Global Hardware As A Service Market By Hardware Model(Desktop as a Service,Device as a Service,Infrastructure as a Service ,Platform as a Service), By Enterprise Size(Large Enterprises, Small and Medium Enterprises), By Deployment Model(Cloud, On-premise), By End User(IT and Telecommunication, BFSI, Healthcare), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

44657

-

April 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

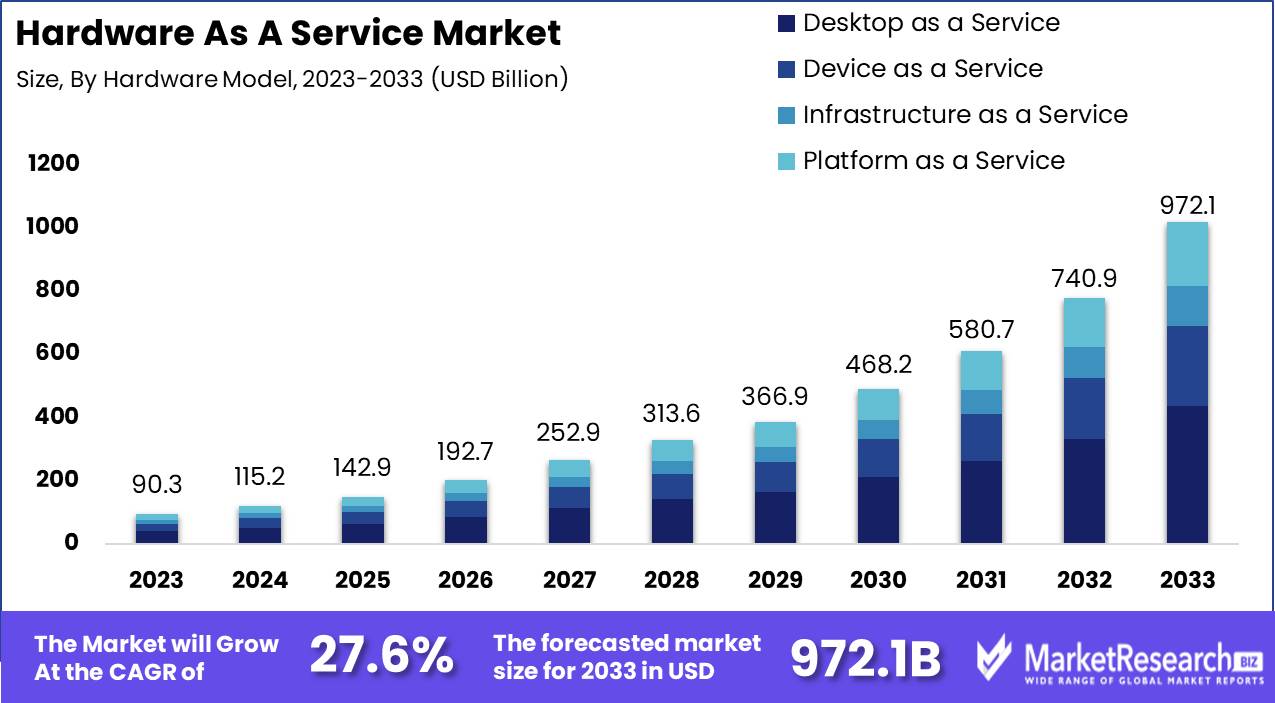

The Global Hardware As A Service Market was valued at USD 90.3 billion in 2023. It is expected to reach USD 972.1 billion by 2033, with a CAGR of 27.6% during the forecast period from 2024 to 2033.

The Hardware as a Service (HaaS) market encompasses a business model where firms provide hardware, combined with managed services, on a subscription basis. This model enables clients to access and utilize the latest technological infrastructure without the significant capital expenditure associated with purchasing and maintaining hardware. Key benefits include cost predictability, scalability, and reduced IT workload, which aligns with strategic business objectives.

The market appeals to organizations prioritizing operational efficiency and technological agility. As such, it holds particular relevance for Product Managers seeking innovative solutions to enhance competitive advantage while managing financial outlays effectively.

The Hardware as a Service (HaaS) market is undergoing a transformative growth phase, driven by an escalating demand for scalable and flexible hardware solutions across various sectors, including transport and digital infrastructure. The Infrastructure Monitor Report 2023 highlights a robust expansion in the broader infrastructure sector, which indirectly supports the proliferation of HaaS offerings. In 2022, the infrastructure market observed an 18% increase in the number of transactions, totaling 1,292. This surge was accompanied by a significant rise in the value of investments, indicating an increase in the average transaction size—a reflection of intensified investments in sectors that commonly require substantial hardware inputs.

In the secondary market for infrastructure, a notable 16% growth was recorded, with the total reaching USD 1 trillion across 1,892 transactions. This growth trajectory was prominently fueled by a 37% increase in acquisitions, amounting to USD 569 billion and accounting for 54% of the total secondary infrastructure investment. Such trends underscore a vibrant market environment for HaaS, as increased infrastructure investments necessitate advanced hardware systems that can be efficiently integrated and managed.

This market dynamics suggest that HaaS providers are well-positioned to leverage these expanding investment patterns. By offering cost-effective, managed hardware solutions, HaaS companies can cater to the growing needs of large-scale infrastructure projects, thereby embedding themselves as crucial enablers in the digital and transport sectors. As this market continues to evolve, the strategic positioning of HaaS offerings in alignment with infrastructure growth will be pivotal in realizing long-term success.

Key Takeaways

- Market Growth: The Global Hardware As A Service Market was valued at USD 90.3 billion in 2023. It is expected to reach USD 972.1 billion by 2033, with a CAGR of 27.6% during the forecast period from 2024 to 2033.

- By Hardware Model: Desktop as a Service dominates hardware model preferences at 45%.

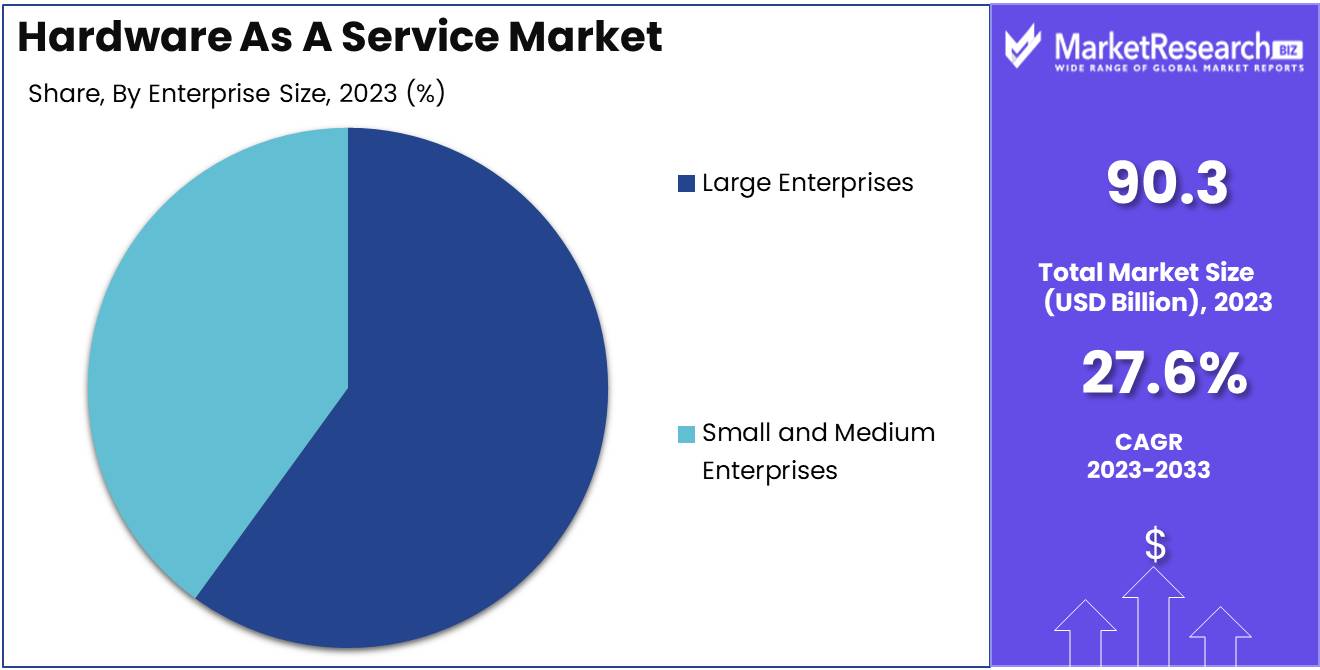

- By Enterprise Size: Large enterprises lead adoption, constituting 65% of users.

- By Deployment Model: Cloud deployment prevails, capturing 65% of the market.

- By End User: IT and telecommunication sectors command 55% of end users.

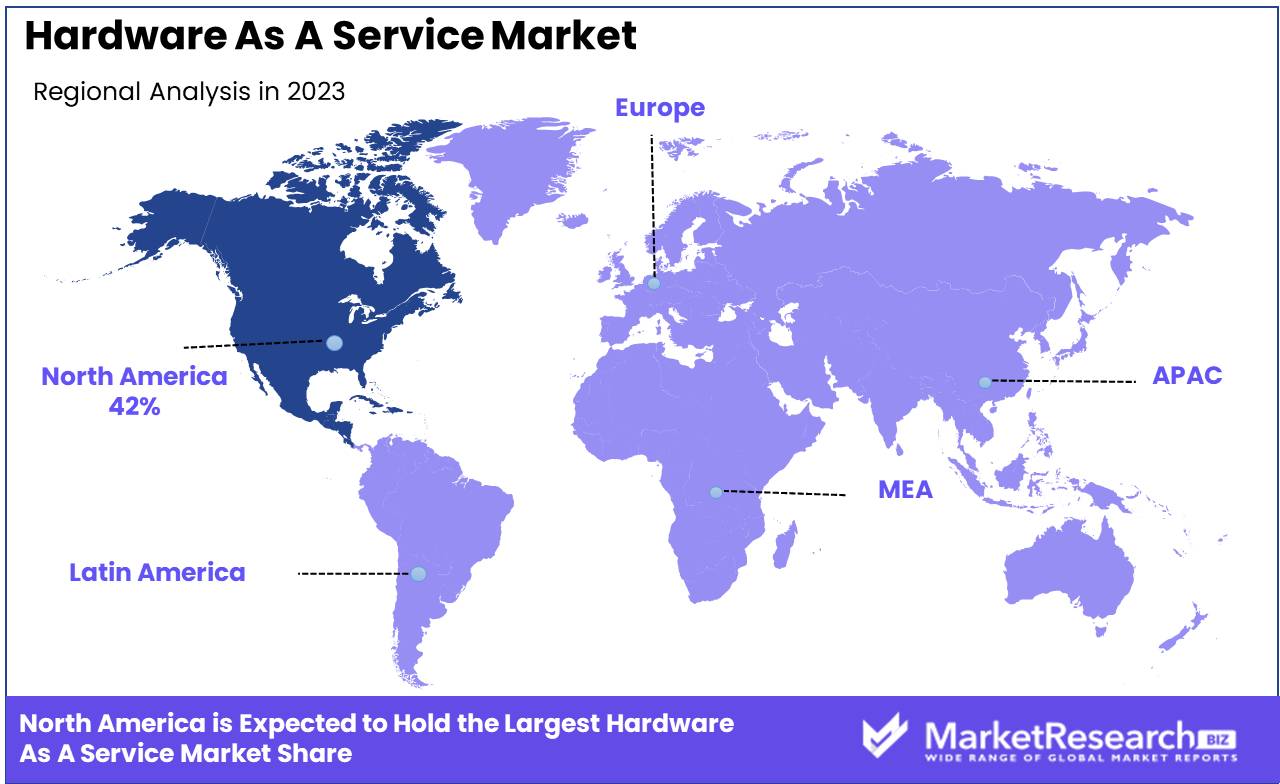

- Regional Dominance: North America holds 42% of the global Hardware as a Service market.

- Growth Opportunity: In 2023, the Hardware as a Service (HaaS) market is poised for growth, driven by its scalability, flexibility, and cost-effectiveness, appealing especially to enterprises and SMEs undergoing digital transformations.

Driving factors

Advancements in Artificial Intelligence (AI) and Machine Learning (ML) Technologies

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into hardware solutions is transforming the Hardware as a Service (HaaS) market. These technologies enable more efficient hardware operations, predictive maintenance, and enhanced performance analytics, crucial for optimizing service delivery.

By leveraging AI and ML, HaaS providers can offer personalized hardware configurations that adapt to real-time data inputs, significantly improving user experience and operational efficiency. This adaptation not only attracts customers seeking cutting-edge technology solutions but also drives market growth by demonstrating increased value through advanced analytics capabilities.

Increased Demand for Smart Devices and Automation in Various Industries

As industries increasingly embrace digital transformation, the demand for smart devices and automation has escalated. This trend is profoundly impacting the HaaS market by expanding its scope beyond traditional IT hardware to include smart appliances and automated systems across sectors such as healthcare, manufacturing, and retail.

The surge in smart device integration necessitates ongoing hardware updates and management, which HaaS providers are uniquely positioned to supply. This not only ensures a continuous revenue stream from hardware upgrades and leases but also from the services required to manage these increasingly complex systems.

Growing Need for Data Storage and Management

In today's data-driven landscape, the exponential growth in data generation across all sectors heightens the demand for robust data storage and management solutions. HaaS models are particularly well-suited to meet this need by providing scalable hardware resources that can adapt to the evolving demands of data-intensive applications.

By offering hardware that supports substantial data storage and efficient data management, HaaS providers ensure that businesses can leverage the latest storage technologies without the associated capital expenditures, thereby facilitating market growth through cost-effective, flexible service offerings.

Restraining Factors

Limited Understanding and Adoption in Certain Industries

The growth of the Hardware as a Service (HaaS) market is significantly hindered by a limited understanding and adoption among certain industries. Traditional sectors such as small-scale manufacturing and older service industries often exhibit reluctance towards transitioning to HaaS models due to unfamiliarity with the concept and perceived complexities in implementation.

This hesitation is compounded by concerns over the return on investment and the disruption of established processes. The lack of industry-specific solutions from HaaS providers can exacerbate this issue, leading to slower market penetration and limited growth within these sectors. Overcoming this barrier requires targeted educational initiatives and the development of tailored HaaS offerings that address specific industry needs and concerns.

Security Concerns and Data Privacy Issues

Security vulnerabilities and data privacy concerns present significant obstacles to the adoption of the HaaS model. As hardware systems increasingly connect to the internet and handle sensitive data, they become prime targets for cyber-attacks. The fear of data breaches and the potential legal and financial repercussions hinder many organizations from adopting HaaS solutions.

According to industry surveys, security concerns are among the top reasons companies hesitate to transition to cloud-based and as-a-service models. Providers must invest heavily in robust security measures and privacy protocols to mitigate these fears and enhance trust among potential customers, thus encouraging wider adoption of HaaS.

By Hardware Model Analysis

In Desktop as a Service, hardware model dominance stands at 45%, emphasizing its growing significance.

In 2023, Desktop as a Service held a dominant market position in the "By Hardware Model" segment of the Hardware as a Service (HaaS) market, capturing more than 45% of the market share. This segment includes various models such as Desktop as a Service, Device as a Service, Infrastructure as a Service, and Platform as a Service.

The robust growth of Desktop as a Service can be attributed to its cost-effectiveness and scalability, offering businesses flexible computing solutions without the heavy upfront costs associated with physical hardware. Enterprises are increasingly adopting this model to enhance their operational efficiency and to reduce the burden of maintaining and updating physical desktop environments.

Device as a Service also showed significant traction, providing companies with the advantage of managing their device lifecycle and reducing the complexity associated with the procurement and management of workplace technology. This service model has been particularly beneficial for organizations looking to streamline operations and focus on core business functions.

Infrastructure as a Service and Platform as a Service has also contributed to the expansion of the HaaS market. These models provide essential back-end services that are critical for cloud computing, including data storage, networking, and servers, which are crucial for supporting the growing demand for online services and applications.

By Enterprise Size Analysis

Large enterprises lead adoption, comprising 65% of users in this realm.

In 2023, Large Enterprises held a dominant market position in the "By Enterprise Size" segment of the Hardware as a Service (HaaS) market, capturing more than 65% of the market share. This segment includes two classifications: Large Enterprises and Small and Medium Enterprises (SMEs).

The substantial share held by Large Enterprises is primarily due to their higher capacity for investment and greater scalability needs, which make the HaaS model particularly attractive. Large organizations often require robust IT infrastructure to support extensive operational demands and customer bases. The HaaS model offers them a way to access the latest hardware and technologies without the associated capital expenditure, thus enabling more predictable budgeting and improved cost management.

On the other hand, Small and Medium Enterprises also benefit from the HaaS model, though they represent a smaller portion of the market share. For SMEs, HaaS provides an opportunity to leverage advanced technologies that might otherwise be inaccessible due to financial constraints. It allows these smaller enterprises to compete more effectively with larger players by enabling technological parity, typically with flexible pricing models suited to their lesser scale.

By Deployment Model Analysis

Cloud deployment prevails with a commanding 65% share, reflecting its scalability and flexibility.

In 2023, Cloud held a dominant market position in the "By Deployment Model" segment of the Hardware as a Service (HaaS) market, capturing more than 65% of the market share. This segment includes two key deployment models: Cloud and On-premise.

The predominant position of Cloud deployment can be largely attributed to its scalability, flexibility, and cost-effectiveness, which are particularly advantageous for businesses looking to adapt to rapidly changing technological landscapes. Cloud-based HaaS allows organizations to access and manage hardware resources over the Internet, eliminating the need for significant capital investments in physical infrastructure. This model supports remote work configurations and enables businesses to easily scale their operations up or down based on current needs, a critical capability in today’s dynamic market environment.

Meanwhile, the On-premise model continues to be relevant, particularly for organizations that require greater control over their hardware and data due to security concerns or regulatory compliance requirements. However, the higher upfront costs and the need for ongoing maintenance and updates make this model less attractive compared to the Cloud.

The Cloud deployment model’s share is expected to grow even further as more businesses move towards digitalization and adopt cloud-first strategies. This shift is driven by the need for greater operational agility and the potential for reduced IT expenditures. As the market evolves, Cloud-based HaaS solutions are poised to play a pivotal role in enabling enterprises to leverage advanced technologies while maintaining flexibility in their IT spending.

By End User Analysis

IT and telecommunication sectors constitute 55% of end users, indicating their reliance on digital infrastructure.

In 2023, IT and Telecommunication held a dominant market position in the "By End User" segment of the Hardware as a Service (HaaS) market, capturing more than 55% of the market share. This segment prominently features three key industries: IT and Telecommunication, BFSI (Banking, Financial Services, and Insurance), and Healthcare.

The commanding lead of the IT and telecommunications sector can be attributed to its inherent need for robust, scalable, and high-performing hardware solutions to manage vast amounts of data and maintain uninterrupted services. The HaaS model is particularly appealing in this sector because it offers the ability to quickly adapt to technological advancements and fluctuating demands without significant capital expenditure. This flexibility not only enhances operational efficiency but also drives innovation within the sector.

The BFSI sector also significantly integrates HaaS solutions to ensure enhanced security and compliance with stringent regulatory requirements while managing large-scale consumer data and complex transactions. Meanwhile, the Healthcare sector leverages HaaS to enhance patient care through better data management and more advanced medical technology, which is critical for diagnostics and treatment.

As businesses in IT and Telecommunication continue to expand their infrastructure to support increasing data traffic and innovative communication solutions, the demand for HaaS is expected to grow. The model's scalability and cost-effectiveness will further solidify its position as a preferred choice for companies aiming to remain competitive in a technologically evolving landscape. Thus, the HaaS market is poised for continued expansion across these key sectors, driven by the ongoing digital transformation and increasing reliance on high-performance computing solutions.

Key Market Segments

By Hardware Model

- Desktop as a Service

- Device as a Service

- Infrastructure as a Service

- Platform as a Service

By Enterprise Size

- Large Enterprises

- Small and Medium Enterprises

By Deployment Model

- Cloud

- On-premise

By End User

- IT and Telecommunication

- BFSI

- Healthcare

Growth Opportunity

Scalability and Flexibility Demand

In 2023, the global Hardware as a Service (HaaS) market is anticipated to experience significant growth driven by increasing demands for scalability and flexibility in corporate IT environments. Organizations are actively seeking solutions that allow them to scale their hardware resources dynamically in response to fluctuating business requirements. The HaaS model addresses this need by offering customizable hardware solutions that can be scaled up or down based on operational demands, without necessitating substantial upfront capital expenditure.

This model not only facilitates greater operational agility but also ensures that businesses can rapidly adapt to changing market conditions and technological advancements. The growth of the market can thus be attributed to the increasing recognition of these benefits among enterprises, particularly those undergoing digital transformation initiatives.

Cost-Effective Hardware Solutions

Economic considerations continue to propel the adoption of the Hardware as a Service model. By transitioning to HaaS, companies can convert large fixed costs into more manageable variable expenses. This shift is particularly advantageous for small to medium-sized enterprises (SMEs) that may lack the financial resources to invest in expensive hardware upfront.

The HaaS model offers a predictable expense structure, often including maintenance, updates, and replacements, thereby reducing the total cost of ownership and eliminating concerns related to hardware obsolescence. The cost-effectiveness of HaaS is further enhanced by the potential for customized service packages, which align precisely with specific business needs, ensuring that organizations pay only for the hardware capabilities they require. This strategic financial flexibility is a key factor driving market expansion in 2023.

Latest Trends

Security Enhancements for Hardware Infrastructure

The global Hardware as a Service (HaaS) market in 2023 is witnessing a pronounced emphasis on security enhancements for hardware infrastructure. As businesses increasingly rely on digital platforms and cloud-based solutions, the necessity for robust hardware security measures becomes paramount. Service providers are enhancing their offerings by integrating advanced security protocols directly into their hardware services, which include real-time threat detection systems, hardware-based encryption, and multi-factor authentication solutions.

These enhancements are crucial in safeguarding sensitive data and ensuring compliance with global data protection regulations. The proactive incorporation of these security measures within the HaaS model significantly increases its attractiveness to sectors with stringent security requirements, such as finance and healthcare. Consequently, the market is observing a heightened adoption rate as confidence in the security capabilities of HaaS solutions strengthens.

Increased Demand for GPU-as-a-Service (GPUaaS)

Parallel to traditional hardware offerings, 2023 marks a surge in demand for GPU-as-a-Service (GPUaaS) within the HaaS market. Driven by advancements in artificial intelligence, machine learning, and complex data analytics, GPUs are becoming indispensable for their superior processing power and efficiency. GPUaaS offers a cost-effective, scalable solution for businesses requiring intensive computational capabilities without the associated capital expenditure on high-end hardware.

This trend is particularly evident in industries engaged in video rendering, scientific computations, and AI research, where GPUs can significantly accelerate project timelines. As businesses continue to leverage data-intensive applications, the demand for GPUaaS is expected to grow, contributing to the broader expansion and diversification of the HaaS market.

Regional Analysis

The Hardware as a Service market in North America accounts for 42% of the global share.

North America continues to lead the global HaaS market, commanding a dominant 42% share. This region's prominence is underpinned by robust IT infrastructure, early adoption of technology solutions by enterprises, and significant investment in cloud-based services. The U.S. and Canada are pivotal in driving North American market dynamics, with a strong focus on reducing capital expenditure and enhancing operational efficiencies.

Europe holds a critical position in the HaaS landscape, driven by stringent regulatory frameworks mandating data security and an increasing inclination towards sustainable technology solutions. Western European countries, particularly Germany, the UK, and France, are at the forefront, leveraging HaaS to navigate digital transformation in the manufacturing and healthcare sectors.

The Asia Pacific region is witnessing the fastest growth in the HaaS market, fueled by rapid urbanization, digitalization initiatives, and the expansion of small and medium-sized enterprises (SMEs) in countries like China, India, and Japan. The region's market expansion is also supported by improvements in IT infrastructure and increased technology penetration in the business sector.

The Middle East & Africa (MEA) and Latin America are emerging as potential growth areas for HaaS. These regions benefit from the gradual shift to cloud computing and the growing demand for cost-effective IT management solutions. In particular, countries such as Brazil, South Africa, and the UAE are increasingly adopting HaaS models to optimize resource utilization and cost efficiencies.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global Hardware as a Service (HaaS) market features a diverse array of key players, each contributing uniquely to the industry's growth and evolution. Among them, companies such as Dell Inc., Microsoft Corporation, and Amazon.com stand out due to their extensive technological infrastructure and broad market reach.

Dell Inc. continues to leverage its robust supply chain and wide-ranging technology solutions to offer comprehensive HaaS offerings. Microsoft Corporation and Amazon.com, leading the cloud services sector, integrate their cloud capabilities with HaaS offerings to provide scalable and efficient solutions to businesses of all sizes.

Mid-sized companies such as Phoenix NAP and Design Data Systems, Inc. demonstrate significant agility in adapting to market needs, focusing on specialized services and customized solutions that cater to niche markets. Their ability to deliver personalized customer service enhances their competitive edge in a crowded marketplace.

Emerging players like ZNet Technologies Pvt. Ltd. and Navitas Lease Corp. are pivotal in introducing innovative financial models and technological integrations, facilitating easier adoption of HaaS solutions in less penetrated markets.

Furthermore, companies such as Fujitsu Ltd and Lenovo Group are expanding their HaaS services globally, capitalizing on their established presence in hardware manufacturing to offer integrated solutions that are appealing to a global clientele.

The diversity and specialization of these key players enrich the HaaS market, making it both competitive and dynamic. Each company's strategy not only defines its individual growth trajectory but also shapes the broader market trends, influencing how hardware solutions are consumed and managed across different regions and industries.

Market Key Players

- Custard group

- Phoenix NAP

- Dell Inc.

- Design Data Systems, Inc.

- FUSE3 Communications

- Ingram Micro

- ITque, Inc.

- Amazon.com

- MasterIT, LLC

- Managed IT Solutions

- Microsoft Corporation

- Navitas Lease Corp.

- ZNet Technologies Pvt. Ltd.

- Fujitsu Ltd

- Lenovo Group

- Machado Consulting

Recent Development

- In March 2024, Arrow Electronics, Avnet, and CDW remain prominent VARs, adapting to evolving tech landscapes by offering customized IT solutions and embracing cloud and hybrid cloud services to ensure relevance and resilience.

- In February 2024, Telefónica, Lenovo, NearbyComputing, Fogsphere, and Nemergent showcase a multi-cloud environment enabling instant, life-saving responses with edge technology in telco networks, heralding a new era in telecommunications.

- In February 2024, Ericsson unveils 12 new solutions for high-performing, sustainable, and open networks, including the energy-efficient AIR 3255 Massive MIMO radio, advancing 5G performance and sustainability goals.

Report Scope

Report Features Description Market Value (2023) USD 90.3 Billion Forecast Revenue (2033) USD 972.1 Billion CAGR (2024-2032) 27.6% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Hardware Model(Desktop as a Service,Device as a Service,Infrastructure as a Service ,Platform as a Service), By Enterprise Size(Large Enterprises, Small and Medium Enterprises), By Deployment Model(Cloud, On-premise), By End User(IT and Telecommunication, BFSI, Healthcare) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Custard group, Phoenix NAP, Dell Inc., Design Data Systems, Inc., FUSE3 Communications, Ingram Micro, ITque, Inc., Amazon.com, MasterIT, LLC, Managed IT Solutions, Navitas Lease Corp., ZNet Technologies Pvt. Ltd., Fujitsu Ltd, Lenovo Group, Machado Consulting Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Custard group

- Phoenix NAP

- Dell Inc.

- Design Data Systems, Inc.

- FUSE3 Communications

- Ingram Micro

- ITque, Inc.

- Amazon.com

- MasterIT, LLC

- Managed IT Solutions

- Microsoft Corporation

- Navitas Lease Corp.

- ZNet Technologies Pvt. Ltd.

- Fujitsu Ltd

- Lenovo Group

- Machado Consulting