment, and Cardiovascular Treatment also contribute substantially to the medical tourism landscape. Each of these segments caters to a specific patient need and demographic, with dental treatments being popular for their quick and noticeable results and orthopedic treatments increasing due to the aging global population. However, their roles, while significant, do not eclipse the market share and growth driven by cosmetic surgery.

Purpose of Travel Analysis

Medical Treatment dominates with 70% due to critical health needs and access to advanced care.

The purpose of travel within the Medical Tourism Market is primarily driven by Medical Treatment, constituting the majority of the market's purpose segment. This dominance is due to patients seeking high-quality medical care for conditions that require advanced treatments not available or affordable in their home countries. Countries such as India, Malaysia, and Singapore are preferred destinations due to their advanced healthcare infrastructure, English-speaking medical staff, and significantly lower costs compared to Western nations.

Medical treatment includes a variety of procedures from life-saving surgeries like cardiovascular and cancer treatments to elective surgeries such as orthopedic and neurological treatments. The extensive range of services available, coupled with the international accreditation of hospitals, reinforces the trust and reliability perceived by medical tourists.

Wellness and Spa, the other key sub-segment, also plays a critical role in attracting medical tourists. Though not as large in market share, this segment complements the medical treatment segment by offering recovery and rehabilitation services that are an essential part of the medical tourism experience. These services often include traditional and alternative therapies that help patients recover in a serene and supportive environment, thus enhancing the overall attractiveness of medical tourism destinations.

Service Provider Analysis

Hospitals dominate with 80% due to comprehensive services and integrated care.

Hospitals are the cornerstone of the Medical Tourism Market, primarily because they offer an integrated approach to healthcare that includes state-of-the-art medical facilities, skilled personnel, and a wide range of services. The dominance of hospitals is rooted in their ability to provide comprehensive care that covers all aspects of a patient's treatment plan, from initial consultations and diagnostics to surgery and post-operative care.

The leading position of hospitals in the medical tourism industry is reinforced by their accreditation from international organizations, which ensures that they meet rigorous healthcare standards. This accreditation is crucial for medical tourists, as it provides assurance of quality care and safety.

While hospitals hold the majority of the market, Specialty Clinics, Medical Tourism Agencies, and other service providers also contribute to the sector's diversity and growth. Specialty clinics offer focused expertise in areas like cosmetic and dental treatments, appealing to niche markets. Medical tourism agencies facilitate the travel and treatment process, providing tailored packages that simplify logistics and enhance the overall patient experience. These entities support the market by addressing specific needs and preferences, thus broadening the scope and accessibility of medical tourism services.

Key Market Segments

By Treatment Type

- Cosmetic Surgery

- Dental Treatment

- Orthopedic Treatment

- Cardiovascular Treatment

- Fertility Treatment

- Cancer Treatment

- Neurological Treatment

- Bariatric Surgery

- Others

By Purpose of Travel

- Medical Treatment

- Wellness and Spa

- Others

By Service Provider Type

- Hospitals

- Specialty Clinics

- Medical Tourism Agencies

- Others

Growth Opportunities

Development of Niche Medical Services Offers Growth Opportunity

The development of niche medical services presents significant growth opportunities in the Medical Tourism Market. Destinations that specialize in areas such as fertility treatments, stem cell therapies, or alternative medicine can differentiate themselves and attract patients seeking specialized care. For example, India and Thailand are renowned for their expertise in Ayurvedic and traditional medicine, drawing patients interested in holistic and alternative treatments.

This specialization allows these destinations to stand out in a competitive market by offering unique medical services that are not widely available elsewhere. By focusing on niche services, medical tourism destinations can cater to specific patient needs, enhancing their market appeal and driving growth.

Integration of Medical Tourism with Wellness and Preventive Care Offers Growth Opportunity

The integration of medical tourism with wellness and preventive care offers a robust growth opportunity. There is a growing trend for destinations to offer comprehensive healthcare packages that combine medical treatments with wellness programs and preventive care services. This holistic approach appeals to patients seeking a complete healthcare experience, including medical procedures, rejuvenation, relaxation, and lifestyle modifications.

Countries like Thailand, India, and Bali are leading this trend by providing integrated medical tourism and wellness packages. This integration enhances the attractiveness of these destinations, catering to the increasing demand for holistic health solutions and driving market expansion.

Trending Factors

Telemedicine and Remote Monitoring Are Trending Factors

Telemedicine and remote monitoring are trending factors in the Medical Tourism Market, offering significant advantages for patients and providers. These technologies allow patients to have virtual consultations, receive follow-up care, and undergo ongoing monitoring from their home countries, reducing the need for prolonged stays or repeated visits to medical tourism destinations.

This trend is especially beneficial for non-invasive treatments and post-operative care. Companies like Medigo and Bookimed are capitalizing on telemedicine to enhance the medical tourism experience, making it more accessible and convenient. The integration of telemedicine improves patient satisfaction and expands the market's reach, contributing to its growth.

Personalized Medicine and Targeted Treatments Are Trending Factors

Personalized medicine and targeted treatments are increasingly influencing the Medical Tourism Market. Advances in these areas enable treatments tailored to individual genetic profiles, molecular biomarkers, and specific health conditions.

Countries like Singapore and the United Arab Emirates are at the forefront, investing heavily in personalized medicine programs. These destinations attract patients seeking advanced, customized therapies that offer higher efficacy and fewer side effects. The trend towards personalized medicine enhances the appeal of medical tourism destinations by providing cutting-edge treatments, thus driving market expansion and catering to the growing demand for specialized medical care.

Regional Analysis

APAC Dominates with 42.5% Market Share

The Asia-Pacific (APAC) region leads the Medical Tourism Market, commanding a significant 42.5% market share. This dominance is driven by several factors, including cost-effective medical treatments, advanced healthcare facilities, and a wide range of specialized medical services. Countries like India, Thailand, and Singapore are major contributors, offering high-quality medical care at much lower costs compared to Western nations. Additionally, these countries have invested heavily in medical infrastructure and technology, enhancing their appeal to international patients. The availability of diverse treatment options, coupled with shorter waiting times and the allure of exotic destinations, further strengthens APAC’s position in the market.

APAC’s dominance is primarily fueled by the affordability of medical procedures, advanced medical technology, and the presence of internationally accredited hospitals. The region offers significant cost savings, with treatments often costing 50% to 70% less than in Western countries. For example, heart surgery in India can cost a fraction of the price in the US. Moreover, countries like Singapore and Thailand are renowned for their state-of-the-art medical facilities and highly skilled healthcare professionals. The region's emphasis on medical tourism infrastructure, including specialized clinics and wellness centers, also contributes to its market leadership.

Regional Market Share Overview

North America holds approximately 15% of the Medical Tourism Market. This region’s market share is driven by high healthcare costs and long waiting times, prompting patients to seek affordable and timely medical treatments abroad.

Europe accounts for around 20% of the market. European patients often travel to neighboring countries for cost-effective medical care, particularly for dental and cosmetic procedures, contributing to the region’s market share.

Asia Pacific (APAC) leads with 42.5% of the market share. This region’s dominance is attributed to affordable treatments, advanced medical facilities, and a wide range of specialized services.

Middle East & Africa holds about 10% of the market. The region is growing as a medical tourism destination due to investments in healthcare infrastructure and the availability of specialized treatments in countries like the UAE and South Africa.

Latin America has a market share of roughly 12.5%. Countries like Mexico and Brazil are popular destinations for medical tourists, offering affordable healthcare and specialized treatments, particularly in cosmetic surgery and dental care.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Medical Tourism Market is characterized by a diverse group of hospitals and health facilities that collectively enhance the sector's growth and global reach. Key players such as Apollo Hospitals Enterprise Ltd and Bumrungrad International Hospital are pivotal, with their extensive international accreditation and reputation for quality care attracting patients globally. These institutions not only lead in volume but also in innovative treatment options, setting industry standards.

KPJ Healthcare Berhad and Raffles Medical Group further strengthen the market by integrating luxury healthcare services with standard medical treatments, catering to a broad spectrum of medical tourists. Their strategic locations in Asia enhance access to cutting-edge healthcare for regional and international patients.

European player Asklepios Kliniken GmbH stands out for its high-end medical technology and specialist services, making significant inroads into the European medical tourism market. Similarly, facilities like Seoul National University Hospital and Wooridul Spine Hospital in South Korea are renowned for their specialization in complex procedures and advanced healthcare technologies, drawing a specialized clientele.

Lesser-known yet impactful contributors such as Aditya Birla Memorial Hospital and B. L. Kapur Memorial Hospital cater predominantly to the South Asian market, providing cost-effective solutions without compromising on quality. Their strategic positioning within densely populated regions enables them to influence local and regional markets profoundly.

Emerging facilities like Kasemrad Hospital International Rattanathibet and Miot Hospital are gradually making their mark through strategic marketing and partnerships, focusing on niche medical services that attract international patients seeking specific treatments.

Overall, these key players collectively define the contours of the medical tourism market, driven by quality, accessibility, and specialization, which are crucial for maintaining competitiveness and market growth.

Market Key Players

- Bumrungrad International Hospitals

- KPJ Healthcare Berhad

- Raffles Medical Group

- Apollo Hospitals Enterprise Limited

- Asklepios Kliniken GmbH &

- Aditya Birla Memorial Hospital

- Seoul National University Hospital

- Wooridul Spine Hospital

- B. L. Kapur Memorial Hospital

- Kasemrad Hospital International Rattanathibet

- Miot Hospital

- Mission Hospital

Recent Developments

- On May 2024, the number of medical tourists in India is projected to exceed pre-pandemic levels in CY24. This surge indicates a significant recovery and growth in India's medical tourism sector.

- On May 2024, a collaboration between EBL and Mastercard to introduce a prepaid card specifically designed for medical tourism. This initiative aims to facilitate financial transactions for medical tourists, enhancing their experience and convenience.

- As per March 2024, Tunisia's flourishing medical tourism industry has been attracting millions of foreigners. The sector in Tunisia generates substantial annual revenues, contributing significantly to the country's overall tourism income. Medical tourism in Tunisia is closely linked to the general tourism sector, emphasizing the dual nature of foreign patients as both medical and leisure travelers.

- On January 2024, Financial Express reported that Ferns N Petals has diversified into medical tourism by launching Medijourney. This move signifies the company's expansion into the healthcare sector, offering a new avenue for individuals seeking medical treatments combined with travel experiences.

Report Scope

Report Features Description Market Value (2023) USD 12.2 Billion Forecast Revenue (2033) USD 39.5 Billion CAGR (2024-2033) 12.8% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Treatment Type (Cosmetic Surgery, Dental Treatment, Orthopedic Treatment, Cardiovascular Treatment, Fertility Treatment, Cancer Treatment, Neurological Treatment, Bariatric Surgery, Others), By Purpose of Travel (Medical Treatment, Wellness and Spa, Others), By Service Provider Type (Hospitals, Specialty Clinics, Medical Tourism Agencies, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Bumrungrad International Hospitals, KPJ Healthcare Berhad, Raffles Medical Group, Asklepios Kliniken GmbH &, Aditya Birla Memorial Hospital, Seoul National University Hospital, Wooridul Spine Hospital, B. L. Kapur Memorial Hospital, Kasemrad Hospital International Rattanathibet, Miot Hospital, Mission Hospital, Apollo Hospitals Enterprise Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Apollo Hospitals Enterprise Limited

- Aditya Birla Memorial Hospital

- Asian Heart Institute

- Bangkok Hospital Medical Center

- Barbados Fertility Centre

- Bumrungrad International Hospital

- Fortis Healthcare Limited

- Infectious Diseases Partners Pte Ltd

- KPJ Healthcare Berhad

- Min-Sheng General Hospital