Marine Port Services Market Report By Service Analysis (Container Handling Services, Ship Repair & Maintenance Services, Navigation Services, Supply Chain & Logistics Solution Services, Mechanical & Electrical Engineering Services) By Port Size and Capacity Analysis (Major Ports, Minor Ports), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

42454

-

Dec 2023

-

130

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Driving Factors

- Restraining Factors

- Marine Port Services Market Segmentation Analysis

- Marine Port Services Industry Segments

- Marine Port Services Market Regional Analysis

- Marine Port Services Industry By Region

- Marine Port Services Market Key Player Analysis

- Marine Port Services Industry Key Players

- Recent Developments

- Report Scope

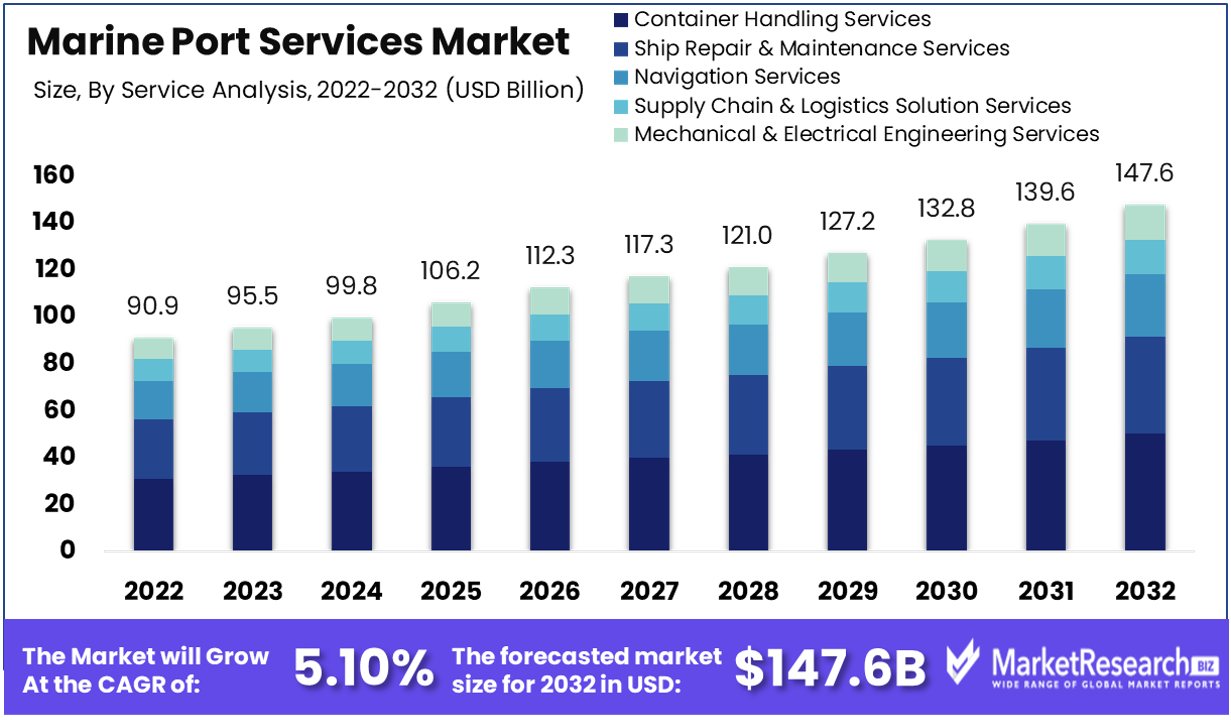

The Marine Port Services Market size is predicted to reach approximately USD 147.9 Bn by 2032, from a valuation of USD 90.09 Bn in 2022, growing at a CAGR of 5.10% during the forecast period from 2023 to 2032.

Marine Port Services encompass a broad spectrum of activities essential for the efficient and effective operation of seaports. These services include cargo handling, vessel berthing, pilotage, towing, and anchorage, as well as logistics support like warehousing and distribution. Key to global trade, they facilitate the smooth transition of goods and passengers between sea transport and land-based transportation systems.

The efficiency of these services directly impacts global supply chains, influencing trade flow and economic dynamics. With the increasing complexity of global trade and the rise of mega-ships, the demand for more sophisticated and integrated marine port services is growing, highlighting their critical role in international commerce and logistics.

Global container port throughput continued to increase in 2022, reaching 866 million TEUs. US container port throughput also increased year-over-year, with December 2021 volumes reaching 62 million TEUs compared to 54 million TEUs in December 2020 - growth of around 15%. This indicates rising demand for port services in the US specifically.

Moreover the World Bank data shows that container port traffic has been increasing in recent years across many major economies. This points to solid overall growth in seaborne container trade volumes, driving increased demand for marine terminal operations, cargo handling, storage etc. at ports globally.

As global maritime traffic intensifies, the need for advanced systems to monitor and guide vessel movements becomes crucial. This demand boosts the market for companies specializing in VTS, as they offer solutions to optimize traffic flow and enhance navigational safety.

Investing in automation technologies like AI, self-driving vehicles, self-unloading bulk carrier technology, and automated cranes is pivotal in enhancing port safety, efficiency, and productivity. The integration of these technologies streamlines operations, reduces manual errors, and accelerates cargo shipping processes.

The implementation of IoT systems further optimizes tracking and monitoring, leading to more efficient port operations. This technological shift is supported by data indicating a rise in smart port initiatives worldwide. Ports adopting these innovations can significantly improve their competitive edge and operational capacity, driving market growth in an increasingly digitized industry.

The emergence of new regional trade hubs presents lucrative opportunities for marine port services companies. As global trade patterns evolve, establishing a presence in emerging trade centers becomes essential for tapping into new markets. Marine VFDs optimize port services by enhancing vessel maneuverability and power efficiency, elevating the overall efficiency of marine operations.

Moreover, developing high-value-added activities like assembly, manufacturing, and customization enables marine port service companies to participate more extensively in the supply chain. By offering these services, ports can attract a wider range of clients seeking integrated logistics solutions, enhancing their value proposition.

Additionally, offering differentiated sustainability services, including renewable energy, emissions reduction, and waste management, aligns with the increasing focus on environmental responsibility in the shipping industry. For Instance, the Maritime & Port Authority of Singapore (MPA), Port of Los Angeles, and Port of Long Beach have formed a strategic partnership for a green and digital shipping corridor (GDSC) across the Pacific.

Driving Factors

Containerized and Bulk Cargo Demand Drives Port Services Growth

The rising customer demand for containerized and bulk cargo transportation is evident in the significant growth in global containerized export, mainly driven by strength in U.S. container imports, which is expected to continue growing by about 2-3% in 2022.

Furthermore, the Review of Maritime Transport 2022 reports that world maritime trade bounced back in 2021, with shipments growing by an estimated 3.2% to reach 11 billion tons, riding on the surge in demand for containerized cargo. Ports play a crucial role in facilitating this demand, offering services that ensure the smooth transit of goods. This trend is expected to continue, fueled by the ongoing globalization and expansion of international trade, indicating sustained growth in the marine port services market.

Marine Freight Transportation Surge Boosts Port Services

The high growth of the marine freight transportation market and increasing global exports are substantially contributing to the expansion of the Marine Port Services Market. As international trade volumes grow, driven by economic globalization and expanding global exports, the demand for efficient and effective port services also rises.

This growth in marine freight transportation reflects a broader economic trend of increased international trade, suggesting a continued demand for port services to accommodate the growing flow of goods.

New Regional Trade Hubs and Ports Expand Services Market

The expansion of new regional trade hubs and ports is a key driver for the Marine Port Services Market. The development of new ports and the enhancement of existing ones in emerging trade hubs are essential to support the growing volume of maritime trade.

As trade patterns shift and new economic corridors emerge, there is a need for ports that can handle increased traffic and provide efficient services. The establishment of these new hubs and ports is not only a response to current trade demands but also a strategic move to cater to future trade growth. This expansion indicates a market evolving in response to shifting global trade dynamics, with port services expanding to meet the needs of new and developing trade management hubs.

Restraining Factors

Environmental Concerns Slow Down Marine Port Services Market Expansion

The expansion of marine port services is significantly hindered by environmental concerns, specifically air and water pollution and habitat disruption. Expanding port infrastructure often involves extensive land and water area development, which can lead to significant ecological impacts, including habitat destruction and pollution.

These environmental concerns have led to stricter regulatory approvals and increased public scrutiny, significantly slowing down the expansion process. Marine shipping is responsible for two to three percent of global greenhouse gas emissions, which are predicted to increase to 17% by 2050 if left unchecked. Additionally, port operations can lead to environmental impacts on air, water, and land, including noise pollution, water pollution, and ecological impacts.

Technological Complexities in Modern Port Operations Restrain Market Growth

Today's ports are increasingly reliant on sophisticated technologies for cargo handling, logistics management, security, and communication systems. Implementing and integrating these advanced technologies requires substantial investment, skilled labor, and regular maintenance.

Smaller ports or those in developing regions may find it challenging to adopt and maintain these technologies due to financial constraints or lack of technical expertise. This technological divide can lead to inefficiencies and limit the competitiveness and growth of ports unable to keep pace with technological advancements.

Marine Port Services Market Segmentation Analysis

By Service Analysis

Container Handling Services dominate the Marine Port Services Market with a 34% share, reflecting the critical role these services play in global trade. The increase in international trade, particularly in containerized cargo, has significantly driven the demand for efficient container shipping. Advanced technologies like automated cranes, GPS tracking, and sophisticated software systems are being employed to enhance efficiency and throughput at ports.

Ship repair & maintenance services are vital for maintaining the operational efficiency and safety of vessels. With increasing regulatory requirements and the need for environmental compliance, ship repair and maintenance services are experiencing steady growth.

Navigation services are essential for the safe and efficient movement of ships within ports, navigation services like pilotage, towing, and mooring are critical, especially in congested or complex port environments. Supply chain & logistics solution services is growing rapidly due to the increasing need for integrated logistics solutions. Ports are evolving into logistics hubs, offering value-added services that extend beyond traditional loading and unloading.

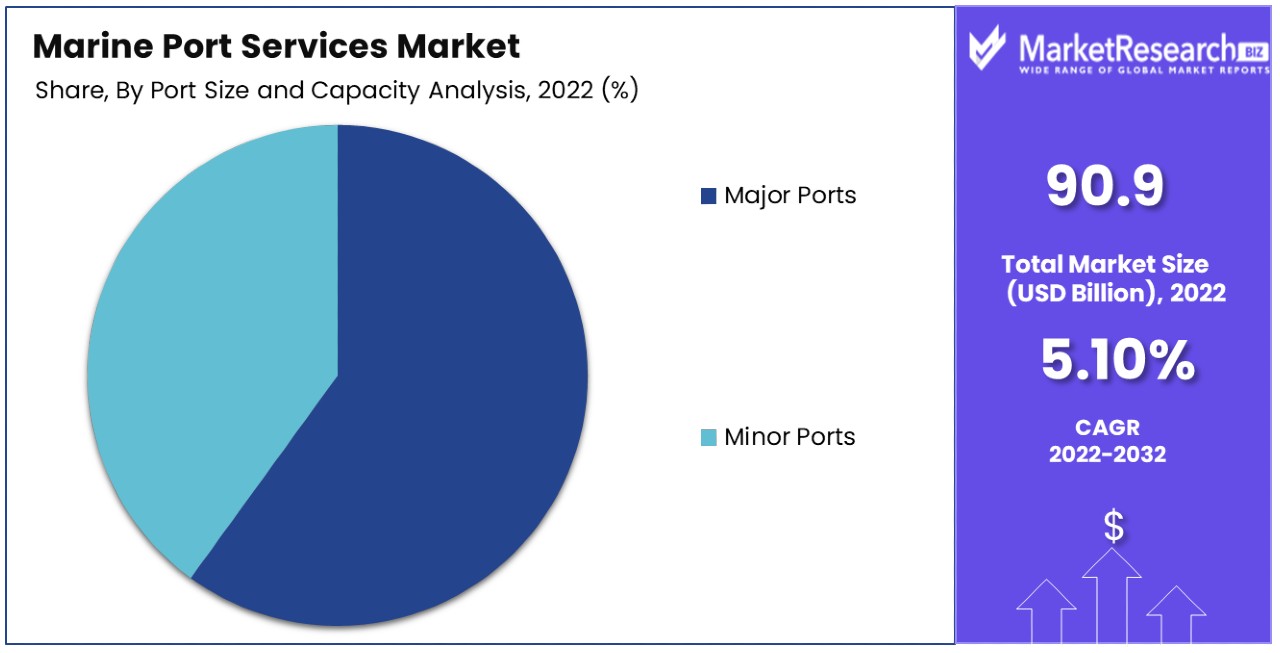

By Port Size and Capacity Analysis

Major ports represent the dominant segment in the marine port services market, characterized by their extensive size, capacity, and the volume of cargo they handle. These ports serve as primary hubs for international trade, offering a wide range of services including container handling, trade management, ship repair and maintenance, and navigation assistance. Major ports' dominance can be attributed to their strategic locations, which often serve as key links in global supply chains. They boast advanced infrastructure such as deep-water berths, container terminals and state-of-the-art handling equipment capable of accommodating even the largest vessels efficiently.

Minor ports often serve a significant function in regional trade and transportation. With limited capacity and cargo handling capabilities compared to major ports, minor ports play a vital role in regional commerce and commerce. These ports often cater to specific types of cargo or serve particular geographic areas. The importance of minor ports is growing, especially in facilitating local economic development, catering to smaller shipping lines, and providing alternatives to alleviate congestion in major ports.

Marine Port Services Industry Segments

By Service Analysis

- Container Handling Services

- Ship Repair & Maintenance Services

- Navigation Services

- Supply Chain & Logistics Solution Services

- Mechanical & Electrical Engineering Services

By Port Size and Capacity Analysis

- Major Ports

- Minor Ports

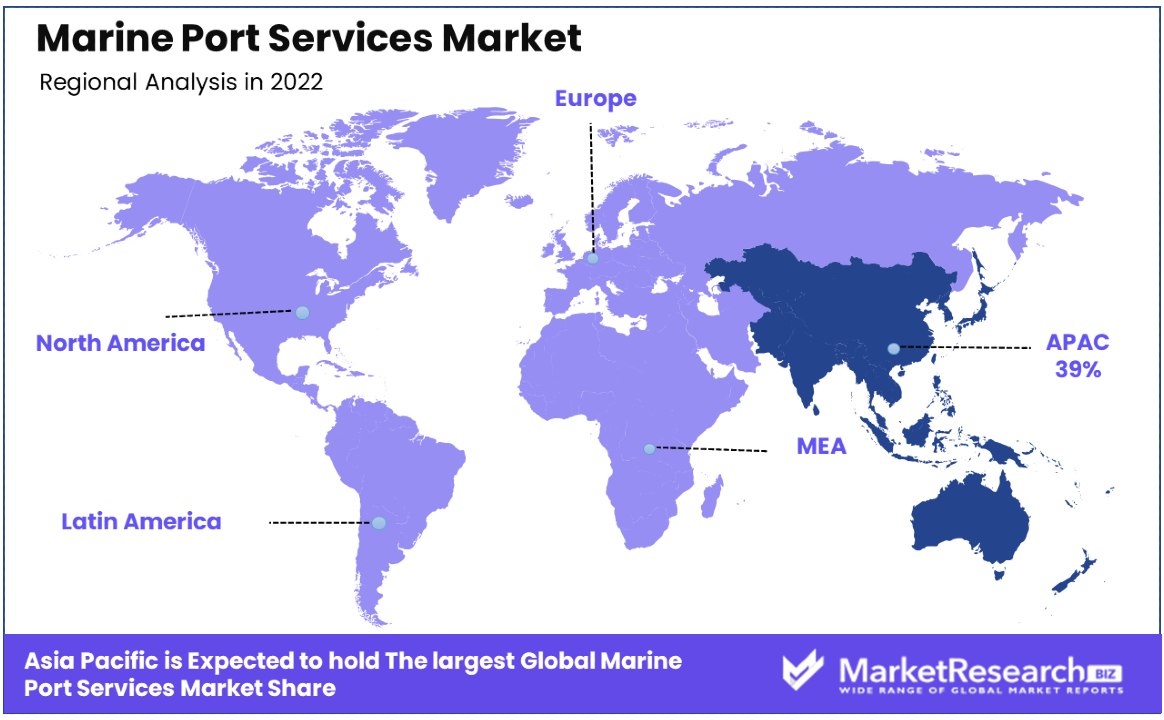

Marine Port Services Market Regional Analysis

Asia Pacific Dominates with 39% Market Share

Asia Pacific's commanding 39% share in the Marine Port Services Market is largely driven by the region's status as a key hub in global trade and shipping. The presence of some of the world's busiest ports, like Shanghai, Singapore, and Hong Kong, significantly contributes to this market dominance. Additionally, the region's rapid economic growth, particularly in countries like China and India, has led to an increase in maritime trade activities, thereby boosting the demand for port services. The strategic geographical location of many countries in Asia Pacific also facilitates extensive trade routes, both intra-regionally and internationally.

The market dynamics in Asia Pacific are influenced by substantial investments in port infrastructure development and modernization. The region’s focus on enhancing port efficiency and capacity through technological advancements, such as automation and digitalization, plays a crucial role. Furthermore, the increasing adoption of green port initiatives for sustainable and eco-friendly port operations boosts the market.

Europe's Strategic Location and Advanced Port Infrastructure

Europe’s marine port services market benefits from the region's strategic location, connecting major global trade routes. European ports are known for their advanced infrastructure, efficient logistics, and integration with other modes of transportation. The strategic location of Europe and its advanced port infrastructure are key factors in the region's maritime prominence.

For instance, the Port of Rotterdam in the Netherlands benefits from its strategic location, connecting the European continent to the world and its extensive network of highways, railways, and inland waterways, allowing for efficient distribution of goods throughout Europe.

North America Has Robust Trade Activities and Technological Adoption

The region’s focus on enhancing port capacities and efficiency, combined with its significant role in international trade, supports the market. North America has a blooming ocean-tech innovation ecosystem, with high concentrations of marine-tech innovation hubs in Halifax and Boston, which specialize in sectors of the ocean economy well suited to their geography.

Marine Port Services Industry By Region

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

Marine Port Services Market Key Player Analysis

DP World and APM Terminals, as major players, offer extensive port management services, setting benchmarks in operational efficiency, product launches and technological integration. Their strategic positioning across major global routes highlights their influence on international trade dynamics.

Hutchison Port Holdings and China Merchants Port Holdings, with their significant port networks, are pivotal in facilitating global maritime trade, emphasizing the market's focus on strategic geographic presence and capacity enhancement. CMA CGM and MSC, both major shipping companies, contribute to the market with their terminal operations, reflecting the industry's trend towards vertical integration for more streamlined logistics.

Maersk, ONE, and Evergreen Marine, renowned for their shipping services, also play significant roles in port operations, showcasing the market's diversity and the growing need for comprehensive service offerings. Yang Ming Marine Transport and Hapag-Lloyd, while smaller in comparison, provide specialized port services, catering to specific market segments and routes.

Collectively, these key companies drive the Marine Port Services Market, representing a range of strategies - from expanding port networks to integrating shipping and terminal operations - crucial for enhancing global trade efficiency and maritime logistics.

Marine Port Services Industry Key Players

- DP World

- APM Terminals

- Hutchison Port Holdings

- China Merchants Port Holdings

- CMA CGM

- MSC

- Maersk

- ONE

- Evergreen Marine

- Yang Ming Marine Transport

- Hapag-Lloyd

- K Line

- Mitsui O.S.K. Lines

- Nippon Yusen Kaisha

- Mediterranean Shipping Company

- CSAV

- Shanghai International Port

- PIL

- Ningbo Port Company Limited

- ZIM Integrated Shipping Services

- Hamburger Hafen Und Logistik AG

Recent Developments

- In November 2023, U.S. Senator Susan Collins announced a significant development in Marine Port Services. The Maine Department of Transportation (MaineDOT) was awarded $14,240,000 through the U.S. Department of Transportation Maritime Administration’s (MARAD) Port Infrastructure Development Program (PIDP). This funding is allocated to support components of MaineDOT's "Enhancing Maine's Three-Port Strategy for the Future" proposal.

- In August 2023, The Indian government announced the establishment of the Bureau of Port Security, with the aim of upgrading security measures across all ports in the country. This announcement was made by Shri Sarbananda Sonowal, the Union Minister for Ports, Shipping, and Waterways, during the 19th Maritime States Development Council meeting held in Kevadia, Gujarat.

- In 2023, The Port of NEOM, described as the primary seaport of entry to the northwest of Saudi Arabia and which now incorporates Duba Port, officially opened for business in May 2023. The operations include a CMA CGM scheduled liner service, general cargo facilities, storage, and passenger services. More than SAR7.5 billion ($2.025 billion) has been committed to the new port's development so far. It serves as a key entry point for goods and materials required for the development of the City of NEOM, Saudi Arabia's vast new city of the future.

- In March 2023, the Egyptian government signed a significant agreement with the UAE to enhance logistics and port management at its commercial maritime gateways in the Suez Canal area.

Report Scope

Report Features Description Market Value (2022) US$ 90.9 Bn Forecast Revenue (2032) US$ 147.6 Bn CAGR (2023-2032) 5.10% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Service Analysis (Container Handling Services, Ship Repair & Maintenance Services, Navigation Services, Supply Chain & Logistics Solution Services, Mechanical & Electrical Engineering Services) By Port Size and Capacity Analysis (Major Ports, Minor Ports) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape DP World, APM Terminals, Hutchison Port Holdings, China Merchants Port Holdings, CMA CGM, MSC, Maersk, ONE, Evergreen Marine, Yang Ming Marine Transport, Hapag-Lloyd, K Line, Mitsui O.S.K. Lines, Nippon Yusen Kaisha, Mediterranean Shipping Company, CSAV, Shanghai International Port, PIL, Ningbo Port Company Limited, ZIM Integrated Shipping Services, Hamburger Hafen Und Logistik AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- DP World

- APM Terminals

- Hutchison Port Holdings

- China Merchants Port Holdings

- CMA CGM

- MSC

- Maersk

- ONE

- Evergreen Marine

- Yang Ming Marine Transport

- Hapag-Lloyd

- K Line

- Mitsui O.S.K. Lines

- Nippon Yusen Kaisha

- Mediterranean Shipping Company

- CSAV

- Shanghai International Port

- PIL

- Ningbo Port Company Limited

- ZIM Integrated Shipping Services

- Hamburger Hafen Und Logistik AG