Healthcare Fabrics Market Healthcare Fabrics Market, By Raw Material (Polypropylene, Cotton, Polyester, Viscose, Polyamide, Others, By Fabric Types (Non-Woven, Woven, Knitted, By Applications (Hygiene Products, Dressing Products, Clothing, Blanket & Bedding, Upholstery, Privacy Curtains, Others, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

47584

-

Feb 2025

-

136

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

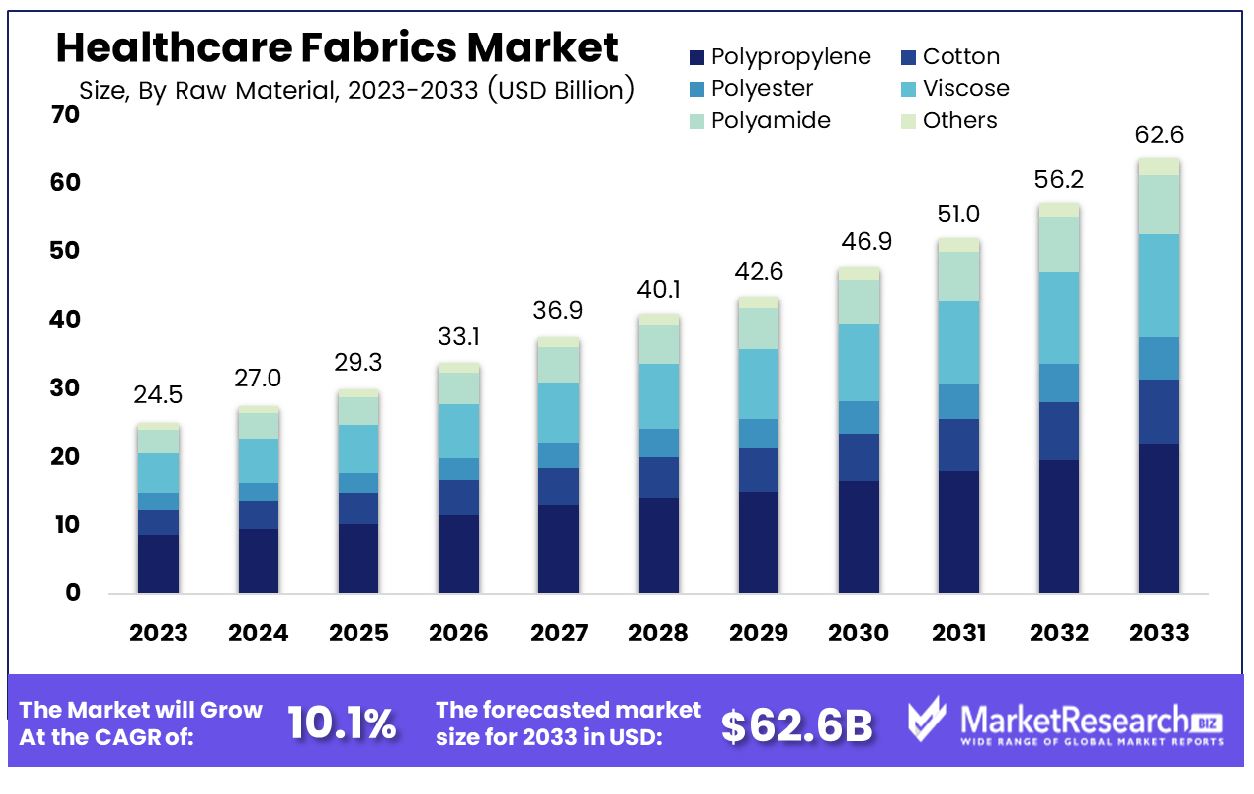

The Global Healthcare Fabrics Market was valued at USD 24.5 Bn in 2023. It is expected to reach USD 62.6 Bn by 2033, with a CAGR of 10.1% during the forecast period from 2024 to 2033.

The Healthcare Fabrics Market encompasses specialized textiles designed for use in medical and healthcare settings, catering to stringent safety, hygiene, and comfort standards. These fabrics are crucial components in the manufacturing of medical apparel, bedding, curtains, and surgical drapes, offering properties such as antimicrobial protection, fluid resistance, and breathability.

With an increasing emphasis on infection control and patient comfort, the market is driven by innovations in fabric technology that ensure durability and performance under rigorous healthcare environments. Key players in this market are continuously developing advanced materials to meet the evolving needs of healthcare providers globally, enhancing patient care and operational efficiencies.

With an increasing emphasis on infection control and patient comfort, the market is driven by innovations in fabric technology that ensure durability and performance under rigorous healthcare environments. Key players in this market are continuously developing advanced materials to meet the evolving needs of healthcare providers globally, enhancing patient care and operational efficiencies.The Healthcare Fabrics Market is experiencing significant growth driven by the increasing demand for textiles that combine functionality, comfort, and safety in medical and healthcare environments. These fabrics play a pivotal role in enhancing patient care, infection control measures, and operational efficiencies across hospitals, clinics, and long-term care facilities globally. An alternative to 100% cotton, cotton-rich fabrics, which blend the comfort and absorbency of cotton with the durability and performance attributes of polyester, offering healthcare providers versatile options for various applications.

Fabrics treated with advanced OC1 finish chemicals represent a notable advancement. These eco-friendly treatments enhance fabric properties akin to those of cotton-rich fabrics, with the added assurance of OEKO-TEX® 100 Class 1 certification. This certification ensures that the fabrics are skin-friendly and safe, meeting stringent health and safety standards crucial for healthcare settings, including sensitive patient populations like infants.

As healthcare facilities prioritize patient comfort and infection prevention, there is a growing preference for fabrics that not only meet regulatory requirements but also contribute to a comfortable and hygienic environment. Manufacturers in the Healthcare Fabrics Market are increasingly focusing on sustainability and technological advancements to meet these demands while enhancing product durability and performance.

Key Takeaways

- Market Value: The Global Healthcare Fabrics Market was valued at USD 24.5 Bn in 2023. It is expected to reach USD 62.6 Bn by 2033, with a CAGR of 10.1% during the forecast period from 2024 to 2033.

- By Raw Material: Polypropylene dominates the market with approximately 35% market share due to its extensive use in non-woven hygiene products like disposable gowns and masks.

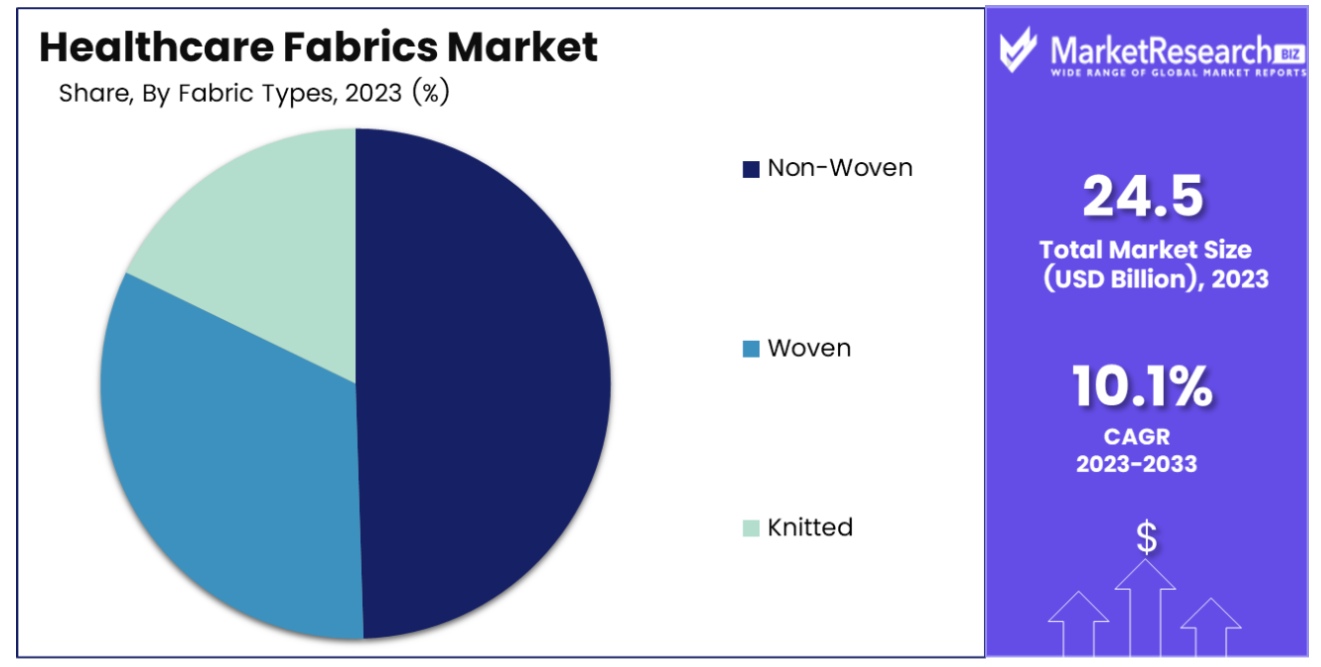

- By Fabric Types: Non-Woven leads the market with around 50% market share, primarily driven by its application in disposable medical products and hygiene items.

- By Applications: Hygiene Products commands the highest market share of about 40%, fueled by the high demand for disposable items like diapers, sanitary napkins, and adult incontinence products.

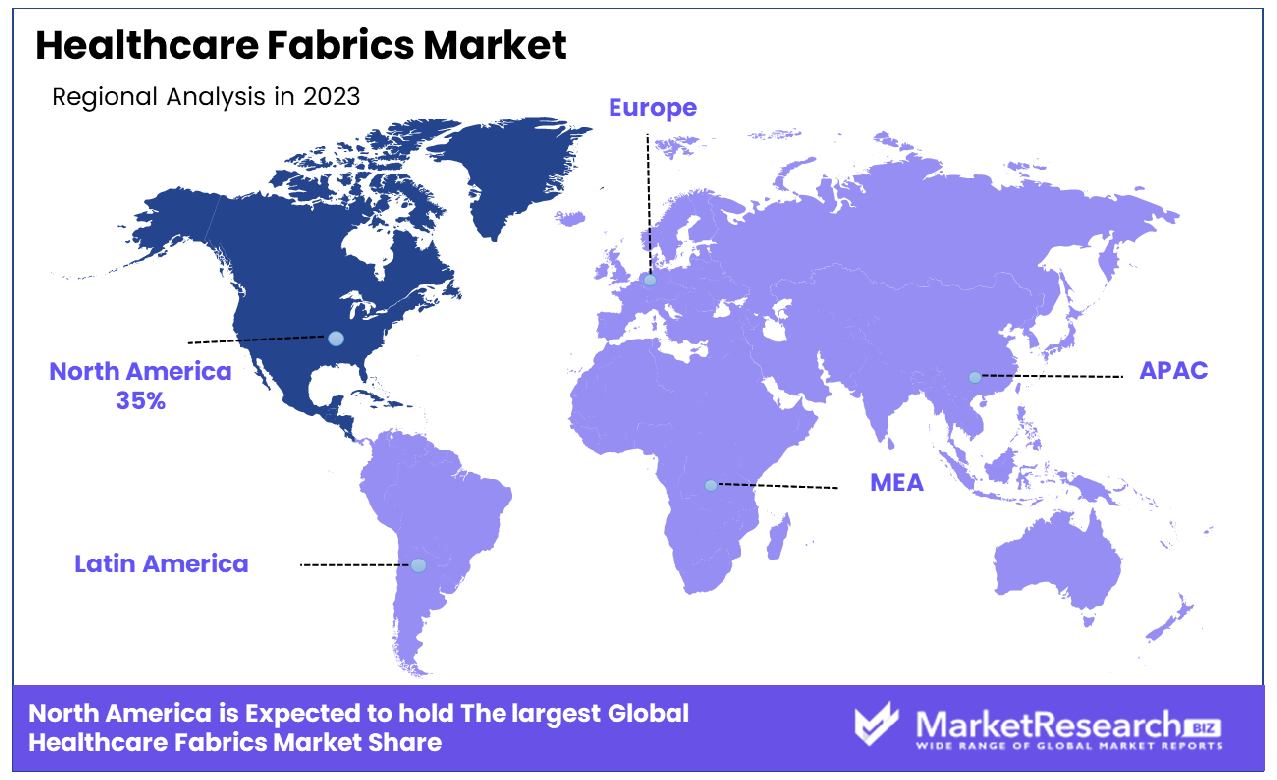

- Regional Dominance: North America: Leads the healthcare fabrics market with around 35% market share, owing to advanced healthcare infrastructure for hygiene and medical products.

- Growth Opportunities: The healthcare fabrics market has substantial growth opportunities driven by the aging global population, increasing the demand for hygiene products, medical textiles, and advanced healthcare facilities.

Driving factors

Growing Demand for Connected Devices

The growing demand for connected medical devices is a pivotal driver for the Healthcare Fabrics Market. As healthcare systems worldwide embrace digital transformation, there is an increasing integration of sensors and electronic components into medical textiles. Smart fabric softener embedded with sensors can monitor vital signs, track patient movements, and even deliver therapeutic treatments.

This trend not only enhances patient care by providing real-time data but also necessitates fabrics that are durable, comfortable, and washable. According to industry reports, the global market for smart textiles in healthcare is projected to grow significantly, driven by advancements in wearable technologies and remote patient monitoring systems.

Increased Awareness of Hygiene Products

The heightened awareness of hygiene and infection control is another crucial factor fueling the growth of the Healthcare Fabrics Market. In light of global health crises and ongoing efforts to prevent hospital-acquired infections (HAIs), there is a growing emphasis on using antimicrobial and antibacterial fabrics in healthcare settings.

These fabrics inhibit the growth of pathogens, thereby reducing the risk of cross-contamination and improving patient outcomes. The market for antimicrobial textiles is expanding rapidly, supported by stringent regulatory standards and increased adoption by healthcare facilities worldwide.

Improved Quality of Healthcare Fabrics

Advancements in textile manufacturing technologies have led to significant improvements in the quality and performance of healthcare fabrics. Modern healthcare fabrics are designed to be lightweight, breathable, moisture-wicking, and durable, meeting the rigorous demands of medical environments.

Enhanced fabric properties such as stain resistance, flame retardancy, and ease of sterilization contribute to their widespread adoption across hospitals, clinics, and ambulatory care centers. Manufacturers are investing in research and development to innovate new materials and finishing techniques that enhance comfort for patients and healthcare professionals alike.

Restraining Factors

Increased Carbon Footprint

The rising carbon footprint presents a significant challenge and opportunity for the Healthcare Fabrics Market. As global awareness of environmental sustainability grows, industries are under pressure to reduce their carbon emissions, including the healthcare sector. Textile manufacturing, particularly in healthcare fabrics, contributes to greenhouse gas emissions through energy-intensive processes and transportation logistics. Manufacturers are increasingly adopting sustainable practices such as using recycled fibers, reducing water consumption, and optimizing energy efficiency in production facilities.

Efforts to mitigate the carbon footprint in healthcare fabrics align with regulatory mandates and consumer preferences for environmentally responsible products. Market trends show a growing demand for eco-friendly textile that minimize environmental impact without compromising on performance or safety standards. Companies investing in sustainable practices and obtaining certifications for their products are likely to gain a competitive edge in the evolving market landscape.

Counterfeited Healthcare Fabrics

The proliferation of counterfeited healthcare fabrics poses a significant risk to the Healthcare Fabrics Market. Counterfeiting not only compromises product quality and safety but also undermines consumer trust in legitimate brands and manufacturers. Counterfeit fabrics in healthcare settings can lead to substandard performance, failed infection control measures, and potential health risks for patients and healthcare workers.

Stakeholders across the healthcare fabric supply chain are implementing stringent quality control measures, including traceability technologies and authentication systems. These measures ensure the authenticity and integrity of products from manufacturing to distribution and use. Regulatory bodies are also tightening regulations and enforcement actions against counterfeiters to protect public health and uphold industry standards.

By Raw Material Analysis

In 2023, Polypropylene held a dominant market position in By Raw Material segment of Healthcare Fabrics Market, capturing more than a 35% share.

Polypropylene has emerged as the leading raw material in the healthcare fabrics market, owing to its exceptional properties such as durability, moisture resistance, and affordability. These characteristics make polypropylene fabrics ideal for use in medical gowns, face masks, surgical drapes, and other healthcare-related textiles. The material's ability to provide effective barrier protection against fluids and microorganisms has been crucial, particularly during the global health crisis, driving its widespread adoption and securing a significant market share exceeding 35% in 2023.

Cotton remains a formidable contender in the healthcare fabrics market, valued for its natural softness, breathability, and hypoallergenic properties. These qualities make cotton fabrics suitable for patient apparel, wound dressings, and bedding within healthcare settings. Despite facing competition from synthetic materials like polypropylene nonwoven fabric, cotton maintains a substantial presence in the market, appealing to consumers and healthcare professionals alike who prioritize comfort and sustainability.

Polyester and Viscose fabrics also play pivotal roles in the healthcare sector. Polyester fabrics are appreciated for their strength, wrinkle resistance, and ease of maintenance, making them suitable for durable medical textiles such as bedding linens and scrubs. Viscose, known for its softness and moisture absorption properties, finds application in wound care products and hygiene products. Both materials contribute to the versatility and functionality of healthcare fabrics, addressing specific needs across various medical and hygiene applications.

Polyamide and other specialty materials cater to niche segments within the healthcare fabrics market, offering unique characteristics such as elasticity, abrasion resistance, and thermal insulation. These materials are utilized in advanced medical textiles, including compression garments, orthopedic supports, and specialized wound care products, where performance and comfort are paramount.

By Fabric Types Analysis

In 2023, Non-Woven held a dominant market position in By Fabric Types segment of Healthcare Fabrics Market, capturing more than a 50% share.

Non-woven fabrics have solidified their position as the leading fabric type in the healthcare fabrics market due to their versatility, cost-effectiveness, and superior performance in medical applications. The widespread adoption of non-woven fabrics across healthcare facilities and medical settings has propelled its market share to over 50% in 2023, underscoring its indispensable role in the healthcare fabrics market. Non-woven fabrics are manufactured by bonding fibers together through various processes, such as thermal, chemical, or mechanical methods, resulting in materials that offer excellent barrier properties, absorbency, and disposability.

Woven fabrics, while facing stiff competition from non-woven materials, continue to maintain a significant presence in the market. Woven fabrics are constructed by interlacing yarns using weaving techniques, resulting in durable and breathable textiles. They are valued for their strength, longevity, and aesthetic appeal, making them suitable for applications such as patient apparel, blanket, bedding, and surgical drapes. The inherent properties of woven fabrics, including their ability to withstand repeated laundering and sterilization, ensure their continued relevance in healthcare settings where durability and reusability are paramount.

Knitted fabrics, known for their stretchability, flexibility, and comfort, also play a crucial role in the healthcare fabrics market. Knitted fabrics are created by interlocking yarns in a series of loops, offering superior elasticity and drape compared to woven or non-woven materials. These characteristics make knitted fabrics well-suited for applications such as compression garments, bandages, and support braces, providing patients with comfort and therapeutic benefits. Despite representing a smaller segment compared to non-woven and woven fabrics, knitted fabrics cater to specialized medical needs and niche markets within healthcare textiles.

By Applications Analysis

In 2023, Hygiene Products held a dominant market position in By Applications segment of Healthcare Fabrics Market, capturing more than a 40% share.

Hygiene products have emerged as the leading application segment in the healthcare fabrics market, driven by increasing awareness of infection control and hygiene standards in healthcare settings. Fabrics used in hygiene products, such as surgical masks, gowns, and drapes, require high levels of barrier protection, comfort, and breathability to ensure effective infection prevention and patient safety. The demand for reliable and durable hygiene products has propelled this segment to capture over 40% of the market share in 2023, highlighting its critical role in supporting healthcare professionals and patients alike.

Dressing products represent another significant segment within the healthcare fabrics market, catering to wound care and medical dressing applications. Fabrics used in dressing products must exhibit qualities such as absorbency, sterility, and non-adherence to wounds to facilitate proper healing and patient comfort. These fabrics are integral to managing various types of wounds, from minor injuries to chronic conditions, contributing to the segment's importance in the healthcare textiles industry.

Clothing for healthcare professionals and patients also commands a notable share of the market. Fabrics used in healthcare clothing, including scrubs, lab coats, and patient apparel, prioritize comfort, durability, and ease of laundering. The functionality and performance of these fabrics play a crucial role in maintaining hygiene standards and enhancing the overall experience for healthcare personnel and patients.

Blanket & bedding fabrics cater to the comfort and well-being of patients in healthcare facilities, providing warmth, softness, and ease of maintenance. These fabrics are designed to meet stringent hygiene requirements while offering comfort and durability, ensuring a conducive environment for patient recovery and rest.

Upholstery and privacy curtains round out the diverse applications of healthcare fabrics, offering solutions that enhance the aesthetic appeal and functionality of healthcare environments. Fabrics used in upholstery and curtains are chosen for their durability, ease of cleaning, and ability to maintain privacy and infection control standards in hospitals and medical facilities.

Key Market Segments

By Raw Material

- Polypropylene

- Cotton

- Polyester

- Viscose

- Polyamide

- Others

By Fabric Types

- Non-Woven

- Woven

- Knitted

By Applications

- Hygiene Products

- Dressing Products

- Clothing

- Blanket & Bedding

- Upholstery

- Privacy Curtains

- Others

Growth Opportunity

Growing Demand for Disposable Clothing

The increasing demand for disposable clothing in healthcare settings is a significant opportunity for the Healthcare Fabrics Market. Disposable medical textiles, including gowns, masks, and drapes, are essential for infection control and preventing cross-contamination.

The COVID-19 pandemic has accelerated the adoption of disposable healthcare fabrics globally, highlighting the need for reliable, cost-effective, and easily disposable materials. Market projections indicate robust growth in the demand for disposable medical textiles, driven by ongoing healthcare infrastructure developments and stringent hygiene protocols.

Advancements in Medical Science

Advancements in medical science and textile technology are poised to propel market expansion in 2024. Innovations such as smart textiles embedded with sensors for continuous monitoring, antimicrobial fabrics for infection prevention, and biocompatible materials for wound care are enhancing the functionality and performance of healthcare fabrics.

These advancements not only improve patient care outcomes but also increase the efficiency of healthcare operations. The integration of advanced materials and manufacturing techniques enables the development of tailored solutions that meet the evolving needs of modern healthcare practices.

Shift Toward Eco-Friendly Products

The global shift toward eco-friendly products presents a strategic opportunity for the Healthcare Fabrics Market. Increasing awareness of environmental sustainability and regulatory pressures are driving healthcare facilities to adopt greener practices and products.

Sustainable healthcare fabrics made from recycled fibers, organic cotton, and biodegradable materials are gaining traction. Manufacturers investing in eco-friendly innovations are well-positioned to capitalize on this trend, meeting consumer preferences for environmentally responsible healthcare solutions.

Latest Trends

Rise of Non-Woven Fabrics

One of the prominent trends reshaping the Healthcare Fabrics Market is the increasing adoption of non-woven fabrics. Non-woven materials are engineered fabrics made from fibers bonded together through mechanical, chemical, or thermal processes, rather than weaving or knitting. These fabrics offer advantages such as high absorbency, liquid repellence, breathability, and barrier properties against bacteria and viruses.

In healthcare applications, non-woven fabrics are extensively used in surgical gowns, masks, wound dressings, and disposable medical textiles due to their cost-effectiveness and superior performance in infection control.

Advancements in Textile Technology

Advancements in textile technology are driving innovation and expanding the capabilities of healthcare fabrics. Cutting-edge developments include the integration of smart textiles with sensors for continuous health monitoring, antimicrobial treatments for infection prevention, and biocompatible materials for improved patient comfort and safety.

Advanced manufacturing techniques such as 3D printing and nanotechnology enable the production of complex textile structures with precise functionalities tailored to specific medical applications. These innovations enhance the performance, durability, and functionality of healthcare fabrics, meeting the stringent requirements of modern healthcare environments.

Regional Analysis

North America leads the Healthcare Fabrics Market with a substantial 35% market share.

North America leads the global healthcare fabrics market with a dominant share of approximately 35%. This region benefits from a well-established healthcare infrastructure, advanced medical technologies, and stringent regulatory standards that drive the demand for high-performance fabrics in medical applications. The United States, in particular, is a major contributor to market growth, supported by robust investments in healthcare facilities and increasing focus on infection control measures.

Europe holds a significant share in the global healthcare fabrics market, characterized by stringent regulations promoting the use of antimicrobial and sterile fabrics in medical settings. Countries such as Germany, France, and the UK are key markets, driven by aging demographics, rising healthcare expenditure, and increasing awareness regarding infection prevention.

Asia Pacific emerges as a rapidly growing region in the healthcare fabrics market, driven by expanding healthcare infrastructure, rising healthcare expenditures, and growing awareness of hygiene standards. Countries like China, Japan, and India are witnessing increased adoption of medical textiles in hospitals, clinics, and home healthcare settings. The region's market share is projected to grow significantly, fueled by government initiatives supporting healthcare reforms and the increasing prevalence of chronic diseases.

The Middle East & Africa region shows promising growth prospects in the healthcare fabrics market, supported by improving healthcare access and infrastructure development initiatives. Countries such as Saudi Arabia, UAE, and South Africa are key contributors to market expansion, driven by investments in healthcare facilities and rising demand for advanced medical textiles.

Latin America represents a growing market for healthcare fabrics, propelled by expanding healthcare coverage and investments in public health initiatives. Brazil, Mexico, and Argentina are leading markets in the region, driven by rising healthcare spending and the adoption of modern healthcare practices. Although Latin America currently holds a smaller market share compared to other regions, initiatives aimed at improving healthcare infrastructure and enhancing patient care are expected to drive market growth in the coming years.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global healthcare fabrics market is set to witness robust growth, propelled by technological advancements and increasing demand for specialized textiles across healthcare settings. Paramount Tech Fab Industries emerges as a key player, leveraging its extensive expertise in manufacturing high-performance fabrics tailored for medical and hygiene applications. Their commitment to innovation, including antimicrobial treatments and barrier fabrics, positions them strongly amidst growing concerns over infection control in healthcare environments.

Ahlstrom Munksjo OYJ, renowned for its sustainable solutions and focus on biodegradable materials, contributes significantly to the market's evolution. Their emphasis on eco-friendly nonwovens and filtration fabrics addresses the industry's shift towards sustainability and regulatory compliance.

Carnegie Fabrics LLC stands out with its niche in healthcare interior textiles, offering a blend of aesthetic appeal and functionality. Their designs cater to hospital interiors and patient care environments, enhancing comfort and hygiene standards.

Eximius Incorporation and Avgol Ltd. play pivotal roles with their specialization in medical-grade nonwovens and surgical fabrics, meeting stringent performance requirements in wound care and surgical procedures.

The market dynamics are further shaped by global giants like Kimberly-Clark Corporation and Berry Global Group Inc., known for their extensive product portfolios spanning surgical gowns, drapes, and infection control solutions. Their robust distribution networks and brand reputation bolster their market presence.

Asahi Kasei Corporation and Freudenberg Group bring advanced technologies such as breathable membranes and durable fibers, enhancing product durability and comfort in healthcare applications.

Market Key Players

- Paramount Tech Fab Industries

- Ahlstrom Munksjo OYJ

- Carnegie Fabrics LLC

- Eximius Incorporation

- Avgol Ltd.

- KAsahi Kasei Corporation

- Freudenberg Group

- Kimberly-Clark Corporation

- Berry Global Group Inc.

- Designtex

Recent Development

- In May 2024, HCA Healthcare UK has invested £18m in two new women's health centres: a £4.5m facility on King's Road and a £13.5m centre on Harley Street, offering comprehensive gynaecology, breast screening, and specialist women's healthcare services.

- In April 2024, Microsoft's healthcare partners, including Accenture-Avanade and Sectra, are advancing AI solutions post-HIMSS24. They focus on patient engagement, clinical documentation, and imaging innovations to enhance care delivery and operational efficiency.

Report Scope

Report Features Description Market Value (2023) USD 24.5 Bn Forecast Revenue (2033) USD 62.6 Bn CAGR (2024-2033) 10.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Healthcare Fabrics Market, By Raw Material (Polypropylene, Cotton, Polyester, Viscose, Polyamide, Others, By Fabric Types (Non-Woven, Woven, Knitted, By Applications (Hygiene Products, Dressing Products, Clothing, Blanket & Bedding, Upholstery, Privacy Curtains, Others Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Paramount Tech Fab Industries, Ahlstrom Munksjo OYJ, Carnegie Fabrics LLC, Eximius Incorporation, Avgol Ltd., KAsahi Kasei Corporation, Freudenberg Group, Kimberly-Clark Corporation, Berry Global Group Inc., Designtex Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Paramount Tech Fab Industries

- Ahlstrom Munksjo OYJ

- Carnegie Fabrics LLC

- Eximius Incorporation

- Avgol Ltd.

- KAsahi Kasei Corporation

- Freudenberg Group

- Kimberly-Clark Corporation

- Berry Global Group Inc.

- Designtex