Green Finance Market Report By Type (Green Bonds, Green Loans, Green Investment Funds, Sustainability-Linked Financial Instruments), By Industry Vertical (Renewable Energy, Sustainable Agriculture, Green Real Estate, Environmental Technology), By End-User (Commercial Banks, Investment Banks, Asset Management Firms, Insurance Companies), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

44705

-

April 2024

-

280

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

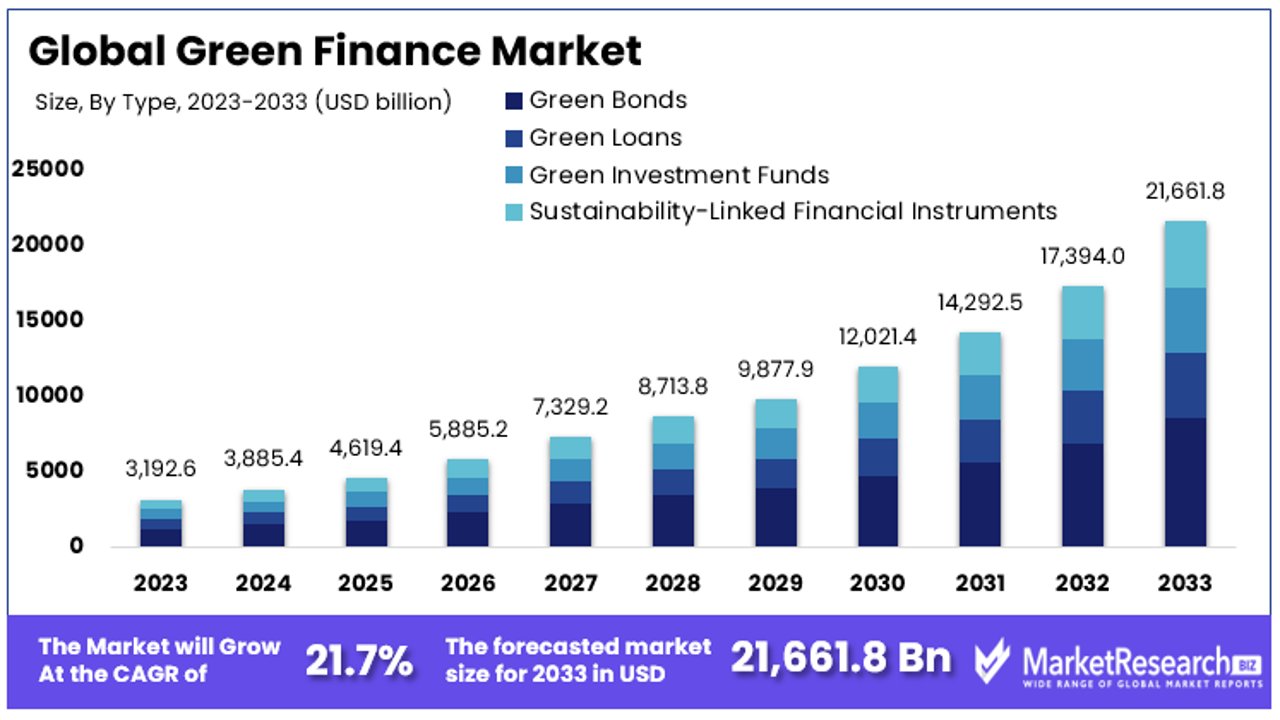

The Global Green Finance Market size is expected to be worth around USD 21,661.8 Billion by 2033, from USD 3,192.61 Billion in 2023, growing at a CAGR of 21.70% during the forecast period from 2024 to 2033.

Green finance refers to the financial investments flowing into sustainable development projects and initiatives that support environmental and climate-related objectives. This market prioritizes investments in renewable energy, energy efficiency, water management, and clean transportation sectors, among others.

Geen finance represents an opportunity to drive growth through sustainable practices, enhance brand reputation, and comply with global environmental standards. By allocating resources to green finance, companies can achieve competitive advantages, mitigate risks associated with climate change, and capitalize on the increasing demand for environmentally responsible operations.

The Green Finance Market is experiencing unprecedented growth, driven significantly by heightened global awareness and policy responses to environmental challenges. Since the Paris Agreement, the commitment to climate-conscious investments has accelerated, exemplified by a 317% increase in green financial measures.

This surge is underpinned by robust policy frameworks, with the Green Finance Platform's Green Finance Measures Database reporting 100 new policy and regulatory measures in 2022 alone. The cumulative impact of these 784 national and sub-national measures underscores a shifting paradigm in financial markets, towards prioritizing sustainable economic practices.

This dynamic expansion offers substantial opportunities for market participants. Financial institutions, investors, and corporations are increasingly aligning their strategies with green finance principles to capitalize on the growing demand for sustainable investment options.

This alignment not only mitigates risks associated with climate change but also enhances brand reputation and opens new avenues for growth. The implementation of regulatory measures further supports this trend by providing a more structured and secure investment environment, encouraging more stakeholders to commit to green finance initiatives.

The Green Finance Market is poised for robust growth. The ongoing development and enforcement of supportive policies are likely to foster more innovative financial products and services that cater to environmental sustainability. For executives, understanding these trends is crucial for strategizing investments and operations to leverage the advantages that green finance offers. The market's growth potential, backed by a strong regulatory framework, presents a compelling case for increased engagement in green finance initiatives.

Key Takeaways

- Market Value Projection: The Global Green Finance Market is anticipated to reach USD 21,661.8 Billion by 2033, exhibiting a remarkable growth trajectory from USD 3,192.61 Billion in 2023, with a CAGR of 21.70% during 2024-2033.

- Dominant Market Segments:

- Green Bonds command a significant 40% market share, facilitating capital raising for projects with environmental benefits.

- Renewable Energy stands as the leading industry vertical, holding a 45% market share, vital for global sustainability efforts.

- Commercial Banks dominate end-user engagement, occupying a 38% market share, leveraging their significant role in providing capital for green projects.

- Regional Dynamics:

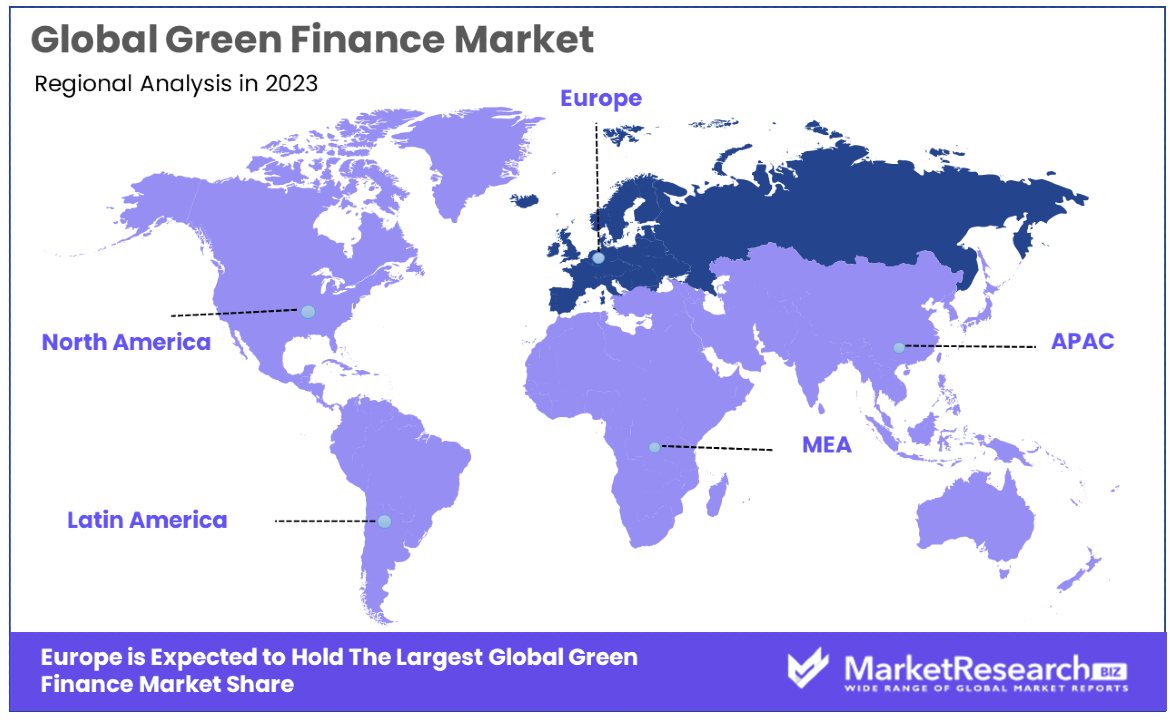

- Europe leads with a 35% market share, driven by stringent environmental policies and extensive regulatory frameworks.

- North America witnesses an increasing focus on sustainable investments, while Asia-Pacific experiences rapid growth propelled by policy support and rising environmental awareness.

- Key Players and Analyst Viewpoint:

- Major players like JP Morgan Chase & Co., Bank of America Corporation, and CitiGroup Inc. shape investment strategies and fund eco-friendly projects.

- Analysts emphasize the substantial opportunities arising from climate risk quantification, mainstreaming ESG investing, and government policies, urging market participants to align strategies accordingly.

- Growth Opportunities:

- Developing methodologies for climate risk measurement presents growth potential, fostering informed green financing decisions.

- Mainstreaming ESG investing drives capital influx into green assets and companies, fueling market expansion and innovation.

- Recent Developments: Initiatives like the ADB-BII partnership in Asia and the Pacific and the Tesco-NatWest scheme in the UK underscore the increasing momentum towards green finance globally.

Driving Factors

Climate Awareness Drives Market Growth

Consumers, corporations, and investors are increasingly cognizant of the financial and societal repercussions climate change poses. With global greenhouse gas emissions still on the rise, as evidenced by a marginal increase in the second quarter of 2023, the urgency for effective solutions is evident.

A study by CDP highlights this urgency, revealing that 215 of the world's largest companies face nearly $1 trillion in climate-related risks, affecting everything from food supplies to economic productivity. This awareness fuels the demand for green finance products that support sustainability initiatives. The understanding of these risks is becoming more widespread, driving innovation and investment in sustainable projects and products.

Policy Incentives Fuel Market Expansion

Numerous governments are implementing regulations, subsidies, and incentives to foster sustainable finance and investments, with strategies ranging from carbon pricing schemes to renewable energy targets.

A pivotal move by the U.S. Securities and Exchange Commission (SEC) to require publicly traded companies to disclose climate change-related financial risks exemplifies the trend towards transparency and accountability. These regulatory measures not only promote the adoption of green financial practices but also ensure that investors and consumers are well-informed about the environmental and financial implications of their decisions.

Innovative Financial Products Spur Market Growth

Institutions like Equinix are at the forefront, issuing $1.2 billion in green bonds and engaging in significant renewable energy commitments through Power Purchase Agreements (PPAs). These efforts, resulting in substantial CO2e reductions, exemplify the market's shift towards sustainability. Additionally, the emergence of Sustainability-linked Loans (SLLs) and climate risk insurance addresses the urgent need for financial mechanisms that support environmental objectives.

These innovative products not only meet the increasing demand for green finance but also encourage other institutions to develop similar offerings. As the market continues to evolve, these products will likely become more prevalent, further driving growth and encouraging a shift towards a more sustainable and resilient financial system.

Restraining Factors

Perceived Higher Costs Deter Investment in Green Finance Market

Perceived higher costs are a significant factor restraining the growth of the Green Finance Market. Many sustainable projects and assets, such as renewable energy installations, initially require more capital than their conventional counterparts. Even as the cost of green technologies decreases, the perception of high expense persists, especially in emerging markets where financial resources are scarcer.

For instance, while renewable energy is becoming more cost-competitive, it often still relies on subsidies or incentives, making it less attractive to investors seeking immediate, high returns without long-term commitment, thus deterring substantial investment in green projects.

Limited Track Record Creates Uncertainty in Green Finance Market

Unlike conventional assets with a long history of performance data, green investments like green bonds or sustainable funds lack extensive records. This absence makes it challenging to assess their risk and return profiles accurately, leading to valuation difficulties and investment uncertainty.

For example, projecting future cash flows and understanding the long-term benefits of investing in a new category like green bonds can be daunting for investors accustomed to the predictable patterns of traditional markets, making them hesitant to allocate significant capital to green finance.

Type Analysis

Green Bonds Lead Green Finance Market with 40% Share, Driven by Sustainable Project Funding

Green Bonds are the dominant segment in the Green Finance Market, holding a 40% market share. The popularity of Green Bonds stems from their role in raising capital for projects with environmental benefits. These bonds have become pivotal in funding sustainable initiatives, particularly in sectors like renewable energy, green buildings, and sustainable transport.

An example of this trend is Societe Generale’s issuance of its first digital green bond in November 2023. This bond, registered on the Ethereum blockchain by SG-FORGE, exemplifies the innovative approach to enhancing transparency and traceability in green financing. The use of blockchain technology in this context marks a significant step towards more accountable and transparent environmental, social, and governance (ESG) investments and green bonds.

Other segments like Green Loans, Green Investment Funds, and Sustainability-Linked Financial Instruments also contribute to green finance, but Green Bonds lead the way in channeling large-scale investments into sustainable development projects.

Industry Vertical Analysis

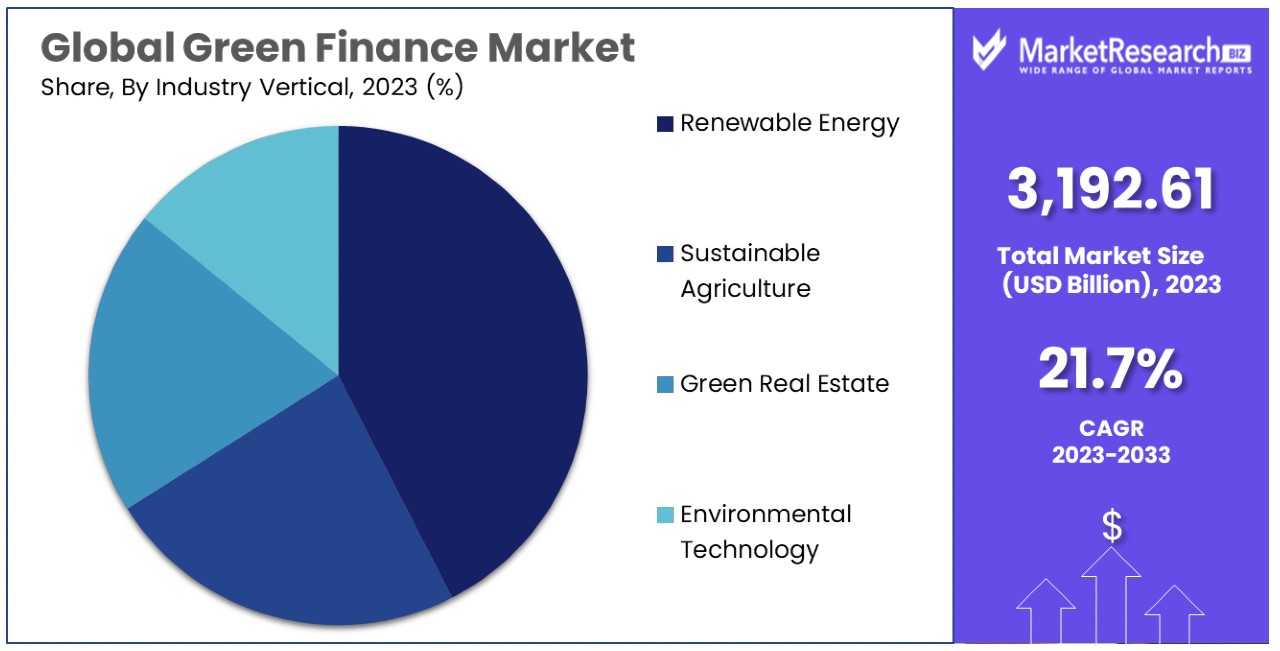

Renewable Energy Sector Commands 45% Market Share in Green Finance, Driving Global Sustainability Efforts

In the Green Finance Market, the Renewable Energy sector is the leading industry vertical, commanding a 45% market share. The sector’s dominance is driven by the global shift towards sustainable energy sources to combat climate change and reduce greenhouse gas emissions. Green finance plays a crucial role in funding renewable energy projects, including solar, wind, hydroelectric, and biomass energy. These investments are essential for developing new renewable energy technologies and expanding existing capacity to meet rising global energy demand sustainably.

Other important sectors include Sustainable Agriculture, Green Real Estate, and Environmental Technology. Each of these sectors leverages green finance to implement sustainable practices and technologies, but Renewable Energy stands out due to its critical role in the global transition to a low-carbon economy and its substantial capital requirements for development and expansion.

End-User Analysis

Commercial Banks Dominate Green Finance Market with 38% Share, Fueling Sustainable Development Initiatives

Commercial Banks are the predominant end-user in the Green Finance Market, holding a 38% market share. Their dominant position is attributed to their significant role in providing capital for green projects through various financial instruments, including green bonds and loans. Commercial banks are increasingly committing to sustainable financing, recognizing both the environmental necessity and the business opportunity it presents. This commitment is evident in their growing portfolio of green finance products aimed at supporting sustainable development initiatives.

Investment Banks, Asset Management Firms, and Insurance Companies are also key players in the green finance landscape. Investment banks facilitate the issuance of green bonds and other sustainable investments, asset management firms incorporate ESG criteria into their investment strategies, and insurance companies invest in and underwrite green projects. However, commercial banks’ extensive networks and capital resources position them as the leading facilitators of green finance.

Key Market Segments

By Type

- Green Bonds

- Green Loans

- Green Investment Funds

- Sustainability-Linked Financial Instruments

By Industry Vertical

- Renewable Energy

- Sustainable Agriculture

- Green Real Estate

- Environmental Technology

By End-User

- Commercial Banks

- Investment Banks

- Asset Management Firms

- Insurance Companies

Growth Opportunities

Climate Risk Quantification Catalyzes Green Finance Growth

The development of new methodologies to measure climate and carbon risks presents a significant growth opportunity in the Green Finance Market. As the financial sector recognizes the need to understand and mitigate climate-related risks, there's an increasing demand for robust, data-driven approaches to quantifying these risks.

This demand spurs investments in climate mitigation and adaptation projects. The current pain point is the lack of comprehensive data and advanced modeling capabilities. However, as these tools evolve and become more sophisticated, they will enable more informed, risk-adjusted green financing decisions, driving growth in the market.

Mainstreaming ESG Investing Fuels Expansion in Green Finance

The surging demand for ESG (Environmental, Social, and Governance) investment strategies is mainstreaming capital into green assets and companies, offering a substantial growth opportunity for the Green Finance Market. Investors are increasingly seeking opportunities that align with sustainability and social responsibility values.

For instance, ABN AMRO Corporate Investments' strategic investment in SET Fund IV in January 2024 exemplifies how mainstream financial institutions are directing funds towards initiatives that drive the energy transition to a zero-carbon society. This trend of mainstreaming ESG investing not only channels more capital into green projects but also promotes a broader shift in the market towards sustainable and ethical investment practices.

Trending Factors

Government Policies and Regulations Are Trending Factors

Government initiatives are foundational to the expansion of the Green Finance Market. These policies not only incentivize but also mandate the adoption of sustainable practices. For example, the European Union’s Green Deal, targeting carbon neutrality by 2050, has catalyzed an uptick in green investments across Europe. Financial incentives like tax breaks and subsidized loan terms are pivotal, making green projects more appealing and financially viable.

As a result, there is a discernible increase in the issuance of green bonds and investments in renewable projects. The ongoing refinement of these policies is anticipated to perpetually drive the market's growth, as governments remain steadfast in their commitment to environmental sustainability.

Corporate Sustainability Initiatives Are Trending Factors

Corporate commitment to sustainability is increasingly becoming a market differentiator in the Green Finance Market. Corporations like Apple, which have utilized green bonds to fund substantial renewable energy initiatives, exemplify this trend. Such actions not only reduce the carbon footprint but also bolster corporate reputations among environmentally conscious consumers and investors.

The rise in sustainability-linked financial products evidences this shift; these instruments allow companies to capitalize financially on their commitment to sustainability. As public and investor demand for environmentally responsible conduct escalates, more companies are likely to engage in green finance, propelling market expansion and innovation in green technologies and sustainable business practices.

Regional Analysis

Europe Dominates with 35% Market Share in Green Finance Market

Europe's substantial 35% share of the Green Finance Market is driven by its strong commitment to sustainability and climate goals. The European Investment Bank's significant issuance of EUR 19.9 billion in Climate and Sustainability Awareness Bonds in 2022, and the increase of its climate and sustainability funding portion from 21% in 2021 to 45% in 2022, highlight the region's aggressive approach towards financing green initiatives.

The region's stringent environmental policies, along with the high level of stakeholder awareness regarding climate change, drive the demand for green finance. Additionally, Europe's leadership in renewable energy and sustainable infrastructure projects necessitates substantial green financing.

The market dynamics in Europe are influenced by the region's comprehensive regulatory framework supporting green investments, including the EU Green Deal and various national strategies aimed at achieving carbon neutrality. The growing emphasis on Environmental, Social, and Governance (ESG) criteria in investment decisions and the active participation of private and public sectors in green financing are pivotal in driving the market.

North America: Increasing Focus on Sustainable Investments

North America's Green Finance Market is driven by an increasing focus on sustainable investments and a growing recognition of climate-related financial risks. The United States and Canada are seeing a rise in green bonds issuance and sustainable asset funds, reflecting a shift towards environmentally responsible investing. The region's technological advancements and the private sector's commitment to reducing carbon footprints contribute to the growth of green finance.

Asia-Pacific: Rapid Growth and Policy SupportIn Asia-Pacific, the Green Finance Market is experiencing rapid growth due to strong policy support and increasing environmental awareness. Countries like China, Japan, and India are actively promoting green projects through various government initiatives and incentives. The rising urbanization and the need for sustainable infrastructure drive the demand for green financing. As the region continues to focus on economic development while addressing environmental concerns, Asia-Pacific is expected to witness substantial growth in the Green Finance Market.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the Green Finance Market, a critical sector for driving sustainable economic growth and environmental initiatives, the companies listed are instrumental in shaping investment strategies and funding eco-friendly projects. JP Morgan Chase & Co. and Bank of America Corporation are industry leaders, known for their significant commitments to financing renewable energy and sustainability projects. Their strategic positioning emphasizes corporate responsibility and innovative financial products, significantly influencing the flow of capital towards green initiatives.

CitiGroup Inc. and HSBC Holdings plc are key players with a strong focus on green bonds and sustainable investment portfolios, reflecting the industry's shift towards more environmentally and socially responsible banking practices. BlackRock, Inc. and UBS Group AG contribute with their extensive asset management services, offering green funds and strategies that cater to a growing demand for sustainable investment options.

BNP Paribas and Credit Agricole Group, recognized for their leadership in European green finance, play crucial roles in advancing sustainable finance on a global scale, showcasing the market's potential for comprehensive and integrated eco-financial solutions. Morgan Stanley and Goldman Sachs Group, Inc., with their robust advisory and investment services, demonstrate the industry's adaptability and commitment to funding renewable energy and clean technologies.

Market Key Players

- JP Morgan Chase & Co.

- Bank of America Corporation

- CitiGroup Inc.

- UBS Group AG

- BlackRock, Inc.

- BNP Paribas

- Morgan Stanley

- ING Group

- Credit Agricole Group

- HSBC Holdings plc

- Goldman Sachs Group, Inc.

- State Street Corporation

- Other Key Players

Recent Developments

- On January 18, 2024, the Asian Development Bank (ADB) and British International Investment (BII) initiated a new trade finance partnership to promote green trade in Asia and the Pacific. Managed by ADB’s Trade and Supply Chain Finance Program (TSCFP), this collaboration focuses on renewable energy, energy efficiency, and climate-smart agriculture to reduce reliance on fossil fuels.

- On February 21, 2024, CAF, FinDev Canada, and IDB Invest announced their commitment to strengthen climate action in Latin America and the Caribbean by supporting the region's first private credit climate finance fund. This collaboration, involving FinDev Canada, IDB Invest, and CAF, aims to mobilize both development finance and private institutional capital to support the provision of long-term financing.

- On March 28, 2024, Tesco and NatWest launched a discounted climate and sustainable finance scheme for 1,500 of Tesco's farmers, including the 600+ farmers in the UK. This partnership aims to provide discounted green finance options for farmers who wish to transition to more sustainable practices.

Report Scope

Report Features Description Market Value (2023) USD 3,192.61 Billion Forecast Revenue (2033) USD 21,661.8 Billion CAGR (2024-2033) 21.70% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Green Bonds, Green Loans, Green Investment Funds, Sustainability-Linked Financial Instruments), By Industry Vertical (Renewable Energy, Sustainable Agriculture, Green Real Estate, Environmental Technology), By End-User (Commercial Banks, Investment Banks, Asset Management Firms, Insurance Companies) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape JP Morgan Chase & Co., Bank of America Corporation, CitiGroup Inc., UBS Group AG, BlackRock, Inc., BNP Paribas, Morgan Stanley, ING Group, Credit Agricole Group, HSBC Holdings plc, Goldman Sachs Group, Inc., State Street Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- JP Morgan Chase & Co.

- Bank of America Corporation

- CitiGroup Inc.

- UBS Group AG

- BlackRock, Inc.

- BNP Paribas

- Morgan Stanley

- ING Group

- Credit Agricole Group

- HSBC Holdings plc

- Goldman Sachs Group, Inc.

- State Street Corporation

- Other Key Players