Home Decor Market Report By Product Type (Home Furniture, Rugs, Bath Textiles, Bed Textiles, Kitchen and Dining Textiles Tiles, Wood & Laminate Flooring, Vinyl & Rubber Flooring, Lighting, Other Products), By Distribution Channel (Direct to Consumer, Retail Stores, Others), By Application, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

7162

-

March 2024

-

181

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

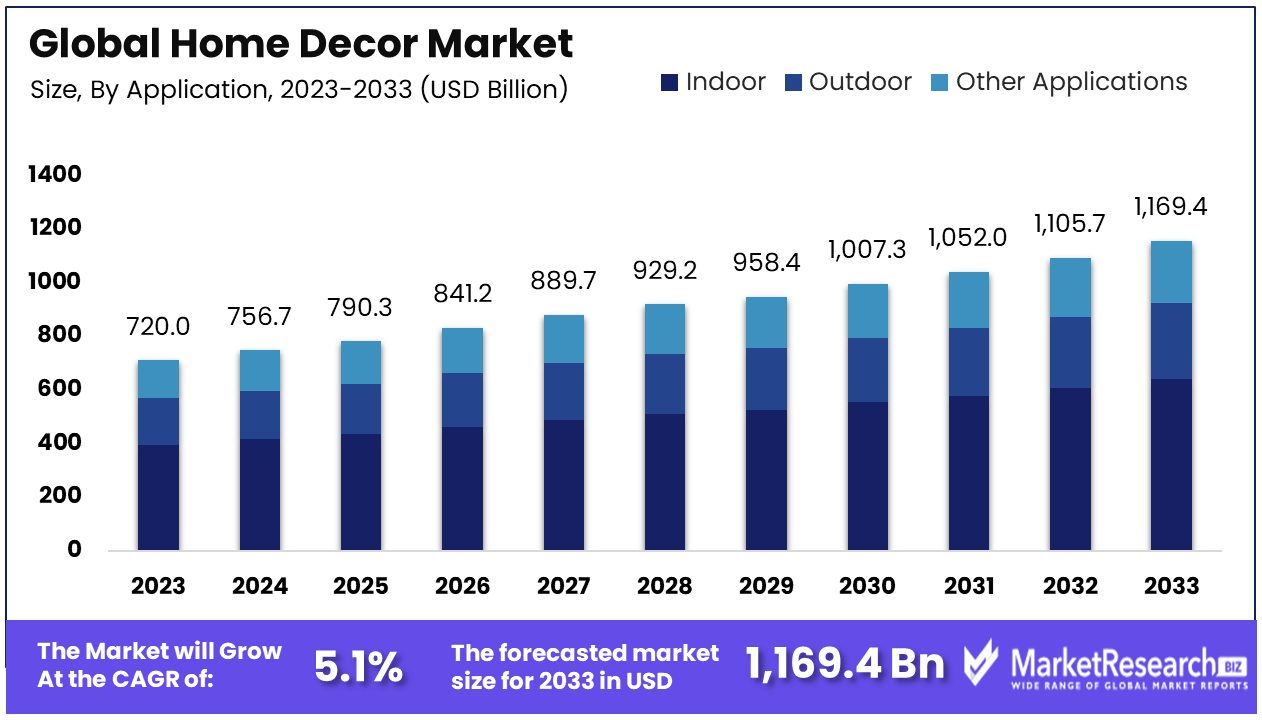

The Global Home Decor Market size is expected to be worth around USD 1,169.4 Billion by 2033, from USD 720 Billion in 2023, growing at a CAGR of 5.10% during the forecast period from 2024 to 2033.

The surge in demand for advanced new technologies, customization according to the customers and beautiful interior designs are some of the main key driving factors for the home décor market.

Home décor is defined as the art of improving and beautifying the living areas and spaces through carefully preferred furnishings, designs element and accessories. It comprises of a wide range of styles from old traditional to modern, rural to minimalist, permitting the individuals to express their own personal tastes and build a comfortable, beautifully appealing environment.

Elements such as furniture, lighting, textiles, wall art and colour schemes plays an important role in transforming the structure of a house. The goal of home décor is to build a pleasant and inviting surrounding that mirrors the inhabitant’s personality and lifestyle.

Whether it is through collections, DIY projects and unique arrangements, home décor changes a house into a customized sanctuary, nurturing the sense of belongingness and contentment. It is an ongoing method that get adapted to changing preference and trends, turning a living area into a true reflection of individual’s identity.

According to an article published by markets insider in July 2023, Herman miller intertwines together with Stefan diez to build a fold nesting chair. It has a smooth and sleek design that makes flexible configurations for workspaces. It is available in many colour options comprises of the seat, legs and seat back in one type and more than colour combination.

Moreover, according to an article published by Home24 in September 2022, Home 24 has launched marketplace offers in France, Austria and Switzerland before the end of the year. In July 2022, Home24 has launched its marketplaces in Germany, with more than 100,000 products from around 100 sellers to its ranges.

Home decors plays a major role in renovating the house and makes the living areas more beautiful and aesthetic. With more remote work, individuals giving importance by building inspiring and functional spaces, highlighting furniture with practical style. Sustainability is the key that reflects wider trends towards eco-conscious living.

Modern home décor adjusts and accepts the change in requirement by promoting well-being, eco-friendly and productivity that is responsible in customization and functional living spaces. The demand for the home décor will increase due to its change in customer preference and appeal to get beautiful home interiors that will help in market expansion during the forecast period.

Key Takeaways

- Market Value: The Global Home Decor Market is projected to reach approximately USD 1,169.4 Billion by 2033, showing a significant growth from USD 720 Billion in 2023, with a CAGR of 5.10% during the forecast period from 2024 to 2033.

- Dominant Segments:

- Product Type Analysis: Home furniture leads the market with a substantial 24.6% share, emphasizing the essential role of furniture in creating inviting living spaces. Other segments like rugs, textiles, flooring, lighting, and more contribute to the market's dynamism, catering to diverse consumer needs and design preferences.

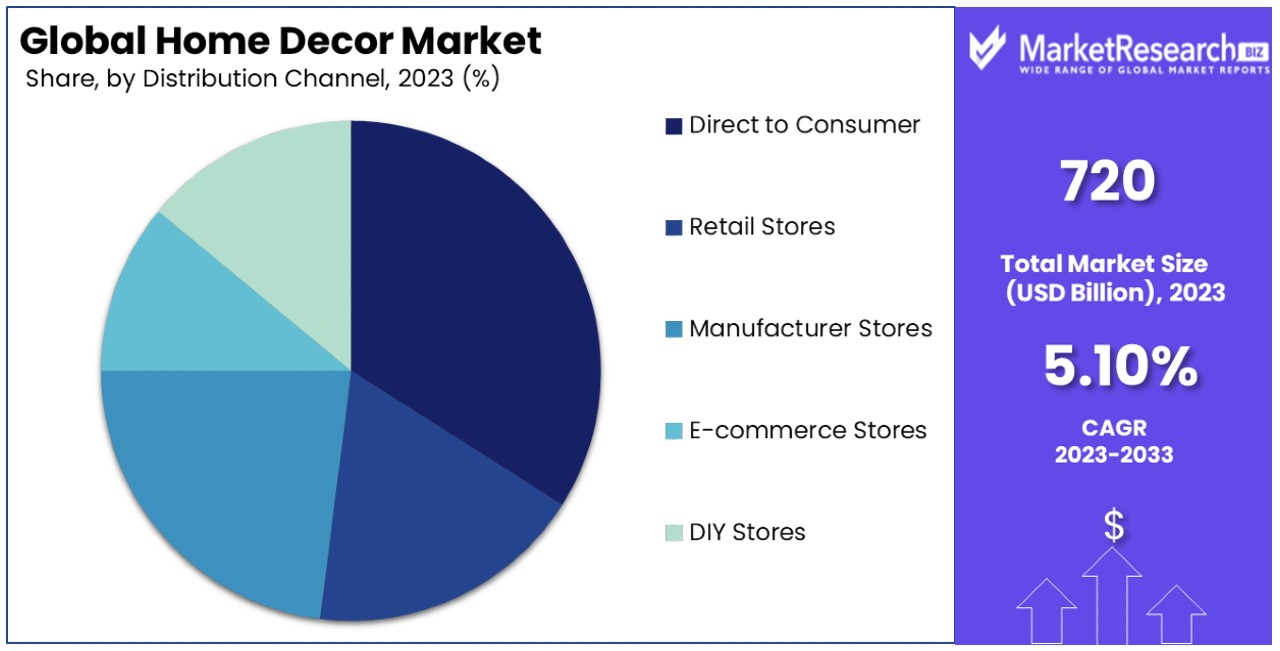

- Distribution Channel Analysis: Direct to Consumer (D2C) channel holds a significant share of 17%, reflecting the trend of manufacturers bypassing traditional retail intermediaries to connect directly with buyers. Retail stores, including independent boutiques and e-commerce platforms, remain crucial, providing consumers with diverse purchasing options and experiences.

- Application Analysis: Indoor decor dominates, driven by consumers' desire for personalized, comfortable, and aesthetically pleasing living spaces. Outdoor decor is gaining traction, especially in regions with favorable climates, as outdoor living spaces become extensions of indoor living areas.

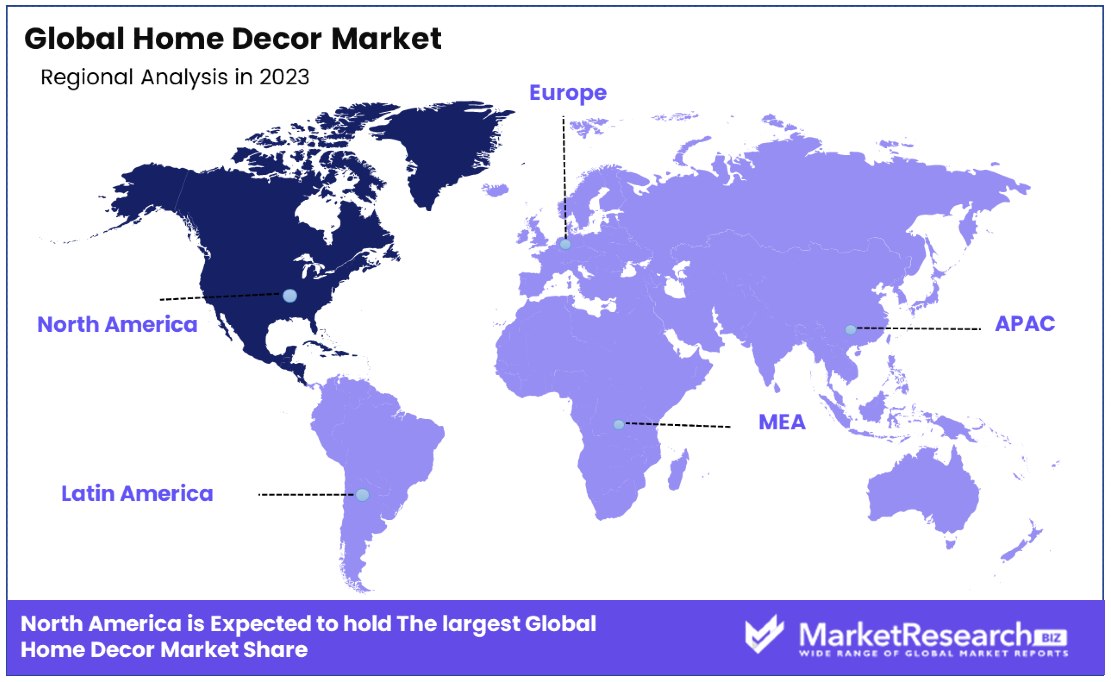

- Regional Analysis: North America dominates the market with a 36.6% market share, indicating a strong consumer preference for home decor products in the region.

- Key Players: Major players in the Home Decor Market include Kimball International Inc., Inter IKEA Systems B.V., Ashley Furniture Industries, Conair Corporation, Siemens AG, and others, driving innovation and market growth through diverse product offerings and distribution strategies.

- Analyst Viewpoint: The home decor market is propelled by consumer preferences for personalized living spaces, convenience in purchasing, and the growing trend of manufacturers engaging directly with consumers. Growth opportunities lie in catering to diverse design preferences, expanding e-commerce channels, and leveraging outdoor living trends to reach new customer segments.

Driving Factors

Increased Disposable Income and Consumer Spending Drives Market Growth

The surge in disposable income and consumer spending is a pivotal driver for the home decor market's expansion. As global incomes rise, particularly within the burgeoning middle class of developing countries, there's a marked increase in expenditures on home furnishing and decoration. By 2046-47, India's middle class is projected to swell to nearly 1.02 billion individuals, a significant leap from 432 million in 2020-21.

This demographic shift underscores a robust demand for home decor products as more consumers seek to enhance their living spaces. The interplay between increased disposable incomes and consumer desires for aesthetically pleasing homes fuels the market, enabling a broader range of consumers to invest in quality home decor. This trend not only augments the market size but also encourages diversification of product offerings to cater to varied tastes and budgets.

Growth of Online and Omni-Channel Retail Catalyzes Market Expansion

The home decor market is experiencing substantial growth thanks to the rise of online and omni-channel retail strategies. In 2023, e-commerce sales are expected to climb by 10.4%, accounting for 20.8% of all retail transactions. This digital boom makes home decor items more accessible, offering consumers a vast selection at their fingertips.

Retail giants like Amazon and Wayfair, alongside omni-channel pioneers such as IKEA and Crate & Barrel, allow customers to seamlessly transition between online research and in-store purchases. This accessibility not only simplifies the shopping experience but also widens the market's reach, catering to a diverse consumer base with varying preferences and shopping behaviors. The fusion of online convenience with physical retail experiences creates a dynamic market environment conducive to growth.

Increased Residential Construction Propels Market Demand

The uptick in residential construction directly influences the demand for home decor, as new and existing homeowners seek to personalize their spaces. In January 2024, the United States saw existing-home sales rise to 4.00 million units, an increase from 3.88 million units the previous December.

This growth indicates a healthy demand for housing, subsequently driving the need for home furnishings and accessories to fill these spaces. The cycle of buying, renovating, and decorating homes sustains a continuous demand for the home decor market, with residential construction acting as a primary catalyst. This relationship highlights the market's sensitivity to housing trends, where construction booms translate to increased opportunities for home decor businesses.

Rise of DIY and Personalization Enriches Market Diversity

The ascent of DIY and personalization trends within the home decor market speaks to a growing consumer desire to customize living spaces. Millennials, in particular, are at the forefront of this movement, seeking unique and creative ways to express their individuality through home decor. Platforms like Etsy serve this demand by offering handmade and bespoke decor items, enabling consumers to imbue their homes with personal flair.

This trend not only diversifies the market's product range but also encourages innovation among creators and manufacturers. The DIY and personalization wave enriches the market, fostering a culture of creativity and individual expression that resonates with a wide audience. This engagement with consumers on a personal level drives market growth by aligning product offerings with evolving consumer preferences and lifestyle trends.

Restraining Factors

Market Saturation in Developed Countries Restrains Market Growth

Market saturation in developed countries like the US and Western Europe significantly hampers the growth of the home decor market. In these mature markets, most households have already acquired essential furniture and decor items, leading to less frequent replacement cycles.

The primary growth opportunities lie with new homeowners, a relatively smaller segment compared to the overall population. This saturation challenges market expansion, as demand stabilizes and becomes more reliant on the housing market's fluctuations. Without substantial growth in new housing or major shifts in consumer behavior towards more frequent updates, the potential for market expansion in these regions is limited.

Highly Fragmented Market Limits Industry Expansion

The home decor industry's highly fragmented nature poses a considerable barrier to its growth. With a multitude of small players competing for market share, achieving economies of scale becomes a formidable challenge. This fragmentation means that no single retailer can easily dominate the market; for instance, the top 4 US furniture stores hold less than 20% of the market share.

This scenario complicates efforts to reach critical mass and efficiency, making it difficult for smaller players to compete effectively and for larger entities to leverage scale advantages. Consequently, the market's fragmented structure restricts consolidation benefits, hindering overall industry growth by limiting the capacity for significant market penetration and cost optimization.

Product Type Analysis

In the diverse landscape of the home decor market, the "Product Type" segment encompasses a wide array of items designed to enhance the aesthetic and functional appeal of living spaces. Among these, home furniture emerges as the dominant sub-segment, commanding a significant 24.6% share.

This dominance can be attributed to the essential nature of furniture in creating livable and inviting spaces, coupled with consumer inclination towards refreshing their living environments through major furniture updates. The variety within the furniture segment, from sofas and beds to tables and storage solutions, caters to a broad spectrum of consumer needs and design preferences, driving its substantial market share.

Other sub-segments, including rugs, bath textiles, bed textiles, kitchen and dining textiles, tiles, wood & laminate flooring, vinyl & rubber flooring, and lighting, each play a pivotal role in the overall growth and dynamism of the home decor market. Rugs and textiles add layers of texture and color, allowing for easy and cost-effective room updates.

Tiles and flooring options offer durable and aesthetic solutions for different spaces, with wood & laminate and vinyl & rubber flooring providing options ranging from classic to contemporary. Lighting, another critical component, influences the ambiance and perceived size of a space, with innovations in design and technology continuously evolving.

While home furniture leads in market share, the combined contribution of the other segments facilitates a comprehensive approach to home decoration, addressing not only functional needs but also aesthetic preferences. The growth in these segments is propelled by trends in interior design, technological advancements, and consumer demand for customization and personalization. As consumers continue to invest in their living spaces, the synergy between these diverse product types underscores the home decor market's capacity for sustained growth and innovation.

Distribution Channel Analysis

In the Home Decor Market, the distribution channel plays a pivotal role in defining how products reach consumers, influencing purchasing decisions and market accessibility. The dominant sub-segment, Direct to Consumer (D2C), which holds a 17% share, reflects a growing trend among manufacturers to bypass traditional retail intermediaries, connecting directly with buyers. This model benefits both consumers and producers by offering lower prices, better customer experiences, and more personalized products.

Retail stores, including both independent boutiques and large chains, continue to be significant, offering consumers the advantage of experiencing products firsthand. Manufacturer stores provide brand loyalists a direct avenue to purchase, while e-commerce stores have surged in popularity, driven by the convenience of online shopping. Discount stores appeal to budget-conscious shoppers, rental stores cater to temporary furnishing needs, club stores attract bulk purchasers, and DIY stores serve the home improvement segment.

The D2C channel's growth is fueled by advancements in digital marketing and e-commerce platforms, allowing brands to engage consumers more effectively. However, other channels remain vital, contributing to the industry's dynamism. E-commerce, in particular, is rapidly expanding, driven by consumer demand for convenience and choice. Retail and manufacturer stores reinforce brand identity and customer loyalty. Meanwhile, discount, rental, club, and DIY stores fulfill specific consumer needs, from affordability to project-based purchasing, indicating a diverse and adaptive distribution landscape.

Application Analysis

The application segment of the Home Decor Market is chiefly divided into indoor, outdoor, and other applications, with indoor applications dominating. The focus on indoor home decor stems from consumers' desire to create personalized, comfortable, and aesthetically pleasing living spaces. This drive is reflected in the continuous demand for home furniture, textiles, flooring, and lighting solutions that enhance the functionality and beauty of indoor environments.

Outdoor decor, though a smaller segment, is gaining traction, especially in regions with favorable climates, where outdoor living spaces are viewed as extensions of the indoor living area. This segment includes garden furniture, outdoor rugs, lighting, and weather-resistant decorations that transform outdoor areas into functional, stylish spaces for relaxation and entertainment.

Other applications may include specialized decor for commercial spaces, holiday decorations, and event-specific decor, catering to niche markets with specific needs. These segments, while smaller, are essential for diversifying product offerings and reaching a broader customer base.

Indoor decor's predominance is driven by the increasing importance of home as a sanctuary and personal space, especially highlighted by recent global events that have underscored the value of comfortable and functional living environments. The growth in outdoor decor is fueled by lifestyle trends favoring outdoor living and entertainment. Meanwhile, the "other applications" segment benefits from commercial sector demands and seasonal decoration trends, offering additional growth avenues for the market.

Key Market Segments

By Product Type

- Home Furniture

- Rugs

- Bath Textiles

- Bed Textiles

- Kitchen and Dining Textiles Tiles

- Wood & Laminate Flooring

- Vinyl & Rubber Flooring

- Lighting

- Other Products

By Distribution Channel

- Direct to Consumer

- Retail Stores

- Manufacturer Stores

- E-commerce Stores

- DIY Stores

By Application

- Indoor

- Outdoor

- Other Applications

Growth Opportunities

Smart Home Technology Offers Growth Opportunity

The proliferation of smart home technology opens new avenues for the Home Decor Market. As consumers increasingly adopt WiFi-enabled lights, thermostats, and security systems, there's a burgeoning opportunity for home decor retailers to incorporate smart technology into their products. This integration can extend beyond traditional items, offering consumers furniture, appliances, and accessories that enhance both the functionality and aesthetic appeal of their living spaces.

IKEA's introduction of Bluetooth-enabled lights, shades, and speakers exemplifies this trend, showcasing how home decor can evolve to meet the modern consumer's demand for smart, interconnected living environments. This shift not only aligns with technological advancements but also caters to a growing consumer desire for convenience, security, and energy efficiency, marking a significant growth potential within the market.

Emerging Markets Offer Growth Opportunity

Emerging markets, characterized by rapidly developing economies such as India, China, and Indonesia, present significant growth opportunities for the Home Decor Market. These regions are experiencing a notable rise in their middle-class populations, accompanied by an increase in disposable incomes, which in turn fuels demand for home decor products.

The market in India, for example, is projected to grow at a Compound Annual Growth Rate (CAGR) of 10% from 2019-2024. This growth is driven by consumers seeking to improve their living standards, which includes investing in home decor to enhance their living environments. As these economies continue to grow, the demand for home decor products is expected to surge, offering a lucrative expansion opportunity for manufacturers and retailers in the home decor industry. This trend underscores the importance of tailoring product offerings and marketing strategies to meet the unique needs and preferences of consumers in these burgeoning markets.

Trending Factors

Personalization Is a Trending Factor

Personalization has emerged as a significant trend within the Home Decor Market, as consumers increasingly seek to express their individual style and personality through their living spaces. The demand for customizable options in furniture, accessories, and designs is growing, with retailers responding by offering services like customized furniture dimensions and personalized design selections.

This trend not only enhances customer satisfaction by allowing consumers to create truly unique spaces but also opens up new market opportunities for businesses that can offer these personalized services efficiently. The move towards personalization reflects a broader shift in consumer behavior towards products and services that can be tailored to individual preferences, signaling a growth avenue for retailers and manufacturers in the home decor sector.

Eco-Consciousness Is a Trending Factor

Eco-consciousness is rapidly becoming a dominant trend in the Home Decor Market, as consumers increasingly prioritize sustainable materials, ethical production practices, and green retail operations. This shift towards sustainability is driven by a growing awareness of environmental issues and a desire to reduce personal and societal carbon footprints.

For brands, this means a need to reevaluate sourcing, supply chains, and operational practices to meet the demands of eco-aware consumers. Incorporating sustainable practices can not only help brands align with consumer values but also differentiate themselves in a competitive market. The eco-conscious trend presents an opportunity for expansion as more consumers opt for products that promise minimal environmental impact, indicating a significant shift in market preferences towards sustainability.

Regional Analysis

North America Dominates with 36.6% Market Share

North America, holding a commanding 36.6% share of the Home Decor Market, stands as a testament to the region's strong economic foundations, high consumer spending power, and a deep-seated culture of personalizing living spaces.

Key factors propelling this dominance include a robust real estate market, significant consumer interest in home renovation and decoration, and the region's quick adoption of e-commerce for home decor purchases. The market dynamics in North America are characterized by a preference for quality, sustainability, and innovative design, driving the demand for premium home decor products.

The region's technological advancement and high internet penetration rates have also made online retail a significant contributor to the market's growth, facilitating easy access to a wide range of home decor products. The forecast implications suggest that North America will maintain its market leadership due to ongoing trends in home personalization, sustainability, and digital shopping. However, the growth rate may moderate as emerging markets gain momentum.

- Europe: Europe has traditionally been a strong market for home decor, driven by its rich design heritage and high living standards. The region likely follows North America in terms of market share, with a significant emphasis on eco-friendly and designer products.

- Asia Pacific: The fastest-growing region, thanks to rapidly expanding middle-class populations in countries like China and India. Increasing disposable incomes and urbanization are key drivers of this growth.

- Middle East & Africa: This region shows potential for growth, albeit from a smaller base, driven by luxury home decor demand in affluent areas and expanding urban middle classes.

- Latin America: Growth in Latin America is driven by improving economic conditions, rising urbanization, and a growing interest in interior design, though it starts from a smaller base compared to other regions.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the evolving Home Decor Market, key players such as Kimball International Inc., Inter IKEA Systems B.V., and Ashley Furniture Industries are pivotal in shaping the competitive landscape. These companies, alongside Springs Window Fashions LLC, Conair Corporation, and Siemens AG, leverage their strategic positioning to meet the growing demand for furniture and eco-friendly products. Their efforts are closely tied to the real estate industry's dynamics, influencing the decor market size through innovative product launches.

Notably, entities like Inter IKEA Holding B.V., Suofeiya Home Collection Co., Ltd., and Hanssem Corporation underscore the importance of raw materials and wooden furniture in offering valuable insight into product accessibility. Mannington Mills Inc., Shaw Industries Group Inc., and Herman Miller Inc., together with Armstrong World Industries, Inc., and Mohawk Industries, Inc., highlight the significance of eco-friendly products, contributing to a sustainable competitive landscape.

These major players are instrumental in addressing consumer preferences for eco-friendly and accessible home decor solutions, reflecting a keen understanding of market demands. Their strategic market influence extends beyond mere product offerings to encompass a broader vision for the Home Decor Market, intertwined with the fabric of the real estate industry and its consequent impact on the demand for furniture.

Market Key Players

- Kimball International Inc.

- Inter IKEA Systems B.V.

- Ashley Furniture Industries

- Springs Window Fashions LLC

- Conair Corporation

- Siemens AG

- Inter IKEA Holding B.V.

- Suofeiya Home Collection Co., Ltd.

- Hanssem Corporation

- Mannington Mills Inc.

- Shaw Industries Group Inc.

- Herman Miller Inc.

- Armstrong World Industries, Inc.

- Mohawk Industries, Inc.

- Shaw Industries Group, Inc.

Recent Developments

- On March 15, 2024, Dolly Parton unveiled her first multi-category home collection, which includes tabletop, home décor, and kitchen tools inspired by her rural upbringing in the Smoky Mountains.

- On March 2024, Ruggable introduced an elegant 'Bridgerton'-inspired line, among other new home products, offering consumers a range of stylish options to enhance their living spaces.

- On February 2024, Banana Republic celebrated the launch of BR Home, introducing an expansive collection across home furniture and furnishings.

- On July 2023, Mensa Brands introduced the home décor label Folkulture to the Indian market, expanding its range of products and offerings in the furniture segment.

- On August 2023, D'Décor, a premium home décor brand in India, launched its new campaign titled 'Curtains You Will Love to Draw,' featuring the renowned Bollywood couple Gauri Khan and Shahrukh Khan.

Report Scope

Report Features Description Market Value (2023) USD 720 Billion Forecast Revenue (2033) USD 1,169.4 Billion CAGR (2024-2033) 5.10% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Home Furniture, Rugs, Bath Textiles, Bed Textiles, Kitchen and Dining Textiles Tiles, Wood & Laminate Flooring, Vinyl & Rubber Flooring, Lighting, Other Products), By Distribution Channel (Direct to Consumer, Retail Stores, Manufacturer Stores, E-commerce Stores, DIY Stores), By Application (Indoor, Outdoor, Other Applications) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Kimball International Inc., Inter IKEA Systems B.V., Ashley Furniture Industries, Springs Window Fashions LLC, Conair Corporation, Siemens AG, Inter IKEA Holding B.V., Suofeiya Home Collection Co., Ltd., Hanssem Corporation, Mannington Mills Inc., Shaw Industries Group Inc., Herman Miller Inc., Armstrong World Industries, Inc., Mohawk Industries, Inc., Shaw Industries Group, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Home Decor Market Overview

- 2.1. Home Decor Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Home Decor Market Dynamics

- 3. Global Home Decor Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Home Decor Market Analysis, 2016-2021

- 3.2. Global Home Decor Market Opportunity and Forecast, 2023-2032

- 3.3. Global Home Decor Market Analysis, Opportunity and Forecast, By Product Type, 2016-2032

- 3.3.1. Global Home Decor Market Analysis by Product Type: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product Type, 2016-2032

- 3.3.3. Home Furniture

- 3.3.4. Rugs

- 3.3.5. Bath Textiles

- 3.3.6. Bed Textiles

- 3.3.7. Kitchen and Dining Textiles Tiles

- 3.3.8. Wood & Laminate Flooring

- 3.3.9. Vinyl & Rubber Flooring

- 3.3.10. Lighting

- 3.3.11. Other Products

- 3.4. Global Home Decor Market Analysis, Opportunity and Forecast, By Distribution Channel, 2016-2032

- 3.4.1. Global Home Decor Market Analysis by Distribution Channel: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Distribution Channel, 2016-2032

- 3.4.3. Direct to Consumer

- 3.4.4. Retail Stores

- 3.4.5. Manufacturer Stores

- 3.4.6. E-commerce Stores

- 3.4.7. DIY Stores

- 3.5. Global Home Decor Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 3.5.1. Global Home Decor Market Analysis by Application: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 3.5.3. Indoor

- 3.5.4. Outdoor

- 3.5.5. Other Applications

- 4. North America Home Decor Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Home Decor Market Analysis, 2016-2021

- 4.2. North America Home Decor Market Opportunity and Forecast, 2023-2032

- 4.3. North America Home Decor Market Analysis, Opportunity and Forecast, By Product Type, 2016-2032

- 4.3.1. North America Home Decor Market Analysis by Product Type: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product Type, 2016-2032

- 4.3.3. Home Furniture

- 4.3.4. Rugs

- 4.3.5. Bath Textiles

- 4.3.6. Bed Textiles

- 4.3.7. Kitchen and Dining Textiles Tiles

- 4.3.8. Wood & Laminate Flooring

- 4.3.9. Vinyl & Rubber Flooring

- 4.3.10. Lighting

- 4.3.11. Other Products

- 4.4. North America Home Decor Market Analysis, Opportunity and Forecast, By Distribution Channel, 2016-2032

- 4.4.1. North America Home Decor Market Analysis by Distribution Channel: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Distribution Channel, 2016-2032

- 4.4.3. Direct to Consumer

- 4.4.4. Retail Stores

- 4.4.5. Manufacturer Stores

- 4.4.6. E-commerce Stores

- 4.4.7. DIY Stores

- 4.5. North America Home Decor Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 4.5.1. North America Home Decor Market Analysis by Application: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 4.5.3. Indoor

- 4.5.4. Outdoor

- 4.5.5. Other Applications

- 4.6. North America Home Decor Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.6.1. North America Home Decor Market Analysis by Country : Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.6.2.1. The US

- 4.6.2.2. Canada

- 4.6.2.3. Mexico

- 5. Western Europe Home Decor Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Home Decor Market Analysis, 2016-2021

- 5.2. Western Europe Home Decor Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Home Decor Market Analysis, Opportunity and Forecast, By Product Type, 2016-2032

- 5.3.1. Western Europe Home Decor Market Analysis by Product Type: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product Type, 2016-2032

- 5.3.3. Home Furniture

- 5.3.4. Rugs

- 5.3.5. Bath Textiles

- 5.3.6. Bed Textiles

- 5.3.7. Kitchen and Dining Textiles Tiles

- 5.3.8. Wood & Laminate Flooring

- 5.3.9. Vinyl & Rubber Flooring

- 5.3.10. Lighting

- 5.3.11. Other Products

- 5.4. Western Europe Home Decor Market Analysis, Opportunity and Forecast, By Distribution Channel, 2016-2032

- 5.4.1. Western Europe Home Decor Market Analysis by Distribution Channel: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Distribution Channel, 2016-2032

- 5.4.3. Direct to Consumer

- 5.4.4. Retail Stores

- 5.4.5. Manufacturer Stores

- 5.4.6. E-commerce Stores

- 5.4.7. DIY Stores

- 5.5. Western Europe Home Decor Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 5.5.1. Western Europe Home Decor Market Analysis by Application: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 5.5.3. Indoor

- 5.5.4. Outdoor

- 5.5.5. Other Applications

- 5.6. Western Europe Home Decor Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.6.1. Western Europe Home Decor Market Analysis by Country : Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.6.2.1. Germany

- 5.6.2.2. France

- 5.6.2.3. The UK

- 5.6.2.4. Spain

- 5.6.2.5. Italy

- 5.6.2.6. Portugal

- 5.6.2.7. Ireland

- 5.6.2.8. Austria

- 5.6.2.9. Switzerland

- 5.6.2.10. Benelux

- 5.6.2.11. Nordic

- 5.6.2.12. Rest of Western Europe

- 6. Eastern Europe Home Decor Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Home Decor Market Analysis, 2016-2021

- 6.2. Eastern Europe Home Decor Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Home Decor Market Analysis, Opportunity and Forecast, By Product Type, 2016-2032

- 6.3.1. Eastern Europe Home Decor Market Analysis by Product Type: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product Type, 2016-2032

- 6.3.3. Home Furniture

- 6.3.4. Rugs

- 6.3.5. Bath Textiles

- 6.3.6. Bed Textiles

- 6.3.7. Kitchen and Dining Textiles Tiles

- 6.3.8. Wood & Laminate Flooring

- 6.3.9. Vinyl & Rubber Flooring

- 6.3.10. Lighting

- 6.3.11. Other Products

- 6.4. Eastern Europe Home Decor Market Analysis, Opportunity and Forecast, By Distribution Channel, 2016-2032

- 6.4.1. Eastern Europe Home Decor Market Analysis by Distribution Channel: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Distribution Channel, 2016-2032

- 6.4.3. Direct to Consumer

- 6.4.4. Retail Stores

- 6.4.5. Manufacturer Stores

- 6.4.6. E-commerce Stores

- 6.4.7. DIY Stores

- 6.5. Eastern Europe Home Decor Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 6.5.1. Eastern Europe Home Decor Market Analysis by Application: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 6.5.3. Indoor

- 6.5.4. Outdoor

- 6.5.5. Other Applications

- 6.6. Eastern Europe Home Decor Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.6.1. Eastern Europe Home Decor Market Analysis by Country : Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.6.2.1. Russia

- 6.6.2.2. Poland

- 6.6.2.3. The Czech Republic

- 6.6.2.4. Greece

- 6.6.2.5. Rest of Eastern Europe

- 7. APAC Home Decor Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Home Decor Market Analysis, 2016-2021

- 7.2. APAC Home Decor Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Home Decor Market Analysis, Opportunity and Forecast, By Product Type, 2016-2032

- 7.3.1. APAC Home Decor Market Analysis by Product Type: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product Type, 2016-2032

- 7.3.3. Home Furniture

- 7.3.4. Rugs

- 7.3.5. Bath Textiles

- 7.3.6. Bed Textiles

- 7.3.7. Kitchen and Dining Textiles Tiles

- 7.3.8. Wood & Laminate Flooring

- 7.3.9. Vinyl & Rubber Flooring

- 7.3.10. Lighting

- 7.3.11. Other Products

- 7.4. APAC Home Decor Market Analysis, Opportunity and Forecast, By Distribution Channel, 2016-2032

- 7.4.1. APAC Home Decor Market Analysis by Distribution Channel: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Distribution Channel, 2016-2032

- 7.4.3. Direct to Consumer

- 7.4.4. Retail Stores

- 7.4.5. Manufacturer Stores

- 7.4.6. E-commerce Stores

- 7.4.7. DIY Stores

- 7.5. APAC Home Decor Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 7.5.1. APAC Home Decor Market Analysis by Application: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 7.5.3. Indoor

- 7.5.4. Outdoor

- 7.5.5. Other Applications

- 7.6. APAC Home Decor Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.6.1. APAC Home Decor Market Analysis by Country : Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.6.2.1. China

- 7.6.2.2. Japan

- 7.6.2.3. South Korea

- 7.6.2.4. India

- 7.6.2.5. Australia & New Zeland

- 7.6.2.6. Indonesia

- 7.6.2.7. Malaysia

- 7.6.2.8. Philippines

- 7.6.2.9. Singapore

- 7.6.2.10. Thailand

- 7.6.2.11. Vietnam

- 7.6.2.12. Rest of APAC

- 8. Latin America Home Decor Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Home Decor Market Analysis, 2016-2021

- 8.2. Latin America Home Decor Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Home Decor Market Analysis, Opportunity and Forecast, By Product Type, 2016-2032

- 8.3.1. Latin America Home Decor Market Analysis by Product Type: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product Type, 2016-2032

- 8.3.3. Home Furniture

- 8.3.4. Rugs

- 8.3.5. Bath Textiles

- 8.3.6. Bed Textiles

- 8.3.7. Kitchen and Dining Textiles Tiles

- 8.3.8. Wood & Laminate Flooring

- 8.3.9. Vinyl & Rubber Flooring

- 8.3.10. Lighting

- 8.3.11. Other Products

- 8.4. Latin America Home Decor Market Analysis, Opportunity and Forecast, By Distribution Channel, 2016-2032

- 8.4.1. Latin America Home Decor Market Analysis by Distribution Channel: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Distribution Channel, 2016-2032

- 8.4.3. Direct to Consumer

- 8.4.4. Retail Stores

- 8.4.5. Manufacturer Stores

- 8.4.6. E-commerce Stores

- 8.4.7. DIY Stores

- 8.5. Latin America Home Decor Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 8.5.1. Latin America Home Decor Market Analysis by Application: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 8.5.3. Indoor

- 8.5.4. Outdoor

- 8.5.5. Other Applications

- 8.6. Latin America Home Decor Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.6.1. Latin America Home Decor Market Analysis by Country : Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.6.2.1. Brazil

- 8.6.2.2. Colombia

- 8.6.2.3. Chile

- 8.6.2.4. Argentina

- 8.6.2.5. Costa Rica

- 8.6.2.6. Rest of Latin America

- 9. Middle East & Africa Home Decor Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Home Decor Market Analysis, 2016-2021

- 9.2. Middle East & Africa Home Decor Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Home Decor Market Analysis, Opportunity and Forecast, By Product Type, 2016-2032

- 9.3.1. Middle East & Africa Home Decor Market Analysis by Product Type: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product Type, 2016-2032

- 9.3.3. Home Furniture

- 9.3.4. Rugs

- 9.3.5. Bath Textiles

- 9.3.6. Bed Textiles

- 9.3.7. Kitchen and Dining Textiles Tiles

- 9.3.8. Wood & Laminate Flooring

- 9.3.9. Vinyl & Rubber Flooring

- 9.3.10. Lighting

- 9.3.11. Other Products

- 9.4. Middle East & Africa Home Decor Market Analysis, Opportunity and Forecast, By Distribution Channel, 2016-2032

- 9.4.1. Middle East & Africa Home Decor Market Analysis by Distribution Channel: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Distribution Channel, 2016-2032

- 9.4.3. Direct to Consumer

- 9.4.4. Retail Stores

- 9.4.5. Manufacturer Stores

- 9.4.6. E-commerce Stores

- 9.4.7. DIY Stores

- 9.5. Middle East & Africa Home Decor Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 9.5.1. Middle East & Africa Home Decor Market Analysis by Application: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 9.5.3. Indoor

- 9.5.4. Outdoor

- 9.5.5. Other Applications

- 9.6. Middle East & Africa Home Decor Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.6.1. Middle East & Africa Home Decor Market Analysis by Country : Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.6.2.1. Algeria

- 9.6.2.2. Egypt

- 9.6.2.3. Israel

- 9.6.2.4. Kuwait

- 9.6.2.5. Nigeria

- 9.6.2.6. Saudi Arabia

- 9.6.2.7. South Africa

- 9.6.2.8. Turkey

- 9.6.2.9. The UAE

- 9.6.2.10. Rest of MEA

- 10. Global Home Decor Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Home Decor Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Home Decor Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Kimball International Inc.

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Inter IKEA Systems B.V.

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Ashley Furniture Industries

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Springs Window Fashions LLC

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Conair Corporation

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Siemens AG

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Inter IKEA Holding B.V.

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Suofeiya Home Collection Co., Ltd.

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Hanssem Corporation

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Mannington Mills Inc.

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. Shaw Industries Group Inc.

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 11.15. Armstrong World Industries, Inc.

- 11.15.1. Company Overview

- 11.15.2. Financial Highlights

- 11.15.3. Product Portfolio

- 11.15.4. SWOT Analysis

- 11.15.5. Key Strategies and Developments

- 11.16. Mohawk Industries, Inc.

- 11.16.1. Company Overview

- 11.16.2. Financial Highlights

- 11.16.3. Product Portfolio

- 11.16.4. SWOT Analysis

- 11.16.5. Key Strategies and Developments

- 11.17. Shaw Industries Group, Inc.

- 11.17.1. Company Overview

- 11.17.2. Financial Highlights

- 11.17.3. Product Portfolio

- 11.17.4. SWOT Analysis

- 11.17.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

List of Figures

-

- Figure 1: Global Home Decor Market Revenue (US$ Mn) Market Share by Product Type in 2022

- Figure 2: Global Home Decor Market Attractiveness Analysis by Product Type, 2016-2032

- Figure 3: Global Home Decor Market Revenue (US$ Mn) Market Share by Distribution Channelin 2022

- Figure 4: Global Home Decor Market Attractiveness Analysis by Distribution Channel, 2016-2032

- Figure 5: Global Home Decor Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 6: Global Home Decor Market Attractiveness Analysis by Application, 2016-2032

- Figure 7: Global Home Decor Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 8: Global Home Decor Market Attractiveness Analysis by Region, 2016-2032

- Figure 9: Global Home Decor Market Revenue (US$ Mn) (2016-2032)

- Figure 10: Global Home Decor Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 11: Global Home Decor Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Figure 12: Global Home Decor Market Revenue (US$ Mn) Comparison by Distribution Channel (2016-2032)

- Figure 13: Global Home Decor Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 14: Global Home Decor Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 15: Global Home Decor Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Figure 16: Global Home Decor Market Y-o-Y Growth Rate Comparison by Distribution Channel (2016-2032)

- Figure 17: Global Home Decor Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 18: Global Home Decor Market Share Comparison by Region (2016-2032)

- Figure 19: Global Home Decor Market Share Comparison by Product Type (2016-2032)

- Figure 20: Global Home Decor Market Share Comparison by Distribution Channel (2016-2032)

- Figure 21: Global Home Decor Market Share Comparison by Application (2016-2032)

- Figure 22: North America Home Decor Market Revenue (US$ Mn) Market Share by Product Typein 2022

- Figure 23: North America Home Decor Market Attractiveness Analysis by Product Type, 2016-2032

- Figure 24: North America Home Decor Market Revenue (US$ Mn) Market Share by Distribution Channelin 2022

- Figure 25: North America Home Decor Market Attractiveness Analysis by Distribution Channel, 2016-2032

- Figure 26: North America Home Decor Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 27: North America Home Decor Market Attractiveness Analysis by Application, 2016-2032

- Figure 28: North America Home Decor Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 29: North America Home Decor Market Attractiveness Analysis by Country, 2016-2032

- Figure 30: North America Home Decor Market Revenue (US$ Mn) (2016-2032)

- Figure 31: North America Home Decor Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 32: North America Home Decor Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Figure 33: North America Home Decor Market Revenue (US$ Mn) Comparison by Distribution Channel (2016-2032)

- Figure 34: North America Home Decor Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 35: North America Home Decor Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 36: North America Home Decor Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Figure 37: North America Home Decor Market Y-o-Y Growth Rate Comparison by Distribution Channel (2016-2032)

- Figure 38: North America Home Decor Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 39: North America Home Decor Market Share Comparison by Country (2016-2032)

- Figure 40: North America Home Decor Market Share Comparison by Product Type (2016-2032)

- Figure 41: North America Home Decor Market Share Comparison by Distribution Channel (2016-2032)

- Figure 42: North America Home Decor Market Share Comparison by Application (2016-2032)

- Figure 43: Western Europe Home Decor Market Revenue (US$ Mn) Market Share by Product Typein 2022

- Figure 44: Western Europe Home Decor Market Attractiveness Analysis by Product Type, 2016-2032

- Figure 45: Western Europe Home Decor Market Revenue (US$ Mn) Market Share by Distribution Channelin 2022

- Figure 46: Western Europe Home Decor Market Attractiveness Analysis by Distribution Channel, 2016-2032

- Figure 47: Western Europe Home Decor Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 48: Western Europe Home Decor Market Attractiveness Analysis by Application, 2016-2032

- Figure 49: Western Europe Home Decor Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 50: Western Europe Home Decor Market Attractiveness Analysis by Country, 2016-2032

- Figure 51: Western Europe Home Decor Market Revenue (US$ Mn) (2016-2032)

- Figure 52: Western Europe Home Decor Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 53: Western Europe Home Decor Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Figure 54: Western Europe Home Decor Market Revenue (US$ Mn) Comparison by Distribution Channel (2016-2032)

- Figure 55: Western Europe Home Decor Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 56: Western Europe Home Decor Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 57: Western Europe Home Decor Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Figure 58: Western Europe Home Decor Market Y-o-Y Growth Rate Comparison by Distribution Channel (2016-2032)

- Figure 59: Western Europe Home Decor Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 60: Western Europe Home Decor Market Share Comparison by Country (2016-2032)

- Figure 61: Western Europe Home Decor Market Share Comparison by Product Type (2016-2032)

- Figure 62: Western Europe Home Decor Market Share Comparison by Distribution Channel (2016-2032)

- Figure 63: Western Europe Home Decor Market Share Comparison by Application (2016-2032)

- Figure 64: Eastern Europe Home Decor Market Revenue (US$ Mn) Market Share by Product Typein 2022

- Figure 65: Eastern Europe Home Decor Market Attractiveness Analysis by Product Type, 2016-2032

- Figure 66: Eastern Europe Home Decor Market Revenue (US$ Mn) Market Share by Distribution Channelin 2022

- Figure 67: Eastern Europe Home Decor Market Attractiveness Analysis by Distribution Channel, 2016-2032

- Figure 68: Eastern Europe Home Decor Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 69: Eastern Europe Home Decor Market Attractiveness Analysis by Application, 2016-2032

- Figure 70: Eastern Europe Home Decor Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 71: Eastern Europe Home Decor Market Attractiveness Analysis by Country, 2016-2032

- Figure 72: Eastern Europe Home Decor Market Revenue (US$ Mn) (2016-2032)

- Figure 73: Eastern Europe Home Decor Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 74: Eastern Europe Home Decor Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Figure 75: Eastern Europe Home Decor Market Revenue (US$ Mn) Comparison by Distribution Channel (2016-2032)

- Figure 76: Eastern Europe Home Decor Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 77: Eastern Europe Home Decor Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 78: Eastern Europe Home Decor Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Figure 79: Eastern Europe Home Decor Market Y-o-Y Growth Rate Comparison by Distribution Channel (2016-2032)

- Figure 80: Eastern Europe Home Decor Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 81: Eastern Europe Home Decor Market Share Comparison by Country (2016-2032)

- Figure 82: Eastern Europe Home Decor Market Share Comparison by Product Type (2016-2032)

- Figure 83: Eastern Europe Home Decor Market Share Comparison by Distribution Channel (2016-2032)

- Figure 84: Eastern Europe Home Decor Market Share Comparison by Application (2016-2032)

- Figure 85: APAC Home Decor Market Revenue (US$ Mn) Market Share by Product Typein 2022

- Figure 86: APAC Home Decor Market Attractiveness Analysis by Product Type, 2016-2032

- Figure 87: APAC Home Decor Market Revenue (US$ Mn) Market Share by Distribution Channelin 2022

- Figure 88: APAC Home Decor Market Attractiveness Analysis by Distribution Channel, 2016-2032

- Figure 89: APAC Home Decor Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 90: APAC Home Decor Market Attractiveness Analysis by Application, 2016-2032

- Figure 91: APAC Home Decor Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 92: APAC Home Decor Market Attractiveness Analysis by Country, 2016-2032

- Figure 93: APAC Home Decor Market Revenue (US$ Mn) (2016-2032)

- Figure 94: APAC Home Decor Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 95: APAC Home Decor Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Figure 96: APAC Home Decor Market Revenue (US$ Mn) Comparison by Distribution Channel (2016-2032)

- Figure 97: APAC Home Decor Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 98: APAC Home Decor Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 99: APAC Home Decor Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Figure 100: APAC Home Decor Market Y-o-Y Growth Rate Comparison by Distribution Channel (2016-2032)

- Figure 101: APAC Home Decor Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 102: APAC Home Decor Market Share Comparison by Country (2016-2032)

- Figure 103: APAC Home Decor Market Share Comparison by Product Type (2016-2032)

- Figure 104: APAC Home Decor Market Share Comparison by Distribution Channel (2016-2032)

- Figure 105: APAC Home Decor Market Share Comparison by Application (2016-2032)

- Figure 106: Latin America Home Decor Market Revenue (US$ Mn) Market Share by Product Typein 2022

- Figure 107: Latin America Home Decor Market Attractiveness Analysis by Product Type, 2016-2032

- Figure 108: Latin America Home Decor Market Revenue (US$ Mn) Market Share by Distribution Channelin 2022

- Figure 109: Latin America Home Decor Market Attractiveness Analysis by Distribution Channel, 2016-2032

- Figure 110: Latin America Home Decor Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 111: Latin America Home Decor Market Attractiveness Analysis by Application, 2016-2032

- Figure 112: Latin America Home Decor Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 113: Latin America Home Decor Market Attractiveness Analysis by Country, 2016-2032

- Figure 114: Latin America Home Decor Market Revenue (US$ Mn) (2016-2032)

- Figure 115: Latin America Home Decor Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 116: Latin America Home Decor Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Figure 117: Latin America Home Decor Market Revenue (US$ Mn) Comparison by Distribution Channel (2016-2032)

- Figure 118: Latin America Home Decor Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 119: Latin America Home Decor Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 120: Latin America Home Decor Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Figure 121: Latin America Home Decor Market Y-o-Y Growth Rate Comparison by Distribution Channel (2016-2032)

- Figure 122: Latin America Home Decor Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 123: Latin America Home Decor Market Share Comparison by Country (2016-2032)

- Figure 124: Latin America Home Decor Market Share Comparison by Product Type (2016-2032)

- Figure 125: Latin America Home Decor Market Share Comparison by Distribution Channel (2016-2032)

- Figure 126: Latin America Home Decor Market Share Comparison by Application (2016-2032)

- Figure 127: Middle East & Africa Home Decor Market Revenue (US$ Mn) Market Share by Product Typein 2022

- Figure 128: Middle East & Africa Home Decor Market Attractiveness Analysis by Product Type, 2016-2032

- Figure 129: Middle East & Africa Home Decor Market Revenue (US$ Mn) Market Share by Distribution Channelin 2022

- Figure 130: Middle East & Africa Home Decor Market Attractiveness Analysis by Distribution Channel, 2016-2032

- Figure 131: Middle East & Africa Home Decor Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 132: Middle East & Africa Home Decor Market Attractiveness Analysis by Application, 2016-2032

- Figure 133: Middle East & Africa Home Decor Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 134: Middle East & Africa Home Decor Market Attractiveness Analysis by Country, 2016-2032

- Figure 135: Middle East & Africa Home Decor Market Revenue (US$ Mn) (2016-2032)

- Figure 136: Middle East & Africa Home Decor Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 137: Middle East & Africa Home Decor Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Figure 138: Middle East & Africa Home Decor Market Revenue (US$ Mn) Comparison by Distribution Channel (2016-2032)

- Figure 139: Middle East & Africa Home Decor Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 140: Middle East & Africa Home Decor Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 141: Middle East & Africa Home Decor Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Figure 142: Middle East & Africa Home Decor Market Y-o-Y Growth Rate Comparison by Distribution Channel (2016-2032)

- Figure 143: Middle East & Africa Home Decor Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 144: Middle East & Africa Home Decor Market Share Comparison by Country (2016-2032)

- Figure 145: Middle East & Africa Home Decor Market Share Comparison by Product Type (2016-2032)

- Figure 146: Middle East & Africa Home Decor Market Share Comparison by Distribution Channel (2016-2032)

- Figure 147: Middle East & Africa Home Decor Market Share Comparison by Application (2016-2032)

- List of Tables

- Table 1: Global Home Decor Market Comparison by Product Type (2016-2032)

- Table 2: Global Home Decor Market Comparison by Distribution Channel (2016-2032)

- Table 3: Global Home Decor Market Comparison by Application (2016-2032)

- Table 4: Global Home Decor Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 5: Global Home Decor Market Revenue (US$ Mn) (2016-2032)

- Table 6: Global Home Decor Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 7: Global Home Decor Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Table 8: Global Home Decor Market Revenue (US$ Mn) Comparison by Distribution Channel (2016-2032)

- Table 9: Global Home Decor Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 10: Global Home Decor Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 11: Global Home Decor Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Table 12: Global Home Decor Market Y-o-Y Growth Rate Comparison by Distribution Channel (2016-2032)

- Table 13: Global Home Decor Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 14: Global Home Decor Market Share Comparison by Region (2016-2032)

- Table 15: Global Home Decor Market Share Comparison by Product Type (2016-2032)

- Table 16: Global Home Decor Market Share Comparison by Distribution Channel (2016-2032)

- Table 17: Global Home Decor Market Share Comparison by Application (2016-2032)

- Table 18: North America Home Decor Market Comparison by Distribution Channel (2016-2032)

- Table 19: North America Home Decor Market Comparison by Application (2016-2032)

- Table 20: North America Home Decor Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 21: North America Home Decor Market Revenue (US$ Mn) (2016-2032)

- Table 22: North America Home Decor Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 23: North America Home Decor Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Table 24: North America Home Decor Market Revenue (US$ Mn) Comparison by Distribution Channel (2016-2032)

- Table 25: North America Home Decor Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 26: North America Home Decor Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 27: North America Home Decor Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Table 28: North America Home Decor Market Y-o-Y Growth Rate Comparison by Distribution Channel (2016-2032)

- Table 29: North America Home Decor Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 30: North America Home Decor Market Share Comparison by Country (2016-2032)

- Table 31: North America Home Decor Market Share Comparison by Product Type (2016-2032)

- Table 32: North America Home Decor Market Share Comparison by Distribution Channel (2016-2032)

- Table 33: North America Home Decor Market Share Comparison by Application (2016-2032)

- Table 34: Western Europe Home Decor Market Comparison by Product Type (2016-2032)

- Table 35: Western Europe Home Decor Market Comparison by Distribution Channel (2016-2032)

- Table 36: Western Europe Home Decor Market Comparison by Application (2016-2032)

- Table 37: Western Europe Home Decor Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 38: Western Europe Home Decor Market Revenue (US$ Mn) (2016-2032)

- Table 39: Western Europe Home Decor Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 40: Western Europe Home Decor Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Table 41: Western Europe Home Decor Market Revenue (US$ Mn) Comparison by Distribution Channel (2016-2032)

- Table 42: Western Europe Home Decor Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 43: Western Europe Home Decor Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 44: Western Europe Home Decor Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Table 45: Western Europe Home Decor Market Y-o-Y Growth Rate Comparison by Distribution Channel (2016-2032)

- Table 46: Western Europe Home Decor Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 47: Western Europe Home Decor Market Share Comparison by Country (2016-2032)

- Table 48: Western Europe Home Decor Market Share Comparison by Product Type (2016-2032)

- Table 49: Western Europe Home Decor Market Share Comparison by Distribution Channel (2016-2032)

- Table 50: Western Europe Home Decor Market Share Comparison by Application (2016-2032)

- Table 51: Eastern Europe Home Decor Market Comparison by Product Type (2016-2032)

- Table 52: Eastern Europe Home Decor Market Comparison by Distribution Channel (2016-2032)

- Table 53: Eastern Europe Home Decor Market Comparison by Application (2016-2032)

- Table 54: Eastern Europe Home Decor Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 55: Eastern Europe Home Decor Market Revenue (US$ Mn) (2016-2032)

- Table 56: Eastern Europe Home Decor Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 57: Eastern Europe Home Decor Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Table 58: Eastern Europe Home Decor Market Revenue (US$ Mn) Comparison by Distribution Channel (2016-2032)

- Table 59: Eastern Europe Home Decor Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 60: Eastern Europe Home Decor Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 61: Eastern Europe Home Decor Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Table 62: Eastern Europe Home Decor Market Y-o-Y Growth Rate Comparison by Distribution Channel (2016-2032)

- Table 63: Eastern Europe Home Decor Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 64: Eastern Europe Home Decor Market Share Comparison by Country (2016-2032)

- Table 65: Eastern Europe Home Decor Market Share Comparison by Product Type (2016-2032)

- Table 66: Eastern Europe Home Decor Market Share Comparison by Distribution Channel (2016-2032)

- Table 67: Eastern Europe Home Decor Market Share Comparison by Application (2016-2032)

- Table 68: APAC Home Decor Market Comparison by Product Type (2016-2032)

- Table 69: APAC Home Decor Market Comparison by Distribution Channel (2016-2032)

- Table 70: APAC Home Decor Market Comparison by Application (2016-2032)

- Table 71: APAC Home Decor Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 72: APAC Home Decor Market Revenue (US$ Mn) (2016-2032)

- Table 73: APAC Home Decor Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 74: APAC Home Decor Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Table 75: APAC Home Decor Market Revenue (US$ Mn) Comparison by Distribution Channel (2016-2032)

- Table 76: APAC Home Decor Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 77: APAC Home Decor Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 78: APAC Home Decor Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Table 79: APAC Home Decor Market Y-o-Y Growth Rate Comparison by Distribution Channel (2016-2032)

- Table 80: APAC Home Decor Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 81: APAC Home Decor Market Share Comparison by Country (2016-2032)

- Table 82: APAC Home Decor Market Share Comparison by Product Type (2016-2032)

- Table 83: APAC Home Decor Market Share Comparison by Distribution Channel (2016-2032)

- Table 84: APAC Home Decor Market Share Comparison by Application (2016-2032)

- Table 85: Latin America Home Decor Market Comparison by Product Type (2016-2032)

- Table 86: Latin America Home Decor Market Comparison by Distribution Channel (2016-2032)

- Table 87: Latin America Home Decor Market Comparison by Application (2016-2032)

- Table 88: Latin America Home Decor Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 89: Latin America Home Decor Market Revenue (US$ Mn) (2016-2032)

- Table 90: Latin America Home Decor Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 91: Latin America Home Decor Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Table 92: Latin America Home Decor Market Revenue (US$ Mn) Comparison by Distribution Channel (2016-2032)

- Table 93: Latin America Home Decor Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 94: Latin America Home Decor Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 95: Latin America Home Decor Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Table 96: Latin America Home Decor Market Y-o-Y Growth Rate Comparison by Distribution Channel (2016-2032)

- Table 97: Latin America Home Decor Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 98: Latin America Home Decor Market Share Comparison by Country (2016-2032)

- Table 99: Latin America Home Decor Market Share Comparison by Product Type (2016-2032)

- Table 100: Latin America Home Decor Market Share Comparison by Distribution Channel (2016-2032)

- Table 101: Latin America Home Decor Market Share Comparison by Application (2016-2032)

- Table 102: Middle East & Africa Home Decor Market Comparison by Product Type (2016-2032)

- Table 103: Middle East & Africa Home Decor Market Comparison by Distribution Channel (2016-2032)

- Table 104: Middle East & Africa Home Decor Market Comparison by Application (2016-2032)

- Table 105: Middle East & Africa Home Decor Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 106: Middle East & Africa Home Decor Market Revenue (US$ Mn) (2016-2032)

- Table 107: Middle East & Africa Home Decor Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 108: Middle East & Africa Home Decor Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Table 109: Middle East & Africa Home Decor Market Revenue (US$ Mn) Comparison by Distribution Channel (2016-2032)

- Table 110: Middle East & Africa Home Decor Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 111: Middle East & Africa Home Decor Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 112: Middle East & Africa Home Decor Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Table 113: Middle East & Africa Home Decor Market Y-o-Y Growth Rate Comparison by Distribution Channel (2016-2032)

- Table 114: Middle East & Africa Home Decor Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 115: Middle East & Africa Home Decor Market Share Comparison by Country (2016-2032)

- Table 116: Middle East & Africa Home Decor Market Share Comparison by Product Type (2016-2032)

- Table 117: Middle East & Africa Home Decor Market Share Comparison by Distribution Channel (2016-2032)

- Table 118: Middle East & Africa Home Decor Market Share Comparison by Application (2016-2032)

- 1. Executive Summary

-

- Kimball International Inc.

- Inter IKEA Systems B.V.

- Ashley Furniture Industries

- Springs Window Fashions LLC

- Conair Corporation

- Siemens AG

- Inter IKEA Holding B.V.

- Suofeiya Home Collection Co., Ltd.

- Hanssem Corporation

- Mannington Mills Inc.

- Shaw Industries Group Inc.

- Herman Miller Inc.

- Armstrong World Industries, Inc.

- Mohawk Industries, Inc.

- Shaw Industries Group, Inc.