Lip Balm Market By Application(Dry, Sensitive Skin, Others), By Product(Solid Cream Lip Balm, Liquid Gel Lip Balm), By End-User(Women, Men, Children, Others), By Type(Scented, Colored, Others), By Distribution Channel(Hypermarkets & Supermarkets, Drugstores/Pharmacies, Specialty Beauty Stores, Online Retailers, Department Stores, Direct Sales (Brand Outlets)), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

43579

-

Feb 2024

-

179

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

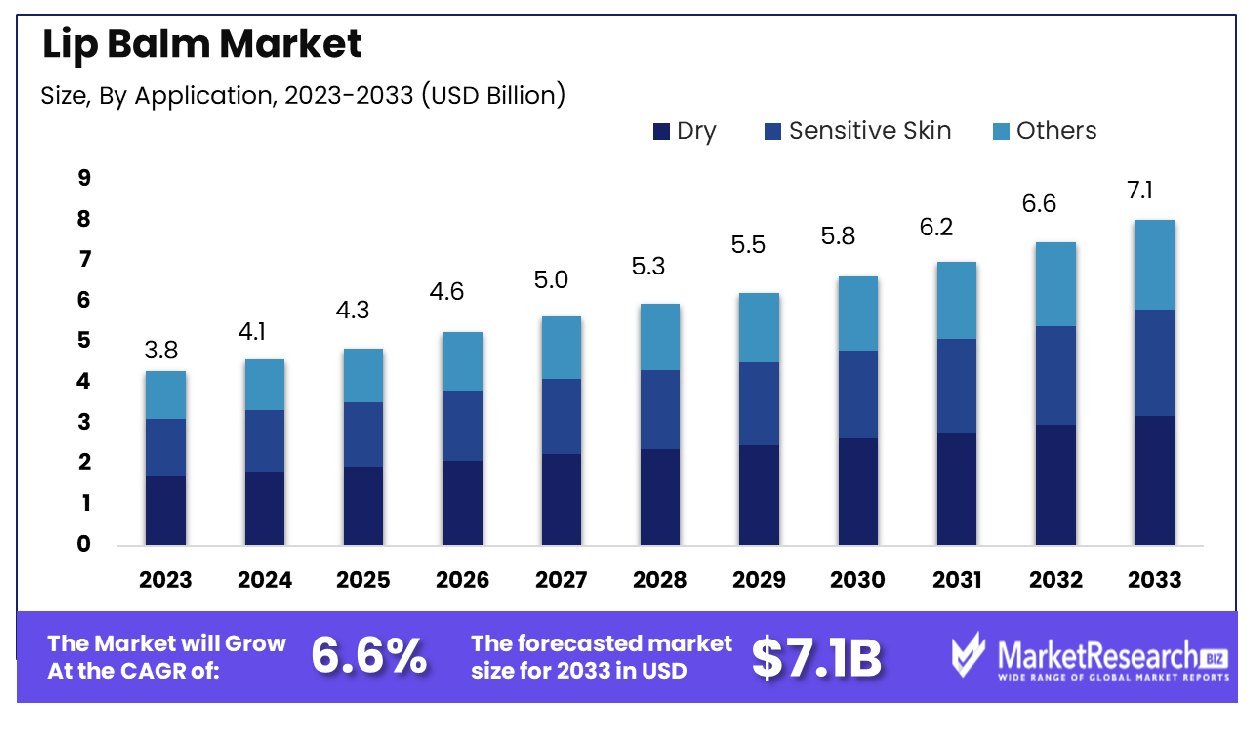

The lip balm market was valued at USD 3.8 billion in 2023, It is expected to reach USD 7.1 billion by 2033, with a CAGR of 6.6% during the forecast period from 2024 to 2033. The surge in demand for change in customer preference and the rise in awareness regarding lip care are some of the main key driving factors for the lip balm market.

Lip balm is defined as a skincare product that is designed to keep the lips moisturized and protect them from getting dry, chapped, and any type of harsh environmental situations. It is generally made with an integration of waxes, emollients, and oil, lip balm builds a form of protection layer on the lips, decreasing the chance of moisture loss and promoting hydration.

There are some ingredients such as beeswax, shea butter, and other different types of oil that work together to smooth and nurture the delicate skin on the lips. Other than relieving dryness, it consists of the SPF to protect the lips from harmful UV rays. These lip balms are available in different types of flavors and formulations, offering an easy and portable solution for maintaining soft, healthy lips in different climates and seasons. The daily use of lip balms helps keep the lips agile and improves the whole lip health.

Cosmetics Design Asia in November 2023, highlights that the K-beauty giant LG household and healthcare has unfolded 16 of its brands that will get launched with its new lipcerin complex by the end of 2023. Moreover, the company has built lipocalin for over 5 years by using the research that is obtained from analyzing lip image data of 57,000 East Asians. LG H&H is expecting to fasten its market presence in the USD 2.83 billion lip care which can augment by 8.8% from 2021 to 2022. The company also expects that the size of the domestic lip care market will expand by 4.2% as compared to the last year.

Lip balms have gained much popularity as it is an important accessory in today’s generation. With the surge in mask usage, individuals are experiencing high skin sensitivity around the mouth area. These products not only offer vital hydration to fight dryness worsened by masks but also act as a shield obstacle against friction. Moreover, the launch of new trendy flavors and formulations in lip balms supports contemporary beauty standards by making them a multifunctional and fashionable element of everyday skincare routines. The demand for lip balm will increase due to its requirement in the skincare and beauty industries which will help in market expansion in the coming years.

Key Takeaways

- Market Growth: Lip Balm Market was valued at USD 3.8 billion in 2023, It is expected to reach USD 7.1 billion by 2033, with a CAGR of 6.6% during the forecast period from 2024 to 2033.

- By Application: In the segment of dry lips, dominating market share is evident.

- By Product: Solid cream lip balm products show dominance in the market.

- By End-User: Women emerge as the dominant end-users within this market sector.

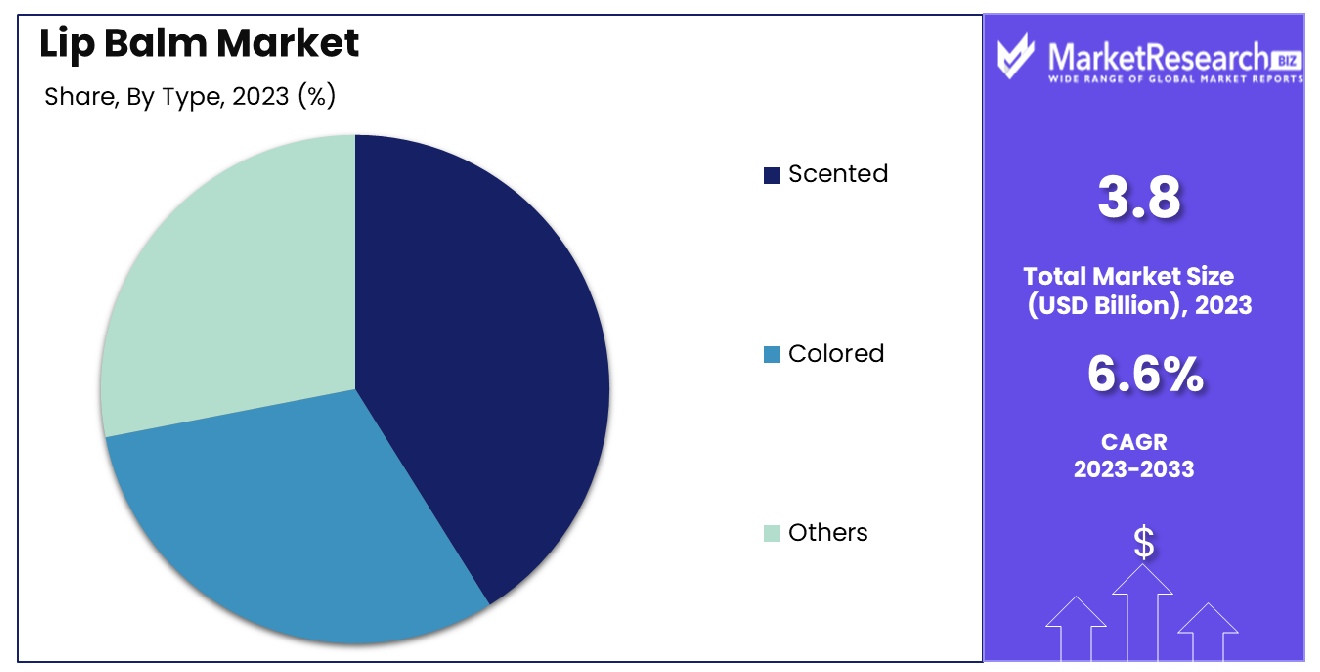

- By Type: Scented lip balm types lead the market in terms of preference.

- By Distribution Channel: Hypermarkets and supermarkets significantly dominate the distribution channels within this market.

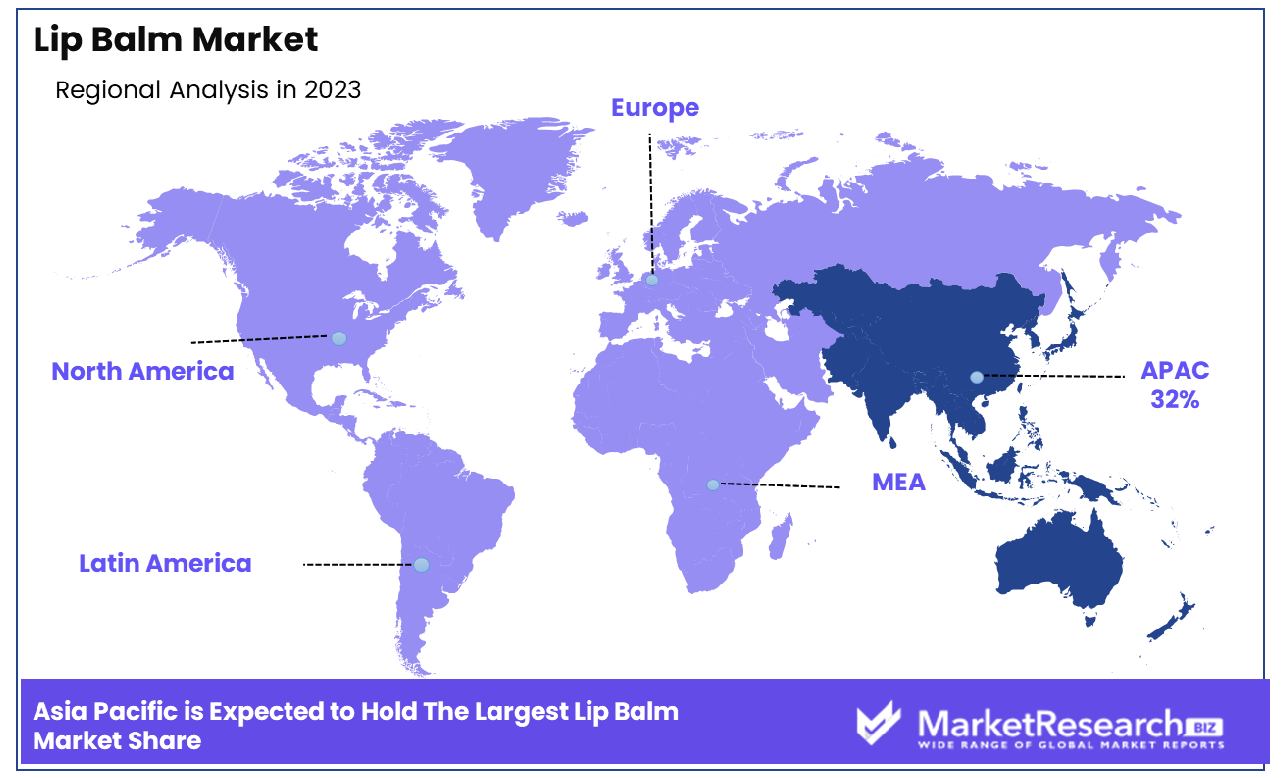

- Regional Dominance In the lip balm market, Asia Pacific commands a significant 32% market share, showcasing its dominant position in the region.

- Growth Opportunity: Consumer demand for natural and organic lip balms, featuring ingredients like coconut oil and shea butter, drives growth opportunities, exemplified by brands like Burt's Bees. Innovative textures and added benefits, such as anti-aging properties, expand the market, as seen with Laneige Lip Sleeping Mask's antioxidant gel formula.

Driving factors

Increasing Awareness of Skin Protection and Care Drives Market Growth

The growing consumer awareness regarding skin protection against sun, pollution, and harsh weather significantly drives the demand for lip balms. With 46% of customers ready to spend over $5 for premium natural lip balms, the market is witnessing a shift towards products offering SPF and enhanced moisturization. This awareness fuels the demand for value-added lip balms, highlighting the importance of incorporating protective ingredients. The trend suggests a long-term market evolution towards more sophisticated formulations, catering to informed consumer preferences for health and wellness in lip care.

Growth of E-commerce and Social Media Expands Market Accessibility

E-commerce and social media have revolutionized the lip balm market by making innovative brands more accessible and discoverable. Influencer marketing and online shopping platforms break geographical barriers, introducing consumers to a wide array of products. This digital shift not only broadens the market reach but also encourages consumer engagement and experimentation, driving growth. The trend indicates a sustained influence on market dynamics, with digital channels becoming increasingly integral to brand strategies.

Product Innovation Spurs Market Diversification

Brands are continuously innovating with new textures, flavors, and natural ingredients, making product innovation a key growth driver. Introducing varieties like soft matte and sheer tint balms caters to diverse consumer tastes, encouraging trials and repeat purchases. This drive for innovation enhances market appeal by offering personalized choices, suggesting a future where customization and novelty remain central to attracting and retaining customers.

Premiumization Elevates Market Value

The fast growth of premium and luxury lip balm brands, such as Dior and Fresh, underscores the trend towards premiumization. Consumers' willingness to invest in high-quality ingredients and brand prestige drives market segmentation towards luxury products. This shift towards premium offerings reflects a broader consumer trend valuing quality over quantity, with long-term implications for brand positioning and market differentiation strategies.

Restraining Factors

Market Saturation Restrains Market Growth

The lip balm market faces significant growth challenges due to its high level of saturation, with established mass brands like Burt's Bees, Chapstick, and Vaseline dominating the market landscape. This saturation creates a formidable barrier for new entrants striving to gain distribution and consumer awareness. The dominance of these brands limits shelf space and visibility for emerging products, making it difficult for new market players to establish a foothold. As a result, market saturation stifles innovation and diversity within the sector, as the entry barriers prevent fresh ideas and unique products from reaching the market.

Competition from Cosmetics Limits Lip Balm Appeal

The competition from cosmetic products such as lipsticks, liquid lip colors, liners, and glosses directly impacts the lip balm market by offering alternatives that provide both color and shine. This competition effectively segments the audience, limiting the appeal of plain lip balms that primarily offer moisturizing benefits without aesthetic enhancements. Consumers drawn to multifunctional cosmetic products may overlook the basic yet essential benefits of lip balms, thus constraining the market’s growth potential. The presence of these cosmetic alternatives challenges the lip balm sector to innovate beyond mere hydration to capture consumer interest.

By Application Analysis

In the segment of dry lips application, dominant market forces highlight a preference for effective moisturizing solutions.

The application segment for dry lips holds the dominant position in the Lip Balm Market, addressing the primary concern for most consumers seeking lip care solutions. This segment's dominance is fueled by the universal need for hydration and protection against harsh environmental factors like wind, cold, and sun exposure, which can cause or exacerbate dryness. Brands like Burt's Bees, known for their beeswax lip balm, and Vaseline, with their petroleum jelly-based products, have become staples in many households globally, offering effective remedies for dry lips. These products are often enriched with moisturizing ingredients such as shea butter and vitamin E, catering to the widespread demand for intensive lip hydration.

The segments for sensitive skin and other specific applications, though smaller in market share, cater to niche consumer needs, such as hypoallergenic formulas for allergy-prone skin or SPF-infused balms for sun protection. These specialized segments contribute to the market's growth by addressing diverse consumer preferences and expanding the overall product range available to consumers.

By Product Analysis

Solid cream lip balm emerges as the market leader, showcasing its efficacy and popularity among consumers.

Solid cream lip balms are the market's cornerstone, favored for their portability, ease of application, and effective formulations. This sub-segment prominence is evidenced by the popularity of brands like ChapStick, known for its iconic stick format, and EOS, which offers spherical balms in distinct, user-friendly packaging. Solid cream balms' wide acceptance is attributed to their convenience for on-the-go application and the ability to incorporate a variety of nourishing ingredients, making them a go-to choice for everyday use.

Liquid gel lip balms, while serving a portion of the market interested in glossier finishes or specific treatment ingredients, complement the dominant solid cream segment. These products, such as Neutrogena's Hydro Boost Hydrating Lip Shine, cater to consumers seeking the hydrating benefits of a lip balm with the aesthetic appeal of a gloss, showcasing the market's adaptability to varying consumer preferences.

By End-User Analysis

Women constitute the primary end-user demographic, driving market demand for lip care products.

Women constitute the largest consumer base for lip balms, driven by higher usage rates and a broader interest in lip care as part of their beauty routines. Brands like Maybelline New York, with their Baby Lips line, and Dior, offering luxury lip glow balms, cater specifically to female consumers, offering products that combine hydration with subtle color or shine, appealing to aesthetic preferences in addition to functional needs.

The segments for men, children, and others are increasingly significant, reflecting the expanding understanding that lip care is essential for all demographics. Men's lip care products, such as those by Jack Black, focus on matte finishes and SPF protection, addressing the demand for functional, unobtrusive products. Children's lip balms, often featuring fun flavors and packaging, like Lip Smacker's character-themed balms, encourage early lip care habits. These segments underscore the lip balm market's diversity, with products tailored to the specific preferences and needs of various consumer groups, contributing to the sector's overall growth.

By Type Analysis

Scented lip balm distinguishes itself as the preferred choice among consumers, leading in market share.

Scented lip balms represent the dominant sub-segment in the Lip Balm Market, driven by consumer preference for products that offer a sensory experience alongside lip care benefits. These products often feature natural or artificial fragrances, ranging from fruity and floral to minty and herbal scents, catering to a wide range of consumer preferences. Brands like Burt's Bees and EOS have capitalized on this trend, offering an assortment of scented options that not only moisturize but also provide a pleasant sensory experience. The appeal of scented lip balms lies in their ability to elevate the lip care routine into a more enjoyable and personalized activity, contributing significantly to their market dominance.

Colored lip balms and other specialized types, such as those offering SPF protection or tailored to specific lip care needs (e.g., plumping, anti-aging), serve complementary roles in the market. Colored balms, like those from Maybelline's Baby Lips range or Fresh's Sugar Lip Treatment, combine the moisturizing benefits of a lip balm with a subtle tint, appealing to consumers seeking a minimalist approach to makeup. These additional segments contribute to the market's diversity, allowing brands to cater to niche consumer needs and preferences, further driving market growth.

By Distribution Channel Analysis

Hypermarkets and supermarkets assert dominance as the favored distribution channels for lip care products, capturing consumer attention effectively.

Hypermarkets and supermarkets have emerged as the leading distribution channels for lip balms, attributed to their extensive reach and the convenience they offer consumers. These retail formats allow customers to explore a wide range of brands and products, including new releases and promotional offers, in one location. The dominance of this channel is supported by the presence of established brands like ChapStick and Carmex, whose wide availability in such outlets ensures that consumers have easy access to their products.

Other distribution channels, including drugstores/pharmacies, specialty beauty stores, online retailers, department stores, and direct sales through brand outlets, play crucial roles in the market's ecosystem. Drugstores/pharmacies are essential for consumers seeking therapeutic or medicated lip care solutions, while specialty beauty stores offer a curated selection of premium and niche brands. Online retailers have seen significant growth, driven by the convenience of home shopping and the broader range of available products, including international brands that may not be readily available in physical stores. Department stores and direct sales outlets provide personalized shopping experiences, often featuring exclusive products or brands not widely distributed elsewhere.

Key Market Segments

By Application

- Dry

- Sensitive Skin

- Others

By Product

- Solid Cream Lip Balm

- Liquid Gel Lip Balm

By End-User

- Women

- Men

- Children

- Others

By Type

- Scented

- Colored

- Others

By Distribution Channel

- Hypermarkets & Supermarkets

- Drugstores/Pharmacies

- Specialty Beauty Stores

- Online Retailers

- Department Stores

- Direct Sales (Brand Outlets)

Growth Opportunity

Natural and Organic Positioning Offers Growth Opportunity

The shift towards natural and organic lip balms, highlighted by consumer demand for products containing ingredients like coconut oil and shea butter, presents a significant growth opportunity. Brands like Burt's Bees, boasting 100% natural origin products, exemplify the market's potential for those adopting such positioning.

This trend reflects a broader consumer awareness and preference for health and wellness, extending into the beauty and personal care sectors. By emphasizing natural ingredients, brands can differentiate themselves, meet consumer expectations for safety and efficacy, and tap into a growing segment that values transparency and sustainability in their lip care choices.

Innovative Textures and Benefits Attract Consumer Interest

The introduction of lip balms with innovative textures and added benefits, such as anti-aging properties, opens new avenues for market expansion. Products like Laneige Lip Sleeping Mask, offering antioxidant benefits through novel gel textures, cater to consumers seeking multifunctional lip care solutions.

This innovation not only enhances the user experience but also broadens the market by appealing to those looking for more than just hydration from their lip balm. Brands that continuously innovate and introduce unique product features can captivate a diverse consumer base, encouraging trials and fostering brand loyalty.

Latest Trends

Artisanal Appeal Engages Millennials and Gen Z

Artisanal and small-batch lip balms, such as Kosas Lipfuel and Wldkat, resonate particularly well with millennial and Gen Z consumers. This segment's preference for unique, story-driven products with handmade branding offers a lucrative growth opportunity for brands.

By emphasizing the artisanal aspect and the uniqueness of ingredients, major companies can create a strong emotional connection with younger consumers who value authenticity, craftsmanship, and individuality in their purchases. This approach not only differentiates products in a crowded market but also aligns with the values of a demographic known for its purchasing power and influence.

Sustainability Claims Drive Brand Preference

Sustainability claims, including recycled packaging and vegan product formulas, are increasingly becoming a determinant of consumer preference. Brands like Bite Beauty, with products like Outburst Longwear Lip Stain, demonstrate how integrating ethical and eco-friendly practices into natural product development and marketing can appeal to environmentally conscious consumers.

This shift towards sustainability reflects a broader trend across industries, where consumers are making purchasing decisions based on a brand's environmental impact and ethical standards. By adopting sustainable practices, lip balm brands can not only capture a segment of the market that prioritizes eco-friendliness but also contribute to a positive social and environmental impact, fostering long-term loyalty and trust.

Regional Analysis

Asia Pacific Dominates with a 32% Market Share

Asia Pacific's commanding 32% share of the global Lip Balm Market is driven by a combination of its large population, increasing disposable income, and growing awareness about personal care. Countries like China, Japan, and South Korea are at the forefront, with their strong cultural emphasis on skincare routines and beauty standards. The region's climate variability also plays a significant role, as it creates a consistent demand for lip care products throughout the year.

The region's dynamics are influenced by a robust manufacturing base, innovative product offerings, and a highly engaged consumer base active on social media platforms. The popularity of e-commerce and influencer marketing further amplifies product reach and consumer engagement, facilitating the introduction of new brands and products tailored to local preferences and needs.

The Asia Pacific region is poised for continued growth in the Lip Balm Market, supported by technological advancements in product formulation and packaging. The rising middle class, along with increasing internet penetration, is expected to keep the region at the forefront of market expansion. The ongoing trend towards natural and organic products is likely to further boost the market, as consumers increasingly prioritize health and wellness in their beauty and personal care choices.

North America: A Close Contender in Market Share

North America, particularly the United States, holds a significant portion of the market share due to high consumer spending on personal care and beauty products. The region's focus on innovative and premium lip care solutions, coupled with a strong presence of leading cosmetic brands, drives its market. The trend towards organic and natural ingredients is particularly strong here, influencing product development and consumer choices. With a robust retail and online distribution network, North America is expected to maintain its position as a key player in the Lip Balm Market.

Europe: Pioneering Natural and Organic Lip Care

Europe is notable for its stringent regulations on cosmetic products, which has led to a high demand for natural and organic lip balms. Countries like France, Germany, and the UK are leaders in the vegan cosmetic industry, emphasizing product quality and sustainability. The European market is characterized by its mature consumer base, which is highly knowledgeable about ingredients and their benefits. This awareness drives the demand for products with proven efficacy and environmentally friendly packaging, positioning Europe as a critical market for innovative and sustainable lip care solutions.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In the competitive landscape of the Lip Balm Market, key players such as Burt's Bees, EOS, ChapStick, and Carmex distinguish themselves through strategic positioning and innovation, commanding significant market influence. Burt's Bees leads with a focus on natural and organic ingredients, appealing to consumers' growing preference for sustainable and health-conscious products. EOS stands out with its unique product design and organic ingredients, capturing the attention of younger demographics. Traditional brands like ChapStick and Carmex maintain their stronghold by leveraging their long-standing reputation for reliability and effectiveness.

Global giants NIVEA, Maybelline New York, L'Oréal Paris, and Vaseline use their extensive distribution networks and brand recognition to dominate shelf space and consumer preference. These key companies invest heavily in marketing and product development, often incorporating skincare benefits into their lip balms to meet the demand for multifunctional products.

Revlon, Clinique, Neutrogena, and Blistex focus on the intersection of cosmetics and skincare, offering products that promise not only to protect and heal but also to enhance natural beauty. Avon, Kiehl's, and Fresh highlight their dedication to quality ingredients and skin benefits, catering to niche markets that prioritize premium and specialty care products.

Market Key Players

- Burt's Bees

- EOS (Evolution of Smooth)

- ChapStick

- Carmex

- NIVEA

- Maybelline New York

- L'Oréal Paris

- Vaseline

- Revlon

- Clinique

- Neutrogena

- Blistex

- Avon

- Kiehl's

- Fresh

Recent Development

- In February 2024, Glowology introduced its Radiance Shield Serum, blending SPF protection with skin-loving ingredients like vitamin C and green tea extract, aligning with the trend towards multifunctional beauty solutions.

- In February 2024, Rhode Skin debuts its revolutionary Lip Balm Infused Face Mask, combining skincare and protection in a single product, catering to modern consumers' needs for convenience and skin health.

- In February 2024, Home Select Beauty introduces its exclusive L'Oréal Lip Gloss Collection, featuring 11 iconic shades curated for impeccable style and nourished lips, catering to beauty enthusiasts seeking timeless elegance and modern flair.

- In February 2024, Holy Cross Catholic Secondary School students in Peterborough launched SeedBalm, an eco-friendly lip balm in biodegradable packaging, showcasing their entrepreneurial spirit and commitment to sustainability in the personal care industry.

Report Scope

Report Features Description Market Value (2023) USD 3.8 Billion Forecast Revenue (2033) USD 7.1 Billion CAGR (2024-2032) 6.6% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Application(Dry, Sensitive Skin, Others), By Product(Solid Cream Lip Balm, Liquid Gel Lip Balm), By End-User(Women, Men, Children, Others), By Type(Scented, Colored, Others), By Distribution Channel(Hypermarkets & Supermarkets, Drugstores/Pharmacies, Specialty Beauty Stores, Online Retailers, Department Stores, Direct Sales (Brand Outlets)) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Burt's Bees, EOS (Evolution of Smooth), ChapStick, Carmex, NIVEA, Maybelline New York, L'Oréal Paris, Vaseline, Revlon, Clinique, Neutrogena, Blistex, Avon, Kiehl's, Fresh Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) - Market Growth: Lip Balm Market was valued at USD 3.8 billion in 2023, It is expected to reach USD 7.1 billion by 2033, with a CAGR of 6.6% during the forecast period from 2024 to 2033.

-

-

- Burt's Bees

- EOS (Evolution of Smooth)

- ChapStick

- Carmex

- NIVEA

- Maybelline New York

- L'Oréal Paris

- Vaseline

- Revlon

- Clinique

- Neutrogena

- Blistex

- Avon

- Kiehl's

- Fresh