GPS Tracking Device Market By Type (Standalone GPS Trackers, OBD GPS Trackers, Personal Trackers, Vehicle Trackers, Asset Trackers), By Deployment Type (Cargo & Container, Commercial Vehicle, Others), By End Use Industry (Government, Construction, Metals and Mining, Transportation and Logistics, Oil and Gas, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

11047

-

July 2024

-

160

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

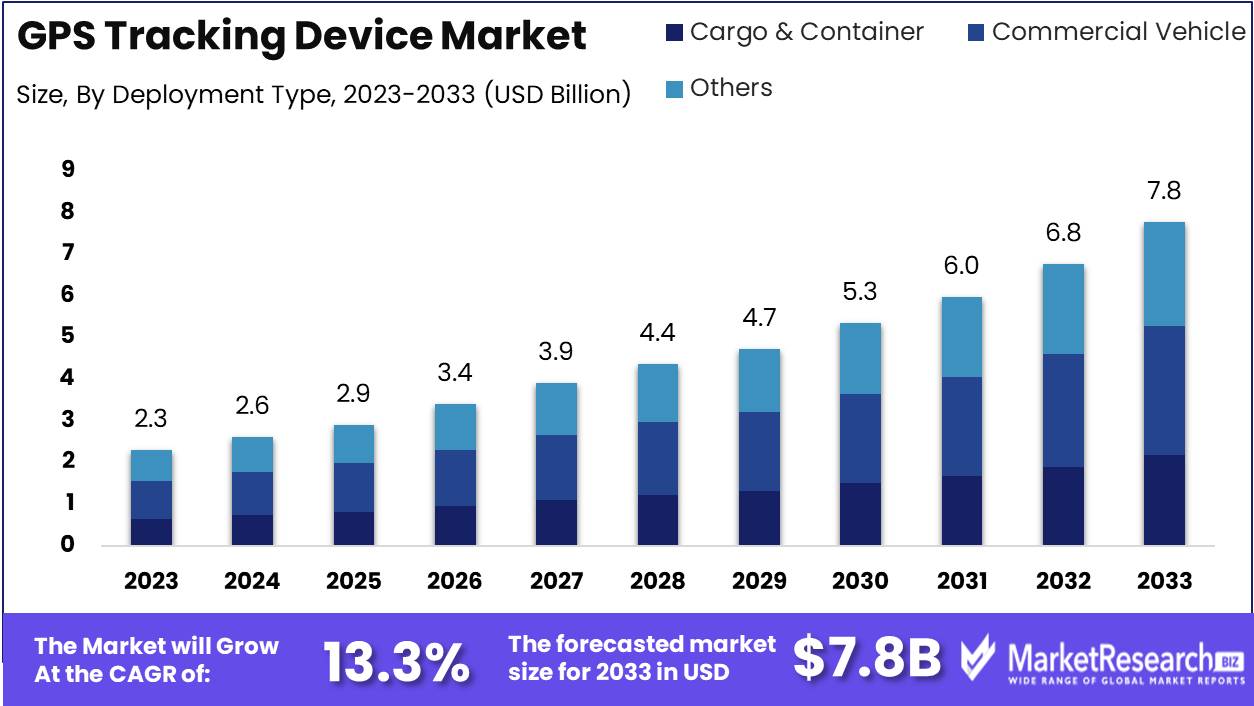

The Global GPS Tracking Device Market was valued at USD 2.3 Bn in 2023. It is expected to reach USD 7.8 Bn by 2033, with a CAGR of 13.3% during the forecast period from 2024 to 2033.

The GPS Tracking Device Market encompasses the range of devices and technologies used for monitoring and tracking the location of assets, vehicles, and individuals through the Global Positioning System (GPS). This market includes personal trackers, vehicle tracking systems, fleet management solutions, and asset tracking devices, all designed to provide real-time location data, enhance operational efficiency, and improve safety and security.

The GPS Tracking Device Market is poised for substantial growth, driven by technological advancements and the increasing demand for real-time location tracking across various sectors. A pivotal moment in this market's evolution was the completion of the full constellation of 24 satellites in 1995, which significantly enhanced the reliability and accuracy of GPS tracking devices. This milestone marked a crucial advancement, providing a robust foundation for the widespread adoption of GPS technology.

Furthermore, the integration of real-time monitoring capabilities has revolutionized the utility of GPS tracking devices. Systems like RapidSOS Monitoring exemplify this by demonstrating a reduction in emergency response times by 25-30%. This capability underscores the transformative potential of GPS tracking in critical applications such as emergency services, where timely interventions can save lives and mitigate risks.

As the market evolves, the focus will likely shift towards enhancing the functionality and integration of GPS tracking devices with other technologies, such as IoT and AI. This integration will enable more sophisticated data analytics, predictive maintenance, and enhanced security features, further expanding the application scope of GPS tracking solutions. Additionally, the growing emphasis on supply chain transparency and fleet management efficiency is expected to drive the adoption of advanced GPS tracking systems in logistics and transportation sectors.

Stakeholders in this market must prioritize continuous innovation and investment in R&D to maintain competitive advantage and address emerging challenges. By leveraging the advancements in GPS technology and expanding their application horizons, businesses can unlock significant value and drive operational excellence in the increasingly connected global economy.

Key Takeaways

- Market Value: The Global GPS Tracking Device Market was valued at USD 2.3 Bn in 2023. It is expected to reach USD 7.8 Bn by 2033, with a CAGR of 13.3% during the forecast period from 2024 to 2033.

- By Type: Vehicle Trackers make up 30% of the market, essential for fleet management and security.

- By Deployment Type: Commercial Vehicle usage leads at 40%, enhancing fleet efficiency and compliance with regulations.

- By End Use Industry: Transportation and Logistics employ 30%, crucial for real-time tracking and operational efficiency.

- Regional Dominance: North America commands 40% of the market, driven by a robust logistics sector and regulatory mandates.

- Growth Opportunity: Expanding into emerging markets with growing commercial fleets and increasing adoption of smart transportation solutions can drive market expansion.

Driving factors

Increasing Demand for Fleet Management

The escalating need for efficient fleet management is a primary driver of the GPS tracking device market. Businesses across logistics, transportation, and delivery services rely heavily on GPS tracking to monitor vehicle locations, optimize routes, and reduce operational costs. By enhancing fleet visibility, companies can improve fuel efficiency, decrease idle times, and enhance overall productivity. The integration of GPS tracking with telematics further provides comprehensive insights into driver behavior, vehicle maintenance needs, and real-time traffic conditions, driving substantial market adoption.

Rising Use in Personal Safety and Asset Tracking

The growing emphasis on personal safety and asset protection has significantly contributed to the GPS tracking device market's expansion. Consumers and businesses alike are increasingly utilizing GPS devices to ensure the safety of individuals, such as children, elderly family members, and employees working in remote or hazardous environments. Additionally, GPS tracking for valuable assets, including machinery, equipment, and high-value goods, helps prevent theft and enhances security measures. This rising use in diverse personal and professional contexts underscores the broad applicability and essential nature of GPS tracking solutions.

Technological Advancements in GPS Accuracy

Technological advancements that enhance GPS accuracy have markedly boosted market growth. Innovations such as multi-constellation GNSS (Global Navigation Satellite System) support, improved signal processing algorithms, and augmentation systems like WAAS (Wide Area Augmentation System) have significantly increased the precision and reliability of GPS tracking devices. These advancements ensure more accurate location data, which is crucial for applications ranging from navigation to precise asset tracking, thus driving widespread adoption across various industries.

Restraining Factors

High Initial Costs

The high initial costs associated with GPS tracking devices and their implementation pose a significant barrier to market growth. These costs encompass the purchase of hardware, installation, and the integration of tracking systems with existing IT infrastructure. For small and medium-sized enterprises (SMEs) and individual consumers, these expenses can be prohibitive, limiting their ability to adopt GPS tracking solutions. Addressing these cost challenges through affordable pricing models or financing options will be critical for broader market penetration.

Privacy and Security Concerns

Privacy and security concerns related to the use of GPS tracking devices are another major restraining factor. As these devices continuously monitor and record location data, there is a risk of unauthorized access and misuse of sensitive information. Ensuring robust data protection measures, compliance with privacy regulations, and educating users about secure practices are essential to mitigate these concerns and foster trust in GPS tracking technologies.

By Type Analysis

In 2023, Vehicle Trackers held a dominant market position in the By Type segment of the GPS Tracking Device Market, capturing more than a 30% share.

In 2023, Vehicle Trackers held a dominant market position in the By Type segment of the GPS Tracking Device Market, capturing more than a 30% share. This significant market share is driven by the high demand for vehicle tracking solutions in both commercial and personal vehicle segments. Vehicle trackers are crucial for fleet management, providing real-time location monitoring, route optimization, and improved security. The increasing adoption of telematics and fleet management systems, particularly in logistics and transportation sectors, significantly supports the dominance of vehicle trackers in the market.

Standalone GPS Trackers are also important in the market, offering versatility and portability for tracking various assets beyond vehicles. However, their market share is smaller compared to vehicle trackers due to their broader but less specialized application.

OBD GPS Trackers are widely used in vehicle diagnostics and monitoring, providing real-time data on vehicle performance and driving behavior. While beneficial, their market share is less dominant due to their specific integration requirements and primary use in vehicles only.

Personal Trackers cater to individual safety and monitoring needs, including applications for children, elderly, and personal items. Despite their importance, their market share is smaller compared to vehicle trackers due to their niche application.

Asset Trackers are essential for monitoring high-value and movable assets, such as machinery and equipment. Although critical for certain industries, their market share remains modest compared to the dominant vehicle trackers.

By Deployment Type Analysis

In 2023, Commercial Vehicle held a dominant market position in the By Deployment Type segment of the GPS Tracking Device Market, capturing more than a 40% share.

In 2023, Commercial Vehicle held a dominant market position in the By Deployment Type segment of the GPS Tracking Device Market, capturing more than a 40% share. This leadership is driven by the extensive use of GPS tracking devices in fleet management to enhance operational efficiency, reduce fuel consumption, and ensure timely delivery of goods. The logistics and transportation sectors heavily rely on GPS tracking for real-time monitoring of vehicle location, driver behavior, and route optimization, which contributes to the significant market share of commercial vehicle deployment.

Cargo & Container tracking is also a critical application, ensuring the security and timely delivery of shipped goods. However, its market share is smaller compared to commercial vehicle deployment due to the specific nature of its application and the smaller volume of tracked units.

Others include various deployment types such as personal, asset, and high-value item tracking. While important, their collective market share is relatively modest due to their specialized and varied applications.

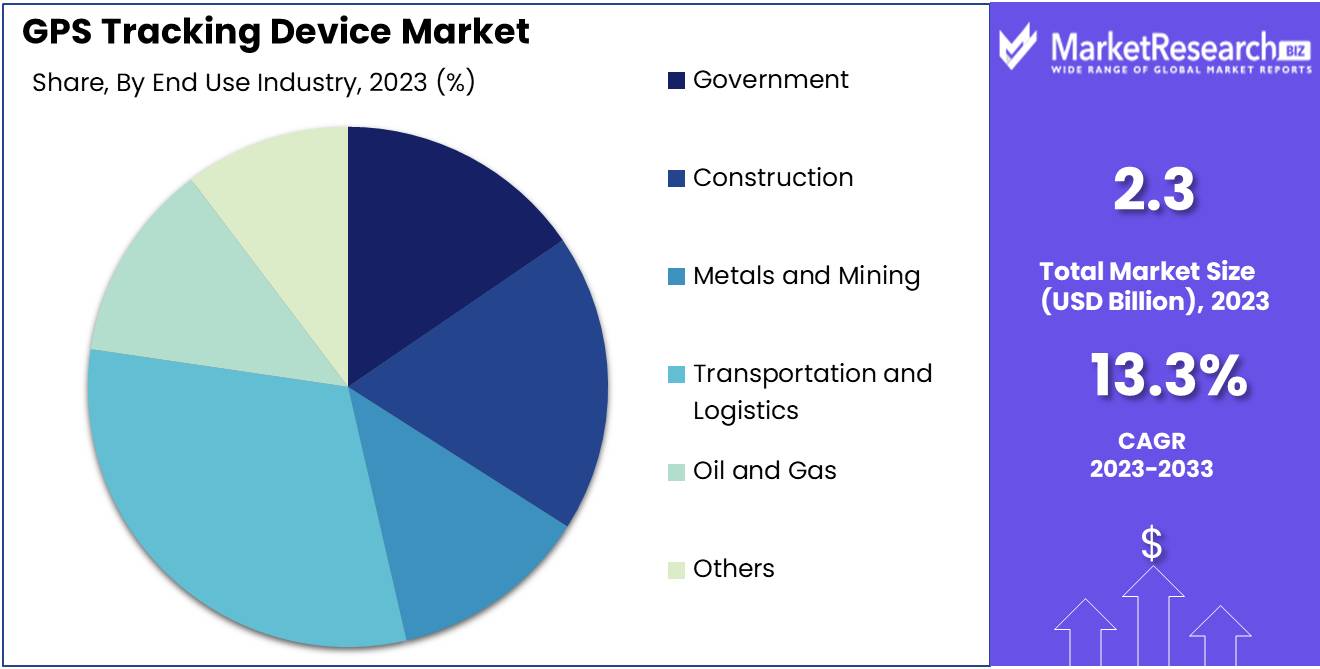

By End Use Industry Analysis

In 2023, Transportation and Logistics held a dominant market position in the By End Use Industry segment of the GPS Tracking Device Market, capturing more than a 30% share.

In 2023, Transportation and Logistics held a dominant market position in the By End Use Industry segment of the GPS Tracking Device Market, capturing more than a 30% share. The significant market share is attributed to the critical role of GPS tracking in optimizing fleet management, enhancing route planning, and ensuring timely delivery of goods. The logistics sector benefits from real-time tracking of vehicles and shipments, which improves operational efficiency and reduces costs.

Government sectors use GPS tracking for public safety, law enforcement, and efficient management of public transportation systems. Despite their importance, the market share is smaller compared to transportation and logistics due to the specific nature of government applications.

Construction industry relies on GPS tracking to monitor the location and usage of heavy equipment and machinery, improving project management and asset utilization. While significant, the market share is less dominant due to the niche application within the industry.

Metals and Mining sectors utilize GPS tracking to ensure the safety and efficiency of mining operations, including the tracking of vehicles and equipment. Despite its critical role, the market share is smaller compared to transportation and logistics due to the specialized nature of the industry.

Oil and Gas industry benefits from GPS tracking for monitoring the transportation of hazardous materials and ensuring compliance with safety regulations. However, its market share remains modest due to the specific requirements and limited volume compared to broader logistics applications.

Others include various industries that use GPS tracking for diverse purposes, such as healthcare and retail. While important, their collective market share is relatively modest due to the varied and specialized nature of their applications.

Key Market Segments

By Type

- Standalone GPS Trackers

- OBD GPS Trackers

- Personal Trackers

- Vehicle Trackers

- Asset Trackers

By Deployment Type

- Cargo & Container

- Commercial Vehicle

- Others

By End Use Industry

- Government

- Construction

- Metals and Mining

- Transportation and Logistics

- Oil and Gas

- Others

Growth Opportunity

Development of Compact and Affordable Devices

In 2024, the development of compact and affordable GPS tracking devices presents a significant growth opportunity. Innovations in miniaturization and cost reduction will make GPS technology more accessible to a broader audience, including SMEs and individual consumers. Smaller, more affordable devices can be easily integrated into various applications, from personal safety wearables to compact asset trackers. This democratization of GPS technology will likely drive substantial market expansion as more users find practical and economic solutions for their tracking needs.

Expansion in Consumer Electronics and Wearable Technology

The expansion of GPS tracking devices into consumer electronics and wearable technology represents another key opportunity. As wearable devices such as smartwatches, fitness trackers, and health monitors increasingly incorporate GPS capabilities, the market for GPS tracking devices will experience robust growth. These consumer electronics not only enhance personal safety and fitness tracking but also offer new avenues for innovative applications such as augmented reality (AR) experiences and location-based services. This trend highlights the convergence of GPS technology with mainstream consumer electronics, opening new market segments and driving demand.

Latest Trends

Integration with IoT and AI for Enhanced Functionality

One of the prominent trends in 2024 is the integration of GPS tracking devices with the Internet of Things (IoT) and Artificial Intelligence (AI ) to enhance functionality. IoT connectivity allows GPS devices to communicate with various sensors and systems, enabling comprehensive monitoring and control over a wide range of applications. AI enhances data analysis capabilities, providing predictive insights and automating responses based on location data. This combination of IoT and AI results in smarter, more efficient tracking solutions that cater to complex needs in logistics, security, and asset management.

Adoption of Real-Time Tracking and Monitoring Solutions

The adoption of real-time tracking and monitoring solutions is set to be a major trend in the GPS tracking device market in 2024. Real-time tracking enables immediate visibility into the location and status of assets, vehicles, and individuals, which is crucial for timely decision-making and responsiveness. This trend is particularly significant in sectors such as emergency services, logistics, and urban mobility, where real-time data can enhance operational efficiency and safety. The increasing demand for instant, accurate information will drive the proliferation of real-time GPS tracking solutions, further solidifying their role in various industries.

Regional Analysis

The GPS Tracking Device Market is dominated by North America, holding a 40% share.

In 2023, North America dominated the GPS Tracking Device Market, capturing 40% of the market share. This dominance is driven by the widespread adoption of GPS technology across various sectors, including transportation, logistics, and personal use, in the United States and Canada. The advanced technological infrastructure, high penetration of IoT devices, and strong demand for fleet management solutions further support the market growth in this region.

Europe holds a significant market share, driven by the growing demand for efficient logistics and transportation management solutions. Countries like Germany, the UK, and France are leading adopters of GPS tracking devices due to stringent regulatory standards and the emphasis on operational efficiency.

Asia Pacific is experiencing rapid growth in the GPS tracking device market, fueled by the expanding transportation and logistics sector and increasing adoption of smart devices in countries like China, India, and Japan. The region's large population base and growing urbanization contribute to the rising demand for GPS tracking solutions.

Middle East & Africa show potential for growth, supported by increasing investments in transportation infrastructure and the growing need for fleet management solutions. However, the market share remains modest due to economic constraints and limited technological adoption.

Latin America is emerging as a growing market, with Brazil and Mexico leading the demand for GPS tracking devices. The region benefits from improving logistics infrastructure and increasing awareness of the benefits of GPS technology.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

ORBCOMM Inc. remains a leader with its expansive IoT and M2M solutions. Their robust satellite and cellular connectivity services cater to diverse industries, ensuring real-time tracking and comprehensive fleet management.

CalAmp Corp. specializes in telematics solutions, integrating GPS tracking with advanced analytics. Their focus on data-driven insights supports enhanced operational efficiencies across sectors.

Queclink Wireless Solutions Co., Ltd. offers a diverse range of GPS devices, focusing on innovation and customization to meet specific industry needs. Their global presence and extensive product portfolio make them a key player.

Sierra Wireless, Inc. provides advanced IoT solutions with integrated GPS tracking, emphasizing secure and reliable connectivity. Their end-to-end solutions cater to complex tracking requirements.

Tomtom International B.V. leverages its expertise in mapping and navigation to offer precise and reliable GPS tracking devices. Their focus on user-friendly interfaces enhances market appeal.

ATrack Technology Inc. delivers versatile GPS tracking solutions with a focus on customization and integration, catering to specific client requirements in various industries.

Laird PLC provides advanced wireless technologies, including GPS tracking, with a strong emphasis on innovation and reliability.

Teltonika stands out with its extensive product range and focus on quality, offering solutions that cater to both individual and industrial tracking needs.

Meitrack Group offers comprehensive GPS tracking solutions, emphasizing affordability and technological advancement.

Geotab Inc. specializes in fleet management solutions, integrating GPS tracking with robust analytics for enhanced decision-making.

Trackimo LLC focuses on personal and asset tracking solutions, offering compact and reliable devices that cater to diverse market needs.

Market Key Players

- ORBCOMM Inc.

- CalAmp Corp.

- Queclink Wireless Solutions Co., Ltd.

- Sierra Wireless, Inc.

- Tomtom International B.V.

- ATrack Technology Inc.

- Laird PLC

- Teltonika

- Meitrack Group

- Geotab Inc.

- Trackimo LLC

Recent Development

- In June 2024, Garmin International released a new GPS tracker with enhanced battery life and real-time tracking features, targeting fleet management and personal safety applications.

- In May 2024, TomTom launched an advanced GPS tracking system integrated with AI analytics, aimed at improving logistics and route optimization for commercial fleets.

Report Scope

Report Features Description Market Value (2023) USD 2.3 Bn Forecast Revenue (2033) USD 7.8 Bn CAGR (2024-2033) 13.3% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Standalone GPS Trackers, OBD GPS Trackers, Personal Trackers, Vehicle Trackers, Asset Trackers), By Deployment Type (Cargo & Container, Commercial Vehicle, Others), By End Use Industry (Government, Construction, Metals and Mining, Transportation and Logistics, Oil and Gas, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape ORBCOMM Inc., CalAmp Corp., Queclink Wireless Solutions Co., Ltd., Sierra Wireless, Inc., Tomtom International B.V., ATrack Technology Inc., Laird PLC, Teltonika, Meitrack Group, Geotab Inc., Trackimo LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- ORBCOMM Inc.

- CalAmp Corp.

- Queclink Wireless Solutions Co., Ltd.

- Sierra Wireless, Inc.

- Tomtom International B.V.

- ATrack Technology Inc.

- Laird PLC

- Teltonika

- Meitrack Group

- Geotab Inc.

- Trackimo LLC