Ready To Assemble Furniture Market Report By Product Type (Desks, Chairs, Tables, Cabinets, Sofas, Beds, Others), By Material Type (Wood, Metal, Plastic, Glass, Others), By Distribution Channel, By End-User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

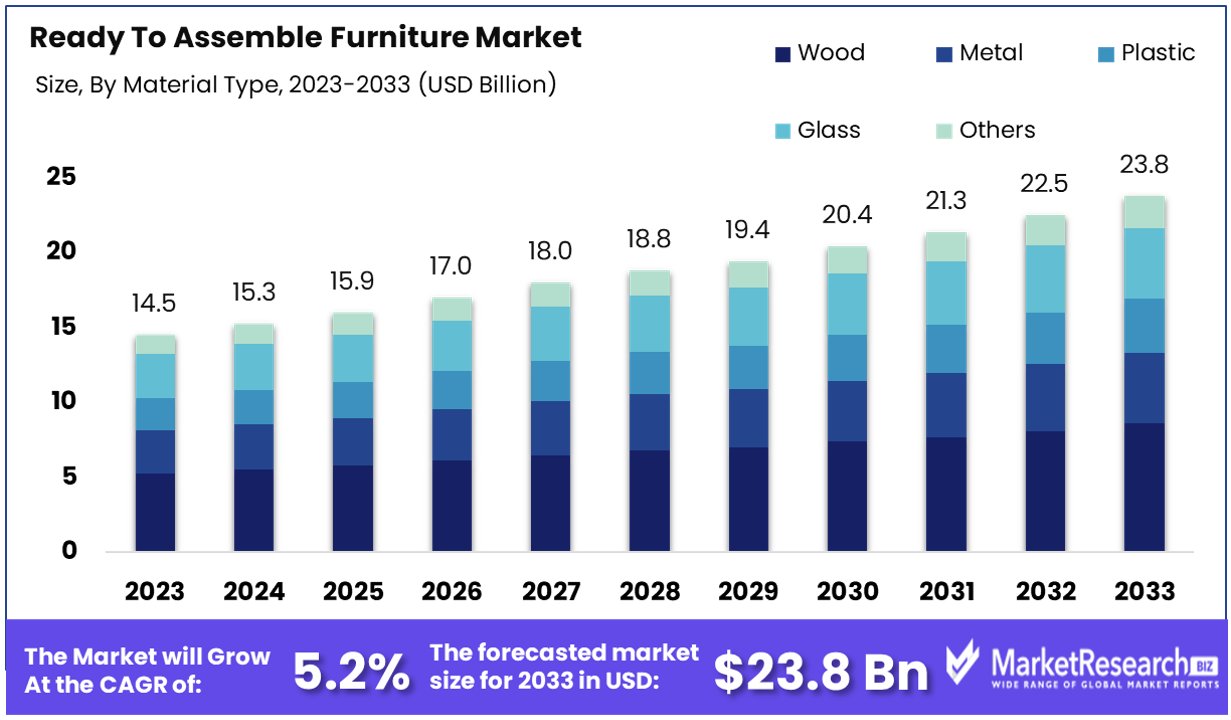

The Global Ready To Assemble Furniture Market size is expected to be worth around USD 23.8 Billion by 2033, from USD 14.5 Billion in 2023, growing at a CAGR of 5.20% during the forecast period from 2024 to 2033.

The Ready to Assemble (RTA) Furniture Market refers to a segment of the furniture industry focusing on furniture that is sold in parts and requires assembly by the customer. This market appeals to consumers seeking affordability, convenience, and style.

RTA furniture caters to a diverse range of settings, including homes, offices, and commercial spaces. The key attraction is the ease of shipping and handling, which reduces costs and appeals to a cost-conscious audience.

The Ready to Assemble (RTA) Furniture Market is positioned for substantial growth, driven by evolving consumer spending habits and preferences. A 2022 study by the National Association of Home Builders highlights a pivotal trend: new homeowners are investing significantly in their living spaces, with expenditures averaging about $12,000 on renovations, $5,000 on furnishings, and $4,000 on appliances within the first year of ownership.

This data underscores the burgeoning opportunity for the RTA furniture segment, especially as it aligns with the increasing demand for cost-effective, stylish, and easy-to-assemble options.

The market is further buoyed by the small space living trend, which necessitates sleek, minimalist bedroom furniture that is multipurpose in design. The growing consumer preference for sustainability is driving interest in bedroom sets made from recycled/upcycled materials and renewable resources like bamboo furniture. This shift not only reflects a change in consumer values but also opens new avenues for product innovation within the RTA furniture market.

Moreover, there is a notable rise in demand for customized furniture solutions. Approximately 30% of furniture buyers express interest in custom-made options, indicating a significant market segment that values personalization and uniqueness. This trend presents an opportunity for RTA furniture manufacturers to diversify their offerings and cater to this desire for customization, thereby enhancing consumer engagement and loyalty.

Key Takeaways

- Market Growth Projection: The Global Ready To Assemble (RTA) Furniture Market is poised for substantial growth, with an expected value of approximately USD 23.8 Billion by 2033, compared to USD 14.5 Billion in 2023, reflecting a steady Compound Annual Growth Rate (CAGR) of 5.20% from 2024 to 2033.

- Product Types: RTA furniture encompasses a diverse range of products, including desks, chairs, tables, cabinets, sofas, beds, and others, catering to various consumer needs and preferences.

- Material Diversity: Wood remains the dominant material choice in RTA furniture, followed by metal, plastic, glass, and other materials, reflecting a blend of traditional and contemporary design elements.

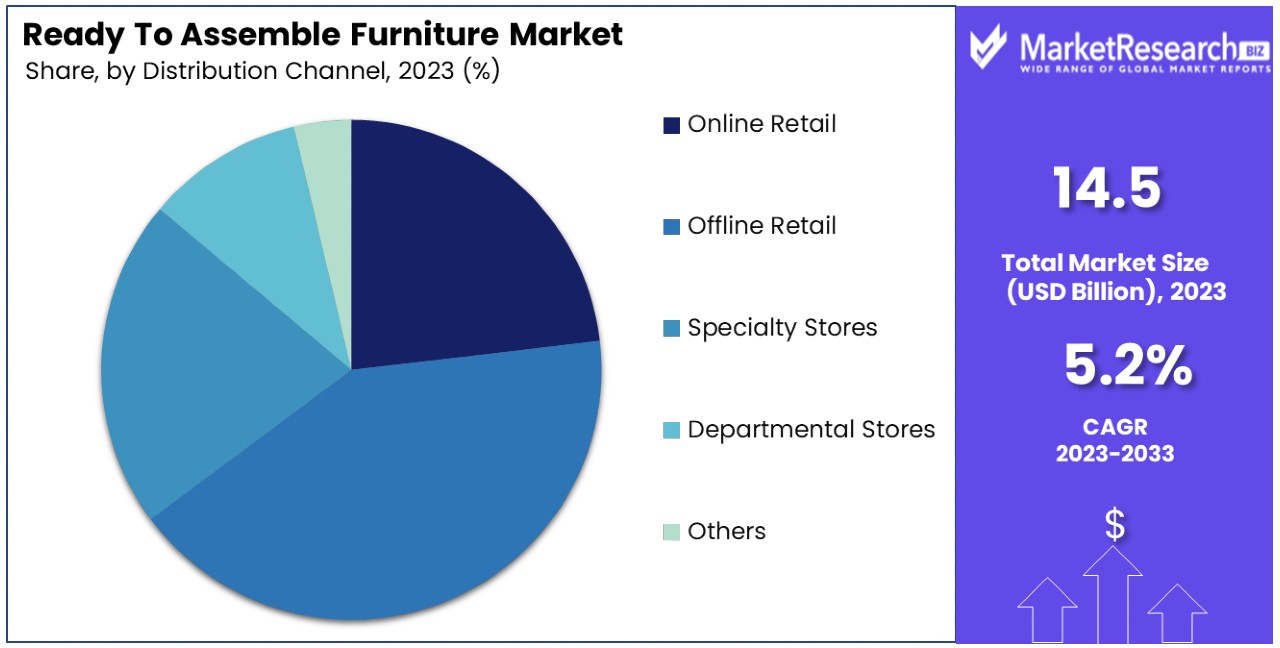

- Distribution Channels: While offline retail, particularly brick-and-mortar stores, currently dominates distribution, online retail is experiencing significant growth. Specialty stores, departmental stores, and other channels also contribute to market accessibility.

- End-User Segmentation: Residential consumers constitute the dominant end-user segment, reflecting the widespread adoption of RTA furniture in homes. However, commercial and institutional sectors also contribute to market demand.

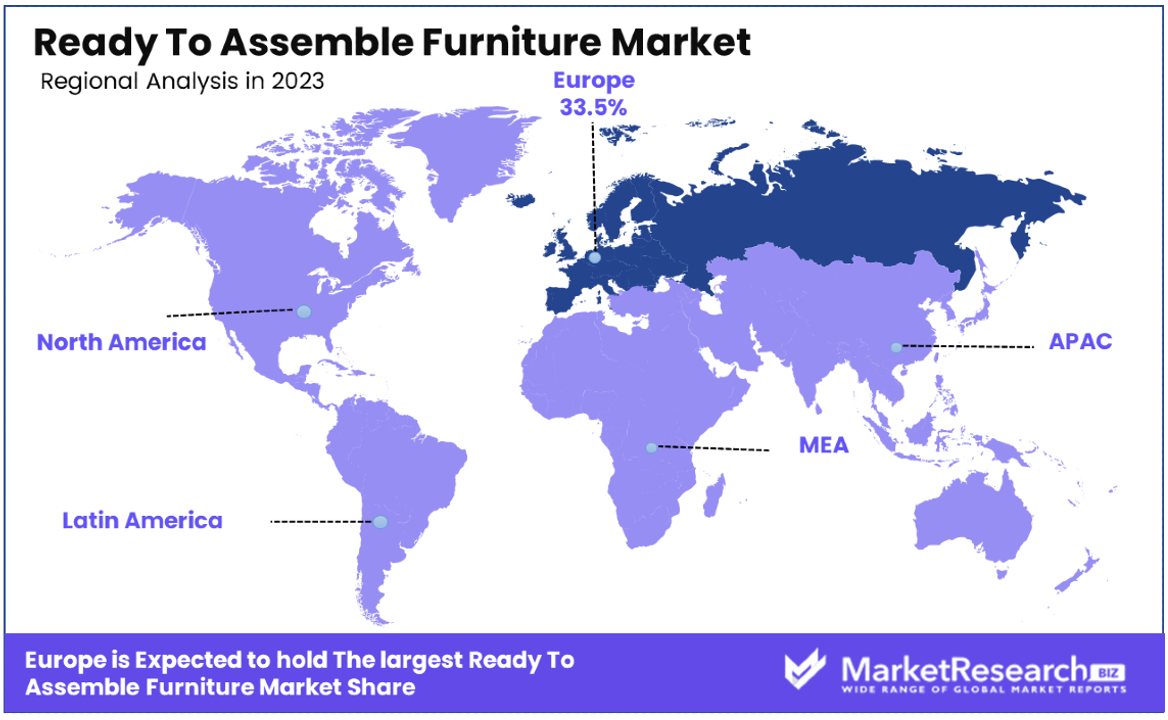

- Regional Analysis: Europe holds a significant market share of 33.5%, driven by consumer preferences for sustainable, affordable furniture solutions. Strong design heritage and a focus on eco-friendly materials contribute to Europe's leadership in the RTA furniture market.

Driving Factors

Increased Urbanization and Smaller Living Spaces Drive Market Growth

With the United Nations projecting that 60% of India's population will live in urban areas by 2050, the shift towards city living and consequently, smaller living spaces, is unmistakable. This trend significantly influences the Ready To Assemble (RTA) Furniture Market, as compact and flexible furniture solutions become essential for apartment and condo residents. RTA furniture, with its ease of customization, reconfiguration, and transportation, is perfectly aligned with the needs of urban dwellers, thereby driving market growth.

Cost Savings Fuel Market Expansion

RTA furniture, being 20-50% cheaper than fully assembled options, taps into the budget-conscious segment of the market, including first-time homeowners. The reduced costs, attributed to lower manufacturing and transportation expenses, not only make RTA furniture an attractive choice for consumers but also serve as a key growth driver in the market. This affordability, coupled with the rising cost of living, ensures that RTA furniture remains a preferred option among a broad base of customers, further fueling market expansion.

Growth of Online Furniture Shopping Enhances Accessibility

The surge in e-commerce has revolutionized the furniture buying experience, making RTA furniture more accessible to a wider audience. Major online retailers like IKEA, Amazon, and Wayfair have played pivotal roles in mainstreaming RTA furniture, thereby significantly contributing to market growth. This ease of access, combined with the convenience of home delivery and a wide range of options available online, has attracted a larger customer base, driving sales and market expansion.

Demand for Customization Attracts Millennials and Gen Z

The increasing demand for customization in RTA furniture, allowing customers to select configurations, finishes, and add-ons, resonates strongly with millennials and Gen Z consumers. This desire for smart furniture has not only expanded the market demographic but also encouraged innovation and product diversification within the industry. The flexibility offered by RTA furniture to meet individual tastes and preferences is a critical factor in its growing popularity and market growth.

Restraining Factors

Perception of Lower Quality Restrains Market Growth

The belief that Ready To Assemble (RTA) furniture is of inferior quality significantly impacts its market growth. This perception, often associated with the furniture being cheaply made and disposable, poses a substantial challenge in attracting higher-income demographics.

Consumers in this segment typically seek durability and high-quality finishes in their furniture choices, areas where RTA products are often mistakenly thought to fall short. Overcoming this stereotype is crucial for the RTA furniture market to expand its appeal beyond budget-conscious consumers and tap into a broader customer base seeking both affordability and quality.

Assembly Challenges Deter Consumer Engagement

The complexity and time investment required to assemble RTA furniture can act as a significant barrier to market growth. For some customers, the prospect of putting together furniture pieces is daunting and viewed as an inconvenience, overshadowing the benefits of cost savings and customization.

This assembly challenge can lead to customer frustration, negatively impacting their purchase experience and deterring future purchases. Addressing these concerns by simplifying the assembly process and providing clearer instructions or more intuitive designs is essential for the RTA furniture market to minimize this restraint and enhance overall customer satisfaction.

Product Type Analysis

In the Ready To Assemble (RTA) Furniture Market, desks emerge as the dominant sub-segment. This prominence is largely due to the increasing trend of remote work and home offices, necessitating ergonomic and space-saving furniture solutions. Desks in the RTA category satisfy these requirements with their affordability and ease of assembly, appealing particularly to consumers setting up home offices on a budget. The versatility and design innovations within this sub-segment cater to a wide range of consumer preferences, further fueling its growth.

Other significant segments include chairs, tables, cabinets, sofas, beds, and others, each contributing to the market's diversity. Chairs, particularly office and gaming chairs, have seen increased demand parallel to the rise in home office setups. Tables, including dining and coffee tables, cater to the multifunctional furniture trend, offering versatility for small living spaces.

Cabinets play a crucial role in storage solutions, especially in urban homes where space is limited. Sofas and beds, designed for comfort and space efficiency, address the needs of modern, minimalist living spaces. The "others" category, encompassing various niche products, indicates the market's capacity to innovate and adapt to specific consumer needs.

Material Type Analysis

Wood stands as the dominant material in the RTA Furniture Market, prized for its durability, aesthetic appeal, and versatility. Wood-based RTA furniture caters to a wide array of interior designs, from traditional to contemporary, making it a popular choice among consumers. The material's perceived value and sustainability, especially when sourced from certified forests, add to its appeal.

Metal, plastic, glass, and other materials also play vital roles in diversifying the RTA furniture offering. Metal is valued for its strength and modern look, fitting well in contemporary and industrial-style interiors. Plastic offers affordability and versatility in colors and designs, appealing to a cost-sensitive market segment.

Glass is used in combination with other materials to add elegance and lightness to furniture designs. The "others" category, which may include composite materials and textiles, reflects the industry's innovation in using various materials to enhance functionality, sustainability, and aesthetic appeal.

Distribution Channel Analysis

The Ready To Assemble (RTA) Furniture Market is significantly influenced by its distribution channels, with offline retail, comprising brick-and-mortar stores, standing as the dominant sub-segment. This dominance is attributed to consumer preference for physically examining furniture before purchase, seeking firsthand assurance of quality, comfort, and design suitability. Brick-and-mortar stores offer the tactile experience that many consumers value, especially when making decisions on substantial household items.

However, the market also sees substantial contributions from other distribution channels such as online retail, specialty stores, departmental stores, and others. Online retail has been growing rapidly, fueled by the convenience of shopping from home, a wider selection of products, and often, competitive pricing.

Specialty stores offer focused collections for specific needs, such as office furniture or outdoor setups, providing customers with expert advice and personalized service. Departmental stores, while not as specialized, offer the advantage of one-stop shopping for various household items, including RTA furniture. The "others" category includes various emerging retail formats that cater to niche markets or offer innovative shopping experiences.

End-User Analysis

In the Ready To Assemble (RTA) Furniture Market, the residential segment is the most significant end-user, driven by the continuous demand for home furnishings. This segment's growth is bolstered by factors such as the rising number of households, the trend towards home renovation and decoration, and the need for cost-effective furniture solutions that can be easily replaced or upgraded. RTA furniture meets these needs by offering a wide range of styles, functionality, and price points, making it an attractive option for residential consumers.

The commercial, institutional, and other segments also contribute to the market's diversity and growth. Commercial end-users, including offices, retail spaces, and hospitality industries, seek practical, stylish, and budget-friendly furniture solutions that RTA furniture can provide.

Institutional end-users, such as schools and hospitals, require durable and functional furniture that can withstand heavy use, a need that RTA furniture manufacturers are increasingly addressing with specialized product lines. The "others" category might include temporary setups, event management companies, and rental markets, each finding value in the flexibility and cost-effectiveness of RTA furniture.

Key Market Segments

By Product Type

- Desks

- Chairs

- Tables

- Cabinets

- Sofas

- Beds

- Others

By Material Type

- Wood

- Metal

- Plastic

- Glass

- Others

By Distribution Channel

- Online Retail

- Offline Retail

- Specialty Stores

- Departmental Stores

- Others

By End-User

- Residential

- Commercial

- Institutional

- Others

Growth Opportunities

Small Space/Multifunctional Furniture Offers Growth Opportunity

The trend towards rising urbanization has led to an increased demand for furniture that is adaptable to small living spaces. RTA brands are uniquely positioned to capitalize on this demand by creating innovative, multifunctional furniture pieces such as murphy beds, storage ottomans, and convertible coffee tables.

These products not only address the need for space-saving solutions in compact apartments and tiny homes but also cater to the modern consumer's desire for efficiency and functionality. By focusing on multifunctional furniture, RTA brands can tap into a growing segment of the market looking for smart, space-efficient living solutions, thereby driving market expansion.

Technology-Enabled Customization Offers Growth Opportunity

Advancements in technology, including digital printing, CNC machining, and 3D printing, have opened up new avenues for the mass customization of RTA furniture. This technological evolution allows consumers to personalize their furniture in ways previously not possible, adjusting everything from finishes to dimensions.

Such customization capabilities provide an engaging purchase experience and meet the growing consumer expectation for personalized products. The opportunity for RTA brands lies in leveraging these technologies to offer unique, customizable options, appealing to a broader demographic seeking individuality in their furniture choices.

Trending Factors

Direct-to-Consumer (DTC) Models Are Trending Factors

Direct-to-consumer (DTC) sales models are revolutionizing the Ready To Assemble (RTA) Furniture Market by enabling brands to directly control design, pricing, and the customer experience. This model eliminates retailer markup and bypasses traditional retail space constraints, allowing for more competitive pricing and innovative marketing strategies.

Brands like Burrow and Floyd leverage social media marketing to directly engage with consumers, enhancing brand visibility and customer loyalty. The DTC approach also opens avenues for subscription-based furniture models, catering to a growing consumer interest in flexibility and sustainability.

Green/Lean Supply Chains Are Trending Factors

The shift towards green and lean supply chains is a significant trending factor in the RTA Furniture Market. By optimizing packaging, simplifying SKUs, and digitally managing inventory, RTA brands can significantly reduce waste in production and delivery processes.

This efficiency is crucial for maintaining profit margins and meeting consumer demand for sustainable practices. Brands that prioritize environmentally friendly materials and efficient logistics, such as IKEA with its focus on sustainable sourcing and modular design, are setting industry standards. This trend not only appeals to environmentally conscious consumers but also aligns with global efforts to reduce carbon footprints and waste, making it a key factor in the market's ongoing evolution.

Regional Analysis

Europe Dominates with 33.5% Market Share

Europe's leading position in the Ready To Assemble (RTA) Furniture Market can be attributed to high consumer preference for sustainable and affordable furniture solutions, coupled with strong design heritage. European consumers value quality and sustainability, driving demand for RTA furniture made from eco-friendly materials. Major companies like IKEA, headquartered in Sweden, have significantly contributed to the market's growth through innovation and extensive distribution networks across the region.

The region benefits from advanced logistics, sophisticated e-commerce platforms, and high consumer spending power. The presence of numerous design schools and a rich history in furniture design also contribute to Europe's dominance, fostering innovation and setting trends in the RTA furniture industry.

Europe is expected to maintain its leadership position due to ongoing commitments to sustainability, design innovation, and the integration of digital technologies in retail. The market is likely to see increased competition and growth in eco-friendly product offerings.

North America

North America is a significant player in the RTA furniture market, driven by consumer preference for cost-effective and customizable furniture solutions. The U.S. sees major contributions from companies like Wayfair and Walmart, capitalizing on the e-commerce boom and DIY culture. The region's market is bolstered by technological advancements in manufacturing and a strong distribution network.

Asia Pacific

The Asia Pacific region is rapidly growing in the RTA furniture market, thanks to increasing urbanization and rising middle-class populations in countries like China and India. Local brands, alongside international ones, are expanding their footprint to meet the growing demand for affordable and space-saving furniture solutions.

Middle East & Africa

The Middle East & Africa region shows promising growth in the RTA furniture market, driven by urban development and an increasing number of expatriates. The demand for modern, stylish, and affordable furniture is rising, with Dubai and Saudi Arabia being notable markets for expansion.

Latin America

Latin America's RTA furniture market is expanding, with Brazil and Mexico leading the way. The growth is supported by increasing urbanization, a young population, and an interest in modern, sustainable living solutions. Local manufacturers and retailers are tapping into this trend, offering competitive and diverse RTA furniture options.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the Ready To Assemble (RTA) Furniture Market, key players such as Inter IKEA Systems B.V., Dorel Industries Inc, Steinhoff International, and Tvilum A/S, among others, play pivotal roles in shaping industry dynamics. Inter IKEA Systems B.V. stands out for its global reach and innovative approach to furniture design and sustainability, setting industry trends. Dorel Industries Inc and Sauder Woodworking Company are recognized for their extensive product lines that cater to a wide range of consumer preferences, from traditional to contemporary styles.

Steinhoff International and its subsidiary, Steinhoff Holding, leverage their global presence to offer a diverse portfolio of products, enhancing their market influence. Companies like Simplicity Sofas and Bush Industries, Inc. focus on niche markets, offering specialized products that emphasize customization and space efficiency. Whalen Furniture Manufacturing and Leicht Kuchen AG are noted for their quality craftsmanship and design excellence, appealing to higher-end markets.

South Shore Furniture and Flexsteel (Home Styles) contribute to the market with their focus on affordability and durability, targeting the budget-conscious segment. These companies' strategic positioning, from offering eco-friendly products to leveraging e-commerce for direct-to-consumer sales, significantly impacts the RTA furniture market. Their collective efforts in innovation, sustainability, and customer engagement drive the industry forward, meeting the evolving needs of consumers worldwide.

Market Key Players

- Inter IKEA Systems B.V.

- Dorel Industries Inc

- Steinhoff International

- Tvilum A/S

- Simplicity Sofas

- Sauder Woodworking Company

- Bush Industries, Inc.

- Whalen Furniture Manufacturing

- Steinhoff Holding

- Leicht Kuchen AG

- South Shore Furniture

- Flexsteel (Home Styles)

Recent Developments

- On November 2023, Kilim Mobilya, a well-established furniture company in Turkey, has recently introduced a new collection of smart and easy-to-assemble furniture featuring Välinge's innovative Threespine® technology. This collection, named "Kilim Klik," is the first to utilize the Threespine technology in Turkey.

- On June 2023, The Pioneer Woman, Ree Drummond, has recently launched a new line of ready-to-assemble furniture at Walmart. This collection includes items for various spaces in the home such as the kitchen, dining room, living room, office, and bedroom.

- On April 2023, Amazon is planning to introduce a furniture assembly service that allows customers to opt for assembling furniture or appliances as soon as they arrive at their homes. This premium service aims to enhance customer convenience and compete more effectively with other retailers like Wayfair, Best Buy, Home Depot, and Lowe's, which offer similar options.

Report Scope

Report Features Description Market Value (2023) USD 14.5 Billion Forecast Revenue (2033) USD 23.8 Billion CAGR (2024-2033) 5.20% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Desks, Chairs, Tables, Cabinets, Sofas, Beds, Others), By Material Type (Wood, Metal, Plastic, Glass, Others), By Distribution Channel (Online Retail, Offline Retail, Specialty Stores, Departmental Stores, Others), By End-User (Residential, Commercial, Institutional, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Inter IKEA Systems B.V., Dorel Industries Inc, Steinhoff International, Tvilum A/S, Simplicity Sofas, Sauder Woodworking Company, Bush Industries, Inc., Whalen Furniture Manufacturing, Steinhoff Holding, Leicht Kuchen AG, South Shore Furniture, Flexsteel (Home Styles) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Inter IKEA Systems B.V.

- Dorel Industries Inc.

- Ashley Home Stores, Ltd.

- Steinhoff International Holdings N.V.

- Tvilum A/S

- Simplicity Sofas

- Home Reserve, LLC

- Sauder Woodworking Company

- FabriTec Structures

- Bush Industries, Inc.