Hepatitis C Treatment Market Report By Treatment Type (Direct-Acting Antivirals (DAAs), Interferon-Based Therapy, Combination Therapy (DAAs + Interferon ± Ribavirin)), By Stage of Liver Disease (Compensated Cirrhosis, Decompensated Cirrhosis, Liver Transplantation), By End Users, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

45393

-

May 2024

-

290

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

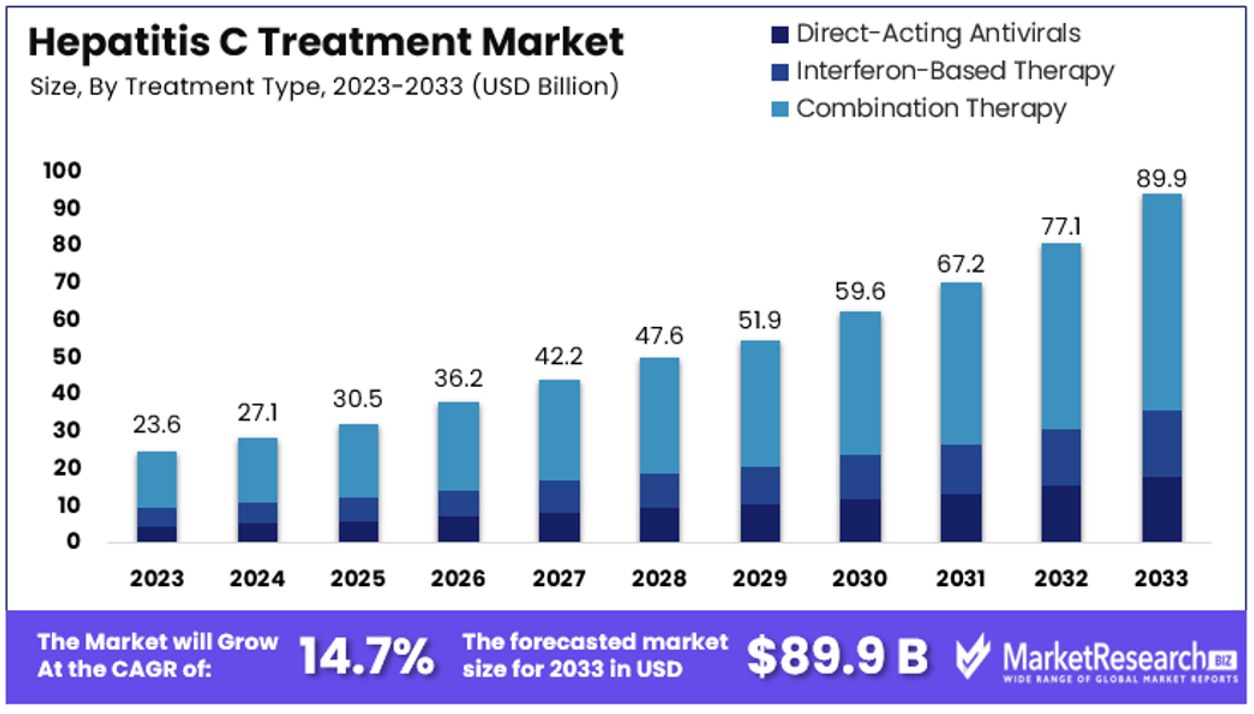

The Global Hepatitis C Treatment Market size is expected to be worth around USD 89.9 Billion by 2033, from USD 23.6 Billion in 2023, growing at a CAGR of 14.7% during the forecast period from 2024 to 2033.

The Hepatitis C Treatment Market encompasses a range of medical solutions aimed at combating the Hepatitis C virus (HCV). This market includes pharmaceuticals like antiviral drugs, which are pivotal in managing and curing the infection. Innovations in therapy, such as combination treatments, have significantly enhanced the efficacy and reduced the duration of treatment, thereby improving patient outcomes.

The market is driven by advancements in diagnostic technologies, increasing awareness of the disease, and improved healthcare infrastructure. As this sector evolves, it offers substantial opportunities for pharmaceutical companies and healthcare providers to develop and market new and effective treatment modalities.

The Hepatitis C Treatment Market is currently positioned at a critical juncture, shaped by a persistent high global prevalence and ongoing medical advancements. Approximately 50 million people worldwide are living with chronic hepatitis C virus (HCV) infection, with around 1.0 million new cases reported annually. This enduring high incidence underlines a robust and continuous demand for effective treatment solutions.

In the United States alone, the year 2021 witnessed 107,300 new identifications of chronic hepatitis C cases, equating to a rate of 39.8 cases per 100,000 individuals. This data not only highlights the significant healthcare burden but also underscores the market's potential capacity for growth and expansion.

Market dynamics are influenced by several key factors, including advancements in pharmaceutical therapies that offer higher cure rates and shorter treatment durations. The introduction of direct-acting antivirals (DAAs) has revolutionized the landscape, offering over 90% cure rates, which significantly drives market growth. Moreover, increasing government initiatives aimed at hepatitis C screening and awareness campaigns are pivotal in diagnosing hidden cases, further fueling the demand for treatment options.

Economic factors also play a crucial role, as treatment affordability and access to healthcare services vary widely across different regions, affecting the market's penetration rates and growth prospects. As stakeholders continue to invest in research and development, the market is expected to see the introduction of more innovative and cost-effective treatment regimens.

Thus, the Hepatitis C Treatment Market presents a valuable opportunity for pharmaceutical companies and healthcare providers to not only contribute to public health improvement but also capitalize on the substantial economic prospects offered by increasing treatment demands.

Key Takeaways

- Market Value: The Global Hepatitis C Treatment Market is anticipated to reach a substantial value of USD 89.9 billion by 2033, showing remarkable growth from USD 23.6 billion in 2023, with a robust CAGR of 14.7% during the forecast period from 2024 to 2033.

- Treatment Type Analysis: Combination Therapy (DAAs + Interferon ± Ribavirin) leads with 65.3% dominance due to its enhanced efficacy and improved patient outcomes. Interferon-Based Therapy serves a smaller segment, primarily in scenarios where DAAs are not suitable or available.

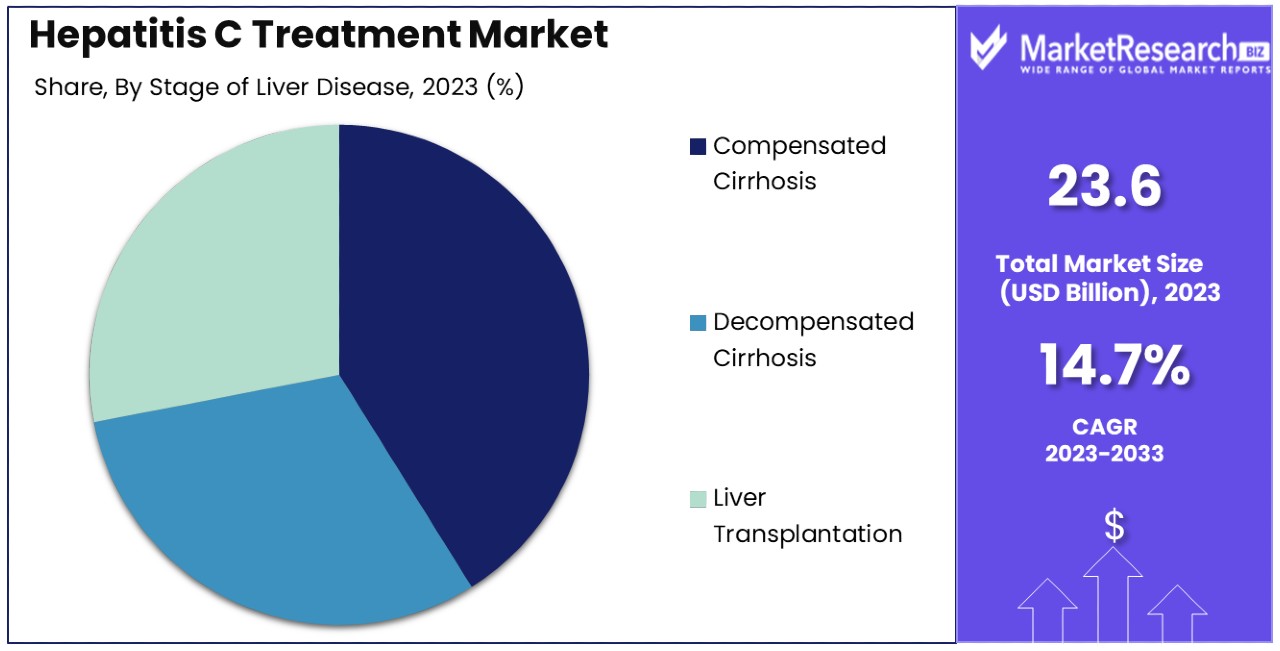

- Stage of Liver Disease Analysis: Compensated and decompensated cirrhosis segments drive ongoing treatment needs and research focus, while Liver Transplantation represents a critical but less frequent stage requiring specialized care.

- End Users Analysis: Hospitals dominate with 47.2% market share due to their comprehensive care facilities and advanced treatment options. Specialty clinics and retail pharmacies also play vital roles in providing specialized care and medication access.

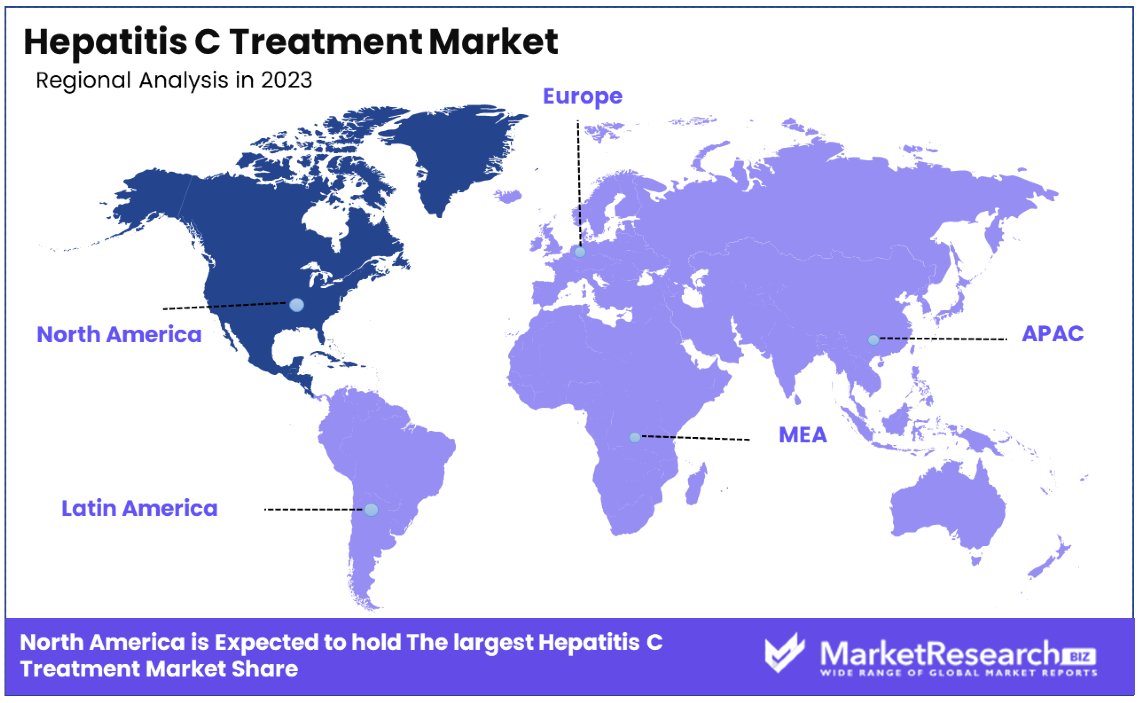

- North America: Dominates the market with a 46.2% share, showcasing advanced healthcare systems and extensive treatment accessibility.

- Europe: Holds a significant share of approximately 25.6%, supported by robust healthcare systems and widespread treatment accessibility.

- Analyst Viewpoint: Opportunities exist for continued advancements in Combination Therapy, focusing on enhancing efficacy and reducing treatment costs. Further research into liver disease stages, especially in decompensated cirrhosis and Liver Transplantation, can lead to improved treatment strategies and outcomes.

Driving Factors

Increasing Prevalence of Hepatitis C Drives Market Growth

The escalating global prevalence of hepatitis C significantly propels the Hepatitis C Treatment Market. Currently, an estimated 58 million individuals worldwide are living with chronic hepatitis C, as reported by the World Health Organization (WHO).

This substantial and growing patient base necessitates a steady demand for effective therapeutic options, thus directly contributing to market expansion. Particularly in regions like Egypt, Pakistan, and China, where hepatitis C rates are notably high, the demand for treatments intensifies. The increasing number of patients correlates with a heightened urgency for healthcare systems to address this healthcare challenge, thereby boosting the market's volume and dynamics.

Launch of Highly Effective Direct-Acting Antiviral (DAA) Therapies Drives Market Growth

The introduction and availability of Direct-Acting Antiviral (DAA) therapies have transformed the Hepatitis C Treatment Market. Drugs such as sofosbuvir, ledipasvir, and velpatasvir deliver high cure rates—often exceeding 90%—alongside shorter treatment durations and fewer side effects compared to older, interferon-based regimens.

This significant improvement in treatment efficacy and patient experience has led to increased adoption of these therapies. Gilead Sciences' DAAs, Harvoni and Sovaldi, are prime examples, having greatly expanded market boundaries through their effectiveness. The shift towards DAA therapies underscores a pivotal trend in market growth, marked by advanced treatment solutions replacing outdated methods.

Favorable Government Initiatives and Awareness Programs Drive Market Growth

Governmental initiatives and awareness programs play a critical role in amplifying the growth of the Hepatitis C Treatment Market. By promoting hepatitis C screening and enhancing disease awareness, these programs aim to facilitate early diagnosis and improve access to effective treatments.

In the United States, for example, the CDC's recommendation for hepatitis C screening among the 1945 to 1965 birth cohort—identified as a high-risk group—has significantly boosted the identification of new cases. These efforts help in diagnosing previously unrecognized infections, increasing the number of individuals seeking treatment, and consequently expanding the market. Such policies not only promote health but also drive demand within the treatment market by ensuring a larger number of patients are aware of and able to access necessary therapies.

Restraining Factors

High Cost of Treatment Restrains Market Growth

The elevated cost of hepatitis C treatment, especially with Direct-Acting Antiviral (DAA) therapies, significantly restricts market growth. In the United States, the price for a standard 12-week course of Harvoni, a leading DAA treatment, can vary from $63,000 to $94,500, depending on the healthcare setting and insurance coverage.

This high cost poses a formidable barrier, particularly for patients in low-income countries or those lacking sufficient health insurance. The financial inaccessibility of these treatments reduces the patient base that can afford these life-saving drugs, thereby limiting market expansion. High treatment costs may deter patients from seeking necessary care, directly impacting market growth as fewer individuals can access these advanced therapies.

Patent Expiration and Generic Competition Restrains Market Growth

The expiration of patents on branded hepatitis C drugs and the consequent surge of generic versions have introduced significant challenges to the market. Generic drugs, typically offered at a lower price, exert downward pressure on the pricing of branded treatments, squeezing profit margins.

This heightened competition not only affects the profitability of existing products but can also discourage pharmaceutical companies from investing in new drug development due to reduced potential returns. As generics become more prevalent, branded manufacturers may see slowed growth rates, hindering overall market expansion and innovation in treatment options.

Treatment Type Analysis

Combination Therapy (DAAs + Interferon ± Ribavirin) dominates with 65.3% due to enhanced efficacy and improved patient outcomes.

The Hepatitis C Treatment Market is segmented by treatment types, among which Combination Therapy emerges as the dominant sub-segment, accounting for 65.3% of the market. This therapy typically combines Direct-Acting Antivirals (DAAs) with Interferon and, in some cases, Ribavirin, capitalizing on the strengths of each to maximize patient recovery rates. The efficacy of Combination Therapy is particularly high, often leading to better clearance rates of the hepatitis C virus from the bloodstream when compared to treatments using a single medication approach.

DAAs alone have transformed Hepatitis C treatment due to their high success rates and fewer side effects compared to older therapies. However, for certain genotypes of the virus and in cases of advanced liver disease, the addition of Interferon and Ribavirin can be necessary to achieve the desired treatment outcomes. While DAAs are highly effective, their high cost can be a limitation, making Combination Therapy a more viable option in varying economic settings.

Interferon-Based Therapy, once the standard of care, now serves a smaller segment of the market. It is primarily used in scenarios where DAAs are not suitable or available. Interferon-Based Therapy has more side effects and a longer treatment duration, which can impact patient adherence and comfort.

Stage of Liver Disease Analysis

Liver Transplantation is a critical but less frequent stage, while compensated and decompensated cirrhosis drive ongoing treatment needs and research focus.

In the segmentation by the stage of liver disease, each sub-segment addresses the specific needs and treatment approaches required for different severities of Hepatitis C-induced liver damage. Compensated cirrhosis, where the liver still maintains function despite damage, and decompensated cirrhosis, a more severe form where the liver cannot function properly, typically require ongoing management and can often be treated with medication to slow disease progression and manage symptoms.

Liver Transplantation represents a smaller but vital segment of the market. It is considered for patients who have developed severe, irreversible liver damage that no longer responds to other forms of therapy. This segment, while not as large in volume as medication therapy for earlier stages of liver disease, is crucial and involves significant medical care and follow-up treatments.

The management of hepatitis C in the context of liver transplantation involves not only the surgical procedure but also pre- and post-transplantation antiviral treatments to prevent the recurrence of the virus, which can infect the new liver. This comprehensive approach underscores the complexity and depth of care required for these patients, reflecting ongoing needs for specialized treatments and medications that can adapt to such high-risk scenarios.

End Users Analysis

Hospitals dominate with 47.2% due to comprehensive care facilities and the ability to administer advanced treatments.

The Hepatitis C Treatment Market by end users is significantly led by hospitals, which account for 47.2% of the market share. Hospitals are typically the primary centers for comprehensive healthcare, offering advanced diagnostic tools and treatment options, including high-end medication therapies and access to specialist care. This makes them a crucial point for the treatment of Hepatitis C, especially for severe cases that may require detailed monitoring or combination therapies.

Specialty clinics, which include gastroenterology and hepatology clinics, also play a vital role in the Hepatitis C Treatment Market. These clinics offer specialized care focused specifically on liver diseases and are essential for managing the ongoing needs of patients with less severe forms of hepatitis C or those in post-treatment recovery.

Retail pharmacies complement the treatment landscape by providing access to prescribed medications and ongoing pharmaceutical care, which is critical for sustained treatment adherence and management of the disease in a community setting.

Hospitals' dominance in the market is due to their equipped facilities that can handle complex and severe medical cases, combined with their role in providing immediate and comprehensive care, which is essential for effective hepatitis C management.

Key Market Segments

By Treatment Type

- Direct-Acting Antivirals (DAAs)

- Interferon-Based Therapy

- Combination Therapy (DAAs + Interferon ± Ribavirin)

By Stage of Liver Disease

- Compensated Cirrhosis

- Decompensated Cirrhosis

- Liver Transplantation

By End Users

- Hospitals

- Specialty Clinics

- Gastroenterology Clinics

- Hepatology Clinics

- Retail Pharmacies

Growth Opportunities

Development of Pan-Genotypic Treatments Offers Growth Opportunity

The advancement of pan-genotypic treatments in the Hepatitis C Treatment Market presents significant growth opportunities. These treatments, capable of targeting multiple virus genotypes, broaden the scope of who can be effectively treated, surpassing the limitations of genotype-specific therapies.

By simplifying treatment regimens and improving patient adherence, pan-genotypic drugs like AbbVie's Mavyret (glecaprevir/pibrentasvir), which is approved for all major genotypes, can serve a larger and more diverse patient base. This capability not only enhances patient outcomes but also extends the market reach into regions with varied genotype distributions. The introduction of such versatile treatments is pivotal in driving market growth by catering to a broader demographic, thus expanding the addressable market significantly.

Expansion into Emerging Markets Offers Growth Opportunity

Emerging markets represent a critical area for expansion within the Hepatitis C Treatment Market. Countries like India, Brazil, and parts of Africa, with their high prevalence of hepatitis C and increasing healthcare access, are ripe for market penetration. Pharmaceutical companies can exploit these opportunities through strategic partnerships and innovative pricing strategies to make treatments more accessible and affordable.

Gilead Sciences' approach of partnering with generic manufacturers to supply low-cost hepatitis C therapies in developing countries exemplifies how companies can effectively enter and expand in these underserved markets. Such strategies not only meet significant healthcare needs but also drive substantial market growth by tapping into new patient populations that were previously unreachable. This strategic market expansion is essential for pharmaceutical companies looking to increase their global footprint and impact on public health.

Trending Factors

Focus on Microelimination Strategies Are Trending Factors

The trend towards microelimination strategies in the Hepatitis C Treatment Market is gaining traction as a method to address the disease in specific, high-risk populations. These targeted approaches include intensified screening, direct linkage to care, and tailored treatments for groups such as people who inject drugs, incarcerated individuals, and certain ethnic minorities.

By focusing on these segments, microelimination efforts aim to significantly lower the overall hepatitis C burden. Initiatives like the CDC's Hepatitis C Microelimination Projects in the United States exemplify this strategy by concentrating resources on eliminating the virus within defined high-risk groups. This focused approach not only improves health outcomes for these communities but also opens up new market opportunities for treatments and diagnostics tailored to meet their specific needs.

Emphasis on Point-of-Care Testing and Decentralized Care Are Trending Factors

The increasing emphasis on point-of-care testing and decentralized care represents a significant trend within the Hepatitis C Treatment Market. This shift is driven by the goal of enhancing accessibility to diagnosis and treatment, particularly in underserved areas. Rapid point-of-care tests, such as those developed by Abbott and OraQuick, allow for immediate hepatitis C detection, which facilitates quicker linkage to treatment.

By bringing care closer to where patients live, these decentralized models help to reduce barriers to access, such as travel or long wait times for appointments. This trend is particularly important for reaching populations that have traditionally been difficult to serve, thereby broadening the market's reach and enhancing the uptake of hepatitis C treatments. These innovations in care delivery are critical for expanding treatment access and improving patient outcomes across diverse settings.

Regional Analysis

North America Dominates with 46.2% Market Share

North America's prominent position in the Hepatitis C Treatment Market, holding a 46.2% share, is driven by several robust factors. High disease awareness, advanced healthcare infrastructure, and the presence of leading pharmaceutical companies contribute significantly. The region's aggressive public health strategies, including widespread screening and the adoption of the latest treatment protocols, also enhance market penetration. Moreover, North America benefits from substantial healthcare spending and supportive government policies that encourage research and development in hepatitis C therapies.

The dynamics within North America are characterized by an integrated approach to hepatitis care. The region's well-established healthcare system enables effective implementation of treatment and management strategies. This, combined with high patient awareness and the availability of medical insurance, facilitates access to the latest treatments, thus maintaining a high treatment uptake rate. The prevalence of key market players in the region supports continuous innovation and availability of advanced therapeutic options, keeping the market vibrant and responsive to patient needs.

Regional Market Shares:

- Europe: Europe holds a significant share of the global market, with approximately 25.6%. This is supported by robust healthcare systems and widespread treatment accessibility.

- Asia Pacific: This region is rapidly growing with a market share of 18.9%, driven by increasing healthcare infrastructure and rising public health awareness.

- Middle East & Africa: Despite being smaller markets, these regions are experiencing gradual growth, currently holding a 4.8% market share, due to improving healthcare systems and government initiatives.

- Latin America: Latin America has a 4.5% share of the market, with growth influenced by increasing public health campaigns and improving treatment access.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the Hepatitis C Treatment Market, several key players exhibit significant influence and strategic positioning. Gilead Sciences Inc. stands out as a dominant force, primarily due to its revolutionary antiviral treatments which have significantly advanced the standard of care. AbbVie Inc. and Merck & Co., Inc. also play crucial roles, with robust drug portfolios and substantial market shares.

Companies like Bristol-Myers Squibb Company and F. Hoffmann-La Roche Ltd. enhance the competitive dynamics through continuous innovation and global outreach, further supported by strong R&D capabilities. Pfizer Inc. and AstraZeneca PLC contribute to the market with their broad therapeutic lines and significant investments in new treatment modalities.

On the generics front, Teva Pharmaceutical Industries Ltd. and Mylan N.V. are important due to their cost-effective alternatives, which are vital for increasing accessibility in lower-income regions. Roche Holding AG, with its dual focus on original and generic medicines, holds a unique position influencing both ends of the market spectrum.

Vertex Pharmaceuticals Inc., Janssen Pharmaceuticals Inc., and Eli Lilly and Company are noted for their targeted therapies and commitment to research that could potentially lead to breakthroughs in Hepatitis C treatment.

Sanofi S.A. and Bayer AG, although more diversified, still impact the Hepatitis C market through their investments in liver diseases and related conditions. Collectively, these companies shape the market landscape, driving forward innovations and accessibility in Hepatitis C treatment.

Market Key Players

- Bristol-Myers Squibb Company

- AbbVie Inc.

- Gilead Sciences Inc.

- Merck & Co., Inc.

- Pfizer Inc.

- F. Hoffmann-La Roche Ltd.

- Teva Pharmaceutical Industries Ltd.

- Roche Holding AG

- Mylan N.V.

- Bayer AG

- Sanofi S.A.

- Vertex Pharmaceuticals Inc.

- Janssen Pharmaceuticals Inc.

- Eli Lilly and Company

- AstraZeneca PLC

Recent Developments

- On April 2024, a study published in the Journal of the American Medical Association (JAMA) found that early treatment with direct-acting antiviral (DAA) therapy for children with perinatally acquired hepatitis C virus (HCV) infection is highly effective and cost-effective in the United States.

- On April 2024, the Health Service Executive (HSE) in Ireland announced that it is on track to meet the World Health Organization's (WHO) target of eliminating 80% of hepatitis C by 2030. The HSE has treated over 7,000 people, 95% of whom have been cured, and has launched a free home testing service to increase diagnosis and treatment.

- On April 2024 the WHO announced upcoming updates on the co-administration of treatment for drug-resistant tuberculosis and hepatitis C, which could have significant implications for the management of these co-occurring conditions.

- On October 2023, researchers at the University of California, San Francisco (UCSF) developed a new model of care that brings hepatitis C treatment directly to people, including those who inject drugs and lack stable housing, immediately after their diagnosis. The study found that 92% of those who completed the treatment had undetectable levels of the hepatitis C virus, and 84% were cured three months after treatment.

Report Scope

Report Features Description Market Value (2023) USD 23.6 Billion Forecast Revenue (2033) USD 89.9 Billion CAGR (2024-2033) 14.70% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Treatment Type (Direct-Acting Antivirals (DAAs), Interferon-Based Therapy, Combination Therapy (DAAs + Interferon ± Ribavirin)), By Stage of Liver Disease (Compensated Cirrhosis, Decompensated Cirrhosis, Liver Transplantation), By End Users (Hospitals, Specialty Clinics, Gastroenterology Clinics, Hepatology Clinics, Retail Pharmacies) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Bristol-Myers Squibb Company, AbbVie Inc., Gilead Sciences Inc., Merck & Co., Inc., Pfizer Inc., F. Hoffmann-La Roche Ltd., Teva Pharmaceutical Industries Ltd., Roche Holding AG, Mylan N.V., Bayer AG, Sanofi S.A., Vertex Pharmaceuticals Inc., Janssen Pharmaceuticals Inc., Eli Lilly and Company, AstraZeneca PLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Bristol-Myers Squibb Company

- AbbVie Inc.

- Gilead Sciences Inc.

- Merck & Co., Inc.

- Pfizer Inc.

- F. Hoffmann-La Roche Ltd.

- Teva Pharmaceutical Industries Ltd.

- Roche Holding AG

- Mylan N.V.

- Bayer AG

- Sanofi S.A.

- Vertex Pharmaceuticals Inc.

- Janssen Pharmaceuticals Inc.

- Eli Lilly and Company

- AstraZeneca PLC