Home Improvement Market By Home Section(Exterior Replacements , Disaster Repairs, Bath Improvement & Additions, Kitchen Improvement & Additions, Disaster Repairs, System Upgrades, Property Improvements, Others), By Type(Do It For Me (DIFM), Do It Yourself (DIY)), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

43695

-

March 2024

-

179

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

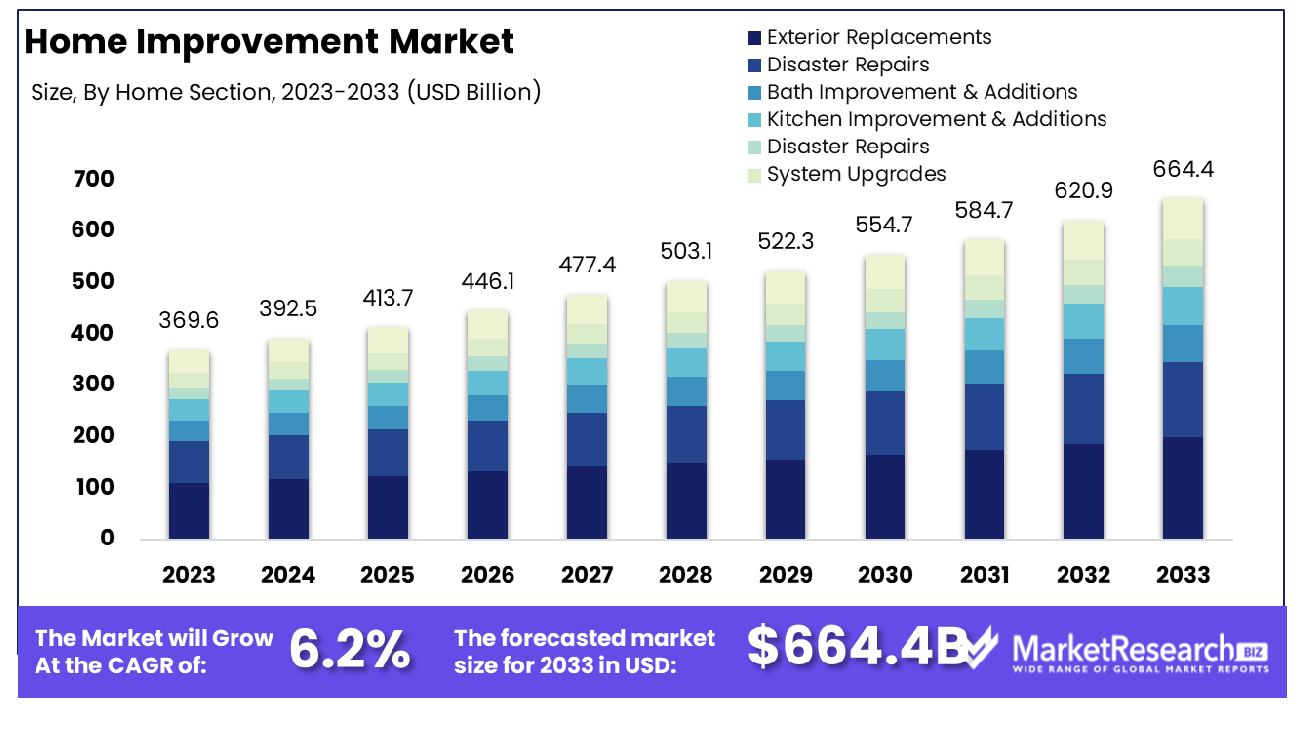

The global Home Improvement Market was valued at USD 369.6 billion in 2023, It is expected to reach USD 664.4 billion by 2033, with a CAGR of 6.2% during the forecast period from 2024 to 2033.

The surge in demand for disposable income and the rise in urbanization are some of the main key driving factors for the home improvement market.

Home improvement is defined as the process of improving, restructuring, and upgrading the features of a residential property to augment its appearance, functionality, and whole value. This includes various types of projects like interior and exterior changes, repairs, and additions. Interior enhancement also includes transforming kitchens, and bathrooms and renovating flooring, while the exterior projects also include roofing, landscaping, and installing new siding.

Many homeowners often board on enhancement of the project to improve the comfort, and energy efficacy and adapt their homes to transform their needs and style. Home improvement industry efforts range from simple cosmetic changes to more structural transformation and they may be undertaken for personal satisfaction or to augment the property’s resale value. Whether it's do-it-yourself or contracted out to experts, home improvement contributes to developing a more comfortable, functional living space and is beautifully pleasing.

Forbes in December 2023, highlights that homeowners are making their whole homes more sustainable and developing spaces that can reflect personal style and needs. As per the home office structure, in 2023, remote work has strengthened its place as a part of everyday life. Moreover, 12.7% of full-time employees work from home all of the time, while 28.2% prefer to work a hybrid model as per Forbes advisors. That makes the homeowners more focused on developing dedicated spaces that can combine both personal style with everyday things to make the workday easier.

Home improvement has gained much attention due to the new dynamics of remote work. With more homeowners spending extended periods at the house, there is more focus on developing comfortable and more efficient living spaces. These home improvement projects address the requirement for devoted home offices, improved technology infrastructure, and aesthetical designs.

Additionally, the trend towards implementing sustainable living has provoked homeowners to invest in eco-friendly upgrades like energy-efficient appliances and renewable sources bringing into line home improvements with environmental consciousness. The demand for home improvement will rise due to homeowners' preferences for aesthetic designs that will help in market expansion in the coming years.

Key Takeaways

- Market Growth: The Home Improvement Market was valued at USD 369.6 billion in 2023, It is expected to reach USD 664.4 billion by 2033, with a CAGR of 6.2% during the forecast period from 2024 to 2033.

- By Home Section: In the Home Section, Exterior Replacements command a significant 19% market share, showcasing strong consumer preference.

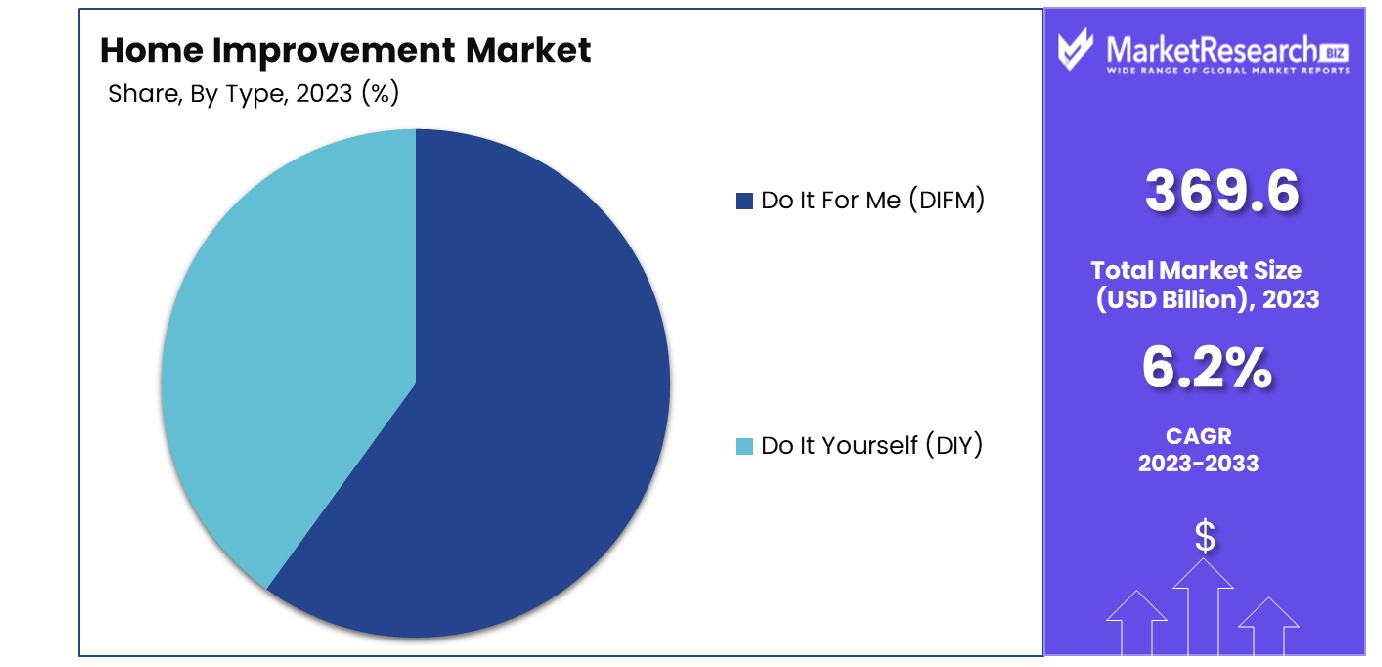

- By Type: Meanwhile, the Do It For Me (DIFM) category holds a dominant 56% market share by type.

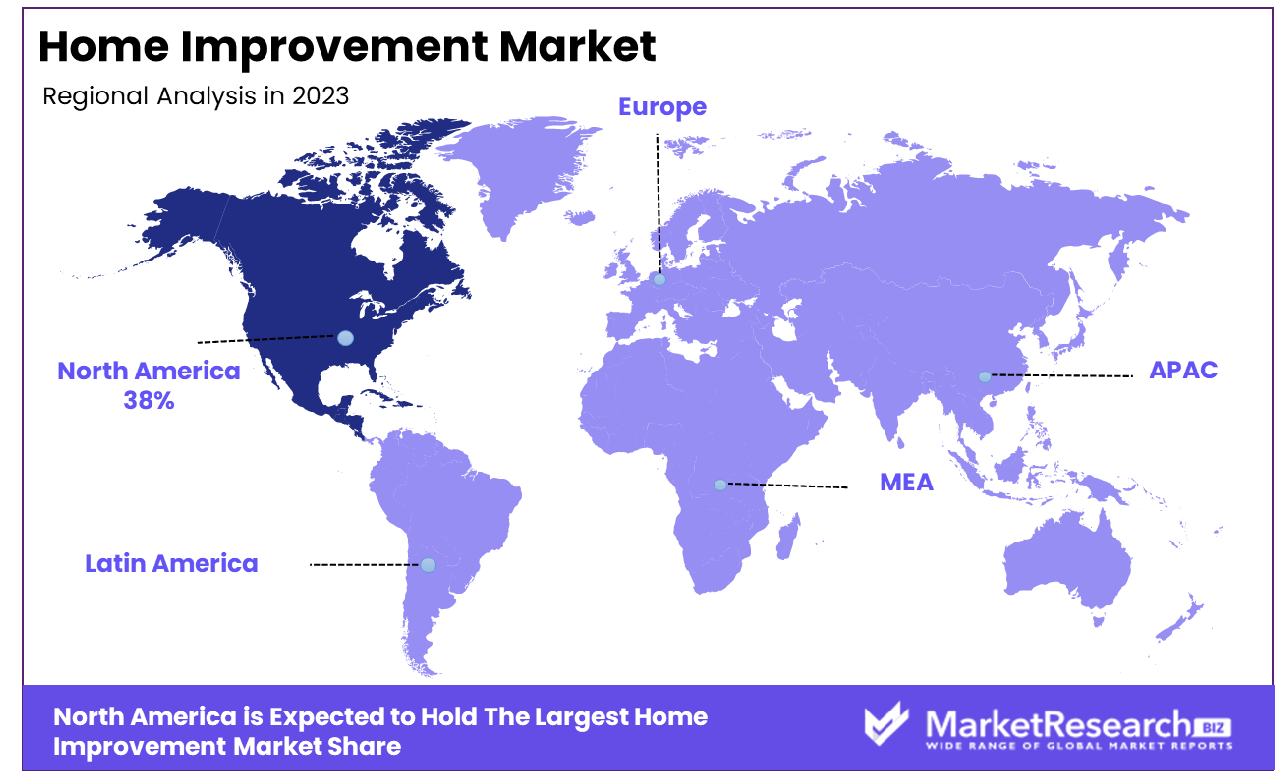

- Regional Dominance: North America maintains its stronghold, leading with a commanding 38% share of the market in the region.

- Growth Opportunity: Smart home technology's proliferation offers substantial market growth prospects in the Home Improvement Market, driven by convenience, energy efficiency, and security demands. Investment in outdoor living spaces also enhances market potential, reflecting homeowners' desire for relaxation and entertainment hubs.

Driving factors

Rising Home Prices and Equity Drive Market Growth

The escalating value of homes serves as a potent catalyst for the expansion of the Home Improvement Market. As homeowners witness an increase in their property's equity, largely attributable to rising home prices, they are more inclined to invest in remodeling industry projects to further enhance their home's value. The National Association of Home Builders' 2022 study highlights this trend, revealing that new homeowners spend on average $12,000 on renovations, $5,000 on furnishings, and $4,000 on appliances within the first year of purchase.

This increased spending reflects a strategic investment to maintain or elevate home value, underpinning the market growth. Additionally, this trend synergizes with other market drivers, such as the demand for modernized living spaces and the adaptation of homes to support remote work, further stimulating the industry's expansion. The sustained rise in home equity and prices is expected to continually fuel investments in home improvement, signaling a robust market growth trajectory for the market.

Aging Homes Needing Updates Propel Market Expansion

The necessity for updates in aging homes, with the average US home exceeding 40 years old, significantly contributes to the growth of the Home Improvement Market. Older properties demand more maintenance, repairs, and modern upgrades, such as kitchen and bathroom renovations, to remain functional and appealing. This need for updates not only ensures the preservation of the home's structural integrity but also aligns with homeowners' desires for modern amenities and aesthetics.

The refurbishment of aging homes fosters a cycle of continuous market demand, as homeowners invest in renovations to meet current living standards and lifestyle preferences. This factor, combined with the rising home equity, creates a compounded effect on market growth. The ongoing requirement for home updates underscores a long-term, sustained demand within the home improvement sector, reinforcing its growth potential.

Remote Work Trends Enhance Market Dynamics

The shift towards remote work, significantly accelerated by the pandemic, has reshaped homeowners' priorities, thereby fueling the Home Improvement Market's growth. The transformation of residential spaces into productive work environments has led to increased investments in home offices, backyard upgrades, and technological enhancements. This evolution reflects a broader trend towards optimizing living spaces for both comfort and functionality, catering to the new normal of work.

The convergence of remote work consumer trends with homeowners' aspirations for improved lifestyle amenities—such as home gyms and media rooms—further amplifies market growth. This integration of work and lifestyle upgrades within the home environment is expected to have lasting implications, as the demand for multifunctional and comfortable living spaces continues to rise, thereby sustaining market expansion.

Focus on Amenities and Lifestyle Enriches Market Growth

The homeowner's increasing focus on amenities and lifestyle has become a pivotal driver of the Home Improvement Market's expansion. This shift towards prioritizing experiences at home, through the integration of home gyms, media rooms, and enhanced outdoor living areas, mirrors a broader trend of seeking comfort and luxury within one's living space. The pursuit of such lifestyle-oriented improvements not only enhances the quality of life but also contributes to the property's value.

This emphasis on amenities complements the rising trend of home personalization and modernization, catalyzing further investments in the home improvement sector. The interplay between the demand for luxury amenities and the necessity of functional upgrades, such as those driven by remote work, indicates a multifaceted growth trajectory for the market. The long-term implications of this focus suggest a continued elevation of living standards and an enduring market demand for home improvement services

Restraining Factors

Rising Material and Labor Costs Restrains Market Growth

The surge in material and labor costs, exacerbated by supply chain disruptions, high demand, and inflationary pressures, presents significant barriers to the Home Improvement Market's growth. Essentials such as lumber and appliances have seen a sharp increase in prices, pushing the overall cost of home renovation projects upward. Additionally, labor expenses have risen, making professional services more expensive for homeowners.

This uptick in costs can deter homeowners from initiating or completing planned projects, as evidenced by the 14.8% drop in US housing starts in January 2024, the most significant decline since April 2020. The escalating costs not only limit the accessibility of home improvement projects but also discourage investment in larger-scale renovations, ultimately constraining market expansion.

Higher Interest Rates Dampen Market Dynamics

The upward trajectory of interest rates significantly dampens the Home Improvement Market by increasing the cost of financing. As the average 30-year mortgage rate escalated from 3% to over 6% within the last year, the affordability of home improvement projects financed through loans or home equity lines of credit has been adversely affected. Higher interest rates elevate the financial burden on homeowners, making it more challenging to justify the expense of larger renovations.

This increase in borrowing costs acts as a deterrent, potentially leading to a postponement or downsizing of home improvement plans. The resultant decrease in renovation activities due to higher financing costs serves as a restraint on the market's growth, impacting both demand and the scale of projects undertaken.

By Home Section Analysis

In the Home Section, Exterior Replacements command a significant 19% market share, indicating strong consumer preference.

Exterior Replacements have emerged as the dominant sub-segment within the Home Improvement Market, accounting for 19% of the market's focus. This segment's leadership is underpinned by homeowners' increasing prioritization of curb appeal and exterior maintenance, which are essential for both aesthetic appeal and property value enhancement. Exterior replacements include roofing, siding, windows, and doors—areas that not only improve the home's visual appeal but also its energy efficiency and weather resilience. This dual benefit of aesthetic improvement and functional upgrades makes exterior replacements a compelling investment for homeowners.

The importance of this segment is further bolstered by evolving consumer preferences towards sustainable and energy-efficient home solutions, driving demand for modern exterior materials and technologies. Additionally, the segment benefits from a relatively higher necessity rate compared to elective interior upgrades, as exterior features often require updates or replacements to protect the home's structural integrity.

Other segments like Disaster Repairs, Bath and Kitchen Improvements & Additions, System Upgrades, Property Improvements, and others also play critical roles in the market's growth. These areas cater to both functional needs and lifestyle upgrades. For instance, Kitchen and Bath Improvements & Additions not only enhance the home's value but also reflect homeowners' desires for modern, high-utility spaces.

System Upgrades, such as HVAC and electrical systems, are essential for maintaining a home's functionality and comfort, indicating steady demand driven by necessity. Property Improvements, including landscaping and outdoor living spaces, cater to the growing interest in enhancing outdoor lifestyle quality. Each of these segments contributes to the market's diversity and growth, catering to a wide range of homeowner needs and preferences.

By Type Analysis

Within the industry, the Do It For Me (DIFM) segment leads with an impressive 56% market dominance.

The "Do It For Me" (DIFM) segment represents the majority of the Home Improvement Market, with a dominant 56% share. This dominance underscores a growing preference among homeowners to engage professionals for their home improvement projects, driven by the desire for quality, reliability, and the complexities involved in many renovations. The DIFM segment's growth is fueled by the increasing complexity of home improvement projects that require specialized skills, tools, and knowledge, which are beyond the scope of most DIY enthusiasts.

Homeowners' inclination towards DIFM services is also reflective of broader lifestyle consumer trends, where time constraints and the valuation of leisure over labor encourage the outsourcing of home improvement tasks. This trend is further supported by the expanding array of services offered by professionals, including comprehensive project management, which alleviates the homeowner's burden of dealing with multiple contractors and suppliers. The DIY segment, while smaller in comparison, still plays a significant role in the market, particularly among a segment of homeowners who take pride in personal involvement and the satisfaction of completing home improvement projects independently.

DIY projects often encompass simpler tasks like painting, minor repairs, or small-scale renovations that do not require extensive professional expertise. This segment benefits from a wealth of resources, including online tutorials, workshops, and home improvement stores that support DIY activities. Both DIFM and DIY segments are vital to the Home Improvement Market's ecosystem, catering to different homeowner needs, preferences, and skills. The DIFM segment's dominance is a testament to the growing complexity of home improvements and the value placed on professional expertise and convenience.

In contrast, the DIY segment represents a significant niche market, driven by personal satisfaction, cost savings, and the desire for hands-on involvement in home projects. Together, these segments reflect the diverse approaches homeowners take to improve and personalize their living spaces, contributing to the overall growth and dynamism of the Home Improvement Market.

Key Market Segments

By Home Section

- Exterior Replacements

- Disaster Repairs

- Bath Improvement & Additions

- Kitchen Improvement & Additions

- Disaster Repairs

- System Upgrades

- Property Improvements

- Others

By Type

- Do It For Me (DIFM)

- Do It Yourself (DIY)

Growth Opportunity

Smart Home Technology Offers Growth Opportunity

The proliferation of smart home technology presents significant expansion prospects within the Home Improvement Market. As demand for connected devices and home automation systems—such as smart thermostats, lights, and appliances—continues to rise, this sector is poised for substantial growth. Although specific future market valuation statistics require clarification, the trajectory suggests a robust increase, with projections indicating the smart home market could witness considerable expansion by 2032.

This surge is driven by homeowners' growing desire for convenience, enhanced energy efficiency, and improved security features. Smart home technologies not only cater to these demands but also offer home improvement businesses, from contractors to retailers, new avenues for innovation and service offerings. The integration of these technologies into home improvement projects represents a pivotal opportunity for market differentiation and value addition, appealing to a tech-savvy consumer base seeking to modernize their living spaces.

Outdoor Living Enhances Market Potential

Investment in outdoor living spaces—encompassing outdoor kitchens, living areas, pools, and landscaping—emerges as a lucrative growth opportunity for the Home Improvement Market. This trend is fueled by the increased emphasis on home as a hub for relaxation and entertainment, particularly in the wake of pandemic-induced lifestyle changes. The potential return on investment (ROI) for homes with outdoor kitchens, for instance, ranges impressively between 100% and 200%, with even higher returns achievable in warmer climates.

Such statistics underscore the financial and lifestyle value perceived by homeowners in enhancing their outdoor spaces. The growing popularity of outdoor living projects presents a flourishing opportunity for contractors, designers, and retailers, catering to the burgeoning demand for spaces that blend functionality with leisure and aesthetic appeal.

Latest Trends

Sustainability Drives Market Innovation

The shift towards sustainability represents a pivotal growth opportunity within the Home Improvement Market. Homeowners today prioritize eco-friendly and energy-efficient projects, from solar panel installations and electric vehicle (EV) charging setups to tankless water heaters and the use of green building materials. This collective push towards sustainability not only aligns with environmental objectives but also meets consumer demands for cost-effective, energy-saving home solutions.

As such, the market for sustainable home improvements is expanding, driven by both regulatory incentives and growing consumer awareness. The incorporation of sustainable practices and technologies into home improvement offerings can differentiate market players, tapping into a growing segment of environmentally conscious consumers and fostering long-term loyalty through shared values.

Multigenerational Housing Opens New Avenues

The rise of multigenerational housing creates diverse opportunities for growth in the Home Improvement Market. As homes increasingly accommodate family members across various age groups and abilities, the demand for renovations that cater to a broad spectrum of needs has risen. This trend towards multigenerational living necessitates modifications that enhance accessibility, privacy, and functionality, from in-law suites to adaptable living spaces.

Addressing these needs offers home improvement professionals a chance to specialize in renovations that facilitate multigenerational living, tapping into a market segment characterized by its unique requirements. This evolution in housing preferences not only reflects changing demographic trends but also signifies a growing market niche for home improvements designed to support family dynamics across generations.

Regional Analysis

North America Dominates with a 38% Market Share

North America's commanding 38% share of the Home Improvement Market can be attributed to several key factors, including high homeownership rates, substantial spending power, and a strong culture of home renovation and DIY projects. The region's market dominance is further bolstered by the presence of major home improvement retail chains and service providers, facilitating easy access to materials and services. Additionally, technological advancements and the integration of smart home technologies are significantly contributing to market growth. The region's emphasis on sustainability and energy-efficient renovations also aligns with growing environmental awareness among consumers. Looking forward, North America is poised to maintain its leading position due to ongoing innovations, an aging housing stock requiring updates, and increasing interest in home customization.

Europe's Growing Influence in the Home Improvement Market

Europe holds a significant position in the Home Improvement Market, driven by a combination of regulatory support for energy efficiency, a robust tradition of home preservation, and an increasing inclination towards eco-friendly and smart home renovations. The region's focus on sustainability, coupled with high standards for living conditions, propels demand for renovations that enhance energy efficiency and reduce carbon footprints. Moreover, Europe's diverse cultural heritage contributes to a wide variety of home improvement products and industry trends and practices. As European homeowners continue to prioritize green renovations and smart technology integration, the region is expected to see a sustained growth rate, further cementing its influence in the global market.

Asia-Pacific's Rapid Ascension in the Home Improvement Sector

The Asia-Pacific region is rapidly ascending in the Home Improvement Market, thanks to burgeoning economic growth, rising homeownership rates, and an expanding middle class with increasing disposable incomes. Urbanization and the desire for modernized living spaces also drive market growth in this region. Furthermore, Asia-Pacific benefits from a large, young population keen on adopting the latest home improvement trends, including smart home technologies and sustainable living solutions. The region's dynamic economic development and cultural shift towards higher-quality living standards forecast a promising future, with Asia-Pacific potentially challenging North America's dominance in the home improvement arena over time.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In the Home Improvement Market, the landscape is defined by a mix of well-established players and specialized companies, each contributing to the sector's dynamics and growth. The Home Depot, Inc. and Lowe's Companies, Inc. stand out for their extensive retail presence and broad product offerings, catering to both DIY enthusiasts and professional contractors. These giants are pivotal in setting market trends and customer expectations, leveraging their scale to offer competitive pricing and innovation.

Kingfisher plc and Travis Perkins plc, with their brands B&Q, Screwfix, Wickes, and Toolstation, underscore the market's diversity in Europe, offering specialized products and services that cater to local demands and construction practices. Their strategic positioning emphasizes convenience, product range, and accessibility, enhancing their footprint across various consumer segments.

Saint-Gobain and Stanley Black & Decker, Inc. highlight the industry's focus on quality and innovation, with products that span from construction materials to tools and equipment, catering to a global market with high standards for durability and performance. Similarly, companies like Masco Corporation and Sherwin-Williams Company underline the importance of niche specialization—be it in decorative products, finishes, or specific home improvement materials—that add value through aesthetics and functionality.

Emerging from a slightly different angle, IKEA capitalizes on the demand for affordable, stylish, and easy-to-assemble furniture and home accessories, appealing to the segment of the market looking for quick and impactful home upgrades.

Market Key Players

- The Home Depot, Inc.

- Lowe's Companies, Inc.

- Kingfisher plc (B&Q, Screwfix)

- Travis Perkins plc (Wickes, Toolstation)

- Saint-Gobain

- Stanley Black & Decker, Inc.

- Masco Corporation

- Sherwin-Williams Company

- Ferguson plc

- IKEA

- Builders FirstSource, Inc.

- Wolseley plc (Ferguson)

- Beacon Roofing Supply, Inc.

- Fastenal Company

- Sonepar SA

Recent Development

- In March 2024, The St. George Home Expo, organized by Nationwide Expos, showcases cutting-edge home improvement trends and offers exclusive deals from local and national vendors. Attendees explore innovative solutions for sustainable living and smart home technology.

- In March 2024, Etobicoke Roofing Innovations Ltd. pioneers sustainable roofing solutions, integrating solar technology, cool roofing systems, and advanced materials. Emphasis on durability, aesthetics, and weather resistance drives the industry forward.

- In February 2024, The Downtown Raleigh Home Show, organized by Home Show Productions, offers a diverse marketplace of home improvement ideas. Clint Harp's appearance highlights the event's emphasis on inspiration and innovation.

Report Scope

Report Features Description Market Value (2023) USD 369.6 Billion Forecast Revenue (2033) USD 664.4 Billion CAGR (2024-2032) 6.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Home Section(Exterior Replacements , Disaster Repairs, Bath Improvement & Additions, Kitchen Improvement & Additions, Disaster Repairs, System Upgrades, Property Improvements, Others), By Type(Do It For Me (DIFM), Do It Yourself (DIY)) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape The Home Depot, Inc., Lowe's Companies, Inc., Kingfisher plc (B&Q, Screwfix), Travis Perkins plc (Wickes, Toolstation), Saint-Gobain, Stanley Black & Decker, Inc., Masco Corporation, Sherwin-Williams Company, Ferguson plc, IKEA, Builders FirstSource, Inc., Wolseley plc (Ferguson), Beacon Roofing Supply, Inc., Fastenal Company, Sonepar SA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- The Home Depot, Inc.

- Lowe's Companies, Inc.

- Kingfisher plc (B&Q, Screwfix)

- Travis Perkins plc (Wickes, Toolstation)

- Saint-Gobain

- Stanley Black & Decker, Inc.

- Masco Corporation

- Sherwin-Williams Company

- Ferguson plc

- IKEA

- Builders FirstSource, Inc.

- Wolseley plc (Ferguson)

- Beacon Roofing Supply, Inc.

- Fastenal Company

- Sonepar SA